- BentrioTM nasal spray launched in Hong Kong by partner Nuance

Pharma to help protect against viruses and allergens

- COVAMID trial with Bentrio in acute COVID-19 progressing

towards read-out in December

- Strategic Bentrio partnering or divestiture process approaching

decisive phase

- Previously announced divestiture of inner ear assets for up to

$27 million amended for first stage, still expected to close in

December

- Progressing with strategic plan to become ‘pure-play’ RNA

delivery company

Altamira Therapeutics Ltd. (NASDAQ:CYTO), a company dedicated to

developing therapeutics that address important unmet medical needs,

today provided a business update and reported its first half 2022

financial results.

“We continue to make good progress with the transformation of

Altamira into an RNA delivery technology company,” stated Thomas

Meyer, Altamira Therapeutics’ founder, Chairman and CEO. “We are

optimistic of reaching an agreement to divest or partner our

Bentrio nasal spray for key markets in North America and Europe by

year end. Last month, we agreed to divest part or all of our inner

ear therapeutics programs to a European family office. Following

some delay and under slightly amended terms, we expect that

transaction to close in December.

“Heading towards 2023, we look forward to focusing exclusively

on the many emerging opportunities in the fast-growing RNA

therapeutics market. We are increasingly well positioned to advance

our RNA delivery technology throughout 2023.”

As Altamira is going through the final stages of a major

corporate transformation, management intends to hold its next

investor call upon finalization of its partnering / divestiture

projects. On that call, the Company will also provide its outlook

for 2023.

RNA delivery platform update

Altamira continued to make solid progress with the development

of its patented, peptide-based platform for RNA delivery to

extrahepatic tissues (OligoPhore™/SemaPhore™). In recent months,

the RNA team led by Chief Development Officer Covadonga Pañeda,

Ph.D., and Chief Scientific Officer Samuel Wickline, MD, have

advanced various projects, including selection and optimization of

siRNA sequences, formulation, process development and

manufacturing. Starting with project AM-401 for the treatment of

KRAS-driven tumors, the Company added a second project, AM-411 for

the treatment of rheumatoid arthritis (RA). AM-411 nanoparticles

comprise siRNA targeting NF-kB (p65), a key checkpoint in RA

inflammation.

The Company is developing both AM-401 and AM-411 with the

objective of out-licensing the drug products at a later stage. They

serve as a “showcase” for the application of Altamira’s RNA

delivery technology; the Company’s strategy will be to out-license

the technology to pharma and biotech companies for use with their

own RNA molecules. In this context, Altamira has been intensifying

its efforts to raise awareness about OligoPhore/SemaPhore within

science and industry.

In recent months, members of Altamira’s leadership team gave

oral presentations at multiple international conferences,

highlighting the ability to deliver RNA molecules to extrahepatic

tissues and achieve efficient and rapid endosomal release inside

target cells. Concurrently, further data on RNA delivered with

Altamira’s delivery technology has been published by independent

research groups in peer-reviewed scientific journals. Altamira

anticipates entering into its first partnering agreements in 2023.

Bentrio Update

Earlier today, Altamira reported that its licensee and

distribution partner Nuance Pharma has launched Bentrio nasal spray

in Hong Kong to help provide protection against airborne viruses as

well as allergens. This will be the first step to distributing

Bentrio in the other Nuance-licensed territories which is comprised

of mainland China, Macau and South Korea.

As part of its strategy to focus exclusively on RNA delivery,

Altamira has been in discussions with several well-established OTC

consumer health companies for the partnering of Bentrio. Those

discussions intensified following the 510(k) clearance of the

product by the FDA and have advanced well, including due diligence

by interested parties. The Company anticipates entering into a

partnering transaction before year end. In the context of those

partnering discussions, Altamira suspended preparations for

launching the product in the US on its own as well as pausing major

marketing initiatives in Europe. This restraint provides the

prospective strategic partner for Bentrio with maximum flexibility

to fit the product into its business plan.

Beginning in early October, the Bentrio nasal spray was

relaunched in Europe for allergic rhinitis. Previously, the Company

had ceased marketing the product for the indication of viral

infection in the EU and Switzerland although Bentrio’s mode of

action is the same regardless of whether it provides a barrier

against airborne virus or allergen particles. This had been

demonstrated in various relevant in vitro assays. However, certain

countries and regions require specifically clinical performance

data to clear Bentrio for this indication, in particular related to

COVID-19. Such data are expected to become available through the

COVAMID trial.

In September, Altamira announced that it had reached its

extended enrollment target of 160 confirmed subjects in its COVAMID

clinical investigation to evaluate the safety, tolerability, and

efficacy of its Bentrio nasal spray in patients with acute

COVID-19. The read-out of top-line data remains on track for the

current quarter. The Company plans to seek an expansion of its

product label to also include viral infections in those countries

requiring supportive clinical data.

In September, the Company also announced that its “NASAR”

clinical trial in seasonal allergic rhinitis (SAR) resumed

enrollment as the new pollen season started in Australia. The NASAR

trial is expected to enroll a total of 100 patients suffering from

SAR and is designed to compare the safety and efficacy of Bentrio

against a (control) saline nasal spray. The primary endpoint will

be the comparison of the reflective Total Nasal Symptom Score

(rTNSS) under treatment with Bentrio against control.

The NASAR trial was initiated in the fall of 2021. It was

suspended in spring 2022 as the pollen season came to an end before

the enrollment target could be met. Interim data from the trial

were used in support of the 510(k) clearance of Bentrio by the US

FDA. Unless an interim analysis performed upon reaching 50% of the

enrollment target to check the validity of the statistical powering

assumptions requires a change to the target size of 100 patients,

the Company expects to complete enrollment into the NASAR trial by

year-end or in early 2023 with a read-out of top-line data in late

1Q-23.

Inner ear therapeutics update

In June the Company announced positive top-line data from its

exploratory Phase 2 TRAVERS trial with AM-125 (intranasal

betahistine) in acute vertigo. The randomized, double-blind,

placebo-controlled TRAVERS trial enrolled a total of 124 patients

who suffered from acute vertigo (acute vestibular syndrome)

following surgery. TRAVERS demonstrated good safety and

tolerability of AM-125 at doses up to 20 mg administered three

times daily for four weeks. Further, administration of AM-125

resulted in a dose- and time-dependent improvement in balance and

signs and symptoms of vestibular dysfunction. At the end of the

treatment period, patients treated with AM-125 20 mg on average

managed to maintain balance for 12.5 seconds vs. 7.5 seconds for

placebo treated patients, which is a statistically significant

improvement (p=0.0242; least square means in repeated-measure

ANCOVA model, per protocol population). The detailed results from

the TRAVERS trial shall be published in a scientific journal.

Based on the positive outcomes from TRAVERS, Altamira moved

forward with the preparations for filing an Investigational New

Drug (IND) application with the FDA. The IND will include

accumulated clinical data and the protocol for the next clinical

trial with AM-125 as well as data generated through extensive

preclinical toxicology, pharmacology and pharmacokinetic studies.

In the context of its strategy to focus on RNA delivery, Altamira

engaged in discussions with potential partners for future

development steps with AM-125.

Last month, the Company announced that it had entered into an

agreement to sell 90% of the share capital of its wholly owned

inner ear subsidiary Zilentin AG and an option to purchase all of

its additional subsidiaries involved in inner ear projects (“the

“Additional Subsidiaries”) to a European family office (the

“Buyer”) for a cash consideration of $1 million each. Under the

terms of the option agreement (the “Option”) Zilentin will be

entitled to purchase the Additional Subsidiaries for an upfront

payment of $25 million -- plus up to $55 million upon reaching

certain clinical and regulatory milestones as well as royalties on

revenues generated with products based on Altamira’s RNA delivery

technology for certain inner ear targets at a mid-single digit

percentage. The Option was set to be exercisable for 30 days from

October 19, 2022 (the “Closing Date”); beyond that period, Zilentin

would have a right of first refusal to acquire these companies

until year end with the upfront payment increasing by $1 million

per month.

Due to a delay in closing the initial Zilentin purchase

transaction, on November 23, 2022 the Company and the Buyer agreed

to amend their agreement:

- Extending the Closing Date to up to December 15, 2022

- Increasing the Zilentin share capital to be sold from 90% to

100%

- Raising the combined amount of the payment for the purchase of

Zilentin, and for the option to purchase the Additional

Subsidiaries, proportionately from $2 million to $2.2 million.

First Half 2022 Financial Results and Financial

Guidance

- In the first half of 2022 ended June 30, the Company recorded

revenues of CHF 1.2 million related to sales of Bentrio and the

upfront payment received from Nuance Pharma compared with no

revenue a year earlier.

- Total operating expenses for the first half of 2022 were CHF

7.5 million compared with CHF 6.5 million for the first half of

2021.

- R&D expenses for the first half of 2022 were CHF 3.6

million compared with CHF 3.4 million for the first half of

2021.

- General and administrative expenses for the first half of 2022

were CHF 2.1 million compared with CHF 3.1 million for the first

half of 2021.

- Net loss for the first half of 2022 was CHF 7.3 million, or CHF

9.43 per share, compared with CHF 6.8 million, or CHF 10.85 per

share for the first half of 2021.

On October 25, 2022 the Company effected a one-for-twenty

reverse stock split. All per share data are shown on a post-split

basis which has been reflected retrospectively.

Altamira expects its total cash need for funding operations in

2022 to be in the range of CHF 12.0 to 13.0 million. Funding

requirements for operations and financial obligations until the end

of 2023 are expected to amount to CHF 22.0 to 25.0 million, or to

CHF 17.0 to 20 million if the convertible loan provided by FiveT

will be converted into Common Shares. This guidance does not

include any proceeds from the partnering of the Company’s legacy

assets or partnering of the RNA delivery technology.

FINANCIAL TABLES

Condensed Consolidated Interim Statement

of Profit or Loss and Other Comprehensive Income or Loss

(unaudited)For the Six Months Ended June 30, 2022 and 2021

(in CHF)

|

|

|

|

|

SIX MONTHS ENDED |

|

|

|

|

|

|

JUNE 30 |

|

| Revenue |

|

|

|

|

1,222,998 |

|

|

|

- |

|

| Cost of Sales |

|

|

|

|

(1,192,232 |

) |

|

|

- |

|

| Gross

profit |

|

|

|

|

30,766 |

|

|

|

- |

|

| Other operating income |

|

|

|

|

255,820 |

|

|

|

- |

|

| Research and development |

|

|

|

|

(3,563,883 |

) |

|

|

(3,393,710 |

) |

| Sales and marketing |

|

|

|

|

(2,129,881 |

) |

|

|

- |

|

| General and

administrative |

|

|

|

|

(2,076,383 |

) |

|

|

(3,062,199 |

) |

| Operating

loss |

|

|

|

|

(7,483,561 |

) |

|

|

(6,455,909 |

) |

| Interest expense |

|

|

|

|

(376,848 |

) |

|

|

(172,462 |

) |

| Foreign currency exchange gain

(loss), net |

|

|

|

|

58,296 |

|

|

|

291,892 |

|

| Revaluation (loss) gain from

derivative financial instruments |

|

|

|

|

450,847 |

|

|

|

(428,742 |

) |

| Transaction costs |

|

|

|

|

(1,137 |

) |

|

|

- |

|

| Loss before

tax |

|

|

|

|

(7,352,403 |

) |

|

|

(6,765,221 |

) |

| Income tax gain |

|

|

|

|

46,085 |

|

|

|

10,642 |

|

| Net loss attributable

to owners of the Company |

|

|

|

|

(7,306,318 |

) |

|

|

(6,754,579 |

) |

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

|

|

| Items that will never

be reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

|

| Remeasurement of defined

benefit liability, net of taxes of CHF 0.00 |

|

|

|

|

209,526 |

|

|

|

448,946 |

|

| Items that are or may

be reclassified to |

|

|

|

|

|

|

|

|

|

|

| Profit or

loss |

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

differences, net of taxes of CHF 0.00 |

|

|

|

|

(63,477 |

) |

|

|

(41,922 |

) |

| Other comprehensive

income, net of taxes of CHF 0 |

|

|

|

|

146,049 |

|

|

|

407,024 |

|

| Total comprehensive

loss attributable to owners of the Company |

|

|

|

|

(7,160,269 |

) |

|

|

(6,347,555 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per

share |

|

|

|

|

(9.43 |

) |

|

|

(10.85 |

) |

Condensed Consolidated Interim Statement

of Financial Position (unaudited)As of June 30, 2022 and

December 31, 2021 (in CHF)

|

|

|

|

JUNE 30, |

|

|

DECEMBER 31, |

|

|

|

|

|

2022 |

|

|

2021 |

|

| ASSETS |

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

|

Property and equipment |

|

|

|

1 |

|

|

|

1 |

|

|

Right-of-use assets |

|

|

|

505,270 |

|

|

|

564,714 |

|

|

Intangible assets |

|

|

|

15,851,501 |

|

|

|

14,314,877 |

|

|

Other non-current financial assets |

|

|

|

195,421 |

|

|

|

199,105 |

|

|

Total non-current assets |

|

|

|

16,552,193 |

|

|

|

15,078,697 |

|

| |

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

Inventories |

|

|

|

146,366 |

|

|

|

839,221 |

|

|

Trade receivables |

|

|

|

182,167 |

|

|

|

21,746 |

|

|

Other receivables |

|

|

|

444,034 |

|

|

|

671,340 |

|

|

Prepayments |

|

|

|

782,469 |

|

|

|

1,575,126 |

|

|

Cash and cash equivalents |

|

|

|

372,647 |

|

|

|

984,191 |

|

|

Total current assets |

|

|

|

1,927,683 |

|

|

|

4,091,624 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

18,479,876 |

|

|

|

19,170,321 |

|

| |

|

|

|

|

|

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

Share capital |

|

|

|

170,643 |

|

|

|

149,643 |

|

|

Share premium |

|

|

|

190,108,850 |

|

|

|

188,511,476 |

|

|

Foreign currency translation reserve |

|

|

|

(1,408 |

) |

|

|

62,069 |

|

|

Accumulated deficit |

|

|

|

(182,602,921 |

) |

|

|

(175,686,937 |

) |

|

Total shareholders’ equity attributable to owners of the

Company |

|

|

|

7,675,164 |

|

|

|

13,036,251 |

|

| |

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

Derivative financial instruments |

|

|

|

- |

|

|

|

1,233 |

|

|

Non-current lease liabilities |

|

|

|

403,015 |

|

|

|

461,485 |

|

|

Employee benefits |

|

|

|

515,174 |

|

|

|

668,319 |

|

|

Deferred tax liabilities |

|

|

|

95,999 |

|

|

|

142,484 |

|

|

Total non-current liabilities |

|

|

|

1,014,188 |

|

|

|

1,273,521 |

|

| |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Loan |

|

|

|

4,701,906 |

|

|

|

- |

|

|

Derivative financial instruments |

|

|

|

284 |

|

|

|

- |

|

|

Current lease liabilities |

|

|

|

116,040 |

|

|

|

114,251 |

|

|

Trade and other payables |

|

|

|

3,164,754 |

|

|

|

3,697,723 |

|

|

Accrued expenses |

|

|

|

1,807,540 |

|

|

|

1,048,575 |

|

|

Total current liabilities |

|

|

|

9,790,524 |

|

|

|

4,860,549 |

|

|

Total liabilities |

|

|

|

10,804,712 |

|

|

|

6,134,070 |

|

|

Total equity and liabilities |

|

|

|

18,479,876 |

|

|

|

19,170,321 |

|

About Altamira TherapeuticsAltamira

Therapeutics (NASDAQ:CYTO) is dedicated to developing therapeutics

that address important unmet medical needs. The Company is

currently active in three areas: the development of RNA

therapeutics for extrahepatic therapeutic targets (OligoPhore™ /

SemaPhore™ platforms; preclinical), nasal sprays for protection

against airborne allergens and, where approved, viruses (Bentrio™;

commercial) or for the treatment of vertigo (AM-125; post Phase 2),

and the development of therapeutics for intratympanic treatment of

tinnitus or hearing loss (Keyzilen® and Sonsuvi®; Phase 3). Founded

in 2003, it is headquartered in Hamilton, Bermuda, with its main

operations in Basel, Switzerland. For more information,

visit: https://altamiratherapeutics.com/

Forward-Looking StatementsThis press release

may contain statements that constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are statements other than historical facts and may

include statements that address future operating, financial or

business performance or Altamira Therapeutics' strategies or

expectations. In some cases, you can identify these statements by

forward-looking words such as "may", "might", "will", "should",

"expects", "plans", "anticipates", "believes", "estimates",

"predicts", "projects", "potential", "outlook" or "continue", or

the negative of these terms or other comparable terminology.

Forward-looking statements are based on management's current

expectations and beliefs and involve significant risks and

uncertainties that could cause actual results, developments and

business decisions to differ materially from those contemplated by

these statements. These risks and uncertainties include, but are

not limited to, the effect of the reverse split on Altamira’s stock

price and compliance with Nasdaq listing requirements, the closing

of the initial sale of Zilentin, the exercise by Zilentin of its

option to purchase additional legacy assets, the achievement by

Altamira of the milestones set forth in the option agreement,

Altamira’s ability to complete a divestiture transaction of

Bentrio, Altamira Therapeutics' need for and ability to raise

substantial additional funding to continue the development of its

product candidates, the timing and conduct of clinical trials of

Altamira Therapeutics' product candidates, the clinical utility of

Altamira Therapeutics' product candidates, the timing or likelihood

of regulatory filings and approvals, Altamira Therapeutics'

intellectual property position and Altamira Therapeutics' financial

position, including the impact of any future acquisitions,

dispositions, partnerships, license transactions or changes to

Altamira Therapeutics' capital structure, including future

securities offerings. These risks and uncertainties also include,

but are not limited to, those described under the caption "Risk

Factors" in Altamira Therapeutics' Report on Form 6-K for the six

months ended June 30, 2022, and in Altamira Therapeutics' other

filings with the SEC, which are available free of charge on the

Securities Exchange Commission's website at: www.sec.gov Should one

or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated. All forward-looking statements and

all subsequent written and oral forward-looking statements

attributable to Altamira Therapeutics or to persons acting on

behalf of Altamira Therapeutics are expressly qualified in their

entirety by reference to these risks and uncertainties. You should

not place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date they are made,

and Altamira Therapeutics does not undertake any obligation to

update them in light of new information, future developments or

otherwise, except as may be required under applicable law.

CONTACT

Investors@altamiratherapeutics.com

800-460-0183

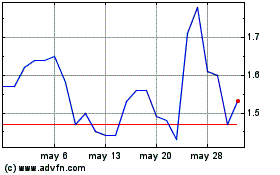

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025