As filed with the Securities and Exchange Commission on May 13, 2022

Registration No. 333-258976

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT

NO. 1

TO

FORM F-3

REGISTRATION STATEMENT

UNDER SECURITIES ACT OF 1933

LUOKUNG TECHNOLOGY CORP.

(Exact name of registrant

as specified in its charter)

| British Virgin Islands |

|

Not Applicable |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

B9-8, Block B, SOHO Phase

II, No. 9, Guanghua Road, Chaoyang District,

Beijing People’s

Republic of China 100020

(86) 10-65065217

(Address, including zip

code, and telephone number, including

area code, of Registrant’s

principal executive offices)

Worldwide Stock Transfer

LLC

One University Plaza,

Suite 505

Hackensack, New Jersey

07601

(201) 820-2008

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copy To:

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0199

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to general Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

EXPLANATORY NOTE

This Post-Effective Amendment

No. 1 (this “Amendment”) to the Registration Statement on Form F-3 (Registration No. 333-258976) (the “Registration

Statement”) is being filed to reflect that Luokung Technology Corp. (the “Company”) expects that it will no longer

be a well-known seasoned issuer, as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”),

upon the filing by the Company of its annual report on Form 20-F for the fiscal year ended December 31, 2021 with the Securities and

Exchange Commission. This Amendment is being filed by the Company to include information that is required to be included in the Registration

Statement on Form F-3 for registrants who are no longer well-known seasoned issuers, and to make certain other amendments. The Company

may continue to offer and sell the securities registered hereunder in accordance with Rule 415(a)(5) under the Securities Act. This

Registration Statement contains a base prospectus which covers the offering, issuance and sale of up to $300,000,000 of the Company’s

ordinary shares, preferred shares, debt securities, warrants, subscription rights and units.

PROSPECTUS

$300,000,000

Ordinary Shares

Preferred Shares

Warrants

Subscription Rights

Debt Securities

Units

LUOKUNG TECHNOLOGY CORP.

The aggregate initial offering

price of the securities that we may offer and sell under this prospectus will not exceed $300,000,000. We may offer, issue and sell from

time to time our securities, including in the form of ordinary shares, preferred shares, warrants to purchase ordinary shares or preferred

shares, subscription rights, debt securities and a combination of such securities, separately or as units, in one or more offerings.

This prospectus provides a general description of offerings of these securities that we may undertake.

We refer to our ordinary

shares, preferred shares, warrants, subscription rights, debt securities, and units collectively as “securities” in this

prospectus.

Each time we sell our securities

pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this prospectus. The prospectus supplement

may also add, update, or change information contained in this prospectus. You should read this prospectus, the accompanying prospectus

supplement and any free writing prospectus, together with the additional information described under the heading “Where You Can

More Find Information,” before you make your investment decision.

We may, from time to time,

offer to sell the securities, through public or private transactions, directly or through underwriters, agents or dealers, on or off

The NASDAQ Capital Market, at prevailing market prices or at privately negotiated prices. If any underwriters, agents or dealers are

involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names of the underwriter, agent

or dealer and any applicable fees, commissions or discounts.

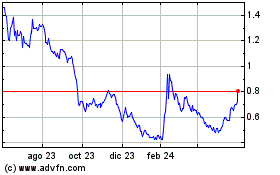

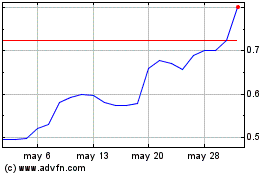

Our ordinary shares are listed

on The NASDAQ Capital Market under the symbol “LKCO”. On May 12, 2022, the last reported price of our ordinary shares on The

NASDAQ Capital Market was $0.43 per ordinary share.

This prospectus may not be

used to offer or sell any securities unless accompanied by a prospectus supplement.

We are a holding company

incorporated in the British Virgin Islands. As a holding company with no material operations of our own, we conducted the majority of

our business through our wholly-owned or majority-owned subsidiaries and certain business through our operating entities established

in the People’s Republic of China, or the PRC, primarily our VIEs. Due to PRC legal restrictions on foreign ownership in any internet-related

businesses we may explore and operate, we do not have any equity ownership of our VIEs, instead we receive the economic benefits of our

VIEs’ business operations through certain contractual arrangements. Our ordinary shares that currently listed on the Nasdaq Capital

Markets are shares of our Nevada holding company that maintains service agreements with the associated operating companies. The Chinese

regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities

could decline or become worthless. For a description of our corporate structure and contractual arrangements, see “Corporate Structure”

on page 3.

We believe that our corporate

structure and contractual arrangements comply with the current applicable PRC laws and regulations. We also believe that each of the

contracts among our wholly-owned PRC subsidiary, our consolidated VIEs and its shareholders is valid, binding and enforceable in accordance

with its terms. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws

and regulations. Thus, the PRC governmental authorities may take a view contrary to the opinion of our PRC legal counsel. It is uncertain

whether any new PRC laws or regulations relating to variable interest entity structure will be adopted or if adopted, what they would

provide. PRC laws and regulations governing the validity of these contractual arrangements are uncertain and the relevant government

authorities have broad discretion in interpreting these laws and regulations.

If these regulations change

or are interpreted differently in the future and our corporate structure and contractual arrangements are deemed by the relevant regulators

that have competent authority, to be illegal, either in whole or in part, we may be unable to direct the operations of our consolidated

VIEs in the future, which conducts our manufacturing operations, holds significant assets and accounts for significant revenue, and may

need to modify such structure to comply with regulatory requirements. However, there can be no assurance that we can achieve this without

material disruption to our business. Further, if our corporate structure and contractual arrangements are found to be in violation of

any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such

violations, including revoking our business and operating licenses, levying fines on us, confiscating any of our income that they deem

to be obtained through illegal operations, shutting down our services, discontinuing or restricting our operations in China, imposing

conditions or requirements with which we may not be able to comply, requiring us to change our corporate structure and contractual arrangements,

restricting or prohibiting our use of the proceeds from overseas offering to finance our consolidated VIEs’ business and operations

and taking other regulatory or enforcement actions that could be harmful to our business

Furthermore, new PRC laws,

rules and regulations may be introduced to impose additional requirements that may be applicable to our corporate structure and contractual

arrangements. Occurrence of any of these events could materially and adversely affect our business, financial condition and results of

operations and the market price of our ordinary shares. In addition, if the imposition of any of these penalties or requirement to restructure

our corporate structure causes us to lose the rights to direct the activities of our consolidated VIEs or our right to receive their

economic benefits, we would no longer be able to consolidate the financial results of such VIEs in our consolidated financial statements,

which may cause the value of our securities to significantly decline or even become worthless.

In addition, while we will

take every precaution available to effectively enforce the contractual and corporate relationship of the VIE agreements, these contractual

arrangements are less effective than direct ownership and we may incur substantial costs to enforce the terms of the arrangements. For

example, the VIEs and its shareholders could breach their contractual arrangements with us by, among other things, failing to conduct

their operations in an acceptable manner or taking other actions that are detrimental to our interests. If we had direct ownership of

the VIEs, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of the VIEs, which in

turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under

VIE Agreements, we will rely on the performance by the VIEs and its shareholders of their obligations under the contracts to direct the

operation of the VIEs. As such, the shareholders of VIEs may not act in the best interests of our company or may not perform their obligations

under these contracts. In addition, failure of the VIE shareholders to perform certain obligations could compel us to rely on legal remedies

available under PRC laws, including seeking specific performance or injunctive relief, and claiming damages, which may not be effective.

Our former independent registered

public accounting firm, Moore Stephens CPA Limited issued an audit opinion on the financial statements for the fiscal year ended December

31, 2020 contained in the Annual Report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on May 14, 2021 (the

“Form 20-F for 2020”). Our current auditor, MSPC Certified Public Accountants and Advisors, a professional Corporation (“MSUSA”)

will issue audit reports related to us for the fiscal year ended December 31, 2021 and in the future. As auditors of companies that are

traded publicly in the United States and a firm registered with the PCAOB, our current auditor is required by the laws of the United

States to undergo regular inspections by the PCAOB. However, to the extent that our current auditor’s work papers become located

in China, such work papers will not be subject to inspection by the PCAOB because the PCAOB is currently unable to conduct inspections

without the approval of the Chinese authorities. Inspections of certain other firms that the PCAOB has conducted outside of China have

identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the

inspection process to improve future audit quality. We are required by the HFCAA to have an auditor that is subject to the inspection

by the PCAOB. While our present auditor is located in the United States and the PCAOB is able to conduct inspections on such auditor,

to the extent this status changes in the future and our auditor’s audit documentation related to their audit reports for our company

becomes outside of the inspection by the PCAOB or if the PCAOB is unable to inspect or investigate completely our auditor because of

a position taken by an authority in a foreign jurisdiction, trading in our ordinary shares could be prohibited under the HFCAA, and as

a result our ordinary shares could be delisted from Nasdaq.

INVESTING IN OUR ORDINARY

SHARES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 4, AS WELL AS THE RISKS DISCUSSED UNDER THE CAPTION

“RISK FACTORS” IN THE DOCUMENTS INCORPORATED BY REFERENCE IN THIS PROSPECTUS.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 13, 2022

TABLE OF CONTENTS

You should rely only on the

information contained or incorporated by reference in this prospectus or any supplement. We have not authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are

not, and any underwriter or agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not

permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of

this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration

process. Under this shelf registration process, we may sell up to an aggregate of $300,000,000 of our securities described in this prospectus

in one or more offerings. Each time we offer our securities, we will provide you with a supplement to this prospectus that will describe

the specific amounts, prices and terms of the securities we offer. The prospectus supplement or any free writing prospectus may also

add, update or change information contained in this prospectus. This prospectus, together with applicable prospectus supplements or free

writing prospectus and the documents incorporated by reference in this prospectus and any prospectus supplements, includes all material

information relating to this offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain

material information relating to these offerings. Please read carefully both this prospectus and any prospectus supplement or free writing

prospectus together with additional information described below under “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.”

You should rely only on the

information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement or free writing prospectus.

We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not

an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement or free writing prospectus,

as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of

those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates. This

prospectus may not be used to consummate a sale of our securities unless it is accompanied by a prospectus supplement.

In this prospectus, unless

we indicate otherwise, “we”, “us”, “our”, “the Company” and “Luokung” refer

to Luokung Technology Corp., as consolidated with its various subsidiaries. References to “variable interest entities” or

“VIEs” refer to Beijing Zhong Chuan Shi Xun Technology Limited, eMapgo Technologies (Beijing) Co., Ltd. and Beijing BotBrain

AI Technology Co., Ltd. References to “ordinary shares”, “preference shares”, “warrants” and “share

capital” refer to the ordinary shares, preference shares, warrants and share capital, respectively, of Luokung.

Certain figures included

in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic

aggregation of the figures that precede them.

We have not authorized anyone

to provide you with information that is different from that contained in this prospectus, any amendment or supplement to this prospectus,

or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to sell securities,

and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. The information contained

in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus

or any sale of the securities. For investors outside of the United States: We have not taken any action to permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You

are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, we have

used industry and market data obtained from our own internal estimates and research as well as from industry publications and research,

surveys and studies conducted by third parties. We have compiled, extracted and reproduced industry and market data from external sources

that we believe to be reliable. We caution prospective investors not to place undue reliance on the above mentioned data. Unless otherwise

indicated in the prospectus, the basis for any statements regarding our competitive position is based on our own assessment and knowledge

of the market in which we operate. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to

differ materially from those expressed in the estimates made by the independent parties and by us.

We are a “foreign private

issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. As a result, our proxy

solicitations are not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act and transactions

in our equity securities by our officers and directors are exempt from Section 16 of the Exchange Act. In addition, we are not required

under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S. companies whose securities

are registered under the Exchange Act.

BUSINESS DESCRIPTION

We are a holding company

and conduct our operations through our wholly-owned subsidiary named LK Technology Ltd., a British Virgin Islands limited liability company

(“LK Technology”), and its wholly-owned subsidiaries, MMB Limited and its respective subsidiaries, which possess two core

brands “Luokuang” and “SuperEngine”. “Luokuang” is a mobile application to provide Business to Customer

(B2C) location-based services and “SuperEngine” provides Business to Business (B2B) and Business to Government (B2G) services

in connection with spatial-temporal big data processing. In May 2010, we consummated an initial public offering of our American Depository

Shares, or ADSs, for gross proceeds of $16 million, and our ADSs were listed on the NASDAQ Capital Market under the ticker symbol “KONE”.

On August 17, 2018, we completed the transactions contemplated by the Asset Exchange Agreement (“AEA”) with C Media Limited

(“C Media”) entered into on January 25, 2018. On August 20, 2018, we changed our name to Luokung Technology Corp., our American

Depository Shares (“ADSs”) were voluntarily delisted from the NASDAQ Capital Market on September 19, 2018 and on January

3, 2019 our ordinary shares started trading on NASDAQ under the ticker symbol “LKCO”.

On August 17, 2018, we consummated

an asset exchange transaction, pursuant to which we exchanged all issued and outstanding capital stock in Topsky Info-Tech Holdings Pte

Ltd., the parent of Softech, for the issued and outstanding capital stock of LK Technology (the “Asset Exchange”). In connection

with the Asset Exchange, we changed our name on August 20, 2018, and on September 20, 2018, issued to the shareholders of C Media Limited,

the former parent of LK Technology, (i) 185,412,599 of our ordinary shares, par value $0.01 per share and (ii) 1,000,000 of our preferred

shares. Upon the consummation of the Asset Exchange, we ceased our previous business operations and became a company focused on the provision

of location-based service and mobile application products for long distance rail travelers in China.

On August 25, 2018, LK Technology

entered into a Stock Purchase Agreement (the “Agreement”) with the shareholders (“Shareholders”) of Superengine

Holding Limited, a limited liability company incorporated under the laws of the British Virgin Islands (the “Superengine”),

pursuant to which LK Technology acquired all of the issued and outstanding shares of Superengine for an aggregate purchase price of US$60

million (the “Purchase Price”), which was paid by the issuance of our Ordinary Shares in an amount equal to the quotient

of (x) the Purchase Price divided by (y) the average of the closing prices of the Ordinary Shares on the NASDAQ Capital Market over the

12 months period preceding July 31, 2018. We are a party to the Agreement in connection with the issuance of the Ordinary Shares and

certain other limited purposes.

On August 28, 2019, the Company

entered into a Share Purchase Agreement, pursuant to which the Company will acquire 100% of the equity interests of Saleya Holdings Limited

(“Saleya”) from Saleya’s shareholders for an aggregate purchase price of approximately $120 million. On March 17, 2021,

the Company completed the acquisition of 100% equity interest in Saleya for a consideration of (i) a cash amount of $102 million (RMB666

million), (ii) 9,819,926 LKCO ordinary shares and (iii) 1,500,310 LKCO preferred shares pursuant to a supplemental agreement dated February

24, 2021. The main operating subsidiary, eMapgo Technologies (Beijing) Co., Ltd. is a provider of navigation and electronic map services

in China.

On May 10, 2019 and November

6, 2020, the Company entered into a Stock Purchase Agreement and The Supplementary Agreement to Stock Purchase Agreement with the shareholders

of Botbrain AI Limited (“Botbrain”), a limited liability company incorporated under the laws of the British Virgin Islands,

pursuant to which the Company acquired 67.36% of the issued and outstanding shares of Botbrain for an aggregate purchase price of $2.5

million (RMB 16.4 million), of which $1.5 million (RMB 9.6 million) was to be paid in cash to obtain 20% of Botbrain and the Company

issued 1,789,618 ordinary shares to acquire the remaining 47.36% of Botbrain. The closing of the acquisition was completed on December

4, 2020.

On November 13, 2019, the

Company entered into a Share Subscription Agreement with Geely Technology Group Co., Ltd. (“Geely Technology”) to issue 21,794,872

series A preferred shares at a purchase price of $1.95 per share for an aggregate purchase price of $42,500,000. Per the terms of the

agreement, the Company recognized $32,910,257 as a loan. The Company received $21,743,857 as of December 31, 2019 and the remaining amount

was received in January 2020. Geely Technology may request the repayment after November 2020, under such circumstance, the Company shall

pay it back in January of 2021. On December 24, 2020, Geely Technology sent a notice of redemption. The Company is in negotiation for

an extension with Geely Technology.

On November 13, 2019, the

Company entered into a Securities Purchase Agreement with Acuitas Capital, LLC. and a Warrant to purchase the Company’s ordinary

shares pursuant to which the Purchaser subscribed to purchase up to $100,000,000 of units with up to a $10,000,000 subscription at each

closing, with each Unit consisting of one ordinary share and one warrant, where each whole warrant entitles the holder to purchase one

ordinary share. The Securities Purchase Agreement contemplates periodic closings of $10,000,000. On July 16, 2020, the Company held the

first closing pursuant to the Purchase Agreement and received $10,000,000. The Purchaser had received 7,763,975 ordinary shares on November

13, 2019 in consideration for such $10,000,000. The Purchaser also exercised the Warrant and received 15,897,663 ordinary shares upon

the exercise of the Warrant. On December 31, 2020, the Purchase Agreement has been terminated.

On August 10, 2020, the Company

entered into a cooperation framework agreement with Nanjing Antong Meteorological Data Limited (“Nanjing Antong”) and Nanjing

Weida Electronic Technology Co., Ltd. (“Nanjing Weida”), pursuant to which the Company would invest $153,000 (RMB 1 million)

each to Nanjing Antong and Nanjing Weida in order to establish a joint venture with Nanjing Antong. On August 27, 2020, the joint venture

was established, SuperEngine, eMapgo Technologies (Beijing) Co., Ltd. (“EMG”) and Nanjing Antong hold 50%, 20% and 30% of

equity of interest, respectively. The joint venture engages in real-time traffic information services for China’s high-class highways,

urban roads, urban and rural roads, as well as expressway data and travel value-added services.

Corporate Information

Our principal executive offices

are located at B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District, Beijing, People’s Republic of China 100020.

Our website is www.luokung.com. We routinely post important information on our website. The information contained on our website is not

a part of this annual report.

Our agent for service of

process in the United States is Worldwide Stock Transfer, LLC, the current transfer agent of the Company, with a mailing address of One

University Plaza, Suite 505, Hackensack, New Jersey 07601.

The SEC maintains an internet

site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC at www.sec.gov. The Company’s website is www.luokung.com.

The following diagram illustrates

our corporate structure and the place of formation and affiliation of each of our subsidiaries and affiliates as of December 31, 2021.

RISK FACTORS

An investment in our

ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below, the

information contained in or incorporated by reference into this prospectus, the risks described in page 1 to page 16 of our Annual

Report on Form 20-F, filed on May 14, 2021, for our most recent fiscal year, which are incorporated by reference into this

prospectus and other risks and other information that may be contained in, or incorporated by reference from, other filings we make

with the SEC, together with all other information contained in this annual report, including the matters discussed under

“Special Note Regarding Forward-Looking Statements,” before you decide to invest in our ordinary shares. You should pay

particular attention to the fact that we are a holding company with substantial operations in China and are subject to legal and

regulatory environments that in many respects differ from those of the United States. If any of the following risks, or any other

risks and uncertainties that are not presently foreseeable to us, actually occur, our business, financial condition, results of

operations, liquidity and our future growth prospects would be materially and adversely affected. You should also consider all other

information contained in this annual report before deciding to invest in our ordinary shares. The risk factors related to our

business contained in or incorporated by reference into this prospectus comprise the material risks of which we are aware. If any of

the events or developments described actually occurs, our business, financial condition or results of operations would likely

suffer.

We may undertake acquisitions, investments,

joint ventures or other strategic alliances, which could have a material adverse effect on our ability to manage our business. In addition,

such undertakings may not be successful.

Our strategy includes plans

to grow both organically and through acquisitions, participation in joint ventures or other strategic alliances. Joint ventures and strategic

alliances may expose us to new operational, regulatory and market risks, as well as risks associated with additional capital requirements.

We may not be able, however, to identify suitable future acquisition candidates or alliance partners. Even if we identify suitable candidates

or partners, we may be unable to complete an acquisition or alliance on terms commercially acceptable to us. If we fail to identify appropriate

candidates or partners, or complete desired acquisitions, we may not be able to implement our strategies effectively or efficiently.

In addition, our ability

to successfully integrate acquired companies and their operations may be adversely affected by several factors. These factors include:

| |

1. |

diversion of management’s attention; |

| |

|

|

| |

2. |

difficulties in retaining customers of the acquired companies; |

| |

|

|

| |

3. |

difficulties in retaining personnel of the acquired companies; |

| |

4. |

entry into unfamiliar markets; |

| |

|

|

| |

5. |

unanticipated problems or legal liabilities; and |

| |

|

|

| |

6. |

tax and accounting issues. |

If we fail to integrate acquired

companies efficiently, our earnings, revenue growth and business could be negatively affected.

Due to intense competition for highly-skilled

personnel, we may fail to attract and retain enough sufficiently trained employees to support our operations; our ability to bid for

and obtain new projects may be negatively affected and our revenues could decline as a result.

The IT industry relies on

skilled employees, and our success depends to a significant extent on our ability to attract, hire, train and retain qualified employees.

There is significant competition in China for professionals with the skills necessary to develop the products and perform the services

we offer to our customers. Increased competition for these professionals, in the mobile application design area or otherwise, could have

an adverse effect on us if we experience significant increase in the attrition rate among employees with specialized skills, which could

decrease our operating efficiency and productivity and could lead to a decline in demand for our services.

In addition, our ability

to serve existing customers and business partners and obtain new business will depend, in large part, on our ability to attract, train

and retain skilled personnel that enable us to keep pace with growing demands for spatial-temporal big-data processing and interactive

location-based services, evolving industry standards and changing customer preferences. Our failure to attract, train and retain personnel

with the qualifications necessary to fulfill the needs of our existing and future customers or to assimilate new employees successfully

could have a material adverse effect on our business, financial condition and results of operations. Our failure to retain our key personnel

on business development or find suitable replacements of the key personnel upon their departure may lead to shrinking new implementation

projects, which could materially adversely affect our business.

Our business depends substantially on the

continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily

depends upon the continued services of our senior executives and other key employees, particularly since we recently appointed a new

Chairman. We are reliant on the services of Mr. Xuesong Song, our Chairman, Chief Executive Officer and member of our board of directors.

If one or more of our senior executives or key employees is unable or unwilling to continue in his or her present position, we may not

be able to replace such employee easily, or at all, we may incur additional expenses to recruit, train and retain replacement personnel,

our business may be severely disrupted, and our financial condition and results of operations may be materially adversely affected.

Our business could suffer if our executives

and directors compete against us and our non-competition agreements with them cannot be enforced.

If any of our senior executives

or key employees joins a competitor or forms a competing company, we may lose customers, know-how and key professionals and staff members

to them. Also, if any of our business development managers who keep a close relationship with our customers and business partners joins

a competitor or forms a competing company, we may lose customers, and our revenues may be materially adversely affected. Most of our

executives have entered, or will soon enter, into employment agreements with us that contain or will contain non-competition provisions.

However, if any dispute arises between our executive officers and us, such non-competition provisions may not be enforceable, especially

in China, where all of these executive officers and key employees reside, in light of the uncertainties with China’s legal system.

See “Risk Factors — Risks Related to Doing Business in China — Uncertainties with respect to the PRC

legal system could adversely affect us.”

Our computer networks may be vulnerable

to security risks that could disrupt our services and adversely affect our results of operations.

Our computer networks may

be vulnerable to unauthorized access, computer hackers, computer viruses and other security problems caused by unauthorized access to,

or improper use of, systems by third parties or employees. We have been the target of attempted cyber-security breaches in the past and

expect that we will continue to be subject to such attempts in the future. A hacker who circumvents security measures could misappropriate

proprietary information or cause interruptions or malfunctions in operations. Computer attacks or disruptions may jeopardize the security

of information stored in and transmitted through computer systems and mobile devices of our customers. Actual or perceived concerns that

our systems may be vulnerable to such attacks or disruptions may deter customers from using our services. As a result, we may be required

to expend significant resources to protect against the threat of these security breaches or to alleviate problems caused by these breaches,

which could adversely affect our results of operations.

Widespread health developments, including

the recent global COVID-19 pandemic, could materially and adversely affect our business, financial condition and results of operations.

Our business has been, and

may continue to be, impacted by the fear of exposure to or actual effects of the COVID-19 pandemic, such as recommendations or mandates

from governmental authorities to close businesses, limit travel, avoid large gatherings or to self-quarantine. These impacts could place

limitations on our ability to execute on our business plan and could materially and adversely affect our business, financial condition

and results of operations. We continue to monitor the situation, have actively implemented policies and procedures to address the situation,

and may adjust our current policies and procedures as more information and guidance become available to address the evolving situation.

The impact of COVID-19 may also exacerbate other risks discussed in this Report, any of which could have a material effect on us.

If we do not continually enhance our solutions

and service offerings, we may have difficulty in retaining existing customers and attracting new customers.

We believe that our future

success will depend, to a significant extent, upon our ability to enhance our existing technologies, applications and platform, and to

introduce new features to meet the preferences and requirements of our customers in a rapidly developing and evolving market. Unexpected

technical, operational, distribution or other problems could delay or prevent the introduction of one or more of these products or services,

or any products or services that we may plan to introduce in the future. Our present or future products may not satisfy the evolving

preferences and tastes of our customers, and these solutions and services may not achieve anticipated market acceptance or generate incremental

revenue. If we are unable to anticipate or respond adequately to the need for service or product enhancements due to resource, technological

or other constraints, our business, financial condition and results of operations could be materially and adversely affected.

If we are unable to develop competitive

new products and service offerings our future results of operations could be adversely affected.

Our future revenue stream

depends to a large degree on our ability to utilize our technology in a way that will allow us to offer new types of products in relation

to maps and geospatial data processing, mobile applications and services to a broader customer base. We will be required to make investments

in research and development in order to continually develop new products, software applications and related service offerings, enhance

our existing products, platform, mobile applications and related service offerings and achieve market acceptance of our mobile applications

and service offerings. We may incur problems in the future in innovating and introducing new products, mobile applications and service

offerings. Our development-stage products, mobile applications may not be successfully completed or, if developed, may not achieve significant

customer acceptance. If we are unable to successfully define, develop and introduce competitive new mobile applications, and enhance

existing mobile applications, our future results of operations would be adversely affected. The timely availability of new applications

and their acceptance by customers are important to our future success. A delay in the development of new applications could have a significant

impact on its results of operations.

Changes in technology could adversely affect

our business by increasing our costs, reducing our profit margins and causing a decline in our competitiveness.

China’s spatial-temporal

big-data processing and interactive location-based services industry, in which we operate, is characterized by rapidly changing technology,

evolving industry standards, frequent introductions of new services and solutions and enhancements as well as changing customer demands.

New solutions and new technologies often render existing solutions and services obsolete, excessively costly or otherwise unmarketable.

As a result, our success depends on our ability to adapt to the latest technological progress, such as the 5G standard and technologies,

and to develop or acquire and integrate new technologies into our products, mobile applications and related services. Advances in technology

also require us to commit substantial resources to developing or acquiring and then deploying new technologies for use in our operations.

We must continuously train personnel in new technologies and in how to integrate existing systems with these new technologies. We may

not be able to adapt quickly to new technologies or commit sufficient resources to compete successfully against existing or new competitors

in bringing to market solutions and services that incorporate these new technologies. We may incur problems in the future in innovating

and introducing new mobile applications and service offerings. Our development of new mobile applications and platform enhancements may

not be successfully completed or, if developed, may not achieve significant customer acceptance. If we fail to adapt to changes in technologies

and compete successfully against established or new competitors, our business, financial condition and results of operations could be

adversely affected.

Problems with the quality or performance

of our software or other systems may cause delays in the introduction of new solutions or result in the loss of customers and revenues,

which could have a material and adverse effect on our business, financial condition and results of operations.

Our products are complex

and may contain defects, errors or bugs when first introduced to the market or to a particular customer, or as new versions are released.

Because we cannot test for all possible scenarios, our systems may contain errors that are not discovered until after they have been

installed or implemented, and we may not be able to timely correct these problems. These defects, errors or bugs could interrupt or delay

the completion of projects or sales to our customers. In addition, our reputation may be damaged and we may fail to acquire new projects

from existing customers or new customers. Errors may occur when we provide systems integration and maintenance services. Even in cases

where we have agreements with our customers that contain provisions designed to limit our exposure to potential claims and liabilities

arising from customer problems, these provisions may not effectively protect us against such claims in all cases and in all jurisdictions.

In addition, as a result of business and other considerations, we may undertake to compensate our customers for damages arising from

the use of our solutions, even if our liability is limited by these provisions. Moreover, claims and liabilities arising from customer

problems could also result in adverse publicity and materially and adversely affect our business, results of operations and financial

condition. We currently do not carry any product or service liability insurance and any imposition of liability on us may materially

and adversely affect our business and increase our costs, resulting in reduced revenues and profitability.

Our products may contain undetected software

defects, which could negatively affect our revenues.

Our software products are

complex and may contain undetected defects. Although we test our products, it is possible that errors may be found or occur in our new

or existing products after we have delivered those products to the customers. Defects, whether actual or perceived, could result in adverse

publicity, loss of revenues, product returns, a delay in market acceptance of our products, loss of competitive position or claims against

us by customers. Any such problems could be costly to remedy and could cause interruptions, delays, or cessation of our product sales,

which could cause us to lose existing or prospective customers and could negatively affect our results of operations.

We may be subject to infringement, misappropriation

and indemnity claims in the future, which may cause us to incur significant expenses, pay substantial damages and be prevented from providing

our services or technologies.

Our success depends, in part,

on our ability to carry out our business without infringing the intellectual property rights of third parties. Patent and copyright law

covering software-related technologies is evolving rapidly and is subject to a great deal of uncertainty. Our self-developed or licensed

technologies, processes or methods may be covered by third-party patents or copyrights, either now existing or to be issued in the future.

Any potential litigation may cause us to incur significant expenses. Third-party claims, if successfully asserted against us may cause

us to pay substantial damages, seek licenses from third parties, pay ongoing royalties, redesign our services or technologies, or prevent

us from providing services or technologies subject to these claims. Even if we were to prevail, any litigation would likely be costly

and time-consuming and divert the attention of our management and key personnel from our business operations.

Our failure to protect our intellectual

property rights may undermine our competitive position, and subject us to costly litigation to protect our intellectual property rights.

Any misappropriation of our

technology or the development of competitive technology could seriously harm our business. We regard a substantial portion of our hardware

and software systems as proprietary and rely on statutory copyright, trademark, patent, trade secret laws, customer license agreements,

employee and third-party non-disclosure agreements and other methods to protect our proprietary rights. Nevertheless, these resources

afford only limited protection and the actions we take to protect our intellectual property rights may not be adequate. In particular,

third parties may infringe or misappropriate our proprietary technologies or other intellectual property rights, which could have a material

adverse effect on our business, financial condition and results of operations. In addition, intellectual property rights and confidentiality

protection in China may not be as effective as in the United States, and policing unauthorized use of proprietary technology can be difficult

and expensive. Further, litigation may be necessary to enforce our intellectual property rights, protect our trade secrets or determine

the validity and scope of the proprietary rights of others. The outcome of any such litigation may not be in our favor. Any such litigation

may be costly and may divert management attention, as well as our other resources, away from our business. An adverse determination in

any such litigation will impair our intellectual property rights and may harm our business, prospects and reputation. In addition, we

have no insurance coverage against litigation costs and would have to bear all litigation costs in excess of the amount recoverable from

other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results

of operations.

Our solutions incorporate a portion of,

and work in conjunction with, third-party hardware and software solutions. If these third-party hardware or software solutions are not

available to us at reasonable costs, or at all, our results of operations could be adversely impacted.

Although our hardware and

software systems and mobile applications primarily rely on our own core technologies, some elements of our systems incorporate a small

portion of third-party hardware and software solutions. If any third party were to discontinue making their intellectual property available

to us or our customers on a timely basis, or increase materially the cost of their licensing such intellectual property, or if our systems

or applications failed to properly function or interoperate with replacement intellectual property, we may need to incur costs in finding

replacement third-party solutions and/or redesigning our systems or applications to replace or function with or on replacement third-party

proprietary technology. Replacement technology may not be available on terms acceptable to us or at all, and we may be unable to develop

alternative solutions or redesign our systems or applications on a timely basis or at a reasonable cost. If any of these were to occur,

our results of operations could be adversely impacted.

Our ability to sell our products is highly

dependent on the quality of our service and support offerings, and our failure to offer high quality service could have a material adverse

effect on our ability to market and sell our products.

Our customers depend upon

our customer service and support staff to resolve issues relating to our products. High-quality support services are critical for the

successful marketing and sale of our products. If we fail to provide high-quality support on an ongoing basis, our customers may react

negatively and we may be materially and adversely affected in our ability to sell additional products to these customers. This could

also damage our reputation and prospects with potential customers. Our failure to maintain high-quality support services could have a

material and adverse effect on our business, results of operations and financial condition.

Weaknesses in our internal controls over

financial reporting or disclosure controls and procedures may have a material adverse effect on our business, the price of our ordinary

shares, operating results and financial condition.

We are required to establish

and maintain appropriate internal controls over financial reporting and disclosure controls and procedures. Pursuant to Section 404 of

the Sarbanes-Oxley Act of 2002 and the related rules adopted by the Securities and Exchange Commission (the “SEC”), every

public company is required to include a management report on its internal controls over financial reporting in its annual report, which

contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. This requirement

first applied to our annual report on Form 20-F for the fiscal year ended on September 30, 2011. In connection with our assessments of

our disclosure controls and procedures and internal controls over financial reporting, management concluded that as of December 31,

2021, our disclosure controls and procedures and our internal controls over financial reporting were not effective due to lack of U.S.

generally accepted accounting principles (“U.S. GAAP”) expertise in our current accounting team. Please refer to the discussion

under Item 15 of the Form 20-F for 2020, “Controls and Procedures” for further discussion of our material weakness as of

December 31, 2021. Should we be unable to remediate the material weakness promptly and effectively, such weakness could harm our

operating results, result in a material misstatement of our financial statements, cause us to fail to meet our financial reporting obligations

or prevent us from providing reliable and accurate financial reports or avoiding or detecting fraud. This, in turn, could result in a

loss of investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on the trading

price of our ordinary shares. Any litigation or other proceeding or adverse publicity relating to the material weaknesses could have

a material adverse effect on our business and operating results.

We have very limited insurance coverage

which could expose us to significant costs and business disruption.

We do not maintain any insurance

coverage for our leased properties. Should any natural catastrophes such as earthquakes, floods, typhoons or any acts of terrorism occur

in Beijing, China, where our head office is located and most of our employees are based, or elsewhere in China, we might suffer not only

significant property damages, but also loss of revenues due to interruptions in our business operations, which could have a material

adverse effect on our business, operating results or financial condition.

The insurance industry in

China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not,

to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations.

Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance

are such that we do not require it at this time. Any business disruption, litigation or natural disaster might result in substantial

costs and diversion of resources, particularly if it affects our technology platforms which we depend on for delivery of our software

and services, and could have a material adverse effect on our financial condition and results of operations.

We may be liable to our customers for damages

caused by unauthorized disclosure of sensitive and confidential information, whether through our employees or otherwise.

We are typically required

to manage, utilize and store sensitive or confidential customer data in connection with the products and services we provide. Under the

terms of our customer contracts, we are required to keep such information strictly confidential. We seek to implement specific measures

to protect sensitive and confidential customer data. We require our employees to enter into non-disclosure agreements to limit such employees’

access to, and distribution of, our customers’ sensitive and confidential information and our own trade secrets. We can give no

assurance that the steps taken by us in this regard will be adequate to protect our customers’ confidential information. If our

customers’ proprietary rights are misappropriated by our employees, in violation of any applicable confidentiality agreements or

otherwise, our customers may consider us liable for that act and seek damages and compensation from us. However, we currently do not

have any insurance coverage for mismanagement or misappropriation of such information by our employees. Any litigation with respect to

unauthorized disclosure of sensitive and confidential information might result in substantial costs and diversion of resources and management

attention.

We may face intellectual property infringement

claims that could be time-consuming and costly to defend. If we fail to defend ourselves against such claims, we may lose significant

intellectual property rights and may be unable to continue providing our existing products and services.

It is critical that we use

and develop our technology and products without infringing upon the intellectual property rights of third parties, including patents,

copyrights, trade secrets and trademarks. Intellectual property litigation is expensive and time-consuming and could divert management’s

attention from our business. A successful infringement claim against us, whether with or without merit, could, among others things, require

us to pay substantial damages, develop non-infringing technology, or re-brand our name or enter into royalty or license agreements that

may not be available on acceptable terms, if at all, and cease making, licensing or using products that have infringed a third party’s

intellectual property rights. Protracted litigation could also result in existing or potential customers deferring or limiting their

purchase or use of our products until resolution of such litigation, or could require us to indemnify our customers against infringement

claims in certain instances. Also, we may be unaware of intellectual property registrations or applications relating to our services

that may give rise to potential infringement claims against us. Parties making infringement claims may be able to obtain an injunction

to prevent us from delivering our services or using technology containing the allegedly infringing intellectual property. Any intellectual

property litigation could have a material adverse effect on our business, results of operations or financial condition.

Seasonality and fluctuations in our customers’

spending cycles and other factors can cause our revenues and operating results to vary significantly from quarter to quarter and from

year to year.

Our revenues and operating

results will vary from quarter to quarter and from year to year due to a number of factors, many of which are outside of our control.

Our new lines of business acquired upon the consummation of the asset exchange transaction discussed below see higher customer use and

activity during the Chinese New Year holiday than other times during the year, which lead to higher revenue during this period as more

customers would like to place more advertising. Historically, the products of our subsidiary Superengine Graphics Software Technology

Development (Suzhou) Co., Ltd (“Superengine”) have a pattern of decreased sales in the first fiscal quarter as a result of

industry buying patterns. Due to these and other factors, our operating results may fluctuate from quarter to quarter and from year to

year. These fluctuations are likely to continue in the future, and operating results for any period may not be indicative of our future

performance in any future period.

Our corporate actions are substantially

controlled by Mr. Xuesong Song, our Chairman and Chief Executive Officer, who can cause us to take actions in ways you may not agree

with.

Mr. Xuesong Song, our Chairman

and Chief Executive Officer, beneficially owns 9.90% of our outstanding ordinary shares and 1,000,000 preferred shares, and each preferred

share has the right to 399 votes at a meeting of the shareholders of the Company. As a result, Mr. Song has approximately 55.72% of the

voting rights of the shareholders of the Company. Mr. Song can exert control and substantial influence over matters such as electing

directors, amending our constitutional documents, and approving acquisitions, mergers or other business combination transactions. This

concentration of ownership and voting power may also discourage, delay or prevent a change in control of our company, which could deprive

our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price

of our shares. Alternatively, our controlling shareholders may cause a merger, consolidation or change of control transaction even if

it is opposed by our other shareholders, including those who purchase shares in this offering.

We depend on a small number of customers

to derive a significant portion of our revenues. If we were to continue being dependent upon a few customers, such dependency could negatively

impact our business, operating results and financial condition.

We derived a material portion

of our revenues from a small number of customers. In the years ended December 31, 2021, 2020 and 2019, our five largest customers

accounted for 43.6%, 49.8% and 69.3% of our total sales, respectively. As our customer base may change from year-to-year, during such

years that the customer base is highly concentrated, the fluctuation of our sales to any of such major customers could have a material

adverse effect on our business, operating results and financial condition. Moreover, our high customer base concentration may also adversely

affect our ability to negotiate contract prices with these customers, which may in turn materially and adversely affect our results of

operations.

Our historical outstanding accounts receivable

have been relatively high. Inability to collect our accounts receivable on a timely basis, if at all, could materially and adversely

affect our financial condition, liquidity and results of operations.

Historically, our outstanding

accounts receivable have been relatively high. As of December 31, 2021, 2020 and 2019, our outstanding accounts receivable before

impairment were $38.1 million, $26.9 million and $23.8 million, respectively. Although we conduct credit evaluations of our customers,

we generally do not require collateral or other security from our customers. In addition, we have had a relatively high customer concentration.

The largest outstanding accounts receivable balance accounted for 18.5%, 27.9% and 31.8% of our total accounts receivable balance as

of December 31, 2021, 2020 and 2019, respectively. As a result, an extended delay or default in payment relating to a significant

account would likely have a material and adverse effect on the aging schedule and turnover days of our accounts receivable. Our inability

to collect our accounts receivable on a timely basis, if at all, could materially and adversely affect our financial condition, liquidity

and results of operations.

Risks Related to Doing Business in China

If the PRC government deems that our agreements

with our variable interest entities (our “VIEs”) do not comply with PRC regulatory restrictions on foreign investment in

the relevant industries or other laws or regulations of the PRC, or if these regulations or the interpretation of existing regulations

change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, which may

therefore materially reduce the value of our ordinary shares.

We are a holding company

incorporated in the British Virgin Islands. As a holding company with no material operations of our own, we conducted the majority of

our business through our wholly-owned or majority-owned subsidiaries and certain business through our operating entities established

in the People’s Republic of China, or the PRC, primarily our VIEs. Due to PRC legal restrictions on foreign ownership in any internet-related

businesses we may explore and operate, we do not have any equity ownership of our VIEs, instead we receive the economic benefits of our

VIEs’ business operations through certain contractual arrangements. Our ordinary shares that currently listed on the Nasdaq Capital

Markets are shares of our Nevada holding company that maintains service agreements with the associated operating companies. The Chinese

regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities

could decline or become worthless. For a description of our corporate structure and contractual arrangements, see “Corporate Structure”

on page 3.

We believe that our corporate

structure and contractual arrangements comply with the current applicable PRC laws and regulations. We also believe that each of the

contracts among our wholly-owned PRC subsidiary, our consolidated VIEs and its shareholders is valid, binding and enforceable in accordance

with its terms. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws

and regulations. Thus, the PRC governmental authorities may take a view contrary to the opinion of our PRC legal counsel. It is uncertain

whether any new PRC laws or regulations relating to variable interest entity structure will be adopted or if adopted, what they would

provide. PRC laws and regulations governing the validity of these contractual arrangements are uncertain and the relevant government

authorities have broad discretion in interpreting these laws and regulations.

If these regulations change

or are interpreted differently in the future and our corporate structure and contractual arrangements are deemed by the relevant regulators

that have competent authority, to be illegal, either in whole or in part, we may be unable to direct the operations of our consolidated

VIEs in the future, which conducts our manufacturing operations, holds significant assets and accounts for significant revenue, and may

need to modify such structure to comply with regulatory requirements. However, there can be no assurance that we can achieve this without

material disruption to our business. Further, if our corporate structure and contractual arrangements are found to be in violation of

any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such

violations, including:

| |

● |

revoking our business and operating licenses; |

| |

● |

confiscating any of our income that they deem to be obtained through

illegal operations; |

| |

● |

shutting down our services; |

| |

● |

discontinuing or restricting our operations in China; |

| |

● |

imposing conditions or requirements with which we may not be able to

comply; |

| |

● |

requiring us to change our corporate structure and contractual arrangements; |

| |

● |

restricting or prohibiting our use of the proceeds from

overseas offering to finance our consolidated VIEs’ business and operations; and |

| |

● |

taking other regulatory or enforcement actions that could be harmful

to our business. |

Furthermore, new PRC laws,

rules and regulations may be introduced to impose additional requirements that may be applicable to our corporate structure and contractual

arrangements. Occurrence of any of these events could materially and adversely affect our business, financial condition and results of

operations and the market price of our ordinary shares. In addition, if the imposition of any of these penalties or requirement to restructure

our corporate structure causes us to lose the rights to direct the activities of our consolidated VIEs or our right to receive their

economic benefits, we would no longer be able to consolidate the financial results of such VIEs in our consolidated financial statements,

which may cause the value of our securities to significantly decline or even become worthless.

In addition, while we will

take every precaution available to effectively enforce the contractual and corporate relationship of the VIE agreements, these contractual

arrangements are less effective than direct ownership and we may incur substantial costs to enforce the terms of the arrangements. For

example, the VIEs and its shareholders could breach their contractual arrangements with us by, among other things, failing to conduct

their operations in an acceptable manner or taking other actions that are detrimental to our interests. If we had direct ownership of

the VIEs, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of the VIEs, which in

turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under

VIE Agreements, we will rely on the performance by the VIEs and its shareholders of their obligations under the contracts to direct the

operation of the VIEs. As such, the shareholders of VIEs may not act in the best interests of our company or may not perform their obligations

under these contracts. In addition, failure of the VIE shareholders to perform certain obligations could compel us to rely on legal remedies

available under PRC laws, including seeking specific performance or injunctive relief, and claiming damages, which may not be effective.

Adverse changes in political and economic

policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand

for our services and materially and adversely affect our competitive position.

Substantially all of our

business operations are conducted in China. Accordingly, our business, results of operations, financial condition and prospects are subject

to a significant degree to economic, political and legal developments in China. Although the Chinese economy is no longer a planned economy,

the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources,

monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries

by foreign investors, control the exchange between RMB and foreign currencies, and regulate the growth of the general or specific market.

These government involvements have been instrumental in China’s significant growth in the past 30 years. The reorganization of

the telecommunications industry encouraged by the PRC government has directly affected our industry and our growth prospect.

Growth of China’s economy

has been uneven, both geographically and among various sectors of the economy, and the growth of the Chinese economy has slowed down

in recent years. Some of the government measures may benefit the overall Chinese economy, but may have a negative effect on us. For example,

our financial condition and results of operations may be adversely affected by government control over capital investments or changes

in tax regulations. Any stimulus measures designed to boost the Chinese economy may contribute to higher inflation, which could adversely

affect our results of operations and financial condition. For example, certain operating costs and expenses, such as employee compensation

and office operating expenses, may increase as a result of higher inflation.

Our business benefits from certain government

tax incentives. Expiration, reduction or discontinuation of, or changes to, these incentives will increase our tax burden and reduce

our net income.

Under the PRC Enterprise

Income Tax Law passed in 2007 and the implementing rules, both of which became effective on January 1, 2008, or the New EIT Law, a unified

enterprise income tax rate of 25% and unified tax deduction standard is applied equally to both domestic-invested enterprises and foreign-invested

enterprises, or FIEs. Enterprises established prior to March 16, 2007 eligible for preferential tax treatment in accordance with the

then tax laws and administrative regulations shall gradually become subject to the New EIT Law rate over a five-year transition period

starting from the date of effectiveness of the New EIT Law. However, certain qualifying high-technology enterprises may still benefit

from a preferential tax rate of 15% if they own their core intellectual properties and they are enterprises in certain high-tech industries

to be later specified by the government. As a result, if our PRC subsidiaries qualify as “high-technology enterprises,” they

will continue to benefit from the preferential tax rate of 15%, subject to transitional rules implemented from January 1, 2008. Our subsidiaries,

Beijing Zhong Chuan Shi Xun Technology Limited, Superengine Graphics Software Technology Development (Suzhou) Co., Ltd, eMapgo Technologies

(Beijing) Co., Ltd., DMG Infotech Co., Ltd, and Beijing BotBrain AI Technology Ltd., are qualified as a “high-technology enterprise”

until November 28, 2021 to December 17, 2024, respectively, and therefore they have benefited from the preferential tax rate of 15%,

subject to transitional rules implemented on January 1, 2008. Although we intend to apply for a renewal of this qualification, if these

subsidiaries cease to qualify as a “high-technology enterprise”, or the tax authorities change their position on our preferential

tax treatments in the future, our future tax liabilities may materially increase, which could materially and adversely affect our financial

condition and results of operations.

If we were deemed a “resident enterprise”

by PRC tax authorities, we could be subject to tax on our global income at the rate of 25% under the New EIT Law and our non-PRC shareholders

could be subject to certain PRC taxes.

Under the New EIT Law and

the implementing rules, both of which became effective January 1, 2008, an enterprise established outside of the PRC with “de facto

management bodies” within the PRC may be considered a PRC “resident enterprise” and will be subject to the enterprise

income tax at the rate of 25% on its global income as well as PRC enterprise income tax reporting obligations. The implementing rules

of the New EIT Law define “de facto management” as “substantial and overall management and control over the production

and operations, personnel, accounting, and properties” of the enterprise. However, as of the date of this annual report, no final

interpretations on the implementation of the “resident enterprise” designation are available. Moreover, any such designation,

when made by PRC tax authorities, will be determined based on the facts and circumstances of individual cases. Therefore, if we were

to be considered a “resident enterprise” by the PRC tax authorities, our global income would be taxable under the New EIT

Law at the rate of 25% and, to the extent we were to generate a substantial amount of income outside of PRC in the future, we would be

subject to additional taxes. In addition, the dividends we pay to our non-PRC enterprise shareholders and gains derived by such shareholders

from the transfer of our shares may also be subject to PRC withholding tax at the rate up to 10%, if such income were regarded as China-sourced

income.

Our holding company structure may limit

the payment of dividends.

We have no direct business

operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in

the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends

or other payments from our operating subsidiaries and other holdings and investments. Current PRC regulations permit our PRC subsidiaries