Manitex International, Inc. (Nasdaq: MNTX) ("Manitex" or the

"Company"), a leading international provider of truck cranes,

specialized industrial equipment, and construction equipment rental

solutions to infrastructure and construction markets, today

reported financial results for the three months ended June 30,

2024.

SECOND QUARTER 2024 RESULTS (all comparisons versus the

prior year period unless otherwise noted)

- Net revenue of $76.2 million, +3.7%

- Gross profit of $17.2 million, +14.9%; gross margin of 22.5%,

+220 basis points

- Net Income of $1.5 million; Adjusted Net Income of $2.2

million, or $0.11 per diluted share

- Adjusted EBITDA of $8.1 million, +19.0%; Adjusted EBITDA margin

of 10.6%, +137 basis points

- Net Debt decrease of $2.4 million from 1Q24; Net leverage of

2.5x as of June 30, 2024

- Reiterated full-year 2024 adjusted EBITDA guidance; Adjusted

full-year 2024 revenue guidance

MANAGEMENT COMMENTARY

“Our second quarter results highlight our continued progress

under our Elevating Excellence strategy, as we produced further

margin expansion, generated strong adjusted EBITDA growth, and

reduced net leverage” stated Michael Coffey, Chief Executive

Officer of Manitex. “Our second quarter performance was driven by

strong growth in our rental operations, cost reductions which are

gaining momentum, and ongoing process improvements, resulting in

nearly 20% year-over-year growth in adjusted EBITDA.”

“While we continue to see some apprehension from our dealers and

customers, likely driven by the stubbornly high interest rates,

macro uncertainty, and upcoming elections, which is weighing on

order patterns and our backlog, we remain confident in the

long-term drivers of our business,” noted Coffey. “The need to

invest in infrastructure, enhance the durability of the electric

grid, and mine critical materials to support the energy transition

has not changed, and these factors will drive our business in the

coming years. In the meantime, we will continue to focus on our

commercial growth initiatives, and we made important progress

during the second quarter, including growing momentum in our dealer

network expansion strategy and increased new product adoption.”

“The continued progress under our operational excellence

initiatives was once again clearly evident during the second

quarter based on our 220 basis points of gross margin expansion,”

continued Coffey. “During the second quarter, we made additional

progress on our supply chain initiatives, resulting in lower

materials costs, and further improved our manufacturing velocity.

These actions contributed to an adjusted EBITDA margin of 10.6% in

the second quarter, an improvement of nearly 140 basis points from

the prior-year period, despite some mixed headwinds.”

“We remain committed to our disciplined capital allocation

strategy, with a near-term priority on reducing our debt levels and

net leverage,” stated Joseph Doolan, Chief Financial Officer of

Manitex. “We finished the second quarter with net debt of $83.9

million, down over $2 million from the end of the first quarter,

and our ratio of net debt to trailing twelve-month adjusted EBITDA

was 2.5x, down from 2.9x at the end of 2023. At June 30, 2024 we

had approximately $33 million of cash and availability under our

credit facilities, which provides us with ample financial

flexibility to support our growth initiatives.”

"We are extremely proud of the progress we’ve made under

Elevating Excellence, and we remain laser-focused on continuing to

drive critical change under this program in the coming years in an

effort to drive shareholder value,” noted Coffey. “It is this

disciplined focus on our strategic priorities that has enabled us

to deliver strong adjusted EBITDA growth and margin expansion

during 2024, despite the slowing in order trends we have

experienced in recent quarters. As a result of the recent order

trends, we are lowering our full-year 2024 revenue guidance to a

range of $290 million to $300 million. However, we continue to

expect our 2024 adjusted EBITDA to be in a range of $30 million to

$34 million, demonstrating our strong execution against our

operational excellence priorities.”

SECOND QUARTER 2024 PERFORMANCE

Manitex reported net revenue of $76.2 million for the second

quarter 2024, up 3.7% from net revenue of $73.5 million for the

same period last year owing to growth in both the Lifting Equipment

and Rental segments.

Lifting Equipment Segment revenue was $67.9 million during the

second quarter 2024, an increase of 2.4%, versus the prior-year

period. The revenue increase was a result of the continued

improvements in manufacturing velocity.

Rental Equipment Segment revenue was $8.4 million in the second

quarter 2024, an increase of 15.0% versus the prior year, driven by

strong end-market demand and investments in rental fleet

growth.

Total gross profit was $17.2 million in the second quarter, an

increase of 14.9% from the prior-year period due to increased

manufacturing throughput, lower material costs driven by supply

chain initiatives, and increased contribution from the Rental

segment. As a result of these factors, gross profit margin

increased 220 basis points to 22.5% during the second quarter

2024.

SG&A expense was $11.1 million for the second quarter, up

modestly from $10.8 million for the comparable period last year.

R&D costs of $0.9 million were up modestly from $0.8 million

from last year.

Operating income was $5.1 million for the second quarter 2024,

compared to $3.3 million for the same period last year. Second

quarter operating margin was 6.7%, an improvement from 4.5% in the

prior year period. The year-over-year improvement in operating

income and operating margin was driven by the improved gross margin

performance.

The Company delivered net income of $1.5 million, or $0.07 per

diluted share, for the second quarter 2024, compared to a net

income of $0.4 million, or $0.02 per diluted share, for the same

period last year.

Adjusted EBITDA was $8.1 million for the second quarter 2024, or

10.6% of sales, up 19.0% from adjusted EBITDA of $6.8 million, or

9.3% of sales, for the same period last year. See Non-GAAP

reconciliations in the appendix of this release.

As of June 30, 2024, total backlog was $116 million, down from

$170 million at the end of the fourth quarter 2023.

BALANCE SHEET AND LIQUIDITY

As of June 30, 2024, total debt was $89.2 million. Cash and cash

equivalents as of June 30, 2024, were $5.3 million, resulting in

net debt of $83.9 million. Net leverage was 2.5x at the end of the

second quarter 2024, down from 2.9x at the end of fourth quarter

2023. As of June 30, 2024, Manitex had total cash and availability

of approximately $33 million.

2024 FINANCIAL GUIDANCE

The following forward-looking guidance reflects the management’s

current expectations and beliefs as of August 7, 2024, and is

subject to change.

Full-Year

Full-Year

Prior Full-Year

2023 Actual

2024

2024

Total Revenue ($MM)

$291.4

$290 to $300

$300 to $310

Total Adjusted EBITDA ($MM)

$29.6

$30 to $34

$30 to $34

Total Adjusted EBITDA Margin

10.1%

10.8%*

10.5%*

*Assumes mid-point of the guidance range.

SECOND QUARTER 2024 RESULTS CONFERENCE CALL

Manitex will host a conference call today at 9:00 AM ET to

discuss the Company’s second quarter 2024 results.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

the Manitex website at

https://www.manitexinternational.com/eventspresentations.aspx, and

a replay of the webcast will be available at the same time shortly

after the webcast is complete.

To participate in the live

teleconference:

Domestic Live:

(800) 717-1738

International Live:

(646) 307-1865

To listen to a replay of the

teleconference, which will be available through August 21,

2024:

Domestic Replay:

(844) 512-2921

International Replay:

(412) 317-6671

Passcode:

1123676

NON-GAAP FINANCIAL MEASURES AND OTHER ITEMS

In this press release, we refer to various non-GAAP (U.S.

generally accepted accounting principles) financial measures which

management uses to evaluate operating performance, to establish

internal budgets and targets, and to compare the Company's

financial performance against such budgets and targets. These

non-GAAP measures, as defined by the Company, may not be comparable

to similarly titled measures being disclosed by other companies.

While adjusted financial measures are not intended to replace any

presentation included in our condensed consolidated financial

statements under generally accepted accounting principles (GAAP)

and should not be considered an alternative to operating

performance or an alternative to cash flow as a measure of

liquidity, we believe these measures are useful to investors in

assessing our operating results, capital expenditures and working

capital requirements and the ongoing performance of its underlying

businesses. A reconciliation of Adjusted GAAP financial measures is

included with this press release. All per share amounts are on a

fully diluted basis. The quarterly amounts described below are

unaudited, are reported in thousands of U.S. dollars, and are as of

the dates indicated.

ABOUT MANITEX INTERNATIONAL

Manitex International is a leading provider of mobile truck

cranes, industrial lifting solutions, aerial work platforms,

construction equipment and rental solutions that serve general

construction, crane companies, and heavy industry. The company

engineers and manufactures its products in North America and

Europe, distributing through independent dealers worldwide. Our

brands include Manitex, PM, Oil & Steel, Valla, and Rabern

Rentals.

FORWARD-LOOKING STATEMENTS

Safe Harbor Statement under the U.S. Private Securities

Litigation Reform Act of 1995: This release contains statements

that are forward-looking in nature which express the beliefs and

expectations of management including statements regarding the

Company's expected results of operations or liquidity; statements

concerning projections, predictions, expectations, estimates or

forecasts as to our business, financial and operational results and

future economic performance; and statements of management's goals

and objectives and other similar expressions concerning matters

that are not historical facts. In some cases, you can identify

forward-looking statements by terminology such as "anticipate,"

"estimate," "plan," "project," "continuing," "ongoing," "expect,"

"we believe," "we intend," "may," "will," "should," "could," and

similar expressions. Such statements are based on current plans,

estimates and expectations and involve a number of known and

unknown risks, uncertainties and other factors that could cause the

Company's future results, performance or achievements to differ

significantly from the results, performance or achievements

expressed or implied by such forward-looking statements. These

factors and additional information are discussed in the Company's

filings with the Securities and Exchange Commission and statements

in this release should be evaluated in light of these important

factors. Although we believe that these statements are based upon

reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they

are made, and the Company undertakes no obligation to update

publicly or revise any forward-looking statement, whether as a

result of new information, future developments or otherwise.

MANITEX INTERNATIONAL, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current assets

Cash

$

5,097

$

9,269

Cash – restricted

206

212

Trade receivables (net)

51,695

49,118

Other receivables

1,715

553

Inventory (net)

82,268

82,337

Prepaid expenses and other current

assets

3,659

4,084

Total current assets

144,640

145,573

Total fixed assets, net of accumulated

depreciation of $33,035 and $29,751 at June 30, 2024 and December

31, 2023, respectively

52,194

49,560

Operating lease assets

7,832

7,416

Intangible assets (net)

10,511

12,225

Goodwill

36,854

37,354

Deferred tax assets

3,220

3,603

Total assets

$

255,251

$

255,731

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

$

49,987

$

47,644

Accrued expenses

14,346

14,503

Related party payables (net)

548

27

Revolving term credit facilities

2,106

2,185

Notes payable (net)

21,153

23,343

Current portion of finance lease

obligations

651

605

Current portion of operating lease

obligations

2,210

2,100

Customer deposits

2,021

2,384

Total current liabilities

93,022

92,791

Long-term liabilities

Revolving term credit facilities (net)

48,817

49,781

Notes payable (net)

14,064

16,249

Finance lease obligations (net of current

portion)

2,444

2,777

Operating lease obligations (net of

current portion)

5,622

5,315

Deferred tax liability

4,719

4,145

Other long-term liabilities

3,334

4,989

Total long-term liabilities

79,000

83,256

Total liabilities

172,022

176,047

Commitments and contingencies

Equity

Preferred stock—Authorized 150,000 shares,

no shares issued or outstanding at June 30, 2024 and December 31,

2023

—

—

Common stock—no par value 25,000,000

shares authorized, 20,390,299 and 20,258,194 shares issued and

outstanding at June 30, 2024 and December 31, 2023,

respectively

135,226

134,328

Additional paid-in capital

5,454

5,440

Retained deficit

(62,209

)

(65,982

)

Accumulated other comprehensive loss

(5,686

)

(4,169

)

Equity attributable to shareholders of

Manitex International

72,785

69,617

Equity attributed to noncontrolling

interest

10,444

10,067

Total equity

83,229

79,684

Total liabilities and equity

$

255,251

$

255,731

MANITEX INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except for share and per

share amounts)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenues

$

76,235

$

73,534

$

149,578

$

141,405

Cost of sales

59,074

58,599

115,534

112,060

Gross profit

17,161

14,935

34,044

29,345

Operating expenses

Research and development costs

929

837

1,783

1,651

Selling, general and administrative

expenses

11,125

10,766

22,244

21,797

Total operating expenses

12,054

11,603

24,027

23,448

Operating income

5,107

3,332

10,017

5,897

Other income (expense)

Interest expense

(1,931

)

(1,896

)

(3,803

)

(3,661

)

Interest income

91

-

170

-

Foreign currency transaction loss

(353

)

(718

)

(829

)

(773

)

Other income (expense)

(17

)

21

17

(737

)

Total other expense

(2,210

)

(2,593

)

(4,445

)

(5,171

)

Income before income taxes

2,897

739

5,572

726

Income tax expense

1,178

207

1,422

220

Net income

1,719

532

4,150

506

Net income attributable to noncontrolling

interest

229

128

377

49

Net income attributable to

shareholders

of Manitex International, Inc.

$

1,490

$

404

$

3,773

$

457

Income per share

Basic

$

0.07

$

0.02

$

0.19

$

0.02

Diluted

$

0.07

$

0.02

$

0.19

$

0.02

Weighted average common shares

outstanding

Basic

20,368,668

20,206,919

20,326,794

20,164,486

Diluted

20,392,756

20,209,959

20,378,199

20,166,968

Net Sales and Gross Margin

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

As Reported

As A djusted

As Reported

As Adjusted

As Reported

As Adjusted

Net sales

$

76,235

$

76,235

$

73,343

$

73,343

$

73,534

$

73,534

% change Vs Q1 2024

3.9

%

3.9

%

% change Vs Q2 2023

3.7

%

3.7

%

Gross margin

17,161

17,161

16,883

16,883

14,935

14,935

Gross margin % of net sales

22.5

%

22.5

%

23.0

%

23.0

%

20.3

%

20.3

%

Backlog

June 30, 2024

Mar 31, 2024

Dec 31, 2023

Sept 30, 2023

June 30, 2023

Backlog from continuing operations

115,811

154,182

170,286

196,872

223,236

Change Versus Current Period

(24.9%)

(32.0%)

(41.2%)

(48.1%)

Backlog is defined as orders for equipment which have not

yet shipped as well as orders by foreign subsidiaries for

international deliveries. The disclosure of backlog aids in the

analysis the Company's customers' demand for product, as well as

the ability of the Company to meet that demand. Backlog is not

necessarily indicative of sales to be recognized in a specified

future period.

Reconciliation of Net Income

Attributable to Shareholders of Manitex International, Inc. to

Adjusted Net Income

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net income attributable to shareholders of

Manitex International, Inc.

$

1,490

$

2,283

$

404

Adjustments, including net tax impact

713

1,127

1,307

Adjusted net income attributable to

shareholders of Manitex International, Inc.

$

2,203

$

3,410

$

1,711

Weighted diluted shares outstanding

20,392,756

20,363,642

20,209,959

Diluted earnings per share as reported

$

0.07

$

0.11

$

0.02

Total EPS effect

$

0.04

$

0.06

$

0.06

Adjusted diluted earnings per share

$

0.11

$

0.17

$

0.08

Reconciliation of Net Income to

Adjusted EBITDA

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net Income

$

1,719

$

2,431

$

532

Interest expense

1,840

1,793

1,896

Tax expense

1,178

244

207

Depreciation and amortization expense

2,651

2,794

2,869

EBITDA

$

7,388

$

7,262

$

5,504

Adjustments:

Stock compensation

$

360

$

633

$

589

FX

353

476

718

Severance / restructuring costs

-

(51

)

-

Other

-

69

-

Total Adjustments

$

713

$

1,127

$

1,307

Adjusted EBITDA

$

8,101

$

8,389

$

6,811

Adjusted EBITDA as % of sales

10.6

%

11.4

%

9.3

%

Net Debt

June 30, 2024

March 31, 2024

June 30, 2023

Total cash & cash

equivalents

$

5,303

$

5,054

$

7,302

Notes payable - short term

$

21,153

$

22,658

$

23,857

Current portion of finance leases

651

632

555

Notes payable - long term

14,064

17,004

21,585

Finance lease obligations - LT

2,444

2,609

3,093

Revolver, net

50,923

48,531

45,982

Total debt

$

89,235

$

91,434

$

95,072

Net debt

$

83,932

$

86,380

$

87,770

Net debt is calculated using the Consolidated Balance Sheet

amounts for current and long-term portion of long-term debt,

capital lease obligations, notes payable, and revolving credit

facilities minus cash and cash equivalents.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807051696/en/

IR CONTACT Paul Bartolai or Noel Ryan

MNTX@val-adv.com

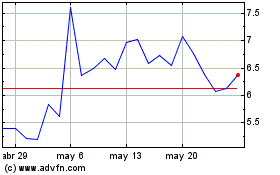

Manitex (NASDAQ:MNTX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Manitex (NASDAQ:MNTX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024