United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

SCHEDULE

13D

(Rule

13d-101)

Information

to be Included in Statements Filed Pursuant to § 240.13d-1(a) and Amendments Thereto Filed Pursuant to § 240.13d-2(a)

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)*

Shenandoah

Telecommunications Company

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

82312B106

(CUSIP

Number)

Christopher

M. Leininger, Esq.

c/o

ECP

40

Beechwood Road

Summit,

NJ 07901

(973)

671-6100

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 30, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 82312B106 | 13D | Page 1 of 18 Pages |

| 1 |

Names

of Reporting Persons

ECP

ControlCo, LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

OO

(Limited Liability Company) |

| CUSIP No. 82312B106 | 13D | Page 2 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV, LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ☐ |

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

OO

(Limited Liability Company) |

| CUSIP No. 82312B106 | 13D | Page 3 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners GP IV, LP

|

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) ☐

(b) ☐ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 4 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV-A, LP |

| 2 |

Check

the Appropriate Box if a Member of a Group |

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 5 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV-B, LP |

| 2 |

Check

the Appropriate Box if a Member of a Group |

(a)

☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 6 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV-C, LP |

| 2 |

Check

the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 7 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV-D, LP |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

5,815,571 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

5,815,571 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

5,815,571 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

10.0% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 8 of 18 Pages |

| 1 |

Names

of Reporting Persons

Energy

Capital Partners IV-B (Hill City IP), LP |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

2,452,384 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

2,452,384 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,452,384 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

4.5% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 9 of 18 Pages |

| 1 |

Names

of Reporting Persons

ECP

Fiber Holdings GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

3,363,187 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

3,363,187 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

3,363,187 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

5.8% |

| 14 |

Type

of Reporting Person

OO

(Limited Liability Company) |

| CUSIP No. 82312B106 | 13D | Page 10 of 18 Pages |

| 1 |

Names

of Reporting Persons

ECP

Fiber Holdings, LP |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

3,363,187 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

3,363,187 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

3,363,187 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

5.8% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 11 of 18 Pages |

| 1 |

Names

of Reporting Persons

Hill

City Holdings GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

2,452,384 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

2,452,384 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,452,384 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

4.5% |

| 14 |

Type

of Reporting Person

OO

(Limited Liability Company) |

| CUSIP No. 82312B106 | 13D | Page 12 of 18 Pages |

| 1 |

Names

of Reporting Persons

Hill

City Holdings, LP |

| 2 |

Check the Appropriate Box if a Member of a Group

|

(a) ☐

(b) ☐ |

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole

Voting Power

0 |

| 8 |

Shared

Voting Power

2,452,384 |

| 9 |

Sole

Dispositive Power

0 |

| 10 |

Shared

Dispositive Power

2,452,384 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,452,384 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

4.5% |

| 14 |

Type

of Reporting Person

PN |

| CUSIP No. 82312B106 | 13D | Page 13 of 18 Pages |

Explanatory

Note

This

Amendment No. 1 to Schedule 13D (this “Amendment No. 1”) amends and supplements the statement on Schedule 13D filed with

the United States Securities and Exchange Commission on April 8, 2024 (the “Schedule 13D”), relating to the common stock,

no par value (the “Common Stock”), of Shenandoah Telecommunications Company (the “Issuer”) whose principal executive

office is located at 500 Shentel Way, P.O. Box 459, Edinburg, VA 22824. Capitalized terms used herein without definition shall have the

meaning set forth in the Schedule 13D.

| Item

3. | Source

and Amount of Funds or Other Consideration. |

Item

3 of the Schedule 13D is hereby amended and supplemented as follows:

On

July 15, 2024, the ECP Investor acquired 1,398 shares of Series A Preferred Stock (the “PIK Shares”) as a result of a dividend

payment in-kind from Shentel Broadband Holding Inc. on the Series A Preferred Stock. The PIK Shares are exchangeable for 57,065 shares

of Common Stock.

| Item 4. |

Purpose of Transaction. |

Item

4 of the Schedule 13D is hereby amended and supplemented as follows:

Standstill

Waiver

On

July 30, 2024, ECP Management and the Issuer executed a waiver of certain standstill provisions in the Investment Agreement (the “Standstill

Waiver”). Matthew DeNichilo, the current ECP Investor Director, may from time to time be granted equity-based compensation (“Director

Equity”) for his service as a director of the Issuer. Mr. DeNichilo has entered into an agreement with Energy Capital Partners

Management, LP (“ECP Management”), an affiliate of ECP ControlCo, LLC, pursuant to which any Director Equity issued to him

will be (i) held on behalf of ECP Management by Mr. DeNichilo, (ii) transferred to ECP Management, (or an affiliate of ECP Management)

or (iii) sold by Mr. DeNichilo, in each case, as directed by ECP Management and subject to the same terms, conditions and restrictions

applicable to Mr. DeNichilo (such agreement, the “Director Agreement”).

The

Standstill Waiver waives, to the extent any Director Equity is issued to Mr. DeNichilo, the acquisition of beneficial ownership by the

ECP Investor of such Director Equity pursuant to the Director Agreement; provided that such acquisition of beneficial ownership by the

ECP Investor would not reasonably be likely to result in the Issuer, Shentel Broadband Holding, Inc., or any Subsidiary of Shentel Broadband

Holding, Inc., taken as a whole, incurring any material increased costs, expenses or obligations under any federal or state law governing

the United States telecommunications sector, including without limitation, with respect to foreign ownership.

The

forgoing description of the Standstill Waiver does not purport to be complete and is qualified by reference to the full text of the Standstill

Waiver, which is filed as an exhibit to this Schedule 13D, and incorporated herein by reference.

| CUSIP No. 82312B106 | 13D | Page 14 of 18 Pages |

| Item 5. |

Interest in Securities of the Issuer. |

Item

5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a)

– (b)

The

following sets forth, as of the date of this Schedule 13D, the aggregate number of shares of Common Stock and percentage of shares of

Common Stock beneficially owned by each of the Reporting Persons, as well as the number of shares of Common Stock as to which each Reporting

Person has the sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct

the disposition of, or shared power to dispose or to direct the disposition of, as of the date hereof, based on (i) 57,910,280 shares

of Common Stock outstanding, which includes, (a) 54,547,093 shares of Common Stock outstanding as of April 26, 2024, as disclosed in

the Issuer’s Quarterly Report on Form 10-Q as filed with the Securities and Exchange Commission on May 3, 2024, and (b) 3,363,187

shares of Common Stock issuable upon exchange of 82,398 shares of Series A Preferred Stock held of record by the ECP Investor; and (ii)

solely with respect to Hill City IP, Hill City Holdings GP, LLC and Hill City, 54,547,093 shares of Common Stock outstanding as of April

26, 2024, as disclosed in the Issuer’s Quarterly Report on Form 10-Q as filed with the Securities and Exchange Commission on May

3, 2024.

| Reporting

Person | |

Amount beneficially owned | | |

Percent of class | | |

Sole

power to vote or to direct the vote | | |

Shared

power to vote or to direct the vote | | |

Sole

power to dispose or to direct the disposition | | |

Shared

power to dispose or to direct the disposition | |

| ECP

ControlCo, LLC | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV, LLC | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners GP IV, LP | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV-A, LP | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV-B, LP | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV-C, LP | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV-D, LP | |

| 5,815,571 | | |

| 10.0 | % | |

| 0 | | |

| 5,815,571 | | |

| 0 | | |

| 5,815,571 | |

| Energy

Capital Partners IV-B (Hill City IP), LP | |

| 2,452,384 | | |

| 4.5 | % | |

| 0 | | |

| 2,452,384 | | |

| 0 | | |

| 2,452,384 | |

| ECP

Fiber Holdings GP, LLC | |

| 3,363,187 | | |

| 5.8 | % | |

| 0 | | |

| 3,363,187 | | |

| 0 | | |

| 3,363,187 | |

| ECP

Fiber Holdings, LP | |

| 3,363,187 | | |

| 5.8 | % | |

| 0 | | |

| 3,363,187 | | |

| 0 | | |

| 3,363,187 | |

| Hill

City Holdings GP, LLC | |

| 2,452,384 | | |

| 4.5 | % | |

| 0 | | |

| 2,452,384 | | |

| 0 | | |

| 2,452,384 | |

| Hill

City Holdings, LP | |

| 2,452,384 | | |

| 4.5 | % | |

| 0 | | |

| 2,452,384 | | |

| 0 | | |

| 2,452,384 | |

The

securities reported herein include (i) 3,363,187 shares of Common Stock issuable upon exchange of 82,398 shares of Series A Preferred

Stock held of record by the ECP Investor and (ii) 2,452,384 shares of Common Stock held of record by Hill City. The amounts reported

in the table above do not include any Director Equity granted to Mr. DeNichilo, as such securities will not vest within 60 days of the

date of this filing.

| CUSIP No. 82312B106 | 13D | Page 15 of 18 Pages |

ECP

ControlCo, LLC is the managing member of Energy Capital Partners IV, LLC, which is the general partner of Energy Capital Partners GP

IV, LP, which is the general partner of each of (i) Energy Capital Partners IV-A, LP, (ii) Energy Capital Partners IV-B, LP, (iii) Energy

Capital Partners IV-C, LP, and (iv) Energy Capital Partners IV-D, LP (the “Funds”). Energy Capital Partners GP IV, LP is

also the general partner of Hill City IP. The Funds are the members of ECP Fiber Holdings GP, LLC, which is the general partner of the

ECP Investor. Each of (i) Energy Capital Partners IV-A, LP, (ii) Hill City IP, (iii) Energy Capital Partners IV-C, LP, and (iv) Energy

Capital Partners IV-D, LP are the members of Hill City Holdings GP, LLC, which is the general partner of Hill City.

The

managing members of ECP ControlCo, LLC are Douglas Kimmelman, Andrew Singer, Peter Labbat, Tyler Reeder and Rahman D’Argenio all

of whom collectively share the power to vote and dispose of the securities beneficially owned by ECP ControlCo, LLC. As a result of these

relationships, each of the foregoing entities and individuals may be deemed to share beneficial ownership of the securities held of record

by Hill City and the ECP Investor. Each such individual disclaims beneficial ownership of such securities.

| (c) | Except

as disclosed in Item 3 and Item 4 herein, the Reporting Persons have not effected any transactions

in the Issuer’s Common Stock in the past 60 days. |

| | |

| (d) | None. |

| | |

| (e) | Not

applicable. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With

Respect to Securities of the Issuer. |

Item

6 of the Schedule 13D is hereby amended and supplemented as follows:

Item

4 above summarizes certain provisions of the Standstill Waiver and is incorporated herein by reference. The Standstill Waiver is attached

as an exhibit to this Schedule 13D and is incorporated herein by reference.

Except

as set forth herein, none of the Reporting Persons or Related Persons has any contracts, arrangements, understandings or relationships

(legal or otherwise) with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements,

understandings or relationships concerning the transfer or voting of such securities, finder’s fees, joint ventures, loan or option

arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

| Item 7. |

Materials to be Filed as Exhibits |

Item

7 of the Schedule 13D is hereby amended and supplemented as follows:

| CUSIP No. 82312B106 | 13D | Page 16 of 18 Pages |

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule 13D is true,

complete and correct.

Date:

August 1, 2024.

| |

ECP

ControlCo, LLC |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

|

|

| |

Energy Capital Partners IV, LLC

|

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

|

|

| |

Energy Capital Partners GP IV, LP

|

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

|

|

| |

Energy Capital Partners IV-A, LP

|

| |

By: |

Energy

Capital Partners GP IV, LP, its general partner |

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| CUSIP No. 82312B106 | 13D | Page 17 of 18 Pages |

| |

Energy Capital Partners IV-B, LP

|

| |

By: |

Energy

Capital Partners GP IV, LP, its general partner |

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

Energy Capital Partners IV-C, LP

|

| |

By: |

Energy

Capital Partners GP IV, LP, its general partner |

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

|

|

| |

Energy Capital Partners IV-D, LP

|

| |

By: |

Energy

Capital Partners GP IV, LP, its general partner |

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| |

|

|

| |

Energy Capital Partners IV-B (Hill City IP), LP

|

| |

By: |

Energy

Capital Partners IV-B, LP, its general partner |

| |

By: |

Energy

Capital Partners GP IV, LP, its general partner |

| |

By: |

Energy

Capital Partners IV, LLC, its general partner |

| |

By: |

ECP

ControlCo, LLC, its managing member |

| |

|

|

| |

By: |

/s/

Christopher M. Leininger |

| |

Name: |

Christopher

M. Leininger |

| |

Title:

|

Partner

and General Counsel |

| CUSIP No. 82312B106 | 13D | Page 18 of 18 Pages |

| |

ECP

Fiber Holdings GP, LLC |

| |

|

|

| |

By: |

/s/

Matthew DeNichilo |

| |

Name: |

Matthew

DeNichilo |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

ECP FIBER HOLDINGS, LP

|

| |

By: |

ECP

Fiber Holdings GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/

Matthew DeNichilo |

| |

Name: |

Matthew

DeNichilo |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

Hill

City Holdings GP, LLC |

| |

|

|

| |

By: |

/s/

Jennifer Gray |

| |

Name: |

Jennifer

Gray |

| |

Title:

|

Executive

Vice President and Secretary |

| |

|

|

| |

Hill

City Holdings, LP

|

| |

By: |

Hill

City Holdings GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/

Jennifer Gray |

| |

Name: |

Jennifer

Gray |

| |

Title:

|

Executive

Vice President and Secretary |

Exhibit 4

ENERGY

CAPITAL PARTNERS MANAGEMENT, LP

40

Beechwood Road

Summit, New Jersey 07901

July

30, 2024

Via

e-mail

Shenandoah

Telecommunications Company

500 Shentel Way

Edinburg,

Virginia 22824

Attention: Derek C. Rieger

Email:

Derek.Rieger@emp.shentel.com

| Re: |

Request for a Waiver (Standstill Provision) |

Ladies

and Gentlemen:

Reference

is made to that certain Investment Agreement dated as of October 24, 2023 (the “Agreement”), by and among Shenandoah

Telecommunications Company, a Virginia corporation ( “Parent”), Shentel Broadband Holding, Inc., a Delaware

corporation and direct, wholly owned Subsidiary of Parent (the “Company”), ECP Fiber Holdings, LP, a Delaware

limited partnership (the “Investor”), and, solely for the purposes set forth therein, Hill City Holdings, LP,

a Delaware limited partnership affiliated with the Investor (“Hill City”). Capitalized terms used herein and

not otherwise defined shall have the meanings given to them in the Agreement.

With

approval of the Board, Parent from time to time pays non-employee members of the Board for service to the Company, which may include

Parent Common Stock or other equity- based securities convertible or exchangeable into, or settled in, Parent Common Stock (such Parent

Common Stock or other equity-based securities, “Director Equity”).

Investor

is the indirect wholly owned subsidiary of certain investment funds managed by Energy Capital Partners Management, LP (“ECP”)

and its Affiliates. Matthew DeNichilo is the current Investor Director of the Investor and a Partner of ECP or one or more of its Affiliates.

As such, Mr. DeNichilo is generally required to remit outside compensation received in such capacity to ECP. To that end, ECP has entered

into an agreement with Mr. DeNichilo whereby any Director Equity issued to him will be (i) held on behalf of ECP by Mr. DeNichilo, (ii)

transferred to ECP (or an Affiliate of ECP designated in writing to the Company) or (iii) sold by Mr. DeNichilo, in each case, as directed

by ECP and subject to the same terms, conditions and restrictions applicable to Mr. DeNichilo (such agreement, the “Director

Agreement”). Enclosed with this notice as Exhibit A is an execution copy of the Director Agreement.

Pursuant

to Section 8.01 of the Agreement, by signing the acknowledgement below, Parent hereby waives (i) the entry into the Director

Agreement by Mr. DeNichilo and ECP and (ii) to the extent any Director Equity is issued to Mr. DeNichilo, the acquisition of

beneficial ownership by Investor of such Director Equity pursuant to the Director Agreement; provided that such acquisition of

beneficial ownership by Investor would not reasonably be likely to result in Parent, the Company or any Subsidiary of the Company,

taken as a whole, incurring any material increased costs, expenses or obligations under any federal or state Law governing the

United States telecommunications sector, including without limitation, with respect to foreign ownership.

The

waiver contained herein shall apply to (x) the entry of any agreement by ECP (or an Affiliate of ECP) and any successor Investor Director

with the same terms and conditions as the Director Agreement, and (y) the acquisition of any beneficial ownership by ECP (or any of its

Affiliates) of any such successor Director Equity pursuant to the agreement specified in clause (x).

Parent’s

waiver shall exclusively and solely be for the purposes of Section 5.07(a) of the Agreement in connection with the acquisition

of beneficial ownership of the Director Equity by ECP or its Affiliates and the entry into the Director Agreement for such purpose. Except

as expressly set forth in this letter, Parent reserves all rights and remedies set forth in the Agreement.

Article

VIII of the Agreement is hereby incorporated by reference, mutatis mutandis, as if fully set forth herein.

Please

notify the undersigned if you have any questions regarding any of the matters contained in this letter.

[Signature

page to follow]

Very

truly yours,

| |

ECP: |

| |

|

| |

ENERGY CAPITAL

PARTNERS |

| |

MANAGEMENT,

LP |

| |

|

|

| |

By: |

ECP Management GP, LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

ECP ControlCo, LLC |

| |

Its: |

Sole Member |

| |

|

|

| |

|

|

| |

By: |

/s/

Matthew DeNichilo |

| |

Name: |

Matthew

DeNichilo |

| |

Title: |

Authorized

Signatory |

Accepted

and agreed to as of the date first written above:

| |

PARENT: |

| |

|

| |

SHENANDOAH

TELECOMMUNICATIONS |

| |

COMPANY |

| |

|

|

| |

By: |

/s/

Christopher E. French |

| |

Name: |

Christopher

E. French |

| |

Title: |

President

and CEO |

| cc: |

Hunton

Andrews Kurth LLP |

|

| |

951

East Byrd Street |

|

| |

Richmond,

VA 23219 |

|

| |

Attention:

Steven M. Haas |

|

| |

Email:

shaas@huntonak.com |

|

| |

|

|

| |

and |

|

| |

|

|

| |

Hunton

Andrews Kurth LLP |

|

| |

600

Travis Street |

|

| |

Suite

4200 |

|

| |

Houston,

TX 77002 |

|

| |

Attention:

J.A. Glaccum |

|

| |

Email:

j.a.glaccum@huntonak.com |

|

[Signature Page to Request for Waiver]

EXHIBIT A

Director

Agreement

Attached.

Shenandoah

Telecommunications Company

Re:

Assignment of Director Equity

Dear Mr. DeNichilo,

Shenandoah

Telecommunications Company (“Parent”) from time to time provides compensation to non- employee members of its board

of directors (the “Board”) for their service on the Board, which may include restricted stock units and/or other equity-based

awards relating to common stock of Parent (“Parent Common Stock”). You were previously granted 4,751 restricted stock

units (the “July 2024 RSUs”), and you may be granted additional restricted stock units (together with the July 2024

RSUs, the “RSUs”) in respect of your service on the Board.

This

letter confirms the understanding, agreement and acknowledgement by and between you and Energy Capital Partners Management, LP (“ECP”)

that any shares of Parent Common Stock issued upon vesting and settlement of the RSUs will be immediately transferred to ECP, or, if

directed by ECP, will be held by you and sold upon such terms and at such time as determined by ECP (and any resulting proceeds received

upon such sale shall be immediately transferred to ECP), and ECP shall and hereby does accept the same and the benefits of the foregoing

and any obligations related thereto, including, for the avoidance of doubt, obligations with respect to any taxes incurred in connection

with the RSUs. Each of the parties hereto agrees to perform any further acts and to execute and deliver any additional documents, including

the filing of any applicable tax forms, which may be reasonably necessary or appropriate to carry out the provisions of this letter.

This

letter shall be governed by and construed in accordance with the internal laws of the State of Delaware without regard to its principles

of conflicts of laws that would result in the application of the substantive laws of any other jurisdiction. This letter shall be binding

upon and inure to the benefit of the parties hereto and their respective successors, heirs, executors, administrators, assigns and other

legal representatives. No modifications of this letter nor waiver of the terms or conditions thereof shall be binding upon a party hereto

unless approved in writing by an authorized representative of such party. The letter may be executed in one or more counterparts, including

by way of any electronic signature, subject to applicable law, each of which will be deemed an original and all of which together will

constitute one instrument. Delivery of an executed counterpart of a signature page to this letter by facsimile, “.pdf” format,

scanned pages or other electronic means shall be effective as delivery of a manually executed counterpart to this letter. Nothing herein

is intended to otherwise amend or modify any terms of the RSUs.

Please

indicate your acknowledgement of the foregoing by returning a countersigned copy of this letter to me.

Sincerely,

| Energy Capital Partners Management, LP |

|

| |

|

|

| By: |

ECP

Management GP, LLC |

|

| Its: |

General

Partner |

|

| |

|

|

| By: |

ECP

ControlCo, LLC |

|

| Its: |

Sole

Member |

|

| |

|

|

| By: |

/s/

Matt DeNichilo |

|

| Name: |

Matt

DeNichilo |

|

| Title: |

Authorized

Signatory |

|

| Acknowledged

and agreed: |

|

| |

|

| /s/

Matt DeNichilo |

|

| Matthew

DeNichilo |

|

| Acknowledged

and agreed: |

|

| |

|

| Shenandoah

Telecommunications Company |

|

| |

|

|

| By: |

/s/

Christopher E. French |

|

| Name: |

Christopher

E. French |

|

| Title: |

President

and CE |

|

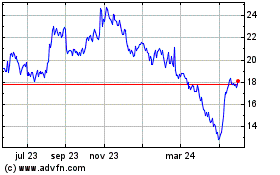

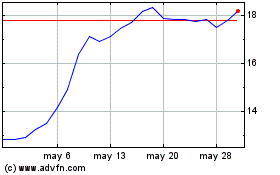

Shenandoah Telecommunica... (NASDAQ:SHEN)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Shenandoah Telecommunica... (NASDAQ:SHEN)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025