- Fourth quarter revenue grew 11% year-over-year to $62.9

million; full year revenue grew 7% year-over-year to $235.1

million

- Fourth quarter subscription revenue grew 15% year-over-year to

$27.3 million; full year subscription revenue grew 19%

year-over-year to $106.4 million

- Annual Recurring Revenue (ARR) grew 11% year-over-year to

$154.6 million1

- Net Retention Rate (NRR) of 110%2

OneSpan Inc. (NASDAQ: OSPN), the digital agreements security

company, today reported financial results for the fourth quarter

and full year ended December 31, 2023.

“We ended the year on a high note led by strong operational

rigor and accelerated cost reduction actions over the second half

of 2023, resulting in 3% GAAP operating margin and 18% adjusted

EBITDA margin in the fourth quarter, a dramatic improvement from

the prior year,” stated OneSpan interim CEO, Victor Limongelli. “We

will continue to focus on driving efficient revenue growth,

profitability and cash flow in 2024.”

Fourth Quarter 2023 Financial Highlights

- Total revenue was $62.9 million, an increase of 11%

compared to $56.6 million for the same quarter of 2022. Digital

Agreements revenue was $14.5 million, an increase of 17%

year-over-year. Security Solutions revenue was $48.4 million, an

increase of 10% year-over-year.

- ARR grew 11% year-over-year to $154.6 million.

- Gross profit was $43.5 million, or 69% gross margin,

compared to $38.0 million, or 67% in the same period last

year.

- Operating income was $1.8 million, compared to operating

loss of $4.0 million in the same period last year.

- Net income was $0.4 million, or $0.01 per diluted share,

compared to net loss of $3.1 million, or $0.08 per diluted share,

in the same period last year. Non-GAAP net income was $7.5 million,

or $0.19 per diluted share, compared to $1.2 million, or $0.03 per

diluted share in the same period last year.3

- Adjusted EBITDA was $11.2 million, compared to $3.2

million in the same period last year.

- Cash and cash equivalents were $42.5 million at December

31, 2023. During the year ended December 31, 2023, we used $29.2

million, net of fees and expenses, to repurchase shares of our

common stock, including $25.4 million in conjunction with our

modified Dutch tender offer we completed in December 2023. We used

$5.7 million, net of fees and expenses, to repurchase shares of our

common stock during the year ended December 31, 2022.

Full Year 2023 Financial Highlights

- Total revenue was $235.1 million, an increase of 7%

compared to $219.0 million for the same period of 2022. Digital

Agreements revenue was $50.9 million, an increase of 5%

year-over-year. Security Solutions revenue was $184.2 million, an

increase of 8% year-over-year.

- Gross profit was $157.7 million, or 67% gross margin,

compared to $148.6 million, or 68% in the same period last

year.

- Operating loss was $28.9 million, compared to $27.1

million in the same period last year.

- Net loss was $29.8 million, or $0.74 per diluted share

compared to $14.4 million, or $0.36 per diluted share in the same

period last year. Non-GAAP net income was $0.0 million, or $0.00

per diluted share, compared to net loss of $1.8 million, or $0.05

per diluted share in the same period last year.

- Adjusted EBITDA was $12.0 million compared to $6.4

million in the same period last year.

Financial Outlook

For the Full Year 2024, OneSpan expects:

- Revenue to be in the range of $238 million to $246 million,

consistent with our previously communicated target range of low to

mid-single digit growth.

- ARR to be in the range of $160 million to $168 million.

- Adjusted EBITDA to be in the range of $47 million to $52

million, consistent with the low to mid-range of our previously

communicated target of 20% to 23% margin for the year.3

Conference Call Details

In conjunction with this announcement, OneSpan Inc. will host a

conference call today, March 6, 2024, at 4:30 p.m. EST. During the

conference call, Mr. Victor Limongelli, Interim CEO, and Mr. Jorge

Martell, CFO, will discuss OneSpan’s results for the fourth quarter

and full year 2023.

For investors and analysts accessing the conference call by

phone, please refer to the press release dated January 10, 2024,

announcing the date of OneSpan’s fourth quarter and full year 2023

earnings release. It can be found on the OneSpan investor relations

website at investors.onespan.com.

The conference call is also available in listen-only mode at

investors.onespan.com. Shortly after the conclusion of the call, a

replay of the webcast will be available on the same website for

approximately one year.

_________________

- ARR is calculated as the approximate annualized value of our

customer recurring contracts as of the measurement date. These

include subscription, term-based license, and maintenance and

support contracts and exclude one-time fees. To the extent that we

are negotiating a renewal with a customer within 90 days after the

expiration of a recurring contract, we continue to include that

revenue in ARR if we are actively in discussion with the customer

for a new recurring contract or renewal and the customer has not

notified us of an intention to not renew. See our Annual Report on

Form 10-K for the year ended December 31, 2023 for additional

information describing how we define ARR, including how ARR differs

from GAAP revenue.

- NRR is defined as the approximate year-over-year growth in ARR

from the same set of customers at the end of the prior year

period.

- An explanation of the use of Non-GAAP financial measures is

included below under the heading “Non-GAAP Financial Measures.” A

reconciliation of each Non-GAAP financial measure to the most

directly comparable GAAP financial measure has also been provided

in the tables below. We are not providing a reconciliation of

Adjusted EBITDA guidance to GAAP net income, the most directly

comparable GAAP measure, because we are unable to predict certain

items included in GAAP net income without unreasonable

efforts.

About OneSpan

OneSpan helps organizations accelerate digital transformations

by enabling secure, compliant, and refreshingly easy customer

agreements and transaction experiences. Organizations requiring

high assurance security, including the integrity of end-users and

the fidelity of transaction records behind every agreement, choose

OneSpan to simplify and secure business processes with their

partners and customers. Trusted by global blue-chip enterprises,

including more than 60% of the world’s largest 100 banks, OneSpan

processes millions of digital agreements and billions of

transactions in 100+ countries annually.

For more information, go to www.onespan.com. You can also follow

@OneSpan on Twitter or visit us on LinkedIn and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of applicable U.S. securities laws, including

statements regarding our 2024 financial guidance and our plans to

continue to focus on driving efficient revenue growth,

profitability and cash flow in 2024; our plans for managing our

Digital Agreements and Security Solutions segments; and our general

expectations regarding our operational or financial performance in

the future. Forward-looking statements may be identified by words

such as "seek", "believe", "plan", "estimate", "anticipate",

“expect", "intend", "continue", "outlook", "may", "will", "should",

"could", or "might", and other similar expressions. These

forward-looking statements involve risks and uncertainties, as well

as assumptions that, if they do not fully materialize or prove

incorrect, could cause our results to differ materially from those

expressed or implied by such forward-looking statements. Factors

that could materially affect our business and financial results

include, but are not limited to: our ability to execute our updated

strategic transformation plan and cost reduction and restructuring

actions in the expected timeframe and to achieve the outcomes we

expect from them; unintended costs and consequences of our cost

reduction and restructuring actions, including higher than

anticipated restructuring charges, disruption to our operations,

litigation or regulatory actions, reduced employee morale,

attrition of valued employees, adverse effects on our reputation as

an employer, loss of institutional know-how, slower customer

service response times, and reduced ability to complete or

undertake new product development projects and other business,

product, technical, compliance or risk mitigation initiatives; our

ability to attract new customers and retain and expand sales to

existing customers; our ability to successfully develop and market

new product offerings and product enhancements; changes in customer

requirements; the potential effects of technological changes; the

loss of one or more large customers; difficulties enhancing and

maintaining our brand recognition; competition; lengthy sales

cycles; challenges retaining key employees and successfully hiring

and training qualified new employees; security breaches or

cyber-attacks; real or perceived malfunctions or errors in our

products; interruptions or delays in the performance of our

products and solutions; reliance on third parties for certain

products and data center services; our ability to effectively

manage third party partnerships, acquisitions, divestitures,

alliances, or joint ventures; economic recession, inflation, and

political instability; claims that we have infringed the

intellectual property rights of others; price competitive bidding;

changing laws, government regulations or policies; pressures on

price levels; component shortages; delays and disruption in global

transportation and supply chains; impairment of goodwill or

amortizable intangible assets causing a significant charge to

earnings; actions of activist stockholders; and exposure to

increased economic and operational uncertainties from operating a

global business, as well as other factors described in the “Risk

Factors” section of our most recent Annual Report on Form 10-K, as

updated by the “Risk Factors” section of our subsequent Quarterly

Reports on Form 10-Q (if any). Our filings with the Securities and

Exchange Commission (the “SEC”) and other important information can

be found in the Investor Relations section of our website at

investors.onespan.com. We do not have any intent, and disclaim any

obligation, to update the forward-looking information to reflect

events that occur, circumstances that exist or changes in our

expectations after the date of this press release, except as

required by law.

Unless otherwise noted, references in this press release to

“OneSpan”, “Company”, “we”, “our”, and “us” refer to OneSpan Inc.

and its subsidiaries.

OneSpan Inc.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

December 31,

Years Ended December

31,

2023

2022

2023

2022

Revenue

Product and license

$

35,387

$

31,930

$

130,848

$

121,426

Services and other

27,541

24,692

104,258

97,580

Total revenue

62,928

56,622

235,106

219,006

Cost of goods sold

Product and license

12,346

12,434

48,676

45,106

Services and other

7,116

6,233

28,715

25,330

Total cost of goods sold

19,462

18,667

77,391

70,436

Gross profit

43,466

37,955

157,715

148,570

Operating costs

Sales and marketing

13,847

15,756

70,235

60,949

Research and development

8,734

8,139

38,420

41,735

General and administrative

14,229

16,003

58,267

55,552

Restructuring and other related

charges

4,235

1,482

17,311

13,310

Amortization of intangible assets

604

584

2,353

4,139

Total operating costs

41,649

41,964

186,586

175,685

Operating income (loss)

1,817

(4,009

)

(28,871

)

(27,115

)

Interest income (expense), net

415

398

2,090

595

Other income (expense), net

(874

)

1,010

(532

)

14,827

Income (loss) before income taxes

1,358

(2,601

)

(27,313

)

(11,693

)

Provision for income taxes

917

496

2,486

2,741

Net income (loss)

$

441

$

(3,097

)

$

(29,799

)

$

(14,434

)

Net income (loss) per share

Basic

$

0.01

$

(0.08

)

$

(0.74

)

$

(0.36

)

Diluted

$

0.01

$

(0.08

)

$

(0.74

)

$

(0.36

)

Weighted average common shares

outstanding

Basic

39,716

39,906

40,193

40,143

Diluted

40,095

39,906

40,193

40,143

OneSpan Inc.

CONSOLIDATED BALANCE

SHEETS

(In thousands,

unaudited)

December 31,

2023

2022

ASSETS

Current assets

Cash and cash equivalents

$

42,493

$

96,167

Restricted cash

1,037

1,208

Short-term investments

—

2,328

Accounts receivable, net of allowances of

$1,536 in 2023 and $1,600 in 2022

64,387

65,132

Inventories, net

15,553

12,054

Prepaid expenses

6,575

6,222

Contract assets

5,139

4,520

Other current assets

11,159

10,757

Total current assets

146,343

198,387

Property and equipment, net

18,722

12,681

Operating lease right-of-use assets

6,171

8,022

Goodwill

93,684

90,514

Intangible assets, net of accumulated

amortization

10,832

12,482

Deferred income taxes

1,721

1,901

Other assets

11,718

11,095

Total assets

$

289,191

$

335,082

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

17,452

$

17,357

Deferred revenue

69,331

64,637

Accrued wages and payroll taxes

14,335

18,345

Short-term income taxes payable

2,646

2,438

Other accrued expenses

10,684

7,664

Deferred compensation

382

373

Total current liabilities

114,830

110,814

Long-term deferred revenue

4,152

6,269

Long-term lease liabilities

6,824

8,442

Long-term income taxes payable

—

2,565

Deferred income taxes

1,067

1,197

Other long-term liabilities

3,177

2,484

Total liabilities

130,050

131,771

Stockholders' equity

Preferred stock: 500 shares authorized,

none issued and outstanding at December 31, 2023 and 2022

—

—

Common stock: $0.001 par value per share,

75,000 shares authorized; 41,243 and 40,764 shares issued; 37,519

and 39,726 shares outstanding at December 31, 2023 and 2022

38

40

Additional paid-in capital

118,620

107,305

Treasury stock, at cost, 3,724 and 1,038

shares outstanding at December 31, 2023 and 2022, respectively

(47,377

)

(18,222

)

Retained earnings

98,939

128,738

Accumulated other comprehensive loss

(11,079

)

(14,550

)

Total stockholders' equity

159,141

203,311

Total liabilities and stockholders'

equity

$

289,191

$

335,082

OneSpan Inc.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands,

unaudited)

Years Ended December

31,

2023

2022

Cash flows from operating activities:

Net loss from operations

$

(29,799

)

$

(14,434

)

Adjustments to reconcile net loss from

operations to net cash used in operations:

Depreciation and amortization of

intangible assets

6,479

7,066

Loss on disposal of asset

455

—

Write-off of property and equipment,

net

2,728

3,828

Impairment of inventories, net

143

—

Gain on sale of equity-method

investment

—

(14,810

)

Deferred tax benefit

118

1,637

Stock-based compensation

14,252

8,642

Allowance for doubtful accounts

(65

)

184

Changes in operating assets and

liabilities:

Accounts receivable

1,571

(9,705

)

Inventories, net

(3,275

)

(2,168

)

Contract assets

(574

)

52

Accounts payable

(253

)

9,261

Income taxes payable

(2,367

)

(1,140

)

Accrued expenses

(1,531

)

2,197

Deferred compensation

9

(504

)

Deferred revenue

2,015

8,173

Other assets and liabilities

(641

)

(4,038

)

Net cash used in operating activities

(10,735

)

(5,759

)

Cash flows from investing activities:

Purchase of short-term investments

—

(15,812

)

Maturities of short-term investments

2,330

48,550

Additions to property and equipment

(12,484

)

(4,996

)

Additions to intangible assets

(59

)

(29

)

Cash paid for acquisition of business

(1,800

)

—

Sale of equity-method investment

—

18,874

Net cash provided by (used in) investing

activities

(12,013

)

46,587

Cash flows from financing activities:

Repurchase of common stock

(29,155

)

(5,721

)

Tax payments for restricted stock

issuances

(2,939

)

(1,587

)

Net cash used in financing activities

(32,094

)

(7,308

)

Effect of exchange rate changes on

cash

997

(372

)

Net (decrease) increase in cash

(53,845

)

33,148

Cash, cash equivalents, and restricted

cash, beginning of period

97,375

64,227

Cash, cash equivalents, and restricted

cash, end of period

$

43,530

$

97,375

Operating Segments

In May 2022, we announced a three-year strategic transformation

plan that began on January 1, 2023. In conjunction with the

strategic transformation plan and to enable a more efficient

capital deployment model, effective with the quarter ended June 30,

2022, we began reporting under the following two lines of business,

which are our reportable operating segments: Digital Agreements and

Security Solutions.

- Digital Agreements. Digital Agreements consists of

solutions that enable our clients to secure and automate business

processes associated with their digital agreement and customer

transaction lifecycles that require consent, non-repudiation and

compliance. These solutions, which are largely cloud-based, include

OneSpan Sign e-signature, OneSpan Notary and OneSpan Trust Vault.

This segment also includes costs attributable to our transaction

cloud platform.

- Security Solutions. Security Solutions consists of our

broad portfolio of software products, software development kits

(SDKs) and Digipass authenticator devices that are used to build

applications designed to defend against attacks on digital

transactions across online environments, devices, and applications.

The software products and SDKs included in the Security Solutions

segment are largely on-premises software products and include

identity verification, multi-factor authentication and transaction

signing solutions, such as mobile application security and mobile

software tokens.

Segment operating income consists of the revenues generated by a

segment, less the direct costs of revenue, sales and marketing,

research and development expenses, amortization expense, and

restructuring and other related charges that are incurred directly

by a segment. Unallocated corporate costs include costs related to

administrative functions that are performed in a centralized manner

that are not attributable to a particular segment.

Prior to 2023, the Company allocated certain cost of goods sold

and operating expenses to its two reportable operating segments

using a direct cost allocation and an allocation based on revenue

split between the segments. As a result of the ongoing strategic

transformation, the Company refined its operating segment

allocation methodology to better align internal and external costs

more directly to where the employee efforts are being spent on each

segment moving forward. The revised methodology was applied on a

prospective basis beginning in 2023. As a result of this change,

there was an increase in cost of goods sold and operating expenses

being allocated to the Digital Agreements segment, which better

aligns with the investments the Company is making to grow that

segment as compared to its Security Solutions segment.

Segment and consolidated operating results (in thousands,

except percentages)(unaudited):

Three Months Ended

December 31,

Years Ended December

31,

(In thousands, except percentages)

2023

2022

2023

2022

Digital Agreements

Revenue

$

14,499

$

12,446

$

50,925

$

48,401

Gross profit

$

10,902

$

9,819

$

37,742

$

37,488

Gross margin

75

%

79

%

74

%

77

%

Operating (loss) income

$

(705

)

$

2,525

$

(18,525

)

$

5,348

Security Solutions

Revenue

$

48,429

$

44,176

$

184,181

$

170,605

Gross profit (1)

$

32,564

$

28,136

$

119,974

$

111,082

Gross margin

67

%

64

%

65

%

65

%

Operating income (2)

$

20,363

$

10,652

$

60,190

$

32,051

Total Company:

Revenue

$

62,928

$

56,622

$

235,106

$

219,006

Gross profit

$

43,466

$

37,955

$

157,715

$

148,570

Gross margin

69

%

67

%

67

%

68

%

Statements of operations

reconciliation:

Segment operating income

$

19,658

$

13,177

$

41,665

$

37,399

Corporate operating expenses not allocated

at the segment level

17,841

17,186

70,536

64,514

Operating income (loss)

$

1,817

$

(4,009

)

$

(28,871

)

$

(27,115

)

Interest income, net

$

415

$

398

$

2,090

$

595

Other income (expense), net

$

(874

)

$

1,010

$

(532

)

$

14,827

Income (loss) before income taxes

$

1,358

$

(2,601

)

$

(27,313

)

$

(11,693

)

Revenue by major products and services (in thousands,

unaudited):

Three Months Ended December

31,

2023

2022

(In thousands)

Digital Agreements

Security Solutions

Digital Agreements

Security Solutions

Subscription

$

13,245

$

14,065

$

11,301

$

12,492

Maintenance and support

1,022

10,326

998

10,372

Professional services and other (1)

232

1,423

147

1,760

Hardware products

—

22,615

—

19,552

Total Revenue

$

14,499

$

48,429

$

12,446

$

44,176

Years Ended December

31,

2023

2022

(In thousands)

Digital Agreements

Security Solutions

Digital Agreements

Security Solutions

Subscription

$

45,886

$

60,550

$

42,029

$

47,124

Maintenance and support

4,143

42,240

5,451

42,894

Professional services and other (1)

896

5,425

921

7,087

Hardware products

—

75,966

—

73,500

Total Revenue

$

50,925

$

184,181

$

48,401

$

170,605

(1)

Professional services and other includes

perpetual software licenses revenue, which was approximately 1% of

total revenue for both the three months and year ended December 31,

2023, and approximately 2% of total revenue for both the three

months and year ended December 31, 2022.

Non-GAAP Financial Measures

We report financial results in accordance with GAAP. We also

evaluate our performance using certain Non-GAAP financial metrics,

namely Adjusted EBITDA, Non-GAAP Net Income (Loss) and Non-GAAP Net

Income (Loss) Per Diluted Share. Our management believes that these

measures, when taken together with the corresponding GAAP financial

metrics, provide useful supplemental information regarding the

performance of our business, as further discussed in the

descriptions of each of these Non-GAAP metrics below.

These Non-GAAP financial measures are not measures of

performance under GAAP and should not be considered in isolation or

as alternatives or substitutes for the most directly comparable

financial measures calculated in accordance with GAAP. While we

believe that these Non-GAAP financial measures are useful for the

purposes described below, they have limitations associated with

their use, since they exclude items that may have a material impact

on our reported results and may be different from similar measures

used by other companies. Additional information about the Non-GAAP

financial measures and reconciliations to their most directly

comparable GAAP financial measures appear below.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) before interest,

taxes, depreciation, amortization, long-term incentive

compensation, restructuring and other related charges, and certain

non-recurring items, including acquisition related costs,

rebranding costs, and non-routine shareholder matters. We use

Adjusted EBITDA as a simplified measure of performance for use in

communicating our performance to investors and analysts and for

comparisons to other companies within our industry. As a

performance measure, we believe that Adjusted EBITDA presents a

view of our operating results that is most closely related to

serving our customers. By excluding interest, taxes, depreciation,

amortization, long-term incentive compensation, restructuring

costs, and certain other non-recurring items, we are able to

evaluate performance without considering decisions that, in most

cases, are not directly related to meeting our customers’

requirements and were either made in prior periods (e.g.,

depreciation, amortization, long-term incentive compensation,

non-routine shareholder matters), deal with the structure or

financing of the business (e.g., interest, one-time strategic

action costs, restructuring costs, impairment charges) or reflect

the application of regulations that are outside of the control of

our management team (e.g., taxes). In addition, removing the impact

of these items helps us compare our core business performance with

that of our competitors.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(in thousands,

unaudited)

Three Months Ended

December 31,

Years Ended December

31,

2023

2022

2023

2022

Net income (loss)

$

441

$

(3,097

)

$

(29,799

)

$

(14,434

)

Interest income, net

(415

)

(398

)

(2,090

)

(595

)

Provision for income taxes

917

496

2,486

2,741

Depreciation and amortization of

intangible assets (1)

1,955

1,375

6,479

7,066

Long-term incentive compensation (2)

4,136

3,197

14,562

8,813

Restructuring and other related

charges

4,235

1,482

17,311

13,310

Other non-recurring items (3)

(112

)

127

3,048

(10,505

)

Adjusted EBITDA

$

11,157

$

3,182

$

11,997

$

6,396

(1)

Includes cost of sales depreciation and

amortization expense directly related to delivering cloud

subscription revenue of $0.8 million and $1.5 million for the three

months and year ended December 31, 2023, respectively, and $0 for

the three months and year ended December 31, 2022. Costs are

recorded in “Cost of goods sold - Services and other” on the

consolidated statements of operations.

(2)

Long-term incentive compensation includes

immaterial expense for cash incentive grants awarded to employees

located in jurisdictions where we do not issue stock-based

compensation due to tax, regulatory or similar reasons. The expense

associated with these cash incentive grants was less than $0.1

million for both the three months ended December 31, 2023 and 2022,

respectively, and $0.3 million and $0.2 million for the years ended

December 31, 2023 and 2022, respectively.

(3)

For the three months ended December 31,

2023, other non-recurring items consist of an inventory write-off

reversal of $1.4 million, offset by $1.4 million of fees related to

non-recurring items, primarily severance payable to our former

chief executive officer.

For the three months ended December 31,

2022, other non-recurring items consist of $0.1 million of outside

services related to our strategic action plan.

For the year ended December 31, 2023,

other non-recurring items consist of $1.6 million of fees related

to non-recurring projects and our acquisition of ProvenDB, and $1.4

million of fees related to non-recurring items, primarily severance

payable to our former chief executive officer.

For the year ended December 31, 2022,

other non-recurring items consist of $4.3 million of outside

services related to our strategic action plan, and a $(14.8)

million non-operating gain on the sale of our investment in Promon

AS.

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per

Diluted Share

We define Non-GAAP Net Income (Loss) and Non-GAAP Net Income

(Loss) Per Diluted Share as net income (loss) or net income (loss)

per diluted share, as applicable, before the consideration of

long-term incentive compensation expenses, the amortization of

intangible assets, restructuring costs, and certain other

non-recurring items. We use these measures to assess the impact of

our performance excluding items that can significantly impact the

comparison of our results between periods and the comparison to

competitor results.

We exclude long-term incentive compensation expense because our

long-term incentives generally reflect the use of restricted stock

unit grants or cash incentive grants, including incentives directly

tied to the performance of the business, while other companies may

use different forms of incentives that have different cost impacts,

which makes comparison difficult. We exclude amortization of

intangible assets as we believe the amount of such expense in any

given period may not be correlated directly to the performance of

the business operations and that such expenses can vary

significantly between periods as a result of new acquisitions, the

full amortization of previously acquired intangible assets, or the

write down of such assets due to an impairment event. However,

intangible assets contribute to current and future revenue, and

related amortization expense will recur in future periods until

expired or written down.

We also exclude certain non-recurring items including one-time

strategic action costs and non-recurring shareholder matters, as

these items are unrelated to the operations of our core business.

By excluding these items, we are better able to compare the

operating results of our underlying core business from one

reporting period to the next.

We make a tax adjustment based on the above adjustments

resulting in an effective tax rate on a Non-GAAP basis, which may

differ from the GAAP tax rate. We believe the effective tax rates

we use in the adjustment are reasonable estimates of the overall

tax rates for the Company under its global operating structure.

Reconciliation of Net Income

(Loss) to Non-GAAP Net Income (Loss)

(in thousands, except per

share data)

(unaudited)

Three Months Ended

December 31,

Years Ended December

31,

2023

2022

2023

2022

Net income (loss)

$

441

$

(3,097

)

$

(29,799

)

$

(14,434

)

Long-term incentive compensation (1)

4,136

3,197

14,562

8,813

Amortization of intangible assets (2)

604

584

2,353

4,139

Restructuring and other related

charges

4,235

1,482

17,311

13,310

Other non-recurring items (3)

(112

)

127

3,048

(10,505

)

Tax impact of adjustments (4)

(1,773

)

(1,078

)

(7,455

)

(3,151

)

Non-GAAP net income (loss)

$

7,531

$

1,215

$

20

$

(1,828

)

Non-GAAP net income (loss) per share

$

0.19

$

0.03

$

0.00

$

(0.05

)

Shares

40,095

40,396

40,833

40,143

(1)

Long-term incentive compensation includes

immaterial expense for cash incentive grants awarded to employees

located in jurisdictions where we do not issue stock-based

compensation due to tax, regulatory or similar reasons. The expense

associated with these cash incentive grants was less than $0.1

million for both the three months ended December 31, 2023 and 2022,

respectively, and $0.3 million and $0.2 million for the years ended

December 31, 2023 and 2022, respectively.

(2)

Includes cost of sales amortization

expense directly related to delivering cloud subscription revenue

of $0.8 million and $1.5 million for the three months and year

ended December 31, 2023, respectively, and $0 for the three months

and year ended December 31, 2022. Costs are recorded in “Cost of

goods sold - Services and other” on the consolidated statements of

operations.

(3)

See the footnotes to the Reconciliation of

Net Income (Loss) to Adjusted EBITDA for a description of the

components of other non-recurring items for each period

presented.

(4)

The tax impact of adjustments is

calculated as 20% of the adjustments in all periods.

Copyright© 2024 OneSpan North America Inc., all rights reserved.

OneSpan™ is a registered or unregistered trademark of OneSpan North

America Inc. or its affiliates in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306242921/en/

Investor Contact: Joe Maxa Vice President of Investor

Relations +1-312-766-4009 joe.maxa@onespan.com

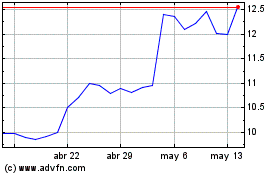

OneSpan (NASDAQ:OSPN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

OneSpan (NASDAQ:OSPN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024