UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

under the Securities Exchange

Act of 1934

For the month of August

2024

Commission file number: 001-41334

RAIL VISION LTD.

(Translation of registrant’s

name into English)

15 Ha’Tidhar

St.

Ra’anana, 4366517

Israel

(Address of principal

executive offices)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On August 16, 2024 Rail Vision Ltd. (the “Company”)

announced that it will hold an Annual and Extraordinary General Meeting of Shareholders on September 23, 2024 at 15.00 p.m. (Israel time)

at the offices of the Company at 15 Ha’Tidhar St. Ra’anana, Israel. In connection with the meeting, the Company furnishes

the following documents:

| 1. |

A copy of the Notice and Proxy Statement with respect to the Company’s Annual and Extraordinary General Meeting of Shareholders describing the proposals to be voted upon at the meeting, the procedure for voting in person or by proxy at the meeting and various other details related to the meeting, attached hereto as Exhibit 99.1; and |

| 2. |

A form of Proxy Card whereby holders of ordinary shares of the Company may vote at the meeting without attending in person, attached hereto as Exhibit 99.2. |

This Report is incorporated

by reference into the Registrant’s Registration Statements on Form F-3 (File Nos. 333-271068 and 333-272933) and

Form S-8 (File Nos. 333-265968 and 333-281329), filed with the Securities and Exchange Commission, to be a part thereof

from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

RAIL VISION LTD. |

| |

|

|

| Date: August 16, 2024 |

By: |

/s/ Shahar Hania |

| |

|

Shahar Hania |

| |

|

Chief Executive Officer |

Exhibit 99.1

NOTICE OF

ANNUAL AND EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD ON SEPTEMBER 23, 2024

To the shareholders of Rail

Vision Ltd.:

Notice is hereby given that

an Annual and Extraordinary General Meeting (the “Meeting”) of the shareholders of Rail Vision Ltd. (the “Company”)

will be held at the offices of the Company, at 15 Ha’Tidhar St. Ra’anana, Israel at 15.00 p.m. (Israel Time), on September

23, 2024.

The agenda of the Meeting

will be as follows:

| |

1. |

To approve the re-appointment of Brightman Almagor Zohar & Co., a Firm in the Deloitte Global Network, as our independent registered public accounting firm for the year ending December 31, 2024 and until our next annual general meeting of shareholders, and to authorize our Board of Directors to fix such accounting firm’s annual compensation. |

| |

|

|

| |

2. |

To approve an amendment of the Company’s Amended and Restated Articles of Association (the “Articles”) relating to the appointment of directors of the Company, including to classify the Board of Directors (the “Board”) into three classes with staggered three-year terms. |

| |

|

|

| |

3-8. |

To re-elect each of Mr. Eli Yoresh, Mr. Yossi Daskal, Mr. Oz Adler, Mr. Mark Cleobury, Mr. Ariel Dor and Ms. Hila Kiron Revach to our Board, each until the next annual general meeting of shareholders, or each to serve for staggered terms ending in accordance with his or her class, if Proposal 2 is approved, and in accordance with article 39 of the Articles. (A separate vote for each director will be taken). |

| |

|

|

| |

9. |

To approve amendment of the Company’s Remuneration Policy. |

| |

|

|

| |

10. |

To approve the remuneration of Mr. Eli Yoresh for his service as Chairman of the Board and the grant of 191,000 restricted shares units (the “RSUs”). |

| |

|

|

| |

11. |

To approve an updated remuneration of members of the Board, which are not otherwise engaged by the Company, and the grant of 50,000 RSUs to each of the Company’s Board members Mr. Yossi Daskal, Mr. Oz Adler, Mr. Ariel Dor and Ms. Hila Kiron Revach. |

| |

|

|

| |

12. |

To approve the grant of 336,000 RSUs to the Company’s CEO Mr. Shahar Hania. |

| |

|

|

| |

13. |

To approve a reverse share split of the Company’s ordinary shares in the range of up to 10:1, to be effected at the discretion of, and at such ratio and on such date as shall be determined by, the Board; and to amend the Company’s Articles accordingly. |

| |

|

|

| |

14. |

To discuss the auditor’s report of our independent registered public accounting firm and audited financial statements for the year ended December 31, 2023, and to transact such other business as may properly come before the meeting. |

We are currently unaware of

any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated

as proxies shall vote according to their own judgment on those matters.

Only shareholders at the close

of business on August 16, 2024 are entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof. You

are cordially invited to attend the Meeting in person.

If you are unable to attend

the Meeting in person, you are requested to complete, date and sign the enclosed proxy and to return it promptly in the pre-addressed

envelope provided. Shareholders who attend the Meeting may revoke their proxies and vote their shares in person.

| |

By Order of the Board |

| |

|

| |

/s/ Shahar Hania |

| |

Shahar Hania

Chief Executive Officer |

| |

August 16, 2024 |

15 Ha’Tidhar St.

Ra’anana, Israel 4366517

PROXY STATEMENT

FOR ANNUAL AND EXTRAORDINARY GENERAL MEETING

OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 23, 2024

This Proxy Statement is furnished

to holders of our ordinary shares in connection with Annual and Extraordinary General Meeting of Shareholders, to be held on September

23, 2024, at 15.00 p.m. Israel time at the offices of the Company at 15 Ha’Tidhar St. Ra’anana, Israel (the “Meeting”),

or at any adjournments thereof.

Throughout this Proxy Statement,

we use terms such as “Rail Vision” “RV,” “we”, “us”, “our” and the “Company”

to refer to Rail Vision Ltd. and terms such as “you” and “your” to refer to our shareholders.

Agenda Items

The agenda of the Meeting

will be as follows:

| |

1. |

To approve the re-appointment of Brightman Almagor Zohar & Co., a Firm in the Deloitte Global Network, as our independent registered public accounting firm for the year ending December 31, 2024 and until our next annual general meeting of shareholders, and to authorize our Board of Directors to fix such accounting firm’s annual compensation. |

| |

|

|

| |

2. |

To approve an amendment of the Company’s Amended and Restated Articles of Association (the “Articles”) relating to the appointment of directors of the Company, including to classify the Board of Directors (the “Board”) into three classes with staggered three-year terms. |

| |

|

|

| |

3-8. |

To re-elect each of Mr. Eli Yoresh, Mr. Yossi Daskal, Mr. Oz Adler, Mr. Mark Cleobury, Mr. Ariel Dor and Ms. Hila Kiron Revach to our Board, each until the next annual general meeting of shareholders, or each to serve for staggered terms ending in accordance with his or her class, if Proposal 2 is approved, and in accordance with article 39 of the Articles. (A separate vote for each director will be taken). |

| |

|

|

| |

9. |

To approve an amendment to the Company’s Remuneration Policy. |

| |

|

|

| |

10. |

To approve the remuneration of Mr. Eli Yoresh for his service as Chairman of the Board and the grant of 191,000 restricted shares units (the “RSU’s”) to Mr. Yoresh. |

| |

|

|

| |

11. |

To approve an updated remuneration of members of the Board, which are not otherwise engaged by the Company, and the grant of 50,000 RSU’s to each of the Company’s Board members Mr. Yossi Daskal, Mr. Oz Adler, Mr. Ariel Dor and Ms. Hila Kiron Revach. |

| |

|

|

| |

12. |

To approve the grant of 336,000 RSU’s to the Company’s CEO Mr. Shahar Hania. |

| |

|

|

| |

13. |

To approve a reverse share split of the Company’s ordinary shares in the range of up to 10:1, to be effected at the discretion of, and at such ratio and on such date as shall be determined by, the Board; and to amend the Company’s Articles accordingly. |

| |

|

|

| |

14. |

To discuss the auditor’s report of our independent registered public accounting firm and audited financial statements for the year ended December 31, 2023, and to transact such other business as may properly come before the meeting. |

We are currently unaware of

any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated

as proxies shall vote according to their own judgment on those matters.

Board Recommendation

Our Board unanimously recommends

that you vote “FOR” all items.

Record Date, Share

Ownership and Quorum

Only

the holders of record of ordinary shares of the Company as at the close of business on August 16, 2024, (the “Record Date”)

are entitled to receive notice of and attend the Meeting and any adjournment thereof. No person shall be entitled to vote at the Meeting

unless such person is registered as a shareholder of the Company on the Record Date for the Meeting.

As

of the close of business on the Record Date, 20,110,965 ordinary shares were issued and outstanding. A quorum shall be the presence of

at least two (2) shareholders who hold at least twenty five percent (25%) of the voting rights (including through a proxy or voting instrument)

within one half hour from the time the meeting was designated to start.

If

within half an hour from the time appointed for the Meeting a quorum is not present, then without any further notice the Meeting shall

be adjourned to the same day in the next week, at the same time and place. No business shall be transacted at any adjourned meeting except

business which might lawfully have been transacted at the Meeting as originally called. At such adjourned meeting any shareholder (not

in default as aforesaid) present in person or by proxy, shall constitute a quorum.

Abstentions

and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote”

occurs when a bank, broker or other holder of record holding ordinary shares for a beneficial owner attends the Meeting but does not vote

on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions

from the beneficial owner. Brokers that hold ordinary shares in “street name” for clients (as described below) typically have

authority to vote on “routine” proposals even when they have not received instructions from beneficial owners. The only item

on the Meeting agenda that may be considered routine is Proposal 1 relating to the reappointment of the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2024; however, we cannot be certain whether this will be treated as a routine

matter since our proxy statement is prepared in compliance with the Israeli Companies Law 5759-1999 (the “Companies Law”),

rather than the rules applicable to domestic U.S. reporting companies. Therefore, it is important for a shareholder that holds ordinary

shares through a bank or broker to instruct its bank or broker how to vote its ordinary shares if the shareholder wants its ordinary shares

to count for the Proposals.

Position Statement

To

the extent you would like to submit a position statement with respect to any of proposals described in this proxy statement pursuant to

the Companies Law you may do so by delivery of appropriate notice to the offices of our attorneys, Shibolet & Co. (Attention: Ron

Soulema, Adv) located at 4 Its’hak Sadeh St., Tel-Aviv, Israel, not later than ten days before the convening of the Meeting (i.e. September

13, 2024). The response of the Board to the position statement may be submitted not later than five days after the deadline for sending

the position statement (i.e. September 18, 2024).

Cost of Soliciting Votes for the Meeting

We

will bear the cost of soliciting proxies from our shareholders. Proxies will be solicited by mail and may also be solicited in person,

by telephone or electronic communication, by our directors, officers and employees. We will reimburse brokerage houses and

other custodians, nominees and fiduciaries for their expenses in accordance with the regulations of the SEC concerning the sending of

proxies and proxy material to the beneficial owners of our shares.

Voting

Each

ordinary share issued and outstanding as of the close of business on the Record Date is entitled to one vote at the Meeting.

Ordinary

shares that are properly voted, for which proxy cards are properly executed and returned within the deadline set forth below, will be

voted at the Meeting in accordance with the directions given. If no specific instructions are given in such proxy cards, the proxy holder

will vote in favor of the item(s) set forth in the proxy card. The proxy holder will also vote in the discretion of such proxy holder

on any other matters that may properly come before the Meeting, or at any adjournment thereof. Where any holder of ordinary shares affirmatively

abstains from voting on any particular resolution, the votes attaching to such ordinary shares will not be included or counted in the

determination of the number of ordinary shares present and voting for the purposes of determining whether such resolution has been passed

(but they will be counted for the purposes of determining the quorum, as described above).

Proxies

submitted by registered shareholders and street shareholders (by returning the proxy card) must be received by us no later than 8:00 a.m.,

Eastern Time, on September 19, 2024, to ensure your representation at our Meeting.

The

manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are

represented by book entry in your name so that you appear as a shareholder on the records of VStock Transfer, LLC (“VStock”)

(i.e., you are a registered shareholder), our stock transfer agent, this Proxy Statement, the notice of Meeting and the proxy card will

be mailed to you by VStock. You may provide voting instructions by returning a proxy card. You also may attend the Meeting and vote in

person. If you own ordinary shares of record and you do not vote by proxy or in person at the Meeting, your shares will not be voted.

If

you own shares in street name (i.e., you are a street shareholder), meaning that your shares are held by a bank, brokerage firm, or other

nominee, you are then considered the “beneficial owner” of shares held in “street name,” and as a result, this

Proxy Statement, the notice of Meeting and the proxy card will be provided to you by your bank, brokerage firm, or other nominee holding

the shares. You may provide voting instructions to them directly by returning a voting instruction form received from that institution.

If you own ordinary shares in street name and attend the Meeting, you must obtain a “legal proxy” from the bank, brokerage

firm, or other nominee that holds your shares in order to vote your shares at the Meeting and present your voting information card.

Revocability of Proxies

Registered

shareholders may revoke their proxy or change voting instructions before shares are voted at the Meeting by submitting a written notice

of revocation to our Chief Financial Officer at ofer@railvision.io or Rail Vision Ltd., 15 Ha’Tidhar St. Ra’anana, Israel,

or a duly executed proxy bearing a later date (which must be received by us no later than the date set forth below) or by attending the

Meeting and voting in person. A beneficial owner owning ordinary shares in street name may revoke or change voting instructions by contacting

the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institution and voting in person

at the Meeting.

If you are not planning

to attend in person, to ensure your representation at our Meeting, revocation of proxies submitted by registered shareholders and street

shareholders (by returning a proxy card) must be received by us no later than 8:00 a.m., Eastern Time, on September 19, 2024.

Availability of Proxy Materials

Copies of the proxy card and

voting instruction card, the notice of Meeting and this Proxy Statement are available at the “Investor Relations” portion

of our website, http://www.railvision.io. The contents of that website are not a part of this Proxy Statement.

Reporting Requirements

We are subject to the information

reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to foreign private

issuers. We fulfill these requirements by filing reports with the Securities and Exchange Commission, or the Commission. Our filings are

available to the public on the Commission’s website at http://www.sec.gov.

As a foreign private issuer,

we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this

notice and Proxy Statement should not be taken as an admission that we are subject to the proxy rules under the Exchange Act.

Vote Required for Each Proposal

The affirmative vote of the

holders of a majority of the voting power present at the Meeting in person or by proxy and voting thereon is necessary for the approval

of each of Proposals 1-8, 10-11, and 13.

The approval of Proposals

9 and 12 require the affirmative vote of a majority of the voting power present at the Meeting in person or by proxy and voting thereon,

and as long as one of following conditions is met:

| |

a. |

The majority of shares that voted for the approval of the respective resolution includes at least majority of the shares held by non-controlling and non-interested shareholders voted at the Meeting (excluding abstaining votes); or |

| |

|

|

| |

b. |

The total number of shares of non-controlling and non-interested shareholders that voted against the approval of the respective resolution does not exceed two percent (2%) of the aggregate voting rights in the Company. |

Under the Companies Law, (1)

the term “Controlling Shareholder” means a shareholder having the ability to direct the activities of a company, other than

by virtue of being an office holder. A shareholder is presumed to be a controlling shareholder if the shareholder holds 50% or more of

the voting rights in a company or has the right to appoint the majority of the directors of the company or its chief executive officer;

and (2) a “personal interest” of a shareholder (i) includes a personal interest of any members of the shareholder’s

family (or spouses thereof) or a personal interest of a company with respect to which the shareholder (or such family member) serves as

a director or the CEO, owns at least 5% of the shares or has the right to appoint a director or the CEO but (ii) excludes an interest

arising solely from the ownership of our ordinary shares. As of the date hereof, we have no Controlling Shareholder within the above meaning

of the Companies Law. However, according to the Companies Law, if there is no shareholder who holds 50% or more of the voting rights in

a company, any shareholder who holds 25% or more of the voting rights in a company will be considered a “Controlling Shareholder”

with respect to approval of related party transactions. Therefore, currently, no shareholder is regarded as a Controlling Shareholder.

The Companies Law requires

that each shareholder voting on Proposals 9 and 12 will indicate whether or not the shareholder has a personal interest in the proposed

resolutions. Otherwise, the shareholder is not eligible to vote on such proposals. As such, in the proxy card attached to the

proxy statement you will be asked to indicate whether you have a personal interest with respect to Proposals 9 and 12. If any shareholder

casting a vote in connection hereto does not notify us whether or not they have a personal interest with respect to Proposals 9 and 12

their vote with respect to such Proposals will be disqualified.

If you provide specific instructions

(mark boxes) with regard to certain proposals, your shares will be voted as you instruct. If you sign and return your proxy card or voting

instruction form without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board.

The proxy holders will vote in their discretion on any other matters that properly come before the Meeting.

PROPOSAL 1:

APPROVAL OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTANTS AND

AUTHORIZATION OF THE BOARD AND/OR AUDIT COMMITTEE

TO FIX THEIR COMPENSATION

Background

At the Meeting, you will be

asked to approve the reappointment of Brightman Almagor Zohar & Co., a Firm in the Deloitte Global Network, as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024 and until our next annual general meeting of

shareholders and to authorize our Board (upon recommendation of the audit committee) and/or the audit committee (subject to ratification

by our Board) to fix their compensation.

The following table sets forth,

for each of the years indicated, the fees billed by our independent registered public accounting firm.

| | |

Year Ended

December 31, | |

| | |

2022 | | |

2023 | |

| (USD in thousands) | |

| | |

| |

| Audit fees (1) | |

| 120 | | |

| 120 | |

| Audit-related fees (2) | |

| 220 | | |

| 50 | |

| Tax fees (3) | |

| 21 | | |

| - | |

| All other fees | |

| - | | |

| - | |

| | |

| | | |

| | |

| Total | |

| 361 | | |

| 170 | |

| (1) | Audit

fees consist of professional services provided in connection with the audit of our annual financial statements. |

| (2) | Audit-related

fees in 2022 consist of services in connection with our initial public offering and in 2023 includes a consent and a comfort letter. |

| (3) | Tax

fees consist of fees for professional services for tax compliance, tax advice, and tax audits |

For the fiscal years ended

December 31, 2023, all of our audit and audit-related fees were pre-approved by our Board or the Audit Committee.

Proposed Resolution

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 1 - “RESOLVED,

that the appointment of Brightman Almagor Zohar & Co., a Firm in the Deloitte Global Network, as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2024 and until our next annual general meeting of shareholders, is hereby

approved and the Audit Committee or the Board be, and hereby is, authorized to fix the compensation of such independent auditors.”

Required Vote

The affirmative vote of the

holders of a majority of the voting power represented and voting on this proposal in person or by proxy is necessary to approve the resolution

to approve the appointment of our independent auditors and authorize the audit committee to fix the independent auditors’ compensation.

Board Recommendation

Our Board recommends a vote

FOR the foregoing resolution approving the reappointment of our independent auditors and authorization of our Audit Committee or Board

to fix the independent auditors’ compensation.

PROPOSAL 2

APPROVAL OF AN AMENDMENT OF THE COMPANY’S

ARTICLES OF ASSOCIATION

Background

On August 6, 2024 the Board

resolved to approve that, in case the majority of the Company’s directors are independent and there is no controlling shareholder

in the Company, the Company shall adopt all the reliefs under regulation 5D of the Companies Regulations (facilitation for companies whose

securities are listed for trading on a stock exchange outside of Israel), 2000, releasing the Company from its obligations under sections

115, 116A, 118A, 219(c), 239(a), 243, and 249 of the Israeli Companies Law.

Further to the above resolution,

the Board resolved to approve and recommend to the Company’s Shareholders meeting to approve an amendment of the Company’s

Articles in the form attached hereto as Exhibit A (the “Articles Amendment”), relating to the appointment of directors,

including to establish a classified board of directors consisting of three classes of directors with staggered three-year terms of office

(the “Classified Board”).

Our

Articles of Association currently provide that all of the Company’s directors (other than external directors) are to be elected

annually to serve until their successors have been elected and qualified. However, if the Articles Amendment is approved and

the Classified Board structure becomes effective, our Board would be classified into three classes, as nearly equal in number as possible,

with each class having a three-year term expiring in a different year. However, for the initial terms immediately following the division

of the Board into three classes, directors would be assigned terms of one, two or three years, as described below.

If

this Proposal 2 is approved, the Board has initially designated the three classes to initially contain the following directors, if elected at

the Meeting:

Class I Director (Term

to Expire at the 2025 Annual General Meeting)

Ariel Dor

Hila Kiron

Class II Director (Term

to Expire at the 2026 Annual General Meeting)

Oz Adler

Mark Cleobury

Class III Director

(Term to Expire at the 2027 Annual General Meeting)

Eli Yoresh

Yossi Daskal

If

this Proposal 2 is approved at the Meeting and the Classified Board structure becomes effective, at each successive annual general meeting of

shareholders following the Meeting, the class of directors to be elected in such year would be elected for a three-year term so that the

term of office of one class of directors expires in each year. If this Proposal 2 is not approved at the Meeting, then each director

will continue to be elected annually, at our annual general meeting of shareholders.

The

Classified Board structure also provides that a director (other than an external director) elected by the Board to fill a vacancy holds

office until the next election of the class for which such director has been chosen, and until that director’s successor has

been elected and qualified or until his or her earlier death, resignation, retirement or removal. Any additional directorships resulting

from an increase in the number of directors will be distributed between the three classes so that, as nearly as possible, each class will

consist of one-third of the total number of directors.

To

preserve the Classified Board structure and other provisions in Article 39 of our Articles relating the appointment of directors, if approved

at the Meeting, the proposed Articles Amendment provides that any amendment to the provisions of Article 39 of our Articles relating to

the Classified Board and certain other provisions of Article 39 relating to the appointment of directors, as set forth in the Articles

Amendment, shall require the approval of at least sixty-six and two thirds’ percent (66 2/3%) of the ordinary

shares represented at a shareholder meeting, in person or by proxy, voting on the matter, which we refer to as the “Special

Majority Amendment Provision.” Under the Companies Law, in order to include the Special Majority Amendment Provision in our

Articles, such provision must be approved by the shareholders by the same special majority. Accordingly, if this Proposal 2 is approved

by our shareholders at the Meeting (by an ordinary majority) but does not receive the affirmative vote of the holders of at least

sixty-six and two thirds’ percent (66 2/3%) of the ordinary shares represented at the Meeting, in person or by proxy, voting

on the proposal, the Articles Amendment shall be approved without the Special Majority Amendment Provision.

Further,

our Articles currently provide that directors shall be elected at an annual meeting and/or an extraordinary meeting and we are proposing

to amend Article 39 of our Articles to provide that directors shall be elected only at an annual meeting, as set forth on Exhibit

A attached hereto.

Advantages of Proposed

Amendments to Articles of Association

Our

Board believes that the proposed amendments to the Articles will help to assure the continuity and stability of our long-term policies

in the future and to reduce our vulnerability to hostile and potentially abusive takeover tactics that could be adverse to the

best interests of the Company’s shareholders. A longer term in office would allow our directors to stay focused on long-term

value creation, without undue pressure that may come from special interest groups intent on pursuing their own agenda at the expense of

the interests of the Company and its other shareholders. Further, it would enable us to benefit more effectively from directors’

experience, knowledge of the Company and wisdom, while helping us attract and retain highly qualified individuals willing to commit the

time and dedication necessary to understand the Company and its operations. The Classified Board would not preclude unsolicited acquisition

proposals but, by eliminating the threat of imminent removal, would put our Board in a position to act to maximize value for all shareholders.

Unless a director is removed or resigns, three annual elections are needed to replace all the directors on the classified Board. The proposed

amendments to the Articles may, therefore, discourage an individual or entity from acquiring a significant position in the Company’s

shares with the intention of obtaining immediate control of the Board, without the cooperation of our Board. If this Proposal 2

is approved at the Meeting, these provisions will be applicable to each annual election of directors (other than external directors),

including the elections following any change of control of the Company.

Disadvantages of

Proposed Amendments to Articles of Association

While

the proposed amendments to the Articles may have the beneficial effects discussed immediately above, it may also discourage some takeover

bids, including some that would otherwise allow shareholders the opportunity to realize a premium over the market price of their shares

or that a majority of our shareholders otherwise believes may be in their best interests to accept or where the reason for the desired

change is inadequate performance of our directors or management. Because of the additional time required to change control of our

Board, the proposed amendments to the Articles may make it more difficult and more expensive for a potential acquirer to gain control

of our Board and the Company, even if the takeover bidder were to acquire a majority of our outstanding shares. Currently, a change

in control of our Board can be made by shareholders holding a majority of the votes cast at a single annual or extraordinary meeting of

shareholders where there is a contested director election. If the proposed amendments to the Articles are amended, it will take

at least two annual general meetings of shareholders following the annual meeting at which the Classified Board structure becomes effective

for a potential acquirer to effect a change in control of our Board or to take action to remove other impediments to its acquisition of

our Company, even if the potential acquirer were to acquire a majority of our outstanding ordinary shares.

Further,

the proposed Articles Amendments will make it more difficult for shareholders to change the majority composition of the Board, even if

the shareholders believe such a change would be beneficial. Because the proposed amendments to the Articles will make the removal

or replacement of directors more difficult, it would increase the directors’ security in their positions, and could be viewed as

tending to perpetuate incumbent management.

However,

our Board believes that forcing potential bidders to negotiate with our Board for a change of control transaction will allow

our Board to better maximize shareholders value in any change of control transaction. The Board is not presently aware of any attempt,

or contemplated attempt, to acquire control of the Company.

Proposed Resolution

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 2 - “RESOLVED,

to approve the amendment of the Company’s Amended and Restated Articles of Association relating to the appointment of directors

of the Company, including to classify the Board of Directors into three classes with staggered three-year terms, as detailed in the Proxy

Statement dated August 16, 2024.”

Required Vote

The affirmative vote of the

holders of a majority of the voting power represented and voting on this proposal in person or by proxy is necessary to approve the resolution

to approve the amendment of the Articles. Notwithstanding the above, for the approval of Article 39(i) of the proposed amendment Articles

the affirmative vote of the holders of a majority of sixty-six and two thirds’ percent (66 2/3%) of the voting power represented

and voting on this proposal in person or by proxy shall be required.

Board Recommendation

Our Board recommends a vote

FOR the foregoing resolution approving the amendment of the Articles.

PROPOSALS 3-8

RE-ELECTION OF THE COMPANY’S BOARD MEMBERS

Background

Under the Companies Law and

our Articles, the management of our business is vested in our Board. The Board may exercise all powers and may take all actions that are

not specifically granted to our shareholders.

Our Board currently consists

of six (6) directors, two of whom were external directors. Under our Articles our Board must consist of at least four (4) directors and

not more than thirteen (13) directors, including at least two external directors, to the extent External Directors are required to be

elected and to serve on the Board pursuant to the requirements of the Companies Law.

Subject to the approval of

the Articles amendment according to Proposal 2 above, the Company’s Board members shall be elected, under Article 39 of the Articles,

as follows:

The Directors (excluding External

Directors, to the extent External Directors are required to be elected and to serve on the Board pursuant to the requirements of the Companies

Law), shall be classified, with respect to the term for which they each severally hold office, into three classes, as nearly equal in

number as practicable, hereby designated as Class I, Class II and Class III (each, a “Class”).

If Proposal 2 above is not

approved at the Meeting, each of the re-elected directors will hold office until the next annual general meeting of shareholders, unless

any office is earlier vacated under any relevant provisions of the articles of association of the Company or applicable laws or regulations.

The Board may assign members

of the Board already in office to each Class at the time such classification becomes effective.

The term of office of the

initial Class I directors shall commence on the Annual General Meeting held in 2024 and shall expire at the first Annual General Meeting

to be held in 2025 and when their successors are elected and qualified; The term of office of the initial Class II directors shall commence

on the Annual General Meeting held in 2024 and shall expire at the Annual General Meeting to be held in 2026 and when their successors

are elected and qualified; and The term of office of the initial Class III directors shall commence on the Annual General Meeting held

in 2024 and shall expire at the Annual General Meeting to be held in 2027 and when their successors are elected and qualified.

At each Annual General Meeting,

commencing with the Annual General Meeting to be held in 2025, each of the successors elected to replace the Directors of a Class whose

term shall have expired at such Annual General Meeting shall be elected to hold office until the third Annual General Meeting next succeeding

his or her election and until his or her respective successor shall have been elected and qualified. Notwithstanding anything to the contrary,

each Director shall serve until his or her successor is elected and qualified or until such earlier time as such Director’s office

is vacated.

On August 6, 2024 the Board

resolved, in reference to the proposed amended Article 39 and subject to its approval by the Meeting, to assign the members of the Board

already in office to classes as follows: Class I - Ariel Dor and Hila Kiron Revach, Class II - Oz Adler and Mark Cleobury, and Class III

- Eli Yoresh and Yossi Daskal.

The Board further resolved

to recommend the Meeting to approve in accordance with Article 39 of Articles, to re-elect all the directors in office, including the

former external directors, to the Board for a tenure according to their classes as assigned by the Board.

Mr. Eli Yoresh

has served on our Board since August 2017 and was appointed as the Chairman in January 2024. Mr. Yoresh is a seasoned executive with over

25 years of executive and financial management experience, mainly with companies in the financial, technology and industrial sectors.

Mr. Yoresh has served as chief financial officer since March 2010at Foresight Autonomous Holdings Ltd. (Nasdaq and TASE: FRSX), one of

our previous shareholders. Mr. Yoresh served as the chief executive officer of Tomcar Global Holdings Ltd., a global manufacturer of off-road

vehicles, from 2005 to 2008. In addition, since October 2018 Mr. Yoresh serves as chairman of the board at Xylo Technologies Ltd (Nasdaq:

XYLO), since November 2020 as Chairman of the board at Gix Internet Ltd (TASE: GIX), since August 2021 as a director at Elbit Imaging

Ltd (TASE: EMITF), since September 2022 as a director at Jeffs Brands Ltd (Nasdaq: JFBR), since September 2022 as a director at Viewbix

Inc (OTC: VBIX) and since April 2023 as a director at Charging Robotics Inc (OTC: CHEV) . Mr. Yoresh holds a B.A. in Business Administration

from the College of Management, Israel and an M.A. in Law from Bar-Ilan University, Israel. Mr. Yoresh is a Certified Public Accountant

in Israel.

Mr. Oz Adler,

CPA, has served on our board of directors since June 2022. Mr. Adler currently serves as the chief executive officer and chief financial

officer of SciSparc Ltd. Mr. Adler has served as SciSparc’s chief financial officer since April 2018 and as its chief executive

officer since January 2022. Prior to that, from September 2017 until March 2018, he served as the VP Finance of SciSparc. From December

2020 to April 2021, Mr. Adler served as the chief financial officer of Medigus Ltd. Mr. Adler also worked in the audit department of Kost

Forer Gabbay & Kasierer, a member of Ernst & Young Global between December 2012 and August 2017. Additionally, Mr. Adler currently

serves on the board of directors of numerous private and publicly traded companies, including Elbit Imaging Ltd. (TASE: EMITF), Clearmind

Medicine Inc. (CSE: CMND) (OTC: CMNDF) (FSE:CWY), Jeffs’ Brands Ltd., Polyrizon Ltd. and Charging Robotics Ltd. Mr. Adler is a certified

public accountant in Israel and holds a B.A. degree in Accounting and Business Management from The College of Management, Israel.

Mr. Yossi Daskal

has served on our board of directors since March 2022. Mr. Daskal serves as the President of Israel-Canada Chamber of Commerce since 2013.

From 2003 to 2019, Mr. Daskal established Bombardier Israel, working as Chief Country Representative, Project Manager, Financing&

Head of Sales. Prior to that, Mr. Daskal was the General Manager of Chemitron Technologies from 1999 to 2003. Since 2021, he is the chairman

of the board of directors and the director of the finance committee of the Tel Aviv Museum of Art. Mr. Daskal has a Bachelors of Arts

in Mediterranean and Arabic History Science and a Masters of Arts in Political Science, and is completing a PhD in Decision-Making from

Haifa University.

Mr. Ariel Dor

has served on our board of directors since March 2024. Mr. Dor is a seasoned entrepreneur and leader in the fields of engineering and

business. From 2011 to 2013, Mr. Dor served as the Team Leader of the Aerospace division at Elbit Systems. From 2014 to 2015, he served

as Business Unit Director at Galooli Fleet & Energy, a subsidiary of the Galooli Group that specializes in IoT solutions for vehicles.

Transitioning to the autonomous vehicle industry, Mr. Dor served as the Co-CEO of Foresight Autonomous Holdings from 2016 to 2019. In

2019, Mr. Dor founded Upsellon Brands Holdings and has served as its CEO since that time. Upsellon Brands is an innovative e-commerce

dedicated to revolutionizing the landscape of Amazon FBA aggregation. Mr. Dor holds a B.Sc. in Electrical Engineering from the Tel Aviv

University.

Ms. Hila Kiron-Revach

has served on our board of directors since January 2024. Ms. Kiron-Revach has served as a member of the board of directors of Geffen Biomed

Ltd. since 2014 and has been a member of the board of directors of Zmiha Investment House Ltd. since 2021. In 2021, Ms. Kiron-Revach served

as a professional advisor to the chairman of the board of directors and acting secretary of Europe Asia Pipeline Company. From 2015

until 2021, Ms. Kiron-Revach served as a senior professional advisor to ministers in the Israeli government, including the minister of

foreign affairs and minister of transportation. From 2012 until 2015, Ms. Kiron-Revach served as CEO of Hamil 38 – the Israeli Center

for National Master Plan to Strengthen Existing Building in the Face of Earthquakes, Tama 38 Ltd. and as an attorney at Tabakman &

Co. Law Firm. In 2007, Ms. Kiron-Revach founded Eliya – AB and served as its chief executive officer until 2010. Ms. Kiron-Revach

hold an LL.B. from the Netanya Academic College and is a licensed attorney in Israel.

Mr. Mark Cleobury

has served on our board of directors since December 1, 2022 and served as the Chairman from January 2023 to January 2024. Mr Cleobury

currently serves as Senior Vice President of Knorr-Bremse’s Rail Systems Division, since April 2022. Prior to this role, Mr. Cleobury

held positions of increasing responsibility at Knorr-Bremse, including between July 2016 and April 2022, Mr. Cleobury served as a Member

of the Management Board of Knorr-Bremse Systems for Rail. Prior to that, between April 2011 and June 2016, Mr. Cleobury served as Vice

President Sales and Systems for Client Management Trains. Prior to that, between January 2007 and April 2011, he served as Manager Sales

& Systems Trains.

During

his twenty years of tenure at Knorr-Bremse, in addition to his executive roles, Mr. Cleobury held several global directorship roles within

the Knorr-Bremse group, including serving as Vice President for the Knorr-Bremse Company in the U.S., a Director of Knorr-Bremse Investment

(UK) Ltd in the UK, Chairman of Knorr-Bremse Nordic Rail Services in Sweden, a Director of Knorr-Bremse Rail Systems (UK) Ltd in the UK,

a Member of the Board of Knorr-Bremse Rail Systems Italia S.r.L in Italy, a Member of the Supervisory Board of Knorr-Bremse systemy Kolejowe

Polska Sp. Zoo in Poland, a Director of Knorr-Bremse Systemes Ferroviares France SA in France, Consiglio D’Amministrazione at Microelettrica

Scientifica s.p.a in Italy, a Director of Knorr-Bremse Systems for Railways in Russia, and a Director of Knorr-Bremse 1520 in Russia.

Diversity of the Board of Directors

Board Diversity Matrix

(As of August 16, 2024)

| Country of Principal Executive Offices |

Israel |

| |

|

| Foreign Private Issuer |

Yes |

| |

|

| Disclosure Prohibited under Home Country Law |

No |

| |

|

| Total Number of Directors |

6 |

| Part I: Gender Identity | |

Female | | |

Male | | |

Non-Binary | | |

Did Not

Disclose

Gender |

|

| Directors | |

1 | | |

5 | | |

- | | - |

|

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

|

|

| Underrepresented Individual in Home Country Jurisdiction | |

- |

| LGBTQ+ | |

- |

| Did Not Disclose Demographic Background | |

- |

Proposed Resolutions

It is proposed that at the

Meeting the following resolutions be adopted:

Proposal No. 3 - “RESOLVED,

to re-elect Mr. Ariel Dor to the Board for a tenure according to his class as assigned by the Board until the next annual general meeting

of shareholders, or to serve for a staggered term ending in accordance with his class, if Proposal 2 is approved, as detailed in the Proxy

Statement dated August 16, 2024.”

Proposal No. 4 - “RESOLVED,

to re-elect Ms. Hila Kiron-Revach to the Board for a tenure according to her class as assigned by the Board until the next annual general

meeting of shareholders, or to serve for a staggered term ending in accordance with her class, if Proposal 2 is approved, as detailed

in the Proxy Statement dated August 16, 2024.”

Proposal No. 5 - “RESOLVED,

to re-elect Mr. Oz Adler to the Board for a tenure according to his class as assigned by the Board until the next annual general meeting

of shareholders, or to serve for a staggered term ending in accordance with his class, if Proposal 2 is approved, as detailed in the Proxy

Statement dated August 16, 2024.”

Proposal No. 6 - “RESOLVED,

To re-elect Mr. Mark Cleobury to the Board for a tenure according to his class as assigned by the Board until the next annual general

meeting of shareholders, or to serve for a staggered term ending in accordance with his class, if Proposal 2 is approved, as detailed

in the Proxy Statement dated August 16, 2024.”

Proposal No. 7 - “RESOLVED,

to re-elect Mr. Eli Yoresh to the Board for a tenure according to his class as assigned by the Board until the next annual general meeting

of shareholders, or to serve for a staggered term ending in accordance with his class, if Proposal 2 is approved, as detailed in the Proxy

Statement dated August 16, 2024.”

Proposal No. 8 - “RESOLVED,

to re-elect Mr. Yossi Daskal to the Board for a tenure according to his class as assigned by the Board until the next annual general meeting

of shareholders, or to serve for a staggered term ending in accordance with his class, if Proposal 2 is approved, as detailed in the Proxy

Statement dated August 16, 2024.”

Required Vote

The affirmative vote of the

holders of a majority of the voting power represented and voting on proposal no. 3 - 8 in person or by proxy is necessary to approve the

resolution to re-elect the Board’s members.

Board Recommendation

Our Board recommends a vote

FOR the foregoing resolution approving the re-election of all the directors in office to the Board for a tenure according to their classes

as assigned by the Board.

PROPOSAL 9

APPROVAL OF AN AMENDMENT OF THE COMPANY’S

REMUNERATION POLICY

Background

On August 6, 2024 the Board

resolved, following the approval of the Company’s Audit and Compensation Committee, to approve and recommend to the Meeting to approve

an amendment of the Company’s Remuneration Policy in the form attached hereto as Exhibit B.

Proposed Resolution

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 9 - “RESOLVED,

to approve the amendment of the Company’s Remuneration Policy as detailed in the Proxy Statement dated August 16, 2024.”

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person

or by proxy, entitled to vote and voting on the matter, is required to approve the amendment of the Company’s Remuneration Policy,

provided that one of following conditions is met:

| |

a. |

The majority of shares that voted for the approval of the respective resolution includes at least majority of the shares held by non-controlling and non-interested shareholders voted at the Meeting (excluding abstain votes); or |

| |

|

|

| |

b. |

The total number of shares of non-controlling and non-interested shareholders that voted against the approval of the respective resolution does not exceed two percent (2%) of the aggregate voting rights in the Company. |

Under the Companies Law, (1)

the term “controlling shareholder” means a shareholder having the ability to direct the activities of a company, other

than by virtue of being an office holder. A shareholder is presumed to be a controlling shareholder if the shareholder holds 50% or more

of the voting rights in a company or has the right to appoint the majority of the directors of the company or its chief executive officer;

and (2) a “personal interest” of a shareholder (i) includes a personal interest of any members of the shareholder’s

family (or spouses thereof) or a personal interest of a company with respect to which the shareholder (or such family member) serves as

a director or the CEO, owns at least 5% of the shares or has the right to appoint a director or the CEO but (ii) excludes an interest

arising solely from the ownership of our ordinary shares. According to the Companies Law, if there is no shareholder who holds 50% or

more of the voting rights in a company, any shareholder who holds 25% or more of the voting rights in a company will be considered a “Controlling

Shareholder” with respect to approval of related party transactions.

The Companies Law requires

that each shareholder voting on Proposal 9 will indicate whether or not the shareholder is a controlling shareholder or has a personal

interest in the proposed resolution. Otherwise, the shareholder is not eligible to vote on such proposals. As such, in the proxy

card attached to the proxy statement you will be asked to indicate whether you are a controlling shareholder or have a personal interest

with respect to Proposal 9. If any shareholder casting a vote in connection hereto does not notify us whether or not they are controlling

shareholders or have a personal interest with respect to Proposal 9 their vote with respect to such Proposal will be disqualified.

Board Recommendation

Our Board recommends a vote

FOR the foregoing resolution approving the amendment of the Company’s Remuneration Policy.

PROPOSALS 10:

APPROVAL OF REMUNERATION TO THE CHAIRMAN OF

THE BOARD

Background

Mr. Eli Yoresh has served

on our Board as of August 2017 and was appointed as the Chairman of the Board in January 2024.

Following the approval of

our shareholders meeting on March 27, 2022, on May 11, 2022, the Company granted Mr. Yoresh 39,932 options to purchase 4,992 ordinary

shares at a price per share of US $14.80 (equal to the average closing share price of the Company’s ordinary shares on Nasdaq Capital

Market during the first 30 days following the IPO). These options vest in three annual tranches over a three-year period as of May 11,

2022.

According to an option agreement

between the Company and Mr. Eli Yoresh, on January 4, 2018, the Company granted Mr. Yoresh options to purchase 2,107 ordinary shares of

the Company at an exercise price of US $14.80 per-share (as adjusted following bonus shares distribution), which have fully vested and

are currently exercisable.

Mr. Yoresh is included in

the Company’s Directors and Officers insurance policy and was issued letters of indemnification and exculpation by the Company.

Mr. Yoresh, as well as other

Board members who were not otherwise engaged or employed by the Company, were entitled until December 31, 2023 to an annual fee of NIS

48,000 and a per-meeting fee of NIS 2,000. Since January 1, 2024, Mr. Yoresh, has been entitled to an annual fee of NIS 32,515 and a per-meeting

fee of NIS 1,040.

On August 6, 2024, our Board

resolved, following the approval of the Company’s Audit and Compensation Committee, to approve and recommend to the Company’s

Shareholders meeting to approve the engagement of the Company in a service agreement with Mr. Eli Yoresh, in his capacity as the Chairman

of the Board in accordance with the following terms: (1) The service agreement shall be effective as of July 1, 2024; (2) Mr. Yoresh shall

provide the services in a scope reflecting a 30% full-time position; (3) In consideration of his services, Mr. Yoresh shall be entitled

to a monthly fee of NIS 24,000 (plus VAT) (the “Monthly Fee”); (4) The Monthly Fee shall be automatically increased to NIS

30,000 (plus VAT) upon the Company’s raising capital investments of an aggregate amount of US$ 10 Million within a consecutive 12-month

period; and (5) Effective as of 2025, Mr. Yoresh shall be entitled to an annual bonus of up to three (3) Monthly Fee, based on the achievement

of certain measurable targets, as shall be determined in advance by the Company’s Compensation Committee and Board, at the beginning

of each Year.

Furthermore, on August 11,

2024, our Board approved, following the approval of the Company’s Audit and Compensation Committee and subject to the approval of

the Meeting, grant of 191,000 restricted shares units (the “RSU’s”) to Mr. Yoresh. The RSU’s shall be subject

to a quarterly vesting over a period of 3 years (so that by the end of each quarter, 1/12 of the RSU’s shall vest) provided that

the grantee is engaged by the Company on the applicable vesting date.

Proposed Resolutions

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 10 - RESOLVED,

to approve the engagement of the Company in a service agreement with Mr. Eli Yoresh, in his capacity as the Chairman of the Board effective

as of July 1, 2024 and grant of 191,000 RSU’s.

Required Vote

Under the Companies Law, the

affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, entitled to vote

and voting on the matter, is required to approve the engagement of the Company in a service agreement with Mr. Eli Yoresh, in his capacity

as the Chairman of the Board and the grant of 191,000 RSU’s.

Board Recommendation

Our Board recommends a vote

FOR the engagement of the Company in a service agreement with Mr. Eli Yoresh, in his capacity as the Chairman of the Board and grant of

191,000 RSU’s.

PROPOSAL 11:

APPROVAL OF THE REMUNERATION TO THE COMPANY’S

BOARD MEMBERS

Background

The Company’s Board

members who are not otherwise engaged or employed by the Company, were entitled until December 31, 2023, to an annual fee of NIS 48,000

and a per meeting fee of NIS 2,000. As of January 1, 2024, these Board members are entitled to the “fixed amount”, as defined

in the Companies Regulations (Rules Regarding Remuneration and Expenses for an External Director), 5760-2000 of (the: “Regulations”),

which are effective as of January 1, 2024, an annual fee of NIS 32,515 and a per meeting fee of NIS 1,040.

In addition, some of these

directors were granted options to purchase 4,992 ordinary shares. The options are exercisable at a price per share of US$14.80. The options

vest in three equal tranches over a three-year period, conditioned upon continuous service with the Company. Board members may waive their

right to receive the above fees or any part thereof.

The Company’s Board

members are included in the Company’s Directors and Officers insurance policy and were issued letters of indemnification and exculpation

by the Company.

On August 6, 2024, our Board

resolved, following the approval of the Company’s Audit and Compensation Committee, to approve and recommend to the Meeting to approve

that, effective as of July 1, 2024, all serving members of the Board, who are not otherwise engaged by the Company, shall be entitled

to the payment of a fixed annual fee in the amount of NIS 48,000 (plus VAT), which shall be paid in four quarterly installments of NIS

12,000, each; and Board members who also serve as members of the Company’s Audit and Compensation Committee shall be entitled to

the payment of a fixed annual fee in the amount of NIS 56,000 (plus VAT), which shall be paid in four quarterly installments of NIS 14,000,

each.

Furthermore, on August 11,

2024 our Board approved, following the approval of the Company’s Audit and Compensation Committee and subject to the approval of

the Meeting, the grant of 50,000 RSU’s to each of our Board members Mr. Oz Adler, Mr. Yossi Daskal, Mr. Ariel Dor and Mrs. Hila

Kiron Revah, subject to a quarterly vesting over a period of 3 years (so that by the end of each quarter, 1/12 of the RSU’s shall

vest) provided that the grantee is continuing his/her office as Board member on the applicable vesting date.

Proposed Resolutions

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 11 - RESOLVED,

to approve that, effective as of July 1, 2024, all serving members of the Board, who are not otherwise engaged by the Company, shall be

entitled to the payment of a fixed annual fee in the amount of NIS 48,000 (plus VAT), Board members who also serve as members of the Company’s

Audit and Compensation Committee shall be entitled to the payment of a fixed annual fee in the amount of NIS 56,000 (plus VAT); and approve

the grant of 50,000 RSU’s to each of the Company’s Board members Mr. Oz Adler, Mr. Yossi Daskal, Mr. Ariel Dor and Mrs. Hila

Kiron Revah.

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person

or by proxy, entitled to vote and voting on the matter, is required to approve the entitlement of Board members to a fixed annual fee

and the grant of 50,000 RSUs to each of the Company’s Board members Mr. Oz Adler, Mr. Yossi Daskal, Mr. Ariel Dor and Mrs. Hila

Kiron Revah.

Board Recommendation

Our Board recommends a vote

FOR the approval of the entitlement of Board members to a fixed annual fee and the grant of 50,000 RSUs to each of the Company’s

Board members Mr. Oz Adler, Mr. Yossi Daskal, Mr. Ariel Dor and Mrs. Hila Kiron Revah.

PROPOSAL 12:

GRANT OF RSU’s TO THE COMPANY’S

CEO

Background

Mr. Shahar Hania

has served as our Chief Executive Officer since November 2020. Previously, Mr. Hania served as a member of our Board from November 2020

to March 2022, and as our Vice President of Research and Development from April 2016 to March 2021. Mr. Hania is an electro-optics expert

with vast experience (since 1994) in the fields of combined electro-optics systems, detection, infrared systems and lasers. Mr. Hania

held senior system engineering positions in Bird Aerosystems Ltd. From April 2012 to May 2016, and Elbit Systems Electro-Optics ELOP

Ltd. From 2000 to 2012. Mr. Hania holds a B.Sc. in Physics and Electro-optics engineering from the Jerusalem College of Technology, Israel

and a M.Sc. in electro-optics engineering from Ben-Gurion University, Israel.

On August 20, 2016, the Company

entered into a service agreement with Mr. Hania (as amended on March 20, 2018, February 4, 2021, May 29, 2022 and November 14, 2023) under

which he was engaged to serve as our Vice President of Research and Development from April 2016 to March 2021 and as our CEO since November

2020. In consideration for his services as our CEO, Mr. Hania is entitled to a monthly fee of NIS 93,000 (plus VAT).

According to option agreements

between the Company and Mr. Hania, Mr. Hania was granted on January 4, 2018 and October 12, 2020 options to purchase

up to 12,964 ordinary shares of the Company (as adjusted following bonus shares distribution and reverse split) at an exercise price of

US $49.11 per-share, of which 3,850 options expired, 3,850 options are subject to vesting upon meeting sales goals until October 13,

2024 and 5,264 options are fully vested and are currently exercisable. On June 18, 2023, following approval by the Company’s

Compensation Committee and Board, the Company’s Shareholders Meeting approved the amendment of the exercise price of the remaining

options to US $14.8 per-share (equal to the average closing share price on the Nasdaq over the first 30 calendar days that followed

our IPO).

On May 11, 2022, Mr. Hania

was granted options to purchase 19,510 ordinary shares, with an exercise price per share of US $14.80 of which 14,608 options are fully

vested and are currently exercisable, and 4,902 will vest quarterly where the last vesting occurs in the second quarter of 2025.

On October 31, 2023 the Company’s

shareholders meeting approved that during his engagement as the CEO of the Company, Mr. Hania may be entitled to an annual bonus

of up to six (6) New Monthly Fee (the “Maximal Annual Bonus Amount”), as set out in the Company’s

Remuneration Policy for the Company’s officers, based, among others, on the achievement of certain goals, as shall be determined

by the Company’s Compensation Committee and the Board. The Company’s shareholders meeting further approved the grant to Mr. Hania

of options to purchase 42,497 ordinary shares at an exercise price of US $14.80 per-share, to be vested over a three-year period as of

the grant date on quarterly basis. Currently 10,624 of these options are fully vested and exercisable.

Mr. Hania is included in the

Company’s Directors and Officers insurance policy and was issued letters of indemnification and exculpation by the Company.

On August 11, 2024 our Board

approved, following the approval of the Company’s Audit and Compensation Committee and subject to the approval of the Meeting, the

grant of 336,000 RSU’s to Mr. Hania. The RSU’s shall be subject to a quarterly vesting over a period of 3 years (so that by

the end of each quarter, 1/12 of the RSU’s shall vest) provided that the grantee is engaged by the Company on the applicable vesting

date.

Proposed Resolutions

It is proposed that at the

Meeting the following resolution be adopted:

Proposal No. 12 - RESOLVED,

to approve the grant of 336,000 RSU’s to Mr. Shahar Hania for his services as the Company’s CEO.

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person

or by proxy, entitled to vote and voting on the matter, is required to approve the grant of the RSU’s to Mr. Hania, provided that

one of following conditions is met:

| |

a. |

The majority of shares that voted for the approval of the respective resolution includes at least majority of the shares held by non-controlling and non-interested shareholders voted at the Meeting (excluding abstain votes); or |

| |

|

|

| |

b. |

The total number of shares of non-controlling and non-interested shareholders that voted against the approval of the respective resolution does not exceed two percent (2%) of the aggregate voting rights in the Company. |

Under the Companies Law, (1)

the term “controlling shareholder” means a shareholder having the ability to direct the activities of a company, other

than by virtue of being an office holder. A shareholder is presumed to be a controlling shareholder if the shareholder holds 50% or more

of the voting rights in a company or has the right to appoint the majority of the directors of the company or its chief executive officer;

and (2) a “personal interest” of a shareholder (i) includes a personal interest of any members of the shareholder’s

family (or spouses thereof) or a personal interest of a company with respect to which the shareholder (or such family member) serves as

a director or the CEO, owns at least 5% of the shares or has the right to appoint a director or the CEO but (ii) excludes an interest

arising solely from the ownership of our ordinary shares. According to the Companies Law, if there is no shareholder who holds 50% or

more of the voting rights in a company, any shareholder who holds 25% or more of the voting rights in a company will be considered a “Controlling

Shareholder” with respect to approval of related party transactions.

The Companies Law requires

that each shareholder voting on Proposal 12 will indicate whether or not the shareholder is a controlling shareholder or has a personal

interest in the proposed resolution. Otherwise, the shareholder is not eligible to vote on such proposals. As such, in the proxy

card attached to the proxy statement you will be asked to indicate whether you are a controlling shareholder or have a personal interest

with respect to Proposal 12. If any shareholder casting a vote in connection hereto does not notify us whether or not they are

controlling shareholders or have a personal interest with respect to Proposal 12 their vote with respect to such Proposal will be disqualified.

Board Recommendation

Our Board recommends a vote

FOR the grant of 336,000 RSU’s to Mr. Hania.

PROPOSAL 13:

REVERSE SHARE SPLIT OF THE COMPANY’S ORDINARY SHARES IN THE RANGE OF UP TO 10:1

Background

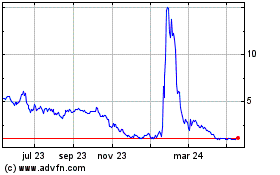

On July 22, 2024 we received

a notification from the Nasdaq Stock Market LLC (“Nasdaq”) that we are not in compliance with the minimum bid price requirement

for continued listing, as set forth in Listing Rule 5550(a)(2) (the “Nasdaq Minimum Bid Price Rule”), which requires

listed securities to maintain a minimum bid price of $1.00 per share, and that we had 180 calendar days, until January 21, 2025 (the

“Initial Period”), to regain compliance with the minimum bid price requirement. If we are not in compliance by the end of

the Initial Period, we may be afforded a second 180-calendar day compliance period (the “Extension Period”). To qualify

for this additional time, we will be required to meet the continued listing requirement for market value of publicly held shares and all

other initial listing standards for The Nasdaq Capital Market with the exception of the minimum bid price requirement and will need to

provide written notice of its intention to cure the deficiency during the second compliance period. We can regain compliance if, by the

end of the Extension Period, the closing bid price of our ordinary shares is at least $1.00 for a minimum of ten consecutive business

days. If we cannot demonstrate compliance by the end of the Extension Period, the Nasdaq staff may notify us that our ordinary shares

are subject to delisting. If our ordinary shares’ bid price does not demonstrate compliance by itself during the abovementioned

timeframe, the proposed reverse share split is intended to adjust our ordinary shares’ bid price. If the reverse share split is

authorized by our shareholders, our Board will have the discretion to implement the reverse share split at a ratio within the range that

was approved by the shareholders or effect no reverse share split at all.

Due to the decrease in the

share price of the Company’s ordinary shares, we believe that a reverse share split of our ordinary shares is advisable in order

to regain compliance with the Nasdaq Minimum Bid Price Rule. In addition, we also believe that a reverse split of our ordinary shares

may make our ordinary shares more attractive to a broader range of investors, including professional investors, institutional investors

and the general investing public. Our Board believes that the anticipated increased price resulting from the reverse share split may generate

additional interest and trading in our ordinary shares.

We are therefore seeking approval

of the shareholders to approve a reverse share split of the Company’s ordinary shares in the range of up to 10:1, to be effected

at the discretion of, and at such ratio and at such date as shall be determined by the Board (the “Reverse Split”), and subject

to and upon such determination, to amend the Company’s Articles accordingly. If the Reverse Split is approved by our shareholders,

then the Board will have the authority to decide whether and when to implement the Reverse Split and to determine the exact ratio for

the Reverse Split within the range. Following such determination, if any, by our Board, we will issue a press release announcing the effective

date of the Reverse Split and will amend our Articles accordingly to effect such Reverse Split. The Company is required to give notice

to Nasdaq at least 5 trading days prior to the record date of a Reverse Split.

If the Reverse Split is implemented,

the number of the issued and outstanding ordinary shares would be reduced in accordance with the Reverse Split ratio selected by the Board

while the number of Ordinary Shares in the Company’s authorized share capital shall remain unchanged. Furthermore, upon completion

of the Reverse Split, the number of ordinary shares issuable pursuant to our Amended Share Option Plan, as well as the number of shares

and exercise prices subject to outstanding options under the plan shall be appropriately adjusted (including the number of the RSUs granted

by the Company to the Chairman of the Board, our CEO and to members of the Board, to the extent approved by the shareholders at the Meeting).

In the event that the Company’s

shareholders do not approve the Reverse Split and the proposed amendments to the Company’s Articles and the Company does not otherwise

regain compliance with the minimum bid price requirements in the requisite time period, the Company’s ordinary shares will likely

be delisted from trading on the Nasdaq Capital Market. Delisting could also negatively impact the Company’s ability to secure additional

financing. Accordingly, the Board recommends that the shareholders vote to approve the Reverse Split as described above, on a date and

at such ratio to be determined by our Board, which will be announced by the Company and to authorize the Company to amend the Articles

accordingly.

Implementation of Reverse Split

If our shareholders approve

the Reverse Split and our Board decides to effectuate the Reverse Split, each block of up to 10 (depending on the Reverse Split ratio)

ordinary shares issued and outstanding will be reclassified and changed into one fully paid and non-assessable ordinary share of the Company.

In addition, the number of authorized ordinary shares that the Company may issue will be reclassified, and proportionately decreased in

accordance with the Reverse Split ratio.

Upon the implementation of

the Reverse Split, we intend to treat shares held by shareholders through a bank, broker, custodian or other nominee in the same manner

as registered shareholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed

to effect the Reverse Split for their beneficial holders holding our ordinary shares in street name. However, these banks, brokers, custodians

or other nominees may have different procedures than registered shareholders for processing the Reverse Split. Shareholders who hold our

ordinary shares with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their

banks, brokers, custodians or other nominees.

Our registered holders of ordinary

shares hold their shares electronically in book-entry form with the transfer agent. These shareholders do not have share certificates

evidencing their ownership of their ordinary shares. They are, however, provided with a statement reflecting the number of shares registered

in their accounts. Registered holders who hold shares electronically in book-entry form with the transfer agent will not need to take

action (the exchange will be automatic) to receive whole shares of post-Reverse Split ordinary shares. No fractional shares will be issued

as a result of the Reverse Split. In accordance with our Articles, all fractional shares will be rounded to the nearest whole ordinary

share, such that only shareholders holding fractional consolidated shares of more than half of the number of shares which consolidation

constitutes one whole share, shall be entitled to receive one consolidated share.

Certain Risks Associated with the Reverse

Split

There are numerous factors

and contingencies that could affect our price following the proposed Reverse Split, including the status of the market for our ordinary

shares at the time, our reported results of operations in future periods, and general economic, market and industry conditions. Accordingly,

the market price of our ordinary shares may not be sustainable at the direct arithmetic result of the Reverse Split. If the market price

of our ordinary shares declines after the Reverse Split, our total market capitalization (the aggregate value of all of our outstanding

ordinary shares at the then existing market price) after the Reverse Split will be lower than before the Reverse Split.

The Reverse Split may result

in some shareholders owning “odd lots” of less than 100 ordinary shares on a post-split basis. Odd lots may be more difficult

to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

Material U.S. Federal Income Tax Consequences

The following is a summary

of the material U.S. federal income tax consequences of the Reverse Split to U.S. Holders (as defined below) of our ordinary

shares. This summary does not purport to be a complete discussion of all of the possible U.S. federal income tax consequences. Further,

it does not address the impact of the Medicare surtax on certain net investment income or the alternative minimum tax, U.S. federal

estate or gift tax laws, any state, local or foreign income or other tax consequences or any tax treaties. Also, it does not address the

tax consequences to holders that are subject to special tax rules, such as (i) persons who are not U.S. Holders; (ii) banks,

insurance companies, or other financial institutions; (iii) regulated investment companies; (iv) tax-qualified retirement plans;

(v) dealers in securities and foreign currencies; (vi) persons whose functional currency is not the U.S. dollar; (vii) traders

in securities that use the mark-to-market method of accounting for U.S. federal income tax purposes; (viii) persons deemed to

sell our ordinary shares under the constructive sale provisions of the Code; (ix) persons that acquired our ordinary shares through

the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement plan; (x) persons that

hold our ordinary shares as part of a straddle, appreciated financial position, synthetic security, hedge, conversion transaction or other