Surmodics, Inc. (Nasdaq: SRDX), a leading provider of medical

device and in vitro diagnostic technologies to the healthcare

industry, today reported financial results for its third quarter

ended June 30, 2024.

Third Quarter Fiscal 2024 Financial Summary

- Total Revenue of $30.3 million, compared to $52.5 million in

the prior-year period which included $24.6 million in license fee

revenue recognized upon receipt of a $27.0 million milestone

payment associated with obtaining FDA premarket approval of the

SurVeil™ drug-coated balloon (“DCB”)

- Total Revenue excluding SurVeil DCB license fee revenue(1) of

$29.2 million, an increase of 10% year-over-year

- GAAP net loss of $(7.6) million, compared to net income of $7.3

million in the prior-year period

- Adjusted EBITDA(2) of $1.6 million, compared to $24.6 million

in the prior-year period

Third Quarter and Recent Business Highlights

- On May 29, 2024, Surmodics announced it had entered into a

definitive agreement to be acquired by GTCR for $43.00 per share in

cash, representing an approximate equity value of $627 million,

subject to customary closing conditions, including approval by

Surmodics’ shareholders and required regulatory approval. A special

meeting of shareholders to vote on a proposal to approve the merger

agreement and related matters has been scheduled for August 13,

2024.

- On June 10, 2024, Surmodics announced it has been awarded a

group purchasing agreement for thrombectomy products with Premier,

Inc. (“Premier”), which is expected to expand national market reach

for the company’s endovascular thrombectomy solutions. Effective

June 1, 2024, the new agreement allows Premier members, at their

discretion, to take advantage of special pricing and terms

pre-negotiated by Premier for Surmodics’ Pounce™ and Pounce™ Venous

Thrombectomy Systems.

“Our team’s focus and execution in the third quarter enabled us

to deliver total revenue results consistent with the expectations

shared on our most recent earnings call, benefiting from strength

across multiple areas of our business,” said Gary Maharaj,

President and CEO of Surmodics, Inc. “Specifically, we saw strong

contributions from growth in both Medical Device product revenue –

driven primarily by demand for our SurVeil DCB and Pounce

thrombectomy products – and performance coating royalties and

license fees, along with broad-based growth in sales of our In

Vitro Diagnostics products as well.”

Third Quarter Fiscal 2024 Financial Results

Three Months Ended June

30,

Increase (Decrease)

2024

2023

$

%

Revenue:

Medical Device

$

23,383

$

46,014

$

(22,631

)

(49

)%

In Vitro Diagnostics

6,958

6,469

489

8

%

Total revenue

$

30,341

$

52,483

$

(22,142

)

(42

)%

Total revenue decreased $22.1 million, or 42%, to $30.3 million,

compared to $52.5 million in the third quarter of fiscal 2023.

Excluding SurVeil DCB license fee revenue,(1) total revenue

increased $2.6 million, or 10%, to $29.2 million, compared to $26.6

million in the third quarter of fiscal 2023.

Medical Device revenue decreased $22.6 million, or 49%, to $23.4

million, compared to $46.0 million in the third quarter of fiscal

2023. Medical Device revenue included a total of $1.1 million in

SurVeil DCB license fee revenue, compared to $25.9 million in the

third quarter of fiscal 2023 – of which $24.6 million was revenue

recognized on the $27.0 million milestone payment received in the

period from Abbott Vascular, Inc. (“Abbott”) associated with

obtaining FDA approval of the SurVeil DCB. Excluding SurVeil DCB

license fee revenue,(1) Medical Device revenue increased $2.1

million, or 10%, to $22.2 million, compared to $20.1 million in the

third quarter of fiscal 2023, driven primarily by product sales and

performance coating royalties and license fee revenue. Medical

Device product sales increased $1.4 million, or 15%, to $10.7

million, compared to $9.3 million in the third quarter of fiscal

2023, driven primarily by commercial shipments of the SurVeil DCB

to Abbott, the company’s exclusive distribution partner for the

product, and growth in sales of the Pounce thrombectomy device

platform. Medical Device performance coating royalties and license

fee revenue increased $1.0 million, or 13%, to $9.3 million,

compared to $8.3 million in the third quarter of fiscal 2023,

driven primarily by continued growth in customer utilization of

Surmodics’ Serene™ hydrophilic coating. In Vitro Diagnostics

(“IVD”) revenue increased $0.5 million, or 8%, to $7.0 million,

compared to $6.5 million in the third quarter of fiscal 2023,

driven by broad-based product sales growth.

Product gross profit(3) increased $0.4 million, or 4%, to $9.1

million, compared to $8.7 million in the third quarter of fiscal

2023. Product gross margin(3) was 51.9%, compared to 55.8% in the

third quarter of fiscal 2023. The decrease in product gross margin

was primarily driven by increased sales of SurVeil DCB, Pounce

thrombectomy and Sublime™ radial access products as a proportion of

total product sales, as these devices were not at scale, and

product gross margins reflected the associated under-absorption and

production inefficiencies, including expiration of inventory.

Operating costs and expenses, excluding product costs, increased

$3.1 million, or 13%, to $27.3 million, compared to $24.2 million

in the third quarter of fiscal 2023. The increase was primarily

driven by $2.9 million of merger-related charges incurred in the

third quarter of fiscal 2024 associated with the pending

acquisition of Surmodics by GTCR, which were reported in selling,

general and administrative expense. In addition, the third quarter

of fiscal 2023 included a $0.8 million gain from the fair value

adjustment of acquisition-related contingent consideration. These

increases were offset, in part, by lower research and development

expense, which decreased $1.5 million year-over-year primarily due

to the transition of the SurVeil DCB to commercialization, as well

as the timing of development and commercialization of Surmodics’

thrombectomy devices.

GAAP net loss was $(7.6) million, or $(0.53) per diluted share,

compared to GAAP net income of $7.3 million, or $0.52 per diluted

share in the third quarter of fiscal 2023. Non-GAAP net loss(4) was

$(3.9) million, or $(0.27) per diluted share,(4) compared to

Non-GAAP net income(4) of $7.3 million, or $0.52 per diluted

share(4) in the third quarter of fiscal 2023.

Adjusted EBITDA(2) was $1.6 million, compared to Adjusted

EBITDA(2) of $24.6 million in the third quarter of fiscal 2023.

Balance Sheet Summary

As of June 30, 2024, Surmodics reported $38.2 million in cash

and investments, $5.0 million in outstanding borrowings on its

revolving credit facility, and $25.0 million in outstanding

borrowings on its term loan facility. The company had access to

approximately $65.0 million in additional debt capital as of June

30, 2024 under its revolving credit and term loan facilities.

Surmodics reported $2.0 million in cash used in operating

activities and $1.0 million in capital expenditures in the third

quarter of fiscal 2024. In the third quarter of fiscal 2024, cash

and investments decreased by $2.8 million, which consisted of the

change in the combined balance of cash and cash equivalents and

investments in available-for-sale securities from March 31, 2024 to

June 30, 2024.

Fiscal Year 2024 Financial Guidance

Surmodics is suspending its previously issued financial guidance

for fiscal 2024 in light of the pending acquisition by GTCR.

Conference Call

Given the pending acquisition by GTCR, Surmodics will not be

hosting a live webcast and conference call to discuss third quarter

of fiscal 2024 financial results and accomplishments.

About the Pending Acquisition of Surmodics by GTCR

On May 29, 2024, Surmodics announced it had entered into a

definitive agreement to be acquired by GTCR, a leading private

equity firm with a long track record of investment expertise across

healthcare and healthcare technology. Under the terms of the

agreement, affiliates of GTCR will acquire all outstanding shares

of Surmodics (the “Merger”). Surmodics shareholders will receive

$43.00 per share in cash, for a total equity valuation of

approximately $627 million. The per-share acquisition price

represents a 41.1% premium to Surmodics’ 30-trading day

volume-weighted average closing price through May 28, 2024.

Surmodics’ Board of Directors has unanimously approved the

transaction and resolved to recommend that shareholders vote in

favor of the transaction. The transaction remains subject to

customary closing conditions, including approval by Surmodics

shareholders and required regulatory approval. It will be financed

through a combination of committed equity from funds affiliated

with GTCR and committed debt financing. Upon completion of the

transaction, Surmodics will be a privately held company and its

common stock will no longer be listed on The Nasdaq Stock

Exchange.

About Surmodics, Inc.

Surmodics, Inc. is a leading provider of performance coating

technologies for intravascular medical devices and chemical and

biological components for in vitro diagnostic immunoassay tests and

microarrays. Surmodics also develops and commercializes highly

differentiated vascular intervention medical devices that are

designed to address unmet clinical needs and engineered to the most

demanding requirements. This key growth strategy leverages the

combination of the company’s expertise in proprietary surface

modification and drug-delivery coating technologies, along with its

device design, development and manufacturing capabilities. The

company’s mission is to improve the detection and treatment of

disease. Surmodics is headquartered in Eden Prairie, Minnesota. For

more information, visit www.surmodics.com. The content of

Surmodics’ website is not part of this press release or part of any

filings that the company makes with the SEC.

Safe Harbor for Forward-looking Statements

This press release, and disclosures related to it, contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements that are not

historical or current facts, including statements regarding: the

proposed Merger, including anticipated timing of the same; future

success; our focus on disciplined expense management and

optimization of working capital; our access to additional

borrowings under our existing credit agreement; our ability to

capitalize on the key near-term growth catalysts in our vascular

interventions portfolio by facilitating the adoption and

utilization of SurVeil DCB products, Pounce thrombectomy products,

and Sublime radial access products; the potential for Abbott’s

sales team to use the results of the TRANSCEND trial with potential

SurVeil DCB physician users; Abbott’s progress in the market as

they work to facilitate the adoption of the SurVeil DCB; our

ability to obtain long-term growth by developing and introducing

new products and line extensions to enhance our existing Pounce,

Sublime, and medical device performance coatings portfolios; the

likely key drivers of adoption of the Pounce Venous Thrombectomy

System; whether we will continue to enhance and strengthen our

position as an industry-leading provider of performance coating

technologies; our ability to obtain durable revenue growth and cash

flow generation across our core performance coatings and IVD

products; being well-capitalized to support future growth

objectives; being well positioned to achieve and deliver strong,

sustained revenue growth; and delivering sustained improvements in

our underlying profitability profile, are forward-looking

statements. Forward-looking statements involve inherent risks and

uncertainties, and important factors could cause actual results to

differ materially from those anticipated, including, without

limitation: (1) risks related to the consummation of the proposed

Merger, including the risks that (a) the Merger may not be

consummated within the anticipated time period, or at all, (b) the

parties may fail to obtain shareholder approval of the merger

agreement for the Merger (the “Merger Agreement”), (c) the parties

may fail to secure the termination or expiration of any waiting

period applicable under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended, (d) other conditions to the

consummation of the Merger under the Merger Agreement may not be

satisfied, (e) all or part of GTCR’s financing may not become

available, and (f) the significant limitations on remedies

contained in the Merger Agreement may limit or entirely prevent the

company from specifically enforcing the buyer’s obligations under

the Merger Agreement or recovering damages for any breach by the

buyer; (2) the effects that any termination of the Merger Agreement

may have on the company or its business, including the risks that

(a) the company’s stock price may decline significantly if the

Merger is not completed, (b) the Merger Agreement may be terminated

in circumstances requiring the company to pay the buyer a

termination fee of $20,380,000, or (c) the circumstances of the

termination, including the possible imposition of a 12-month tail

period during which the termination fee could be payable upon

certain subsequent transactions, may have a chilling effect on

alternatives to the Merger; (3) the effects that the announcement

or pendency of the Merger may have on the company and its business,

including the risks that as a result (a) the company’s business,

operating results or stock price may suffer, (b) the company’s

current plans and operations may be disrupted, (c) the company’s

ability to retain or recruit key employees may be adversely

affected, (d) the company’s business relationships (including,

customers, franchisees and suppliers) may be adversely affected, or

(e) the company’s management’s or employees’ attention may be

diverted from other important matters; (4) the effect of

limitations that the Merger Agreement places on the company’s

ability to operate its business, return capital to shareholders or

engage in alternative transactions; (5) the nature, cost and

outcome of pending and future litigation and other legal

proceedings, including proceedings related to the Merger and

instituted against the company and others; (6) the risk that the

Merger and related transactions may involve unexpected costs,

liabilities or delays; (7) our ability to successfully

commercialize our SurVeil DCB (including realization of the full

potential benefits of our agreement with Abbott), Sundance™ DCB,

and other proprietary products; (8) our reliance on third parties

(including our customers and licensees) and their failure to

successfully develop, obtain regulatory approval for, market, and

sell products incorporating our technologies; (9) possible adverse

market conditions and possible adverse impacts on our cash flows;

(10) our ability to successfully and profitably produce and

commercialize our vascular intervention products; (11) supply chain

constraints; (12) whether our operating expenses are effective in

generating profitable revenues; (13) the factors identified under

“Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K

for the fiscal year ended September 30, 2023 and subsequent SEC

filings. These reports are available in the Investors section of

our website at https://surmodics.gcs-web.com and at the SEC website

at www.sec.gov. Forward-looking statements speak only as of the

date they are made, and we undertake no obligation to update them

in light of new information or future events.

Use of Non-GAAP Financial Information

In addition to reporting financial results in accordance with

U.S. generally accepted accounting principles, or GAAP, Surmodics

is reporting non-GAAP financial results including total revenue

excluding SurVeil DCB license fee revenue, Medical Device revenue

excluding SurVeil DCB license fee revenue, EBITDA and Adjusted

EBITDA, non-GAAP operating (loss) income, non-GAAP operating (loss)

income percentage, non-GAAP (loss) income before income taxes,

non-GAAP net (loss) income, and non-GAAP (loss) income per diluted

share. We believe that these non-GAAP measures, when read in

conjunction with the company’s GAAP financial statements, provide

meaningful insight into our operating performance excluding certain

event-specific matters, and provide an alternative perspective of

our results of operations. We use non-GAAP measures, including

those set forth in this release, to assess our operating

performance and to determine payouts under our executive

compensation programs. We believe that presentation of certain

non-GAAP measures allows investors to review our results of

operations from the same perspective as management and our board of

directors and facilitates comparisons of our current results of

operations. The method we use to produce non-GAAP results is not in

accordance with GAAP and may differ from the methods used by other

companies. Non-GAAP results should not be regarded as a substitute

for corresponding GAAP measures but instead should be utilized as a

supplemental measure of operating performance in evaluating our

business. Non-GAAP measures do have limitations in that they do not

reflect certain items that may have a material impact on our

reported financial results. As such, these non-GAAP measures should

be viewed in conjunction with both our financial statements

prepared in accordance with GAAP and the reconciliation of the

supplemental non-GAAP financial measures to the comparable GAAP

results provided for the specific periods presented, which are

attached to this release.

Surmodics, Inc. and

Subsidiaries Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Revenue:

Product sales

$

17,562

$

15,667

$

54,488

$

45,251

Royalties and license fees

10,458

34,153

31,048

52,347

Research, development and other

2,321

2,663

7,315

7,016

Total revenue

30,341

52,483

92,851

104,614

Operating costs and expenses:

Product costs

8,448

6,921

24,352

17,926

Research and development

9,765

11,232

28,658

36,899

Selling, general and administrative

16,627

12,874

42,257

39,077

Acquired intangible asset amortization

870

879

2,616

2,659

Restructuring expense

—

—

—

1,282

Contingent consideration gain

—

(835

)

—

(829

)

Total operating costs and expenses

35,710

31,071

97,883

97,014

Operating (loss) income

(5,369

)

21,412

(5,032

)

7,600

Other expense, net

(442

)

(763

)

(1,337

)

(2,324

)

(Loss) income before income taxes

(5,811

)

20,649

(6,369

)

5,276

Income tax expense

(1,743

)

(13,303

)

(1,724

)

(13,506

)

Net (loss) income

$

(7,554

)

$

7,346

$

(8,093

)

$

(8,230

)

Basic net (loss) income per share

$

(0.53

)

$

0.52

$

(0.57

)

$

(0.59

)

Diluted net (loss) income per share

$

(0.53

)

$

0.52

$

(0.57

)

$

(0.59

)

Weighted average number of shares

outstanding:

Basic

14,170

14,050

14,141

14,020

Diluted

14,170

14,072

14,141

14,020

Surmodics, Inc. and

Subsidiaries Condensed Consolidated Balance Sheets (in

thousands)

June 30,

September 30,

2024

2023

Assets

(Unaudited)

(See Note)

Current Assets:

Cash and cash equivalents

$

24,301

$

41,419

Available-for-sale securities

13,874

3,933

Accounts receivable, net

13,390

10,850

Contract assets, current

10,021

7,796

Inventories

15,405

14,839

Prepaids and other

3,365

7,854

Total Current Assets

80,356

86,691

Property and equipment, net

25,319

26,026

Intangible assets, net

23,702

26,206

Goodwill

43,355

42,946

Other assets

4,681

3,864

Total Assets

$

177,413

$

185,733

Liabilities and Stockholders’

Equity

Current Liabilities:

Deferred revenue

3,681

4,378

Other current liabilities

16,515

19,576

Total Current Liabilities

20,196

23,954

Long-term debt, net

29,517

29,405

Deferred revenue

—

2,400

Other long-term liabilities

9,556

10,064

Total Liabilities

59,269

65,823

Total Stockholders’ Equity

118,144

119,910

Total Liabilities and Stockholders’

Equity

$

177,413

$

185,733

Note: Derived from audited financial

statements as of the date indicated.

Surmodics, Inc. and

Subsidiaries Condensed Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

Nine Months Ended June

30,

2024

2023

Operating Activities:

Net loss

$

(8,093

)

$

(8,230

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation and amortization

6,555

6,365

Stock-based compensation

6,138

5,662

Deferred taxes

(262

)

(187

)

Other

394

217

Change in operating assets and

liabilities:

Accounts receivable and contract

assets

(5,533

)

(1,825

)

Inventories

(566

)

(2,790

)

Prepaids and other

3,965

(961

)

Accounts payable

185

(669

)

Accrued liabilities

(3,249

)

(2,474

)

Income taxes

153

15,583

Deferred revenue

(3,097

)

(1,427

)

Net cash (used in) provided by operating

activities

(3,410

)

9,264

Investing Activities:

Purchases of property and equipment

(2,950

)

(2,170

)

Purchases of available-for-sale

securities

(25,445

)

—

Maturities of available-for-sale

securities

16,000

—

Net cash used in investing activities

(12,395

)

(2,170

)

Financing Activities:

Payments of short-term borrowings

—

(10,000

)

Proceeds from issuance of long-term

debt

—

29,664

Payments of debt issuance costs

—

(614

)

Issuance of common stock

663

803

Payments for taxes related to net share

settlement of equity awards

(1,120

)

(888

)

Payments for acquisition of in-process

research and development

(931

)

(978

)

Net cash (used in) provided by financing

activities

(1,388

)

17,987

Effect of exchange rate changes on cash

and cash equivalents

75

500

Net change in cash and cash

equivalents

(17,118

)

25,581

Cash and Cash Equivalents:

Beginning of period

41,419

18,998

End of period

$

24,301

$

44,579

Surmodics, Inc. and

Subsidiaries Supplemental Revenue Information (in

thousands)

(Unaudited)

Three Months Ended June

30,

Increase (Decrease)

2024

2023

$

%

Medical Device Revenue

Product sales

$

10,726

$

9,299

$

1,427

15

%

Royalties & license fees – performance

coatings

9,324

8,286

1,038

13

%

License fees – SurVeil DCB(1)

1,134

25,867

(24,733

)

(96

)%

R&D and other

2,199

2,562

(363

)

(14

)%

Medical Device revenue

23,383

46,014

(22,631

)

(49

)%

In Vitro Diagnostics Revenue

Product sales

6,836

6,368

468

7

%

R&D and other

122

101

21

21

%

In Vitro Diagnostics revenue

6,958

6,469

489

8

%

Total Revenue

$

30,341

$

52,483

$

(22,142

)

(42

)%

Medical Device Revenue, excluding

SurVeil DCB license fees(1)

$

22,249

$

20,147

$

2,102

10

%

Total Revenue, excluding SurVeil DCB

license fees(1)

$

29,207

$

26,616

$

2,591

10

%

Nine Months Ended June

30,

Increase (Decrease)

2024

2023

$

%

Medical Device Revenue

Product sales

$

33,776

$

25,593

$

8,183

32

%

Royalties & license fees – performance

coatings

27,855

23,853

4,002

17

%

License fees – SurVeil DCB(1)

3,193

28,494

(25,301

)

(89

)%

R&D and other

6,930

6,799

131

2

%

Medical Device revenue

71,754

84,739

(12,985

)

(15

)%

In Vitro Diagnostics Revenue

Product sales

20,712

19,658

1,054

5

%

R&D and other

385

217

168

77

%

In Vitro Diagnostics revenue

21,097

19,875

1,222

6

%

Total Revenue

$

92,851

$

104,614

$

(11,763

)

(11

)%

Medical Device Revenue, excluding

SurVeil DCB license fees(1)

$

68,561

$

56,245

$

12,316

22

%

Total Revenue, excluding SurVeil DCB

license fees(1)

$

89,658

$

76,120

$

13,538

18

%

Surmodics, Inc. and

Subsidiaries Supplemental Segment Information (in

thousands)

(Unaudited)

Three Months Ended June

30,

Increase (Decrease)

2024

2023

$

Operating (Loss) Income:

Medical Device

$

(2,288

)

$

21,777

$

(24,065

)

In Vitro Diagnostics

3,153

2,866

287

Total segment operating income

865

24,643

(23,778

)

Corporate

(6,234

)

(3,231

)

(3,003

)

Total Operating (Loss) Income

$

(5,369

)

$

21,412

$

(26,781

)

Nine Months Ended June

30,

Increase (Decrease)

2024

2023

$

Operating (Loss) Income:

Medical Device

$

(2,210

)

$

7,483

$

(9,693

)

In Vitro Diagnostics

9,633

9,450

183

Total segment operating income

7,423

16,933

(9,510

)

Corporate

(12,455

)

(9,333

)

(3,122

)

Total Operating (Loss) Income

$

(5,032

)

$

7,600

$

(12,632

)

Surmodics, Inc. and

Subsidiaries GAAP to Non-GAAP Reconciliation: EBITDA and Adjusted

EBITDA (in thousands)

(Unaudited)

Three Months Ended June

30,

Increase (Decrease)

2024

2023

$

Net (loss) income

$

(7,554

)

$

7,346

$

(14,900

)

Income tax expense

1,743

13,303

(11,560

)

Depreciation and amortization

2,126

2,151

(25

)

Interest expense, net

879

884

(5

)

Investment income, net

(488

)

(182

)

(306

)

EBITDA

(3,294

)

23,502

(26,796

)

Adjustments:

Stock-based compensation expense

2,044

1,915

129

Merger-related charges(5)

2,864

—

2,864

Contingent consideration fair value

adjustment(6)

—

(829

)

829

Adjusted EBITDA

$

1,614

$

24,588

$

(22,974

)

Nine Months Ended June

30,

Increase (Decrease)

2024

2023

$

Net loss

$

(8,093

)

$

(8,230

)

$

137

Income tax expense

1,724

13,506

(11,782

)

Depreciation and amortization

6,555

6,365

190

Interest expense, net

2,656

2,594

62

Investment income, net

(1,487

)

(531

)

(956

)

EBITDA

1,355

13,704

(12,349

)

Adjustments:

Stock-based compensation expense

6,138

5,662

476

Merger-related charges(5)

2,864

—

2,864

Restructuring expense(7)

—

1,282

(1,282

)

Contingent consideration fair value

adjustment(6)

—

(829

)

829

Adjusted EBITDA

$

10,357

$

19,819

$

(9,462

)

Surmodics, Inc. and

Subsidiaries

GAAP to Non-GAAP

Reconciliation: Net (Loss) Income and Diluted EPS

(in thousands, except per share

data)

(Unaudited)

Three Months Ended June 30,

2024

Operating Loss

Loss Before Income

Taxes

Net Loss(9)

Diluted EPS

GAAP

$

(5,369

)

(17.7

)%

$

(5,811

)

$

(7,554

)

$

(0.53

)

Adjustments:

Amortization of acquired intangible

assets(8)

870

2.9

%

870

810

0.06

Merger-related charges(5)

2,864

9.4

%

2,864

2,864

0.20

Non-GAAP

$

(1,635

)

(5.4

)%

$

(2,077

)

$

(3,880

)

$

(0.27

)

Diluted weighted average shares

outstanding(10)

14,170

Three Months Ended June 30,

2023

Operating Income

Income Before Income

Taxes

Net Income(9)

Diluted EPS

GAAP

$

21,412

40.8

%

$

20,649

$

7,346

$

0.52

Adjustments:

Amortization of acquired intangible

assets(8)

879

1.7

%

879

813

0.06

Contingent consideration fair value

adjustment(6)

(829

)

(1.6

)%

(829

)

(829

)

(0.06

)

Non-GAAP

$

21,462

40.9

%

$

20,699

$

7,330

$

0.52

Diluted weighted average shares

outstanding(10)

14,072

Nine Months Ended June 30,

2024

Operating (Loss)

Income

Loss Before Income

Taxes

Net Loss(9)

Diluted EPS

GAAP

$

(5,032

)

(5.4

)%

$

(6,369

)

$

(8,093

)

$

(0.57

)

Adjustments:

Amortization of acquired intangible

assets(8)

2,616

2.8

%

2,616

2,420

0.17

Merger-related charges(5)

2,864

3.1

%

2,864

2,864

0.20

Non-GAAP

$

448

0.5

%

$

(889

)

$

(2,809

)

$

(0.20

)

Diluted weighted average shares

outstanding(10)

14,141

Nine Months Ended June 30,

2023

Operating Income

Income Before Income

Taxes

Net Loss(9)

Diluted EPS

GAAP

$

7,600

7.3

%

$

5,276

$

(8,230

)

$

(0.59

)

Adjustments:

Amortization of acquired intangible

assets(8)

2,659

2.5

%

2,659

2,467

0.18

Restructuring expense(7)

1,282

1.2

%

1,282

1,282

0.09

Contingent consideration fair value

adjustment(6)

(829

)

(0.8

)%

(829

)

(829

)

(0.06

)

Non-GAAP

$

10,712

10.2

%

$

8,388

$

(5,310

)

$

(0.38

)

Diluted weighted average shares

outstanding(10)

14,020

(1)

SurVeil DCB license fee revenue

represents revenue recognition on milestone payments received under

the company’s Development and Distribution Agreement with Abbott

(“Abbott Agreement”). For further details, refer to Supplemental Revenue Information.

(2)

For the calculation of Adjusted

EBITDA, refer to GAAP to Non-GAAP

Reconciliation: EBITDA and Adjusted EBITDA.

(3)

Product gross profit equals

product sales less product costs, as reported on the condensed

consolidated statements of operations. Product gross margin equals

product gross profit as a percentage of product sales.

(4)

For the calculation of Non-GAAP

net (loss) income and Non-GAAP (loss) income per diluted share

(also referred to as Non-GAAP diluted EPS), refer to GAAP to Non-GAAP Reconciliation: Net (Loss) Income and

Diluted EPS.

(5)

Merger-related charges consisted

of expenses specifically associated with the proposed acquisition

of Surmodics by GTCR, which were reported in selling, general and

administrative expense on the condensed consolidated statements of

operations. Merger-related charges were not tax deductible.

(6)

Contingent consideration fair

value adjustment represented accounting adjustments to state

acquisition-related contingent consideration liabilities at their

estimated fair value as of the period end date related to changes

in the timing and/or probability of achieving milestones.

(7)

Restructuring expense consisted

of severance and related costs specifically associated with a

workforce restructuring implemented in the second quarter of fiscal

2023.

(8)

Represents amortization of

business acquisition-related intangible assets and associated tax

impact. A significant portion of the business acquisition-related

amortization is not tax deductible.

(9)

Net (loss) income includes the

effect of GAAP to Non-GAAP adjustments on income tax expense,

taking into account deferred taxes net of valuation allowances, as

well as non-deductible items. Income tax impacts were estimated

using the applicable statutory rate (21% in the U.S. and 12.5% in

Ireland).

(10)

Diluted weighted average shares

outstanding used in the calculation of EPS was the same for GAAP

EPS and Non-GAAP EPS for the three and nine month periods ended

June 30, 2024 and 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731409750/en/

Surmodics Investor Inquiries Jack Powell, Investor Relations

ir@surmodics.com

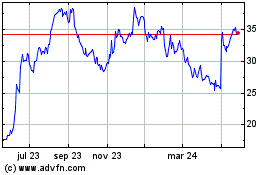

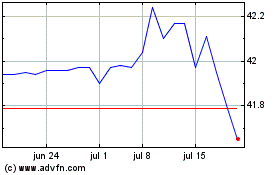

SurModics (NASDAQ:SRDX)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

SurModics (NASDAQ:SRDX)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024