- Third quarter 2023 GAAP EPS of $1.53, compared to $1.86 in

2022

- Third quarter 2023 adjusted EPS (Non-GAAP) of $1.88, compared

to $2.00 in 2022

- Increases quarterly dividend 5% to $0.6425 per share

- Revises 2023 GAAP EPS guidance range to $3.22 to $3.32; narrows

2023 adjusted EPS (Non-GAAP) guidance range to $3.55 to $3.65 from

$3.55 to $3.75

Evergy, Inc. (NASDAQ: EVRG) today announced third quarter 2023

GAAP earnings of $351.6 million, or $1.53 per share, compared to

GAAP earnings of $428.2 million, or $1.86 per share, for third

quarter 2022.

Evergy’s third quarter 2023 adjusted earnings (non-GAAP) and

adjusted earnings per share (non-GAAP) were $432.3 million and

$1.88, respectively, compared to $460.8 million and $2.00 in 2022.

Adjusted earnings (non-GAAP) and adjusted earnings per share

(non-GAAP) are reconciled to GAAP earnings in the financial table

included in this release.

Third quarter adjusted earnings (non-GAAP) per share were driven

by lower operations and maintenance expense, higher corporate owned

life insurance proceeds, and tax items partially offset by

unfavorable weather compared to the corresponding period in the

prior year, lower weather-normalized demand, higher depreciation

and amortization expense, and higher interest expense.

"We reached an important milestone in the third quarter in

announcing a unanimous settlement agreement in our Kansas rate

cases, which, if approved by the Kansas Corporation Commission

(KCC), will deliver significant savings back to our customers and

advance regional rate competitiveness," said David Campbell, Evergy

president and chief executive officer. "We are narrowing our 2023

adjusted earnings per share guidance range to $3.55 to $3.65 from

$3.55 to $3.75 and establishing a long-term growth target of 4% to

6% off the original 2023 midpoint of $3.65. As we look ahead, we

remain focused on operational and financial execution and advancing

constructive regulatory policies. Constructive and competitive

regulatory frameworks are crucial to our ability to compete for

capital that funds our investment programs, which are essential to

our ability to support economic development, reliability, and

affordability in Kansas and Missouri."

Earnings Guidance

The Company revised its 2023 GAAP EPS guidance range to $3.22 to

$3.32 from its original guidance of $3.55 to $3.75 and narrowed its

2023 adjusted EPS (non-GAAP) guidance range to $3.55 to $3.65 from

its original guidance of $3.55 to $3.75. Additionally, the Company

issued its new long-term adjusted EPS (non-GAAP) annual growth

target of 4% to 6% through 2026 off the original $3.65 midpoint of

2023 guidance. The 2023 midpoint of $3.65 also represents a 5% CAGR

off our initial 2021 adjusted earnings per share guidance midpoint

of $3.30. Adjusted EPS (non-GAAP) guidance is reconciled to GAAP

EPS guidance in the financial table included in this release.

Dividend Declaration

The Board of Directors declared a dividend on the Company’s

common stock of $0.6425 per share payable on December 20, 2023. The

dividend of $0.6425 per share, or $2.57 per share annualized,

reflects an increase of 5%. The dividends are payable to

shareholders of record as of November 22, 2023.

Earnings Conference Call

Evergy management will host a conference call Tuesday, November

7, with the investment community at 9:00 a.m. ET (8:00 a.m. CT). To

view the webcast and presentation slides, please go to

investors.evergy.com. To access via phone, investors and analysts

will need to register using this link where they will be provided a

phone number and access code.

Members of the media are invited to listen to the conference

call and then contact Gina Penzig with any follow-up questions.

This earnings announcement, a package of detailed third quarter

financial information, the Company's quarterly report on Form 10-Q

for the period ended September 30, 2023, and other filings the

Company has made with the Securities and Exchange Commission are

available on the Company's website at

http://investors.evergy.com.

Adjusted Earnings (non-GAAP) and

Adjusted Earnings Per Share (non-GAAP)

Management believes that adjusted earnings (non-GAAP) and

adjusted EPS (non-GAAP) are representative measures of Evergy's

recurring earnings, assist in the comparability of results and are

consistent with how management reviews performance. Evergy's

adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) for the

three months ended and year to date September 30, 2022 have been

recast, as applicable, to conform to the current year

presentation.

Evergy's adjusted earnings (non-GAAP) and adjusted EPS

(non-GAAP) for the three months ended and year to date September

30, 2023 were $432.3 million or $1.88 per share and $754.5 million

or $3.27 per share, respectively. For the three months ended and

year to date September 30, 2022, Evergy's adjusted earnings

(non-GAAP) and adjusted EPS (non-GAAP) were $460.8 million or $2.00

per share and $785.2 million or $3.41 per share, respectively.

In addition to net income attributable to Evergy, Inc. and

diluted EPS, Evergy's management uses adjusted earnings (non-GAAP)

and adjusted EPS (non-GAAP) to evaluate earnings and EPS without

i.) the costs resulting from nonregulated energy marketing margins

from the February 2021 winter weather event; ii.) gains or losses

related to equity investments subject to a restriction on sale;

iii.) the revenues collected from customers for the return on

investment of the retired Sibley Station in 2022 for future refunds

to customers; iv.) the mark-to-market impacts of economic hedges

related to Evergy Kansas Central's non-regulated 8% ownership share

of JEC; v.) costs resulting from executive transition and advisor

expenses; vi.) the transmission revenues collected from customers

in 2022 through Evergy Kansas Central's FERC TFR to be refunded to

customers in accordance with a December 2022 FERC order; vii.) the

impairment loss on Sibley Unit 3; viii.) the second quarter 2023

deferral of the cumulative amount of prior year revenues collected

since October 2019 for costs related to an electric subdivision

rebate program to be refunded to customers in accordance with a

June 2020 KCC order; and ix.) the deferral of revenues for future

refund of amounts previously collected from customers related to

COLI rate credits in accordance with a September 2023 KCC rate case

unanimous settlement agreement.

Adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) are

intended to aid an investor's overall understanding of results.

Management believes that adjusted earnings (non-GAAP) provides a

meaningful basis for evaluating Evergy's operations across periods

because it excludes certain items that management does not believe

are indicative of Evergy's ongoing performance or that can create

period to period earnings volatility.

Adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) are

used internally to measure performance against budget and in

reports for management and the Evergy Board. Adjusted earnings

(non-GAAP) and adjusted EPS (non-GAAP) are financial measures that

are not calculated in accordance with GAAP and may not be

comparable to other companies' presentations or more useful than

the GAAP information provided elsewhere in this report.

Evergy, Inc. Consolidated

Earnings and Diluted Earnings Per Share (Unaudited)

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Three Months Ended September 30

2023

2022

(millions, except per share

amounts)

Net income attributable to Evergy,

Inc.

$

351.6

$

1.53

$

428.2

$

1.86

Non-GAAP reconciling items:

Non-regulated energy marketing margin

related to February 2021 winter weather event, pre-tax(a)

—

—

2.1

0.01

Sibley Station return on investment,

pre-tax(b)

—

—

44.4

0.19

Mark-to-market impact of JEC economic

hedges, pre-tax(c)

6.8

0.03

(10.3

)

(0.04

)

Non-regulated energy marketing costs

related to February 2021 winter weather event, pre-tax(d)

—

—

0.3

—

Executive transition costs, pre-tax(e)

—

—

0.7

—

Advisor expenses, pre-tax(f)

—

—

0.6

—

Sibley Unit 3 impairment loss,

pre-tax(g)

—

—

6.0

0.03

TFR refund, pre-tax(i)

—

—

(2.0

)

(0.01

)

Customer refund related to COLI rate

credits, pre-tax(k)

96.5

0.42

—

—

Income tax benefit(l)

(22.6

)

(0.10

)

(9.2

)

(0.04

)

Adjusted earnings (non-GAAP)

$

432.3

$

1.88

$

460.8

$

2.00

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Year to Date September 30

2023

2022

(millions, except per share

amounts)

Net income attributable to Evergy,

Inc.

$

673.3

$

2.92

$

745.2

$

3.23

Non-GAAP reconciling items:

Non-regulated energy marketing margin

related to February 2021 winter weather event, pre-tax(a)

—

—

2.1

0.01

Sibley Station return on investment,

pre-tax(b)

—

—

38.2

0.17

Mark-to-market impact of JEC economic

hedges, pre-tax(c)

4.8

0.02

(10.3

)

(0.04

)

Non-regulated energy marketing costs

related to February 2021 winter weather event, pre-tax(d)

0.2

—

0.9

—

Executive transition costs, pre-tax(e)

—

—

0.7

—

Advisor expenses, pre-tax(f)

—

—

3.1

0.01

Sibley Unit 3 impairment loss,

pre-tax(g)

—

—

6.0

0.03

Restricted equity investment losses,

pre-tax(h)

—

—

16.3

0.07

TFR refund, pre-tax(i)

—

—

(5.8

)

(0.03

)

Electric subdivision rebate program costs

refund, pre-tax(j)

2.6

0.01

—

—

Customer refunds related to COLI rate

credits, pre-tax(k)

96.5

0.42

—

—

Income tax benefit(l)

(22.9

)

(0.10

)

(11.2

)

(0.04

)

Adjusted earnings (non-GAAP)

$

754.5

$

3.27

$

785.2

$

3.41

(a)

Reflects non-regulated energy marketing

margins related to the February 2021 winter weather event and are

included in operating revenues on the consolidated statements of

comprehensive income.

(b)

Reflects revenues collected from customers

for the return on investment of the retired Sibley Station and the

2022 deferral of the cumulative amount of revenues collected since

December 2018 that are included in operating revenues on the

consolidated statements of comprehensive income.

(c)

Reflects mark-to-market gains or losses

related to forward contracts for natural gas and electricity

entered into as economic hedges against fuel price volatility

related to Evergy Kansas Central's non-regulated 8% ownership share

of JEC that are included in operating revenues on the consolidated

statements of comprehensive income.

(d)

Reflects non-regulated energy marketing

incentive compensation costs related to the February 2021 winter

weather event that are included in operating and maintenance

expense on the consolidated statements of comprehensive income.

(e)

Reflects costs associated with executive

transition including inducement bonuses, severance agreements and

other transition expenses and are included in operating and

maintenance expense on the consolidated statements of comprehensive

income.

(f)

Reflects advisor expenses incurred

associated with strategic planning and are included in operating

and maintenance expense on the consolidated statements of

comprehensive income.

(g)

Reflects the impairment loss on Sibley

Unit 3 and is included in Sibley Unit 3 impairment loss on the

consolidated statements of comprehensive income.

(h)

Reflects losses related to equity

investments which were subject to a restriction on sale that are

included in investment earnings on the consolidated statements of

comprehensive income.

(i)

Reflects transmission revenues collected

from customers in 2022 through Evergy Kansas Central's FERC TFR to

be refunded to customers in accordance with a December 2022 FERC

order that are included in operating revenues on the consolidated

statements of comprehensive income.

(j)

Reflects the deferral of the cumulative

amount of prior year revenues collected since October 2019 for

costs related to an electric subdivision rebate program to be

refunded to customers in accordance with a June 2020 KCC order that

are included in operating revenues on the consolidated statements

of comprehensive income.

(k)

Reflects the deferral of revenues for

future refund of amounts previously collected from customers

related to COLI rate credits in accordance with a September 2023

KCC rate case unanimous settlement agreement reached between

Evergy, the KCC staff and other intervenors that are included in

operating revenues on the consolidated statements of comprehensive

income.

(l)

Reflects an income tax effect calculated

at a statutory rate of approximately 22%.

GAAP to Non-GAAP

Earnings Guidance

Original 2021 Earnings per

Diluted Share Guidance

2023 Earnings per

Diluted Share Guidance

Net income attributable to Evergy,

Inc.

$3.14 - $3.34

$3.22 - $3.32

Non-GAAP reconciling items:

Advisor expense, pre-tax(a)

0.05

-

Executive transition cost, pre-tax(b)

0.03

-

Customer refunds related to COLI rate

credits, pre-tax(c)

-

0.42

Income tax benefit(d)

(0.02

)

(0.09

)

Adjusted earnings (non-GAAP)

$3.20 - $3.40

$3.55 - $3.65

(a)

Reflects our advisor expense incurred

associated with strategic planning.

(b)

Reflects costs associated with certain

executive transition costs at the Evergy Companies.

(c)

Reflects the deferral of revenues for

future refund of amounts previously collected from customers

related to COLI rate credits in accordance with a September 2023

KCC rate case unanimous settlement agreement reached between

Evergy, the KCC staff and other intervenors that are included in

operating revenues on the consolidated statements of comprehensive

income.

(d)

Reflects an income tax effect calculated

at statutory rates of approximately 26% and 22% in 2021 and 2023,

respectively, with the exception of certain non-deductible

items.

About Evergy

Evergy, Inc. (NASDAQ: EVRG), serves 1.7 million customers in

Kansas and Missouri. Evergy’s mission is to empower a better

future. Our focus remains on producing, transmitting and delivering

reliable, affordable, and sustainable energy for the benefit of our

stakeholders. Today, about half of Evergy’s power comes from

carbon-free sources, creating more reliable energy with less impact

to the environment. We value innovation and adaptability to give

our customers better ways to manage their energy use, to create a

safe, diverse and inclusive workplace for our employees, and to add

value for our investors. Headquartered in Kansas City, our

employees are active members of the communities we serve.

For more information about Evergy, visit us at

http://investors.evergy.com.

Forward Looking

Statements

Statements made in this document that are not based on

historical facts are forward-looking, may involve risks and

uncertainties, and are intended to be as of the date when made.

Forward-looking statements include, but are not limited to,

statements relating to Evergy's strategic plan, including, without

limitation, those related to earnings per share, dividend,

operating and maintenance expense and capital investment goals; the

outcome of legislative efforts and regulatory and legal

proceedings; future energy demand; future power prices; plans with

respect to existing and potential future generation resources; the

availability and cost of generation resources and energy storage;

target emissions reductions; and other matters relating to expected

financial performance or affecting future operations.

Forward-looking statements are often accompanied by forward-looking

words such as "anticipates," "believes," "expects," "estimates,"

"forecasts," "should," "could," "may," "seeks," "intends,"

"proposed," "projects," "planned," "target," "outlook," "remain

confident," "goal," "will" or other words of similar meaning.

Forward-looking statements involve risks, uncertainties and other

factors that could cause actual results to differ materially from

the forward-looking information.

In connection with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, the Evergy Companies are

providing a number of risks, uncertainties and other factors that

could cause actual results to differ from the forward-looking

information. These risks, uncertainties and other factors include,

but are not limited to: economic and weather conditions and any

impact on sales, prices and costs; changes in business strategy or

operations; the impact of federal, state and local political,

legislative, judicial and regulatory actions or developments,

including deregulation, re-regulation, securitization and

restructuring of the electric utility industry; decisions of

regulators regarding, among other things, customer rates and the

prudency of operational decisions such as capital expenditures and

asset retirements; changes in applicable laws, regulations, rules,

principles or practices, or the interpretations thereof, governing

tax, accounting and environmental matters, including air and water

quality and waste management and disposal; the impact of climate

change, including increased frequency and severity of significant

weather events and the extent to which counterparties are willing

to do business with, finance the operations of or purchase energy

from the Evergy Companies due to the fact that the Evergy Companies

operate coal-fired generation; prices and availability of

electricity and natural gas in wholesale markets; market perception

of the energy industry and the Evergy Companies; the impact of

future Coronavirus (COVID-19) variants on, among other things,

sales, results of operations, financial condition, liquidity and

cash flows, and also on operational issues, such as supply chain

issues and the availability and ability of the Evergy Companies'

employees and suppliers to perform the functions that are necessary

to operate the Evergy Companies; changes in the energy trading

markets in which the Evergy Companies participate, including

retroactive repricing of transactions by regional transmission

organizations (RTO) and independent system operators; financial

market conditions and performance, disruptions in the banking

industry, including changes in interest rates and credit spreads

and in availability and cost of capital and the effects on

derivatives and hedges, nuclear decommissioning trust and pension

plan assets and costs; impairments of long-lived assets or

goodwill; credit ratings; inflation rates; effectiveness of risk

management policies and procedures and the ability of

counterparties to satisfy their contractual commitments; impact of

physical and cybersecurity breaches, criminal activity, terrorist

attacks, acts of war and other disruptions to the Evergy Companies'

facilities or information technology infrastructure or the

facilities and infrastructure of third-party service providers on

which the Evergy Companies rely; impact of the Ukrainian and Middle

East conflicts on the global energy market; ability to carry out

marketing and sales plans; cost, availability, quality and timely

provision of equipment, supplies, labor and fuel; ability to

achieve generation goals and the occurrence and duration of planned

and unplanned generation outages; delays and cost increases of

generation, transmission, distribution or other projects; the

Evergy Companies' ability to manage their transmission and

distribution development plans and transmission joint ventures; the

inherent risks associated with the ownership and operation of a

nuclear facility, including environmental, health, safety,

regulatory and financial risks; workforce risks, including those

related to the Evergy Companies' ability to attract and retain

qualified personnel, maintain satisfactory relationships with their

labor unions and manage costs of, or changes in, wages, retirement,

health care and other benefits; disruption, costs and uncertainties

caused by or related to the actions of individuals or entities,

such as activist shareholders or special interest groups, that seek

to influence Evergy's strategic plan, financial results or

operations; the impact of changing expectations and demands of the

Evergy Companies' customers, regulators, investors and

stakeholders, including heightened emphasis on environmental,

social and governance concerns; the possibility that strategic

initiatives, including mergers, acquisitions and divestitures, and

long-term financial plans, may not create the value that they are

expected to achieve in a timely manner or at all; difficulties in

maintaining relationships with customers, employees, regulators or

suppliers; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not

possible to predict all factors. You should also carefully consider

the information contained in the Evergy Companies' other filings

with the Securities and Exchange Commission (SEC). Additional risks

and uncertainties are discussed from time to time in current,

quarterly and annual reports filed by the Evergy Companies with the

SEC. New factors emerge from time to time, and it's not possible

for the Evergy Companies to predict all such factors, nor can the

Evergy Companies assess the impact of each such factor on the

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained or implied in any forward-looking statement. Given these

uncertainties, undue reliance should not be placed on these

forward-looking statements. The Evergy Companies undertake no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231106350596/en/

Investor Contact: Pete Flynn Director, Investor Relations

Phone: 816-652-1060 Peter.Flynn@evergy.com

Media Contact: Gina Penzig Director, Corporate

Communications Phone: 785-508-2410 Gina.Penzig@evergy.com Media

line: 888-613-0003

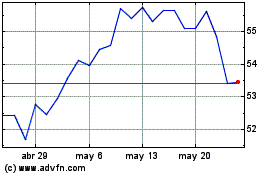

Evergy (NASDAQ:EVRG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Evergy (NASDAQ:EVRG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024