0001495584

false

false

false

false

false

false

0001495584

2023-10-06

2023-10-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: October 6, 2023

(Date of earliest event reported)

Firsthand Technology

Value Fund, Inc.

(Exact name of registrant as specified in its charter)

Maryland

(State or other jurisdiction of incorporation) |

814-00830

(Commission File Number) |

27-3008946

IRS Employer

Identification Number) |

| |

|

|

150 Almaden Blvd., Suite 1250

San Jose, CA

(Address of principal executive offices) |

|

95113

(Zip Code) |

(800) 976-8776

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8–K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a–12 under the Exchange Act (17 CFR 240.14a–12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d–2(b) under the Exchange Act (17 CFR 240.14d–2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e–4(c) under the Exchange Act (17 CFR 240.13e–4(c)) |

| [ ] |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act

of 1934 (§240.12b–2 of this chapter). |

| [ ] | If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 3.01. Notice of Delisting or Failure to Satisfy

a Continued Listing Rule or Standard; Transfer of Listing.

On October 6, 2023, Firsthand

Technology Value Fund, Inc. (NASDAQ: SVVC) (the “Fund” or “Firsthand”), notified the Nasdaq Stock Market LLC (“Nasdaq”)

of the Fund’s decision to voluntarily delist its common stock from the Nasdaq Global Market and its intent to file a Form 25 with

the U.S. Securities and Exchange Commission (the “SEC”) on or about October 16, 2023. As a result, the Fund expects the delisting

of its common stock to become effective on or about October 26, 2023.

As previously noted in the Fund’s Current Report

on Form 8-K filed with the SEC on May 3, 2023, and on the Fund’s Current Report on Form 8-K filed with the SEC on July 28, 2023,

the Fund had received written notices from Nasdaq that the Fund was not in compliance with the minimum bid price and minimum market value

of publicly held shares requirements, respectively, for continued listing on the Nasdaq Global Market.

After careful evaluation of the options available to

the Fund, the Fund’s board of directors (the “Board”) has determined that the voluntary delisting of the Fund’s

common stock from the Nasdaq Global Market is in the best interests of the Fund and its stockholders. The Board’s decision was based

on careful review of several factors, including the likely inability of the company to regain compliance with the relevant Nasdaq listing

rules and the significant costs associated therewith. In addition, the Board believes a delisting provides the Fund and its stockholders

lower operating costs and management time commitment for compliance activities.

The Fund anticipates that its common stock will be quoted

on the OTCQB or other market operated by OTC Markets Group Inc. (the “OTC”), and it intends to take such actions to enable

its common stock to be quoted on the OTCQB or on another OTC market so that a trading market may continue to exist for its common stock.

There is no guarantee, however, that a broker will continue to make a market in the common stock and that trading of the common stock

will continue on an OTC market or otherwise.

At this time, the Fund is not taking steps to deregister

as a public company under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

FIRSTHAND TECHNOLOGY VALUE FUND, INC. |

|

| |

|

|

|

| October 6, 2023 |

|

|

|

| |

|

|

|

| |

By: |

/s/ KEVIN LANDIS |

|

| |

|

Kevin Landis |

|

| |

|

President |

|

News Release

Firsthand Technology Value Fund Announces Voluntary

Delisting from Nasdaq Global Market

San Jose, CA, October 6, 2023 – Firsthand Technology Value Fund,

Inc. (NASDAQ: SVVC) (the “Fund” or “Firsthand”), a publicly-traded venture capital fund that invests in technology

and cleantech companies, today notified the Nasdaq Stock Market LLC (“Nasdaq”) of the Fund’s decision to voluntarily

delist its common stock from the Nasdaq Global Market and its intent to file a Form 25 with the U.S. Securities and Exchange Commission

(the “SEC”) on or about October 16, 2023. As a result, the Fund expects the delisting of its common stock to become effective

on or about October 26, 2023.

As previously noted in the Fund’s Current Report on Form 8-K filed

with the SEC on May 3, 2023, and on the Fund’s Current Report on Form 8-K filed with the SEC on July 28, 2023, the Fund had received

written notices from Nasdaq that the Fund was not in compliance with the minimum bid price and minimum market value of publicly held shares

requirements, respectively, for continued listing on the Nasdaq Global Market.

After careful evaluation of the options available to the Fund, the Fund’s

board of directors (the “Board”) has determined that the voluntary delisting of the Fund’s common stock from the Nasdaq

Global Market is in the best interests of the Fund and its stockholders. The Board’s decision was based on careful review of several

factors, including the likely inability of the company to regain compliance with the relevant Nasdaq listing rules and the significant

costs associated therewith. In addition, the Board believes a delisting provides the Fund and its stockholders lower operating costs and

management time commitment for compliance activities.

The Fund anticipates that its common stock will be quoted on the OTCQB

or other market operated by OTC Markets Group Inc. (the “OTC”), and it intends to take such actions to enable its common stock

to be quoted on the OTCQB or on another OTC market so that a trading market may continue to exist for its common stock. There is no guarantee,

however, that a broker will continue to make a market in the common stock and that trading of the common stock will continue on an OTC

market or otherwise.

At this time, the Fund is not taking steps to deregister as a public company

under the Securities Exchange Act of 1934.

About Firsthand Technology Value Fund

Firsthand Technology Value Fund, Inc. is a publicly-traded venture capital

fund that invests in technology and cleantech companies. More information about the Fund and its holdings can be found online at www.firsthandtvf.com.

# # #

The Fund is a non-diversified, closed-end investment company that elected

to be treated as a business development company under the Investment Company Act of 1940. The Fund’s investment objective is to

seek long-term growth of capital. Under normal circumstances, the Fund will invest at least 80% of its total assets for investment purposes

in technology and cleantech companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press release

contains "forward-looking statements" as defined under the U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will," and similar

expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and

its present expectations or projections indicated in any forward-looking statement. These risks include, but are not limited to, changes

in economic and political conditions, regulatory and legal changes, technology and cleantech industry risk, valuation risk, non-diversification

risk, interest rate risk, tax risk, and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance

on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to publicly update or

revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

We acknowledge that, notwithstanding the foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation

Reform Act of 1995 does not apply to investment companies such as us.

Contact:

Phil Mosakowski

Firsthand Capital Management, Inc.

(408) 624-9526

vc@firsthandtvf.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

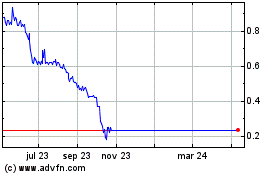

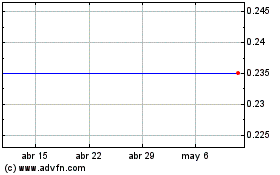

Firsthand Technology Value (NASDAQ:SVVC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Firsthand Technology Value (NASDAQ:SVVC)

Gráfica de Acción Histórica

De May 2023 a May 2024