CORRECTING and REPLACING Trustees Approve Managed Distribution Plans for Certain MFS Closed-End Funds

12 Febrero 2015 - 6:00PM

Business Wire

Reissuing release to correct a ticker symbol for searching

purposes.

The corrected release reads:

TRUSTEES APPROVE MANAGED DISTRIBUTION PLANS

FOR CERTAIN MFS CLOSED-END FUNDS

The Board of Trustees (the “Board”) of the

following MFS closed-end funds (the “funds") has approved the

adoption of managed distribution plans whereby the funds will,

beginning in May 2015, make monthly distributions to common

shareholders at an annual minimum fixed rate based on average

monthly net asset value (NAV) of each fund's common shares. The

funds and rates, respectively, are as follows:

Fund Ticker

Rate MFS® Charter Income Trust

NYSE: MCR

8.00% MFS® InterMarket Income Trust I

NYSE: CMK 7.00% MFS® Intermediate High

Income Fund

NYSE: CIF

9.50% MFS® Multimarket Income Trust

NYSE: MMT

8.00%

The primary purpose of each plan is to provide shareholders with

a constant, but not guaranteed, fixed minimum rate of distribution

each month. The funds' advisor, MFS Investment Management® (MFS®),

recommended each plan to the Board. Each plan is intended to narrow

the discount between the market price and the NAV of each fund's

common shares, but there is no assurance that the plan will be

successful in doing so.

Under a managed distribution plan, to the extent that sufficient

investment income is not available on a monthly basis, the fund

will distribute long-term capital gains and/or return of capital in

order to maintain its managed distribution level. You should not

draw any conclusions about a fund’s investment performance from the

amount of the fund’s distributions or from the terms of the fund’s

managed distribution plan. The Board may amend the terms of a plan

or terminate a plan at any time without prior notice to the fund's

shareholders. The amendment or termination of a plan could have an

adverse effect on the market price of a fund’s common shares. Each

plan will be subject to periodic review by the Board.

With each distribution that does not consist solely of net

investment income, each fund will issue a notice to shareholders

and an accompanying press release which will provide detailed

information regarding the amount and composition of the

distribution and other related information. The amounts and sources

of distributions reported in the notice to shareholders are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon each fund’s investment experience during

its full fiscal year and may be subject to changes based on tax

regulations. Each fund will send shareholders a Form 1099-DIV for

the calendar year that will tell them how to report these

distributions for federal income tax purposes. A fund may at times

distribute more than its net investment income and net realized

capital gains; therefore, a portion of the distribution may result

in a return of capital. A return of capital may occur, for example,

when some or all of the money that shareholders invested in a fund

is paid back to them. A return of capital does not necessarily

reflect a fund’s investment performance and should not be confused

with ‘yield’ or ‘income’. Any such returns of capital will decrease

each fund's total assets and, therefore, could have the effect of

increasing each fund's expense ratio. In addition, in order to make

the level of distributions called for under its plan, a fund may

have to sell portfolio securities at a less than opportune

time.

About MFS Investment

Management

Established in 1924, MFS is an active, global asset manager with

investment offices in Boston, Hong Kong, London, Mexico City, São

Paulo, Singapore, Sydney, Tokyo and Toronto. We employ a uniquely

collaborative approach to build better insights for our clients.

Our investment approach has three core elements: integrated

research, global collaboration and active risk management. As of

January 30, 2015, MFS manages US$426.5 billion in assets on behalf

of individual and institutional investors worldwide. Please visit

mfs.com for more information.

Statements made in this release that look forward in time

involve risks and uncertainties and are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such risks and uncertainties include, without limitation,

the adverse effect from a decline in the securities markets or a

decline in a Fund’s performance, a general downturn in the economy,

competition from other closed-end investment companies, changes in

government policy or regulation, inability of a Fund’s investment

adviser to attract or retain key employees, inability of a Fund to

implement its investment strategy, inability of a Fund to manage

rapid expansion and unforeseen costs and other effects related to

legal proceedings or investigations of governmental and

self-regulatory organizations.

The funds are closed-end investment products. Common shares

of the funds are only available for purchase/sale on the NYSE at

the current market price. Shares may trade at a discount to NAV,

including during periods in which a fund’s managed distribution is

in effect.

MFS Investment Management

111 Huntington Ave, Boston, MA 02199

32399.1

MFS Shareholders or Advisors (investment product

information):Eric Zubris, 800-343-2829, ext. 56152orMedia

Only:James Aber, 617-954-6154orDan Flaherty, 617-954-4256

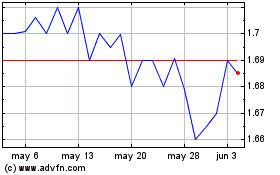

MFS Intermediate High In... (NYSE:CIF)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

MFS Intermediate High In... (NYSE:CIF)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024