Saba Capital Issues Letter Sent to Chair of European Opportunities Trust Board Regarding its Opposition to the Proposed Tender Offer

07 Noviembre 2023 - 2:00AM

Business Wire

Reaffirms Opposition to the Fund’s Continuation

Resolution Until Size of Tender Offer is Increased

Requests that the Fund Offer a 50% Tender of

the Shares Outstanding

Saba Capital Management, L.P. (“Saba” or “we”), one of the

largest shareholders of the European Opportunities Trust PLC (LSE:

EOT) (the "Fund" or the "Trust"), today issued a letter it sent to

the Chairman of the Fund’s Board of Directors (the “Board”)

regarding its opposition to the proposed tender offer the Fund

announced on November 6, 2023. Until the size of the tender offer

is increased, Saba recommends that shareholders reject the

continuation resolution at the Fund’s Annual General Meeting

scheduled to be held on November 15, 2023.

The full text of the letter is below.

November 6, 2023

Matthew Dobbs Chair of the Board European Opportunities Trust 12

Victoria Street London SW1E 6DE

Re: European Opportunities Trust

Dear Chairman Dobbs,

In light of the Fund’s announcement of a proposed tender offer

today, we thought it would be helpful to share our assessment with

you and the Fund’s other shareholders ahead of the vote on the

continuation resolution next week.

For over a decade, our firm, Saba Capital, has been fighting for

the interests of shareholders in closed-end funds and investment

trusts. We have negotiated dozens of shareholder-friendly corporate

actions (i.e., tenders, restructurings, discount management plans)

in funds like EOT, whose shareholders have suffered from sustained

underperformance and prolonged discounts to net asset value.

In our experience, when a fund proposes a modest tender offer

instead of taking more significant action, it raises significant

concerns. In EOT’s case, we believe that following completion of

your proposed 25% tender, the share price would then fall and the

discount to NAV would grow to at least -15% -- a level common in UK

investment trusts that do not have a continuation vote. This could

lead to all shareholders suffering a net loss in value, even the

ones who participate in the tender!

In order to create a positive outcome, we request that the Fund

offer a 50% tender of the shares outstanding, to allow a

significant portion of dissatisfied shareholders to exit. In our

view, a 50% tender will lead to a better price post tender than

your proposal whilst keeping the Fund’s size viable for investors

who wish to remain.

Accordingly, we strongly recommend that our fellow investors

reject the continuation of the Fund until the size of the tender is

increased.

Sincerely,

Paul Kazarian Saba Capital

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba is headquartered in New York

City. Learn more at www.sabacapital.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107371954/en/

Longacre Square Partners Greg Marose / Kate Sylvester,

646-386-0091 gmarose@longacresquare.com /

ksylvester@longacresquare.com

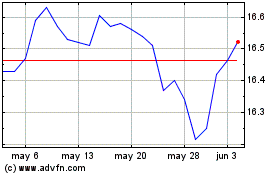

Eaton Vance National Mun... (NYSE:EOT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Eaton Vance National Mun... (NYSE:EOT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024