Blackstone Acquires Majority Stake in Leading Hotel Accounting Software and Services Provider M3

15 Agosto 2024 - 8:00AM

Business Wire

Growth investment made in partnership with

Asian American Hotel Owners Association (AAHOA)

M3, LLC (“M3”), voted the number-one hospitality accounting

software in North America, today announced it has signed a

definitive agreement for a majority investment from Blackstone

Growth and affiliated funds (collectively “Blackstone”). The

investment will help to accelerate the company’s growth by

enhancing new product expansion and supporting the adoption of M3’s

software, which enables hotel operators to run more efficiently and

effectively. AAHOA, representing nearly 20,000 hotel owners and 60%

of hotels across the United States, will make its first ever

strategic investment alongside Blackstone.

Founded in 1998 by hospitality industry veteran John McKibbon to

address the accounting needs of his own family’s hotel management

company, M3 has grown into a leading hospitality-focused

back-office accounting software platform that serves as the

system-of-record for financial data for more than a thousand hotel

operators and management companies today. It currently offers

technological solutions including accounting, labor management and

business intelligence to more than 8,000 properties across North

America. M3 has ranked as the nation’s number-one hotel accounting

software and financial reporting provider by HotelTech Report for

the past four years.

John McKibbon, Founder of M3, said: “Blackstone’s background in

hospitality made them the natural choice as our first equity

partner. Together, we look forward to propelling our innovation and

growth to best serve our customers in an era of continued

technological advancement.”

Ramzi Ramsey, a Managing Director at Blackstone, said: “M3 has

become a leading finance and accounting software platform for

countless independent and family owned hotel operators, as well as

some of the largest hotel management companies, that have relied on

its technology to support the professionalization and scale of

their businesses. As M3’s first institutional capital partner,

we’re excited to harness Blackstone’s deep expertise and network

within the real estate and technology sectors to help enhance its

product offering to better serve new and existing companies as M3

continues to grow.”

Allen Read and Casi Johnson, CEO and President of M3, said: “For

over 25 years, M3 has been focused on delivering a comprehensive

solution while providing world class support to our customers. We

remain steadfast in our commitment to serving our customers and are

thrilled to partner with Blackstone to continue to scale our

vision, team, and culture.”

Kevin Chang, a Principal at Blackstone, said: “M3 has built an

enviable market position thanks to its robust technology and

customer-centric approach. We are eager to build upon this strong

foundation and support M3 in its next phase of growth and expansion

in the broader hospitality market.”

Miraj S. Patel, AAHOA Chairman, said: “AAHOA is excited to make

its first strategic investment alongside Blackstone, a move that

will significantly benefit our members and the entire hospitality

industry. This partnership with M3 will bring AAHOA Members access

to advanced technology and innovative solutions that can enhance

operational efficiency and drive growth. We are committed to

empowering our members with the tools and resources needed to

succeed in an evolving market, and this collaboration marks a

pivotal step toward achieving that goal.”

Terms of the transaction were not disclosed. Carlton Fields,

P.A., served as legal counsel to M3 and Houlihan Lokey has provided

certain assistance to M3 in connection with the transaction.

Evercore served as exclusive financial advisor to Blackstone and

Kirkland & Ellis LLP served as legal counsel to Blackstone.

About M3

Built by hoteliers exclusively for hoteliers, M3 is a robust

cloud-based financial platform and services company serving over

8,000 properties across North America’s hospitality industry

helping drive cost savings, revenue enhancement, and business

insight. After over 25 years in business, M3 touts a 95 percent

customer retention rate. Used by over 1,000 management groups and

owner-operators and hotels of all sizes, the platform works

seamlessly with other key systems and tools in the hospitality

industry. It offers robust accounting and financial analysis across

entire portfolios with optional operations and time management

features. M3’s Professional Services team provides on-demand

accounting and bookkeeping support for hotels and portfolios of any

size by offering a full range of customized accounting solutions

that can scale with a hotelier’s needs. Privately held and

employee-owned, M3 continues to constantly enhance products and

services with regular releases and updates. “M3”, “CoreSelect”, “M3

Concierge”, and “Accounting Core” are all trademarks owned by M3;

all other marks are owned by their respective owners. For more

information, visit www.m3as.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We

seek to deliver compelling returns for institutional and individual

investors by strengthening the companies in which we invest. Our

more than $1 trillion in assets under management include global

investment strategies focused on real estate, private equity,

infrastructure, life sciences, growth equity, credit, real assets,

secondaries and hedge funds. Further information is available at

www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter),

and Instagram.

About AAHOA

AAHOA is the largest hotel owner’s association in the world,

with Member-owned properties representing a significant part of the

U.S. economy. AAHOA's 20,000 members own 60% of the hotels in the

United States and are responsible for 1.7% of the nation’s GDP.

More than 1 million employees work at AAHOA Member-owned hotels,

earning $47 billion annually, and member-owned hotels support 4.2

million U.S. jobs across all sectors of the hospitality industry.

AAHOA's mission is to advance and protect the business interests of

hotel owners through advocacy, industry leadership, professional

development, member benefits, and community engagement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814720837/en/

Contact Blackstone Mariel Seidman-Gati

mariel.seidmangati@blackstone.com (917) 698-1674

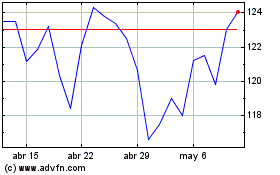

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024