false

--12-31

0001934245

0001934245

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 18, 2024

SACKS

PARENTE GOLF, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41701 |

|

82-4938288 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

551

Calle San Pablo

Camarillo, CA 93012

(Address

of principal executive offices, including ZIP code)

855-774-7888

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (See General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act of 1933 (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(e) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

SPGC |

|

The

Nasdaq Stock Market, LLC |

Item

3.03 Material Modification to Rights of Security Holders.

On

July 18, 2024, Sacks Parente Golf, Inc. (the “Company”) filed a Certificate of Amendment to amend its Certificate of Incorporation

(the “Certificate of Amendment”) with the Secretary of State of the State of Delaware. The Certificate of Amendment effects

a reverse stock split of the Company’s common stock, par value $0.01 per share (the “Common Stock”) at a ratio of 1-for-10

shares, effective as of 12:01 a.m. Eastern Time on July 30, 2024 (the “Reverse Stock Split”).

The

Company expects that the Common Stock will begin trading on a post-split basis under its existing trading symbol, “SPGC,”

when the market opens on July 30, 2024. The new CUSIP identifier for the Common Stock following the Reverse Stock Split will be 78577G202.

As

a result of the Reverse Stock Split, every ten (10) shares of Common Stock will be automatically combined into one share of Common Stock.

The total number of authorized shares of Common Stock will remain the same following the Reverse Stock Split. Any fractional shares resulting

from the Reverse Stock Split will be rounded up to the nearest whole share. Proportionate adjustments for the Reverse Stock Split will

be made to the per share exercise price and the number of shares issuable upon the exercise of warrants, the number of shares reserved

for issuance under the Company’s equity plans, and all then-outstanding awards under the Company’s equity plans, as applicable.

The Reverse Stock Split will not change the par value of the Common Stock or modify any voting rights or other terms of the Common Stock.

The

foregoing summary of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the

full text of the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

To

the extent required by Item 5.03 of Form 8-K, the information contained in Item 3.03 of this Current Report on Form 8-K is incorporated

herein by reference.

Item

8.01 Other Events.

On

July 24, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached as Exhibit

99.1 to this report.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

July 24, 2024 |

SACKS

PARENTE GOLF, INC. |

| |

|

|

| |

By: |

/s/

Steve Handy |

| |

|

Steve

Handy, Chief Financial Officer |

EXHIBIT

3.1

SACKS

PARENTE GOLF, INC.

CERTIFICATE

OF AMENDMENT

OF

CERTIFICATE

OF INCORPORATION

Sacks

Parente Golf, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the provisions of the

Delaware General Corporation Law (the “DGCL”), does hereby certify as follows:

FIRST:

Article IV of the Corporation’s Certificate of Incorporation, shall be amended to add the following paragraph to Section 4.03 of

Article IV:

“(d)

Upon the filing and effectiveness (the “Effective Time”) pursuant to the Delaware General Corporation Law of this

Certificate of Amendment to the Certificate of Incorporation of the Corporation, each ten (10) shares of Common Stock issued and outstanding

immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be

combined and converted into one (1) share of Common Stock (the “Reverse Stock Split”). No fractional shares shall

be issued in connection with the Reverse Stock Split. No certificates representing fractional shares of Common Stock shall be issued

in connection with the Reverse Stock Split and all certificates that otherwise would represent fractional shares shall be rounded up

to the next whole share. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old

Certificates”) shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented

by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above.”

SECOND:

This Certificate of Amendment shall become effective on July 30, 2024 at 12:01 AM.

THIRD:

This Certificate of Amendment was duly adopted in accordance with Sections 228 and 242 of the DGCL.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be duly executed in its corporate name as of July 16, 2024.

| |

Sacks

Parente Golf, Inc. |

| |

|

|

| |

By:

|

/s/

Gregor Campbell |

| |

Name: |

Gregor

Campbell |

| |

Title:

|

Executive

Chairman |

Exhibit 99.1

Sacks Parente Announces 1-For-10 Reverse Stock Split

CAMARILLO, CA, July 24, 2024 – Sacks

Parente Golf Company, Inc. (Nasdaq: SPGC) (“SPG” or the “Company”), a technology forward golf company with a growing

portfolio of golf products, including putters, golf shafts, golf grips, and other related accessories, announces that its board of directors

has approved a 1-for-10 reverse stock split of the Company’s common stock.

The reverse stock split will become effective on July

30, 2024 at 12:01 am, Eastern Time, (“Effective Time”) and the Company’s common stock is expected to begin trading on

a reverse stock split-adjusted basis on The Nasdaq Capital Market (“Nasdaq”) on July 30, 2024 at market open under the existing

ticker symbol, “SPGC.” The reverse stock split is intended to increase the price per share of the Company’s common stock

to allow the Company to demonstrate compliance with the $1.00 minimum bid price requirement for continued listing on Nasdaq, among other

benefits.

As of the Effective Time, every 10 shares of the Company’s

issued and outstanding common stock will be combined into one share of common stock. The par value per share of our common stock will

remain unchanged at $0.001. Proportional adjustments will be made to the number of shares of common stock issuable upon the exercise of

the Company’s equity awards, options, and warrants, as well as the applicable exercise price, and the number of shares authorized

and reserved for issuance pursuant to the Company’s equity incentive plans.

No fractional shares will be issued as a result of

the reverse stock split; rather, the Company will issue a cash payment equal to the value of the fractional shares, so no stockholder

will hold fractional shares following the reverse stock split.

The Company’s transfer agent, VStock Transfer,

LLC, will serve as the exchange agent for the reverse stock split. Registered stockholders holding pre-reverse stock split shares of common

stock electronically in book-entry form are not required to take any action to receive post-reverse stock split shares. Those stockholders

who hold their shares in brokerage accounts or in “street name” will have their positions automatically adjusted to reflect

the reverse stock split, subject to each broker’s particular processes, and will not be required to take any action in connection

with the reverse stock split.

About Sacks Parente Golf

Sacks Parente Golf, Inc. serves as the parent entity

of technology-forward golf companies that help golfers elevate their game. With a growing portfolio of golf products, including putters,

golf shafts, golf grips, and other golf-related accessories, the Company’s innovative accomplishments include: the First Vernier

Acuity putter, patented Ultra-Low Balance Point (ULBP) putter technology, weight-forward Center-of-Gravity (CG) design, and pioneering

ultra-light carbon fiber putter shafts.

In consideration of its growth opportunities in golf

shaft technologies, the Company expanded its manufacturing business in April of 2022 to develop the advanced Newton brand of premium golf

shafts by opening a new shaft manufacturing facility in St. Joseph, MO. It is the Company’s intent to manufacture and assemble substantially

all products in the United States, while also expanding into golf apparel and other golf-related product lines to enhance its growth.

The Company’s future expansions may include

broadening its offerings through mergers, acquisitions or internal developments of product lines that are complementary to its premium

brand. The Company currently sells its products through resellers, the Company’s websites, Club Champion retail stores, and distributors

in the United States, Japan, and South Korea. For more information, please visit the Company’s website at https://sacksparente.com/.

Media Contact for SPG:

Beth Gast

BG Public Relations

beth.gast@bgpublicrelations.com

Investor Contact for SPG:

CORE IR

516-222-2560

investors@sacksparente.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

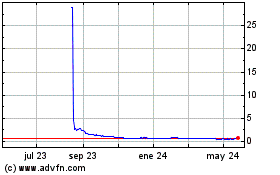

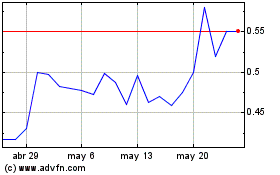

Sacks Parente Golf (NASDAQ:SPGC)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Sacks Parente Golf (NASDAQ:SPGC)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024