Notes to be Assumed by Magnera at Closing of the Transaction

Berry Global Group, Inc. (NYSE:BERY) (“Berry”) and Glatfelter

Corporation (NYSE:GLT) (“Glatfelter”) announced today that Treasure

Escrow Corporation (the “Issuer”), currently an indirect, wholly

owned subsidiary of Berry, priced and upsized its previously

announced offering to $800 million aggregate principle amount of

its senior secured notes due 2031 (the “Notes”).

The Notes are being offered by the Issuer in connection with the

previously announced merger of Berry’s Health, Hygiene and

Specialties Global Nonwovens and Films business with Glatfelter, in

a Reverse Morris Trust transaction (the “Transaction”). In

connection with the closing of the Transaction, the combined

company will be renamed Magnera Corporation (“Magnera”), and the

obligations of the Issuer under the Notes will be ultimately

assumed by Magnera (the “Magnera Assumption”). The Notes are not

and will not be obligations of Berry or its wholly owned subsidiary

Berry Global, Inc. (“BGI”).

The size of the offering reflects an increase of $300 million in

aggregate principal amount of the Notes from the previously

announced offering size of $500 million. The Notes will be issued

in lieu of the same amount of debt previously intended to be

provided under the new term loan facility to be entered into by

Treasure Holdco, Inc. (“Spinco”) and to be assumed by Magnera in

conjunction with and assuming the closing of the Transaction.

The Notes will bear interest at a rate of 7.250% payable

semiannually, in cash in arrears, on April 15 and October 15 of

each year, commencing on April 15, 2025, and will mature on

November 15, 2031. The closing of the offering is expected to be

completed on or about October 25, 2024, subject to customary

closing conditions.

The proceeds from the offering, together with the proceeds of a

term loan financing in connection with the Transaction, will be

used to fund the cash distribution to BGI in connection with the

Transaction, to repay certain existing indebtedness of Glatfelter,

and to pay certain fees and expenses. All proceeds of the offering

will be deposited into a segregated escrow account, together with

any additional amounts necessary to redeem the Notes, until certain

escrow release conditions are satisfied substantially concurrently

with the consummation of the Transaction. Amounts held in the

escrow account will be pledged for the benefit of the holders of

the Notes, pending the release of such funds in connection with the

consummation of the Transaction.

Prior to the date of the Magnera Assumption, the Notes will be

the sole obligation of the Issuer, not Berry or any of its

subsidiaries other than the Issuer. Following the Magnera

Assumption, the Notes and the guarantees thereof will be

unsubordinated obligations of Magnera, and each of Magnera’s

existing and future wholly owned restricted domestic subsidiaries,

subject to certain specified exceptions (the “Subsidiary

Guarantors”), will be equal in right of payment to all existing and

future unsubordinated indebtedness of Magnera and the Subsidiary

Guarantors and structurally subordinated to all the liabilities of

Magnera’s subsidiaries that are not or do not become Subsidiary

Guarantors. Following the Magnera Assumption, the Notes and the

guarantees thereof will be secured by: (i) a second-priority lien

on accounts receivable, inventory, and certain related assets of

Magnera and the Subsidiary Guarantors that will secure Magnera’s

new revolving credit facility on a first-priority basis and

Magnera’s new term loan facility on a second-priority basis, both

anticipated to be established at the closing of the Transaction,

and (ii) a first-priority lien on other assets securing Magnera’s

term loan facility on a first-priority basis and Magnera’s

revolving credit facility on a second-priority basis, in each case,

subject to certain specified exceptions and permitted liens. The

Notes will rank pari passu in right of payment, and will be secured

on an equal and ratable basis, with Magnera’s new term loan

facility and Glatfelter’s existing 4.750% senior notes due 2029,

which are expected to remain outstanding following the closing of

the Transaction. Additionally, the Notes will be effectively senior

to all of Magnera’s and the Subsidiary Guarantors’ existing and

future indebtedness that is not secured by a lien on the collateral

to the extent of the value of the assets securing the Notes.

The Notes are being offered in a private offering exempt from

registration only to persons reasonably believed to be qualified

institutional buyers in reliance on Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”), and outside the

United States, only to non-U.S. investors pursuant to Regulation S.

The Notes have not been and will not be registered under the

Securities Act or any state or other securities laws and may not be

offered or sold in the United States absent an effective

registration statement or an applicable exemption from registration

requirements or a transaction not subject to the registration

requirements of the Securities Act or any state securities

laws.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any security and shall not

constitute an offer, solicitation, or sale in any jurisdiction in

which such offering, solicitation, or sale would be unlawful. Any

offers of the Notes will be made only by means of a private

offering memorandum.

About Berry

At Berry Global Group, Inc. (NYSE: BERY), we create innovative

packaging solutions that we believe make life better for people and

the planet. We do this every day by leveraging our unmatched global

capabilities, sustainability leadership, and deep innovation

expertise to serve customers of all sizes around the world.

Harnessing the strength in our diversity and industry-leading

talent of over 40,000 global employees across more than 250

locations, we partner with customers to develop, design, and

manufacture innovative products with an eye toward the circular

economy. The challenges we solve and the innovations we pioneer

benefit our customers at every stage of their journey.

About Glatfelter

Glatfelter is a leading global supplier of engineered materials

with a strong focus on innovation and sustainability. Glatfelter’s

high-quality, technology-driven, innovative, and customizable

nonwovens solutions can be found in products that are Enhancing

Everyday Life®. These include personal care and hygiene products,

food and beverage filtration, critical cleaning products, medical

and personal protection, packaging products, as well as home

improvement and industrial applications. Headquartered in

Charlotte, NC, Glatfelter’s 2023 revenue was $1.4 billion with

approximately 2,980 employees worldwide. Glatfelter’s operations

utilize a variety of manufacturing technologies including airlaid,

wetlaid and spunlace with fifteen manufacturing sites located in

the United States, Canada, Germany, France, Spain, the United

Kingdom, and the Philippines. Glatfelter has sales offices in all

major geographies serving customers under the Glatfelter and

Sontara® brands.

Cautionary Statement Concerning Forward-Looking

Statements

Statements in this release that are not historical, including

statements relating to the expected timing, completion and effects

of the proposed Transaction, and about the offering and issuance of

the Notes by the Issuer, are considered “forward-looking” within

the meaning of the federal securities laws and are presented

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,”

“expects,” “may,” “will,” “should,” “would,” “could,” “seeks,”

“approximately,” “intends,” “plans,” “estimates,” “projects,”

“outlook,” “anticipates” or “looking forward,” or similar

expressions that relate to strategy, plans, intentions, or

expectations. All statements relating to estimates and statements

about the expected timing and structure of the proposed

Transaction, including the offering and issuance of the Notes, the

ability of the parties to complete the proposed Transaction,

benefits of the Transaction, including future financial and

operating results, executive and Board transition considerations,

the combined company’s plans, objectives, expectations and

intentions, and other statements that are not historical facts are

forward-looking statements. In addition, senior management of Berry

and Glatfelter, from time to time may make forward-looking public

statements concerning expected future operations and performance

and other developments.

Actual results may differ materially from those that are

expected due to a variety of factors, including without limitation:

the occurrence of any event, change or other circumstances that

could give rise to the termination of the proposed Transaction; the

risk that the Glatfelter shareholders may not approve the

Transaction proposals; the risk that the necessary regulatory

approvals may not be obtained or may be obtained subject to

conditions that are not anticipated or may be delayed; risks that

any of the other closing conditions to the proposed Transaction may

not be satisfied in a timely manner; risks that the anticipated tax

treatment of the proposed Transaction is not obtained; risks

related to potential litigation brought in connection with the

proposed Transaction; uncertainties as to the timing of the

consummation of the proposed transactions; unexpected costs,

charges or expenses resulting from the proposed transactions; risks

and costs related to the implementation of the separation of the

business, operations and activities that constitute the global

nonwovens and hygiene films business of Berry into Spinco,

including timing anticipated to complete the separation; any

changes to the configuration of the businesses included in the

separation if implemented; the risk that the integration of the

combined company is more difficult, time consuming or costly than

expected; risks related to financial community and rating agency

perceptions of each of Berry and Glatfelter and its business,

operations, financial condition and the industry in which they

operate; risks related to disruption of management time from

ongoing business operations due to the proposed Transaction;

failure to realize the benefits expected from the proposed

Transaction; the risk that the offering and issuance of the Notes

may not be effected on terms that are advantageous to the Issuer,

Spinco or, after the closing of the Transaction, Magnera, or at

all; effects of the announcement, pendency or completion of the

proposed Transaction on the ability of the parties to retain

customers and retain and hire key personnel and maintain

relationships with their counterparties, and on their operating

results and businesses generally; and other risk factors detailed

from time to time in Glatfelter’s and Berry’s reports filed with

the Securities and Exchange Commission (“SEC”), including annual

reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and other documents filed with the SEC. These

risks, as well as other risks associated with the proposed

Transaction, are more fully discussed in the proxy

statement/prospectus and the registration statements filed with the

SEC in connection with the proposed Transaction. The foregoing list

of important factors may not contain all of the material factors

that are important to you. New factors may emerge from time to

time, and it is not possible to either predict new factors or

assess the potential effect of any such new factors. Accordingly,

readers should not place undue reliance on those statements. All

forward-looking statements are based upon information available as

of the date hereof. All forward-looking statements are made only as

of the date hereof and neither Berry, Glatfelter, the Issuer,

Spinco nor Magnera undertake any obligation to update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed Transaction between Berry and Glatfelter.

In connection with the proposed Transaction, Glatfelter filed a

registration statement on Form S-4 containing a proxy

statement/prospectus with the SEC which was declared effective on

September 17, 2024. Glatfelter has also filed a proxy

statement/prospectus which was sent to Glatfelter’s shareholders on

or about September 20, 2024. In addition, Spinco filed a

registration statement on Form 10 in connection with its separation

from Berry. The Form 10 has not yet been declared effective. This

communication is not a substitute for the registration statements,

proxy statement/prospectus or any other document which Berry and/or

Glatfelter may file with the SEC. STOCKHOLDERS OF BERRY AND

GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE

SEC, INCLUDING THE REGISTRATION STATEMENTS AND PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION. Investors and security holders will

be able to obtain copies of the registration statements and proxy

statement/prospectus as well as other filings containing

information about Berry and Glatfelter, as well as Spinco, without

charge, at the SEC’s website, www.sec.gov. Copies of documents

filed with the SEC by Berry or Spinco will be made available free

of charge on Berry’s investor relations website at

ir.berryglobal.com. Copies of documents filed with the SEC by

Glatfelter will be made available free of charge on Glatfelter’s

investor relations website at www.glatfelter.com/investors.

No Offer or Solicitation

This communication is for informational purposes only and is not

intended to and does not constitute an offer to sell, or the

solicitation of an offer to sell, subscribe for or buy, or a

solicitation of any vote or approval in any jurisdiction, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in which such offer, sale or solicitation would be

unlawful, prior to registration or qualification under the

securities laws of any such jurisdiction. No offer or sale of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act, as amended,

and otherwise in accordance with applicable law.

Participants in Solicitation

Berry and its directors and executive officers, and Glatfelter

and its directors and executive officers, may be deemed to be

participants in the solicitation of proxies from the holders of

Glatfelter common stock and/or the offering of securities in

respect of the proposed Transaction. Information about the

directors and executive officers of Berry, including a description

of their direct or indirect interests, by security holdings or

otherwise, is set forth under the caption “Security Ownership of

Beneficial Owners and Management” in the definitive proxy statement

for Berry’s 2024 Annual Meeting of Stockholders, which was filed

with the SEC on January 4, 2024

(www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm).

Information about the directors and executive officers of

Glatfelter including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth under

the caption “Security Ownership of Certain Beneficial Owners and

Management” in the proxy statement for Glatfelter’s 2024 Annual

Meeting of Shareholders, which was filed with the SEC on March 26,

2024

(www.sec.gov/ix?doc=/Archives/edgar/data/0000041719/000004171924000013/glt-20240322.htm).

Additional information regarding the interests of these

participants can also be found in the Form S-4 and the proxy

statement/prospectus filed by Glatfelter with the SEC and the

registration statement on Form 10 filed by Spinco with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241010092889/en/

Berry Global, Inc. Investor Contact Dustin

Stilwell VP, Investor Relations +1 812.306.2964

ir@berryglobal.com

Glatfelter Corporation Investor Contact Ramesh

Shettigar +1 717.225.2746 Ramesh.Shettigar@glatfelter.com

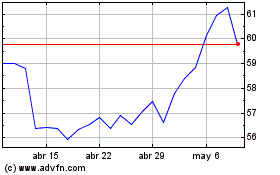

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

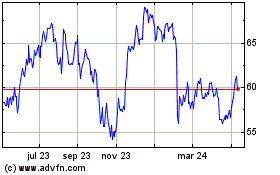

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024