Wynn Resorts Announces Pricing of Private Add-On Offering of $400 Million Aggregate Principal Amount of Wynn Resorts Finance 7.125% Senior Notes due 2031

08 Febrero 2024 - 4:00PM

Business Wire

Wynn Resorts, Limited (“Wynn Resorts”) (NASDAQ: WYNN) announced

today the pricing by Wynn Resorts Finance, LLC (“Wynn Resorts

Finance”) and its subsidiary Wynn Resorts Capital Corp. (“Wynn

Resorts Capital” and, together with Wynn Resorts Finance, the

“Issuers”), each an indirect wholly-owned subsidiary of Wynn

Resorts, of $400 million aggregate principal amount of 7.125%

Senior Notes due 2031 (the “Notes”) in a private offering. The

initial purchasers of the Notes will offer the Notes for resale

initially at a price equal to 103.000% of the principal amount

thereof, with an initial yield of 6.570%, plus accrued interest

from February 15, 2024.

Wynn Resorts Finance plans to contribute the net proceeds from

the offering, together with cash contributed by Wynn Resorts and/or

borrowings under Wynn Resorts Finance’s senior credit facilities,

to its subsidiary, Wynn Las Vegas, LLC (“Wynn Las Vegas”), and will

cause Wynn Las Vegas to use the contribution, together with cash on

hand, (i) to repurchase up to $800.0 million of the Wynn Las Vegas’

5.500% Senior Notes due 2025 (the “2025 LV Notes”) that are validly

tendered and accepted for payment pursuant to Wynn Las Vegas’

tender offer commenced on the date hereof, (ii) to pay related fees

and expenses, and (iii) the remainder, if any, for general

corporate purposes. If any proceeds remain after the tender offer,

Wynn Las Vegas may use the remaining proceeds, cash contributed by

Wynn Resorts, borrowings under Wynn Resorts Finance’s senior credit

facilities, or proceeds from the issuance of additional notes, from

time to time, to purchase additional 2025 LV Notes in the open

market, in privately negotiated transactions, through tender

offers, or otherwise, or to redeem, discharge or defease the 2025

LV Notes that are able to be redeemed, discharged or defeased

pursuant to their terms. This press release shall not constitute an

offer to purchase or the solicitation of an offer to sell the 2025

LV Notes. This press release does not constitute a notice of

redemption or an offer to purchase or a solicitation of an offer to

sell the 2025 LV Notes.

The Issuers will make the offering pursuant to an exemption

under the Securities Act of 1933, as amended (the “Securities

Act”). The initial purchasers of the Notes will offer the Notes

only to persons reasonably believed to be qualified institutional

buyers in reliance on Rule 144A under the Securities Act or outside

the United States to certain persons in reliance on Regulation S

under the Securities Act. The Notes have not been and will not be

registered under the Securities Act or under any state securities

laws. Therefore, the Issuers may not offer or sell the Notes within

the United States to, or for the account or benefit of, any United

States person unless the offer or sale would qualify for a

registration exemption from the Securities Act and applicable state

securities laws.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the Notes described in this press

release, nor shall there be any sale of the Notes in any state or

jurisdiction in which such an offer, sale or solicitation would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Forward-Looking Statements

This release contains forward-looking statements, including

those related to the offering of Notes and whether or not the

Issuers will consummate the offering. Such forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those we

express in these forward-looking statements, including, but not

limited to, reductions in discretionary consumer spending, adverse

macroeconomic conditions and their impact on levels of disposable

consumer income and wealth, changes in interest rates, inflation, a

decline in general economic activity or recession in the U.S.

and/or global economies, extensive regulation of our business,

pending or future legal proceedings, ability to maintain gaming

licenses and concessions, dependence on key employees, general

global political conditions, adverse tourism trends, travel

disruptions caused by events outside of our control, dependence on

a limited number of resorts, competition in the casino/hotel and

resort industries, uncertainties over the development and success

of new gaming and resort properties, construction and regulatory

risks associated with current and future projects (including Wynn

Al Marjan Island), cybersecurity risk and our leverage and ability

to meet our debt service obligations. Additional information

concerning potential factors that could affect Wynn Resorts’

financial results is included in Wynn Resorts’ Annual Report on

Form 10-K for the year ended December 31, 2022, as supplemented by

Wynn Resorts’ other periodic reports filed with the Securities and

Exchange Commission from time to time. Neither Wynn Resorts nor the

Issuers are under any obligation to (and expressly disclaim any

such obligation to) update or revise their forward-looking

statements as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208168875/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

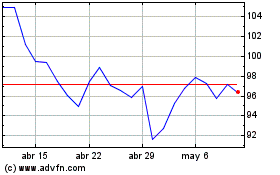

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

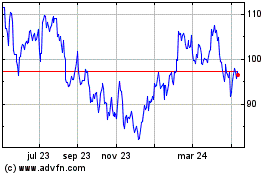

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024