Creative Planning Announces Strategic Investment from TPG Capital

30 Septiembre 2024 - 8:30AM

Business Wire

Creative Planning (“the Company”), a leading independent wealth

management firm, today announced that TPG (NASDAQ: TPG), a leading

global alternative asset management firm, has made a substantial

minority investment in the Company. TPG is investing in the

business through TPG Capital, its U.S. and European private equity

platform. Terms of the transaction were not disclosed.

TPG Capital joins existing investor General Atlantic, who made a

minority investment in 2020, to provide additional resources and

expertise to help Creative Planning continue to enhance its service

offerings and growth trajectory. Creative Planning President and

Chief Executive Officer, Peter Mallouk, will continue to lead the

business and maintain a majority stake.

Creative Planning is a fast-growing, leading independent wealth

management firm that provides comprehensive financial planning-led

wealth management solutions, delivering a best-in-class client

experience. A trusted partner with a track record of client-led

success, Creative Planning and its affiliates currently have more

than $375 billion in combined assets under management and

advisement across all 50 states and 90 countries.

“This new investment from TPG Capital is recognition of the

unique value we create for our clients and the growth and expansion

opportunities ahead for our business,” said Mallouk. “We are

excited to partner with a trusted investor like TPG, with a

well-known global reputation, who shares our vision of leveraging

our planning-led approach and people-first culture to better serve

clients through every phase of their financial lives.”

“As clients are increasingly seeking out holistic wealth

management solutions, Peter Mallouk and Creative Planning have

built an unparalleled business in the space with a track record of

success by offering services that address clients’ unique needs,”

added Peter McGoohan, Partner at TPG Capital. “We look forward to

working closely with Peter and Creative’s impressive management

team and advisors to invest behind the Company’s continued growth

and expansion.”

“In our over four years of partnership together, Creative

Planning has continued to build on its reputation as an

industry-leading wealth management firm with deep client focus and

a unique servicing offering. We are thrilled to continue to support

Peter and the excellent team at Creative Planning as they execute

their long-term vision for the Company,” said Paul Stamas, Managing

Director and Global Head of Financial Services at General

Atlantic.

Goldman Sachs acted as exclusive financial advisor to Creative

Planning, and Paul Weiss provided legal counsel. J.P. Morgan

Securities LLC and RBC Capital Markets acted as financial advisors

to TPG Capital, and Davis Polk provided legal counsel.

About Creative Planning

Creative Planning, LLC is an independent wealth management firm

that provides a financial planning led investment management

approach, retirement planning, estate planning, trust services, tax

planning and family office services for individuals as well as

401(k) and institutional clients. Creative Planning and its

affiliates have more than $375 billion in combined assets under

management and advisement across all 50 states and 90 countries as

of December 31, 2023. United Capital Financial Advisors is an

affiliate of Creative Planning.

About TPG

TPG is a leading global alternative asset management firm,

founded in San Francisco in 1992, with $229 billion of assets under

management and investment and operational teams around the world.

TPG invests across a broadly diversified set of strategies,

including private equity, impact, credit, real estate, and market

solutions, and our unique strategy is driven by collaboration,

innovation and inclusion. Our teams combine deep product and sector

experience with broad capabilities and expertise to develop

differentiated insights and add value for our fund investors,

portfolio companies, management teams, and communities. For more

information, visit www.tpg.com.

About General Atlantic

General Atlantic is a leading global growth investor with more

than four decades of experience providing capital and strategic

support for over 520 growth companies throughout its history.

Established in 1980 to partner with visionary entrepreneurs and

deliver lasting impact, the firm combines a collaborative global

approach, sector-specific expertise, a long-term investment

horizon, and a deep understanding of growth drivers to partner with

great entrepreneurs and management teams to scale innovative

businesses around the world. General Atlantic has approximately $83

billion in assets under management inclusive of all products as of

June 30, 2024, and more than 300 investment professionals based in

New York, Amsterdam, Beijing, Hong Kong, Jakarta, London, Mexico

City, Miami, Mumbai, Munich, San Francisco, São Paulo, Shanghai,

Singapore, Stamford and Tel Aviv. For more information on General

Atlantic, please visit: www.generalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240929582817/en/

For TPG: Julia Sottosanti media@tpg.com

For General Atlantic: Emily Japlon & Sara Widmann

media@generalatlantic.com

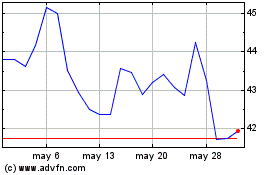

TPG (NASDAQ:TPG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

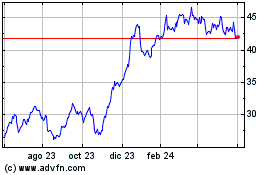

TPG (NASDAQ:TPG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024