Company to post webcast on July 18th to

accompany pro forma disclosures

Alight, Inc. (NYSE: ALIT or the “Company”), a leading

cloud-based human capital technology and services provider, today

announced that it has closed the previously announced sale of its

Professional Services segment and its Payroll & HCM Outsourcing

businesses within the Employer Solutions segment (the “Payroll

& Professional Services business”) to an affiliate of H.I.G.

Capital. The sale of the Payroll & Professional Services

business, which will operate as an independent business and has

been renamed Strada, includes a transaction value of up to $1.2

billion, in the form of upfront gross proceeds of $1 billion in

cash and up to $200 million in seller notes, of which $150 million

is contingent upon Strada reaching certain 2025 financial targets,

which are substantially in line with current performance

levels.

As previously discussed, the Company anticipates using the

majority of its initial net proceeds to reduce its debt, resulting

in a pro forma net leverage ratio of below three times. The

remaining proceeds and future cash flow generation are expected to

be used for share repurchases and for general corporate

purposes.

“Today’s announcement represents a strategic milestone that will

accelerate Alight’s transformation toward a simplified and focused

platform company for employee wellbeing and benefits,” said Chief

Executive Officer Stephan Scholl. “I am pleased with the tremendous

collaboration across both organizations in accomplishing this

pivotal transaction and commencing our strategic partnership with

substantial momentum while preserving our client value proposition.

Together, we will continue to keep our clients front and center,

delivering improved cost, experience and productivity outcomes for

organizations and their valued employees.”

“Culminating in today’s announcement, Alight is now embarking on

its next chapter as a simplified company with even greater agility

and a renewed focus on its sophisticated proprietary technology,”

said Chair of the Board William P. Foley, II. “This strategic

transaction unlocks great potential for a streamlined Alight to

drive sustainable, profitable growth and shareholder value over the

long-term.”

Webcast Details

Alight expects to disclose its historic pro forma results for

the continuing business four days after the completion of the

transaction.

In conjunction with the disclosure, Alight will post a webcast

to the Events and Presentations section of the Company’s Investor

Relations website at 8:30 a.m. (ET) on July 18, 2024, during which

management will review supplemental materials regarding the close

of the transaction.

About Alight Solutions

Alight is a leading cloud-based human capital technology and

services provider for many of the world’s largest organizations.

Through the administration of employee benefits, Alight powers

confident health, wealth, leaves and wellbeing decisions for 35

million people and dependents. Our Alight Worklife® platform

empowers employers to gain a deeper understanding of their

workforce and engage them throughout life’s most important moments

with personalized benefits management and data-driven insights,

leading to increased employee wellbeing, engagement and

productivity. Learn how Alight unlocks growth for organizations of

all sizes at alight.com.

About Strada

Strada is a global leader in full-lifecycle human capital

management and payroll technology and services. With over 8,000

employees across the world, the Company provides an end-to-end

offering of technology and services, including U.S. and

multi-country global payroll, HR administration & outsourced

services, and cloud technology advisory, deployment &

application managed services. Through its differentiated breadth of

services, proprietary technology, and decades-long commitment to

innovation, Strada delivers mission-critical solutions to

enterprise clients across 185 countries. For more information,

visit stradaglobal.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended. These statements include, but are

not limited to, statements regarding the anticipated benefits of

the sale of our Payroll and Professional Services business to an

affiliate of H.I.G. Capital (including the achievement of our

financial objectives), support plans, opportunities, anticipated

future performance and statements regarding our use of proceeds and

expected stock buyback programs. In some cases, these

forward-looking statements can be identified by the use of words

such as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates” or the negative

version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties including, among others, risks related to declines in

economic activity in the industries, markets, and regions our

clients serve, including as a result of elevated interest rates or

changes in monetary and fiscal policies, competition in our

industry, risks related to the performance of our information

technology systems and networks, risks related to our ability to

maintain the security and privacy of confidential and proprietary

information, risks related to actions or proposals from activist

stockholders, risks related to the ability to meet the contingent

payment conditions of the seller note, and risks related to changes

in regulation, including developments on the use of artificial

intelligence and machine learning. Additional factors that could

cause Alight’s results to differ materially from those described in

the forward-looking statements can be found under the section

entitled “Risk Factors” of Alight’s Annual Report on Form 10-K,

filed with the Securities and Exchange Commission (the "SEC") on

February 29, 2024, as such factors may be updated from time to time

in Alight's filings with the SEC, which are, or will be, accessible

on the SEC's website at www.sec.gov. Accordingly, there are or will

be important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. These

factors should not be construed as exhaustive and should be

considered along with other factors noted in this presentation and

in Alight’s filings with the SEC. Alight undertakes no obligation

to publicly update or review any forward-looking statement, whether

as a result of new information, future developments or otherwise,

except as required by law.

Non-GAAP Financial Measures

Included in this press release are certain non-GAAP financial

measures, such as Net Leverage Ratio, designed to complement the

financial information presented in accordance with U.S. GAAP

because management believes Net Leverage Ratio is useful to

investors. This non-GAAP financial measure should be considered

only as supplemental to, and not superior to, financial measures

provided in accordance with GAAP.

Because GAAP financial measures on a forward-looking basis are

not accessible, and reconciling information is not available

without unreasonable effort, we have not provided reconciliations

for forward-looking non-GAAP measures, including our anticipated

Net Leverage Ratio following the completion of the transaction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240712691768/en/

Investors: Jeremy Cohen Investor.Relations@alight.com

Media: Mariana Fischbach mariana.fischbach@alight.com

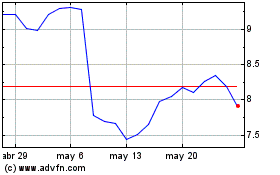

Alight (NYSE:ALIT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alight (NYSE:ALIT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024