false

0001855447

0001855447

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 6, 2024

Tigo

Energy, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40710 |

|

83-3583873 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

655 Campbell Technology Parkway, Suite 150

Campbell, California |

|

95008 |

| (Address of principal executive offices) |

|

(Zip Code) |

(408) 402-0802

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communication pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencements communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

TYGO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On August 6, 2024, Tigo

Energy, Inc. (the “Company”) reported its earnings for its second fiscal quarter ended June 30, 2024. A copy of the Company’s

press release containing this information is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

The information contained

in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section,

or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

The Company is making

reference to non-GAAP financial measures in the press release. A reconciliation of these non-GAAP financial measures to the comparable

GAAP financial measures is contained in the attached press release.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 6, 2024

| |

TIGO ENERGY, INC. |

| |

|

| |

By: |

/s/ Bill Roeschlein |

| |

Name: |

Bill Roeschlein |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Tigo

Energy Reports Second Quarter 2024 Financial Results

CAMPBELL, Calif. – August 6, 2024 –

Tigo Energy, Inc. (“Tigo”, or the “Company”) (NASDAQ: TYGO), a

leading provider of intelligent solar and energy storage solutions, today reported unaudited financial results for the second quarter

ended June 30, 2024 and financial guidance for the third quarter ending September 30, 2024.

Recent

Financial and Operational Highlights

| ● | Quarterly

revenue of $12.7 million |

| ● | GAAP

gross margin of 30.4% |

| ● | GAAP

operating loss of $8.4 million |

| ● | GAAP

net loss of $11.3 million |

| ● | Adjusted

EBITDA loss of $6.4 million |

| ● | Cash,

cash equivalents, and marketable securities of $20.2 million |

| ● | Shipped

378,000 MLPE, or approximately 144MW DC assuming an average panel size of 400W |

| ● | Selected

for a 142MWp Solar Installation, delivering best-in-class safety for large Commercial &

Industrial solar installation in Spain |

| ● | Introduced

EI Professional, offering an unlimited seat subscription that provides a portfolio-wide dashboard

for solar installers to review health, performance and commissioning time data for their

installations |

| ● | Welcomed

Midnite Solar as a new licensee for Tigo’s rapid shutdown technology |

Management

Commentary

“We experienced steady sequential growth

in the second quarter of 2024 as we continue to navigate the prolonged industry recovery,” said Zvi Alon, Chairman and CEO of

Tigo. “Our financial results are within our previously stated guidance and we continue to build off our progress this quarter.

Our newly launched TS4-X product family has been positively received by the market and we received our largest order in history for a

142 MWp installation in Spain. We believe our recent market win sets us up for future success and our TS4-X introduction has positioned

us ahead of the market during this extended recovery period.

While Tigo is not immune to macroeconomic dependencies,

we expect that our robust product portfolio, and recent gains within the utility sector for our MLPE products, will allow us to achieve

increased revenue growth in a sluggish environment and positions us well against our competitors as we move into the second half of 2024.

We believe the scalability we have built into our business model, coupled with our strategic initiatives and TS4-X product offering, give

us a strong foundation to outgrow the industry. We expect our revenues and profitability to slowly continue their upward trajectory as

we move closer to the end of the year, driven by the strong market reception and anticipated increased demand for our solutions. We look

forward to a stronger second half of 2024.”

“Our cost-reduction efforts are starting

to materialize and we expect they will be fully reflected in our financials during the second half of the year,” stated Bill

Roeschlein, Chief Financial Officer of Tigo. “Considering our current supply of inventory on-hand, we expect to continue progressing

toward a cash break-even point at a quarterly revenue level of approximately $17 million to $19 million and an adjusted EBITDA break-even

point at a quarterly revenue level of approximately $33 million to $35 million on a normalized basis. We believe that our revenues will

continue to improve in the second half of the year based on expectations for a recovery in the industry, which would allow us to achieve

profitable growth in the near future.”

Second Quarter 2024 Financial

Results

Results

compare the 2024 fiscal second quarter ended June 30, 2024 to the 2023 fiscal second quarter ended June 30, 2023, unless otherwise indicated.

| ● | Revenues

totaled $12.7 million, an 81.5% decrease from $68.8 million. On a sequential basis, revenues

increased by $2.9 million, or 29.6%. |

| ● | Gross

profit totaled $3.9 million, or 30.4% of total revenue, an 85.1% decrease from $25.9 million,

or 37.6% of total revenue. |

| ● | Total

operating expenses totaled $12.3 million, a 28.8% decrease from $17.2 million. |

| ● | Net

loss totaled $11.3 million, compared to a net loss of $22.2 million. |

| ● | Adjusted

EBITDA loss totaled $6.4 million, compared to an adjusted EBITDA of $13.6 million. |

| ● | Cash,

cash equivalents, and marketable securities totaled $20.2 million at June 30, 2024. On a

sequential basis, cash declined by $1.8 million. |

Third Quarter 2024 Outlook

The Company also provides guidance for the third

quarter ending September 30, 2024 as follows:

| ● | Revenues are expected to be within the range of $13.0 million

to $16.0 million. |

| ● | Adjusted EBITDA loss is expected to be within the range of

$6.5 million to $8.5 million. |

Actual results

may differ materially from the Company’s guidance as a result of, among other things, the factors described below under “Forward-Looking

Statements”.

Conference Call

Tigo management

will hold a conference call today, August 6, 2024, at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss these results. Company

CEO Zvi Alon and CFO Bill Roeschlein will host the call, followed by a question-and-answer period.

Registration Link: Click

here to register

Please

register online at least 10 minutes prior to the start time. If you have any difficulty with registration or connecting to the conference

call, please contact Gateway Group at (949) 574-3860.

The conference

call will be broadcast live and available for replay here and via the Investor Relations section of Tigo’s website.

About Tigo Energy, Inc.

Founded

in 2007, Tigo is a worldwide leader in the development and manufacture of smart hardware and software solutions that enhance safety, increase

energy yield, and lower operating costs of residential, commercial, and utility-scale solar systems. Tigo combines its Flex MLPE (Module

Level Power Electronics) and solar optimizer technology with intelligent, cloud-based software capabilities for advanced energy monitoring

and control. Tigo MLPE products maximize performance, enable real-time energy monitoring, and provide code-required rapid shutdown at

the module level. The Company also develops and manufactures products such as inverters and battery storage systems for the residential

solar-plus-storage market. For more information, please visit www.tigoenergy.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about our ability to increase our revenues, reach cash flow break-even, adjusted EBITDA break-even, become profitable,

and our overall long-term growth prospects, expectations regarding a recovery in our industry, including the timing thereof, current and

future inventory levels and its impact on future financial results, statements about demand for our products, our competitive position,

and our ability to penetrate new markets and expand our market share, including expansion in international markets, our continued expansion

of and investments in our product portfolio, and future financial and operating results, our plans, objectives, expectations and intentions

with respect to future operations, products and services; and other statements identified by words such as “will likely result,”

“are expected to,” “will continue,” “will allow us to” “is anticipated,” “estimated,”

“expected”, “believe,” “intend,” “plan,” “projection,” “outlook”

or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Tigo’s management

and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult

to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated

in these forward-looking statements.

In addition to factors

previously disclosed, or that will be disclosed in, our reports filed with the SEC, factors which may cause actual results to differ materially

from current expectations include, but are not limited to, our ability to effectively develop and sell our product offerings and services, our

ability to compete in the highly-competitive and evolving solar industry; our ability to manage risks associated with macroeconomic

conditions, seasonal trends and the cyclical nature of the solar industry, including the current downturn; whether we continue to grow

our customer base; whether we continue to develop new products and innovations to meet constantly evolving customer demands; the timing

and level of demand for our solar energy solutions; changes in government subsidies and economic incentives for solar energy solutions;

our ability to acquire or make investments in other businesses, patents, technologies, products or services to grow the business and realize

the anticipated benefits therefrom; our ability to meet future liquidity requirements; our ability to respond to fluctuations in foreign

currency exchange rates and political unrest and regulatory changes in the U.S. and international markets into which we expand or otherwise

operate in; our failure to attract, hire retain and train highly qualified personnel in the future; and if we are unable to maintain key

strategic relationships with our partners and distributors.

Actual results, performance

or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions

on which those forward-looking statements are based. There can be no assurance that the forward-looking statements contained herein are

reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor

of future performance as projected financial information and other information are based on estimates and assumptions that are inherently

subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth

herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward-looking statements as a result

of new information, future developments or otherwise occurring after the date of this communication.

Non-GAAP Financial Measures

To

supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP

financial measure: adjusted EBITDA. The presentation of this financial measure is not intended to be considered in isolation or as a substitute

for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use adjusted EBITDA for financial and operational

decision-making and as a means to evaluate period-to-period comparisons. We define adjusted EBITDA, a non-GAAP financial measure, as earnings

(loss) before interest and other expenses, net, income tax expense (benefit), depreciation and amortization, as adjusted to exclude stock-based

compensation and merger transaction related expenses. We believe that adjusted EBITDA provides helpful supplemental information regarding

our performance by excluding certain items that may not be indicative of our recurring core business operating results. We believe that

both management and investors benefit from referring to adjusted EBITDA in assessing our performance and when planning, forecasting, and

analyzing future periods. Adjusted EBITDA also facilitates management’s internal comparisons to our historical performance and comparisons

to our competitors’ operating results. We believe adjusted EBITDA is useful to investors both because it (i) allows for greater

transparency with respect to key metrics used by management in its financial and operational decision-making and (ii) is used by our institutional

investors and the analyst community to help them analyze the health of our business.

The items excluded from adjusted EBITDA may

have a material impact on our financial results. Certain of those items are non-recurring, while others are non-cash in nature. Accordingly,

adjusted EBITDA is presented as supplemental disclosure and should not be considered in isolation of, as a substitute for, or superior

to, the financial information prepared in accordance with GAAP.

There are a number of limitations related to

the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts

excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial

measures in accordance with GAAP.

We refer investors to the reconciliation adjusted

EBITDA to net income (loss) included below. A reconciliation for adjusted EBITDA provided as guidance (including our projected break-even

point) is not provided because, as a forward-looking statement, such reconciliation is not available without unreasonable effort due to

the high variability, complexity, and difficulty of estimating certain items such as charges to stock-based compensation expense and currency

fluctuations which could have an impact on our consolidated results.

Investor Relations Contacts

Matt Glover or Ralf Esper

Gateway Group, Inc.

(949) 574-3860

TYGO@gateway-grp.com

Tigo Energy, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| ASSETS | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 14,943 | | |

$ | 4,405 | |

| Restricted cash | |

| 200 | | |

| — | |

| Marketable securities, short-term | |

| 5,214 | | |

| 26,806 | |

| Accounts receivable, net | |

| 6,917 | | |

| 6,862 | |

| Inventory | |

| 51,311 | | |

| 61,401 | |

| Prepaid expenses and other current assets | |

| 4,509 | | |

| 5,236 | |

| Total current assets | |

| 83,094 | | |

| 104,710 | |

| Property and equipment, net | |

| 3,191 | | |

| 3,458 | |

| Operating right-of-use assets | |

| 2,010 | | |

| 2,503 | |

| Marketable securities, long-term | |

| — | | |

| 1,977 | |

| Intangible assets, net | |

| 2,057 | | |

| 2,192 | |

| Other assets | |

| 768 | | |

| 728 | |

| Goodwill | |

| 12,209 | | |

| 12,209 | |

| Total assets | |

$ | 103,329 | | |

$ | 127,777 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 7,085 | | |

$ | 15,685 | |

| Accrued expenses and other current liabilities | |

| 6,639 | | |

| 8,681 | |

| Deferred revenue, current portion | |

| 275 | | |

| 335 | |

| Warranty liability, current portion | |

| 539 | | |

| 526 | |

| Operating lease liabilities, current portion | |

| 936 | | |

| 1,192 | |

| Total current liabilities | |

| 15,474 | | |

| 26,419 | |

| Warranty liability, net of current portion | |

| 5,238 | | |

| 5,106 | |

| Deferred revenue, net of current portion | |

| 704 | | |

| 466 | |

| Long-term debt, net of unamortized debt discount and issuance costs | |

| 36,040 | | |

| 31,570 | |

| Operating lease liabilities, net of current portion | |

| 1,133 | | |

| 1,392 | |

| Total liabilities | |

| 58,589 | | |

| 64,953 | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock | |

| 6 | | |

| 6 | |

| Additional paid-in capital | |

| 143,364 | | |

| 138,657 | |

| Accumulated deficit | |

| (98,607 | ) | |

| (75,780 | ) |

| Accumulated other comprehensive loss | |

| (23 | ) | |

| (59 | ) |

| Total stockholders’ equity | |

| 44,740 | | |

| 62,824 | |

| Total liabilities and stockholders’ equity | |

$ | 103,329 | | |

$ | 127,777 | |

Tigo Energy, Inc.

Condensed Consolidated Statement of Income

(in thousands, except share and per share data)

(unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net revenue | |

$ | 12,701 | | |

$ | 68,826 | | |

$ | 22,503 | | |

$ | 118,884 | |

| Cost of revenue | |

| 8,834 | | |

| 42,920 | | |

| 15,870 | | |

| 74,609 | |

| Gross profit | |

| 3,867 | | |

| 25,906 | | |

| 6,633 | | |

| 44,275 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,704 | | |

| 2,424 | | |

| 5,175 | | |

| 4,638 | |

| Sales and marketing | |

| 4,055 | | |

| 5,163 | | |

| 8,658 | | |

| 9,935 | |

| General and administrative | |

| 5,511 | | |

| 9,654 | | |

| 10,291 | | |

| 13,217 | |

| Total operating expenses | |

| 12,270 | | |

| 17,241 | | |

| 24,124 | | |

| 27,790 | |

| (Loss) income from operations | |

| (8,403 | ) | |

| 8,665 | | |

| (17,491 | ) | |

| 16,485 | |

| Other expenses (income): | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of preferred stock warrant and contingent shares liability | |

| 41 | | |

| 2,608 | | |

| (155 | ) | |

| 3,120 | |

| Change in fair value of derivative liability | |

| — | | |

| 38,251 | | |

| — | | |

| 38,251 | |

| Loss on debt extinguishment | |

| — | | |

| — | | |

| — | | |

| 171 | |

| Interest expense | |

| 2,862 | | |

| 1,587 | | |

| 5,688 | | |

| 2,365 | |

| Other income, net | |

| (1 | ) | |

| (672 | ) | |

| (213 | ) | |

| (1,223 | ) |

| Total other expenses, net | |

| 2,902 | | |

| 41,774 | | |

| 5,320 | | |

| 42,684 | |

| Loss before income tax expense | |

| (11,305 | ) | |

| (33,109 | ) | |

| (22,811 | ) | |

| (26,199 | ) |

| Income tax expense (benefit) | |

| 16 | | |

| (10,933 | ) | |

| 16 | | |

| (10,933 | ) |

| Net loss | |

| (11,321 | ) | |

| (22,176 | ) | |

| (22,827 | ) | |

| (15,266 | ) |

| Cumulative dividends on convertible preferred stock | |

| — | | |

| (1,248 | ) | |

| — | | |

| (3,399 | ) |

| Net loss attributable to common stockholders | |

$ | (11,321 | ) | |

$ | (23,424 | ) | |

$ | (22,827 | ) | |

$ | (18,665 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.19 | ) | |

$ | (0.84 | ) | |

$ | (0.38 | ) | |

$ | (1.09 | ) |

| Diluted | |

$ | (0.19 | ) | |

$ | (0.84 | ) | |

$ | (0.38 | ) | |

$ | (1.09 | ) |

| Weighted-average common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 60,363,680 | | |

| 27,750,374 | | |

| 59,874,991 | | |

| 17,174,936 | |

| Diluted | |

| 60,363,680 | | |

| 27,750,374 | | |

| 59,874,991 | | |

| 17,174,936 | |

Tigo Energy, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Cash Flows from Operating activities: | |

| | |

| |

| Net loss | |

$ | (22,827 | ) | |

$ | (15,266 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 612 | | |

| 536 | |

| Reserve for inventory obsolescence | |

| 458 | | |

| 410 | |

| Change in fair value of preferred stock warrant and contingent shares liability | |

| (155 | ) | |

| 3,120 | |

| Change in fair value of derivative liability | |

| — | | |

| 38,251 | |

| Deferred tax benefit | |

| — | | |

| (11,147 | ) |

| Non-cash interest expense | |

| 4,470 | | |

| 982 | |

| Stock-based compensation | |

| 4,208 | | |

| 863 | |

| Allowance for credit losses | |

| (1,434 | ) | |

| 170 | |

| Loss on debt extinguishment | |

| — | | |

| 171 | |

| Non-cash lease expense | |

| 619 | | |

| 415 | |

| Accretion of interest on marketable securities | |

| (163 | ) | |

| (204 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 1,379 | | |

| (30,057 | ) |

| Inventory | |

| 9,632 | | |

| (26,134 | ) |

| Prepaid expenses and other assets | |

| 687 | | |

| 167 | |

| Accounts payable | |

| (8,392 | ) | |

| 30,254 | |

| Accrued expenses and other liabilities | |

| (1,648 | ) | |

| 2,267 | |

| Deferred revenue | |

| 178 | | |

| (500 | ) |

| Warranty liability | |

| 145 | | |

| 1,142 | |

| Operating lease liabilities | |

| (641 | ) | |

| (374 | ) |

| Net cash used in operating activities | |

$ | (12,872 | ) | |

$ | (4,934 | ) |

| Investing activities: | |

| | | |

| | |

| Purchase of marketable securities | |

| — | | |

| (50,221 | ) |

| Acquisition of fSight | |

| — | | |

| (16 | ) |

| Purchase of intangible assets | |

| — | | |

| (450 | ) |

| Purchase of property and equipment | |

| (418 | ) | |

| (1,510 | ) |

| Disposals of property and equipment | |

| — | | |

| 73 | |

| Sales and maturities of marketable securities | |

| 23,768 | | |

| — | |

| Net cash provided by (used in) investing activities | |

$ | 23,350 | | |

$ | (52,124 | ) |

| Financing activities: | |

| | | |

| | |

| Proceeds from Convertible Promissory Note | |

| — | | |

| 50,000 | |

| Repayment of from Series 2022-1 Notes | |

| — | | |

| (20,833 | ) |

| Payment of financing costs | |

| — | | |

| (354 | ) |

| Proceeds from Business Combination | |

| — | | |

| 2,238 | |

| Proceeds from exercise of stock options | |

| 260 | | |

| 106 | |

| Payment of tax withholdings on stock options | |

| — | | |

| (91 | ) |

| Net cash provided by financing activities | |

$ | 260 | | |

$ | 31,066 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 10,738 | | |

| (25,992 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 4,405 | | |

| 37,717 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 15,143 | | |

$ | 11,725 | |

Tigo Energy, Inc.

Non-GAAP Financial Measures

(in thousands)

(unaudited)

Reconciliation of Net Loss (GAAP) to Adjusted

EBITDA (Non-GAAP)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net loss | |

$ | (11,321 | ) | |

$ | (22,176 | ) | |

$ | (22,827 | ) | |

$ | (15,266 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Total other expenses, net | |

| 2,902 | | |

| 41,774 | | |

| 5,320 | | |

| 42,684 | |

| Income tax expense (benefit) | |

| 16 | | |

| (10,933 | ) | |

| 16 | | |

| (10,933 | ) |

| Depreciation and amortization | |

| 302 | | |

| 294 | | |

| 612 | | |

| 536 | |

| Stock-based compensation | |

| 1,703 | | |

| 497 | | |

| 4,208 | | |

| 863 | |

| M&A transaction expenses | |

| — | | |

| 4,113 | | |

| — | | |

| 4,246 | |

| Adjusted EBITDA | |

$ | (6,398 | ) | |

$ | 13,569 | | |

$ | (12,671 | ) | |

$ | 22,130 | |

We encourage investors and others to review our

financial information in its entirety and not to rely on any single financial measure.

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity File Number |

001-40710

|

| Entity Registrant Name |

Tigo

Energy, Inc.

|

| Entity Central Index Key |

0001855447

|

| Entity Tax Identification Number |

83-3583873

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

655 Campbell Technology Parkway

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

Campbell

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95008

|

| City Area Code |

408

|

| Local Phone Number |

402-0802

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

TYGO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

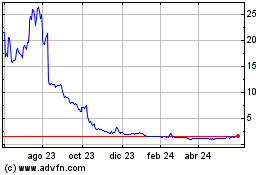

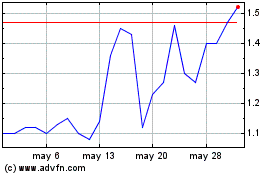

Tigo Energy (NASDAQ:TYGO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Tigo Energy (NASDAQ:TYGO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024