Neurogene Inc., a clinical-stage company founded to bring

life-changing genetic medicines to patients and families affected

by rare neurological diseases, and Neoleukin Therapeutics, Inc.

(NASDAQ:NLTX) today announced that they have entered into a

definitive merger agreement to combine the companies in an

all-stock transaction. The combined company will focus on advancing

Neurogene’s pipeline of differentiated genetic medicines, including

NGN-401, a clinical-stage product for Rett syndrome, which uses

novel gene regulation technology for a potential best-in-class

profile. Upon completion of the merger, which is subject to

approval by Neurogene and Neoleukin stockholders, the combined

company is expected to operate under the name Neurogene Inc. and

trade on the Nasdaq Capital Market under the ticker symbol “NGNE”.

In connection with the merger, Neurogene

announced an oversubscribed $95 million private financing led by

new and existing healthcare-dedicated specialist and mutual fund

institutional investors, including participation from Great Point

Partners, EcoR1 Capital, Redmile Group, Samsara BioCapital, Janus

Henderson Investors, funds and accounts managed by Blackrock,

Casdin Capital, Avidity Partners, Arrowmark Partners, Cormorant

Asset Management, Alexandria Venture Investments, and a healthcare

investment fund.

With the cash from both companies at closing and

the proceeds of the concurrent private financing, the combined

company is expected to have approximately $200 million of cash or

cash equivalents immediately following the closing. The cash

resources are intended to be used to advance Neurogene’s pipeline

through multiple clinical milestones and are expected to fund

operations into the second half of 2026. The merger and concurrent

private financing are expected to close in the fourth quarter of

2023, subject to stockholder approval of both companies, the

effectiveness of a registration statement to be filed with the U.S.

Securities and Exchange Commission to register the securities to be

issued in connection with the merger and concurrent financing, and

the satisfaction of customary closing conditions.

“We are excited to announce our planned merger

with Neoleukin, which we believe is a transformative step forward

in our mission to bring life-changing genetic medicines to the

patients and families impacted by devastating neurological

diseases,” said Rachel McMinn, Ph.D., Founder and Chief Executive

Officer of Neurogene. “This transaction is expected to bolster our

ability to progress our differentiated pipeline, including our

clinical-stage program in Rett syndrome which contains our novel,

proprietary EXACT technology. We believe EXACT represents a

meaningful technological advance for the gene therapy field,

allowing us to develop therapeutic product candidates for complex

diseases with attractive market opportunities not addressable with

conventional gene therapy. This capital will also support our

internal manufacturing capabilities, which we expect will continue

to provide significant financial and strategic flexibility. With

cash on hand at the close of this transaction expected to fund

operations into the second half of 2026, we believe we are well

positioned to successfully execute beyond multiple anticipated

clinical inflection points for both Rett syndrome and Batten

disease, and advance our discovery stage pipeline.”

“This merger with Neurogene reflects the

continued commitment of our management team and Board of Directors

to deliver value to stockholders and, importantly, meaningfully

improve patients’ lives,” said Donna Cochener, Interim Chief

Executive Officer and General Counsel of Neoleukin. “Neurogene has

an innovative genetic medicines portfolio, in-house product design

and manufacturing capabilities, an impressive management team, and

will be well positioned to deliver multiple data readouts in the

next 18 to 24 months. We are grateful to our current and former

employees who contributed to Neoleukin’s efforts and look forward

to the combined company’s continued progress and success.”

About Neurogene’s Portfolio and EXACT

Gene Regulation Platform

Neurogene’s internally manufactured portfolio of

purposefully designed therapies aims to address several key

limitations of conventional gene therapies, including variable gene

expression, safety limitations, and inefficient gene delivery.

The company’s novel and proprietary Expression

Attenuation via Construct Tuning (EXACT) gene regulation platform

technology is a self-contained transgene regulation platform that

can be tuned to deliver a desired level of transgene expression

within a narrow range, potentially avoiding transgene related

toxicities associated with conventional gene therapy. EXACT is

compatible with viral and non-viral delivery platforms.

Neurogene’s clinical-stage portfolio

includes:

NGN-401: NGN-401 is an

investigational AAV9 gene therapy being developed as a one-time

treatment for Rett syndrome. It is the first candidate to deliver

the full-length human MECP2 gene under the control of Neurogene’s

EXACT technology. Embedding EXACT technology into NGN-401 is an

important advancement in gene therapy for Rett syndrome,

specifically because the disorder requires a treatment approach

that enables targeted levels of MECP2 transgene expression without

causing toxic effects associated with conventional gene therapy.

Rett syndrome is a debilitating, X-linked, neurodevelopmental

disorder with significant unmet medical need, and one of the most

common genetic causes of developmental and intellectual impairment

in females.

The robust preclinical data package for NGN-401

provides evidence of a potentially compelling efficacy and safety

profile in Rett syndrome. The company’s Investigational New Drug

(IND) application was cleared by the U.S. Food and Drug

Administration in January 2023. In the U.S., NGN-401 has received

Orphan Drug Designation, Rare Pediatric Disease Designation, and

Fast Track designation. Neurogene plans to commence dosing in a

Phase 1/2 trial (NCT05898620) designed to assess the safety,

tolerability, and efficacy of a single dose of NGN-401 in female

pediatric patients with Rett syndrome in the second half of 2023,

with preliminary data expected in the fourth quarter of 2024 from

the first cohort of patients, and additional expected data in the

second half of 2025 from an expanded set of patients.

NGN-101: NGN-101 is being

developed as a one-time treatment for both ocular and neurological

manifestations of CLN5 Batten disease using AAV9 to deliver the

gene encoding CLN5, which is deficient in children with the

disease. Batten disease is a family of rare neurodegenerative

diseases caused by pathogenic changes in one of a series of genes

that results in the accumulation of toxic deposits across multiple

organ systems. CLN5 Batten disease is a rare, pediatric-onset and

rapidly progressive condition caused by a pathogenic mutation in

the CLN5 gene, leading to loss of function. It is characterized by

loss of vision, seizures, and progressive decline in intellectual

and motor capabilities beginning in childhood leading to

substantial impairments and early mortality.

In preclinical studies, NGN-101 has demonstrated

the potential to slow or halt the key features of disease

progression, including associated vision and motor declines.

NGN-101 has received Orphan Drug Designation by U.S. and European

regulatory agencies and is currently being evaluated in a Phase 1/2

clinical trial in children with CLN5 Batten disease (NCT05228145).

Preliminary data is expected in the second half of 2024.

In addition to these two clinical-stage

programs, Neurogene is also advancing a discovery-stage candidate

that will expand its pipeline into an additional area of high unmet

need. Neurogene expects to initiate a clinical study of this

candidate in 2025.

About the Proposed Merger

Under the terms of the merger agreement,

Neoleukin will issue to pre-merger Neurogene stockholders shares of

Neoleukin common stock as merger consideration in exchange for the

cancellation of shares of capital stock of Neurogene, and Neurogene

will become a wholly owned subsidiary of Neoleukin. Pre-merger

Neoleukin stockholders are expected to own approximately 16% of the

combined company and pre-merger Neurogene stockholders (including

those purchasing Neurogene shares in the concurrent private

financing discussed above) are expected to own approximately 84% of

the combined company. The percentage of the combined company that

pre-merger Neurogene stockholders and pre-merger Neoleukin

stockholders will own as of the close of the proposed transaction

is subject to certain adjustments as described in the merger

agreement, including the amount of Neoleukin’s net cash at closing.

In connection with the closing of the proposed transactions,

Neoleukin stockholders will also be issued contingent value rights

representing the right to receive certain payments from proceeds

received by the combined company, if any, related to Neoleukin’s

pre-transaction legacy assets or from savings realized by the

combined company, if any, related to the reduction of Neoleukin’s

legacy lease obligations.

Upon closing of the proposed transaction,

Neoleukin Therapeutics, Inc., will be renamed Neurogene Inc. The

combined company will be led by Rachel McMinn, Ph.D., Founder and

Chief Executive Officer of Neurogene, and other members of the

Neurogene management team. The combined company’s Board of

Directors will be comprised of five board members selected by

Neurogene and two members selected by Neoleukin. The transaction

has been unanimously approved by the Board of Directors of each

company and is expected to close in the fourth quarter of 2023,

subject to customary closing conditions, including the approval of

the transaction by the stockholders of each company.

TD Cowen is serving as exclusive financial

advisor to Neurogene. TD Cowen and Stifel are serving as placement

agents on Neurogene’s planned concurrent private financing. Gibson

Dunn & Crutcher LLP is serving as legal counsel to Neurogene

and Cooley LLP is serving as legal counsel to the placement agents.

Leerink Partners is serving as the exclusive financial advisor to

Neoleukin. Fenwick & West LLP is serving as legal counsel to

Neoleukin.

Conference Call Information

Neurogene and Neoleukin will host a conference

call today, July 18, 2023, at 8:30 am E.T. to discuss the proposed

merger. The live webcast can be accessed by visiting

https://edge.media-server.com/mmc/p/q3vx354g. To access the event

via phone, please register to receive a unique dial-in and PIN

number using the following

link:https://register.vevent.com/register/BI3014e8ea8bec4d9cbdf9a68a0b5c78ec

A replay of the webcast will be available for a

limited time following the event on the Events & Presentations

section of Neoleukin’s website at

https://investor.neoleukin.com/events and on the News section of

Neurogene’s website at https://www.neurogene.com/news/.

About Neurogene

The mission of Neurogene is to turn devastating

neurological diseases into treatable conditions to improve the

lives of patients and families impacted by these rare diseases.

Neurogene is developing novel approaches and treatments to address

the limitations of conventional gene therapy in central nervous

system disorders. This includes selecting a delivery approach to

maximize distribution to target tissues and by designing products

to maximize potency and purity for an optimized efficacy and safety

profile. The company’s novel and proprietary EXACT gene regulation

platform technology allows for the delivery of therapeutic levels

while limiting transgene toxicity associated with conventional gene

therapy. For more information, visit www.neurogene.com.

About Neoleukin

Neoleukin is a biopharmaceutical company

creating next generation immunotherapies for cancer, inflammation

and autoimmunity using de novo protein design technology.

Neoleukin uses sophisticated computational methods to design

proteins that demonstrate specific pharmaceutical properties that

provide potentially superior therapeutic benefit over native

proteins. For more information, please visit the Neoleukin website:

www.neoleukin.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements (including within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended, and Section 27A of the

Securities Act of 1933, as amended (Securities Act)) concerning

Neurogene, Neoleukin, the proposed transactions and other matters.

These statements may discuss goals, intentions and expectations as

to future plans, trends, events, results of operations or financial

condition, or otherwise, based on current expectations and beliefs

of the management of Neoleukin and Neurogene, as well as

assumptions made by, and information currently available to,

management of Neoleukin and Neurogene. Forward-looking statements

generally include statements that are predictive in nature and

depend upon or refer to future events or conditions, and include

words such as “may,” “will,” “should,” “would,” “expect,”

“anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,”

“intend,” and other similar expressions or the negative or plural

of these words, or other similar expressions that are predictions

or indicate future events or prospects, although not all

forward-looking statements contain these words. Statements that are

not historical facts are forward-looking statements.

Forward-looking statements in this communication include, but are

not limited to, expectations regarding the proposed merger and

financing transactions; the potential benefits and results of such

transactions; the sufficiency of the combined company’s capital

resources; the combined company’s cash runway; the expected timing

of the closing of the proposed transactions; statements regarding

the potential and timing of, and expectations regarding,

Neurogene’s programs, including NGN-101, NGN-401 and its research

stage opportunities; statements by Neoleukin’s Interim Chief

Executive Officer and General Counsel; and statements by

Neurogene’s Founder and Chief Executive Officer. Forward-looking

statements are based on current beliefs and assumptions that are

subject to risks and uncertainties and are not guarantees of future

performance. Actual results could differ materially from those

contained in any forward-looking statement as a result of various

factors, including, without limitation: the limited operating

history of each company; the significant net losses incurred since

inception of each company; the ability to raise additional capital

to finance operations; the ability to advance product candidates

through preclinical and clinical development; the ability to obtain

regulatory approval for, and ultimately commercialize, Neurogene’s

product candidates; the outcome of preclinical testing and early

clinical trials for Neurogene’s product candidates, including the

ability of those trials to satisfy relevant governmental or

regulatory requirements; Neurogene’s limited experience in

designing clinical trials and lack of experience in conducting

clinical trials; the ability to identify and pivot to other

programs, product candidates, or indications that may be more

profitable or successful than Neurogene’s current product

candidates; expectations regarding the market and potential for

Neurogene’s current product candidates; the substantial competition

Neurogene faces in discovering, developing, or commercializing

products; the negative impacts of the COVID-19 pandemic on

operations, including ongoing and planned clinical trials and

ongoing and planned preclinical studies; the ability to attract,

hire, and retain skilled executive officers and employees; the

ability of Neoleukin or Neurogene to protect their respective

intellectual property and proprietary technologies; reliance on

third parties, contract manufacturers, and contract research

organizations; the risk that the conditions to the closing of the

proposed transactions are not satisfied, including the failure to

obtain stockholder approval for the proposed transactions from both

Neoleukin and Neurogene’s stockholders or to complete the

transactions in a timely manner or at all; uncertainties as to the

timing of the consummation of the proposed transactions and the

ability of each of the parties to consummate the proposed

transactions; risks related to Neoleukin’s continued listing on the

Nasdaq Capital Market until closing of the proposed transactions;

risks related to Neoleukin’s and Neurogene’s ability to correctly

estimate their respective operating expenses and expenses

associated with the proposed transactions, as well as uncertainties

regarding the impact any delay in the closing would have on the

anticipated cash resources of the combined company upon closing and

other events and unanticipated spending and costs that could reduce

the combined company’s cash resources; the occurrence of any event,

change or other circumstance or condition that could give rise to

the termination of the merger agreement or the financing

transaction; competitive responses to the proposed transactions;

unexpected costs, charges or expenses resulting from the proposed

transactions; the outcome of any legal proceedings that may be

instituted against Neoleukin, Neurogene or any of their respective

directors or officers related to the merger, the financing

transaction, or the proposed transactions contemplated thereby;

potential adverse reactions of changes to business relationships

resulting from the announcement or completion of the proposed

transactions; the effect of the announcement or pendency of the

transactions on Neoleukin’s or Neurogene’s business relationships,

operating results and business generally; the expected trading of

the combined company’s stock on Nasdaq Capital Market under the

ticker symbol “NGNE” and the combined company’s ability to remain

listed following the proposed transactions; and legislative,

regulatory, political and economic developments and general market

conditions. The foregoing review of important factors that could

cause actual events to differ from expectations should not be

construed as exhaustive and should be read in conjunction with

statements that are included herein and elsewhere, including the

risk factors included in Neoleukin’s most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K filed with the SEC, the registration statement on Form S-4

to be filed with the SEC by Neoleukin, as well as risk factors

associated with companies, such as Neurogene, that operate in the

biopharma industry. There can be no assurance that the conditions

of the proposed transactions will be satisfied or that future

developments affecting Neurogene, Neoleukin or the proposed

transactions will be those that have been anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond Neurogene and Neoleukin’s control) or

other assumptions that may cause actual results or performance to

be materially different from those expressed or implied by these

forward-looking statements. Nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that the

contemplated results of any such forward-looking statements will be

achieved. Forward-looking statements in this press release speak

only as of the day they are made and are qualified in their

entirety by reference to the cautionary statements herein. Except

as required by applicable law, Neoleukin and Neurogene undertake no

obligation to revise or update any forward-looking statement, or to

make any other forward-looking statements, whether as a result of

new information, future events or otherwise.

This press release contains hyperlinks to

information that is not deemed to be incorporated by reference into

this press release.

No Offer or Solicitation

This press release and the information contained

herein is not intended to and does not constitute (i) a

solicitation of a proxy, consent or approval with respect to any

securities or in respect of the proposed transactions or (ii) an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities

pursuant to the proposed transactions or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

the Securities Act of 1933, as amended, or an exemption

therefrom.

Subject to certain exceptions to be approved by

the relevant regulators or certain facts to be ascertained, the

public offer will not be made directly or indirectly, in or into

any jurisdiction where to do so would constitute a violation of the

laws of such jurisdiction, or by use of the mails or by any means

or instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or foreign

commerce, or any facility of a national securities exchange, of any

such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR

DETERMINED IF THIS PRESS RELEASE IS TRUTHFUL OR COMPLETE.

Important Additional Information About the Proposed

Transactions Will be Filed with the SEC

This press release is not a substitute for the

registration statement or for any other document that Neoleukin may

file with the SEC in connection with the proposed transactions. In

connection with the proposed transactions, Neoleukin intends to

file relevant materials with the SEC, including a registration

statement on Form S-4 that will contain a proxy

statement/prospectus of Neoleukin. NEOLEUKIN URGES INVESTORS AND

STOCKHOLDERS TO READ THE REGISTRATION STATEMENT, PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT NEOLEUKIN, NEUROGENE, THE PROPOSED TRANSACTIONS AND RELATED

MATTERS. Investors and stockholders will be able to obtain free

copies of the proxy statement/prospectus and other documents filed

by Neoleukin with the SEC (when they become available) through the

website maintained by the SEC at www.sec.gov. In addition,

investors and stockholders should note that Neoleukin communicates

with investors and the public using its website

(www.neoleukin.com), the investor relations website

(https://investors.neoleukin.com/) where anyone will be able to

obtain free copies of the proxy statement/prospectus and other

documents filed by Neoleukin with the SEC and stockholders are

urged to read the proxy statement/prospectus and the other relevant

materials when they become available before making any voting or

investment decision with respect to the proposed transactions.

Participants in the

Solicitation

Neoleukin, Neurogene and their respective

directors and executive officers may be considered participants in

the solicitation of proxies in connection with the proposed

transaction. Information about Neoleukin’s directors and executive

officers is included in Neoleukin’s most recent Annual Report on

Form 10-K, including any information incorporated therein by

reference, as filed with the SEC, and the proxy statement for

Neoleukin’s 2023 annual meeting of stockholders, filed with the SEC

on April 27, 2023. Additional information regarding the persons who

may be deemed participants in the solicitation of proxies will be

included in the proxy statement/prospectus relating to the proposed

transaction when it is filed with the SEC. These documents can be

obtained free of charge from the sources indicated above.

Contacts:

Neurogene Contacts:

Investor Relations:Melissa ForstArgot

PartnersNeurogene@argotpartners.com

Media:David RosenArgot Partnersdavid.rosen@argotpartners.com

Neoleukin Contact:

Investor Relations and Media:Neoleukin Therapeutics

investors@neoleukin.com

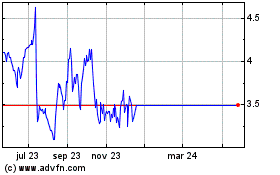

Neoleukin Therapeutics (NASDAQ:NLTX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Neoleukin Therapeutics (NASDAQ:NLTX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024