UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission

File Number: 001-36582

Altamira

Therapeutics Ltd.

(Exact

name of registrant as specified in its charter)

Clarendon

House, 2 Church Street

Hamilton

HM 11, Bermuda

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Warrant

Inducement Agreement

On

December 7, 2023, Altamira Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company”)

entered into a letter agreement (the “Warrant Inducement Agreement”) with the holder (the “Holder”)

of certain warrants (the “Existing Warrants”) to purchase an aggregate of 1,625,487 of the Company’s common

shares, par value $0.0001 per share (the “Common Shares”) dated May 1, 2023 in order to provide the Holder with a

limited opportunity to exercise such Existing Warrants at a reduced exercise price and receive additional warrants upon any such exercise.

Under

the Warrant Inducement Agreement, effective from the date and time of execution thereof until 12:59 PM ET on December 14, 2023 (such

period, the “Exercise Window”), the Existing Warrants are temporarily amended by reducing the Exercise Price (as defined

therein; currently CHF 1.538 per common share) of the Existing Warrants from time to time during such period to an amount with respect

to each exercise of Existing Warrants during such Exercise Window (the “Reduced Exercise Price”) equal to 90% of the

daily trading volume weighted average price for Common Shares on the NASDAQ stock exchange on the trading day following the date of each

such exercise upon which settlement of such exercise occurs (a “Settlement Day”) measured commencing at the time of

such settlement, in each case converted into Swiss Francs at the midpoint of the interbank exchange rate shown by UBS on such Settlement

Day at 4:00 pm Central European Time per Common Share (the “Warrant Amendment”). Following the end of the Exercise

Window, the Exercise Price will revert to its original amount in effect immediately prior to the execution of the Warrant Inducement

Agreement.

In

addition, within three trading days after the end of the Exercise Window, the Company will issue and deliver to the Holder additional

warrants using the same form as the Existing Warrants (the “New Warrants”) to purchase 2 Common Shares for each Common

Share that the Holder receives upon any exercises for cash of Existing Warrants during the Exercise Window, provided that the initial

exercise price of such New Warrants will be the volume weighted average of the Reduced Exercise Prices paid by the Holder upon such exercises,

if any, and equal portions (i.e. two portions of 50% each) of such New Warrants will be exercisable for (A) six months from their date

of issuance and (B) two years from their date of issuance, respectively.

The

Company also agreed to file a registration statement to register for resale the Common Shares issuable upon exercise of the New Warrants

within 15 calendar days after the end of the Exercise Window.

The

foregoing description of the terms of the Warrant Inducement Agreement is qualified in its entirety by reference to the full text of

the Warrant Inducement Agreement, which is filed as Exhibit 10.1 to this Report on Form 6-K and incorporated by reference herein.

The

Common Shares issuable upon exercise of the Existing Warrants were registered for resale under the registration statement on Form F-3

(No. 333-272338), filed on June 1, 2023 and declared effective on June 9, 2023.

EXHIBIT

INDEX

INCORPORATION

BY REFERENCE

This

Report on Form 6-K, including the exhibit to this Report on Form 6-K, shall be deemed to be incorporated by reference into the registration

statements on Form F-3 (Registration Numbers 333-228121, 333-249347, 333-261127, 333-264298, 333-267584 and 333-272338) and Form

S-8 (Registration Numbers 333-232735 and 333-252141) of Altamira Therapeutics Ltd. and to be a part thereof from the date on which this

report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Altamira

Therapeutics Ltd. |

| |

|

| Date:

December 8, 2023 |

By: |

/s/

Thomas Meyer |

| |

|

Name: |

Thomas

Meyer |

| |

|

Title: |

Chief

Executive Officer |

Exhibit

10.1

December

7, 2023

Holder

of Warrants to Purchase Common Shares issued on May 1, 2023

| Re: | Amendment

to Existing Warrants and Inducement for Exercise |

Dear

Holder:

Reference

is hereby made to the existing warrants (the “Existing Warrants”) to purchase up to 1,625,487 common shares, par value

$0.0001 per share (the “Common Shares”) of Altamira Therapeutics Ltd. (the “Company”), issued by

the Company to the undersigned holder (the “Holder”) on May 1, 2023.

This

letter agreement (this “Agreement”) confirms that, in consideration for the agreements contained herein, the Company

hereby temporarily amends, effective from the date and time of execution hereof until 12:59 PM ET on December 14, 2023 (such period,

the “Exercise Window”), the Existing Warrants by reducing the Exercise Price (as defined therein) of the Existing

Warrants from time to time during such period to an amount with respect to each exercise of Existing Warrants during such Exercise Window

(the “Reduced Exercise Price”) equal to 90% of the daily trading volume weighted average price for Common Shares on

the NASDAQ stock exchange on the trading day following the date of each such exercise upon which settlement of such exercise occurs (a

“Settlement Day”) measured commencing at the time of such settlement, in each case converted into Swiss Francs at the midpoint

of the interbank exchange rate shown by UBS on such Settlement Day at 4:00 pm Central European Time per Common Share (the “Warrant

Amendment”); provided that following the end of the Exercise Window the Exercise Price will revert to its original amount in

effect immediately prior to the execution of this Agreement.

In

addition, within 3 Trading Days (as defined in the Existing Warrants) after the end of the Exercise Window, the Company shall issue and

deliver to the Holder additional warrants using the same form as the Existing Warrants (the “New Warrants”) to purchase

2 Common Shares for each Common Share that the Holder receives upon any exercises for cash of Existing Warrants during the Exercise Window,

provided that (i) the initial exercise price of such New Warrants shall be the volume weighted average of the Reduced Exercise Prices

paid by the Holder upon such exercises, if any, (ii) equal portions (i.e. two portions of 50% each) of such New Warrants will be exercisable

for (A) six months from their date of issuance and (B) two years from their date of issuance, respectively and (iii) such New Warrants

will contain a customary beneficial ownership blocker at the 9.99% ownership level.

As

soon as practicable (and in any event within 15 calendar days) after the end of the Exercise Window, the Company shall file a registration

statement on Form F-3 (or other appropriate form) providing for the resale by the Holder of the Common Shares issued and issuable upon

exercise of any New Warrants issued under this Agreement. The Company shall use best efforts to cause such resale registration statement

to become effective within 60 days following the filing date (or, in the event of a “full review” by the SEC, the 90th calendar

day following the filing date) and to keep the registration statement effective at all times until the earlier of (1) the date as of

which the Holder may sell such Common Shares without restriction or limitation pursuant to Rule 144 under the U.S. Securities Act of

1933, as amended, and without the requirement to be in compliance with Rule 144(c)(1) (or any successor thereto) or (2) the date on which

the Holder no longer owns any such Common Shares.

Except

as expressly set forth herein, the terms and provisions of the Existing Warrants shall remain in full force and effect after the execution

of this letter and shall not be in any way changed, modified or superseded except by the terms set forth herein.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this agreement to be duly executed by their respective authorized signatories as of the

date first indicated above.

| ALTAMIRA

THERAPEUTICS LTD. |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

Name

of Holder: ________________________________________________________

Signature

of Authorized Signatory of Holder: __________________________________

Name

of Authorized Signatory: ____________________________________________________

[Signature

Page to CYTO Warrant Amendment and Inducement Agreement]

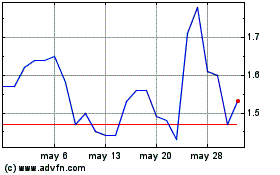

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025