A U.S.-China Trade War Would Reshape Tech Investment

20 Abril 2018 - 7:00AM

Noticias Dow Jones

By Dan Strumpf and Yoko Kubota

HONG KONG--Technology has emerged as the early battleground in

the U.S.-China trade dispute, triggering predictions of significant

changes in the global investment strategies of Chinese tech

companies.

Chinese companies will be more likely to invest in emerging

markets such as India and Southeast Asia, said Fan Bao, the

chairman and chief executive of investment bank China Renaissance

Partners.

In the current environment, Mr. Fan said, he foresees reduced

investment in the U.S. "The reality is, it's difficult to get

things done...given uncertainty around approval."

His comments came during The Wall Street Journal's two-day

D.Live Asia conference in Hong Kong, following a turbulent week for

the technology sector that saw regulators in the U.S. and China

taking aim at some of the biggest companies in the field.

Among the week's developments: Chinese regulators signaled a

rocky path ahead for the $44 billion attempted takeover by U.S.

chip maker Qualcomm Inc. of NXP Semiconductors NV. That came just

days after the U.S. Commerce Department slapped Chinese telecom

giant ZTE Corp. with a seven-year ban on buying U.S. products, a

move that ZTE said threatens its survival.

The moves have thrust technology companies onto the front lines

of an intensifying trade dispute between the U.S. and China. The

Trump administration has ratcheted up pressure on Beijing with

threatened tariffs on a total of $150 billion in Chinese imports,

and China has shot back with plans for tariffs of its own.

"I'm very concerned," Charles Li, chief executive at Hong Kong

Exchanges and Clearing Ltd., said Friday. "This is just inevitable

because you have a rising power and an existing incumbent power and

they've all sort of frictions--particularly when their political

and ideological systems are different."

As trade tensions escalate, some executives expressed concerns

about rising economic nationalism. Among them was Carlos Ghosn, the

chairman of the automotive alliance between Renault SA, Nissan

Motor Co. and Mitsubishi Motors Corp.

While Mr. Ghosn said he is worried, he also said he doesn't see

the dispute becoming a full-blown trade war. "I think it's more a

pressure to renegotiate deals" that the U.S. considered were not

too fair, he said.

Mr. Ghosn, referring to the renegotiations of the North American

Free Trade Agreement, said that for auto makers, knowing what the

trade rules are going to be in the future is more important than

the details of the rules. Car makers plan for 10 years down the

road when it comes to building plants or where and which vehicles

to make, and must know what the rules are going to be then to make

meaningful plans, he said.

"Being in a situation where one party is not happy with the deal

is very preoccupying," he said.

Among the reasons trade friction has increased is U.S.

accusations that China has been trying to steal U.S. technology

through unfair trade practices.

Chinese companies have an advantage in the tech face-off with

the U.S. in their deep set of data, said Ralph Haupter, Microsoft

Corp.'s corporate vice president. But they can face challenges

competing in multiple markets.

"If you look at AI, you need data; China has that. You need

talent; China has a lot of that," he said. "At the same time, all

of the companies which are building businesses in China, they

struggle because they either don't find a way to get out of the

domestic market or they go to the U.S. immediately."

Write to Dan Strumpf at daniel.strumpf@wsj.com and Yoko Kubota

at yoko.kubota@wsj.com

(END) Dow Jones Newswires

April 20, 2018 07:45 ET (11:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

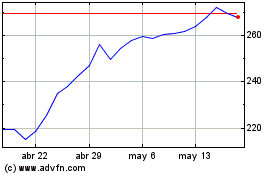

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

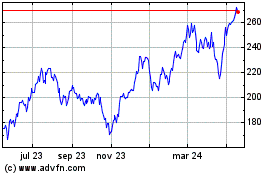

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024