false

0000029534

0000029534

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 13, 2024

| DOLLAR GENERAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Tennessee |

|

001-11421 |

|

61-0502302 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

100 MISSION RIDGE

GOODLETTSVILLE, TN |

|

37072 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (615) 855-4000

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on

which registered |

| Common Stock, par value $0.875 per share |

DG |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT. |

On

February 13, 2024, Dollar General Corporation (the “Company”) entered into Amendment No. 2 (the “Amendment”) to

the unsecured amended and restated credit agreement, dated December 2, 2021, with the lenders named therein, Citibank, N.A. as administrative

agent, Bank of America, N.A. as syndication agent, Citibank, N.A., BofA Securities, Inc., U.S. Bank National Association and Wells Fargo

Securities, LLC as joint lead arrangers and joint bookrunners, and Fifth Third Bank, National Association, Goldman Sachs Bank USA, JPMorgan

Chase Bank, N.A., PNC Bank, National Association, Regions Bank, Truist Bank, U.S. Bank National Association and Wells Fargo Bank, National

Association as co-documentation agents, as amended by Amendment No. 1 dated as of January 31, 2023 (the “Credit Agreement”).

The Credit Agreement, as amended by the Amendment, provides for a $2.0 billion unsecured revolving credit facility terminating on December

2, 2026 (the “Revolving Facility”) of which up to $100.0 million is available for letters of credit. The Revolving Facility

also includes borrowing capacity available for short-term borrowings referred to as swingline loans.

The

terms of the Credit Agreement require the Company to meet certain financial tests, among other things. The Amendment modifies certain

maximum leverage ratio levels as set forth therein.

Certain

lenders under the Credit Agreement, as amended by the Amendment and their affiliates have, from time to time, provided investment banking,

commercial banking, advisory and other services to the Company and/or its affiliates for which they have received customary fees and commissions

and such lenders and their affiliates may provide these services from time to time in the future.

A

copy of the Credit Agreement and the Amendment are attached hereto as Exhibits 4.1, 4.2 and 4.3, respectively, and are incorporated herein

by reference. The descriptions of the Credit Agreement and the Amendment in this report are summaries and are qualified in their entirety

by the terms of the Credit Agreement and the Amendment attached hereto.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

(a) Financial statements

of businesses or funds acquired. N/A

(b) Pro forma financial

information. N/A

(c) Shell company

transactions. N/A

(d) Exhibits. See

Exhibit Index to this report.

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 4.1 |

Amended and Restated Credit Agreement, dated as of December 2, 2021, among Dollar General Corporation, as borrower, Citibank, N.A., as administrative agent, and the other credit parties and lenders party thereto (incorporated by reference to Exhibit 4.1 to Dollar General Corporation’s Current Report on Form 8-K dated December 3, 2021, filed with the SEC on December 3, 2021 (file no. 001-11321)) |

| |

|

| 4.2 |

Amendment No. 1 to the Credit Agreement, dated as of January 31, 2023, among Dollar General Corporation, as borrower, Citibank N.A., as administrative agent, and the other credit parties and lenders party thereto (incorporated by reference to Exhibit 4.2 to Dollar General Corporation’s Current Report on Form 8-K dated January 31, 2023, filed with the SEC on February 1, 2023 (file no. 001-11421)) |

| |

|

| 4.3 |

Amendment No. 2 to the Credit Agreement, dated as of February 13, 2024, among Dollar General Corporation, as borrower, Citibank, N.A., as administrative agent, and the other credit parties and lenders party thereto |

| |

|

| 104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: February 14, 2024 |

DOLLAR GENERAL CORPORATION |

| |

|

|

| |

By: |

/s/ Kelly M. Dilts |

| |

|

Kelly M. Dilts |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 4.3

EXECUTION COPY

AMENDMENT NO. 2 TO THE

CREDIT AGREEMENT

| | Dated as of February 13, 2024 |

AMENDMENT NO. 2 TO THE CREDIT AGREEMENT

(this “Amendment”) among DOLLAR GENERAL CORPORATION, a Tennessee corporation (the “Borrower”), the

banks, financial institutions and other institutional lenders parties to the Credit Agreement referred to below (collectively, the “Lenders”)

and CITIBANK, N.A., as agent (the “Administrative Agent”) for the Lenders.

PRELIMINARY STATEMENTS:

(1) The

Borrower, the Lenders and the Administrative Agent have entered into an Amended and Restated Credit Agreement dated as of December 2,

2021, as amended by Amendment No. 1 dated as of January 31, 2023 (as so amended, the “Credit Agreement”).

Capitalized terms not otherwise defined in this Amendment have the same meanings as specified in the Credit Agreement.

(2) The

Borrower has requested certain amendments to the Credit Agreement, and the parties hereto agree to such amendments as set forth in, and

in accordance with the terms and conditions of, this Amendment (the Credit Agreement as so amended, the “Amended Credit Agreement”).

SECTION 1. Amendments

to Credit Agreement. As of the Amendment Effective Date (as defined below), subject to the satisfaction of the conditions precedent

set forth in Section 2 below, the Required Lenders and the Borrower hereby agree as follows:

(a) Section 5.03(a) of

the Credit Agreement is amended in full to read as follows:

(a) Leverage

Ratio. Maintain a ratio of (i) Consolidated Total Debt as of such Measurement Date to (ii) Consolidated EBITDAR for the four

fiscal quarter period ending on such Measurement Date of not greater than (A) 3.75:1.0 for each four fiscal quarter period ending

on or prior to February 2, 2024, (B) 4.25:1.0 for the four fiscal quarter periods ending May 3, 2024, August 2, 2024,

November 1, 2024 and January 31, 2025, and (C) 3.75:1.0 thereafter.

(b) Schedule

4.01(f) of the Credit Agreement is amended in full to read as set forth on Schedule I hereto.

SECTION 2. Conditions

of Effectiveness. This Amendment shall become effective on and as of the date (the “Amendment Effective Date”)

on which the Administrative Agent shall have received counterparts of this Amendment executed by the Borrower, the Required Lenders and

the Administrative Agent.

SECTION 3. Representations

and Warranties of the Borrower. The Borrower represents and warrants that (i) representations and warranties contained in Section 4.01

of the Amended Credit Agreement are true and correct in all material respects (other than any representation or warranty qualified by

materiality or Material Adverse Effect, which shall be true and correct in all respects) on and as of the Amendment Effective Date, except

to the extent any of such representations and warranties refers to an earlier date, in which case such representation and warranty shall

be true and correct in all material respects (other than any representation or warranty qualified by materiality or Material Adverse Effect,

which shall be true and correct in all respects) on and as of such date and (ii) no event has occurred and is continuing that constitutes

a Default.

SECTION 4. Reference

to and Effect on the Loan Documents. (a) On and after the effectiveness of this Amendment, each reference in the Credit Agreement

to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement,

and each reference in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof”

or words of like import referring to the Credit Agreement, shall mean and be a reference to the Amended Credit Agreement.

(b) The

Credit Agreement and the other Loan Documents, as specifically amended by this Amendment, are and shall continue to be in full force and

effect and are hereby in all respects ratified and confirmed.

(c) The

execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right,

power or remedy of any Lender or the Administrative Agent under the Credit Agreement or any other Loan Documents, nor constitute a waiver

of any provision of the Credit Agreement or any other Loan Documents.

(d) This

Amendment is subject to the provisions of Section 8.01 of the Credit Agreement and shall be deemed to constitute a Loan Document.

SECTION 5. Costs

and Expenses. The Borrower shall pay all reasonable out of pocket expenses incurred by the Agent and its Affiliates (including the

reasonable fees, charges and disbursements of counsel for the Agent), in connection with the preparation, negotiation, execution and delivery

of this Amendment in accordance with Section 8.04 of the Amended Credit Agreement.

SECTION 6. Execution

in Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts,

each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement.

Delivery of an executed counterpart of a signature page to this Amendment by telecopier or email shall be effective as delivery of

a manually executed counterpart of this Amendment.

SECTION 7. Governing

Law. This Amendment and shall be governed by, and construed in accordance with, the law of the State of New York.

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| DOLLAR GENERAL CORPORATION, as Borrower |

| | | |

| | By: | /s/ Kelly M. Dilts |

| | Name: | Kelly M. Dilts |

| | Title: | EVP & CFO |

| | | |

| | CITIBANK, N.A., as Administrative

Agent |

| | | |

| | By: | /s/ Michael Vondriska |

| | Name: | Michael Vondriska |

| | Title: | Vice President |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| CITIBANK, N.A. | |

| | |

| |

| by | /s/ Michael Vondriska | |

| | Name: |

Michael Vondriska | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| BANK OF AMERICA, N.A.: | |

| | |

| |

| by | /s/ Michelle L. Walker | |

| | Name: |

Michelle L. Walker | |

| | Title: |

Director | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: U.S. BANK NATIONAL ASSOCIATION | |

| | |

| |

| by | /s/ Peter Hale | |

| | Name: |

Peter Hale | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| wells fargo bank, national association | |

| | |

| |

| by | /s/ Michael Bruggeman | |

| | Name: |

Michael Bruggeman | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: Goldman Sachs Bank USA | |

| | |

| |

| by | /s/ Priyankush Goswami | |

| | Name: |

Priyankush Goswami | |

| | Title: |

Authorized Signatory | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: Fifth Third Bank, National Association | |

| | |

| |

| by | /s/ N. Calloway | |

| | Name: |

Nate Calloway | |

| | Title: |

Corporate Banking Associate, Officer | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: JPMORGAN CHASE BANK, N.A. | |

| | |

| |

| by | /s/ Charles W. Shaw | |

| | Name: |

Charles W. Shaw | |

| | Title: |

Executive Director | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: PNC Bank, National Association | |

| | |

| |

| by | /s/ Christopher Hand | |

| | Name: |

Christopher Hand | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Regions Bank: | |

| | |

| |

| by | /s/ Tyler Nissen | |

| | Name: |

Tyler Nissen | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: TRUIST BANK | |

| | |

| |

| by | /s/ Carlos Navarrete | |

| | Name: |

J. Carlos Navarrete | |

| | Title: |

Director | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: BMO Bank, N.A. | |

| | |

| |

| by | /s/ Evan Ponder | |

| | Name: |

Evan Ponder | |

| | Title: |

Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: CAPITAL ONE, NATIONAL ASSOCIATION | |

| | |

| |

| by | /s/ Marta Jedrzejowski | |

| | Name: |

Marta Jedrzejowski | |

| | Title: |

Duly Authorized Signatory | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: The Huntington National Bank | |

| | |

| |

| by | /s/ Scott Lyman | |

| | Name: |

Scott Lyman | |

| | Title: |

Assistant Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: The Northern Trust Company | |

| | |

| |

| by | /s/ Mike Fornal | |

| | Name: |

Mike Fornal | |

| | Title: |

Senior Vice President | |

Signature Page to Dollar General Amendment

No. 2

SIGNATURE

PAGE

Consent to amend the Credit Agreement as provided

in the forgoing Amendment:

| Name of Lender: FIRST HORIZON BANK | |

| | |

| |

| by | /s/ Drew Rodgers | |

| | Name: |

Drew Rodgers | |

| | Title: |

Senior Vice President | |

Signature Page to Dollar General Amendment

No. 2

SCHEDULE I TO AMENDMENT NO. 2

SCHEDULE 4.01(f)

DISCLOSED LITIGATION

[schedule omitted]

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

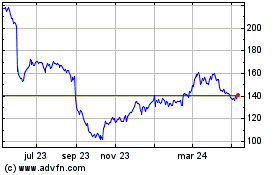

Dollar General (NYSE:DG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

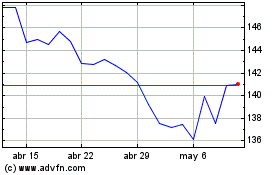

Dollar General (NYSE:DG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024