PRELIMINARY

OFFERING CIRCULAR DATED JULY 22, 2024

An

Offering Circular pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information

contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers

to buy be accepted before the Offering Circular filed with the Commission is qualified. This Preliminary Offering Circular shall not

constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which

such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect

to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the Offering Circular in which such Final Offering Circular

was filed may be obtained.

OFFERING

CIRCULAR

WORKSPORT

LTD.

Up

to 16,025,642 Shares of Common Stock

Up

to 16,025,642 Pre-Funded Warrants

Up

to 16,025,642 Shares of Common Stock Underlying Such Pre-Funded Warrants

By

this offering circular (the “Offering Circular”), Worksport Ltd., a Nevada corporation, is offering on a “best-efforts”

basis up to 16,025,642 shares of common stock (“Shares”). The offering price per Share at a fixed price between $0.72 to

$1.56 (to be fixed by post-qualification supplement). The minimum investment established for each investor is $1,000, though we reserve

the right to accept a subscription for a lesser amount at our sole discretion. This offering is being made pursuant to Tier 2 of Regulation

A of the Securities Act of 1933, as amended (the “Securities Act”).

We

are also offering the opportunity to purchase, if the purchaser so chooses and in lieu of Shares, up to 16,025,642 pre-funded warrants

(the “Pre-Funded Warrants” and, together with the Shares, the “Securities”) to purchasers whose purchase of Shares

in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning

more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the closing. Each

Pre-Funded Warrant will be exercisable for one share of our common stock. The purchase price of each Pre-Funded Warrant is equal to the

price per Share being sold to the public in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant is $0.01 per

share. The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants

are exercised in full.

For

each Pre-Funded Warrant we sell, the number of Shares we are offering will be decreased on a one-for-one basis. Unless otherwise stated

herein, we are using an assumed offering price of $1.56 (the high point of the range) per Share and an offering price of $1.55 per Pre-Funded

Warrant (the high point of the range).There is no trading market for the Pre-Funded Warrants and we do not intend to apply to have the

Pre-Funded Warrants listed on any securities exchange or quoted on any inter-dealer quotation system. This offering also relates to the

shares of common stock issuable upon exercise of the Pre-Funded Warrants.

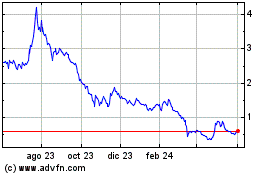

Our

common stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “WKSP.” On July 19, 2024, the

last reported sale price of our common stock was $0.6650 per share.

This

offering is being conducted on a “best-efforts” basis, which means that there is no minimum number of Securities that must

be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. There is no escrow account

or trust account for this offering. All proceeds from this offering will become immediately available to us and may be used as they are

accepted. Purchasers of the Securities will not be entitled to a refund and could lose their entire investments. Please see the “Risk

Factors” section, beginning on page 11, for a discussion of the risks associated with a purchase of the Securities.

We

are a “controlled company” as defined under the corporate governance rules of Nasdaq because our Chief Executive Officer,

President and Chairman of the Board of Directors, Steven Rossi, has 100% of our outstanding Series A Preferred Stock which is entitled

to vote with common stock, except as provided by law, and has 51% control. As a “controlled company,” we are permitted to

elect to rely on certain exemptions from Nasdaq’s corporate governance rules. We do not plan to rely on these exemptions, but we

may elect to do so in the future. Please read “Prospectus Summary—Implications of Being a Controlled Company,”

beginning on page 6 of this prospectus for more information.

We

estimate that this offering will commence within two days of the Form 1-A of which this Offering Circular is a part is qualified by the

SEC qualification. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) one

year from the date of SEC qualification, or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

See “Plan of Distribution.”

| | |

Price Per Share of Common Stock(1) | | |

Price Per Pre-Funded Warrant(2) | | |

Total | |

| Public Offering Price (Assumed) | |

$ | 1.56 | | |

$ | 1.55 | | |

$ | 25,000,000 | |

| Commissions(3) | |

$ | 0.1092 | | |

$ | 0.1085 | | |

$ | 1,750,000 | |

| Proceeds to Worksport Ltd. | |

$ | 1.4508 | | |

$ | 1.4415 | | |

$ | 23,250,000 | (4) |

| (1) |

Assumes

a public offering price of $1.56 per Share, which represents the high point of the offering price range of $0.72 to $1.56 per share. |

| (2) |

Assumes

a public offering price of $1.55 per Pre-Funded Warrant, which represents the high point of the offering price range of $0.71 to

$1.55 per Pre-Funded Warrant. |

| (3) |

The

Company has engaged DealMaker Securities, LLC, member FINRA/SIPC (the “Broker”), as broker-dealer of record, to perform

broker-dealer administrative and compliance related functions in connection with this Offering, and to organize other broker-dealers

to make the Offering available to investors (“Participating Brokers”), but not for underwriting or placement agent services.

Once the Commission has qualified the Offering Statement and this Offering commences, the Broker will receive a cash commission equal

to seven percent (7%) of the amount raised in the Offering, which will also be used to compensate Participating Brokers. The Broker

and its affiliates will receive certain other compensation. See “Plan of Distribution” for more details. The maximum

fees for Broker, its affiliates and Participating Brokers is $2,151,000 (8.60%). |

| (4) |

Does

not account for the payment of expenses of this offering estimated at $200,000. See “Plan of Distribution.” |

You

should purchase Securities only if you can afford a complete loss of your investment. See “Risk Factors,” beginning

on page 11, for a discussion of certain risks that you should consider before purchasing any of the Securities.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR

THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS.

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN

INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The

use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about

the benefits you will receive from an investment in the Securities.

No

sale may be made to you in this offering if you do not satisfy the investor suitability standards described in this Offering Circular

under “Plan of Distribution—State Law Exemption and Offerings to ‘Qualified Purchasers’” on page

37. Before making any representation that you satisfy the established investor suitability standards, we encourage you to

review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to https://www.investor.gov.

This

Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The

date of this Offering Circular is _______________, 2024.

TABLE

OF CONTENTS

ABOUT

THIS OFFERING CIRCULAR

In

this Offering Circular, unless otherwise noted, references to “Worksport,” the “Company,” “we,” “us,”

and “our” refer to Worksport Ltd., a Nevada corporation, and our subsidiaries.

Neither

we nor any of our officers, directors, agents, or representatives make any representation to you about the legality of an investment

in our securities. You should not interpret the contents of this Offering Circular or any free writing Offering Circular to be legal,

business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the

legal, tax, business, financial and other issues that you should consider before investing in our securities. You should rely only on

the information contained in this Offering Circular or in any Offering Circular supplement that we may authorize to be delivered or made

available to you. We have not authorized anyone to provide you with different information. The information in this Offering Circular

is accurate only as of the date hereof, regardless of the time of its delivery or any sale of the Securities.

OFFERING

CIRCULAR SUMMARY

The

following summary highlights material information contained in this Offering Circular. This summary does not contain all the information

you should consider before purchasing our securities. Before making an investment decision, you should read this Offering Circular carefully,

including the section entitled “Risk Factors” and the consolidated financial statements and the notes thereto. Worksport

Ltd. and its consolidated subsidiaries are referred to herein as “Worksport,” “the Company,” “we,”

“us,” and “our,” unless the context indicates otherwise.

Overview

We

design, develop, and manufacture innovative products for various markets, including automotive accessories, consumer electronics, and

both residential and commercial HVAC system markets. We are able monetize and protect our products through a large and growing intellectual

property portfolio with patents and trademarks relating to, among other things, tonneau covers, solar-integrated tonneau covers, portable

power stations, NP (non-parasitic) hydrogen-based green energy systems, residential heating and cooling systems (heat pumps), and electric

vehicle charging stations. We seek to provide consumers with next-generation automotive accessories through the production of our innovative

line of tonneau covers for light trucks while capitalizing on growing consumer interest in clean energy solutions and power grid independence

through the launch of our forthcoming solar tonneau cover (Worksport SOLIS) and mobile battery generator system (Worksport COR). Our

subsidiary, TerraVis Energy, is poised to revolutionize the local and global markets for efficient home and commercial heat pumps through

its groundbreaking TerraVis Energy Aetherlux. This prototype heat pump, currently under rigorous development, showcases exceptional early

test results that underscore its remarkable efficiency in heating and cooling across both extreme hot and cold climates.

Products

We

offer soft- and hard-folding tonneau covers and energy products. Our soft covers have a patented quick latch system and UV-protected

vinyl material. Our hardcovers are made of ultra-thick, formed aluminum and have a low-profile design. Our energy products include the

SOLIS tonneau cover and COR energy storage system, which can be sold with a Maximum Power Point Tracking (MPPT) system. This kit converts

pickup trucks into mobile microgrid power stations.

Worksport

SOLIS

SOLIS,

a unique tonneau cover, features integrated solar panels, generating 170-180 watts per square meter. It is designed to be sold as an

OEM product and can be integrated into electric pickup trucks. SOLIS generates approximately 460 watts on a RAM 6’5” truck

bed. It can provide an estimated 5.6 miles of additional range per day to electric pickup trucks.

Worksport

COR

The

COR energy storage system (“COR”) is a portable power station designed to be mounted onto pickup truck beds with a 120V AC

inverter and up to 6kWh of energy storage. It allows for battery swapping without a drop in power output for 15 seconds at 3000W and

can be used for various activities. It can be purchased separately or with the SOLIS tonneau cover and is Worksport’s first product

in the energy storage market.

Nasdaq

Letter

On

April 19, 2024, we received written notice from The Nasdaq Stock Market LLC (“Nasdaq”) informing us that we had failed to

maintain a minimum bid price of at least $1.00 per share for the prior 30 consecutive trading day period from March 7, 2024 to April

18, 2024, based upon the closing bid price for its common stock as required by Nasdaq Listing Rule 5550(a)(2).

Pursuant

to Nasdaq Listing Rule 5810(c)(3)(A), we have 180 calendar days, or until October 16, 2024, to regain compliance with the minimum bid

requirement under Nasdaq Listing Rule 5550(a)(2). During the compliance period, our common stock will continue to be listed and traded

on The Nasdaq Capital Market. To regain compliance, the closing bid price of our common stock must meet or exceed $1.00 per share for

a minimum of 10 consecutive trading days prior to October 16, 2024.

In

the event we do not regain compliance during the compliance period, we may be eligible for an additional 180 calendar days to comply

with Nasdaq Listing Rule 5550(a)(2), subject to us satisfying the continued listing requirements for the market value of publicly held

shares and all other initial listing standards for The Nasdaq Capital Market with the exception of the bid price requirement, subject

to Nasdaq’s approval.

The

notice from Nasdaq has no immediate effect on the listing of our common stock, and our common stock will continue to be listed on The

Nasdaq Capital Market under the symbol “WKSP.”

Recent

Offerings

May

2024 Inducement Letter; New Warrants

On

May 29, 2024, we entered into an Inducement Letter with a certain investor who had purchased warrants on November 2, 2023 (the “Existing

Warrants”), exercisable for 7,000,000 shares of our common stock for $1.34 per share. As part of the agreement, the investor exercised

their Existing Warrants to buy 7,000,000 shares of our common stock at a reduced price of $0.5198 per share. In consideration for the

investor exercising the Existing Warrants, we issued the investor warrants (the “New Warrants”) to purchase 12,950,000 shares

of our common stock for $0.5198 per share, subject to

adjustment for stock splits, recapitalizations, and reorganizations and beneficial ownership limitations as described therein (or

via a cashless exercise in the event there is not a registration statement effective at the time of exercise). Each New Warrant

is exercisable six months after issuance, or November 29, 2024, until five and a half-year anniversary from the date of issuance. We

received net proceeds of $3,363,898, after deducting commissions and expenses, upon the exercise of the Existing Warrants. If all of

the New Warrants are exercised for cash, we will receive gross proceeds of approximately $6.7 million. We

filed a registration statement on Form S-1 (File No. 333-280676) registering the shares of common stock issuable upon the exercise of

the New Warrants. The SEC declared the registration statement effective on July 12, 2024. The New Warrants can be exercised on a cashless

basis if there is not an effective registration statement effective or prospectus available for the shares of common stock underlying

the such warrants.

March

2024 Direct Offering and Concurrent Private Offering

On

March 18, 2024, we entered into a securities purchase agreement (the “2024 Securities Purchase Agreement”) with a certain

institutional investor (the “2024 Purchaser”) pursuant to which we sold, in a registered direct offering, an aggregate of

(i) 2,372,240 shares (the “2024 Shares”) of common stock and (ii) 1,477,892 Pre-Funded Warrants (the “2024 Pre-Funded

Warrants”) to purchase up to 1,477,892 shares of common stock (the “2024 Pre-Funded Warrant Shares”). The offering

price per 2024 Share was $0.74, and the offering price per 2024 Pre-Funded Warrant was $0.7399.

The

2024 Shares, the 2024 Pre-Funded Warrants and the 2024 Pre-Funded Warrants Shares were offered pursuant to our Form S-3 Registration

Statement (File No. 333-267696) (the “Form S-3”) as supplemented by a prospectus supplement and accompanying base prospectus

dated March 18, 2024, filed with the SEC on March 19, 2024 pursuant to Rule 424(b)(5) promulgated under the Securities Act. The registered

direct offering closed on March 20, 2024.

We

received net proceeds of approximately $2.59 million from the offering, after deducting the estimated offering expenses payable by us,

including the tail fees payable to Maxim Group LLC. We intend to use the net proceeds from the offering for general corporate purposes,

including working capital.

In

a concurrent private placement, we issued the 2024 Purchaser warrants to purchase an aggregate of 7,700,264

shares of common stock for $0.74 per share. Under the warrants, we are obligated to register the shares underlying the warrants

on a registration statement on Form S-3 (or other applicable form). If at the time, there is no effective registration statement available

for the shares of common stock underlying the warrants, the warrants may be exercised via a “cashless exercise.” We will

not receive any proceeds from any warrants exercised by a “cashless exercise.”

March

2024 S-3 Shelf Bringdown

On

March 20, 2024, we received net proceeds of approximately $2.63 million through a registered direct offering pursuant to which the Company

issued 2,372,240 shares of common stock and 1,477,892 Pre-Funded Warrants to the same institutional investor as in the Company’s

registered direct offering on November 2, 2023. Concurrently with the registered direct offering, we issued the institutional investor

7,700,264 warrants in a private sale. The warrants are exercisable for 7,700,264 shares of common stock for $0.74 per share six months

after issuance until five and a half years from the issuance date, subject to beneficial ownership limitations as described in the warrants.

We. registered the 7,700,264 shares of common stock underlying the warrants on a Form S-1 (333-278461) which was declared effective by

the SEC on April 8, 2024.

November

2023 S-3 Shelf Bringdown

On

November 2, 2023, we received net proceeds of approximately $4.26 million through a registered direct offering pursuant to which we issued

1,925,000 shares of common stock and 1,575,000 Pre-Funded Warrants to an institutional investor. Concurrently with the registered direct

offering, we issued the same institutional investor 7,000,000 warrants in a private sale. The warrants are exercisable for 7,000,000

shares of common stock for $1.34 per share six months after issuance and until five and a half years from the issuance date, subject

to beneficial ownership limitations as described in the warrants. The Company registered the 7,000,000 shares of common stock underlying

the warrants on a Form S-1 (333-276241) which was declared effective by the SEC on December 29, 2023.

Recent

Business Developments

The

following highlights recent material developments in our business:

| ● | On

July 11, 2024, we announced a new dealer portal, and provided an update on Worksport business-to-business

sales. Visit www.worksportdealer.com for more information. |

| | | |

| ● | On

June 26, 2024, we announced a development in our maximum power point tracking (MPPT) algorithm

that greatly expands the compatibility and complementarity of our SOLIS Solar Tonneau Cover

such that it can be used with a diverse array of portable power stations and power banks. |

| | | |

| ● | On

June 20, 2024, we announced a record sales month for the Company, achieving $739,417 in single-month

sales for May 2024 (unaudited). May 2024 sales were 332% higher than the monthly average

of Q1 2024, underscoring Worksport’s rapidly growing sales trajectory. |

| | | |

| ● | On

June 5, 2024, we announced the formation of a sales partnership with a prominent Midwest

distributor within the automotive industry. |

| | | |

| ● | On

May 29, 2024, we announced the issuance of a new utility patent from the United States Patent

& Trademark Office related to our highly anticipated SOLIS Solar Tonneau Cover. The patent

covers an innovative design that enhances the efficiency and energy capture capabilities

of the SOLIS. |

| | | |

| ● | On

May 8, 2024, we announced the awarding of a grant worth up to $2.8MM from the State of New

York through its Excelsior Jobs Program for job creation and wage support. Combined with

an electricity subsidy awarded through the New York Power Authority, these grants partially

offset operational costs incurred as Worksport increases its manufacturing presence in New

York. |

| | | |

| ● | On

March 28, 2024, we announced receipt of solar panels required to begin production of the

highly anticipated SOLIS Solar Tonneau Cover. This milestone marks a significant step forward,

allowing the Company to begin initial production of the SOLIS Solar Tonneau Cover. |

| | | |

| ● | On

February 23, 2024, we announced a new arrangement with Dix Performance North, Canada’s

leading wholesaler of aftermarket car and truck products, for Dix to include our tonneau

covers in their catalog. This strategic alliance is expected to make the Company’s

range of covers widely available throughout Canada, accelerate our growth, and contribute

to significant sales and revenue increases. |

| | | |

| ● | On

February 7, 2024, we announced a collaboration with Infineon Technologies AG (FSE: IFX /

OTCQX: IFNNY) pursuant to which we will use Infineon’s GaN power semiconductors GS-065-060-5-B-A

in the converters for our portable power stations to increase efficiency and power density. |

| | | |

| ● | On

January 3, 2024, we announced our strategic arrangement with NeuronicWorks Inc., a Toronto-based

high-tech custom electronic product development and manufacturing company, to manufacture

and assemble our COR battery system in preparation for the system’s anticipated Alpha

release. |

Manufacturing

Our

manufacturing updates reflect our commitment to quality and expansion. We outsource the production of our soft tonneau covers to a facility

in Meizhou, China, as well as to a second facility in Foshan, China, which we began to utilize for increased output in late 2023. We

have also diversified our list of raw material suppliers and, in May 2022, acquired and set up a state-of-the-art partially automated

production facility in West Seneca, New York for domestic manufacturing. In 2023, we initiated early production of our first hard folding

tonneau cover (made in the USA with domestic and foreign parts), the Worksport AL3 Pro; it is now in active production for most major

makes and models of light trucks in North America. These updates demonstrate our dedication to meeting the growing demand for our products.

Intellectual

Property

As

of July 22, 2024, our patent portfolio consists of fifteen (15) issued utility patents and thirty-five (31) pending utility patent applications

in various jurisdictions worldwide. Our portfolio further includes eleven (11) design registrations and forty-five (45) pending design

applications in various jurisdictions worldwide. We are also in the process of preparing and filing several other utility and design

patent applications across relevant countries and jurisdictions.

As

of July 22, 2024, the Company has thirty-six (36) trademark registrations and fifteen (15) pending trademark applications in various

jurisdictions worldwide.

Our

Markets

We

primarily compete in the Automotive Aftermarket Accessories and New Energy industries with a focus on the Tonneau Cover and the Portable

Power Station Markets.

Tonneau

Cover Market

We

offer various types of tonneau covers, primarily focusing on developing affordable and high-functioning soft and hard folding covers.

The demand for pickup truck accessories is expected to grow, with electric pickup trucks gaining popularity. Our covers cater to the

market for truck beds and utility modifications and are sold through various channels, including direct-to-consumer and retailer/dealer

sales. The pickup truck market in North America is projected to see significant growth, and our SOLIS cover addresses the need for charging

infrastructure for electric pickup trucks. The specialty automotive aftermarket is subject to consumer spending trends, which may affect

sales of accessories like tonneau covers. Our covers are popular among pickup truck owners who use their vehicles for work, travel, outdoor

recreation, and off-roading. They are sold through various channels, including online retailers and direct sales to consumers.

Portable

Power Station Market

The

Portable Power Station Market is a young and globalized industry. It is expected to grow from $4.49 billion to $6.13 billion by 2032

at a compound annual growth rate of 3.90%1. North America’s market is currently valued at $1.28 billion with a 3.8%

compound annual growth rate2. When paired with the SOLIS cover, we believe the COR energy storage system will be unique in

that it can be safely charged while in motion.

1Source:

Precedence Research. Portable Power Station Market. Retrieved from https://www.precedenceresearch.com/portable-power-station-market

2Source:

Market Research Future. Global Portable Power Station Market Research Report. 2023.

Distribution

Our

tonneau covers are distributed through wholesalers, private labels, distributors, and online retail channels, including eBay, Amazon,

Walmart, and our own e-commerce platform. We are also pursuing relationships with Original Equipment Manufacturers. Our customers include

master warehouse distributors, big box stores, dealers, wholesalers, and retail end consumers.

Competition

Tonneau

Cover Competitors

The

Tonneau Cover market is dominated by Real Truck, but we compete with other brands such as Truck Accessories Group, Agricover, Truck Covers

U.S., and Paragon. We aim to gain market share by being independent, innovative, lean, and competitively priced. Our small sales and

customer support teams focus on building strong relationships and enforcing MAP policies. Our SOLIS cover offers unique features and

potential partnerships with electric truck manufacturers.

Portable

Power Station Competitors

The

Portable Power Station market is global and highly fragmented, with numerous competitors such as EcoFlow, Alpha ESS Co., Ltd., Anker

Technology, and Bluetti. Our strategy is to focus on one Portable Power Station and offer modular batteries for consumers to customize

their stored energy capacity and upgrade over time.

At

Worksport, we differentiate ourselves from our competitors through innovation, quality, onshoring, and customer focus. We believe our

unique selling propositions, such as the SOLIS solar tonneau cover and the COR portable power station, set us apart in the market by

offering integrated solutions that address the growing demand for renewable energy and sustainable products. Unlike others, we have successfully

leveraged cutting-edge technology to transform traditional pickup truck accessories into multifunctional tools that enhance the utility

and efficiency of vehicles. Our commitment to sustainability is not just a business strategy but a core value that resonates with environmentally

conscious consumers. Moreover, our agile business model and strategic partnerships enable us to quickly adapt to industry trends and

consumer needs, ensuring we stay ahead of the curve. In a market dominated by conventional products, Worksport stands out as a forward-thinking

brand that delivers innovative, high-quality solutions designed to meet the evolving demands of modern consumers and the environment.

Supply

of Components

Our

soft and hard tonneau cover production requires various components such as plastics, rubber, foam, aluminum, and metal. We have a diverse

supplier network in countries like the United States, the People’s Republic of China, Romania, Spain, Turkey, and Canada. We are

also expanding our supply chain to include countries like Malaysia, Hungary, Czech Republic, Estonia, Latvia, Slovakia, Bulgaria, Vietnam,

Thailand, Poland, Finland, Italy, and Lithuania. We are actively reducing our reliance on countries with potential geopolitical risks.

Research

and Development

We

continually invest in research and development, acquiring new assets and developing unique tonneau cover designs and sustainable materials.

Our electrical engineering department continuously sources raw materials, such as solar panels, and develops portable energy storage

solutions. Our subsidiary, TerraVis Energy, Inc., researches green energy solutions for homes, communities, and Electric Vehicle DC charging

and heat-pump technologies.

Going

Concern

We

have incurred significant losses since our inception and have generated only limited revenues. For the three months ended March 31, 2024,

we had a net loss of $3,714,657. As of March 31, 2024, we had $3,536,980 in cash and cash equivalents

and an accumulated deficit of $52,027,834. For the fiscal year ended December 31, 2023,

we had a net loss of $3,523,270. As of December 31, 2023, we had $10,489,214 in cash

and cash equivalents and an accumulated deficit of $48,313,177. Since our inception in fiscal

year 2014, we have never generated a profit.

These

factors, among others, raise substantial doubt as to our ability to continue as a going concern. Our continuation as a going concern

is dependent upon our ability to generate positive cash flows from operations and to secure additional sources of equity and/or debt

financing. Despite our intention to fund operations through equity and debt financing arrangements, there is no assurance that such financing

will be available on terms acceptable to the Company, if at all. See “Risk Factors—Our independent registered public

accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a

“going concern” and “Management’s Discussion and Analysis of Financial Condition—Liquidity and Capital

Resources.”

Our

Corporate Information

Our

principal corporate office and manufacturing, storage, and distribution facility is located at 2500 N. America Dr., West Seneca, NY 14224.

Our main telephone number is (888) 554-8789, and our main website is www.worksport.com. The contents of our website are not incorporated

by reference into this Offering Circular.

We

are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and

in accordance therewith, we file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC

maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC. The address of the SEC’s website is www.sec.gov. We make available free of charge on or through our website our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material

with or otherwise furnish it to the SEC. Information on or accessed through our website or the SEC’s website is not incorporated

into this Offering Circular.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. We will continue to be

a “smaller reporting company” until we have $250 million or more in public float (based on our common stock) measured as

of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float (based on our

common stock) or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during

the most recently completed fiscal year.

We

may choose to take advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in

this Offering Circular. Accordingly, the information contained herein may be different from the information you receive from other public

companies in which you hold stock.

Implications

of Being a Controlled Company

Steven

Rossi, our founder and Chief Executive Officer, currently owns 100% of our outstanding Series A Preferred Stock, which entitles him to

51% of the voting power of our outstanding voting equity. As a result, we currently meet the definition of a “controlled company”

under the corporate governance standards for Nasdaq-listed companies, and for so long as we remain a controlled company under this definition,

we are eligible to utilize certain exemptions from the corporate governance requirements of Nasdaq.

For

so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions

from corporate governance rules, including:

| |

● |

an

exemption from the rule that a majority of our Board of Directors (“Board”) must be independent directors; |

| |

● |

an

exemption from the rule that the compensation of our Chief Executive Officer must be determined or recommended solely by independent

directors; and |

| |

● |

an

exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As

a result, you will not have the same protection afforded to stockholders of companies that are subject to these corporate governance

requirements.

Although

we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on

this exemption either after or before we complete this offering. If we elected to rely on the “controlled company” exemption,

a majority of the members of our Board might not be independent directors and our nominating and corporate governance and compensation

committees might not consist entirely of independent directors.

OFFERING

SUMMARY

| Securities

Offered |

|

16,025,642

shares of common stock.

We

are also offering the opportunity to purchase, if the purchaser so chooses and in lieu of Shares, up to 16,025,642 Pre-Funded Warrants

to purchasers whose purchase of shares in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common

stock immediately after purchase.

The

Pre-Funded Warrants will be exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised

in full. For each Pre-Funded Warrant we sell, the number of Shares we are offering will be decreased on a one-for-one basis. |

| |

|

|

| Offering

Price |

|

A

price between $0.72 and $1.56 per Share (to be fixed by post-qualification supplement).

The

purchase price of each Pre-Funded Warrant is equal to the price at which the Shares are being sold to the public in this offering,

minus $0.01, and the exercise price of each Pre-Funded Warrant is $0.01 per share of Common Stock.

|

| |

|

|

| Minimum

Subscription |

|

The

minimum investment is $1,000, though we reserve the right to accept subscriptions for a lesser amount at our sole discretion. |

| |

|

|

| Shares

Outstanding Before This Offering |

|

28,502,716

shares of common stock issued and outstanding as of July 22, 2024. |

| |

|

|

| Shares

Outstanding After This Offering(1) |

|

44,528,358

shares of common stock issued and outstanding, assuming all of the Shares are sold in this offering and no Pre-Funded Warrants are

sold. |

| Minimum

Number of Shares to Be Sold in This Offering |

|

None |

| |

|

|

| No

Escrow |

|

None

of the proceeds received will be placed in an escrow or trust account. All proceeds from this offering will become immediately available

to us and may be used as they are accepted. Purchasers of the Securities will not be entitled to a refund and could lose their entire

investments. |

| |

|

|

| Investor

Suitability Standards |

|

The

Securities are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act.

“Qualified purchasers” include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation

A under the Securities Act. |

| |

|

|

| Termination

of this Offering |

|

This

offering will terminate at the earliest of (a) the date on which all of the Shares or Pre-Funded Warrants have been sold, (b) the

date which is one year from this offering being qualified by the SEC, and (c) the date on which this offering is earlier terminated

by us, in our sole discretion. See “Plan of Distribution.” |

| |

|

|

| Use

of Proceeds |

|

We

will use the proceeds of this offering for general corporate purposes, including working capital. See “Use of Proceeds.” |

| |

|

|

| Risk

Factors |

|

An

investment in the Securities involves a high degree of risk and should not be purchased by investors who cannot afford the loss of

their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular,

as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Securities. |

| |

|

|

| Transfer

Agent |

|

Our

transfer agent and registrar is Vstock Transfer, LLC, 18 Lafayette Place, Woodmere, NY 11598. Their telephone number is (212) 828-8436. |

| |

|

|

| Ticker

Symbol |

|

Our

common stock is listed on Nasdaq under the symbol “WKSP.” |

| |

|

|

| No

Public Market for Pre-Funded Warrants |

|

There

is no public market for the Pre-Funded Warrants, and none is expected to develop. We do not

intend to apply for the listing of the Pre-Funded Warrants offered in this offering on any

stock exchange. Without an active trading market, the liquidity of the Pre-Funded Warrants

will be limited. See “Risk Factors—Risks Related to Pre-Funded Warrants; There

is no public market for the Pre-Funded Warrants.”

|

| (1) | Based

on 28,502,916 shares of common stock issued and outstanding as of July 22, 2024. Excludes

the following: |

| | | |

| ● | 455,000

shares of our common stock issuable pursuant to options granted pursuant to the Worksport

Ltd. 2015 Equity Incentive Plan with a weighted exercise of $2.54 per share, of which a total

of 425,000 option shares have vested; |

| ● | 185,000

shares of our common stock issuable pursuant to options granted pursuant to the Worksport

Ltd. 2021 Equity Incentive Plan with a weighted exercise of $4.64 per share, of which a total

of 167,500 have vested; |

| ● | 1,330,556

shares of our common stock issuable pursuant to options granted pursuant to the Worksport

Ltd. 2022 Equity Incentive Plan with a weighted exercise of $1.79 per share, of which a total

of 283,125 option shares have vested; |

| ● | 300,000

shares of common stock underlying PSUs, granted pursuant to the Worksport Ltd. 2022 Equity

Incentive Plan, of which 75,000 PSUs have vested; |

| ● | 432,094

shares of Common Stock underlying RSUs, of which 255,742 will vest between July 20, 2024

& August 31, 2026; |

| ● | 3,500,000

of our common stock issuable pursuant to options granted with a weighted exercise of $1.77

per share, of which a total of 400,000 option shares have vested; |

| ● | 600,000

shares of our common stock issuable upon the exercise of warrants issued with an exercise

price of $4.00; |

| ● | 62,500

shares of our common stock issuable upon the exercise of warrants issued with an exercise

price of $2.40, expiring March 20, 2025; |

| ● | 3,446,515

shares of common stock issuable upon the exercise of warrants issued with an exercise price

of $6.05 per share, expiring August 6, 2024; |

| ● | 130,909

shares of common stock issuable upon the exercise of warrants issued with an exercise price

of $6.05 per share, expiring August 3, 2024; |

| ● | 4,160,000

shares of common stock underlying warrants that have been exercised of which shares have

not been issued yet; |

| ● | 7,770,264

shares of our common stock issuable upon the exercise of warrants issued in a registered

direct offering on March 20, 2024, with an exercise price of $0.74 per share; and |

| ● | 12,950,000

shares of common stock issuable upon the exercise of warrants issued in a warrant inducement

on May 29, 2024, with an exercise price of $0.5198 per share. |

Continuing

Reporting Requirements Under Regulation A

We

are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our

continuing reporting obligations under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting

requirements.

RISK

FACTORS

An

investment in the Securities involves substantial risks. You should carefully consider the following risk factors, in addition to the

other information contained in this Offering Circular, before purchasing any of the Securities. The occurrence of any of the following

risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones

we face but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects

and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking

statements. See “Cautionary Statement Regarding Forward-Looking Statements.”

Risks

Related to Our Business

Our

independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about

our ability to continue as a “going concern.”

We

have not been profitable since our inception and have had limited revenue from our operations. As of March 31, 2024, we had $3.5 million

of cash and cash equivalents. During the quarter ended March 31, 2024, we incurred a net loss of approximately $3.7 million and used

cash in operating activities of approximately $2.8 million. As of December 31, 2023, we had approximately $3.7 million of cash and cash

equivalents. During the year ended December 31, 2023, we incurred a net loss of approximately $14.9 million and used cash in operating

activities of approximately $11.9 million. While we have historically been successful in raising capital to meet our working capital

needs, our ability to continue raising such capital to enable the Company to continue its growth is not guaranteed. The Company’s

continuation as a going concern is dependent upon its ability to generate positive cash flows from operations and to secure additional

sources of equity and/or debt financing.

Our

independent auditors have included an explanatory paragraph in their audit report included in this Offering Circular regarding the Company’s

ability to continue as a going concern. This going concern risk may materially limit our ability to raise additional funds through the

issuance of new debt or equity or may adversely affect the terms upon which such capital may be available. The inability to obtain sufficient

financing on acceptable terms could have a material adverse effect on the Company’s financial condition, results of operations,

and business prospects.

The

Company is actively pursuing strategies to mitigate these risks, focusing on transitioning towards revenue generation from its existing

product offerings and expanding its customer base. However, there can be no assurance that these efforts will prove successful or that

the Company will achieve its intended financial stability. The failure to successfully address these going concern risks may materially

and adversely affect the Company’s business, financial condition, and results of operations. Investors should consider the substantial

risks and uncertainties inherent in the Company’s business before investing in the Company’s securities.

We

might not be able to refinance or obtain an extension for our $5.3 million loan secured by our West Seneca, New York facility scheduled

to mature in August 2024.

In

connection with our acquisition of our 152,847 square foot facility and 18-acre land parcel in West Seneca, NY for $8.125 million in

May 2022, we secured a loan of $5.3 million from a third party bank. This mortgage carries an interest rate of the prime rate plus 2.25%

per annum and is secured by the land, property, fixtures, and personal property. As of March 31, 2024, the outstanding principal and

the accrued interest was an aggregate of $5,347,479. Despite successfully extending the initial maturity date from May 10, 2024 to August

10, 2024, there is no guarantee that we will be able to refinance this loan or secure another extension. Failure to do so could result

in the loss of our facility and property, ultimately having a significantly negative impact on our business and operations.

Our

business, results of operations, and financial condition may be adversely impacted by the resurgence of the global COVID-19 pandemic

or other pandemics.

A

significant outbreak, epidemic or pandemic of contagious diseases in any geographic area in which we operate or plan to operate could

result in a health crisis adversely affecting the economies and financial markets in which we operate as well as the overall demand for

our products. In addition, any preventative or protective actions that governments implement or that we take in response to a health

crisis, such as travel restrictions, quarantines, or site closures, may interfere with the ability of our employees, suppliers and customers

to perform their responsibilities. Such results could have a materially adverse effect on our business.

The

continued global COVID-19 pandemic created significant volatility, uncertainty and economic disruption. To date, this pandemic has affected

nearly all regions around the world. In the United States, businesses as well as federal, state and local governments implemented significant

actions to mitigate this public health crisis. We cannot predict the occurrence, duration, or scope of future COVID-19 resurgences or

other pandemics, and we know from the COVID-19 pandemic that such events can have material impacts on supply networks, in-person labor

availability, and global financial markets volatility.

To

the extent the COVID-19 pandemic or a similar public health threat has an impact on our business, it is likely to also have the effect

of heightening many of the other risks described in this “Risk Factors” section.

We

will need additional financing in order to grow our business.

From

time to time, in order to expand operations to meet customer demand, we will need to incur additional capital expenditures. These capital

expenditures are intended to be funded from third party sources, including the incurring of debt and/or the sale of additional equity

securities. In addition to requiring additional financing to fund capital expenditures, we may require additional financing to fund working

capital, research and development, sales and marketing, general and administrative expenditures and operating losses. The incurrence

of debt creates additional financial leverage and therefore an increase in the financial risk of our operations. The sale of additional

equity securities will be dilutive to the interests of current equity holders. In addition, there can be no assurance that such additional

financing, whether debt or equity, will be available to us or that it will be available on acceptable commercial terms. Any inability

to secure such additional financing on appropriate terms could have a materially adverse impact on our business, financial condition

and operating results.

We

are a growth stage company with a history of losses and expect to incur significant expenses and continuing losses for the foreseeable

future.

We

have incurred net losses since our inception. We believe net operating losses will decrease or become net income in the near future as

we ramp up sales of our soft covers and AL3 tonneau covers, although we do intend to concurrently invest further into research and development

of our AL4 tonneau cover, SOLIS cover, and COR energy storage systems; the market releases for these additional product lines may

occur later than we expect or not at all. We are unsure whether we will be profitable in the near future while we continue to ramp up

our product offerings, bolster our sales channels, and increase output capacity, and we cannot assure you that we will ever achieve or

be able to maintain profitability in the future. Even if we can successfully develop our additional products and attract customers, there

can be no assurance that we will be financially successful. For example, as we expand our product portfolio, and expand internationally,

we will need to manage costs effectively to sell those products at our expected margins. Failure to become profitable would materially

and adversely affect the value of your investment. If we are ever to achieve profitability, it will be dependent upon the successful

development and commercial introduction and acceptance of our consumer products and our services, which may not occur.

We

have only sold tonneau covers, the market size of which is limited. Our long-term results depend upon our ability to successfully introduce

and market new products, which may expose us to new and increased challenges and risks.

To

date, we have only sold tonneau covers, the market size of which is limited. Our growth strategy depends, in part, on our ability to

successfully introduce and market new products, such as our SOLIS cover and COR system, as well as develop new products. As we introduce

new products or refine, improve or upgrade versions of existing products, we cannot predict the level of market acceptance or the amount

of market share these products will achieve, if any. We cannot assure you that we will not experience material delays in the introduction

of new products and services in the future. Consistent with our strategy of offering new products and product refinements, we expect

to continue to use a substantial amount of capital for product refinement, research and development, and sales and marketing, which may

not provide a return on investment in the event we fail to bring potential products to market. We will need additional capital for product

development and refinement, and this capital may not be available on terms favorable to us, if at all, which could adversely affect our

business, prospects, financial condition, results of operations, and cash flows. If we are unable to successfully introduce, integrate,

and market new products and services, our business, prospects, financial condition, results of operations, and cash flows may be materially

and adversely affected.

We

may not succeed in establishing, maintaining and strengthening our brand, which would materially and adversely affect customer acceptance

of our products and our business, prospects, financial condition, results of operations and cash flows.

Our

business and prospects heavily depend on our ability to develop, maintain and strengthen the Worksport brand. If we are not able to establish,

maintain and strengthen our brand, we may lose the opportunity to build a critical mass of customers. Our ability to develop, maintain

and strengthen our brand will depend heavily on our ability to provide high quality products and engage with our customers as intended,

as well as depend on the success of our customer development and marketing efforts. The automobile accessory and parts industry is intensely

competitive, and we may not be successful in building, maintaining and strengthening the Worksport brand. Many of our current and potential

competitors have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If

we do not develop and maintain a strong brand, our business, prospects, financial condition, results of operations and cash flows could

be materially and adversely impacted.

In

addition, we could be subject to adverse publicity. In particular, given the popularity of social media, any negative publicity, whether

true or not, could quickly proliferate and harm consumer perceptions and confidence in our brand. In addition, from time to time, our

products may be evaluated and reviewed by third parties. Any negative reviews or reviews which compare us unfavorably to competitors

could adversely affect consumer perception about our products.

The

US Central Bank has provided forward-looking guidance of high interest rates for the near future.

We

may need to invest in additional machinery, equipment and land if demand for our products is higher than anticipated or if we secure

a supplier deal with a major original equipment manufacturer (OEM). With high interest rates, it will be less financially attractive

to finance such purchases, which may lead to an otherwise higher burn rate. High interest rates increase the amount that we must pay

for our mortgage on our West Seneca, New York property. At the same time, it lowers the attractiveness of refinancing, despite the fact

that our anticipated positive future cash flows would allow us to seek financing from a broader selection of lenders.

Continued

uncertain economic conditions, including inflation and the risk of a global recession could impair our ability to forecast and may harm

our business, operating results, including our revenue growth and profitability, financial condition and cash flows.

While

U.S. inflation rates have come down from their 2022 highs, the U.S. economy is still experiencing higher than target inflation rates,

and high inflation levels persist in many countries worldwide. Historically, we have not experienced significant inflation risk in our

business. However, our ability to raise our product prices depends on market conditions, and there may be periods during which we are

unable to recover increases in our costs fully. In addition, the global economy suffers from slowing growth and elevated interest rates,

and many economists are still unsure whether a global recession may begin in the near future. If the global economy slows, our business

would likely be adversely affected.

Also,

a recession may result in job loss and lower discretionary funds among potential customers, lowering demand for automotive aftermarket

accessories. Part of our consumer base for SOLIS includes workers, particularly those in manufacturing and construction environments,

who may have lower job security in the event of a recession and, thus, have lower demand for the SOLIS. Commercial real estate values

may also decrease, which would lower the value of our production facility in West Seneca, New York.

Our

business and operations would suffer in the event of computer system failures, cyberattacks or a deficiency in our cybersecurity or a

natural disaster.

There

are growing risks related to the security, confidentiality and integrity of personal and corporate information stored and transmitted

electronically due to increasingly diverse and sophisticated threats to networks, systems and data security. Potential attacks span a

spectrum from attacks by criminal hackers, hacktivists, and nation state or state-sponsored actors, to employee malfeasance and human

or technological error. Cyberattacks against companies have increased in frequency and potential harm over time, and the methods used

to gain unauthorized access constantly evolve, making it increasingly difficult to anticipate, prevent, and/or detect incidents successfully

in every instance.

Despite

the implementation of security measures, our internal computer systems, and those of third parties on which we rely (including our vendors,

contractors and other third-party partners who process information on our behalf or have access to our systems), are vulnerable to damage

from computer viruses, malware, ransomware, phishing attacks and other forms of social engineering, denial-of-service attacks, third

party or employee theft or misuse and other negligent actions, natural disasters, terrorism, war, telecommunication and electrical failures,

cyberattacks or cyber-intrusions over the internet, security incidents, disruptions, attachments to emails, persons inside our organization,

or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyberattacks

or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number,

intensity and sophistication of attempted attacks and intrusions from around the world have increased. If such an event were to occur

and cause interruptions in our operations, it could result in a material disruption of our product development programs. To the extent

that any disruption or security breach was to result in a loss of or damage to our data or applications, or inappropriate disclosure

of confidential or proprietary information, we could incur material legal claims (including class claims) and liability, substantial

remediation costs, regulatory enforcement, liability under data protection laws, additional reporting requirements and damage to our

reputation, and the further development of our product candidates could be delayed.

The

US is in a state of low unemployment, and many companies that provide wage-based jobs are having trouble filling open positions.

We

need to fill certain positions that do not require specialized knowledge or experience, and we offer competitive pay and benefits in

order to attract people as we compete with other local businesses for employment. Competing with local businesses may delay hiring time

as well as production scaling timelines. Offering more competitive compensation packages also reduces our potential profits and sets

higher forward-looking compensation expectations.

We

have demonstrated historical success in less capital-intensive manufacturing in China, but we have not demonstrated success in low-cost,

domestic, highly capital-intensive manufacturing.

While

we have begun manufacturing in our West Seneca production facility, we are still increasing manufacturing efficiencies by decreasing

direct labor, overhead, materials, and scrap costs. Doing so currently demands manufacturing engineering resources, supply chain research,

and purchasing negotiations. We may require the assistance of or rely on the availability of third parties to assist us in properly establishing

improved processes due to a lack of in-house, capital-intensive domestic manufacturing experience. Lack of experience may create delays,

cost inefficiencies in production scaling, and difficulty identifying necessary process improvements.

We

may not be able to accurately estimate the demand for our tonneau covers, which could result in inefficiencies in our production and

hinder our ability to generate revenue.

If

we fail to predict our manufacturing requirements accurately, we will incur the risk of having to pay for production capacities that

we reserved but will not be able to use or that we will not be able to secure sufficient additional production capacities at reasonable

costs in the event product demand exceeds expectations. A single contract with an OEM, private label or key distributor can significantly

increase demand for our products, requiring investments in expanded operational capacity including personnel, equipment and potentially

facilities.

Our

future growth may be limited.

Our

ability to achieve our expansion objectives and to manage our growth effectively depends upon a variety of factors, including our ability

to internally develop products, to attract and retain skilled employees, to successfully position and market our products, to protect

our existing intellectual property, to capitalize on the potential opportunities we are pursuing with third parties, and to acquire sufficient

funding whether internally or externally. To accommodate growth and compete effectively, we will need working capital to maintain adequate

inventory levels, develop additional procedures and controls and increase, train, motivate and manage our work force. There is no assurance

that our personnel, systems, procedures and controls will be adequate to support our potential future operations. There is no assurance

that we will generate higher revenues from our prospective sales partners nor be able to capitalize on additional third-party manufacturers.

We

rely on two suppliers for the production of our outsourced soft tonneau covers, which may hinder our ability to grow.

We

purchase all of our soft tonneau covers from two supplier sources in China. We carry significant strategic inventories of these finished

goods to reduce the risk associated with this concentration of suppliers. Strategic inventories are managed based on demand. While we

are now manufacturing hard tonneau covers in the United States, the loss of one or both of these suppliers or a delay in shipments could

have a material adverse effect on our soft tonneau cover sales and business.

We

rely on a small number of customers for the majority of our sales.

The

loss of any significant customer could have an adverse effect on our business. A customer is considered to be significant if they account

for greater than 10% of our annual sales. For the year ended December 31, 2023, the Company had one significant customer accounting for

93% of the Company’s revenue. For the year ended December 31, 2022, two customers made up approximately 50% (38% and 12% individually).

For the quarter ended March 31, 2024, the Company had one significant customer accounting for 92% of the Company’s revenue. For

the quarter ended March 31, 2023, two customers made up approximately 22% (18% and 4% individually). The loss of any of these key customers

could have an adverse effect on our business.

We

rely on key personnel, especially Steven Rossi, our Chief Executive Officer, President and Chairman of the Board.

Our

success also will depend in large part on the continued service of our key operational and management personnel, including executive

staff, research and development, engineering, marketing and sales staff. Most specifically, this includes Steven Rossi, our President

and Chief Executive Officer, who oversees the implementation of new products, key customer acquisition and retention, and our overall

management and future growth. Any failure on our part to hire, train and retain a sufficient number of qualified professionals could

impair our business.

We

depend on intellectual property rights that may be infringed upon, and we may infringe upon the intellectual property rights of others.

Our

success depends to a significant degree upon our ability to develop, maintain and protect proprietary products and technologies. However,

patents provide only limited protection of our intellectual property. The assertion of patent protection involves complex legal and factual

determinations and is therefore uncertain and potentially expensive. We cannot provide assurance that patents will be granted with respect

to our pending patent applications, that the scope of any patents we might obtain will be sufficiently broad to offer meaningful protection,

or that we will develop additional proprietary products that are patentable. In fact, any patents which might issue from our patent applications

pending with the United States Patent and Trademark Office could be successfully challenged, invalidated or circumvented. This could

result in our pending patent rights failing to create an effective competitive barrier. Losing a significant patent or failing to get

a patent issued from a pending patent application we consider significant could have a material adverse effect on our business.

We

may not be able to protect our intellectual property rights throughout the world, which could negatively impact our business.

Filing,

prosecuting and defending patents covering our current and future product candidates and technology platforms in all countries worldwide

would be prohibitively expensive. Competitors may use our technologies in jurisdictions where we have not obtained patent protection

to develop their own products and, further, may export otherwise infringing products to territories where we may obtain patent protection

but where patent enforcement is not as strong as that in the United States. These products may compete with our products in jurisdictions

where we do not have any issued or licensed patents, and any future patent claims or other intellectual property rights may not be effective

or sufficient to prevent them from so competing.

Many

companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The

legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets

and other intellectual property protection which could make it difficult for us to stop the infringement of our patents or marketing

of competing products in violation of our intellectual property and proprietary rights, generally. Proceedings to enforce our intellectual

property and proprietary rights in foreign jurisdictions could result in substantial costs and divert our efforts and attention from

other aspects of our business, could put our patents at risk of being invalidated or interpreted narrowly, could put our patent applications

at risk of not issuing, and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate,

and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to enforce our intellectual

property and proprietary rights worldwide may be inadequate to obtain a significant commercial advantage from the intellectual property

we develop or license.

Many

countries have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In addition,

many countries limit the enforceability of patents against government agencies or government contractors. In these countries, the patent

owner may have limited remedies, which could materially diminish the value of such patent. If we or any of our licensors are forced to

grant a license to third parties with respect to any patents relevant to our business, our competitive position may be impaired, and

our business, financial condition, results of operations and prospects may be adversely affected.

Our

patents might not protect our technology from competitors, in which case we may not have any exclusionary advantage over competitors

in selling any products that we may develop.

Our

commercial success will depend in part on our ability to obtain additional patents and protect our existing patent position, as well

as our ability to maintain adequate intellectual property protection for our technologies, product candidates, and any future products

in the United States and other countries. If we do not adequately protect our technology, product candidates and future products, competitors

may be able to use or practice them and erode or negate any competitive advantage we may have, which could harm our business and ability

to achieve profitability. The laws of some foreign countries do not protect our proprietary rights to the same extent or in the same

manner as U.S. laws, and we may encounter significant problems in protecting and defending our proprietary rights in these countries.

We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies,

product candidates and any future products are covered by valid and enforceable patents or are effectively maintained as trade secrets.

Certain

aspects of our technologies are protected by patents, patent applications, and trade secrets. In addition, we have a number of new patent

applications pending. There is no assurance that the applications still pending or which may be filed in the future will result in the

issuance of any patents. Furthermore, there is no assurance as to the breadth and degree of protection any issued patents might afford

us. Disputes may arise between us and others as to the scope and validity of these or other patents. Any defense of the patents could

prove costly and time- consuming, and there can be no assurance that we will be in a position, or deem it advisable, to carry on such

a defense. A suit for patent infringement could result in increasing costs as well as delaying or halting development. Other private

and public entities, including universities, may have filed applications for, may have been issued, or may obtain additional patents

and other proprietary rights to technology potentially useful or necessary to us. We are not currently aware of any such patents, but

the scope and validity of such patents, if any, and the cost and availability of such rights are impossible to predict.

Any

trademarks we may obtain may be infringed or successfully challenged, resulting in harm to our business.

We

expect to rely on trademarks as one means to distinguish our products from our competitors’ products. Once we select trademarks

and apply to register them, our trademark applications may not be approved. Third parties may oppose our trademark applications or otherwise

challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our

products, which could result in a loss of brand recognition and could require us to devote resources to advertising and marketing new

brands. Our competitors may infringe on our trademarks, and we may not have adequate resources to enforce our trademarks.

Much

of our intellectual property is protected as trade secrets or confidential know-how.

We

consider proprietary trade secrets to be important to our business. This type of information must be protected diligently by us to protect

its disclosure to competitors, since legal protections after disclosure may be minimal or non-existent. Accordingly, much of the value

of this intellectual property is dependent upon our ability to keep our trade secrets.

To

protect this type of information against disclosure or appropriation by competitors, our policy is to require our employees, consultants,

contractors and advisors to enter into confidentiality agreements with us. However, current or former employees, consultants, contractors

and advisers may unintentionally or willfully disclose our confidential information to competitors, and confidentiality agreements may

not provide an adequate remedy in the event of unauthorized disclosure of confidential information. Enforcing a claim that a third party

illegally obtained, and is using, trade secrets is expensive, time-consuming and unpredictable. The enforceability of confidentiality

agreements may vary from jurisdiction to jurisdiction.

Failure

to obtain or maintain trade secret protection could adversely affect our competitive position. Moreover, our competitors may independently

develop substantially equivalent proprietary information and may even apply for patent protection in respect of the same. If successful

in obtaining such patent protection, our competitors could limit our use of such trade secrets.

We

may be subject to claims challenging the inventorship or ownership of our patents and other intellectual property.

We

may also be subject to claims that former employees, suppliers, collaborators or other third parties have an ownership interest in our

patents or other intellectual property. We may be subject to ownership disputes in the future arising, for example, from conflicting

obligations of suppliers, consultants or others who are involved in developing our products. Litigation may be necessary to defend against

these and other claims challenging inventorship or ownership. If we fail in defending any such claims, in addition to paying monetary

damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property.

Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation

could result in substantial costs and be a distraction to management and employees.

Intellectual

property rights do not necessarily address all potential threats to our business.

The

degree of future protection afforded by our intellectual property rights is uncertain because intellectual property rights have limitations

and may not adequately protect our business. The following examples are illustrative:

| ● | others

may be able to develop technologies that are similar to our technology platforms but that

are not covered by the claims of any patents, should they issue, that we own or license; |

| | | |

| ● | we

or our licensors might not have been the first to make the inventions covered by the issued