UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 8, 2023

PEARL

HOLDINGS ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Cayman

Islands |

|

001-41165 |

|

98-1593935 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 767

Third Avenue, 11th Floor New York, New York |

|

10017 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(212)

457-1540

(Registrant’s telephone number, including area code)

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each

consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

PRLHU |

|

The

Nasdaq Stock Market LLC |

| Class A ordinary

shares, par value $0.0001 per share |

|

PRLH |

|

The

Nasdaq Stock Market LLC |

| Redeemable

warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

PRLHW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 | Entry

into a Material Definitive Agreement |

The

information disclosed in Item 5.07 of this Current Report on Form 8-K regarding the Trust Amendment (as defined below) is incorporated

by reference into this Item 1.01.

| Item 3.03 | Material

Modification to Rights of Security Holders. |

The

information disclosed in Item 5.07 of this Current Report on Form 8-K regarding the amendments to the Charter (as defined below) is incorporated

by reference into this Item 3.03.

| Item 5.07 | Submission

of Matters to a Vote of Security Holders. |

Extraordinary

General Meeting

On

December 8, 2023, Pearl Holdings Acquisition Corp, a Cayman Islands exempted company (the “Company”), held an extraordinary

general meeting of shareholders (the “Extraordinary General Meeting”), at which holders of 22,193,876 ordinary shares,

comprised of the Company’s Class A ordinary shares, par value $0.0001 per share (“Class A Ordinary Shares”),

and the Company’s Class B ordinary shares, par value $0.0001 per share (“Class B Ordinary Shares” and, together

with the Class A Ordinary Shares, the “Ordinary Shares”), were present in person or by proxy, representing approximately

88.8% of the voting power of the 25,000,000 issued and outstanding Ordinary Shares of the Company, comprised of 20,000,000 Class A Ordinary

Shares and 5,000,000 Class B Ordinary Shares, entitled to vote at the Extraordinary General Meeting at the close of business on November

20, 2023, which was the record date (the “Record Date”) for the Extraordinary General Meeting. The Company’s

shareholders of record as of the close of business on the Record Date are referred to herein as “Shareholders.”

In connection with the vote

to approve the proposals set forth below, the holders of 17,832,307 Class A Ordinary Shares properly exercised their right to redeem

their shares for cash at a redemption price of approximately $10.71 per share, for an aggregate of approximately $191.0 million in connection

with the proposals set forth below. After the satisfaction of such redemptions, the balance in the Company’s trust account will

be approximately $23.3 million.

A

summary of the voting results at the Extraordinary General Meeting for each proposal is set forth below.

Proposal

1

The

Shareholders approved, by a special resolution, the proposal to amend the Company’s Amended and Restated Memorandum and Articles

of Association (the “Charter”) pursuant to an amendment to the Charter in the form set forth in Annex A of the definitive

proxy statement filed by the Company on November 20, 2023 (the “Proxy Statement”), to extend the date by which the

Company must either (i) consummate a merger, share exchange, asset acquisition, share purchase, reorganisation or similar business combination,

as further described in the Charter (an initial “Business Combination”), or (ii) cease its operations except for the

purpose of winding up if it fails to complete such Business Combination and (iii) redeem all of the Class A Ordinary Shares included

as part of the units sold in the Company’s initial public offering that was consummated on December 17, 2021 (the “IPO”),

from December 17, 2023 (such date, giving effect to any exercise of any Extension Option (as defined in the Charter), the “Original

Expiration Date”) to December 17, 2024 (the “Extension Amendment” and such proposal, the “Extension

Amendment Proposal”). The voting results for the Extension Amendment Proposal were as follows:

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 17,467,787 | |

3,619,948 | |

1,106,141 | |

0 |

Proposal

2

The

Shareholders approved, by a special resolution, the proposal to amend the Charter pursuant to an amendment to the Charter in the form

set forth in Annex A of the Proxy Statement (the “Redemption Limitation Amendment” and such proposal, the “Redemption

Limitation Amendment Proposal”) to eliminate from the Charter the limitation that the Company shall not redeem Class A Ordinary

Shares included as part of units sold in the IPO (including any shares issued in exchange thereof, the “Public Shares”)

to the extent that such redemption would cause the Company’s net tangible assets to be less than $5,000,001 following such redemption

(the “Redemption Limitation”). The Redemption Limitation Amendment will allow the Company to redeem Public Shares

irrespective of whether such redemption would exceed the Redemption Limitation. The voting results for the Redemption Limitation Amendment

Proposal were as follows:

For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 19,376,250 |

|

1,710,985 |

|

1,106,141 |

|

0 |

Proposal

3

The

Shareholders approved, by a special resolution, the proposal to amend the Charter pursuant to an amendment to the Charter in the form

set forth in Annex A of the Proxy Statement to allow the Company’s board of directors (the “Board”), in its

sole discretion, to elect to cease all operations on an earlier date (the “Liquidation Amendment” and such proposal,

the “Liquidation Amendment Proposal”). The voting results for the Liquidation Amendment Proposal were as follows:

For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 19,376,250 |

|

1,710,985 |

|

1,106,141 |

|

0 |

Proposal

4

The

Shareholders approved the proposal to amend the Company’s investment management trust agreement, dated as of December 14, 2021,

by and between Continental Stock Transfer & Trust Company (“Continental”) and the Company (the “Trust

Agreement”), pursuant to an amendment to the Trust Agreement in the form set forth in Annex B of the Proxy Statement, to allow

the Company to extend the date by which it must complete its initial Business Combination from December 17, 2023 to December 17, 2024,

or such earlier date as determined by the Board in its sole discretion (the “Trust Amendment” and such proposal, the

“Trust Amendment Proposal”). The voting results for the Trust Amendment Proposal were as follows:

For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 17,467,787 |

|

3,619,948 |

|

1,106,141 |

|

0 |

Proposal

5

The

proposal to adjourn the Extraordinary General Meeting to a later date or dates was not presented at the Extraordinary General Meeting,

as each of the Extension Amendment Proposal, the Redemption Limitation Amendment Proposal, the Liquidation Amendment Proposal and

the Trust Amendment Proposal received a sufficient number of votes for approval.

Under

Cayman Island law, the amendments to the Charter took effect upon approval of the Extension Amendment Proposal, the Redemption Limitation

Amendment Proposal and the Liquidation Amendment Proposal.

The

foregoing descriptions of the amendments to the Charter and the Trust Amendment do not purport to be complete and are qualified in their

entirety by reference to the full text of such documents, copies of which are filed as Exhibits 3.1 and 10.1 to this Current Report on

Form 8-K and are incorporated herein by reference.

Forward-Looking

Statements

This

Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act. The Company has based these forward-looking statements on its current expectations and projections

about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may

cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements include, but are

not limited to, the intention of the Sponsor to convert certain of its shares and the terms thereof, whether the Company will enter into

a definitive agreement or consummate an initial Business Combination, or the timing of any of the foregoing. In some cases, you can identify

forward-looking statements by terminology such as “may,” “should,” “could,” “would,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,”

or the negative of such terms or other similar expressions. A number of factors could cause actual events, performance or results to

differ materially from the events, performance and results discussed in the forward-looking statements. Important factors, among others,

that could cause actual results to differ materially from those anticipated in the forward-looking statements include: the Company’s

ability to enter into a definitive agreement with respect to an initial Business Combination within the time provided in the Company’s

Charter; the ability of the Company to obtain the financing necessary to consummate an initial Business Combination; compliance by the

Company with the listing rules of the Nasdaq Stock Exchange LLC; the failure to realize the anticipated benefits of an initial Business

Combination, including as a result of a delay in consummating an initial Business Combination; the level of redemptions made by the Company’s

shareholders in connection with the Extension Amendment Proposal and a proposed Business Combination and its impact on the amount of

funds available in the trust account to complete an initial Business Combination, and those factors identified in the Company’s

filings with the SEC, including the “Risk Factors” sections of the Company’s Annual Report on Form 10-K filed with

the SEC on March 31, 2023, and the Quarterly Reports on Form 10-Q filed with the SEC on May 15, 2023, August 14, 2023 and November 14,

2023 and in the other reports the Company has filed with the SEC, including the Extension Proxy. The Company’s SEC filings can

be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law,

the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information,

future events or otherwise.

Item

9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

December 14, 2023

| Pearl

Holdings Acquisition Corp |

|

| |

|

| By: |

/s/

Craig E. Barnett |

|

| Name: |

Craig E. Barnett |

|

| Title: |

Chief Executive

Officer |

|

Exhibit

3.1

AMENDMENT

TO THE AMENDED AND RESTATED MEMORANDUM AND

ARTICLES OF ASSOCIATION

OF

PEARL HOLDINGS ACQUISITION CORP

RESOLUTIONS

OF THE SHAREHOLDERS OF THE COMPANY

FIRST,

RESOLVED, as a special resolution THAT, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

| (a) | amending

Article 49.7 by deleting the following introduction of such sub-section: |

“In

the event that the Company does not consummate a Business Combination within 18 months (or up to 24 months if the Sponsor exercises its

Extension Options) from the consummation of the IPO, or such later time as the Members may approve in accordance with the Articles, the

Company shall”

and

replacing it with the following:

“In

the event that the Company does not consummate a Business Combination by December 17, 2024, or such later time as the Members may approve

in accordance with the Articles, the Company shall:”; and

| (b) | amending

Article 49.8 by deleting the words: |

“within

18 months (or up to 24 months if the Sponsor exercises its Extension Options) from the consummation of the IPO, or such later time as

the Members may approve in accordance with the Articles; or”

and

replacing them with the words:

“by

December 17, 2024, or such later time as the Members may approve in accordance with the Articles; or”

SECOND,

RESOLVED, as a special resolution THAT, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

| (a) | amending

Article 49.2 by deleting the words: |

“provide

Members with the opportunity to have their Shares repurchased by means of a tender offer for a per-Share repurchase price payable in

cash, equal to the aggregate amount then on deposit in the Trust Account, calculated as of two business days prior to the consummation

of such Business Combination, including interest earned on the Trust Account (net of taxes paid or payable, if any), divided by the number

of then issued Public Shares, provided that the Company shall not repurchase Public Shares in an amount that would cause the Company’s

net tangible assets to be less than US$5,000,001 following such repurchases. Such obligation to repurchase Shares is subject to the completion

of the proposed Business Combination to which it relates.”

and

replacing them with the words:

“provide

Members with the opportunity to have their Shares repurchased by means of a tender offer for a per-Share repurchase price payable in

cash, equal to the aggregate amount then on deposit in the Trust Account, calculated as of two business days prior to the consummation

of such Business Combination, including interest earned on the Trust Account (net of taxes paid or payable, if any), divided by

the number of then issued Public Shares. Such obligation to repurchase Shares is subject to the completion of the proposed Business Combination

to which it relates”

| (b) | amending

Article 49.4 by deleting the words: |

“At

a general meeting called for the purposes of approving a Business Combination pursuant to this Article, in the event that such Business

Combination is approved by Ordinary Resolution, the Company shall be authorised to consummate such Business Combination, provided that

the Company shall not consummate such Business Combination unless the Company has net tangible assets of at least US$5,000,001 immediately

prior to, or upon such consummation of, or any greater net tangible asset or cash requirement that may be contained in the agreement

relating to, such Business Combination.”

and

replacing them with the words:

“At

a general meeting called for the purposes of approving a Business Combination pursuant to this Article, in the event that such Business

Combination is approved by Ordinary Resolution, the Company shall be authorised to consummate such Business Combination.”

| (c) | amending

Article 49.5 by deleting the words: |

“The

Company shall not redeem Public Shares that would cause the Company’s net tangible assets to be less than US$5,000,001 following

such redemptions (the “Redemption Limitation”)”

| (d) | amending

Article 49.8 by deleting the words: |

“The

Company’s ability to provide such redemption in this Article is subject to the Redemption Limitation”

THIRD,

RESOLVED, as a special resolution THAT, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

| (a) | amending

Article 49.7 by deleting the following introduction of such sub-section: |

“or

such later time as the Members may approve in accordance with the Articles, the Company shall:”

and

replacing it with the following:

“or

such later time as the Members may approve in accordance with the Articles, or such earlier date as determined by the Board, in its sole

discretion, and included in a public announcement, the Company shall:”; and

| (b) | amending

Article 49.8 by deleting the words: |

“or

such later time as the Members may approve in accordance with the Articles; or”

and

replacing them with the words:

“or

such later time as the Members may approve in accordance with the Articles, or such earlier date as determined by the Board, in its sole

discretion, and included in a public announcement; or”

Exhibit

10.1

AMENDMENT

TO THE INVESTMENT MANAGEMENT TRUST AGREEMENT

RESOLUTIONS

OF THE SHAREHOLDERS OF THE COMPANY

THIS

AMENDMENT TO INVESTMENT MANAGEMENT TRUST AGREEMENT (this “Amendment Agreement”), dated as of December

8, 2023, is made by and between Pearl Holdings Acquisition Corp., a Cayman Islands exempted company (the “Company”),

and Continental Stock Transfer & Trust Company, a New York limited purpose trust company (the “Trustee”).

WHEREAS,

the parties hereto are parties to that certain Investment Management Trust Agreement dated as of December 14, 2021 (the “Trust

Agreement”);

WHEREAS,

Section 1(i) of the Trust Agreement sets forth the terms that govern the liquidation of the Trust Account established for the benefit

of the Company and the Public Shareholders under the circumstances described therein;

WHEREAS,

Section 6(c) of the Trust Agreement provides that Section 1(i) of the Trust Agreement may only be changed, amended or modified with the

affirmative vote of at least sixty five percent (65%) of the then outstanding Ordinary Shares and Class B ordinary shares, voting together

as a single class;

WHEREAS,

pursuant to an extraordinary general meeting of the shareholders of the Company held on the date hereof, at least sixty five percent

(65%) of the then Ordinary Shares and Class B ordinary shares, voting together as a single class, voted affirmatively to approve this

Amendment Agreement and (ii) a corresponding amendment to the Company’s amended and restated memorandum of association (the “Charter

Amendment”); and

WHEREAS,

each of the Company and the Trustee desires to amend the Trust Agreement as provided herein concurrently with the effectiveness of the

Charter Amendment.

NOW,

THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1.

Definitions. Capitalized terms contained in this Amendment Agreement, but not specifically defined herein, shall have the meanings

ascribed to such terms in the Trust Agreement.

2.

Amendments to the Trust Agreement.

(a)

Effective as of the execution hereof, Section 1(i) of the Trust Agreement is hereby amended and restated in its entirety as follows:

“(i)

Commence liquidation of the Trust Account only after and promptly after (x) receipt of, and only in accordance with, the terms of a letter

from the Company (“Termination Letter”) in a form substantially similar to that attached hereto as either Exhibit

A or Exhibit B signed on behalf of the Company by its Chief Executive Officer, Co-President, Chief Financial Officer, Chief Operating

Officer, General Counsel, Secretary or Chairman of the board of directors of the Company (the “Board”) or other authorized

officer of the Company, and complete the liquidation of the Trust Account and distribute the Property in the Trust Account, including

interest (less up to $100,000 of interest that may be released to the Company to pay dissolution expenses and which interest shall be

net of any taxes payable, it being understood that the Trustee has no obligation to monitor or question the Company’s position

that an allocation has been made for taxes payable), only as directed in the Termination Letter and the other documents referred to therein,

or (y) upon December 17, 2024 (or such earlier date as determined by the Board, in its sole discretion, and included in a public announcement)

(the “Liquidation Date”), or such later date as may be approved by the Company’s shareholders in accordance

with the Company’s amended and restated memorandum and articles of association, as it may be amended from time to time, if a Termination

Letter has not been received by the Trustee prior to such date, in which case the Trust Account shall be liquidated in accordance with

the procedures set forth in the Termination Letter attached as Exhibit B and the Property in the Trust Account, including interest (less

up to $100,000 of interest that may be released to the Company to pay dissolution expenses and which interest shall be net of any taxes

payable), shall be distributed to the Public Shareholders of record as of such date;”

(b)

Effective as of the execution hereof, Exhibit B of the Trust Agreement is hereby amended and restated, in the form attached hereto, to

implement a corresponding change to the foregoing amendment to Section 1(i) of the Trust Agreement.

3.

No Further Amendment. The parties hereto agree that except as provided in this Amendment Agreement, the Trust Agreement shall

continue unmodified, in full force and effect and constitute legal and binding obligations of the parties thereto in accordance with

its terms. This Amendment Agreement forms an integral and inseparable part of the Trust Agreement. This Amendment Agreement is intended

to be in full compliance with the requirements for an amendment to the Trust Agreement as required by Section 6(c) and Section 6(d) of

the Trust Agreement, and any defect in fulfilling such requirements for an effective amendment to the Trust Agreement is hereby ratified,

intentionally waived and relinquished by all parties hereto.

4.

References.

(a)

All references to the “Trust Agreement” (including “hereof,” “herein,” “hereunder,” “hereby”

and “this Agreement”) in the Trust Agreement shall refer to the Trust Agreement as amended by this Amendment Agreement; and

(b)

All references to the “amended and restated memorandum of association” in the Trust Agreement shall mean the Company’s

second amended and restated memorandum of association as amended by the Charter Amendment.

5.

Governing Law. This Amendment Agreement shall be governed by and construed and enforced in accordance with the laws of the State

of New York, without giving effect to conflicts of law principles that would result in the application of the substantive laws of another

jurisdiction.

6.

Counterparts. This Amendment Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original,

but all such counterparts shall together constitute one and the same instrument. Delivery of a signed counterpart of this Amendment Agreement

by electronic transmission shall constitute valid and sufficient delivery thereof.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties have duly executed this Amendment Agreement as of the date first written above.

| Continental

Stock Transfer & Trust Company |

|

| |

|

| By: |

/s/

Fran Wolf |

|

| |

Name: |

Fran Wolf |

|

| |

Title: |

Vice President |

|

| |

|

|

| Pearl Holdings

Acquisition Corp |

|

| |

|

| By: |

/s/

Craig E. Barnett |

|

| |

Name: |

Craig E. Barnett |

|

| |

Title: |

Chief Executive Officer |

|

[Signature

Page to Amendment to the Investment Management Trust Agreement]

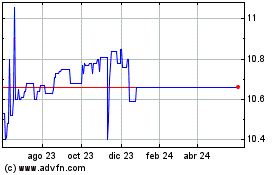

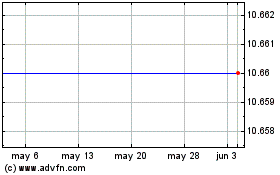

Pearl Holdings Acquisition (NASDAQ:PRLHU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Pearl Holdings Acquisition (NASDAQ:PRLHU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024