Form 8-K - Current report

18 Octubre 2023 - 7:19AM

Edgar (US Regulatory)

0001527541FALSE00015275412023-10-182023-10-180001527541us-gaap:CommonStockMember2023-10-182023-10-180001527541us-gaap:SeriesBPreferredStockMember2023-10-182023-10-180001527541us-gaap:SeriesDPreferredStockMember2023-10-182023-10-180001527541us-gaap:ConvertibleSubordinatedDebtMember2023-10-182023-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): October 18, 2023

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 7.01 Regulation FD Disclosure.

On October 18, 2023, Wheeler Real Estate Investment Trust, Inc. (the “Company”) issued a press release announcing that the Company posted to its website simplified versions of the Holder Redemption Notice and the Stock Ownership Statement (together, the “Series D Redemption Forms”) that any holder (a “Series D Preferred Stockholder”) of the Company’s Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) is required to complete and return to the Company if such holder wishes to request that the Company redeem any or all of such holder’s shares of Series D Preferred Stock.

The Company will continue to accept earlier versions of the Series D Redemption Forms that were previously posted to the Company’s website if submitted by a Series D Preferred Stockholder.

A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information included in this Current Report on Form 8-K under this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

For any Series D Preferred Stockholder who wishes to request that the Company redeem any or all of such holder’s shares of Series D Preferred Stock, the Company made simplified forms of the Holder Redemption Notice and the Stock Ownership Statement available on its website at https://ir.whlr.us/series-d/series-d-redemption.

Information contained on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and should not be considered to be part of this Current Report on Form 8-K.

The form of the Holder Redemption Notice and the Stock Ownership Statement are also filed as Exhibits 99.2 and 99.3, respectively, to this Current Report on Form 8-K.

Neither the information included in this Current Report on Form 8-K nor the exhibits hereto shall constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein and therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: October 18, 2023

Exhibit 99.1 USActive 60008689.3 WHEELER POSTS SIMPLIFIED SERIES D REDEMPTION FORMS ON ITS WEBSITE VIRGINIA BEACH, VA - October 18, 2023 - Based on shareholder feedback, Wheeler Real Estate Investment Trust, Inc. (NASDAQ: WHLR) (“Wheeler” or the “Company”) today posted simplified versions of the Holder Redemption Notice and the Stock Ownership Statement (collectively, the “Series D Redemption Forms”) to its website for use by holders of the Company’s Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) who wish to redeem their Series D Preferred Stock. The Company will continue to accept earlier versions of the forms that were previously posted to the Company’s website if submitted by a holder of Series D Preferred Stock. The simplified Series D Redemption Forms are available at https://ir.whlr.us/series-d/series-d- redemption. Any holder of Series D Preferred Stock that has any questions regarding the completion of the Series D Redemption Forms can contact Investor Relations at investorrelations@whlr.us. This press release is for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any of the securities described herein. Contact Investor Relations: (757) 627-9088 Email: investorrelations@whlr.us About Wheeler Real Estate Investment Trust, Inc. Headquartered in Virginia Beach, Virginia, Wheeler Real Estate Investment Trust, Inc. is a fully integrated, self-managed commercial real estate investment trust (REIT) focused on owning and operating income-producing retail properties with a primary focus on grocery-anchored centers. For more information on the Company, please visitwww.whlr.us.

Exhibit 99.2 USActive 59985087.1 SERIES D CUMULATIVE CONVERTIBLE PREFERRED STOCK HOLDER REDEMPTION NOTICE If you are a holder of Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”), you have the right to request that the Company redeem any or all of your shares of Series D Preferred Stock. If you wish to redeem some or all of your Series D Preferred Stock, please complete this Holder Redemption Notice. Please refer to the attached Instructions in completing this Holder Redemption Notice. If you have any questions, please contact Investor Relations at investorrelations@whlr.us. Thank you in advance. Full Redemption Partial Redemption Number of shares of Series D Preferred Stock for redemption Series D Preferred Stock CUSIP 963025606

Investor Name Social Security or Tax ID Co-Investor Name Social Security or Tax ID Address Daytime Phone Number Email Address City, State & Zip Mobile Phone Number Broker Dealer Name Operations Contact Address City, State& Zip Daytime Phone Number Email Address Clearing Firm The undersigned is the owner (or duly authorized agent of the owner) of the shares presented for redemption and is authorized to present the shares for redemption. The shares presented for redemption are eligible for redemption pursuant to the Company's Charter. The shares are fully transferable and have not been assigned, pledged, or otherwise encumbered in any way. The undersigned hereby indemnifies and holds harmless the Company and its officers and directors from and against any liabilities, damages and expenses, including reasonable legal fees, arising out of or in connection with any misrepresentation made herein. Investor Signature Co-Investor Signature Custodian (if Qualified Account) Custodian Signature

INSTRUCTIONS All redemptions of Series D Preferred Stock will be at the redemption price of $25.00 per share, plus an amount equal to all accrued but unpaid dividends on Series D Preferred Stock to and including the Holder Redemption Date (the "Holder Redemption Price"). At the Company's option, the Holder Redemption Price will be paid in cash, in equal value of shares of the Company's common stock, or in any combination of cash and common stock. Redemptions Payable in Common Stock. Redemptions in the Company's common stock will be based on the volume weighted average price per share of common stock for the ten consecutive trading days immediately preceding (but not including) the Holder Redemption Date. You must coordinate with your broker to initiate the transfer through DTCC's platform, PTOP. Physical certificates will not be issued. Delivery of common stock will be made as soon as possible after the Holder Redemption Date in accordance with customary settlement cycles. Fractional shares of common stock will not be issued and instead you will receive a check in the amount of the cash value of any entitlement to fractional shares. Redemptions Payable in Cash. Cash redemption proceeds will be sent to you based upon instructions provided in this Holder Redemption Notice for delivery to your brokerage account. The default payment method is via check. A wire can be requested but a $100 processing fee will be deducted from the payment to the stockholder; ACH is not permitted. Please note that all redemption requests must include a completed Holder Redemption Notice and Stock Ownership Statement. If you request to redeem shares of Series D Preferred Stock that are held in more than one account, a Holder Redemption Notice and Ownership Statement must be completed for each account. Please send all paperwork to either of the following physical addresses or the email address for the Company listed below: Regular Mail Delivery: Computershare Attn: Corp Action Voluntary PO Box 43011 Providence, RI 02940-3011 OR Overnight Mail Delivery: Computershare Attn: Corp Action Voluntary 150 Royall Street Suite V Canton, MA 02021 OR Email: Wheeler Real Estate Investment Trust, Inc. Attention: Investor Relations investorrelations@whlr.us the month (the "Redemption Request Date"), and (ii) arrange for their broker to submit instructions for each redemption to Stockholders who wish to withdraw their redemption requests must do so by delivering a written notice of withdrawal to the Company and Computershare on or before the Redemption Request Date. The Company intends to pay the Holder Redemption Price in equal value of shares of the Company's common stock. Accordingly, requests for redemptions payable in cash will not be processed and will be returned.

Exhibit 99.3 SERIES D CUMULATIVE CONVERTIBLE PREFERRED STOCK STOCK OWNERSHIP STATEMENT Please refer to the attached Instructions and Definitions in completing this Stock Ownership Statement. If you have any questions, please contact Investor Relations at investorrelations@whlr.us. Thank you in advance. Stockholder Information Name of Stockholder Stockholder Address Contact Person (if Entity): Contact Phone Number: Contact Email Address: I certify that the above‐named holder Actually owns less than 2% of any class of Company Stock and no Convertible Notes.1 (You may skip parts B and C.) Number of Shares or Class Notes Actually Owned Number of Shares or Notes Constructively Owned Common Stock Common (WHLR) Preferred Stock Series B (WHLRP) Series D (WHLRD) Convertible Notes Convertible Notes (WHLRL) 1 Information on the number of outstanding shares of each class of Company Stock can be found at this address: https://ir.whlr.us/series‐d/series‐d‐redemption

2 WWW.WHLR.US (Do not complete if you are an Individual) I certify, after due inquiry and investigation, that (choose one): No Person Constructively owns more than 10% of any class of Company Stock or Convertible Notes that are Actually or Constructively owned by the above‐named holder. The Persons listed below are all of the Persons considered as Constructively owning the following number of shares of Company Stock and Convertible Notes by reason of the above‐named holder’s Actual or Constructive ownership of Company Stock or Convertible Notes (list one Person per line; attach additional pages if necessary): Name of Person Number of Shares or Notes Constructively Owned Common Stock (WHLR) Series B Preferred Stock (WHLRP) Series D Preferred Stock (WHLRD) Convertible Notes (WHLRL) The undersigned stockholder hereby certifies that he or she has read the Ownership Statement Instructions and Definitions and that the answers as set forth herein or upon separate pages attached hereto are true and correct as of the date set forth below: Signature Date Print Name Please return a completed and signed copy of this Ownership Statement with your Holder Redemption Notice.

3 WWW.WHLR.US INSTRUCTIONS Background The Articles of Amendment and Restatement of Wheeler Real Estate Investment Trust, Inc. (the “Company”) filed with the State Department of Assessments and Taxation of Maryland on August 5, 2016, as the same has to date been, and may in the future be, amended, restated, supplemented, and/or corrected (the “Charter”) limit the ability of any person to hold (directly or through certain attribution rules) more than 9.8% of the Company’s capital stock (the “Aggregate Stock Ownership Limit”) or common stock (the “Common Stock Ownership Limit”) in order to maintain the Company’s qualification as a real estate investment trust (“REIT”). To monitor compliance with these requirements, we ask that you complete and return this Stock Ownership Statement (the “Ownership Statement”) with your Holder Redemption Notice available at https://ir.whlr.us/series-d/series-d- redemption. Excepted Holder Limits. Following receipt and review of your Ownership Statement, the Company may request additional information prior to determining whether to issue any Common Stock in redemption of your Series D Cumulative Convertible Preferred Stock (“Series D Preferred Stock”). If, following the receipt of your completed Ownership Statement, together with your response to any requests for additional information, the Company determines that a redemption of your Series D Preferred Stock for Common Stock would cause your actual or constructive ownership (or that of any Person, as defined in the Annex) to exceed the Aggregate Stock Ownership Limit or Common Stock Ownership Limit, you will be required to obtain an exception to the applicable limitation from the Company’s Board of Directors and (if that exception is granted) enter into an Excepted Holder Agreement with the Company before any shares of Common Stock can be issued in respect of your redemption of Series D Preferred Stock. The Company reserves all rights granted to it under the Charter to monitor and enforce compliance with the Aggregate Stock Ownership Limit, the Common Stock Ownership Limit or the provisions of the Code (as defined below) governing its qualification as a REIT. Instructions Please complete the Ownership Statement in accordance with the instructions below. Please refer to the “Definitions” annex for definitions of capitalized terms used in the Ownership Statement and these instructions. Stockholder Information. Each stockholder should provide its name and address, the name of a contact person (if the stockholder is an Entity), and a phone number and email address where the stockholder (or its contact person) can be reached. Part A. Stockholders that Actually own (a) less than 2% of each class of Company Stock and (b) no convertible notes are exempt from completing Parts B and C. Information on the number of outstanding shares of each class of Company Stock can be found at this address: https://ir.whlr.us/series-d/series-d-redemption. If you are exempt, please check the box in Part A certifying that you meet the requirements for this exemption, skip parts B and C, and sign and date the Ownership Statement. Part B. All non‐exempt stockholders should complete Part B of the Ownership Statement. In the first column, report the number of shares of the applicable class of Company Stock or Convertible Notes you Actually own. In the second column, report the number of shares of the applicable class of Company Stock or Convertible Notes that you A Holder Redemption Notice will not be considered complete—and will not be processed—unless it is accompanied by a completed Ownership Statement. THE INFORMATION PROVIDED ON THE OWNERSHIP STATEMENT WILL BE USED FOR THE SOLE PURPOSE OF THE COMPANY MONITORING COMPLIANCE WITH THE REQUIREMENTS NOTED ABOVE AND WILL NOT BE PUBLICLY DISCLOSED.

4 WWW.WHLR.US Constructively own, based on the rules set forth below. Part C. If you are an Entity, you should also complete Part C of the Ownership Statement with respect to each of your 10% Constructive Owners. In the first column, list the name of each 10% Constructive Owner. In the remaining columns, report the number of shares of the applicable class of Company Stock or Convertible Notes that are Constructively owned by such 10% Constructive Owner. In both Parts B and C, calculate the number of shares of Company Stock and Convertible Notes you and any 10% Constructive Owner Actually or Constructively own without regard to any redemption pursuant to the Holder Redemption Notice with which you are including this Ownership Statement. Please send all paperwork to either of the following physical addresses or the email address for the Company listed below: Regular Mail Delivery: OR Overnight Mail Delivery: OR Email: Computershare Attn: Corp Action Voluntary PO Box 43011 Providence, RI 02940‐3011 Computershare Attn: Corp Action Voluntary 150 Royall Street Suite V Canton, MA 02021 Wheeler Real Estate Investment Trust, Inc. Attention: Investor Relations investorrelations@whlr.us If you have any questions regarding the completion of your Ownership Statement, please contact Investor Relations at investorrelations@whlr.us. Thank you in advance for your cooperation in this matter.

5 WWW.WHLR.US DEFINITIONS You are considered as “Actually” owning the number of shares of Company Stock and Convertible Notes that you are treated as owning for U.S. federal income tax purposes (without regard to the rules of attributed or constructive ownership that follow). You should apply the following rules to determine the number of shares of Company Stock or Convertible Notes that are “Constructively” owned by you and, if you are an Entity, each of your 10% Constructive Owners: (1) Shares of any class of Company Stock or Convertible Notes owned by an Entity are considered as being owned proportionately by that Entity’s stockholders, partners, or beneficiaries. (2) If, after the application of the rule in paragraph (1), an Entity is considered as owning more than 5% of the Company Stock or Convertible Notes owned by you, then the rule in paragraph (1) is continually reapplied until all shares of each class of Company Stock or Convertible Notes owned by that Entity are considered as owned by (A) an Individual, (B) an organization exempt from federal income tax under Code section 501(a), or (C) an Entity whose stockholders, partners, or beneficiaries you are unable to determine after the exercise of reasonable diligence. (3) An Individual who Actually owns Company Stock or Convertible Notes, or is considered as owning Company Stock or Convertible Notes by the application of paragraphs (1) and (2), is considered as owning all the shares of Company Stock and Convertible Notes Actually owned by each member of that Individual’s Family or treated as owned by any member of that Individual’s Family after the application of paragraphs (1) and (2). (4) Each member of the Family of an Individual who Actually owns Company Stock or Convertible Notes, or is considered as owning Company Stock or Convertible Notes by the application of paragraphs (1) and (2), is considered as owning all the shares of Company Stock and Convertible Notes Actually owned by that Individual or treated as owned by that Individual after the application of paragraphs (1) and (2). (5) The rules in paragraphs (3) and (4) are not reapplied to then treat another individual as the owner of any shares of Company Stock and Convertible Notes which are considered as owned by any individual by application of those paragraphs. For purposes of applying these constructive ownership rules, terms beginning in capitalized letters have the following meanings: • If you are an Entity, your “10% Constructive Owners” are the Persons considered as Constructively owning, after the application of all the rules in paragraphs (1) through (5) above, at least 10% of the shares of any class of Company Stock or Convertible Notes owned by you. The “Code” means the United States Internal Revenue Code of 1986, as amended, and the Treasury Regulations and rulings promulgated thereunder. • “Company Stock” includes Common Stock, Series B Convertible Preferred Stock (“Series B Preferred Stock”), and Series D Preferred Stock. • “Convertible Notes” mean the Company’s 7.00% Subordinated Convertible Notes. • An “Entity” means a corporation, partnership, estate, Retirement Plan, or trust (other than certain trusts considered to be Individuals).

6 WWW.WHLR.US • Members of an individual’s “Family” include the Individual’s spouse, brothers and sisters (whether by the whole or half‐blood, but excluding brothers and sisters‐in‐law), ancestors, and lineal descendants. • An “Individual” means an individual, a trust or a portion of a trust permanently set aside for charitable purposes (as described by Code section 642(c)), a private foundation (as defined by Code section 509(a)), and certain Retirement Plans described by Code section 856(h)(3)(A)(ii). • A “Person” means an Individual or an Entity. • A “Retirement Plan” is a trust described in Code section 401(a) that is exempt from federal income tax pursuant to Code section 501(a). • “You” and “Your” refer to the stockholder completing this Ownership Statement.

v3.23.3

Cover

|

Oct. 18, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 18, 2023

|

| Entity Registrant Name |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35713

|

| Entity Tax Identification Number |

45-2681082

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001527541

|

| Amendment Flag |

false

|

| Common Stock, $0.01 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

WHLR

|

| Security Exchange Name |

NASDAQ

|

| Series B Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series B Convertible Preferred Stock

|

| Trading Symbol |

WHLRP

|

| Security Exchange Name |

NASDAQ

|

| Series D Cumulative Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series D Cumulative Convertible Preferred Stock

|

| Trading Symbol |

WHLRD

|

| Security Exchange Name |

NASDAQ

|

| 7.00% Subordinated Convertible Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Subordinated Convertible Notes due 2031

|

| Trading Symbol |

WHLRL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_ConvertibleSubordinatedDebtMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

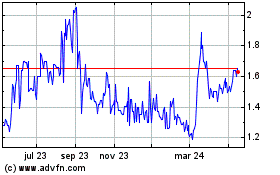

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

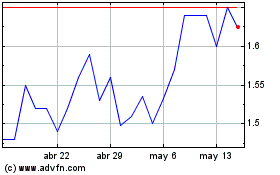

De Abr 2024 a May 2024

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

De May 2023 a May 2024