First Bank (Nasdaq Global Market: FRBA) (the Bank) today announced

its first quarter 2023 financial results, demonstrating continued

strength and resilience in a challenging economic environment. The

Bank achieved net income of $7.0 million, or $0.36 per diluted

share, and maintained solid returns on average assets, equity, and

tangible equityi at 1.03%, 9.70%, and 10.16%, respectively.

Excluding merger-related expenses and losses on sale of investment

securities, First Bank’s first quarter 2023 adjusted diluted

earnings per shareii were $0.38, adjusted return on average

assetsii was 1.11% and adjusted return on average tangible equityii

was 11.17%.

Compared to the same period last year, the

Bank's net income and returns on assets, equity, and tangible

equity were lower, reflecting broader industry headwinds, primarily

increased market interest rates and deposit costs. However, the

Bank remains confident in its ability to navigate the current

economic landscape and achieve sustainable growth in earnings and

book value over the long term.

First Quarter 2023 Performance

Highlights:

- Total loans reached $2.39 billion

at March 31, 2023, marking a 2.3% increase from the end of the

linked quarter at December 31, 2022.

- Total deposits ended the quarter at

$2.24 billion at March 31, 2023, a 2.3% decline from the end of the

linked quarter at December 31, 2022.

- Continued strong asset quality

throughout the quarter, as net charge-offs represented 0.05% of

average loans on an annualized basis, and nonperforming loans

increased slightly to 0.33% at March 31, 2023, compared to 0.27% at

December 31, 2022.

- Net Interest Margin (NIM) for the

quarter of 3.52%, down 5 basis points from first quarter 2022, and

17 basis points from the linked quarter ended December 31,

2022.

- Efficiency ratioiii of 54.42%, up

from the prior quarter reflecting the interest rate environment,

inflationary pressures and the impact from strategic

investments.

- Steady growth in book value per

share to $15.03 and tangible book value per shareiv to $14.05 at

March 31, 2023. Tangible book value per shareiv increased $0.16

from the end of the linked quarter at December 31, 2022, and $1.26

from March 31, 2022, underlining continued value creation for

shareholders.

Patrick L. Ryan, the President, and CEO of First

Bank, reflected on the quarterly results, stating, “Despite the

prevailing challenges in the banking industry, the strength of our

relationships and our community-banking model helped minimize the

impact of industry deposit outflows. While not immune to the

challenges associated with higher funding costs and inflationary

expenses, I’m proud of our ability to generate a return on average

assets in excess of one percent, even after factoring in costs

associated with the pending merger and the sale of certain

investment securities.”

The Bank’s risk management strategy was further

emphasized by the strong asset-quality metrics. Mr. Ryan stated,

“Our focus on risk management underlines our commitment to prudent,

sustainable growth and responsible stewardship of our assets and

the assets of our communities.”

Mr. Ryan acknowledged that margins may compress

further as long as the yield curve remains inverted, and funds

leave the banking industry in search of higher returns.

Nevertheless, he expressed confidence in the Bank's ability to

manage these pressures through portfolio optimization, prudent

reinvestment in higher-yielding C&I loans, and expense savings

initiatives.

First Bank's strategic C&I expansion plans

remain on track, with steady growth and building pipelines in four

key areas: i) Small Business Administration (SBA) lending, ii)

small business lending, iii) Private Equity/Fund Banking, and iv)

Asset-Based Lending. While each initiative is relatively small in

comparison to the overall loan portfolio at this point,

collectively these groups will help us achieve several long-term

goals: i) reduced reliance on commercial real estate lending, ii)

continued growth in high-quality commercial deposits, and iii) a

higher yielding and lower duration loan portfolio.

The Malvern Bancorp acquisition is currently

tracking in-line with the Bank’s original timeline, with First Bank

and Malvern Bancorp shareholder votes on April 28, 2023, all

regulatory filings in place and regulatory approvals in process.

Assuming all closing conditions are completed, closing is currently

expected on June 30, 2023.

First Bank remains committed to prioritizing

technology to enhance its online services and support growth as a

middle-market commercial bank, with efforts aimed at enhancing

online deposit and loan generation capabilities. By merging

technology with traditional personal banking relationships, the

Bank will effectively provide the right blend of service and

convenience to its customer base.

First Bank's capital position and liquidity

remain strong, with a stockholders' equity to assets ratio of

10.44% and tangible stockholders' equity to tangible assets ratiov

of 9.83%. Mr. Ryan expressed his confidence in the Bank’s ability

to expand relationships with new and existing customers, maintain a

strong asset quality position, and effectively manage expenses,

even in the face of inflationary and competitive pressures.

Mr. Ryan concluded that “Our results during the

first quarter of 2023 demonstrate the strength of our relationships

and the quality of our community-focused business model. While we

are required to report on a quarterly basis, we continue to think

strategically with a long-term goal of generating superior returns

through the cycle. Short-term industry headwinds will not distract

us from achieving our long-term value-creation goals. As I look

toward the rest of this year, our new C&I business units,

enhanced technology capabilities and our integrated franchise

across the wealth belts of New Jersey and mainline Philadelphia

will leave us very well positioned to take advantage of a better

interest rate environment and continued strong demand for community

banking services.”

Income Statement

In the first quarter of 2023, First Bank's net

interest income increased to $22.8 million, representing a rise of

$1.6 million, or 7.8%, compared to the same period in 2022. The

increase was primarily driven by the $232.4 million increase in

average loans in the first quarter of 2023 compared to the first

quarter of 2022.

The Bank's tax equivalent net interest margin

decreased by five basis points to 3.52% compared to the prior year

quarter and by 17 basis points from the fourth quarter of 2022. The

decrease was primarily driven by the increase in deposit costs

which was partially offset by the increase in average loan

yields.

The Bank's provision for credit losses increased

to $1.1 million in the first quarter of 2023, compared to $642,000

in the same period of the previous year and $716,000 in the

preceding quarter of 2022. The increase was in line with organic

loan growth.

In the first quarter of 2023, non-interest

income was $964,000, a decrease from $1.3 million during the same

period in 2022. The decrease was primarily due to approximately

$6.8 million in investment sales in the first quarter of 2023,

which generated $207,000 in losses on sales of securities and a

decline in loan fees, primarily loan swap fees, of $156,000. The

declines were partially offset by a $104,000 increase in gains on

sale of loans. The investment sales were executed to generate

additional cash, earning a higher yield to the investments sold

with an anticipated earn-back on the losses of less than 18 months.

Loan swap activity continues to be slow which resulted in the

reduced loan swap income, but SBA loan sale activity picked up

during the first quarter of 2023.

Non-interest expense for the first quarter of

2023 was $13.5 million, an increase of $2.4 million, or 21.4%,

compared to $11.1 million for the prior year quarter. The higher

non-interest expense was primarily due to a $1.3 million or 20.3%

increase in salaries and employee benefits, and $461,000 in

merger-related costs in the first quarter of 2023. The increase in

salaries and employee benefits was due to both merit adjustments

and inflationary market adjustments, increased headcount, primarily

due to new locations and growth initiatives, and increases in

employee benefit costs.

On a linked quarter basis, first quarter 2023

non-interest expense increased $1.0 million, or 8.3%, compared to

$12.5 million for the fourth quarter of 2022 primarily due to

higher salaries and employee benefits and occupancy and equipment

expense. The increase in salaries and employee benefits was due to

the same factors as noted above, and the increase in occupancy

expense was primarily due to the Bank’s new northern New Jersey

regional banking center in Fairfield, New Jersey and the Bank’s

move into an upgraded branch and regional center in West Chester,

Pennsylvania.

The Bank's income tax expense for the first

quarter of 2023 was $2.2 million with an effective tax rate of

23.7%, compared to $2.5 million with an effective tax rate of 23.4%

for the first quarter of 2022 and $2.9 million with an effective

tax rate of 24.3% for the fourth quarter of 2022.

Balance Sheet

First Bank reported total assets of $2.82

billion as of March 31, 2023, an increase of $84.0 million, or

3.1%, from $2.73 billion at December 31, 2022. The Bank's increase

in loans during the twelve-month period ended March 31, 2023,

reflects growth of $227.6 million, which is in line with the Bank's

target loan growth rate for the period.

As of March 31, 2023, the Bank's total deposits

were $2.24 billion, an increase of $63.9 million, or 2.9%, from

$2.18 billion at March 31, 2022, but a decrease of $52.1 million,

or 2.3%, from $2.29 billion at December 31, 2022.

Non-interest-bearing deposits totaled $463.9 million at March 31,

2023, which represents a decrease of $39.9 million, or 7.9%, from

December 31, 2022. In contrast, time deposits increased from 23.1%

of total deposits at December 31, 2022, to 24.7% at March 31, 2023,

a result of customers moving into time deposit products to obtain a

higher yield.

As of March 31, 2023, the Bank's stockholders'

equity totaled $294.2 million, growth of $4.7 million, or 1.6%,

compared to $289.6 million at December 31, 2022. The increase was

mainly driven by the first-quarter 2023 net income and a decline in

accumulated other comprehensive loss. The increase was offset

somewhat by the Bank’s $1.2 million in cash dividends during the

three months ended March 31, 2023.

As of March 31, 2023, the Bank continued to

exceed all regulatory capital requirements to be considered

well-capitalized with a Tier 1 Leverage ratio of 10.30%, a Tier 1

Risk-Based capital ratio of 10.30%, a Common Equity Tier 1 Capital

ratio of 10.30%, and a Total Risk-Based capital ratio of 12.51%.

The Bank's strong capital position provides a cushion against

potential losses and supports its ability to pursue growth

opportunities.

Asset Quality

First Bank's asset quality metrics for the first

quarter of 2023 remained favorable, with net charge-offs of

$315,000 compared to a net recovery of $213,000 in the previous

quarter and net charge-offs of $247,000 in the first quarter of

2022. Nonperforming loans increased from $6.3 million at December

31, 2022, to $7.8 million at March 31, 2023, although they

decreased from $12.6 million at the end of the first quarter of

2022. Nonperforming loans as a percentage of total loans were 0.33%

at March 31, 2023, up from 0.27% at December 31, 2022, but down

from 0.58% at the end of the first quarter of 2022. Despite the

slight increase in nonperforming loans, the allowance for loan

credit losses to nonperforming loans remains healthy at 382.3% at

March 31, 2023, which was a modest decrease from 407.6% at December

31, 2022, but a significant increase from 191.7% at the end of the

first quarter of 2022. The allowance for credit losses as a

percentage of total loans increased to 1.25% at March 31, 2023 from

1.09% at December 31, 2022, primarily due to the implementation of

the adoption of the Current Expected Credit Losses (CECL)

accounting standard during the first quarter of 2023.

Balance Sheet Positioning for the

Current Environment

First Bank enhanced its liquidity position in

the first quarter of 2023. Total cash and cash equivalents

increased $35.1 million during the first quarter to $161.0 million

at March 31, 2023. The decline in deposits and the increased use of

the Bank’s insured reciprocal deposit product contributed to a

decline in adjusted estimated uninsured deposits (estimated

uninsured deposits minus uninsured deposits of states and political

subdivisions which are secured or collateralized as required under

state law) from $808.1 million at December 31, 2022 to $628.5

million at March 31, 2023.

During the first quarter of 2023 the Bank sold

approximately $6.9 million in available for sale securities,

significantly increased its available funding with the Federal Home

Loan Bank through pledging additional commercial loans, and

registered for the Federal Reserve’s Bank Term Funding Program

(BTFP). Subsequent to quarter end, the Bank has rolled out some

enhanced in-market deposit promotions and added additional

collateral for the BTFP and Federal Reserve discount window. These

actions have led to a significantly improved available liquidity

position. Our available liquidity to adjusted estimated uninsured

deposits ratio was approximately 100% at March 31, 2023. Available

liquidity includes cash and due from banks, market value of the

Bank’s investment securities, currently available funding sources

minus pledged securities and restricted cash. This enhanced

liquidity position coupled with the flexibility that the Bank will

gain after the Malvern Bancorp transaction is closed, provides the

Bank with a strong liquidity base and a diverse source of funding

options.

The tangible stockholders' equity to tangible

assets ratio was 9.83% as of March 31, 2023, indicating that the

Bank has a sufficient cushion to absorb potential losses.

Overall, First Bank has a strong capital and

liquidity position, which it believes provides a solid foundation

to navigate future challenges that may arise. The Bank is committed

to managing risk prudently while pursuing growth opportunities and

delivering value to its shareholders.

Cash Dividend Declared

On April 18, 2023, First Bank’s Board of

Directors declared a quarterly cash dividend of $0.06 per share to

common stockholders of record at the close of business on May 12,

2023, payable on May 24, 2023.

Conference Call

First Bank will host its earnings call on

Thursday, April 27, 2023 at 9:00 AM eastern time. The direct dial

toll free number for the live call is 1-844-200-6205 and the access

code is 583346. For those unable to participate in the call, a

replay will be available by dialing 1-866-813-9403 (access code

164395) from one hour after the end of the conference call until

July 25, 2023. Replay information will also be available on First

Bank’s website at www.firstbanknj.com under the “About Us” tab.

Click on “Investor Relations” to access the replay of the

conference call.

About First Bank

First Bank is a New Jersey state-chartered bank

with 18 full-service branches in Cinnaminson, Cranbury, Delanco,

Denville, Ewing, Flemington (2), Hamilton, Lawrence, Monroe,

Pennington, Randolph, Somerset and Williamstown, New Jersey; and

Doylestown, Trevose, Warminster and West Chester, Pennsylvania.

With $2.8 billion in assets as of March 31, 2023, First Bank offers

a full range of deposit and loan products to individuals and

businesses throughout the New York City to Philadelphia corridor.

First Bank's common stock is listed on the Nasdaq Global Market

under the symbol “FRBA.”

Forward Looking Statements

This press release contains certain

forward-looking statements, either express or implied, within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include information regarding First

Bank’s future financial performance, business and growth strategy,

projected plans and objectives, and related transactions,

integration of acquired businesses, ability to recognize

anticipated operational efficiencies, and other projections based

on macroeconomic and industry trends, which are inherently

unreliable due to the multiple factors that impact economic trends,

and any such variations may be material. Such forward-looking

statements are based on various facts and derived utilizing

important assumptions, current expectations, estimates and

projections about First Bank, any of which may change over time and

some of which may be beyond First Bank’s control. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. Further, certain factors that could affect our future

results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not

limited to: whether First Bank can: successfully implement its

growth strategy, including identifying acquisition targets and

consummating suitable acquisitions, sustain its internal growth

rate, and provide competitive products and services that appeal to

its customers and target markets; difficult market conditions and

unfavorable economic trends in the United States generally, and

particularly in the market areas in which First Bank operates and

in which its loans are concentrated, including the effects of

declines in housing market values; the effects of the recent

turmoil in the banking industry (including the failures of two

financial institutions); the impact of disease pandemics, including

COVID-19, on First Bank, its operations and its customers and

employees; an increase in unemployment levels and slowdowns in

economic growth; First Bank's level of nonperforming assets and the

costs associated with resolving any problem loans including

litigation and other costs; changes in market interest rates may

increase funding costs and reduce earning asset yields thus

reducing margin; the impact of changes in interest rates and the

credit quality and strength of underlying collateral and the effect

of such changes on the market value of First Bank's investment

securities portfolio; the extensive federal and state regulation,

supervision and examination governing almost every aspect of First

Bank's operations, including changes in regulations affecting

financial institutions and expenses associated with complying with

such regulations; uncertainties in tax estimates and valuations,

including due to changes in state and federal tax law; First Bank's

ability to comply with applicable capital and liquidity

requirements, including First Bank’s ability to generate liquidity

internally or raise capital on favorable terms, including continued

access to the debt and equity capital markets; and possible changes

in trade, monetary and fiscal policies, laws and regulations and

other activities of governments, agencies, and similar

organizations. For discussion of these and other risks that may

cause actual results to differ from expectations, please refer to

“Forward-Looking Statements” and “Risk Factors” in First Bank’s

Annual Report on Form 10-K and any updates to those risk factors

set forth in First Bank’s proxy statement, subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K. If one or more

events related to these or other risks or uncertainties

materialize, or if First Bank’s underlying assumptions prove to be

incorrect, actual results may differ materially from what First

Bank anticipates. Accordingly, you should not place undue reliance

on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and First

Bank does not undertake any obligation to publicly update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. All forward-looking

statements, expressed or implied, included in this communication

are expressly qualified in their entirety by this cautionary

statement. This cautionary statement should also be considered in

connection with any subsequent written or oral forward-looking

statements that First Bank or persons acting on First Bank’s behalf

may issue.

___________________________________

i Return on average tangible equity is a non-U.S. GAAP financial

measure and is calculated by dividing net income by average

tangible equity (average equity minus average goodwill and other

intangible assets). For a reconciliation of this non-U.S. GAAP

financial measure, along with the other non-U.S. GAAP financial

measures in this press release, to their comparable U.S. GAAP

measures, see the financial reconciliations at the end of this

press release.

ii Adjusted diluted earnings per share, adjusted return on

average assets and adjusted return on average tangible equity are

non-U.S. GAAP financial measures and are calculated by dividing net

income adjusted for certain merger-related expenses and other

one-time gains or expenses by diluted weighted average shares,

average assets and average tangible equity, respectively. For a

reconciliation of these non-U.S. GAAP financial measures, along

with the other non-U.S. GAAP financial measures in this press

release, to their comparable U.S. GAAP measures, see the financial

reconciliations at the end of this press release.

iii The efficiency ratio is a non-U.S. GAAP financial measure

and is calculated by dividing non-interest expense less

merger-related expenses by adjusted total revenue (net interest

income plus non-interest income). For a reconciliation of this

non-U.S. GAAP financial measure, along with the other non-U.S. GAAP

financial measures in this press release, to their comparable U.S.

GAAP measures, see the financial reconciliations at the end of this

press release.

iv Tangible book value per share is a non-U.S. GAAP financial

measure and is calculated by dividing common shares outstanding by

tangible equity (equity minus goodwill and other intangible

assets). For a reconciliation of this non-U.S. GAAP financial

measure, along with the other non-U.S. GAAP financial measures in

this press release, to their comparable U.S. GAAP measures, see the

financial reconciliations at the end of this press release.

v Tangible stockholders' equity to tangible assets ratio is a

non-U.S. GAAP financial measure and is calculated by dividing

tangible equity (equity minus goodwill and other intangible assets)

by tangible assets (total assets minus goodwill and other

intangible assets). For a reconciliation of this non-U.S. GAAP

financial measure, along with the other non-U.S. GAAP financial

measures in this press release, to their comparable U.S. GAAP

measures, see the financial reconciliations at the end of this

press release.

CONTACT: Andrew Hibshman, Chief Financial

Officer(609) 643-0058, andrew.hibshman@firstbanknj.com

| FIRST BANK

AND SUBSIDIARIES |

|

| CONSOLIDATED

STATEMENTS OF FINANCIAL CONDITION |

|

| (in

thousands, except for share data, unaudited) |

|

| |

|

| |

|

|

|

March 31, 2023 |

|

December 31, 2022 |

|

|

Assets |

|

|

|

|

|

|

Cash and due from banks |

$ |

20,627 |

|

|

$ |

17,577 |

|

|

|

Restricted cash |

|

11,700 |

|

|

|

13,580 |

|

|

|

Interest bearing deposits with banks |

|

128,715 |

|

|

|

94,759 |

|

|

| |

|

Cash and cash equivalents |

|

161,042 |

|

|

|

125,916 |

|

|

|

Interest bearing time deposits with banks |

|

747 |

|

|

|

1,293 |

|

|

|

Investment securities available for sale, at fair value |

|

91,818 |

|

|

|

98,956 |

|

|

|

Investment securities held to maturity, net of allowance for

securities credit losses of |

|

|

|

| |

$227 at March 31, 2023 and $0 at December 31, 2022 (fair value of

$41,773 at |

|

|

|

| |

March 31, 2023 and $42,465 at December 31, 2022) |

|

46,270 |

|

|

|

47,193 |

|

|

|

Restricted investment in bank stocks |

|

12,180 |

|

|

|

6,214 |

|

|

|

Other investments |

|

8,829 |

|

|

|

8,372 |

|

|

|

Loans, net of deferred fees and costs |

|

2,392,583 |

|

|

|

2,337,814 |

|

|

| |

Less: Allowance for loan credit losses |

|

29,893 |

|

|

|

25,474 |

|

|

| |

|

Net loans |

|

2,362,690 |

|

|

|

2,312,340 |

|

|

|

Premises and equipment, net |

|

11,502 |

|

|

|

10,550 |

|

|

|

Other real estate owned, net |

|

- |

|

|

|

- |

|

|

|

Accrued interest receivable |

|

8,562 |

|

|

|

8,164 |

|

|

|

Bank-owned life insurance |

|

58,476 |

|

|

|

58,107 |

|

|

|

Goodwill |

|

17,826 |

|

|

|

17,826 |

|

|

|

Other intangible assets, net |

|

1,496 |

|

|

|

1,579 |

|

|

|

Deferred income taxes, net |

|

13,679 |

|

|

|

13,155 |

|

|

|

Other assets |

|

21,780 |

|

|

|

23,275 |

|

|

| |

|

Total assets |

$ |

2,816,897 |

|

|

$ |

2,732,940 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Liabilities: |

|

|

|

|

|

Non-interest bearing deposits |

$ |

463,926 |

|

|

$ |

503,856 |

|

|

|

Interest bearing deposits |

|

1,777,878 |

|

|

|

1,790,096 |

|

|

| |

|

Total deposits |

|

2,241,804 |

|

|

|

2,293,952 |

|

|

|

Borrowings |

|

223,416 |

|

|

|

90,932 |

|

|

|

Subordinated debentures |

|

29,759 |

|

|

|

29,731 |

|

|

|

Accrued interest payable |

|

1,968 |

|

|

|

1,218 |

|

|

|

Other liabilities |

|

25,729 |

|

|

|

27,545 |

|

|

| |

|

Total liabilities |

|

2,522,676 |

|

|

|

2,443,378 |

|

|

|

Stockholders' Equity: |

|

|

|

|

|

Preferred stock, par value $2 per share; 10,000,000 shares

authorized; |

|

|

|

|

| |

no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

|

Common stock, par value $5 per share; 40,000,000 shares authorized;

21,200,398 |

|

|

|

| |

shares issued and 19,569,334 shares outstanding at March 31, 2023

and |

|

|

|

|

| |

21,082,819 shares issued and 19,451,755 shares outstanding at

December 31, 2022 |

|

104,862 |

|

|

|

104,512 |

|

|

|

Additional paid-in capital |

|

80,718 |

|

|

|

80,695 |

|

|

|

Retained earnings |

|

130,808 |

|

|

|

127,532 |

|

|

|

Accumulated other comprehensive loss |

|

(6,324 |

) |

|

|

(7,334 |

) |

|

|

Treasury stock, 1,631,064 shares at March 31, 2023 and December 31,

2022 |

|

(15,843 |

) |

|

|

(15,843 |

) |

|

| |

|

Total stockholders' equity |

|

294,221 |

|

|

|

289,562 |

|

|

| |

|

Total liabilities and stockholders' equity |

$ |

2,816,897 |

|

|

$ |

2,732,940 |

|

|

| |

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| CONSOLIDATED

STATEMENTS OF INCOME |

| (in

thousands, except for share data, unaudited) |

| |

| |

|

|

|

Three Months

Ended |

| |

|

|

|

March 31, |

| |

|

|

|

|

2023 |

|

|

|

2022 |

|

Interest and Dividend Income |

|

|

|

|

Investment securities—taxable |

$ |

1,022 |

|

|

$ |

576 |

|

Investment securities—tax-exempt |

|

38 |

|

|

|

37 |

|

Interest bearing deposits with banks, |

|

|

|

|

Federal funds sold and other |

|

1,252 |

|

|

|

130 |

|

Loans, including fees |

|

31,700 |

|

|

|

22,143 |

| |

Total interest and dividend income |

|

34,012 |

|

|

|

22,886 |

| |

|

|

|

|

|

|

|

Interest Expense |

|

|

|

|

Deposits |

|

|

9,413 |

|

|

|

1,009 |

|

Borrowings |

|

1,364 |

|

|

|

288 |

|

Subordinated debentures |

|

440 |

|

|

|

440 |

| |

Total interest expense |

|

11,217 |

|

|

|

1,737 |

|

Net interest income |

|

22,795 |

|

|

|

21,149 |

|

Credit loss expense |

|

1,091 |

|

|

|

642 |

| |

Net interest income after credit loss expense |

|

21,704 |

|

|

|

20,507 |

| |

|

|

|

|

|

|

|

Non-Interest Income |

|

|

|

|

Service fees on deposit accounts |

|

228 |

|

|

|

252 |

|

Loan fees |

|

|

89 |

|

|

|

245 |

|

Income from bank-owned life insurance |

|

369 |

|

|

|

373 |

|

Losses on sale of investment securities, net |

|

(207 |

) |

|

|

- |

|

Gains on sale of loans |

|

141 |

|

|

|

37 |

|

Gains on recovery of acquired loans |

|

57 |

|

|

|

124 |

|

Other non-interest income |

|

287 |

|

|

|

236 |

| |

Total non-interest income |

|

964 |

|

|

|

1,267 |

| |

|

|

|

|

|

|

|

Non-Interest Expense |

|

|

|

|

Salaries and employee benefits |

|

7,872 |

|

|

|

6,544 |

|

Occupancy and equipment |

|

1,579 |

|

|

|

1,424 |

|

Legal fees |

|

203 |

|

|

|

142 |

|

Other professional fees |

|

651 |

|

|

|

687 |

|

Regulatory fees |

|

234 |

|

|

|

193 |

|

Directors' fees |

|

214 |

|

|

|

218 |

|

Data processing |

|

618 |

|

|

|

596 |

|

Marketing and advertising |

|

240 |

|

|

|

164 |

|

Travel and entertainment |

|

219 |

|

|

|

88 |

|

Insurance |

|

|

173 |

|

|

|

165 |

|

Other real estate owned expense, net |

|

18 |

|

|

|

83 |

|

Merger-related expenses |

|

461 |

|

|

|

- |

|

Other expense |

|

1,021 |

|

|

|

818 |

| |

Total non-interest expense |

|

13,503 |

|

|

|

11,122 |

|

Income Before Income Taxes |

|

9,165 |

|

|

|

10,652 |

|

Income tax expense |

|

2,176 |

|

|

|

2,494 |

|

Net Income |

$ |

6,989 |

|

|

$ |

8,158 |

| |

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.36 |

|

|

$ |

0.42 |

|

Diluted earnings per common share |

$ |

0.36 |

|

|

$ |

0.41 |

|

Cash dividends per common share |

$ |

0.06 |

|

|

$ |

0.06 |

| |

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

19,503,013 |

|

|

|

19,532,811 |

|

Diluted weighted average common shares outstanding |

|

19,667,194 |

|

|

|

19,768,452 |

| |

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| AVERAGE

BALANCE SHEETS WITH INTEREST AND AVERAGE RATES |

| (dollars in

thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

|

2023 |

|

|

|

2022 |

|

| |

Average |

|

|

|

Average |

Average |

|

|

|

Average |

| |

Balance |

|

Interest |

|

Rate(5) |

|

Balance |

|

Interest |

|

Rate(5) |

|

Interest earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities (1) (2) |

$ |

153,760 |

|

|

$ |

1,068 |

|

|

2.82 |

% |

|

$ |

134,033 |

|

|

$ |

621 |

|

|

1.88 |

% |

| Loans

(3) |

|

2,363,365 |

|

|

|

31,700 |

|

|

5.44 |

% |

|

|

2,131,014 |

|

|

|

22,143 |

|

|

4.21 |

% |

| Interest

bearing deposits with banks, |

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds sold and other |

|

96,071 |

|

|

|

1,084 |

|

|

4.58 |

% |

|

|

121,422 |

|

|

|

50 |

|

|

0.17 |

% |

| Restricted

investment in bank stocks |

|

8,257 |

|

|

|

101 |

|

|

4.96 |

% |

|

|

5,616 |

|

|

|

63 |

|

|

4.55 |

% |

| Other

investments |

|

8,641 |

|

|

|

67 |

|

|

3.14 |

% |

|

|

8,073 |

|

|

|

17 |

|

|

0.85 |

% |

|

Total interest earning assets(2) |

|

2,630,094 |

|

|

|

34,020 |

|

|

5.25 |

% |

|

|

2,400,158 |

|

|

|

22,894 |

|

|

3.87 |

% |

| Allowance

for loan losses |

|

(29,331 |

) |

|

|

|

|

|

|

(24,057 |

) |

|

|

|

|

| Non-interest

earning assets |

|

144,472 |

|

|

|

|

|

|

|

146,674 |

|

|

|

|

|

|

Total assets |

$ |

2,745,235 |

|

|

|

|

|

|

$ |

2,522,775 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

| Interest

bearing demand deposits |

$ |

319,242 |

|

|

$ |

979 |

|

|

1.24 |

% |

|

$ |

298,274 |

|

|

$ |

61 |

|

|

0.08 |

% |

| Money market

deposits |

|

756,490 |

|

|

|

4,987 |

|

|

2.67 |

% |

|

|

706,368 |

|

|

|

448 |

|

|

0.26 |

% |

| Savings

deposits |

|

153,639 |

|

|

|

346 |

|

|

0.91 |

% |

|

|

190,222 |

|

|

|

164 |

|

|

0.35 |

% |

| Time

deposits |

|

532,997 |

|

|

|

3,101 |

|

|

2.36 |

% |

|

|

350,223 |

|

|

|

336 |

|

|

0.39 |

% |

| Total

interest bearing deposits |

|

1,762,368 |

|

|

|

9,413 |

|

|

2.17 |

% |

|

|

1,545,087 |

|

|

|

1,009 |

|

|

0.26 |

% |

|

Borrowings |

|

131,211 |

|

|

|

1,364 |

|

|

4.22 |

% |

|

|

76,492 |

|

|

|

288 |

|

|

1.53 |

% |

| Subordinated

debentures |

|

29,742 |

|

|

|

440 |

|

|

5.92 |

% |

|

|

29,632 |

|

|

|

440 |

|

|

5.94 |

% |

|

Total interest bearing liabilities |

|

1,923,321 |

|

|

|

11,217 |

|

|

2.37 |

% |

|

|

1,651,211 |

|

|

|

1,737 |

|

|

0.43 |

% |

| Non-interest

bearing deposits |

|

499,989 |

|

|

|

|

|

|

|

583,543 |

|

|

|

|

|

| Other

liabilities |

|

29,751 |

|

|

|

|

|

|

|

17,874 |

|

|

|

|

|

|

Stockholders' equity |

|

292,174 |

|

|

|

|

|

|

|

270,147 |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

2,745,235 |

|

|

|

|

|

|

$ |

2,522,775 |

|

|

|

|

|

| Net interest

income/interest rate spread (2) |

|

|

|

22,803 |

|

|

2.88 |

% |

|

|

|

|

21,157 |

|

|

3.44 |

% |

| Net interest

margin (2) (4) |

|

|

|

|

3.52 |

% |

|

|

|

|

|

3.57 |

% |

| Tax

equivalent adjustment (2) |

|

|

|

(8 |

) |

|

|

|

|

|

|

(8 |

) |

|

|

| Net interest

income |

|

|

$ |

22,795 |

|

|

|

|

|

|

$ |

21,149 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (1) Average balance of

investment securities available for sale is based on amortized

cost. |

|

|

|

|

|

|

| (2) Interest and

average rates are presented on a tax equivalent basis using a

federal income tax rate of 21%. |

|

|

|

|

| (3) Average balances

of loans include loans on nonaccrual

status. |

|

|

| (4) Net interest

income divided by average total interest earning

assets. |

|

|

| (5)

Annualized. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| QUARTERLY

FINANCIAL HIGHLIGHTS |

| (in

thousands, except for share and employee data,

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of or For the Quarter Ended |

| |

|

3/31/2023 |

|

12/31/2022 |

|

9/30/2022 |

|

6/30/2022 |

|

3/31/2022 |

|

EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

22,795 |

|

|

$ |

23,751 |

|

|

$ |

24,563 |

|

|

$ |

22,910 |

|

|

$ |

21,149 |

|

|

Provision for loan losses |

|

|

1,091 |

|

|

|

716 |

|

|

|

216 |

|

|

|

1,298 |

|

|

|

642 |

|

|

Non-interest income |

|

|

964 |

|

|

|

1,446 |

|

|

|

944 |

|

|

|

1,463 |

|

|

|

1,267 |

|

|

Non-interest expense |

|

|

13,503 |

|

|

|

12,465 |

|

|

|

11,737 |

|

|

|

11,409 |

|

|

|

11,122 |

|

|

Income tax expense |

|

|

2,176 |

|

|

|

2,916 |

|

|

|

3,348 |

|

|

|

2,843 |

|

|

|

2,494 |

|

|

Net income |

|

|

6,989 |

|

|

|

9,100 |

|

|

|

10,206 |

|

|

|

8,823 |

|

|

|

8,158 |

|

| |

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

|

1.03 |

% |

|

|

1.35 |

% |

|

|

1.57 |

% |

|

|

1.38 |

% |

|

|

1.31 |

% |

|

Adjusted return on average assets (1) (2) |

|

|

1.11 |

% |

|

|

1.40 |

% |

|

|

1.57 |

% |

|

|

1.38 |

% |

|

|

1.31 |

% |

|

Return on average equity (1) |

|

|

9.70 |

% |

|

|

12.61 |

% |

|

|

14.46 |

% |

|

|

12.92 |

% |

|

|

12.25 |

% |

|

Adjusted return on average equity (1) (2) |

|

|

10.43 |

% |

|

|

13.11 |

% |

|

|

14.46 |

% |

|

|

12.92 |

% |

|

|

12.25 |

% |

|

Return on average tangible equity (1) (2) |

|

|

10.39 |

% |

|

|

13.53 |

% |

|

|

15.55 |

% |

|

|

13.93 |

% |

|

|

13.22 |

% |

|

Adjusted return on average tangible equity (1) (2) |

|

|

11.17 |

% |

|

|

14.07 |

% |

|

|

15.55 |

% |

|

|

13.93 |

% |

|

|

13.22 |

% |

|

Net interest margin (1) (3) |

|

|

3.52 |

% |

|

|

3.69 |

% |

|

|

3.97 |

% |

|

|

3.76 |

% |

|

|

3.57 |

% |

|

Total cost of deposits (1) |

|

|

1.69 |

% |

|

|

1.21 |

% |

|

|

0.50 |

% |

|

|

0.23 |

% |

|

|

0.19 |

% |

|

Efficiency ratio (2) |

|

|

54.42 |

% |

|

|

47.68 |

% |

|

|

46.01 |

% |

|

|

46.81 |

% |

|

|

49.62 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding |

|

|

19,569,334 |

|

|

|

19,451,755 |

|

|

|

19,447,206 |

|

|

|

19,483,415 |

|

|

|

19,634,744 |

|

|

Basic earnings per share |

|

$ |

0.36 |

|

|

$ |

0.47 |

|

|

$ |

0.52 |

|

|

$ |

0.45 |

|

|

$ |

0.42 |

|

|

Diluted earnings per share |

|

|

0.36 |

|

|

|

0.46 |

|

|

|

0.52 |

|

|

|

0.45 |

|

|

|

0.41 |

|

|

Adjusted diluted earnings per share (2) |

|

|

0.38 |

|

|

|

0.48 |

|

|

|

0.52 |

|

|

|

0.45 |

|

|

|

0.41 |

|

|

Tangible book value per share (2) |

|

|

14.05 |

|

|

|

13.89 |

|

|

|

13.43 |

|

|

|

13.08 |

|

|

|

12.79 |

|

|

Book value per share |

|

|

15.03 |

|

|

|

14.89 |

|

|

|

14.44 |

|

|

|

14.10 |

|

|

|

13.81 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

MARKET DATA |

|

|

|

|

|

|

|

|

|

|

|

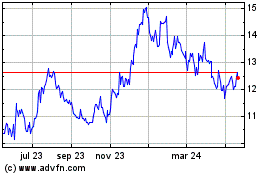

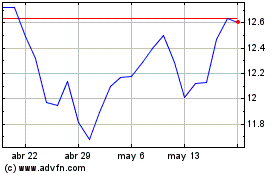

Market value per share |

|

$ |

10.10 |

|

|

$ |

13.76 |

|

|

$ |

13.67 |

|

|

$ |

13.98 |

|

|

$ |

14.22 |

|

|

Market value / Tangible book value |

|

|

71.90 |

% |

|

|

99.07 |

% |

|

|

101.80 |

% |

|

|

106.84 |

% |

|

|

111.14 |

% |

|

Market capitalization |

|

$ |

197,650 |

|

|

$ |

267,656 |

|

|

$ |

265,843 |

|

|

$ |

272,378 |

|

|

$ |

279,206 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

CAPITAL & LIQUIDITY |

|

|

|

|

|

|

|

|

|

|

|

Tangible stockholders' equity / tangible assets (2) |

|

|

9.83 |

% |

|

|

9.96 |

% |

|

|

9.97 |

% |

|

|

9.95 |

% |

|

|

9.79 |

% |

|

Stockholders' equity / assets |

|

|

10.44 |

% |

|

|

10.60 |

% |

|

|

10.64 |

% |

|

|

10.64 |

% |

|

|

10.48 |

% |

|

Loans / deposits |

|

|

106.73 |

% |

|

|

101.91 |

% |

|

|

103.34 |

% |

|

|

103.15 |

% |

|

|

99.41 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY |

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs (recoveries) |

|

$ |

315 |

|

|

$ |

(213 |

) |

|

$ |

705 |

|

|

$ |

404 |

|

|

$ |

247 |

|

|

Nonperforming loans |

|

|

7,820 |

|

|

|

6,250 |

|

|

|

5,107 |

|

|

|

11,888 |

|

|

|

12,591 |

|

|

Nonperforming assets |

|

|

7,820 |

|

|

|

6,250 |

|

|

|

5,400 |

|

|

|

12,181 |

|

|

|

12,884 |

|

|

Net charge offs (recoveries) / average loans (1) |

|

|

0.05 |

% |

|

|

(0.04 |

%) |

|

|

0.13 |

% |

|

|

0.07 |

% |

|

|

0.05 |

% |

|

Nonperforming loans / total loans |

|

|

0.33 |

% |

|

|

0.27 |

% |

|

|

0.23 |

% |

|

|

0.53 |

% |

|

|

0.58 |

% |

|

Nonperforming assets / total assets |

|

|

0.28 |

% |

|

|

0.23 |

% |

|

|

0.20 |

% |

|

|

0.47 |

% |

|

|

0.50 |

% |

|

Allowance for loan losses / total loans |

|

|

1.25 |

% |

|

|

1.09 |

% |

|

|

1.08 |

% |

|

|

1.12 |

% |

|

|

1.12 |

% |

|

Allowance for loan losses / nonperforming loans |

|

|

382.26 |

% |

|

|

407.58 |

% |

|

|

480.61 |

% |

|

|

210.58 |

% |

|

|

191.72 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

2,816,897 |

|

|

$ |

2,732,940 |

|

|

$ |

2,638,060 |

|

|

$ |

2,581,192 |

|

|

$ |

2,587,038 |

|

|

Total loans |

|

|

2,392,583 |

|

|

|

2,337,814 |

|

|

|

2,263,377 |

|

|

|

2,233,278 |

|

|

|

2,164,944 |

|

|

Total deposits |

|

|

2,241,804 |

|

|

|

2,293,952 |

|

|

|

2,190,192 |

|

|

|

2,165,163 |

|

|

|

2,177,895 |

|

|

Total stockholders' equity |

|

|

294,221 |

|

|

|

289,562 |

|

|

|

280,749 |

|

|

|

274,702 |

|

|

|

271,068 |

|

|

Number of full-time equivalent employees (4) |

|

|

252 |

|

|

|

238 |

|

|

|

228 |

|

|

|

233 |

|

|

|

219 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (1)

Annualized. |

|

|

|

|

|

|

|

|

|

|

| (2) Non-U.S. GAAP

financial measure that we believe provides management and investors

with information that is useful in understanding our |

| financial performance

and condition. See accompanying table, "Non-U.S. GAAP Financial

Measures," for calculation and reconciliation. |

| (3) Tax equivalent

using a federal income tax rate of

21%. |

| (4) Includes 8

full-time equivalent seasonal interns as of June 30,

2022. |

| |

|

|

|

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| QUARTERLY

FINANCIAL HIGHLIGHTS |

| (dollars in

thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

As of the Quarter Ended |

| |

|

|

3/31/2023 |

|

12/31/2022 |

|

9/30/2022 |

|

6/30/2022 |

|

3/31/2022 |

|

LOAN COMPOSITION |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

$ |

394,734 |

|

|

$ |

354,203 |

|

|

$ |

323,984 |

|

|

$ |

321,205 |

|

|

$ |

321,979 |

|

|

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

Owner-occupied |

|

|

539,112 |

|

|

|

533,426 |

|

|

|

517,448 |

|

|

|

523,108 |

|

|

|

499,379 |

|

| |

Investor |

|

|

958,574 |

|

|

|

951,115 |

|

|

|

942,151 |

|

|

|

925,643 |

|

|

|

896,435 |

|

| |

Construction

and development |

|

|

143,955 |

|

|

|

142,876 |

|

|

|

126,206 |

|

|

|

117,011 |

|

|

|

96,585 |

|

| |

Multi-family |

|

|

220,101 |

|

|

|

215,990 |

|

|

|

214,819 |

|

|

|

201,269 |

|

|

|

193,865 |

|

| |

Total commercial real estate |

|

|

1,861,742 |

|

|

|

1,843,407 |

|

|

|

1,800,624 |

|

|

|

1,767,031 |

|

|

|

1,686,264 |

|

|

Residential real estate: |

|

|

|

|

|

|

|

|

|

|

| |

Residential

mortgage and first lien home equity loans |

|

|

94,060 |

|

|

|

93,847 |

|

|

|

96,194 |

|

|

|

98,841 |

|

|

|

99,992 |

|

| |

Home

equity–second lien loans and revolving lines of credit |

|

|

29,316 |

|

|

|

33,551 |

|

|

|

31,670 |

|

|

|

30,491 |

|

|

|

30,485 |

|

| |

Total residential real estate |

|

|

123,376 |

|

|

|

127,398 |

|

|

|

127,864 |

|

|

|

129,332 |

|

|

|

130,477 |

|

|

Consumer and other |

|

|

16,413 |

|

|

|

16,318 |

|

|

|

14,654 |

|

|

|

19,694 |

|

|

|

30,096 |

|

| |

Total loans

prior to deferred loan fees and costs |

|

|

2,396,265 |

|

|

|

2,341,326 |

|

|

|

2,267,126 |

|

|

|

2,237,262 |

|

|

|

2,168,816 |

|

|

Net deferred loan fees and costs |

|

|

(3,682 |

) |

|

|

(3,512 |

) |

|

|

(3,749 |

) |

|

|

(3,984 |

) |

|

|

(3,872 |

) |

| |

Total loans |

|

$ |

2,392,583 |

|

|

$ |

2,337,814 |

|

|

$ |

2,263,377 |

|

|

$ |

2,233,278 |

|

|

$ |

2,164,944 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

LOAN MIX |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

|

16.5 |

% |

|

|

15.2 |

% |

|

|

14.3 |

% |

|

|

14.4 |

% |

|

|

14.8 |

% |

|

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

| |

Owner-occupied |

|

|

22.5 |

% |

|

|

22.8 |

% |

|

|

22.9 |

% |

|

|

23.4 |

% |

|

|

23.1 |

% |

| |

Investor |

|

|

40.1 |

% |

|

|

40.7 |

% |

|

|

41.6 |

% |

|

|

41.5 |

% |

|

|

41.4 |

% |

| |

Construction

and development |

|

|

6.0 |

% |

|

|

6.1 |

% |

|

|

5.6 |

% |

|

|

5.2 |

% |

|

|

4.5 |

% |

| |

Multi-family |

|

|

9.2 |

% |

|

|

9.2 |

% |

|

|

9.5 |

% |

|

|

9.0 |

% |

|

|

8.9 |

% |

| |

Total commercial real estate |

|

|

77.8 |

% |

|

|

78.8 |

% |

|

|

79.6 |

% |

|

|

79.1 |

% |

|

|

77.9 |

% |

|

Residential real estate: |

|

|

|

|

|

|

|

|

|

|

| |

Residential

mortgage and first lien home equity loans |

|

|

3.9 |

% |

|

|

4.0 |

% |

|

|

4.3 |

% |

|

|

4.4 |

% |

|

|

4.6 |

% |

| |

Home

equity–second lien loans and revolving lines of credit |

|

|

1.2 |

% |

|

|

1.4 |

% |

|

|

1.4 |

% |

|

|

1.4 |

% |

|

|

1.4 |

% |

| |

Total residential real estate |

|

|

5.1 |

% |

|

|

5.4 |

% |

|

|

5.7 |

% |

|

|

5.8 |

% |

|

|

6.0 |

% |

|

Consumer and other |

|

|

0.7 |

% |

|

|

0.7 |

% |

|

|

0.6 |

% |

|

|

0.9 |

% |

|

|

1.4 |

% |

|

Net deferred loan fees and costs |

|

|

(0.1 |

%) |

|

|

(0.1 |

%) |

|

|

(0.2 |

%) |

|

|

(0.2 |

%) |

|

|

(0.1 |

%) |

| |

Total loans |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| QUARTERLY

FINANCIAL HIGHLIGHTS |

| (dollars in

thousands, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

As of the Quarter Ended |

| |

|

|

3/31/2023 |

|

12/31/2022 |

|

9/30/2022 |

|

6/30/2022 |

|

3/31/2022 |

|

DEPOSIT COMPOSITION |

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing demand deposits |

|

$ |

463,926 |

|

|

$ |

503,856 |

|

|

$ |

584,025 |

|

|

$ |

600,402 |

|

|

$ |

597,333 |

|

|

Interest bearing demand deposits |

|

|

310,140 |

|

|

|

322,944 |

|

|

|

343,042 |

|

|

|

318,687 |

|

|

|

314,564 |

|

|

Money market and savings deposits |

|

|

914,063 |

|

|

|

935,311 |

|

|

|

860,577 |

|

|

|

929,075 |

|

|

|

936,848 |

|

|

Time deposits |

|

|

553,675 |

|

|

|

531,841 |

|

|

|

402,549 |

|

|

|

316,999 |

|

|

|

329,150 |

|

|

|

Total Deposits |

|

$ |

2,241,804 |

|

|

$ |

2,293,952 |

|

|

$ |

2,190,193 |

|

|

$ |

2,165,163 |

|

|

$ |

2,177,895 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSIT MIX |

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing demand deposits |

|

|

20.7 |

% |

|

|

22.0 |

% |

|

|

26.7 |

% |

|

|

27.7 |

% |

|

|

27.4 |

% |

|

Interest bearing demand deposits |

|

|

13.8 |

% |

|

|

14.1 |

% |

|

|

15.7 |

% |

|

|

14.7 |

% |

|

|

14.5 |

% |

|

Money market and savings deposits |

|

|

40.8 |

% |

|

|

40.8 |

% |

|

|

39.3 |

% |

|

|

42.9 |

% |

|

|

43.0 |

% |

|

Time deposits |

|

|

24.7 |

% |

|

|

23.1 |

% |

|

|

18.3 |

% |

|

|

14.7 |

% |

|

|

15.1 |

% |

| |

Total

Deposits |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| NON-U.S.

GAAP FINANCIAL MEASURES |

| (in

thousands, except for share data, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

As of or For the Quarter Ended |

| |

3/31/2023 |

|

12/31/2022 |

|

9/30/2022 |

|

6/30/2022 |

|

3/31/2022 |

|

Return on Average Tangible Equity |

|

|

|

|

|

|

|

|

|

|

Net income (numerator) |

$ |

6,989 |

|

|

$ |

9,100 |

|

|

$ |

10,206 |

|

|

$ |

8,823 |

|

|

$ |

8,158 |

|

| |

|

|

|

|

|

|

|

|

|

| Average

stockholders' equity |

$ |

292,174 |

|

|

$ |

286,283 |

|

|

$ |

280,093 |

|

|

$ |

273,829 |

|

|

$ |

270,147 |

|

| Less:

Average Goodwill and other intangible assets, net |

|

19,379 |

|

|

|

19,533 |

|

|

|

19,669 |

|

|

|

19,823 |

|

|

|

19,916 |

|

| Average

Tangible stockholders' equity (denominator) |

$ |

272,795 |

|

|

$ |

266,750 |

|

|

$ |

260,424 |

|

|

$ |

254,006 |

|

|

$ |

250,231 |

|

| |

|

|

|

|

|

|

|

|

|

| Return on

Average Tangible equity (1) |

|

10.39 |

% |

|

|

13.53 |

% |

|

|

15.55 |

% |

|

|

13.93 |

% |

|

|

13.22 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Tangible Book Value Per Share |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

$ |

294,221 |

|

|

$ |

289,562 |

|

|

$ |

280,749 |

|

|

$ |

274,702 |

|

|

$ |

271,068 |

|

| Less:

Goodwill and other intangible assets, net |

|

19,322 |

|

|

|

19,405 |

|

|

|

19,599 |

|

|

|

19,768 |

|

|

|

19,854 |

|

| Tangible

stockholders' equity (numerator) |

$ |

274,899 |

|

|

$ |

270,157 |

|

|

$ |

261,150 |

|

|

$ |

254,934 |

|

|

$ |

251,214 |

|

| |

|

|

|

|

|

|

|

|

|

| Common

shares outstanding (denominator) |

|

19,569,334 |

|

|

|

19,451,755 |

|

|

|

19,447,206 |

|

|

|

19,483,415 |

|

|

|

19,634,744 |

|

| |

|

|

|

|

|

|

|

|

|

| Tangible

book value per share |

$ |

14.05 |

|

|

$ |

13.89 |

|

|

$ |

13.43 |

|

|

$ |

13.08 |

|

|

$ |

12.79 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Tangible Equity / Assets |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

$ |

294,221 |

|

|

$ |

289,562 |

|

|

$ |

280,749 |

|

|

$ |

274,702 |

|

|

$ |

271,068 |

|

| Less:

Goodwill and other intangible assets, net |

|

19,322 |

|

|

|

19,405 |

|

|

|

19,599 |

|

|

|

19,768 |

|

|

|

19,854 |

|

| Tangible

stockholders' equity (numerator) |

$ |

274,899 |

|

|

$ |

270,157 |

|

|

$ |

261,150 |

|

|

$ |

254,934 |

|

|

$ |

251,214 |

|

| |

|

|

|

|

|

|

|

|

|

| Total

assets |

$ |

2,816,897 |

|

|

$ |

2,732,940 |

|

|

$ |

2,638,060 |

|

|

$ |

2,581,192 |

|

|

$ |

2,587,038 |

|

| Less:

Goodwill and other intangible assets, net |

|

19,322 |

|

|

|

19,405 |

|

|

|

19,599 |

|

|

|

19,768 |

|

|

|

19,854 |

|

| Tangible

total assets (denominator) |

$ |

2,797,575 |

|

|

$ |

2,713,535 |

|

|

$ |

2,618,461 |

|

|

$ |

2,561,424 |

|

|

$ |

2,567,184 |

|

| |

|

|

|

|

|

|

|

|

|

| Tangible

stockholders' equity / tangible assets |

|

9.83 |

% |

|

|

9.96 |

% |

|

|

9.97 |

% |

|

|

9.95 |

% |

|

|

9.79 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Efficiency Ratio |

|

|

|

|

|

|

|

|

|

| Non-interest

expense |

$ |

13,503 |

|

|

$ |

12,465 |

|

|

$ |

11,737 |

|

|

$ |

11,409 |

|

|

$ |

11,122 |

|

| Less:

Merger-related expenses |

|

461 |

|

|

|

452 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Adjusted

non-interest expense (numerator) |

$ |

13,042 |

|

|

$ |

12,013 |

|

|

$ |

11,737 |

|

|

$ |

11,409 |

|

|

$ |

11,122 |

|

| |

|

|

|

|

|

|

|

|

|

| Net interest

income |

$ |

22,795 |

|

|

$ |

23,751 |

|

|

$ |

24,563 |

|

|

$ |

22,910 |

|

|

$ |

21,149 |

|

| Non-interest

income |

|

964 |

|

|

|

1,446 |

|

|

|

944 |

|

|

|

1,463 |

|

|

|

1,267 |

|

| Total

revenue |

|

23,759 |

|

|

|

25,197 |

|

|

|

25,507 |

|

|

|

24,373 |

|

|

|

22,416 |

|

| Add: Losses

on sale of investment securities, net |

|

207 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Adjusted

total revenue (denominator) |

$ |

23,966 |

|

|

$ |

25,197 |

|

|

$ |

25,507 |

|

|

$ |

24,373 |

|

|

$ |

22,416 |

|

| |

|

|

|

|

|

|

|

|

|

| Efficiency

ratio |

|

54.42 |

% |

|

|

47.68 |

% |

|

|

46.01 |

% |

|

|

46.81 |

% |

|

|

49.62 |

% |

| |

|

|

|

|

|

|

|

|

|

| (1)

Annualized. |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| FIRST BANK

AND SUBSIDIARIES |

| NON-U.S.