1 |

NAMES

OF REPORTING PERSONS

ARGO ADVISORY LIMITED |

|

2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

3 |

SEC

USE ONLY

|

|

4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

OO |

5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

|

6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7 |

SOLE VOTING POWER

7,138,305 |

NUMBER OF

SHARES

BENEFICIALLY |

8 |

SHARED VOTING POWER

0 |

OWNED BY

EACH

REPORTING |

9 |

SOLE DISPOSITIVE POWER

7,138,305 |

| PERSON WITH |

10 |

SHARED DISPOSITIVE POWER

0 |

|

11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,138,305 |

|

12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

|

13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.04%(1) |

|

14 |

TYPE

OF REPORTING PERSON

CO |

|

Explanatory Note

This

Amendment No. 1 to Schedule 13D amends and supplements the Schedule 13D filed by Qiuxia Zhang on March 18, 2022 (the “Initial

Statements”). Defined terms have the meaning ascribed to them in the Initial Statements unless otherwise defined in this Amendment

No. 1. Other than as amended by this Amendment, the disclosures in the Initial Statements are unchanged.

Item 2. Identity and Background

This Statement is being

filed by the following persons (each a "Reporting Person", and collectively referred to as the "Reporting Persons"):

| ● | Qiuxia

Zhang (“Mr. Zhang”); and |

| ● | Argo

Advisory Limited (“Argo Advisory”). |

Mr. Zhang established Argo

Advisory Limited, a company incorporated under the Laws of the British Virgin Islands, with the sole purpose to hold the 7,138,305 Ordinary

Shares being reported herein. The registered address of Argo Advisory is Asia Leading Chambers, P.O. Box 986, Road Town, Tortola, British

Virgin Islands.

In such capacities, the

Reporting Persons may, pursuant to Rule 13d-3 under the Act, be deemed to be the beneficial owner of the Shares reported herein.

During the last five years,

the Reporting Persons had not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or were a

party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was or

is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration

Mr. Zhang entered into an

equity transfer agreement with the Issuer pursuant to which the Issuer agreed to purchase 19.99% equity of SmartConn Co., Limited (“SmartConn”)

at 90% of the appraisal price (the “Acquisition”). Mr. Zhang was the sole shareholder of SmartConn prior to the Acquisition.

The consideration of the Acquisition is paid in the form of newly issued Ordinary Shares of the Issuer. An aggregate of 17,138,305 Ordinary

Shares was issued to Mr. Zhang on February 22, 2022 upon the closing of the Acquisition. Reference is made to the Issuer’s report

on Form 6-K filed with the Securities and Exchange Commission on January 28, 2022 for more details on the Acquisition.

Mr. Zhang incorporated Argo

Advisory as its sole owner in April 2022 and transferred the 17,138,305 Ordinary Shares to Argo Advisory. Argo Advisory entered into a

share purchase agreement dated April 14, 2022 with Hogstream International Ltd. (“Hogstream”) pursuant to which Argo

Advisory agreed to transfer 10,000,000 Ordinary Shares of the Issuer to Hogstream at a unit price of USD$0.25 per share (calculated pursuant

to the previous day’s closing price per share after a discount of 20%), for a total consideration of USD$2,536,000. The transaction

was closed and Argo Advisory transferred the above-mentioned 10,000,000 Ordinary Shares to Hogstream on April 20, 2022.

Item 4. Purpose of Transaction

The Reporting Persons

may consider, explore and/or develop plans and/or make proposals (whether preliminary or final) with respect to, among other things, potential

changes to the business of the Issuer, management, board composition, investor communications, operations, capital allocation, dividend

policy, financial condition, mergers and acquisitions strategy, overall business strategy, executive compensation, corporate governance

related to the Issuer's business and stakeholders. The Reporting Persons may also have similar conversations with other stockholders or

other interested parties, such as industry analysts, existing or potential strategic partners or competitors, investment professionals

and other investors and may exchange information with any such persons or the Issuer pursuant to appropriate confidentiality or similar

agreements (which may contain customary standstill provisions). The Reporting Persons may at any time reconsider and change their intentions

relating to the foregoing.

The Reporting Persons intend

to review their investments in the Issuer on a continuing basis. Depending on various factors, including, without limitation, the Issuer's

financial position and strategic direction, the outcome of the actions referenced above, actions taken by the Issuer's board of directors,

price levels of the Shares, liquidity requirements and other investment opportunities available to the Reporting Persons, conditions in

the securities market and general economic and industry conditions, the Reporting Persons may in the future take actions with respect

to their investment position in the Issuer as they deem appropriate, including, without limitation, purchasing additional Shares or other

instruments that are based upon or relate to the value of the Shares or the Issuer in the open market or otherwise, selling some or all

of the securities reported herein, and/or engaging in hedging or similar transactions with respect to the Shares.

Item 5. Interest in Securities of the

Issuer

| |

(a) |

and (b) The responses of the Reporting Persons to rows (7) and (13) of the cover pages to this Amendment of Schedule 13D for the aggregate number of Shares and percentages of the Shares beneficially owned by the Reporting Persons are incorporated herein by reference. |

| (c) | Other than the transaction described herein there has been no

other transactions concerning the Ordinary Shares of the Issuer effected during the past sixty (60) days. |

| |

(d) |

No other person is known by any Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares beneficially owned by the Reporting Persons. |

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer

The information disclosed

under Items 3, 4, and 5 is incorporated by reference into this Item 6.

Except as described above,

to the best knowledge of the Reporting Persons, there are no contracts, arrangements, understandings, or relationships (legal or otherwise)

between the Reporting Persons and any person with respect to any securities of the Issuer including, but not limited to, the transfer

or voting of any of the securities, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits,

division of profits or loss or the giving or withholding of proxies.

Item 7. Materials to be Filed as Exhibits

SIGNATURES

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date:

April 29, 2022

| |

Argo Advisory Limited |

| |

|

| |

By: |

/s/ Qiuxia Zhang |

| |

Name: |

Qiuxia Zhang |

| |

Title: |

Director |

| |

|

| |

Qiuxia Zhang |

| |

|

| |

By: |

/s/ Qiuxia Zhang |

| |

Name: |

Qiuxia Zhang |

7

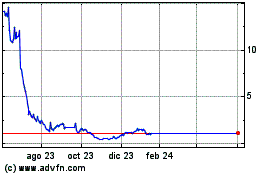

Powerbridge Technologies (NASDAQ:PBTS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Powerbridge Technologies (NASDAQ:PBTS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024