Wetouch Technology Inc. Announces Pricing of $10.8 Million Public Offering of Common Stock and Concurrent Uplisting to the Nasdaq Capital Market

20 Febrero 2024 - 8:45PM

Wetouch Technology Inc. (Nasdaq: WETH ) (“Wetouch” or the

“Company”), a Nevada company, through its wholly-owned subsidiary,

engaged in the research, development, manufacturing, sales and

servicing of projected capacitive touchscreens, announced today the

pricing of an underwritten public offering of 2,160,000 shares of

common stock at a price to the public of $5.00 per share (the

“Offering”). The gross proceeds to the Company from this Offering

are expected to be $10.8 million, prior to deducting offering

expenses, commissions and underwriting discounts. In addition, the

Company granted the underwriters a 45-day option to purchase up to

324,000 additional shares of common stock at the public offering

price per share, less commissions and underwriting discounts. The

Offering is expected to close on February 23, 2024, subject to the

satisfaction of customary closing conditions.

Proceeds from the Offering will be used for the

construction of a new factory, facilities and office buildings, the

purchase of two production lines in the new factory, research and

development, the repayment of convertible promissory notes, and

working capital and general corporate purposes.

The Offering is being conducted on a firm

commitment basis. WestPark Capital, Inc. (“WestPark”), Craft

Capital Management LLC, and R.F. Lafferty & Co., Inc. are the

underwriters for the Offering, with WestPark being the lead book

running manager for the Offering. The Crone Law Group P.C. is

acting as U.S. counsel to the Company and Bevilacqua PLLC is

acting as U.S. counsel to the underwriters in connection

with the Offering.

The Company is also pleased to announce its

common stock has been approved to list on The Nasdaq Capital Market

(“Nasdaq”) under its current “WETH” ticker symbol and is expected

to begin trading on Nasdaq on February 21, 2024.

The shares of common stock described above are

being offered by the Company pursuant to a registration statement

on Form S-1 (File No. 333-270726) that was initially filed by the

Company with the U.S. Securities and Exchange Commission (SEC) on

March 21, 2023 and declared effective by the SEC on February 14,

2024. The Offering is being made only by means of a written

prospectus that forms a part of the registration statement. A

preliminary prospectus relating to the Offering was filed with the

SEC and is available on the SEC’s website located

at http://www.sec.gov. A final prospectus relating to the

Offering will be filed with the SEC. When available, copies of the

final prospectus relating to the Offering may be obtained from

WestPark Capital, Inc., 1800 Century Park East, Suite 220, Los

Angeles, CA 90077, tel: 310-203-2919, e-mail:

jstern@wpcapital.com and will be available on the SEC’s

website.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Wetouch Technology

Inc.

Wetouch Technology Inc. is a holding company

incorporated in Nevada with operations conducted by its

wholly-owned subsidiary engaged in the research, development,

manufacturing, sales and servicing of medium to large sized

projected capacitive touchscreens. The Company specializes in

large-format touchscreens, which are developed and designed for a

wide variety of markets and used in the financial terminals,

automotive, POS, gaming, lottery, medical, HMI, and other

specialized industries.

Forward Looking Statements

This document contains certain “forward-looking

statements”. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and

state securities laws, including, but not limited to, any

projections of earnings, revenue or other financial items; any

statements of the plans, strategies, goals and objectives of

management for future operations; any statements concerning

proposed new products and services or developments thereof; any

statements regarding future economic conditions or performance; any

statements or belief; and any statements of assumptions underlying

any of the foregoing.

Forward looking statements may include the words

“may,” “could,” “estimate,” “intend,” “continue,” “believe,”

“expect” or “anticipate” or other similar words, or the negative

thereof. These forward-looking statements present our estimates and

assumptions only as of the date of this report. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the dates on

which they are made. We do not undertake to update forward-looking

statements to reflect the impact of circumstances or events that

arise after the dates they are made. You should, however, consult

further disclosures and risk factors we include in Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Reports filed on

Form 8-K.

Investor Relations:Core IR+1 516-222-2560

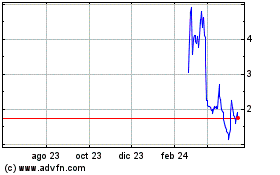

Wetouch Technology (NASDAQ:WETH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

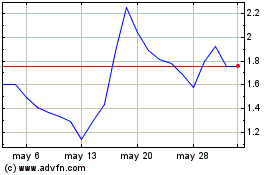

Wetouch Technology (NASDAQ:WETH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024