Integra LifeSciences Holdings Corporation (NASDAQ: IART) today

reported financial results for the fourth quarter and full year

ended December 31, 2023.

Fourth Quarter 2023

- Reported revenues were $397.0 million,

representing a decrease of 0.2% on a reported basis and a decrease

of 1.2% on an organic basis compared to the fourth quarter 2022.

Revenue increased 3.6% on an organic basis excluding Boston.

- GAAP earnings per diluted share were

$0.25, compared to $0.63 in the fourth quarter 2022.

- Adjusted earnings per diluted share

were $0.89, compared to $0.94 in the fourth quarter of 2022.

Full-Year 2023

- Reported revenues were $1,541.6

million representing a decrease of 1.0% on a reported basis and

flat on an organic basis compared to full-year 2022. Revenue

increased 5.5% on an organic basis excluding Boston.

- GAAP earnings per diluted share were

$0.84, compared to $2.16 in 2022.

- Adjusted earnings per diluted share

were $3.10, compared to $3.36 in 2022.

Business Highlights

- Boston relaunch remains on track for

mid-to-late Q2 2024

- Completed global CereLink® relaunch

with 510k clearance and US relaunch in Q1 2024

- Successful integration of the SIA

acquisition

- Advanced PMA clinical strategy for

SurgiMend® and DuraSorb®

- International portfolio expansion of

DuraGen®, CUSA®, and 100+ product registrations

- Building-out in-China-for-China

manufacturing capability

- Obtained 510(k) for next generation

Aurora® Surgiscope

- Signed definitive agreement to acquire

the Acclarent® ENT business by Q2 2024

- Executed $275M in share

repurchases

- Upgraded Quality Management System

with investments in talent and process capabilities

"In 2023, we saw stability in our markets and

resilience of our product portfolio, which demonstrates the impact

of our products and technologies on restoring patients’ lives,"

said Jan De Witte, president and chief executive officer "Despite

the operational challenges last year, I am extremely proud of our

colleagues around the world for remaining focused on advancing our

key pillars of growth and operational excellence, and for their

unwavering commitment to our customers and patients.”

Fourth Quarter 2023 Financial

Summary

Total reported revenues for the fourth quarter were

397.0 million, a decrease of 0.2% from the fourth quarter of 2022.

Fourth quarter organic revenues were down 1.2% compared to the

prior year. Revenue increased 3.6% on an organic basis excluding

Boston.

The Company reported GAAP net income of $19.8

million, or $0.25 per diluted share, in the fourth quarter of 2023,

compared to GAAP net income of $52.9 million, or $0.63 per diluted

share, in the prior year.

Adjusted EBITDA for the fourth quarter of 2023 was

$100.5 million, compared to $109.7 million in the fourth quarter of

the prior year. As a percentage of revenue, adjusted EBITDA was

25.3%, a decrease of 230 basis points from the prior year

period.

Adjusted net income for the fourth quarter of 2023

was $69.1 million, or $0.89 per diluted share, compared to adjusted

net income of $78.8 million, or $0.94 per diluted share, in the

fourth quarter of 2022.

Cash flows from operations totaled $58.7M million

in the fourth quarter and capital expenditures were $24.6M

million.

Fourth Quarter 2023 Segment Performance

- Codman Specialty Surgical (69% of Revenues)

- Total revenues were $271.6 million, representing reported an

increase of 2.7% and organic growth of 2.3% compared to the fourth

quarter of 2022. Sales in Neurosurgery grew 2.0% on an organic

basis.

- CSF management had mid-single digit growth driven by Certas®

Plus valves.

- Mid-single-digit growth in dural access and repair driven by

DuraGen, partially offset by a decline in DuraSeal.

- Neuro monitoring grew low-single digits driven by BactiSeal®

catheters and ICP microsensors.

- Advanced energy was down by low-single digits driven by lower

CUSA® capital sales.

- Sales in Instruments grew 3.0% on an organic

basis.

- Tissue Technologies (31% of Revenue)

- Total revenues were $125.4 million, representing a decrease of

6.0% on a reported basis and organic decline of 8.0% compared to

the fourth quarter of 2022 due to the impact of the lost revenue

related to the Boston product recall which was partially offset by

double digit growth from BioD® and Gentrix® and mid-single digit

growth in Integra skin and MediHoney®.

Full-Year 2023 Financial

Summary

Total reported revenues for the full-year 2023 were

$1,541.6 million, a decrease of 1.0%, from the prior year. Organic

sales for the full-year 2023 were flat compared to 2022. Revenue

increased 5.5% on an organic basis excluding Boston.

The Company reported GAAP net income of $67.7

million, or $0.84 per diluted share, for the full-year 2023,

compared to GAAP net income of $180.6 million, or $2.16 per diluted

share in 2022.

Adjusted EBITDA for the full-year 2023 was $369.7

million, a decrease of $41.6 million versus the prior year. Full

year EBITDA margins were 24.0% a decrease of 240 basis points from

the prior year.

Adjusted net income for the full-year 2023 was

$247.8 million, or $3.10 per diluted share, compared to $280.9

million, or $3.36 per diluted share.

2023 Balance Sheet, Cash Flow and Capital

Allocation

The Company generated cash flow from operations of

$140.0 million for the full-year 2023. Full-year capital

expenditures were $67.0 million. Net debt at the end of the year

was $1.2 billion, and the consolidated total leverage ratio was

3.0x. As of year-end, the Company had total liquidity of

approximately $1.5 billion, including approximately $309 million in

cash plus short-term investments and the remainder available under

its revolving credit facility.

2024 Revenue and Adjusted Earnings Per

Share Guidance

The Company’s guidance for 2024 revenue and

adjusted earnings per share reflects the stability of our markets

and strong demand for our differentiated portfolio, gradual

improvement in supply over the year, continued international

expansion and the relaunch of the Boston portfolio late second

quarter. Our guidance excludes the pending acquisition of the

Acclarent ENT business.

For the full-year 2024, the Company expects

revenues to be in a range of $1,603 million to $1,618 million,

representing reported growth of approximately 4.0% to 5.0% and

organic growth in the range of 4.0% to 5.0%. Adjusted earnings per

diluted share are expected to be between $3.15 and $3.25.

For the first quarter 2024, the Company expects

reported revenues in the range of $360 million to $365 million,

representing reported growth of approximately -5.5% to -4.1% and

organic growth of approximately -5.1% to -3.7%. Adjusted earnings

per diluted share are expected to be in a range of $0.53 to

$0.57.

Organic sales growth excludes acquisitions and

divestitures as well as the effects of foreign currency.

The Company is providing forward-looking guidance

regarding adjusted earnings per diluted share but is not providing

a reconciliation to GAAP earnings per share, because certain GAAP

expense items are highly variable, and management is unable to

predict them with reasonable certainty and without unreasonable

effort. Specifically, the financial impact and timing of

divestitures, acquisitions, integrations, structural optimization

and efforts to comply with the EU Medical Device Regulation are

uncertain, depend on various dynamic factors and are not reasonably

ascertainable at this time. These expense items could have a

material impact on GAAP results.

Conference Call and Presentation Available

Online

Integra has scheduled a conference call for 8:30

a.m. ET on Wednesday, February 28, 2024, to discuss fourth quarter

and full-year 2023 financial results, and forward-looking financial

guidance. The conference call will be hosted by Integra's senior

management team and will be open to all listeners.

Additional forward-looking information may be discussed in a

question-and-answer session following the call. Integra's

management team will reference a presentation during the conference

call, which can be found on the Investor Relations section of the

website at investor.integralife.com.

A live webcast will be available on the Investors

section of the Company’s website at investor.integralife.com. For

those planning to participate on the call, please register here to

receive dial-in details and a unique pin. While not required, it is

recommended to join 10 minutes prior to the start of the event. A

webcast replay of the conference call will be available on the

Investor Relations section of the Company’s website following the

call.

About Integra

At Integra LifeSciences, we are driven by our

purpose of restoring patients’ lives. We innovate treatment

pathways to advance patient outcomes and set new standards of

surgical, neurologic, and regenerative care. We offer a

comprehensive portfolio of high quality, leadership brands that

include AmnioExcel®, Aurora®, Bactiseal®, BioD™, CerebroFlo®,

CereLink® Certas® Plus, Codman®, CUSA®, Cytal®, DuraGen®,

DuraSeal®, DuraSorb®, Gentrix®, ICP Express®, Integra®, Licox®,

MAYFIELD®, MediHoney®, MicroFrance®, MicroMatrix®, NeuraGen®,

NeuraWrap™, PriMatrix®, SurgiMend®, TCC-EZ® and VersaTru®. For the

latest news and information about Integra and its products, please

visit www.integralife.com.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainties and reflect

the Company's judgment as of the date of this release. All

statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements. Some of

these forward-looking statements may contain words like “will,”

“believe,” “may,” “could,” “would,” “might,” “possible,” “should,”

“expect,” “intend,” "forecast," "guidance," “plan,” “anticipate,”

"target," or “continue,” the negative of these words, other terms

of similar meaning or they may use future dates. Forward-looking

statements contained in this news release include, but are not

limited to, statements concerning future financial performance,

including projections for revenues, expected revenue growth (both

reported and organic), GAAP and adjusted net income, GAAP and

adjusted earnings per diluted share, non-GAAP adjustments such as

divestiture, acquisition and integration-related charges,

intangible asset amortization, structural optimization charges, EU

Medical Device Regulation-related charges, charges related to the

voluntary global recall of all products manufactured at the

Company’s facility in Boston, Massachusetts, and income tax expense

(benefit) related to non-GAAP adjustments and other items,

expectations and plans with respect to strategic initiatives,

product development and regulatory approvals and expectations

concerning the resumption of manufacturing at the Company’s Boston,

Massachusetts facility. It is important to note that the Company’s

goals and expectations are not predictions of actual performance.

Such forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from predicted

or expected results. Such risks and uncertainties include, but are

not limited, to the following: the ongoing and possible future

effects of global challenges, including macroeconomic

uncertainties, inflation, supply chain disruptions, trade

regulation and tariffs, other economic disruptions and U.S. and

global recession concerns, on the Company’s customers and on the

Company’s business, financial condition, results of operations and

cash flows; the Company's ability to execute its operating plan

effectively; the Company’s ability to successfully integrate

acquired businesses; the Company’s ability to achieve sales growth

in a timely fashion; the Company's ability to manufacture and ship

sufficient quantities of its products to meet its customers'

demands; the ability of third-party suppliers to supply us with raw

materials and finished products; global macroeconomic and political

conditions, including the war in Ukraine and the conflict in Israel

and Gaza; the Company's ability to manage its direct sales channels

effectively; the sales performance of third-party distributors on

whom the Company relies to generate revenue for certain products

and geographic regions; the Company's ability to access and

maintain relationships with customers of acquired entities and

businesses; physicians' willingness to adopt and third-party

payors' willingness to provide or maintain reimbursement for the

Company's recently launched, planned and existing products;

initiatives launched by the Company's competitors; downward pricing

pressures from customers; the Company's ability to secure

regulatory approval for products in development; the Company's

ability to remediate quality systems violations; fluctuations in

hospitals' spending for capital equipment; the Company's ability to

comply with regulations regarding products of human origin and

products containing materials derived from animal source;

difficulties in controlling expenses, including costs to procure

and manufacture our products; the impact of changes in management

or staff levels; the impact of goodwill and intangible asset

impairment charges if future operating results of acquired

businesses are significantly less than the results anticipated at

the time of the acquisitions, the Company's ability to leverage its

existing selling organizations and administrative infrastructure;

the Company's ability to increase product sales and gross margins,

and control non-product costs; the Company’s ability to achieve

anticipated growth rates, margins and scale and execute its

strategy generally; the amount and timing of divestiture,

acquisition and integration-related costs; the geographic

distribution of where the Company generates its taxable income; new

U.S. and foreign government laws and regulations, and changes in

existing laws, regulations and enforcement guidance, which affect

areas of our operations including, but not limited to, those

affecting the health care industry, including the EU Medical

Devices Regulation; the scope, duration and effect of additional

U.S. and international governmental, regulatory, fiscal, monetary

and public health responses to the COVID-19 pandemic and any future

public health crises; fluctuations in foreign currency exchange

rates; the amount of our bank borrowings outstanding and other

factors influencing liquidity; potential negative impacts resulting

from environmental, social and governance matters; and the

economic, competitive, governmental, technological, and other risk

factors and uncertainties identified under the heading “Risk

Factors” included in Item 1A of Integra's Annual Report on Form

10-K for the year ended December 31, 2023 to be filed with the

Securities and Exchange Commission.

These forward-looking statements are made only as

of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events, or otherwise.

Discussion of Adjusted Financial

Measures

In addition to our GAAP results, we provide certain

non-GAAP measures, including organic revenues, organic revenues

excluding Boston, adjusted earnings before interest, taxes,

depreciation and amortization ("EBITDA"), adjusted net income,

adjusted earnings per diluted share, free cash flow, adjusted free

cash flow conversion, and net debt. Organic revenues

consist of total revenues excluding the effects of currency

exchange rates, revenues from current-period acquisitions and

product divestitures. Organic revenues excluding Boston consist of

total revenues, excluding (i) the effects of currency exchange

rates, revenues from current-period acquisitions and product

divestitures and discontinuances and (ii) revenues associated with

Boston produced products including sales reported prior to the

recall and the impact of sales return provisions recorded. Adjusted

EBITDA consists of GAAP net income excluding: (i) depreciation and

amortization; (ii) other income (expense); (iii) interest income

and expense; (iv) income tax expense (benefit); and (v) those

operating expenses also excluded from adjusted net

income. The measure of adjusted net income consists of

GAAP net income, excluding: (i) structural optimization charges;

(ii) divestiture, acquisition and integration-related charges;

(iii) EU Medical Device Regulation-related charges; (iv) charges

related to the voluntary global recall of products manufactured at

the Company’s Boston, Massachusetts facility; (v) intangible asset

amortization expense; and (vi) income tax impact from adjustments.

The adjusted earnings per diluted share measure is calculated by

dividing adjusted net income attributable to diluted shares by

diluted weighted average shares outstanding. The

measure of free cash flow consists of GAAP net cash provided by

operating activities less purchases of property and

equipment. The adjusted free cash flow conversion

measure is calculated by dividing free cash flow by adjusted net

income. The measure of net debt consists of GAAP total debt

(excluding deferred financing costs) less short-term investments,

cash and cash equivalents.

Reconciliations of GAAP revenues to organic

revenues, GAAP revenues to organic revenues excluding Boston, and

GAAP net income to adjusted EBITDA and adjusted net income, GAAP

total debt to net debt, and GAAP earnings per diluted share to

adjusted earnings per diluted share all for the quarters and years

ended December 31, 2023 and 2022, and the free cash flow and

adjusted free cash flow conversion for the quarters and years ended

December 31, 2023 and 2022, appear in the financial tables in this

release.

The Company believes that the presentation of

organic revenues and the other non-GAAP measures provide important

supplemental information to management and investors regarding

financial and business trends relating to the Company's financial

condition and results of operations. For further

information regarding why Integra believes that these non-GAAP

financial measures provide useful information to investors, the

specific manner in which management uses these measures, and some

of the limitations associated with the use of these measures,

please refer to the Company's Current Report on Form 8-K regarding

this earnings press release filed today with the Securities and

Exchange Commission. This Current Report on Form 8-K is

available on the SEC's website at www.sec.gov or on our website at

www.integralife.com.

Investor Relations

Contact:

Chris Ward(609)

772-7736chris.ward@integralife.com

Media Contact:

Laurene Isip(609)

208-8121laurene.isip@integralife.com

| |

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATIONCONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(UNAUDITED) |

| |

| (In thousands,

except per share amounts) |

| |

| |

Three Months EndedDecember 31, |

|

Twelve Months EndedDecember 31, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Total revenues |

397,039 |

|

|

398,022 |

|

|

1,541,573 |

|

|

1,557,666 |

|

| |

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

170,546 |

|

|

147,937 |

|

|

656,838 |

|

|

587,355 |

|

|

Research and development |

24,284 |

|

|

26,783 |

|

|

104,192 |

|

|

101,193 |

|

|

Selling, general and administrative |

163,128 |

|

|

151,919 |

|

|

656,641 |

|

|

616,316 |

|

|

Intangible asset amortization |

3,034 |

|

|

3,543 |

|

|

12,376 |

|

|

13,882 |

|

|

Total costs and expenses |

360,992 |

|

|

330,182 |

|

|

1,430,047 |

|

|

1,318,746 |

|

|

Operating income |

36,047 |

|

|

67,840 |

|

|

111,526 |

|

|

238,920 |

|

|

Interest income |

4,549 |

|

|

5,311 |

|

|

17,202 |

|

|

11,917 |

|

|

Interest expense |

(13,751 |

) |

|

(12,894 |

) |

|

(51,377 |

) |

|

(49,594 |

) |

|

Gain (loss) from the sale of business |

— |

|

|

— |

|

|

— |

|

|

644 |

|

|

Other income, net |

2,013 |

|

|

3,951 |

|

|

3,718 |

|

|

12,007 |

|

|

Income before taxes |

28,858 |

|

|

64,208 |

|

|

81,069 |

|

|

213,894 |

|

|

Income tax expense (benefit) |

9,024 |

|

|

11,262 |

|

|

13,328 |

|

|

33,344 |

|

|

Net income |

19,834 |

|

|

52,946 |

|

|

67,741 |

|

|

180,550 |

|

| |

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

Diluted net income per share |

0.25 |

|

|

0.63 |

|

|

0.84 |

|

|

2.16 |

|

|

Weighted average common shares outstanding for diluted net income

per share |

77,959 |

|

|

83,568 |

|

|

80,337 |

|

|

83,516 |

|

Segment revenues and growth in total revenues

excluding the effects of currency exchange rates, acquisitions and

discontinued products are as follows:

(In thousands)

| |

Three Months EndedDecember 31, |

|

Twelve Months EndedDecember 31, |

|

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

|

Neurosurgery |

210,204 |

|

205,199 |

|

2.4% |

|

818,101 |

|

794,017 |

|

3.0% |

|

Instruments |

61,423 |

|

59,398 |

|

3.4% |

|

240,892 |

|

225,547 |

|

6.8% |

|

Total Codman Specialty Surgical |

271,627 |

|

264,597 |

|

2.7% |

|

1,058,993 |

|

1,019,564 |

|

3.9% |

| |

|

|

|

|

|

|

|

|

Wound Reconstruction and Care |

93,859 |

|

102,540 |

|

(8.5)% |

|

373,986 |

|

406,689 |

|

(8.0)% |

|

Private Label |

31,553 |

|

30,885 |

|

2.2% |

|

108,594 |

|

131,413 |

|

(17.4)% |

|

Total Tissue Technologies |

125,412 |

|

133,425 |

|

(6.0)% |

|

482,580 |

|

538,102 |

|

(10.3)% |

|

Total Reported Revenues |

397,039 |

|

398,022 |

|

(0.2)% |

|

1,541,573 |

|

1,557,666 |

|

(1.0)% |

| |

|

|

|

|

|

|

|

|

Impact of changes in currency exchange rates |

(928 |

) |

— |

|

— |

|

6,817 |

|

— |

|

— |

|

Less contribution of revenues from acquisitions |

(2,548 |

) |

— |

|

— |

|

(9,753 |

) |

— |

|

— |

|

Less contribution of revenues from divested products |

— |

|

(122 |

) |

— |

|

(245 |

) |

(18,063 |

) |

— |

|

Less contribution of revenues from discontinued products |

(2,068 |

) |

(1,600 |

) |

— |

|

(6,604 |

) |

(7,876 |

) |

— |

|

Total organic revenues(1) |

391,496 |

|

396,300 |

|

(1.2)% |

|

1,531,788 |

|

1,531,727 |

|

—% |

| |

|

|

|

|

|

|

|

|

Boston Revenue impact |

(1,005 |

) |

(19,543 |

) |

|

|

(2,759 |

) |

(83,077 |

) |

|

|

Total Organic Revenues ex Boston |

390,491 |

|

376,756 |

|

|

|

1,529,029 |

|

1,448,650 |

|

|

| |

|

|

|

|

|

|

|

(1) Organic revenues have been adjusted to exclude

foreign currency (current period), acquisitions and to account for

divested and discontinued products.

Items included in GAAP net income and from

continuing operations and locations where each item is recorded are

as follows:

(In thousands)

|

Three Months Ended December 31, 2023 |

|

|

|

|

|

|

|

Item |

TotalAmount |

|

COGS(a) |

|

SG&A(b) |

|

R&D(c) |

|

Amort.(d) |

|

OI&E(e) |

|

Tax(f) |

|

Acquisition, divestiture and integration-related charges |

7,117 |

|

|

73 |

|

8,040 |

|

(880 |

) |

|

— |

|

(116 |

) |

|

— |

|

|

Structural Optimization charges |

7,998 |

|

|

4,859 |

|

3,155 |

|

(16 |

) |

|

— |

|

— |

|

|

— |

|

|

EU Medical Device Regulation charges |

12,387 |

|

|

2,227 |

|

4,653 |

|

5,507 |

|

|

— |

|

— |

|

|

— |

|

|

Boston Recall |

6,346 |

|

|

5,587 |

|

759 |

|

— |

|

|

|

|

|

|

|

|

|

Intangible asset amortization expense |

20,687 |

|

|

17,653 |

|

— |

|

— |

|

|

3,034 |

|

— |

|

|

— |

|

|

Estimated income tax impact from above adjustments and other

items |

(5,272 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

(5,272 |

) |

|

Depreciation expense |

9,834 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) COGS - Cost of goods sold(b) SG&A - Selling, general and

administrative(c) R&D - Research & development(d) Amort. -

Intangible asset amortization(e) OI&E - Other income &

expense(f) Tax - Income tax expense (benefit) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Item |

TotalAmount |

|

COGS(a) |

SG&A(b) |

|

R&D(c) |

|

Amort.(d) |

|

|

OI&E(e) |

|

Tax(f) |

|

Acquisition, divestiture and integration-related charges(1) |

704 |

|

|

619 |

|

620 |

|

477 |

|

|

— |

|

|

(1,013 |

) |

|

— |

|

|

Structural Optimization charges |

(1,533 |

) |

|

(4,195 |

) |

2,669 |

|

(7 |

) |

|

— |

|

|

— |

|

|

— |

|

|

EU Medical Device Regulation charges |

12,177 |

|

|

1,439 |

|

4,855 |

|

5,884 |

|

|

— |

|

|

— |

|

|

— |

|

|

Intangible asset amortization expense |

19,632 |

|

|

16,089 |

|

— |

|

— |

|

|

3,543 |

|

|

— |

|

|

— |

|

|

Estimated income tax impact from above adjustments and other

items |

(5,091 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(5,091 |

) |

|

Depreciation expense |

9,861 |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) COGS - Cost of goods sold (b) SG&A - Selling, general and

administrative (c) R&D - Research and development (d) Amort. -

Intangible asset amortization (e) OI&E - Other income and

expense (f) Tax - Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

Items included in GAAP net income and location

where each item is recorded are as follows:

(In thousands)

|

Twelve Months Ended December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item |

TotalAmount |

|

COGS(a) |

|

SG&A(b) |

|

R&D(c) |

|

Amort.(d) |

|

OI&E(e) |

|

Tax(f) |

|

Acquisition, divestiture and integration-related charges |

25,173 |

|

|

3,045 |

|

25,181 |

|

(2,188 |

) |

|

— |

|

(865 |

) |

|

— |

|

|

Structural Optimization charges |

23,020 |

|

|

15,144 |

|

7,943 |

|

(67 |

) |

|

— |

|

— |

|

|

— |

|

|

EU Medical Device Regulation charges |

46,559 |

|

|

5,813 |

|

20,002 |

|

20,745 |

|

|

— |

|

— |

|

|

— |

|

|

Boston Recall |

40,034 |

|

|

39,181 |

|

853 |

|

— |

|

|

|

|

|

|

|

|

|

Intangible asset amortization expense |

82,823 |

|

|

70,447 |

|

— |

|

— |

|

|

12,376 |

|

— |

|

|

— |

|

|

Estimated income tax impact from above adjustments and other

items |

(37,573 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

(37,573 |

) |

|

Depreciation expense |

39,704 |

|

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) COGS - Cost of goods sold (b) SG&A - Selling, general and

administrative (c) R&D - Research and development (d) Amort. -

Intangible asset amortization (e) OI&E - Interest (income)

expense, net and other (income), net (f) Tax - Income tax

expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item |

TotalAmount |

|

COGS(a) |

|

SG&A(b) |

|

R&D(c) |

|

Amort.(d) |

|

OI&E(e) |

|

Tax(f) |

|

Acquisition, divestiture and integration-related charges |

(18,849 |

) |

|

1,543 |

|

(13,379 |

) |

|

(2,195 |

) |

|

— |

|

(4,818 |

) |

|

— |

|

|

Structural Optimization charges |

23,072 |

|

|

5,554 |

|

17,368 |

|

|

150 |

|

|

— |

|

— |

|

|

— |

|

|

EU Medical Device Regulation charges |

45,147 |

|

|

4,626 |

|

16,596 |

|

|

23,926 |

|

|

— |

|

— |

|

|

— |

|

|

Intangible asset amortization expense |

78,295 |

|

|

64,413 |

|

— |

|

|

— |

|

|

13,882 |

|

— |

|

|

— |

|

|

Estimated income tax impact from above adjustments and other

items |

(27,349 |

) |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

(27,349 |

) |

|

Depreciation expense |

39,943 |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) COGS - Cost of goods sold (b) SG&A - Selling, general and

administrative (c) R&D - Research and development (d) Amort. -

Intangible asset amortization (e) OI&E - Interest (income)

expense, net and other (income), net (f) Tax - Income tax

expense |

|

|

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATION RECONCILIATION OF

NON-GAAP ADJUSTMENTS - GAAP NET INCOME FROM CONTINUING OPERATIONS

TO ADJUSTED EBITDA (UNAUDITED) |

|

|

|

(In thousands) |

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income |

19,834 |

|

|

52,946 |

|

|

67,741 |

|

|

180,550 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Depreciation and intangible asset amortization expense |

30,522 |

|

|

29,493 |

|

|

122,528 |

|

|

118,238 |

|

|

Other (income), net |

(1,897 |

) |

|

(2,938 |

) |

|

(2,853 |

) |

|

(7,833 |

) |

|

Interest expense, net |

9,202 |

|

|

7,583 |

|

|

34,175 |

|

|

37,677 |

|

|

Income tax expense (benefit) |

9,024 |

|

|

11,262 |

|

|

13,328 |

|

|

33,344 |

|

|

Structural optimization charges |

7,998 |

|

|

(1,533 |

) |

|

23,020 |

|

|

23,072 |

|

|

EU Medical Device Regulation charges |

12,387 |

|

|

12,177 |

|

|

46,559 |

|

|

45,147 |

|

|

Boston Recall |

6,346 |

|

|

— |

|

|

40,034 |

|

|

— |

|

|

Acquisition, divestiture and integration-related charges |

7,117 |

|

|

704 |

|

|

25,173 |

|

|

(18,849 |

) |

|

Total of non-GAAP adjustments |

80,700 |

|

|

56,747 |

|

|

301,964 |

|

|

230,796 |

|

|

Adjusted EBITDA |

100,534 |

|

|

109,693 |

|

|

369,705 |

|

|

411,346 |

|

|

|

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATION RECONCILIATION OF

NON-GAAP ADJUSTMENTS - GAAP NET INCOME FROM CONTINUING OPERATIONS

TO MEASURES OF ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE

(UNAUDITED) |

|

|

|

(In thousands, except per share amounts) |

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income |

|

19,834 |

|

|

|

52,946 |

|

|

|

67,741 |

|

|

|

180,550 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Structural optimization charges |

|

7,998 |

|

|

|

(1,533 |

) |

|

|

23,020 |

|

|

|

23,072 |

|

|

Acquisition, divestiture and integration-related charges |

|

7,117 |

|

|

|

704 |

|

|

|

25,173 |

|

|

|

(18,849 |

) |

|

EU Medical Device Regulation charges |

|

12,387 |

|

|

|

12,177 |

|

|

|

46,559 |

|

|

|

45,147 |

|

|

Boston Recall |

|

6,346 |

|

|

|

— |

|

|

|

40,034 |

|

|

|

— |

|

|

Intangible asset amortization expense |

|

20,687 |

|

|

|

19,632 |

|

|

|

82,823 |

|

|

|

78,295 |

|

|

Estimated income tax impact from adjustments and other items |

|

(5,272 |

) |

|

|

(5,091 |

) |

|

|

(37,573 |

) |

|

|

(27,349 |

) |

|

Total of non-GAAP adjustments |

|

49,264 |

|

|

|

25,889 |

|

|

|

180,036 |

|

|

|

100,316 |

|

|

Adjusted net income |

$ |

69,098 |

|

|

$ |

78,835 |

|

|

$ |

247,777 |

|

|

$ |

280,866 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted net income per share |

$ |

0.89 |

|

|

$ |

0.94 |

|

|

$ |

3.10 |

|

|

$ |

3.36 |

|

|

Weighted average common shares outstanding for diluted net income

per share |

|

77,959 |

|

|

|

83,568 |

|

|

|

80,337 |

|

|

|

83,516 |

|

|

|

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATION CONDENSED BALANCE SHEET

DATA (UNAUDITED) |

|

|

|

(In thousands) |

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

276,402 |

|

|

$ |

456,661 |

|

|

Accounts receivable, net |

|

|

259,327 |

|

|

|

263,465 |

|

|

Inventory, net |

|

|

389,608 |

|

|

|

324,583 |

|

|

|

|

|

|

|

|

Current and long-term borrowing under senior credit facility |

|

|

840,094 |

|

|

|

771,274 |

|

|

Borrowings under securitization facility |

|

|

89,200 |

|

|

|

104,700 |

|

|

Long-term convertible securities |

|

|

570,255 |

|

|

|

567,341 |

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

1,587,884 |

|

|

|

1,804,403 |

|

|

|

|

INTEGRA LIFESCIENCES HOLDINGS CORPORATION CONDENSED STATEMENT OF

CASH FLOWS (UNAUDITED) |

|

|

|

|

Twelve Months Ending December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net cash provided by operating activities |

$ |

139,955 |

|

|

$ |

264,469 |

|

|

Net cash used in investing activities |

|

(94,178 |

) |

|

|

(58,580 |

) |

|

Net cash used in by financing activities |

|

(229,925 |

) |

|

|

(251,953 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

3,889 |

|

|

|

(10,723 |

) |

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(180,259 |

) |

|

|

(56,787 |

) |

|

|

|

RECONCILIATION OF NON-GAAP ADJUSTMENTS - GAAP OPERATING CASH FLOW

TO MEASURES OF ADJUSTED FREE CASH FLOW AND ADJUSTED FREE CASH FLOW

CONVERSION (UNAUDITED) |

|

|

|

(In thousands) |

|

|

Three Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

GAAP Net cash provided by operating activities |

$ |

58,746 |

|

$ |

85,333 |

|

|

|

|

|

|

Purchases of property and equipment |

|

(24,563 |

) |

|

(14,455 |

) |

|

Adj. Free Cash Flow |

$ |

34,183 |

|

$ |

70,878 |

|

|

|

|

|

|

Adjusted net income (1) |

$ |

69,098 |

|

|

78,835 |

|

|

Adjusted Free Cash Flow Conversion |

|

49.5 |

% |

|

89.9 |

% |

|

|

|

|

|

|

|

|

|

|

Twelve Months Ending December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

GAAP Net cash provided by operating activities |

$ |

139,955 |

|

$ |

264,469 |

|

|

|

|

|

|

Purchases of property and equipment |

|

(66,865 |

) |

|

(42,343 |

) |

|

Adj. Free Cash Flow |

$ |

73,090 |

|

$ |

222,127 |

|

|

|

|

|

|

Adjusted net income (1) |

$ |

247,777 |

|

|

280,867 |

|

|

Adjusted Free Cash Flow Conversion |

|

29.5 |

% |

|

79.1 |

% |

|

|

|

|

(1) Adjusted net income for quarters and twelve

months ended December 31, 2022 and 2023 are reconciled above.

Adjusted net income for remaining quarters in the trailing twelve

months calculation have been previously reconciled and are publicly

available in the Quarterly Earnings Call Presentations on our

website at investor.integralife.com.

The Company calculates adjusted free cash flow

conversion by dividing its free cash flow by adjusted net income.

The Company believes this measure is a useful metric in evaluating

the significance of the cash special charges in its adjusted

earnings measures.

|

RECONCILIATION OF NON-GAAP ADJUSTMENTS - NET DEBT

CALCULATION(UNAUDITED) |

| |

|

|

| (In thousands) |

|

|

| |

|

December 31,2023 |

December 31,2022 |

|

Short-term borrowings under senior credit facility |

|

$ |

14,531 |

|

$ |

38,125 |

|

| Long-term borrowings under

senior credit facility |

|

|

825,563 |

|

|

733,149 |

|

| Borrowings under

securitization facility |

|

|

89,200 |

|

|

104,700 |

|

| Long-term convertible

securities |

|

|

570,255 |

|

|

567,341 |

|

| Deferred financing costs

netted in the above |

|

|

9,651 |

|

|

11,385 |

|

| Short-term investments |

|

|

(32,694 |

) |

|

— |

|

| Cash & Cash

Equivalents |

|

|

(276,402 |

) |

|

(456,661 |

) |

| Net Debt |

|

$ |

1,200,104 |

|

$ |

998,039 |

|

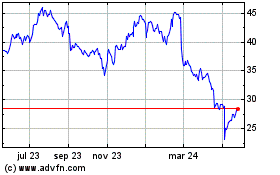

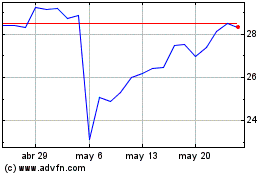

Integra LifeSciences (NASDAQ:IART)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Integra LifeSciences (NASDAQ:IART)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025