Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Julio 2024 - 10:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File No. 001-35193

Grifols, S.A.

(Translation of registrant’s name into English)

Avinguda de la Generalitat, 152-158

Parc de Negocis Can Sant Joan

Sant Cugat del Valles 08174

Barcelona, Spain

(Address of registrant’s principal executive

office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

Grifols, S.A.

TABLE OF CONTENTS

| |

Grifols, S.A. |

| |

|

|

Avinguda de la Generalitat 152-158

08174 Sant Cugat del Vallès

Barcelona - ESPAÑA

Tel. [34] 935 710 500

Fax [34] 935 710 267

www.grifols.com |

Pursuant to the provisions of article 226 of the

Law 6/2023, of March 17, on Securities Markets and Investment Services, Grifols S.A. ("Grifols" or the "Company")

hereby informs about the following

RELEVANT INFORMATION

Grifols reports that, due to an

incorrect accounting treatment, the comparative figures presented in the Condensed Consolidated Interim Financial Statements for the first

half of 2024 have been restated in accordance with paragraph 42 of International Accounting Standard 8, for the reasons stated below:

| (1) | In relation to the communication issued by the Comisión Nacional de Mercado de Valores ("CNMV")

on March 21, 2024, regarding the accounting treatment of the agreement with Immunotek, the following is confirmed: in 2021, Grifols

entered into a collaboration agreement with ImmunoTek GH, LLC for the opening and management of plasma donation centers, resulting in

the creation of a joint venture called Biotek America LLC (“ITK JV”). Until 2022, Grifols had recognized its participation

in ITK JV as a financial investment. However, during 2024, after discussions with the CNMV, it was concluded that this agreement should

be recognized as a joint operation, requiring the recognition of assets, liabilities, and results of the jointly controlled entity. Consequently,

the consolidated annual accounts as of December 31, 2023, included the assets and liabilities of ITK JV, resulting in a negative

adjustment to reserves of €38 million corresponding to losses from financial years 2021, 2022, and 2023. Nevertheless, with the aim

of correctly presenting these losses in the respective income statements for each period, the comparative figures for the first half of

2023 have been restated in the Condensed Consolidated Interim Financial Statements for the first half of 2024, which has resulted in a

reduction of the net income and EBITDA, reducing them by €14 million and €12 million, respectively. Additionally, the comparative

figures for the income statement for financial years 2023 and 2022, which will be restated in the consolidated annual accounts for 2024,

reflecting a reduction in net income and EBITDA of €17 million and €13 million for financial year 2023, and €23 million

and €20 million for financial year 2022. |

| (2) | Grifols made an incorrect application of the accounting treatment of the non-controlling interest in an

associate, resulting in a correction to the equity-method investment in Shanghai RAAS Blood Products Co. Limited (hereinafter referred

to as "SRAAS"). Under the swap agreement entered into with SRAAS in 2019, on March 30, 2020, Grifols received SRAAS shares

corresponding to 26.2% of its share capital in exchange for previously delivering shares representing 45% of the economic rights of its

subsidiary, Grifols Diagnostic Solutions, Inc. (hereinafter "GDS"). Consequently, Grifols held a stake in an associate

that, in turn, held a stake in GDS. Since International Financial Reporting Standards (IFRS) do not specifically address the accounting

treatment of non-controlling interests when an investment in an associate has a stake in a Group company, Grifols chose the accounting

policy to (i) increase the percentage of ownership attributable to Grifols in GDS by the indirect interest Grifols obtained through

its stake in SRAAS by 11.79% (26.2% of 45%), thereby reducing the non-controlling interest by that percentage, and (ii) exclude any

amount recognized by SRAAS for its stake in GDS from the equity-method investment in SRAAS, as Grifols consolidates 100% of the GDS net

assets. Consequently, due to the accounting policy adopted in March 2020, Grifols had an attributable stake of 66.79% (55% + 11.79%)

in GDS, while the non-controlling interest was reduced to 33.21%. This reduction in net equity attributable to the non-controlling interest

was offset against consolidated reserves because it was a transaction with minority shareholders without loss of control. As a result

of selling the 20% equity stake in SRAAS in 2024 and during the limited review as of June 30, 2024, it has been identified that the

initial recognition of the investment in SRAAS should have excluded the amount that SRAAS held in GDS according to Grifols’ accounting

policy at the transaction date, amounting to €457 million. Therefore, the reduction in equity attributable to non-controlling interest

should have decreased the investment in equity-accounted investee in SRAAS recognized in March 2020 instead of affecting consolidated

reserves. Consequently, both the stake in SRAAS and consolidated reserves are overstated by €457 million for the years 2020 to 2023.

In this context, the amounts related to ‘Investment in equity-accounted investees’ ‘Non-current assets held for sale,’

and ‘Consolidated reserves’ as of December 31, 2023, have been restated in the comparative information, decreasing by

€113 million, €344 million, and €457 million, respectively. Despite this correction resulting in a reduction of equity

by €457 million, it has had no impact on the income statement; it represents an incorrect accounting treatment without affecting

the correct results for each affected financial year. Therefore, the results recognized in the equity-method investment in SRAAS and the

results attributable to both the Parent Company and the non-controlling interest in GDS in the consolidated annual accounts from 2020

to 2023 are correctly accounted for. Additionally, following this correction, which decreased the carrying value of the investment in

SRAAS, the net gain recorded from the sale of the 20% stake in SRAAS is accurately accounted for in the 2024 financial statements. |

Furthermore, as a result of the

limited review of the Condensed Consolidated Interim Financial Statements as of June 30, 2024, conducted by Deloitte Auditores, S.L.,

which includes the restatement mentioned in points 1) and 2) above, we highlight that no matter has come to the auditor’s attention

that would lead to the conclusion that the consolidated interim financial statements as of June 30, 2024 have not been prepared,

in all material respects, in accordance with the requirements of International Accounting Standard (IAS) 34.

Finally, Grifols confirms that

it has responded to all information requests required by the Comisión Nacional de Mercado de Valores.

In Barcelona, on 30 July 2024.

| |

|

| Nuria Martín Barnés |

|

| Secretaria del Consejo de Administración |

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| |

Grifols, S.A. |

| |

|

|

| |

|

|

| |

By: |

/s/ David I. Bell |

| |

|

Name: |

David I. Bell |

| |

|

Title: |

Authorized Signatory |

Date: July 30, 2024

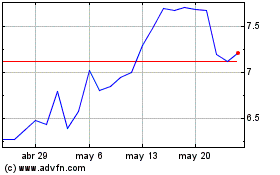

Grifols (NASDAQ:GRFS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

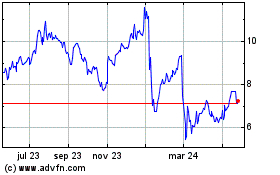

Grifols (NASDAQ:GRFS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024