Holisto Ltd, a technology based online travel booking platform

(“Holisto” or the “Company”), and Moringa Acquisition Corp (Nasdaq:

MACA, “Moringa”), a special purpose acquisition company, today

announced they have entered into a business combination agreement

that would result in Holisto becoming publicly listed on the

Nasdaq. The business combination provides for Holisto Ltd.’s

expected pro forma equity value to be approximately $405 million.

As described below and subject to certain limitations, the

transaction provides Moringa’s non-redeeming public shareholders

the opportunity to receive a pro rata portion of a bonus pool of up

to an additional 1,725,000 shares at transaction close, which would

result in merger consideration of between 1.15 and 1.6 Holisto

ordinary shares for each such Moringa Class A ordinary share not

redeemed. The exact ratio of merger consideration for non-redeeming

shareholders will depend on the number of Moringa shares that are

redeemed.

The closing of the transaction is expected to occur during the

fourth quarter of 2022.

Holisto is a technology-based online travel booking platform

that is disrupting the market by harnessing the power of advanced

AI to make travel more affordable and personalized for consumers.

Holisto’s advanced AI technology leverages its unique holistic view

of hotel rates and plans across multiple inventory sources,

including online travel agencies, global distribution systems,

wholesalers and hotel operators to provide consumers with more

affordable and personalized bookings. Operating under multiple

brands, including GoSplitty (http://www.gosplitty.com/) and

Traveluro (www.traveluro.com).

Holisto’s founders were inspired by the opportunity to disrupt

the large, fragmented and complex travel booking market. Through

the use of advanced big data and AI technologies, Holisto enables

incremental cost savings and simplicity for the consumer

traveler.

“From the outset we were inspired by the opportunity to disrupt

the large, fragmented and complex travel booking market, using

advanced big data and AI technologies that enable incremental cost

savings and simplicity through the ability to combine offerings

from multiple sources”, said Eran Shust, Chief Executive Officer

and co-Founder of Holisto. “Our combination with Moringa and access

to public markets will allow Holisto to continue to aggressively

leverage our technology by scaling our platform and infrastructure

and expand our customer acquisition and brand awareness.”

Ilan Levin, Chief Executive Officer and Chairman

of Moringa, added, “We are incredibly excited to announce the

merger with Holisto. Holisto is innovating with advanced technology

solutions in a large, global market which is ripe for

transformation for the benefit of the consumer traveler. We

look forward to our partnership and opportunity to leverage our

expertise as Holisto continues to rapidly scale its business.”

Holisto Investment

Highlights:

- Operating within a large available global market - the global

online hotel booking market is forecasted at $194 billion in

2022

- Deploying Big Data/AI technologies to disrupt a fragmented and

complex market, empowering the consumer with an affordable and

personalized offering

- Growing market acceptance with

exceptional performance to date, with Q1 ’22 revenues of $7.18

million as compared to Q1 ’21 revenues of $1.97 million

- Transaction-based marketing strategy

yields favorable unit economics

- Near-term and sustained growth outlook based on current product

offering

- Strong management team

Key Transaction Terms

Holisto’s expected implied pro forma equity value is

approximately $405 million, based on a $10 share price. However, a

bonus pool of up to an additional 1,725,000 Holisto shares will be

distributed to non-redeeming Moringa shareholders on a pro rata

basis, which will result in an exchange ratio in the business

combination of between 1.15 and 1.6 Holisto ordinary shares for

each unredeemed Moringa Class A ordinary share, with the exact

ratio to be determined based on the number of Moringa public shares

being redeemed. Assuming a price of $10.00 per Moringa Class A

ordinary share at the closing of the transaction, non-redeeming

Moringa shareholders would receive, in exchange for each Moringa

Class A ordinary share held, shares of the post-combination public

company with a value equating to between $11.50 (assuming no

redemptions by Moringa shareholders) and $16.00 (assuming at least

75% redemptions, resulting in the maximum share ratio).

Contemporaneously with the execution of the business combination

agreement, Moringa and Holisto entered into a securities purchase

agreement with a non-affiliated investor pursuant to which the

investor would purchase a $30 million senior secured convertible

note from Holisto, which would be convertible into Holisto ordinary

shares at the lesser of $11.00 per share or 90% of the market price

at the time of conversion, and a warrant to purchase 1,363,636

Holisto ordinary shares at an exercise price of $11.50. The

convertible note financing is subject to closing conditions of both

Holisto and the note investor.

The business combination, which has been unanimously approved by

the boards of directors of Holisto and Moringa, is expected to

close in the fourth quarter of 2022, subject to the satisfaction of

customary closing conditions, including the approval of Holisto and

Moringa shareholders and Nasdaq approval.

About Holisto

Holisto is a tech-powered online travel agency, aiming to make

hotel booking affordable and personalized for consumers. The

company, founded in 2015, spent over 6 years developing

award-winning AI and machine learning technologies, to provide

consumers with more affordable and personalized hotel bookings,

that otherwise aren't accessible. Instead of simply searching and

comparing available deals as offered by the various industry

channels, Holisto deploys predictive proprietary algorithms,

allowing it to create in real-time, unique booking options based on

travelers' preferences. Company brands include GoSplitty.com

and Traveluro.

About Moringa Acquisition

Corp

Moringa Acquisition Corp (Nasdaq: MACA), is a publicly-listed

special purpose acquisition company.

Moringa is registered as a Cayman Islands exempted company

incorporated as a blank check company for the purpose of entering

into a merger, share exchange, asset acquisition, share purchase,

recapitalization, reorganization, or similar business combination

with one or more businesses or entities.

Advisors

Oppenheimer & Co. Inc. and Fundem Capital are serving as

financial advisor to Holisto. Ellenoff Grossman & Schole LLP

and Shibolet & Co. are serving as legal counsel to Holisto.

Meitar | Law Offices and McDermott Will & Emery are serving

as legal counsel to Moringa.

Important Information About the Proposed Transaction and

Where to Find It

The proposed business combination will be submitted to

shareholders of Moringa for their consideration. Holisto intends to

file a registration statement on Form F-4 (the

“Registration Statement”) with the United States Securities and

Exchange Commission (the “SEC”) which will include preliminary and

definitive proxy statements to be distributed to Moringa’s

shareholders in connection with Moringa’s solicitation for proxies

for the vote by Moringa’s shareholders in connection with the

proposed business combination and other matters as described in the

Registration Statement, as well as the prospectus relating to the

offer of the securities to be issued to Moringa’s shareholders in

connection with the completion of the proposed business

combination. After the Registration Statement has been filed and

declared effective, Moringa will mail a definitive proxy statement

and other relevant documents to its shareholders as of the record

date established for voting on the proposed business combination.

MORINGA’S SHAREHOLDERS AND OTHER INTERESTED PERSONS ARE URGED TO

READ, ONCE AVAILABLE, THE REGISTRATION STATEMENT, THE PRELIMINARY

PROXY STATEMENT / PROSPECTUS AND ANY AMENDMENTS THERETO AND, ONCE

AVAILABLE, THE DEFINITIVE PROXY STATEMENT / PROSPECTUS, IN

CONNECTION WITH MORINGA’S SOLICITATION OF PROXIES FOR ITS SPECIAL

MEETING OF SHAREHOLDERS TO BE HELD TO APPROVE, AMONG OTHER THINGS,

THE PROPOSED BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS WILL

CONTAIN IMPORTANT INFORMATION ABOUT MORINGA, HOLISTO AND THE

PROPOSED BUSINESS COMBINATION.

Shareholders may also obtain a copy of the preliminary or

definitive proxy statement, once available, as well as other

documents filed with the SEC regarding the proposed business

combination and other documents filed with the SEC by Moringa,

without charge, at the SEC’s website located at www.sec.gov, as

well as in the Investor Relations section of the Moringa website at

www.moringaac.com

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN

APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY

AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE PROPOSED TRANSACTION PURSUANT TO WHICH ANY SECURITIES ARE TO

BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED

HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “might” and “continues,” and similar

expressions are intended to identify such forward-looking

statements. These statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectations of Holisto’ and Moringa’s management and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on by any investor as, a

guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of Holisto

and Moringa. These forward-looking statements are subject to a

number of risks and uncertainties, including, but not limited to:

(i) the expected timing and likelihood of completion of the

transaction, including the risk that the transaction may not close

due to one or more closing conditions to the transaction in the

business combination agreement (the “Business Combination

Agreement”) not being satisfied or waived on a timely basis or

otherwise, or that the required approval of the Business

Combination Agreement and related matters by the shareholders of

Moringa is not obtained; (ii) a failure of the convertible note

investor (the “Investor”) to purchase the convertible note (the

“Investor Note”) and warrant (the “Financing Warrant”) from Holisto

or the failure of any other investor, including parties to certain

SAFE agreements with Holisto (the “New SAFE Agreements”), to

purchase the securities pursuant to their respective agreements;

(iii) the effect of the terms of the Investor Note, including, but

not limited to the $30 million purchase price being held in a

controlled account controlled by a designee of the Investor and the

conversion price of the Investor Note being at a discount from

market at the time of conversion, and the terms of the Financing

Warrant on the market price of Holisto’s ordinary shares; (iv) the

Investor’s designee’s control of the $30 million of proceeds from

the sale of the Investor Note and Financing Warrant, which causes

those proceeds not to be treated as cash to Holisto until released

to Holisto, with no assurance as to when or whether those funds

will be released; (v) Moringa’s failure to retain sufficient cash

in its trust account or find replacement financing in order to meet

the minimum of $5,000,001 of net tangible assets, which is a

closing condition to the merger under the business combination

agreement (the “Merger”) and a provision in Moringa’s articles

which cannot be waived by Moringa; (vi) the occurrence of any

event, change or other circumstances that could give rise to the

termination of the Business Combination Agreement; (vii) the

ability of Holisto to meet Nasdaq initial listing standards

following the transaction, including the risk that Holisto may fail

to meet these listing requirements because of the amount of

redemptions of Moringa’s public shares; (viii) costs related to the

transaction, including the requirement of paying secured debt at

the closing; (ix) the failure of Holisto and Moringa to obtain $47

million in financing as required by the securities purchase

agreement for the convertible note financing (the “Securities

Purchase Agreement”); (x) the termination of the Securities

Purchase Agreement by Holisto as a result of its and Moringa’s

failure to raise $47 million in an approved financing and the

failure of Holisto and Moringa to find an alternative financing

source following such termination; (xi) Holisto and Moringa

consummating the Merger without any financing other than the New

SAFE Agreements; (xii) the occurrence of a material adverse change

with respect to the financial position, performance, operations or

prospects of Holisto or Moringa; (xiii) the disruption of Holisto

management’s time from ongoing business operations due to the

transaction; (xiv) announcements relating to the transaction having

an adverse effect on the market price of Moringa's securities; (xv)

the effect of the transaction and the announcement thereof on the

ability of Holisto to retain customers and retain and hire key

personnel and maintain relationships with its suppliers and

customers and on its operating results and businesses generally;

(xvi) the failure of Holisto to meet projected development targets;

(xvii) risks relating to the travel industry generally, including

changes in applicable laws or regulations; (xviii) the effects of

laws and regulations affecting the market for Holisto’s products;

(xix) the possibility that the combined company may be adversely

affected by other economic, business, and/or competitive factors,

or adverse macro-economic conditions, including inflation and

supply chain delays, triggered by the COVID-19 pandemic; (xx) risks

associated with Holisto being an Israeli company located in Israel

and the effect of any security and terrorist activity in or

affecting Israel; and (xxi) other risks and uncertainties,

including those to be identified in the proxy statement/prospectus

on Form F-4 (when available) relating to the transaction, including

those under “Risk Factors,” “Cautionary Note Concerning

Forward-Looking Statements” and “Holisto Management’s Discussion

and Analysis of Financial Condition and Results of Operations”

therein, and in other filings with the SEC by Moringa or,

subsequent to the date of this press release, Holisto. Moringa and

Holisto caution that the foregoing list of factors is not

exclusive. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements. Forward-looking statements relate only to the date they

are made, and readers are cautioned not to place undue reliance

upon any forward-looking statements. Moringa and Holisto undertake

no obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or otherwise,

subject to applicable law.

No Offer or Solicitation

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Participants in Solicitation

Moringa, Holisto, and certain of their respective directors,

executive officers and other members of management and employees

may, under SEC rules, be deemed to be participants in the

solicitations of proxies from Moringa’s shareholders in connection

with the proposed business combination. Information regarding the

persons who may, under SEC rules, be deemed participants in the

solicitation of Moringa’s shareholders in connection with the

proposed business combination will be set forth in the Registration

Statement when it is filed with the SEC. You can find more

information about Moringa’s directors and executive officers in

Moringa’s final prospectus dated February 16, 2021. Additional

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests will be

included in the Registration Statement when it becomes available.

Shareholders, potential investors and other interested persons

should read the Registration Statement and other relevant materials

to be filed with the SEC regarding the proposed business

combination carefully when they become available before making any

voting or investment decisions. You may obtain free copies of these

documents from the sources indicated above.

Contacts

MoringaGil Maman – gil@moringaac.com

HolistoPublic Relations – PR@holisto.com

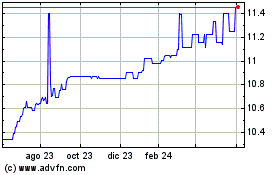

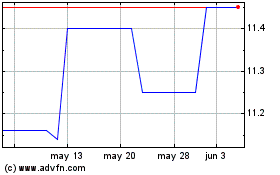

Moringa Acquisition (NASDAQ:MACA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Moringa Acquisition (NASDAQ:MACA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024