SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 6-K

____________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: November, 2024

Commission File Number: 001-13354

____________

BANK OF MONTREAL

(Name of Registrant)

____________

| 100 King Street West |

129 rue Saint-Jacques |

| 1 First Canadian Place |

Montreal, Quebec |

| Toronto, Ontario |

Canada, H2Y 1L6 |

| Canada, M5X 1A1 |

(Head Office) |

| (Executive Offices) |

|

____________

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F: Form 20-F ¨ Form

40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INCORPORATION BY REFERENCE

The information contained in this Form 6-K and any exhibits hereto

shall be deemed filed with the Securities and Exchange Commission (“SEC”) solely for purposes of incorporation by reference

into and as part of the following registration statement of the registrant on file with and declared effective by the SEC:

| 1. | Registration Statement – Form F-3 – File No. 333-264388 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BANK OF MONTREAL |

|

| |

|

|

|

| |

By: |

/s/ Laurence Kaplan |

|

| |

Name: |

Laurence Kaplan |

|

| |

Title: |

Authorized Signing Officer |

|

Date: November 20, 2024

| | [Signature

Page to Form 6-K] | |

Exhibit 5.6

|

Davis Polk & Wardwell llp

450 Lexington Avenue

New York, NY 10017

davispolk.com

|

Bank of Montreal

100 King Street West

1 First Canadian Place

Toronto, Ontario

Canada M5X 1A1

Ladies and Gentlemen:

Bank of Montreal, a Canadian chartered bank (the “Bank”),

has filed with the Securities and Exchange Commission (the “Commission”) a Registration Statement on Form F-3 on April

20, 2022 and a Pre-Effective Amendment No. 1 thereto on May 25, 2022 (together, the “Registration Statement”) for the

purpose of registering under the Securities Act of 1933, as amended (the “Securities Act”), among other securities,

(i) the Bank’s Senior Medium-Term Notes, Series D (the “Series D Notes”); (ii) the Bank’s Senior Medium-Term

Notes, Series E (the “Series E Notes”); (iii) the Bank’s Senior Medium-Term Notes, Series F (the “Series

F Notes”); (iv) the Bank’s Senior Medium-Term Notes, Series G (the “Series G Notes”); and (v) the Bank’s

Senior Medium-Term Notes, Series I (the “Series I Notes” together with the Series D Notes, the Series E Notes, the

Series F Notes and the Series G Notes, the “Notes”). The Series D Notes, the Series E Notes and the Series F Notes

will be issued from time to time pursuant to the Senior Indenture dated as of January 25, 2010, as amended and supplemented by the First

Supplemental Indenture dated as of September 23, 2018 (the “First Supplemental Indenture”) (as so amended and supplemented,

the “Original Indenture”), between the Bank and Computershare Trust Company, N.A., as successor trustee to Wells Fargo

Bank, National Association (the “Original Trustee”). The Series G Notes will be issued from time to time pursuant to

the Original Indenture, as amended and supplemented by the Second Supplemental Indenture dated as of May 17, 2021 (as so amended and supplemented,

the “Series G Indenture”), among the Bank, the Original Trustee and the Bank of New York Mellon, as series trustee

(the “Series Trustee”). The Series I Notes will be issued from time to time pursuant to the Original Indenture, as

amended and supplemented by the Third Supplemental Indenture dated as of May 26, 2022 (as so amended and supplemented, the “Series

I Indenture”), among the Bank, the Original Trustee and the Series Trustee. The Original Indenture, the Series G Indenture and

the Series I Indenture are collectively referred to herein as the “Indentures” and each an “Indenture”.

We have been appointed by you as your special United States products

counsel, and we have examined originals or copies of such documents, corporate records, certificates of public officials and other instruments

as we have deemed necessary or advisable for the purpose of rendering this opinion.

In rendering the opinions expressed herein, we have, without independent

inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents submitted

to us as copies conform to authentic, complete originals, (iii) all documents filed as exhibits to the Registration Statement that have

not been executed will conform to the forms thereof, (iv) all signatures on all documents that we reviewed are genuine, (v) all natural

persons executing documents had and have the legal capacity to do so, (vi) all statements in certificates of public officials and officers

of the Bank that we reviewed were and are accurate and (vii) all representations made by the Bank as to matters of fact in the documents

that we reviewed were and are accurate.

Based upon the foregoing, and subject to the additional assumptions

and qualifications set forth below, we advise you that, in our opinion, when (A) the specific terms of a particular series of Notes have

been duly authorized and established in accordance with the applicable Indenture; and (x) in the case of Notes represented by a master

global note, (i) such Notes have been duly authorized, executed and authenticated in accordance with the applicable Indenture, (ii) such

Notes have been duly issued in accordance with the applicable Indenture, (iii) the applicable trustee has made the appropriate entries

or notations to the master global note that represents such Notes and (iv) such Notes have been delivered in accordance with the applicable

underwriting or other distribution agreement against payment therefor; or (y) in the case of Notes represented by a global note, such

Notes have been duly authorized, executed, authenticated, issued and delivered in accordance with the applicable Indenture and the applicable

underwriting or other distribution agreement against payment therefor, such Notes will constitute valid and binding obligations of the

Bank, enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’

rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts

of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions or applications giving effect to governmental

actions or foreign laws affecting creditors’ rights, provided that we express no opinion as to (i) the enforceability of

any waiver of rights under any usury or stay law; (ii) the effect of fraudulent conveyance, fraudulent transfer or similar provision of

applicable law on the conclusions expressed above or (iii) the validity, legally binding effect or enforceability of any provision that

permits holders to collect any portion of the stated principal amount upon acceleration of the Notes to the extent determined to constitute

unearned interest.

In connection with the opinion expressed above, we have assumed that

at or prior to the time of the delivery of any Notes, (i) pursuant to the authority granted by the Board of Directors of the Bank, duly

authorized officers of the Bank shall have established the terms of the Notes and duly authorized the issuance, execution, sale and delivery

of the Notes, in each case as a matter of Canadian, Québec and Ontario law, and such authorization shall not have been modified

or rescinded; (ii) the Bank is, and will remain, validly existing as a Schedule I bank under the Bank Act (Canada) and has the corporate

power to create, issue and sell the Notes, (iii) the effectiveness of the Registration Statement shall not have been terminated or rescinded;

(iv) the Indentures, any master global note and the Notes (the “Documents”) have been duly authorized, executed, authenticated

(if applicable) and delivered by, and are each valid, binding and enforceable agreements of, each party thereto (other than as expressly

covered above in respect of the Bank); (v) the Notes will be executed in substantially the form reviewed by us; (vi) the execution and

delivery by each such party to each Document to which it is a party, and the performance by each such party of all of its obligations

under each Document to which it is a party, (x) do not contravene, or constitute a default under, the articles or certificate of incorporation

or bylaws or other constitutive documents of such party, (y) require no action by or in respect of, or filing with, any governmental body,

agency or official and (z) do not and will not contravene, or constitute a default under, any provision of applicable law or public policy

or regulation, or any judgment, injunction, order, decree or any agreement or other instrument binding on any such party; and (vii) there

shall not have occurred any change in law affecting the validity or enforceability of such Notes. We have also assumed that none of the

terms of any Note to be established subsequent to the date hereof, nor the issuance and delivery of such Note, nor the compliance by the

Bank with the terms of such Note will violate any applicable law or public policy or will result in a violation of any provision of any

instrument or agreement then binding upon the Bank, or any restriction imposed by any court or other governmental body, agency or official

having jurisdiction over the Bank.

In connection with our opinion above, we note that, as of the date

of this opinion, a judgment for money in an action based on Notes payable in foreign currencies in a federal or state court in the United

States ordinarily would be enforced in the United States only in United States dollars. The date used to determine the rate of conversion

of the foreign currency in which a particular Note is payable into United States dollars will depend upon various factors, including which

court renders the judgment. However, if a judgment for

money in an action based on the Notes were entered by a New York court,

such court would enter the judgment in the foreign currency.

We express no opinion with respect to (i) Section 301(b) of the Original

Indenture or (ii) any provision of the First Supplemental Indenture insofar as it relates to Bail-inable Securities (as defined in the

First Supplemental Indenture), including, but not limited to, Article 16 “Canadian Bail-In And Bail-In Acknowledgment” thereof.

In addition, we express no opinion with respect to choice-of-law provisions of the Indenture (except to the extent that the laws of the

State of New York have been chosen as the governing law of the Indenture).

We are members of the Bar of the State of New York, and the foregoing

opinion is limited to the laws of the State of New York. Insofar as the foregoing opinion involves matters governed by the laws of the

Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we understand that you are relying upon,

the opinion of Osler, Hoskin & Harcourt LLP, Canadian counsel for the Bank, dated April 20, 2022.

We hereby consent to the filing of this opinion as an exhibit to a

report on Form 6-K to be filed by the Bank on the date hereof and its incorporation by reference into the Registration Statement. In giving

this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

In addition, if a pricing supplement relating to the offer and sale

of any particular Note or Notes is prepared and filed by the Bank with the Commission on this date or a future date and the pricing supplement

contains a reference to us and our opinion substantially in the form set forth below, this consent shall apply to the reference to us

and our opinion in substantially such form:

“In the opinion of Davis Polk & Wardwell LLP, as special

United States products counsel to the Bank, [when the notes offered by this pricing supplement have been executed and issued by the Bank

and authenticated by the trustee pursuant to the Indenture, and delivered against payment as contemplated herein] [when the notes offered

by this pricing supplement have been issued by the Bank pursuant to the Indenture, the trustee has made the appropriate entries or notations

to the master global note that represents such notes (the “master note”), and such notes have been delivered against payment

as contemplated herein], such notes will be valid and binding obligations of the Bank, enforceable in accordance with their terms, subject

to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable

principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and

possible judicial or regulatory actions or applications giving effect to governmental actions or foreign laws affecting creditors’

rights, provided that such counsel expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or

stay law; [or] (ii) the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions

expressed above [or (iii) the validity, legally binding effect or enforceability of any provision that permits holders to collect any

portion of the stated principal amount upon acceleration of the notes to the extent determined to constitute unearned interest]. This

opinion is given as of the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion involves

matters governed by the laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we

understand that you are relying upon, the opinion of Osler, Hoskin & Harcourt LLP, Canadian counsel for the Bank, set forth above.

In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the

Indenture and the authentication of the [notes][master note]

and the validity, binding nature and enforceability of the Indenture with respect to the

trustee, all as stated in the opinion of Davis Polk & Wardwell LLP dated November 20, 2024, which has been filed as an exhibit to the report

on Form 6-K referred to above. [This opinion is also subject to the discussion, as stated in such opinion, of the enforcement of notes

denominated in a foreign currency.]”

Very truly yours,

/s/ Davis Polk & Wardwell LLP

Exhibit 23.13

|

Davis Polk & Wardwell llp

450 Lexington Avenue

New York, NY 10017

davispolk.com

|

Bank of Montreal

100 King Street West

1 First Canadian Place

Toronto, Ontario

Canada M5X 1A1

Ladies and Gentlemen:

Bank of Montreal, a Canadian chartered bank (the “Bank”),

has filed with the Securities and Exchange Commission (the “Commission”) a Registration Statement on Form F-3 on April

20, 2022 and a Pre-Effective Amendment No. 1 thereto dated May 25, 2022 (together, the “Registration Statement”) for

the purpose of registering under the Securities Act of 1933, as amended (the “Securities Act”), among other securities,

(i) the Bank’s Senior Medium-Term Notes, Series D, (ii) the Bank’s Senior Medium-Term Notes, Series E; (iii) the Bank’s

Senior Medium-Term Notes, Series F; (iv) the Bank’s Senior Medium-Term Notes, Series G and (v) the Bank’s Senior Medium-Term

Notes, Series I (collectively, the “Notes”).

We hereby consent to any reference to us, in our capacity as special

tax counsel to the Bank, or any opinion of ours delivered in that capacity, in a pricing supplement relating to the offer and sale of

any particular Notes prepared and filed by the Bank with the Commission on this date or a future date.

In giving this consent, we do not admit that we are in the category

of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Davis Polk & Wardwell LLP

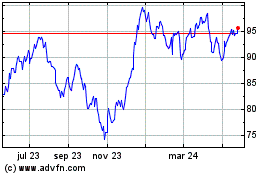

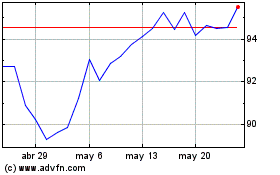

Bank of Montreal (NYSE:BMO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Bank of Montreal (NYSE:BMO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024