Alta Equipment Group Inc. Announces Closing of Secondary Offering of Common Stock

25 Julio 2023 - 3:15PM

Alta Equipment Group Inc. (NYSE: ALTG) (“Alta” or the “Company”), a

leading provider of premium material handling, construction and

environmental processing equipment and related services, today

announced the closing of its previously announced secondary

offering of 2,200,000 shares of common stock at $16.25 per share.

The gross proceeds to the selling stockholder were approximately

$35.8 million, before deducting the underwriting discounts and

commissions and estimated offering expenses payable by the Company.

D.A. Davidson & Co. and B. Riley Securities

acted as joint bookrunning managers and representatives of the

underwriters for the offering. Northland Capital Markets served as

a co-manager for the offering.

The offering of these securities was made

pursuant to a prospectus supplement, dated July 20, 2023, to the

accompanying prospectus included in the Company’s resale shelf

registration statement, which was filed with the U.S. Securities

and Exchange Commission (the “SEC”) on March 25, 2020 and initially

declared effective on April 3, 2020, as amended by Post-Effective

Amendment No. 1, filed with the SEC on July 1, 2021 and declared

effective on July 12, 2021. Copies of the final prospectus

supplement and accompanying prospectus related to the offering may

be obtained, when available, by visiting the SEC’s website at

www.sec.gov. Alternatively, copies of the prospectus and prospectus

supplement relating to the offering may be obtained by contacting:

D.A. Davidson & Co., Attention: Equity Syndicate, 8 Third

Street North, Great Falls, MT 59401, (800) 332-5915,

prospectusrequest@dadco.com or B. Riley Securities, Inc.,

Attention: Prospectus Department, 1300 17th Street North, Suite

1300, Arlington, Virginia 22209, Phone: (703) 312-9580, Email:

prospectuses@brileyfin.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Alta Equipment Group Inc.

Alta owns and operates one of the largest

integrated equipment dealership platforms in the U.S. and has a

presence in Canada. Through its branch network, the Company sells,

rents, and provides parts and service support for several

categories of specialized equipment, including lift trucks and

aerial work platforms, heavy and compact earthmoving equipment,

environmental processing equipment, cranes, paving and asphalt

equipment and other material handling and construction equipment.

Alta has operated as an equipment dealership for 39 years and has

developed a branch network that includes over 75 total locations in

Michigan, Illinois, Indiana, Ohio, Massachusetts, Maine,

Connecticut, New Hampshire, Vermont, Rhode Island, New York,

Virginia, Nevada and Florida and the Canadian provinces of Ontario

and Quebec. Alta offers its customers a one-stop-shop for their

equipment needs through its broad, industry-leading product

portfolio. More information can be found at

www.altaequipment.com.

Investors:Kevin IndaSCR

Partners, LLCkevin@scr-ir.com(225) 772-0254

Media:Glenn MooreAlta Equipment

Group, LLCglenn.moore@altg.com(248) 305-2134

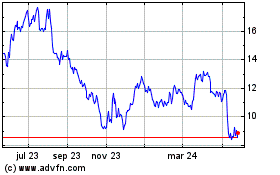

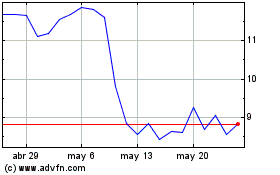

Alta Equipment (NYSE:ALTG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alta Equipment (NYSE:ALTG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024