Form 8-K - Current report

08 Octubre 2024 - 12:00PM

Edgar (US Regulatory)

false

0000722572

0000722572

2024-10-08

2024-10-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: October

8, 2024

Franklin Wireless Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

001-14891 |

95-3733534 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

3940

Ruffin Road, Suite C

San Diego, CA 92123

(Address of principal executive offices)

Registrant's telephone number, including area code:

(858) 623-0000

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $.001 per share |

FKWL |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 Entry into a Material Definitive Agreement.

On October 2, 2024, the Board of Directors (the

“Board”) of Franklin Wireless Corp. (the “Company”) approved a form of Indemnification Agreement and authorized

the Company to enter into such Indemnification Agreements with each of the directors and officers of the Company. These indemnification

agreements require the Company to indemnify its directors and officers for certain expenses, including reasonable attorneys’ fees,

judgments, fines, penalties and any and all amounts paid or payable in settlement (including interest), incurred by a director or officer

in any action or proceeding arising out of their services as one of the Company’s directors or officers or any other company or

enterprise to which the person provides services at the Company’s request.

The foregoing description of the form of Indemnification

Agreement is not complete and is qualified in its entirety by reference to the form of Indemnification Agreement filed herewith as Exhibit

10.1, which is incorporated herein by reference.

Section 9 - Financial Statements and Exhibits

ITEM 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 8, 2024 |

FRANKLIN WIRELESS CORP. |

| |

By: /s/ OC Kim |

| |

OC Kim, President |

Exhibit 10.1

Form of INDEMNIFICATION AGREEMENT

THIS INDEMNIFICATION AGREEMENT (this “Agreement”),

dated _______________, is effective as of the Effective Date (as defined below), by and between Franklin Wireless Corp., a Nevada corporation

(the “Company”), and _______________ (“Indemnitee”).

WHEREAS, it is essential to the Company

and its mission to retain and attract as officers and directors the most capable persons available;

WHEREAS, the Company has asked Indemnitee

to serve as [a director][an officer] of the Company;

WHEREAS, both the Company and Indemnitee

recognize the omnipresent risk of litigation and other claims that are routinely asserted against officers and directors of companies

operating in the public arena in the current environment, and the attendant costs of defending even wholly frivolous claims;

WHEREAS, the articles of incorporation (the

“Articles”) and the bylaws (the “Bylaws”) of the Company provide certain indemnification rights

to the officers and directors of the Company, as provided by Nevada law; and

WHEREAS, to induce Indemnitee to serve as

[a director][an officer] of the Company, and in recognition of Indemnitee’s need for substantial protection against personal liability

in order to enhance Indemnitee’s service to the Company in an effective manner, the Company wishes to provide in this Agreement

for the indemnification of, and the advancing of expenses to, Indemnitee (whether partial or complete) to the fullest extent permitted

by law and as set forth in this Agreement, and, to the extent insurance is maintained, for the continued coverage of Indemnitee under

the Company’s directors’ and officers’ liability insurance policies.

NOW, THEREFORE, in consideration of the

premises, the mutual covenants and agreements contained herein and Indemnitee’s service to the Company, the parties hereto agree

as follows:

| a. | “Change in Control” means the occurrence of any of the following events: |

| i. | any “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”)) becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly

or indirectly, of securities of the Company representing 25% or more of the total voting power represented by the Company’s outstanding

Voting Securities, other than (w) a trustee or other fiduciary holding securities under an employee benefit plan of the Company or (x)

a corporation owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership

of stock of the Company; |

| | | |

| ii. | during any period of two consecutive years, individuals who at the beginning of such period constituted the Board of Directors of

the Company (the “Board”) and any new director whose election by the Board or nomination for election by the Company’s

stockholders was approved by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors at the

beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute a

majority of the Board; or |

| | | |

| iii. | the stockholders of the Company approve a merger or consolidation of the Company with any other entity, other than a merger or consolidation

which would result in the Voting Securities of the Company held by the stockholders of the Company and outstanding immediately prior thereto

continuing to represent or being converted into or exchanged for Voting Securities that represent, immediately following such merger or

consolidation, at least 50% of the total voting power of the Voting Securities of (1) the surviving or resulting entity; or (2) if the

surviving or resulting entity is a wholly owned subsidiary of another entity immediately following such merger or consolidation, the parent

entity of such surviving or resulting entity, or the stockholders of the Company approve a plan of complete liquidation of the Company

or an agreement for the sale or disposition by the Company (in one transaction or a series of transactions) of all or substantially all

the Company’s assets. |

| b. | “Claim” means any threatened, pending or completed action, suit or proceeding, including any arbitration, alternative

dispute resolution mechanism, inquiry or investigation (including any internal investigation, and whether instituted by the Company or

any other party or otherwise), or administrative hearing, whether brought by or in the right of the Company or any other party or otherwise,

whether civil (including intentional and unintentional tort claims), criminal, administrative, investigative or other. |

| | | |

| c. | “Corporate Status” describes the status of a person who is or was a director, officer, employee, agent or fiduciary

of the Company, or is or was serving at the request of the Company as a director, officer, manager, member, general or limited partner,

employee, trustee, agent or fiduciary of another corporation, partnership, limited liability company, joint venture, employee benefit

plan, trust or other enterprise. |

| | | |

| d. | “Expenses” means any attorneys’ fees and all other costs, expenses and obligations actually and reasonably

paid or incurred in connection with defending any Claim, including investigating, being a witness in, subject or target of, or participating

in (including on appeal), or preparing to defend, be a witness in, subject or target of, or participate in, any Claim; and include, for

purposes of Section 4, any such Expenses incurred in connection with the interpretation, enforcement or defense of Indemnitee’s

rights under this Agreement or any other agreement or provision of the Articles or Bylaws now or hereafter in effect or for recovery under

any directors’ and officers’ liability insurance policies maintained by the Company. |

| | | |

| e. | “Independent Legal Counsel” means an attorney or firm of attorneys, selected in accordance with the provisions

of Section 3, who shall not have otherwise performed services for the Company or Indemnitee within the last five years and who

are not currently performing services for the Company or Indemnitee, in each case, other than with respect to matters concerning the rights

of Indemnitee under this Agreement, or of other indemnitees under similar indemnification agreements. |

| | | |

| f. | “Reviewing Party” means (i) any person or body consisting of the members of the Board, by a majority vote of a

quorum consisting of directors who are not party to the particular Claim for which Indemnitee is seeking indemnification (“Disinterested

Directors”), (ii) Independent Legal Counsel, if so ordered by a majority vote of a quorum consisting of Disinterested Directors

or if a quorum consisting of Disinterested Directors cannot be obtained, or (iii) any other person or body as may otherwise be required

by applicable law. |

| | | |

| g. | “Voting Securities” means shares of any series or class of common stock or preferred stock of the Company entitled

to vote generally upon all matters that may be submitted to a vote of stockholders of the Company at any annual or special meeting thereof. |

| 2. | Basic Indemnification and Advancement Arrangement. |

| a. | In the event Indemnitee was, is or becomes a party to, subject or target of, or witness or other participant in, or is threatened

to be made a party to, subject or target of, or witness or other participant in, a Claim by reason of (or arising in part out of) Indemnitee’s

Corporate Status, the Company shall indemnify Indemnitee to the fullest extent permitted by law as soon as practicable but in any event

no later than thirty (30) days after demand is presented to the Company (which demand may only be presented to the Company following the

final judicial disposition of the Claim, as to which all rights of appeal therefrom have been exhausted or lapsed (a “Final Disposition”)),

against any and all Expenses, judgments, fines, penalties and any and all amounts paid or payable in settlement (including all interest,

assessments and other charges paid or payable in connection with or in respect of such Expenses, judgments, fines, penalties or such amounts

paid or payable in settlement) of such Claim. If so requested by Indemnitee, prior to the Final Disposition of a Claim, the Company shall

advance any and all Expenses paid or incurred by or on behalf of Indemnitee (including, without limitation, Expenses billed to or on behalf

of Indemnitee) in connection with any such Claim (an “Expense Advance”). |

| b. | Notwithstanding the foregoing, (i) the obligations of the Company to indemnify Indemnitee under Section 2(a) shall be subject

to the condition that the Reviewing Party shall not have determined (in a written determination, or, in any case in which Independent

Legal Counsel is the Reviewing Party, in a written opinion) that Indemnitee would not be permitted to be indemnified under applicable

law as to such indemnification claims, and (ii) the obligation of the Company to make an Expense Advance pursuant to Section 2(a)

shall be subject to the condition that, if the Reviewing Party determines in good faith that Indemnitee would not be permitted to be indemnified

under applicable law, the Company shall be entitled to be reimbursed by Indemnitee (who hereby undertakes to reimburse the Company) for

all such amounts theretofore paid; provided, however, that if Indemnitee has commenced or thereafter commences legal proceedings in a

court of competent jurisdiction to secure a determination that Indemnitee should be indemnified under applicable law, any determination

made by the Reviewing Party that Indemnitee would not be permitted to be indemnified under applicable law shall not be binding and Indemnitee

shall not be required to reimburse the Company for any Expense Advance until a Final Disposition is made with respect thereto. If there

has not been a Change in Control, the Reviewing Party shall be selected by the Board (unless otherwise required pursuant to the definition

of “Reviewing Party”), and if there has been such a Change in Control, the Reviewing Party shall be the Independent Legal

Counsel referred to in Section 3. If (A) there has been no determination by the Reviewing Party as contemplated by Section 2(b)

within sixty (60) days after receipt by the Company of a written demand for indemnification pursuant to Section 2(a) (subject to

extension for a reasonable time, not to exceed an additional thirty (30) days, if the Reviewing Party in good faith requires such additional

time to obtain or evaluate documentation and/or information relating thereto), or (B) the Reviewing Party determines that Indemnitee substantively

would not be permitted to be indemnified in whole or in part under applicable law, Indemnitee shall have the right to commence litigation

in the Eighth Judicial District Court of the State of Nevada, Clark County, Nevada seeking to enforce Indemnitee’s rights to indemnification

and advancement hereunder or challenging any such determination by the Reviewing Party or any aspect thereof, including the legal or factual

bases therefor, and, in all events, the Company hereby consents to service of process and agrees to appear in any such proceeding. Any

determination by the Reviewing Party that Indemnitee is entitled to indemnification shall be conclusive and binding on the Company and

Indemnitee. Any determination by the Reviewing Party that Indemnitee is not permitted to be indemnified (in whole or in part) under applicable

law shall be in writing (or, in any case in which the Independent Legal Counsel referred to in Section 3 is involved, set forth

in a written opinion). |

| 3. | Change in Control. The Company agrees that if there is a Change in Control of the Company then with respect to all matters

thereafter arising concerning the rights of Indemnitee to indemnity payments and Expense Advances under this Agreement or any other agreement

or provision of the Articles or Bylaws now or hereafter in effect, the Company shall seek legal advice only from Independent Legal Counsel

selected by Indemnitee and approved by the Company (which approval shall not be unreasonably withheld) and the Reviewing Party shall be

such Independent Legal Counsel. If such Independent Legal Counsel determines that Indemnitee is not permitted to be indemnified (in whole

or in part) under applicable law, such counsel, among other things, shall render such determination in a written opinion to the Company

and Indemnitee. The Company agrees to pay the reasonable fees of the Independent Legal Counsel referred to above and to fully indemnify

such counsel against any and all expenses (including attorneys’ fees), claims, liabilities and damages arising out of or relating

to this Agreement or its engagement pursuant hereto. |

| | | |

| 4. | Indemnification for Additional Expenses. It is the intent of the Company that, to the fullest extent permitted by law, Indemnitee

shall not be required to incur legal fees or other Expenses associated with the interpretation, enforcement or defense of Indemnitee’s

rights under this Agreement by litigation or otherwise because the cost and expense thereof would substantially detract from the benefits

intended to be extended to Indemnitee hereunder. The Company shall (i) indemnify Indemnitee (to the extent Indemnitee is successful on

the merits or otherwise in the action provided for in this Section 4) against any and all Expenses (including attorneys’

fees) and, (ii) if requested by Indemnitee, advance such Expenses to Indemnitee (and Indemnitee hereby undertakes to reimburse the Company

for any amounts so advanced if, when, and to the extent Indemnitee is not successful on the merits or otherwise in the action provided

for in this Section 4), which are incurred by or on behalf of Indemnitee in connection with any action brought by Indemnitee (whether

pursuant to Section 19 or otherwise), in each case, for (a) indemnification or advance payment of Expenses by the Company

under this Agreement or any other agreement or provision of the Articles or Bylaws now or hereafter in effect or (b) recovery under any

directors’ and officers’ liability insurance policies maintained by the Company, in all cases, to the fullest extent permitted

by law. |

| 5. | Proceedings Against the Company; Certain Securities Laws Claims. |

| | | |

| | | Anything in this Agreement to the contrary notwithstanding,

except as provided in Section 4, with respect to a Claim initiated against the Company by Indemnitee (whether initiated by Indemnitee

in or by reason of such person’s capacity as an officer or director of the Company or in or by reason of any other capacity), the

Company shall not be required to indemnify or to advance Expenses to Indemnitee in connection with prosecuting such Claim (or any part

thereof) or in defending any counterclaim, cross-claim, affirmative defense, or like claim of the Company in connection with such Claim

(or part thereof) unless such Claim was authorized by the Board. For purposes of this Section 5, a compulsory counterclaim by Indemnitee

against the Company in connection with a Claim initiated against Indemnitee by the Company shall not be considered a Claim (or part thereof)

initiated against the Company by Indemnitee, and Indemnitee shall have all rights of indemnification and advancement with respect to any

such compulsory counterclaim in accordance with and subject to the terms of this Agreement. |

| | | |

| 6. | Partial Indemnity and Success on the Merits. If Indemnitee is entitled under any provision of this Agreement to indemnification

by the Company for some or a portion of the Expenses, judgments, fines, penalties and amounts paid or payable in settlement of a Claim

but not, however, for all of the total amount thereof, the Company shall nevertheless indemnify Indemnitee for the portion thereof to

which Indemnitee is entitled. Moreover, notwithstanding any other provision of this Agreement, to the extent that Indemnitee is successful,

on the merits or otherwise, in whole or in part, in defending a Claim (including dismissal without prejudice), or in defense of any claim,

issue or matter therein, Indemnitee shall be indemnified to the fullest extent permitted by law against all Expenses incurred by Indemnitee

or on Indemnitee’s behalf in connection therewith. |

| | | |

| 7. | Burden of Proof. In connection with any determination by the Reviewing Party or otherwise as to whether Indemnitee is entitled

to be indemnified hereunder or otherwise, the burden shall be on the Company to prove by clear and convincing evidence that Indemnitee

is not so entitled. |

| | | |

| 8. | No Presumptions. For purposes of this Agreement, the termination of any Claim, by judgment, order, settlement (whether with

or without court approval) conviction, or otherwise, or upon a plea of nolo contendere, or its equivalent, shall not create a presumption

that Indemnitee did not meet any particular standard of conduct or have any particular belief or that a court has determined that indemnification

is not permitted by applicable law. In addition, neither the failure of the Reviewing Party to have made a determination as to whether

Indemnitee has met any particular standard of conduct or had any particular belief, nor an actual determination by the Reviewing Party

that Indemnitee has not met such standard of conduct or did not have such belief, prior to the commencement of legal proceedings by Indemnitee

to secure a judicial determination that Indemnitee should be indemnified under applicable law shall be a defense to Indemnitee’s

claim or create a presumption that Indemnitee has not met any particular standard of conduct or did not have any particular belief. |

| | | |

| 9. | Settlement. Indemnitee shall be entitled to settle any Claim, in whole or in part, in such Indemnitee’s sole discretion.

To the fullest extent permitted by law, any settlement of a Claim by Indemnitee shall be deemed the Final Disposition of such Claim for

all purposes of this Agreement. The Company acknowledges that a settlement or other disposition short of final judgment on the merits

may be successful if it permits a party to avoid expense, delay, distraction, disruption, and uncertainty. If any Claim is resolved other

than by adverse judgment against Indemnitee (including, without limitation, settlement of such Claim with or without payment or other

consideration) it shall be presumed that Indemnitee has been successful on the merits or otherwise in such Claim. Any individual or entity

seeking to overcome this presumption shall have the burden to prove by clear and convincing evidence that Indemnitee has not been successful

on the merits or otherwise in such Claim. |

| | | |

| 10. | Nonexclusivity; Subsequent Change in Law. The rights of Indemnitee hereunder shall be in addition to any other rights Indemnitee

may have under the Articles or Bylaws, under Nevada law or otherwise. To the extent that a change in Nevada law (whether by statute or

judicial decision) permits greater indemnification by agreement than would be afforded currently under the Articles or Bylaws and this

Agreement, it is the intent of the parties hereto that Indemnitee shall enjoy by this Agreement the greater benefits so afforded by such

change. |

| 11. | Liability Insurance. To the extent the Company maintains an insurance policy or policies providing directors’ and officers’

liability insurance, Indemnitee shall be covered by such policy or policies, in accordance with its or their terms, to the maximum extent

of the coverage available for any Company director or officer. |

| | | |

| 12. | Amendments; Waiver. No supplement, modification or amendment of this Agreement shall be binding unless executed in writing

by both of the parties hereto. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any

other provisions hereof (whether or not similar) nor shall such waiver constitute a continuing waiver. |

| | | |

| 13. | Subrogation. In the event of payment under this Agreement, the Company shall be subrogated to the extent of such payment to

all of the rights of recovery of Indemnitee, who shall execute all papers required and shall do everything that may be necessary to secure

such rights, including the execution of such documents necessary to enable the Company effectively to bring suit to enforce such rights. |

| | | |

| 14. | No Duplication of Payments. The Company shall not be liable under this Agreement to make any payment in connection with any

Claim made against Indemnitee to the extent Indemnitee has otherwise actually received payment (under any insurance policy, the Articles,

the Bylaws or otherwise) of the amounts otherwise indemnifiable hereunder. |

| | | |

| 15. | Binding Effect. This Agreement shall be binding upon and inure to the benefit of and be enforceable by the parties hereto and

their respective successors, assigns, administrators, heirs, executors and personal and legal representatives. The Company agrees that

in the event the Company or any of its successors (including any successor resulting from the merger or consolidation of the Company with

another corporation or entity where the Company is the surviving corporation or entity) or assigns (i) consolidates with or merges into

any other corporation or entity and shall not be the continuing or surviving corporation or entity of such consolidation or merger or

(ii) transfers or conveys all or substantially all of its properties and assets to any corporation or entity, then, and in each such case,

to the extent necessary, proper provision shall be made so that the successors and assigns of the Company as a result of such transaction

assume the obligations of the Company set forth in this Agreement. This Agreement shall continue in effect regardless of whether Indemnitee

continues to serve as a director, officer, employee, agent or fiduciary of the Company or as a director, officer, manager, member, general

or limited partner, employee, trustee, agent or fiduciary of another corporation, partnership, limited liability company, joint venture,

employee benefit plan, trust or other enterprise at the Company’s request. |

| | | |

| 16. | Severability. The provisions of this Agreement shall be severable in the event that any of the provisions hereof (including

any provision within a single section, paragraph or sentence) is held by a court of competent jurisdiction to be invalid, void or otherwise

unenforceable in any respect, and the validity and enforceability of any such provision in every other respect and of the remaining provisions

hereof shall not be in any way impaired and shall remain enforceable to the fullest extent permitted by law. |

| | | |

| 17. | Effective Date. To the fullest extent permitted by law, this Agreement shall (i) be effective as of the earliest date that

Indemnitee commenced serving as a director or an officer of the Company (the “Effective Date”), and (ii) apply to any

claim for indemnification by Indemnitee with respect to any matters arising from such time and thereafter. |

| | | |

| 18. | Governing Law. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Nevada

applicable to contracts made and to be performed in such state without giving effect to the principles of conflicts of laws. |

| 19. | Injunctive Relief. The parties hereto agree that Indemnitee may enforce this Agreement by seeking specific performance hereof,

without any necessity of showing irreparable harm or that a remedy at law would be inadequate or posting a bond, which requirements are

hereby waived, and that by seeking specific performance, Indemnitee shall not be precluded from seeking or obtaining any other relief

to which he or she may be entitled. |

| | | |

| 20. | Notices. All notices, requests, demands and other communications hereunder may be in writing, or by electronic mail (email),

and shall be deemed to have been duly given if delivered to an official company email address, by hand, against receipt, or mailed, by

postage prepaid, certified or registered mail: |

| a. | if to Indemnitee, to the address set forth on the signature page hereto. |

| | | |

| b. | if to the Company, to: |

Franklin Wireless Corp. |

| | | |

Attn: General Counsel |

| | | |

3940 Ruffin Rd., Suite C |

| | | |

San Diego, CA 92123 |

| 21. | Headings. The headings of the sections and paragraphs of this Agreement are inserted for convenience only and shall not be

deemed to constitute part of this Agreement or to affect the construction or interpretation thereof. |

| | | |

| 22. | Counterparts. This Agreement may be executed in one or more counterparts, each of which shall for all purposes be deemed to

be an original, but all of which together shall constitute one and the same Agreement. |

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have executed

this Agreement as of the date first set forth above.

| |

FRANKLIN WIRELESS CORP. |

| |

|

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

| |

|

| |

|

| |

INDEMNITEE |

| |

|

| |

|

| |

Name: |

|

| |

|

|

| |

|

| |

Address

for notification: |

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| |

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

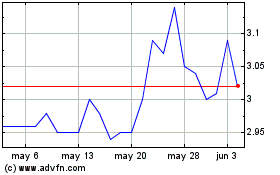

Franklin Wireless (NASDAQ:FKWL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Franklin Wireless (NASDAQ:FKWL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025