TOP Financial Group Limited (the "Company") (NASDAQ: TOP), a

fast-growing online brokerage firm located in Hong Kong

specializing in the trading of local and foreign equities, futures,

options products and other financial services, today reported its

financial results for the fiscal year ended March 31, 2022.

Fiscal year 2022 highlights:

- Revenues generated

from provision of trading solution services to 9 customers was

approximately $3.3 million for the year ended March 31, 2022. The

Company commenced trading solution services in May 2021.

- Other service

revenues increased from $277,937 in the year ended March

31, 2021 to $280,677 in the year ended March 31, 2022.

- Total revenues

decreased by approximately $9.1 million, or 53.7%, to $7.8 million

for the year ended March 31, 2022 from $16.9 million for the year

ended March 31, 2021. The decrease was mainly due to the volatility

of the futures market and our customers reduced risk tolerance,

which negatively impacted the futures contract volume on our

platform.

- Net margin

increased 15.3 percentage points to 44.9% for the year ended March

31, 2022, from 29.6% for the fiscal year ended March 31, 2021.

| |

For fiscal years ended March 31 |

|

($ millions, except per share data,

differences due to rounding) |

2022 |

|

2021 |

|

% Change |

| Total revenues |

$7.8 |

|

$16.9 |

|

(53.8%) |

| Total expenses |

$4.2 |

|

$11.8 |

|

(64.4%) |

| Income before income taxes |

$3.6 |

|

$5.1 |

|

(29.4%) |

| Net income |

$3.5 |

|

$5.0 |

|

(30.0%) |

| Net margin |

44.9% |

|

29.6% |

|

15.3percentage points |

| Earnings per share – Basic and

Diluted |

$0.12 |

|

$0.17 |

|

(29.4%) |

Mr. Ka Fai Yuen, chief executive officer commented: “The past

few years have been quite challenging as factors such as economic

and political conditions, market conditions, clients’ risk appetite

have led to an overall decrease in futures trading activities that

impacted our fiscal quarters ended December 31, 2019 and March 31

2020. The trading activities did recover and remain moderately

stable from the fiscal quarter ended on June 30, 2020 to the fiscal

quarter ended March 31, 2021. However, travel restrictions in Hong

Kong from time to time and the economic and financial impact

brought about by the COVID-19 pandemic had caused a decrease in our

customers’ disposable income and in their willingness to trade and

make investments, and therefore had negatively affected our results

of operation during the latest fiscal quarters.”

“However we have also achieved substantial business growth since

the launch of our operation of online brokerage services. As of

March 31, 2022, we had 292 total registered customer accounts,

growing from 247 accounts as of March 31, 2021. We intend to

leverage our competitive strengths to continue providing our

clients with fast and reliable access to the financial market

through our personalized client services and efficient

organizational structure. In particular, we plan to expand our

services offering and continue integrating value-added services,

including contract for difference (CFD) products and services and

asset management services in the next fiscal quarters and we are

confident that the Company is able to deliver promising financial

performance and create sustainable value for our stakeholders.”

Ms. Yung Yung Lo, chief financial officer commented: “We

maintained a strong balance sheet with cash and cash equivalents of

$6.2 million as of March 31, 2022, compared to $4.9 million at same

time of 2021. During the reporting period, we commenced trading

solution services that generated more than $3 million. The Company

also managed to enhance net margin by more than 15 percentage

points for the financial year ended March 31, 2022. We believe that

we are turning the corner and are cautiously optimistic about the

following fiscal quarters.”

Financial Results for Fiscal Year ended March 31,

2022

The following table sets forth a summary of our consolidated

results of operations for the periods presented:

Revenues

Our revenues consist of commissions, trading solution services

and other service revenues, trading gains, interest income and

others. Total revenues decreased by 53.7%, to $7.8 million for the

year ended March 31, 2022 from $16.9 million for the year ended

March 31, 2021. The decrease was mainly driven by a decrease of

$11.8 million in futures brokerage commission, net off against new

revenues streams from trading solution services and structure note

subscriber services that contributed a total revenue of $3.3

million.

The following table sets forth the breakdown of our total

revenues, both in absolute amount and as a percentage of our total

revenues, for the years indicated:

| |

|

For the Years Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| ($ millions, differences due

to rounding) |

|

US$ |

|

|

% |

|

|

US$ |

|

|

% |

|

|

US$ |

|

|

% |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Futures brokerage commissions |

|

|

4.3 |

|

|

|

55.1 |

|

|

|

16.1 |

|

|

|

95.1 |

|

|

|

16.2 |

|

|

|

98.1 |

|

|

Trading solution services fees |

|

|

3.3 |

|

|

|

42.3 |

|

|

|

- |

|

|

|

0.0 |

|

|

|

- |

|

|

|

0.0 |

|

|

Structure note subscription fees |

|

|

0.7 |

|

|

|

9.0 |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

- |

|

|

|

|

|

|

Other service revenues |

|

|

0.3 |

|

|

|

3.8 |

|

|

|

0.2 |

|

|

|

1.6 |

|

|

|

0.2 |

|

|

|

1.4 |

|

|

Trading (losses) gains |

|

|

(0.8 |

) |

|

|

(10.2 |

) |

|

|

0.4 |

|

|

|

2.3 |

|

|

|

- |

|

|

|

0.1 |

|

|

Interest income and others |

|

|

- |

|

|

|

0.0 |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.1 |

|

|

|

0.4 |

|

| Total

revenues |

|

|

7.8 |

|

|

|

100.0 |

|

|

|

16.9 |

|

|

|

100.0 |

|

|

|

16.5 |

|

|

|

100.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Futures brokerage commissions

Commissions from futures broking make up for most of our

revenues, at 55.1%, 95.1% and 98.1% of the total revenues for the

years ended March 31, 2022, 2021 and 2020, respectively.

Futures brokerage commissions decreased by 73.3% from $16.1

million in the year ended March 31, 2021 to $4.3 million in the

year ended March 31, 2022, primarily due to the volatility of the

futures market and our customers reduced risk tolerance, which

negatively impacted the futures contract volume on our platform.

Trading volume of futures contracts decreased from 9.61 million of

futures contracts in the year ended March 31, 2021 to 2.64 million

of futures contracts in the year ended March 31, 2022. The average

commission rate over trading volumes in the year ended March 31,

2022 and 2021 kept relatively stable at $1.62 and $1.67 per

contract, respectively.

Trading solution services fees

The Company commenced trading solution services to customers

since May 2021. For the year ended March 31, 2022, the Company

generated revenues of $3.3 million from provision of trading

solution services to 9 customers.

Other service revenues

Other service revenues kept stable at US$0.3 million in the year

ended March 31, 2022, as compared with US$0.3 million in the year

ended March 31, 2021.

Trading (losses) gains

The Company had trading gains of $0.4 million in the year ended

March 31, 2021 as compared to trading losses of $0.8 million in the

year ended March 31, 2022, which was mainly driven by the market

condition of the US stock market.

Interest income and others

Interest income and others decreased from $77,252 in the year

ended March 31, 2021 to $3,535 in the year ended March 31, 2022.

The decrease was attributable to the decrease in bank interest

income.

Expenses

Expenses decreased by $7.6 million or

approximately 64.4%, to 4.2 million for the year ended March 31,

2022 from $11.8 million for the year ended March 31, 2021. The

following table sets forth our operating cost and expenses, both in

absolute amount and as a percentage of total revenues, for the

years indicated:

Commission expenses

Commission expenses decreased by 73.4% to $2.7

million in the year ended March 31, 2022 from $10.3 million in the

year ended March 31, 2021. The decrease in commission expenses was

in line with the decrease of commission income resulting from

decrease of futures contract volume on our platform.

Compensation and benefits

Our largest expense other than commission

expenses was compensation and benefits. Compensation and benefits

decreased by 18.6% from $0.7 million in the year ended March 31,

2021 to $0.6 million in the year ended March 31, 2022, which was

mainly caused by resignation of a responsible officer.

Communications and technology

Communications and technology expenses increased

by 113.5% from $0.2 million in the year ended March 31, 2022 to

$0.4 million in the year ended March 31, 2022. The increase in

communications and technology expenses was caused by technology

expenses of $0.2 million to support trading solution services

provided to our customers, which commenced since May 2021.

Occupancy

Occupancy expenses decreased slightly by 2.4%

and kept at $0.13 million in the years ended March 31, 2022 and

2021.

Income before income taxes

We had an income before income taxes of $3.6 million and $5.1

million in the years ended March 31, 2022 and 2021, respectively.

Our operating margin was 45.8% and 30.3% in the year ended March

31, 2022 and 2021, respectively.

Income tax expense

We are subject to Hong Kong profits tax and under Hong Kong tax

laws; Our income tax expense increased from $0.07 million in the

year ended March 31, 2021 to $0.09 million in the year ended March

31, 2022, which was primarily due to the increase of the onshore

profit generated by Zhong Yang Securities Ltd., a company with

limited liability under the laws of Hong Kong, in the year ended

March 31, 2022.

Net income

As a result of the foregoing, our net income decreased by 30.8%

from $5.0 million in the year ended March 31, 2021 to $3.5 million

in the year ended March 31, 2022.

Total cash and cash equivalents

The Company had cash and equivalents of $6.2 million as of March

31, 2022 as compared to $4.9 million as of March 31, 2021.

Recent developments

On June 03, 2022, Univest Securities, LLC (“Univest”) announced

the closing of the initial public offering (the “Offering”) for its

client Zhong Yang Financial Group Limited (the “Company”, Nasdaq:

TOP). The Company received aggregate gross proceeds of US$25

million of 5,000,000 ordinary shares (the "Ordinary Shares") at a

public offering price of US$5.00 per share from this Offering,

before deducting underwriting discounts and offering expenses. The

Offering closed on June 3, 2022 and the Ordinary Shares began

trading on June 1, 2022 on The Nasdaq Capital Market under the

ticker symbol "TOP".

On July 22, 2022, the Company announced that on July 13, 2022,

the shareholders of the Company approved an amendment to the

Company’s certificate of incorporation to change the Company’s name

from Zhong Yang Financial Group Limited to “TOP Financial Group

Limited.”

About TOP Financial Group Limited

Founded in Hong Kong, the Company, through its operating

subsidiaries, operates online brokerage platforms specializing in

the trading of local and foreign equities, futures, and options

products.

The trading platforms, which the operating subsidiaries license

from third parties enable its investors to trade on renowned stock

and futures exchanges around the world, including the Chicago

Mercantile Exchange (“CME”), Hong Kong Futures Exchange (“HKFE”),

The New York Mercantile Exchange (“NYMEX”), The Chicago Board of

Trade (“CBOT”), The Commodity Exchange (“COMEX”), Eurex Exchange

(“EUREX”), ICE Clear Europe Limited (“ICEU”), Singapore Exchange

(“SGX”), Australia Securities Exchange (“ASX”), Bursa Malaysia

Derivatives Berhad (“BMD”), and Osaka Exchange (OSE). The

operating subsidiaries are licensed with the Securities and Futures

Commission of Hong Kong ("HKSFC”) to carry out type 1 (dealing in

securities), type 2 (dealing in futures contracts) regulated

activities, and are licensed with the HKSFC to carry out type 4

(advising on securities), type 5 (advising on futures contracts),

and type 9 (asset management) regulated activities in Hong Kong.

For more information, please visit http://www.zyfgl.com/.

Forward-Looking Statement

This press release contains forward-looking statements as

defined by the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements that are other than

statements of historical facts. When the Company uses words such as

"may, "will, "intend," "should," "believe," "expect," "anticipate,"

"project," "estimate" or similar expressions that do not relate

solely to historical matters, it is making forward-looking

statements. Forward-looking statements are not guarantees of future

performance and involve risks and uncertainties that may cause the

actual results to differ materially from the Company's expectations

discussed in the forward-looking statements. These statements are

subject to uncertainties and risks including, but not limited

to, the uncertainties related to market conditions and the

completion of the initial public offering on the anticipated terms

or at all, and other factors discussed in the “Risk Factors”

section of the registration statement filed with the SEC. For

these reasons, among others, investors are cautioned not to place

undue reliance upon any forward-looking statements in this press

release. Additional factors are discussed in the Company's filings

with the SEC, which are available for review at www.sec.gov. The

Company undertakes no obligation to publicly revise these

forward-looking statements to reflect events or circumstances that

arise after the date hereof.

For more information, please contact:

The Company:

IR DepartmentEmail: IR@zyzq.com.hk

Investor Relations:

EverGreen Consulting Inc.

Ms. Janice Wang, Managing Partner

Email: IR@changqingconsulting.com

Phone: +1 470-940-3308 (from U.S.)

+86 13811768559 (from China)

TOP Financial Group

Limited(formerly “Zhong Yang Financial Group

Limited”)Consolidated Balance

Sheets(Expressed in U.S. Dollars, except for the

number of shares)

|

|

|

As of March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,199,213 |

|

|

$ |

4,858,052 |

|

|

Restricted cash |

|

|

1,757,546 |

|

|

|

1,977,424 |

|

|

Receivables from broker-dealers and clearing organizations |

|

|

2,360,157 |

|

|

|

2,571,080 |

|

|

Receivables from customers |

|

|

1,230,542 |

|

|

|

137,912 |

|

|

Securities owned, at fair value |

|

|

1,288,747 |

|

|

|

481,897 |

|

|

Fixed assets, net |

|

|

421,285 |

|

|

|

18,241 |

|

|

Intangible asset, net |

|

|

63,837 |

|

|

|

64,312 |

|

|

Right of use assets |

|

|

242,665 |

|

|

|

- |

|

|

Income tax recoverable |

|

|

20,292 |

|

|

|

- |

|

|

Other assets |

|

|

296,532 |

|

|

|

155,645 |

|

| Total

assets |

|

$ |

13,880,816 |

|

|

$ |

10,264,563 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

|

|

|

|

|

|

Payable to customers |

|

$ |

3,210,113 |

|

|

$ |

3,262,724 |

|

|

Payable to customers – related parties |

|

|

99,423 |

|

|

|

- |

|

|

Income tax payable |

|

|

- |

|

|

|

129,324 |

|

|

Accrued expenses and other liabilities |

|

|

131,317 |

|

|

|

118,328 |

|

|

Lease liabilities |

|

|

244,861 |

|

|

|

- |

|

| Total

liabilities |

|

|

3,685,714 |

|

|

|

3,510,376 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary share (par value $0.001per share, 150,000,000 shares

authorized; 30,000,000 shares issued and outstanding at March 31,

2022 and 2021)* |

|

|

30,000 |

|

|

|

30,000 |

|

|

Additional paid-in capital |

|

|

2,934,595 |

|

|

|

2,934,595 |

|

|

Retained earnings |

|

|

7,264,531 |

|

|

|

3,773,226 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(34,024 |

) |

|

|

16,366 |

|

| Total shareholders’

equity |

|

|

10,195,102 |

|

|

|

6,754,187 |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ equity |

|

$ |

13,880,816 |

|

|

$ |

10,264,563 |

|

|

|

|

|

|

|

|

|

|

|

TOP Financial Group

Limited(formerly “Zhong Yang Financial Group

Limited”)Consolidated Statements of Income and

Comprehensive Income(Expressed in U.S. dollar,

except for the number of shares)

|

|

|

For the Years Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

Futures brokerage commissions |

|

$ |

4,287,038 |

|

|

$ |

16,085,815 |

|

|

$ |

16,179,198 |

|

|

Trading solution service revenues |

|

|

3,309,288 |

|

|

|

- |

|

|

|

- |

|

|

Structure note subscription fees |

|

|

734,317 |

|

|

|

78,311 |

|

|

|

- |

|

|

Other service revenues |

|

|

280,677 |

|

|

|

277,937 |

|

|

|

226,599 |

|

|

Trading (losses) gains |

|

|

(794,460 |

) |

|

|

387,057 |

|

|

|

22,124 |

|

|

Interest income and other |

|

|

3,535 |

|

|

|

77,252 |

|

|

|

72,304 |

|

|

Total revenues |

|

|

7,820,395 |

|

|

|

16,906,372 |

|

|

|

16,500,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission expenses |

|

|

2,728,389 |

|

|

|

10,263,351 |

|

|

|

12,473,805 |

|

|

Compensation and benefits |

|

|

562,297 |

|

|

|

690,867 |

|

|

|

657,473 |

|

|

Communications and technology |

|

|

428,445 |

|

|

|

200,715 |

|

|

|

417,496 |

|

|

Occupancy |

|

|

129,064 |

|

|

|

132,220 |

|

|

|

133,344 |

|

|

Travel and business development |

|

|

53,337 |

|

|

|

16,880 |

|

|

|

52,167 |

|

|

Professional fees |

|

|

271,477 |

|

|

|

382,827 |

|

|

|

55,946 |

|

|

Other administrative expenses |

|

|

67,434 |

|

|

|

104,077 |

|

|

|

112,475 |

|

|

Total expenses |

|

|

4,240,443 |

|

|

|

11,790,937 |

|

|

|

13,902,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

3,579,952 |

|

|

|

5,115,435 |

|

|

|

2,597,519 |

|

| Income tax expense |

|

|

88,647 |

|

|

|

70,765 |

|

|

|

58,443 |

|

|

Net income |

|

|

3,491,305 |

|

|

|

5,044,670 |

|

|

|

2,539,076 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total foreign currency translation adjustment |

|

|

(50,390 |

) |

|

|

(20,245 |

) |

|

|

72,884 |

|

|

Total comprehensive income |

|

$ |

3,440,915 |

|

|

$ |

5,024,425 |

|

|

$ |

2,611,960 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

0.12 |

|

|

$ |

0.17 |

|

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

0.00 |

|

|

$ |

0.16 |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

ordinary shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted* |

|

|

30,000,000 |

|

|

|

30,000,000 |

|

|

|

30,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOP Financial Group

Limited(formerly “Zhong Yang Financial Group

Limited”)Consolidated Statements of Cash

Flows(Expressed in U.S. dollar)

|

|

|

For the Years Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,491,305 |

|

|

$ |

5,044,670 |

|

|

$ |

2,539,076 |

|

|

Adjustments to reconcile net income to net cash (used in) provided

by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

10,778 |

|

|

|

13,288 |

|

|

|

17,865 |

|

|

Amortization of right of use assets |

|

|

53,799 |

|

|

|

- |

|

|

|

- |

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables from customers |

|

|

(1,092,804 |

) |

|

|

- |

|

|

|

- |

|

|

Receivables from broker-dealers and clearing organizations |

|

|

193,103 |

|

|

|

2,429,830 |

|

|

|

(1,183,953 |

) |

|

Securities owned, at fair value |

|

|

(812,063 |

) |

|

|

(347,112 |

) |

|

|

(133,657 |

) |

|

Other assets |

|

|

(143,229 |

) |

|

|

35,826 |

|

|

|

4,300 |

|

|

Payable to customers |

|

|

(6,636 |

) |

|

|

(2,872,467 |

) |

|

|

(1,930,352 |

) |

|

Payables to customers – related party |

|

|

78,006 |

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other liabilities |

|

|

13,830 |

|

|

|

(40,655 |

) |

|

|

(7,640 |

) |

|

Income tax recoverable and payable |

|

|

(149,579 |

) |

|

|

70,388 |

|

|

|

(243,988 |

) |

|

Lease liabilities |

|

|

(51,589 |

) |

|

|

- |

|

|

|

- |

|

| Net cash provided by/(used in)

operating activities |

|

|

1,584,921 |

|

|

|

4,333,768 |

|

|

|

(938,349 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of fixed assets |

|

|

(413,890 |

) |

|

|

(16,278 |

) |

|

|

- |

|

| Net cash used in investing

activities |

|

|

(413,890 |

) |

|

|

(16,278 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment of dividends |

|

|

- |

|

|

|

(5,202,494 |

) |

|

|

- |

|

|

Amount due from a related party |

|

|

- |

|

|

|

2,876,244 |

|

|

|

(581,954 |

) |

| Net cash used in financing

activities |

|

|

- |

|

|

|

(2,326,250 |

) |

|

|

(581,954 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

|

|

1,171,031 |

|

|

|

1,991,240 |

|

|

|

(1,520,303 |

) |

|

Cash, cash equivalents and restricted cash, beginning of year |

|

|

6,835,476 |

|

|

|

4,864,497 |

|

|

|

6,309,936 |

|

|

Effect of exchange rates on cash, cash equivalents and restricted

cash |

|

|

(49,748 |

) |

|

|

(20,261 |

) |

|

|

74,864 |

|

| Cash, cash equivalents and

restricted cash, end of year |

|

$ |

7,956,759 |

|

|

$ |

6,835,476 |

|

|

$ |

4,864,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents and restricted

cash to the consolidated balance sheets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,199,213 |

|

|

$ |

4,858,052 |

|

|

$ |

3,640,353 |

|

| Restricted cash |

|

|

1,757,546 |

|

|

|

1,977,424 |

|

|

|

1,224,144 |

|

| Total cash, cash

equivalents, and restricted cash |

|

$ |

7,956,759 |

|

|

$ |

6,835,476 |

|

|

$ |

4,864,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash operating, investing and financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends made through reduction in amount due from a related

party |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

191,897 |

|

|

Right of use assets obtained in exchange for operating lease

obligations |

|

$ |

298,178 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

- |

|

|

$ |

7,710 |

|

|

$ |

2,164 |

|

|

Cash paid for taxes, net of refunds |

|

$ |

103,324 |

|

|

$ |

- |

|

|

$ |

304,207 |

|

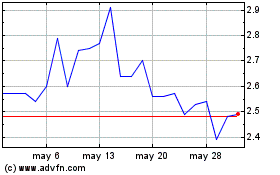

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024