TMT Acquisition Corp Shareholders Approve Business Combination with eLong Power Holding Limited

29 Octubre 2024 - 3:00PM

TMT Acquisition Corp (Nasdaq: TMTCU, TMTC, and TMTCR) (“TMTC”), a

publicly traded special purpose acquisition company, announced at

its extraordinary general meeting earlier today, October 29, 2024,

that its shareholders voted to approve the previously announced

business combination with eLong Power Holding Limited (“eLong

Power”), a provider of high power battery technologies for

commercial and specialty vehicles and energy storage systems.

The transaction has been unanimously approved by

the Board of Directors of TMT and eLong Power. Subject to certain

contractual as well as customary closing conditions, the business

combination is expected to close in the coming weeks. As part of

the consummation of the business combination, the newly combined

public company is expected to trade on the Nasdaq Stock Market

under the symbol “ELPW”.

The business combination is expected to provide

eLong Power with access to the U.S. public equity markets, thereby

accelerating its business expansion and bolstering eLong Power’s

position to explore additional growth and value- creating

opportunities.

Advisors

The Crone Law Group P.C. is acting as U.S. legal

advisor to TMTC. Ogier Global is acting as the Cayman Islands legal

advisor to TMTC. Graubard Miller is acting as U.S. legal advisor to

eLong Power, Harneys is acting as Cayman Islands legal advisor to

eLong Power and Han Kun Law Offices is acting as China legal

advisor to eLong Power.

About eLong Power

eLong Power Holding Limited, a Cayman Islands

exempted company, is committed to the research and development,

manufacturing, sales and service of high-power lithium-ion

batteries for electric vehicles and construction machinery, as well

as large-capacity, long-cycle lithium-ion batteries for energy

storage systems. eLong Power is led by Ms. Xiaodan Liu, eLong

Power’s Chairwoman and CEO.

eLong Power has a comprehensive product and

technology system that includes battery cells, modules, system

integration, and battery management system development, based on

high-power lithium-ion batteries and battery system products for

long-cycle energy storage devices. eLong Power offers advanced

energy applications and full life cycle services. Its product

portfolio includes products utilizing lithium manganese oxide and

lithium iron phosphate, among others, to meet the needs of

high-power applications and energy storage applications in various

scenarios.

About TMT Acquisition Corp

TMT Acquisition Corp is a blank check company,

also commonly referred to as a special purpose acquisition company

(SPAC), formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization, or

similar business combination with one or more businesses or

entities. TMTC is led by Dajiang (“DJ”) Guo, Chairman and Chief

Executive Officer, and Jichuan Yang, Chief Financial Officer, who

are growth-oriented executives with a long track record of value

creation across industries.

Forward-looking Statements

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including statements regarding the benefits of the transaction, the

anticipated timing of the transaction, the products offered by

eLong Power and the markets in which it operates, and eLong Power’s

projected future results. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including, but not limited to: the risk that the

transaction may not be completed by TMTC’s business combination

deadline; the failure to satisfy one or more of the conditions to

the consummation of the transaction; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the business combination agreement; the effect of

the announcement or pendency of the transaction on eLong Power’s

business relationships, performance, and business generally; risks

that the proposed business combination disrupts current plans or

operations of eLong Power; the outcome of any legal proceedings

that may be instituted against eLong Power or TMTC related to the

business combination agreement or the proposed business

combination; the ability of eLong Power to have its securities

listed on Nasdaq commencing on the closing of the transaction and

maintain such listing thereafter; after the closing of the

transaction, the price of eLong Power Inc.’s securities may be

volatile due to a variety of factors, including changes in the

competitive and highly regulated industries in which eLong Power

Inc. will operate, variations in performance across competitors,

changes in laws and regulations affecting eLong Power Inc.’s

business and changes in its capital structure; the ability to

implement business plans, forecasts, and other expectations after

the completion of the proposed business combination, and identify

and realize additional opportunities provided by the business

combination; its need for substantial additional funds; the

parties’ dependence on third-party suppliers; risks relating to the

results of research and development activities, market and other

conditions; its ability to attract, integrate, and retain key

personnel; risks related to its growth strategy; patent and

intellectual property matters; and the parties’ ability to obtain,

perform under and maintain financing and strategic agreements and

relationships. Accordingly, these forward-looking statements do not

constitute guarantees of future performance, and you are cautioned

not to place undue reliance on these forward-looking statements.

Risks regarding TMTC’s and eLong Power’s business are described in

detail in TMTC’s and eLong Power’s SEC filings which are available

on the SEC’s website at www.sec.gov, including in eLong Power’s

registration statement on Form F-4 (File No. 333-280512) and TMTC’s

registration statement on Form S-1 (File No. 333-259879), filed

with the SEC and updated by TMTC’s and eLong Power’s subsequent

filings with the SEC. These forward-looking statements speak only

as of the date hereof, and TMTC expressly disclaims any obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in our expectations or any changes in events, conditions, or

circumstances on which any such statement is based, except as

required by law.

eLong Power Investor

Contact:Shilin XunEmail: xunshilin@elongpower.com

TMTC Contact:Dajiang

GuoEmail: dguo@tmtacquisitioncorp.com347-627-0058

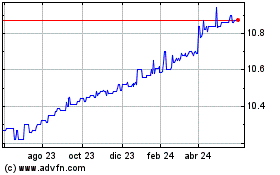

TMT Acquisition (NASDAQ:TMTC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

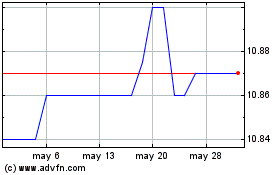

TMT Acquisition (NASDAQ:TMTC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024