Announces acquisition of Grandata

EVERTEC, Inc. (NYSE: EVTC) (“Evertec”, the “Company”, “we” or

“our”) today announced results for the third quarter ended

September 30, 2024.

Third Quarter 2024 Highlights

- Revenue increased 22% to $211.8 million

- GAAP Net Income attributable to common shareholders increased

146% to $24.7 million and increased 153% to $0.38 per diluted

share

- Adjusted EBITDA increased 11% to $87.4 million and Adjusted

earnings per common share increased 8% to $0.86

- Share repurchases totaled $12.3 million.

- Closed on acquisition of 100% of Grandata Inc. ("Grandata") on

October 30th

Mac Schuessler, President and Chief Executive Officer stated,

"We are pleased with our third quarter results that demonstrate our

commitment to continue to improve our margin. We are excited to

announce the acquisition of Grandata, which align with our capital

deployment strategy focusing on Latin America and diversifying our

revenue."

Third Quarter 2024 Results

Revenue. Total revenue for the quarter ended September 30, 2024

was $211.8 million, an increase of 22% compared with $173.2 million

in the prior year quarter as a result of organic growth across all

of the Company's segments as well as the contribution from Sinqia.

Merchant acquiring revenue benefited from an improvement in spread

and sales volume growth. Payments Puerto Rico revenue reflected

continued growth in ATH Movil Business and increased transaction

volumes. Latin America revenue benefited from the contribution from

the Sinqia acquisition as well as continued organic growth across

the region. Latin America revenue also benefited from better than

expected volumes in our GetNet Chile relationship which resulted in

the recognition of an incremental $1.8 million in revenue, compared

with $6.3 million recognized in the prior year quarter for the same

concept. Business Solutions revenue reflected increases for

completed projects, primarily for Banco Popular.

Net Income attributable to common shareholders. For the quarter

ended September 30, 2024, GAAP Net Income attributable to common

shareholders was $24.7 million, or $0.38 per diluted share, an

increase of $14.6 million or $0.23 per diluted share as prior year

Net Income was negatively impacted by the $29.2 million loss on the

foreign currency swap to fix the price of the Sinqia acquisition

and the increase in revenues in the quarter. These positive

variances were partially offset by increased operating expenses, as

Cost of revenues reflected an increase in personnel costs, mostly

due to Sinqia, and, to a lesser extent, an increase in cloud

services and professional fees. Selling, general and administrative

expenses also increased mainly due to the addition of Sinqia

headcount and an increase in equipment expenses, partially offset

by lower professional fees. Interest expense increased from prior

year due to the incremental debt raised to finance the Sinqia

acquisition, while depreciation and amortization expense increase

is primarily related to the intangibles recorded as part of the

Sinqia acquisition. Income tax expense increased to $1.7 million

compared to an income tax benefit in the prior year quarter of $4.9

million, primarily driven by the foreign currency hedge loss.

Adjusted EBITDA and Adjusted EBITDA Margin. For the quarter

ended September 30, 2024, Adjusted EBITDA was $87.4 million, an

increase of $8.7 million when compared to the prior year quarter,

driven by the increase in revenues and the contribution from the

Sinqia acquisition. Adjusted EBITDA margin (Adjusted EBITDA as a

percentage of total revenues) was 41.3%, a decrease of

approximately 420 basis points from the prior year. The decrease in

Adjusted EBITDA margin reflects the addition of Sinqia, which

contributes at a lower margin, as well as the impact of the $6.3

million adjustment for GetNet Chile in the prior year, compared

with $1.8 million in the current year, which is 100% accretive to

margin.

Adjusted Net Income and Adjusted earnings per common share. For

the quarter ended September 30, 2024, Adjusted Net Income was $55.4

million, an increase of $3.0 million compared to $52.4 million in

the prior year. The increase was driven by the higher Adjusted

EBITDA, positively impacted by the factors explained above, and a

decrease in Non-GAAP tax expense, partially offset by higher

operating depreciation and amortization and higher cash interest

expense, due to the incremental debt raised for the Sinqia

acquisition. Adjusted earnings per common share was $0.86, an

increase of $0.06 per diluted share compared to $0.80, in the prior

year driven by the factors explained for Adjusted Net Income and a

lower share count as a result of repurchases completed in 2024.

Share Repurchase

During the three months ended September 30, 2024, the Company

repurchased 374,091 shares of its common stock at an average price

of $32.86 per share for a total of $12.3 million. As of September

30, 2024, a total of approximately $138 million remained available

for future use under the Company's share repurchase program.

Business Acquisition

On October 30, 2024, the Company closed an agreement to acquire

100% of the share capital of Grandata. Grandata is a data analytics

company operating in Mexico that specializes in leveraging

behavioral data to provide credit risk insights, with a focus on

underbanked populations. This transaction enhances our existing

product offering and will enable us to address our customer’s needs

more fully. We plan on leveraging our existing client base to

accelerate the growth of this acquisition similar to what we have

been able to do with other transactions.

2024 Outlook

The Company's financial outlook for 2024 is as follows:

- Total consolidated revenue between $841 million and $847

million approximately 21% to 22% growth.

- Adjusted earnings per common share between $3.08 to $3.15

approximately 9% to 12% growth as compared to $2.82 in 2023.

- Capital expenditures are now anticipated to be approximately

$85 million, including Sinqia.

- Effective tax rate of approximately 5% compared to a 6% to 7%

in 2023.

Earnings Conference Call and Audio Webcast

The Company will host a conference call to discuss its third

quarter 2024 financial results today at 4:30 p.m. ET. Hosting the

call will be Mac Schuessler, President and Chief Executive Officer,

and Joaquin Castrillo, Chief Financial Officer. The conference call

can be accessed live over the phone by dialing (888) 338-7153 or

for international callers by dialing (412) 317-5117. A replay will

be available one hour after the end of the conference call and can

be accessed by dialing (877) 344-7529 or (412) 317-0088 for

international callers; the pin number is 8246402. The replay will

be available through Wednesday, November 13, 2024. The call will be

webcast live from the Company’s website at www.evertecinc.com under

the Investor Relations section or directly at

http://ir.evertecinc.com. A supplemental slide presentation that

accompanies this call and webcast will be available prior to the

call on the investor relations website at ir.evertecinc.com and

will remain available after the call.

About Evertec

EVERTEC, Inc. (NYSE: EVTC) is a leading full-service transaction

processor and financial technology provider in Latin America,

Puerto Rico and the Caribbean, providing a broad range of merchant

acquiring, payment services and business process management

services. Evertec owns and operates the ATH® network, one of the

leading personal identification number (“PIN”) debit networks in

Latin America. In addition, the Company manages a system of

electronic payment networks and offers a comprehensive suite of

services for core banking, cash processing and fulfillment in

Puerto Rico, that process approximately six billion transactions

annually. The Company also offers financial technology outsourcing

in all the regions it serves. Based in Puerto Rico, the Company

operates in 26 Latin American countries and serves a diversified

customer base of leading financial institutions, merchants,

corporations and government agencies with “mission-critical”

technology solutions. For more information, visit

www.evertecinc.com.

Use of Non-GAAP Financial Information

The non-GAAP measures referenced in this earnings release are

supplemental measures of the Company’s performance and are not

required by, or presented in accordance with, accounting principles

generally accepted in the United States of America (“GAAP”). They

are not measurements of the Company’s financial performance under

GAAP and should not be considered as alternatives to total revenue,

net income or any other performance measures derived in accordance

with GAAP or as alternatives to cash flows from operating

activities, as indicators of operating performance or as measures

of the Company’s liquidity. In addition to GAAP measures,

management uses these non-GAAP measures to focus on the factors the

Company believes are pertinent to the daily management of the

Company’s operations and believes that they are also frequently

used by analysts, investors and other stakeholders to evaluate

companies in our industry. These measures have certain limitations

in that they do not include the impact of certain expenses that are

reflected in our condensed consolidated statements of operations

that are necessary to run our business. Other companies, including

other companies in our industry, may not use these measures or may

calculate these measures differently than as presented herein,

limiting their usefulness as comparative measures.

Reconciliations of the non-GAAP measures to the most directly

comparable GAAP measure are included at the end of this earnings

release. These non-GAAP measures include EBITDA, Adjusted EBITDA,

Adjusted Net Income and Adjusted Earnings per common share, each as

defined below.

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization.

Adjusted EBITDA is defined as EBITDA further adjusted to

exclude certain non-cash items and unusual expenses such as:

share-based compensation, restructuring related expenses, fees and

expenses from corporate transactions such as M&A activity and

financing, equity investment income net of dividends received, and

the impact from unrealized gains and losses on foreign currency

remeasurement for assets and liabilities in non-functional

currency. This measure is reported to the chief operating decision

maker for purposes of making decisions about allocating resources

to the segments and assessing their performance. For this reason,

Adjusted EBITDA, as it relates to the Company's segments, is

presented in conformity with Accounting Standards Codification 280,

Segment Reporting, and is excluded from the definition of non-GAAP

financial measures under the Securities and Exchange Commission's

Regulation G and Item 10(e) of Regulation S-K. The Company's

presentation of Adjusted EBITDA is substantially consistent with

the equivalent measurements that are contained in the secured

credit facilities in testing EVERTEC Group’s compliance with

covenants therein such as the secured leverage ratio.

Adjusted Net Income is defined as Adjusted EBITDA less:

operating depreciation and amortization expense, defined as GAAP

Depreciation and amortization less amortization of intangibles

related to acquisitions such as customer relationships, trademarks,

non-compete agreements, among others; cash interest expense defined

as GAAP interest expense, less GAAP interest income adjusted to

exclude non-cash amortization of debt issue costs, premium and

accretion of discount; income tax expense which is calculated on

adjusted pre-tax income using the applicable GAAP tax rate,

adjusted for uncertain tax position releases, tax true-ups,

windfall from share-based compensation, unrealized gains and losses

from foreign currency remeasurement, among others; and

non-controlling interests, net of amortization for intangibles

created as part of the purchase.

Adjusted Earnings per common share is defined as Adjusted

Net Income divided by diluted shares outstanding.

The Company uses Adjusted Net Income to measure the Company's

overall profitability because the Company believes it better

reflects the comparable operating performance by excluding the

impact of the non-cash amortization and depreciation that was

created as a result of merger and acquisition activity. In

addition, in evaluating EBITDA, Adjusted EBITDA, Adjusted Net

Income and Adjusted Earnings per common share, you should be aware

that in the future the Company may incur expenses such as those

excluded in calculating them.

Forward-Looking Statements

Certain statements in this earnings release constitute

“forward-looking statements” within the meaning of, and subject to

the protection of, the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements contained in this press release other than statements of

historical facts, including, without limitation, statements

regarding our ability to meet our guidance expectations for

revenue, earnings per share, Adjusted earnings per common share,

capital expenditures and effective tax rate, including for fiscal

year 2023, are forward looking statements. Words such as

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” and “plans” and similar expressions of future or

conditional verbs such as “will,” “should,” “would,” “may,” and

“could” are generally forward-looking in nature and not historical

facts.

Various factors that could cause actual future results and other

future events to differ materially from those estimated by

management include, but are not limited to: our reliance on our

relationship with Popular, Inc. (“Popular”) for a significant

portion of our revenues pursuant to our second Amended and Restated

Master Services Agreement (“A&R MSA”) with them, and as it may

impact our ability to grow our business; our ability to renew our

client contracts on terms favorable to us, including but not

limited to the current term and any extension of the MSA with

Popular; our dependence on our processing systems, technology

infrastructure, security systems and fraudulent payment detection

systems, as well as on our personnel and certain third parties with

whom we do business, and the risks to our business if our systems

are hacked or otherwise compromised; our ability to develop,

install and adopt new software, technology and computing systems; a

decreased client base due to consolidations and/or failures in the

financial services industry; the credit risk of our merchant

clients, for which we may also be liable; the continuing market

position of the ATH network; a reduction in consumer confidence,

whether as a result of a global economic downturn or otherwise,

which leads to a decrease in consumer spending; our dependence on

credit card associations, including any adverse changes in credit

card association or network rules or fees; changes in the

regulatory environment and changes in macroeconomic, market,

international, legal, tax, political, or administrative conditions,

including inflation or the risk of recession; the geographical

concentration of our business in Puerto Rico, including our

business with the government of Puerto Rico and its

instrumentalities, which are facing severe political and fiscal

challenges; additional adverse changes in the general economic

conditions in Puerto Rico, whether as a result of the government’s

debt crisis or otherwise, including the continued migration of

Puerto Ricans to the U.S. mainland, which could negatively affect

our customer base, general consumer spending, our cost of

operations and our ability to hire and retain qualified employees;

operating an international business in Latin America and the

Caribbean, in jurisdictions with potential political and economic

instability; the impact of foreign exchange rates on operations;

our ability to protect our intellectual property rights against

infringement and to defend ourselves against claims of infringement

brought by third parties; our ability to comply with U.S. federal,

state, local and foreign regulatory requirements; evolving industry

standards and adverse changes in global economic, political and

other conditions; our level of indebtedness and the impact of

rising interest rates, restrictions contained in our debt

agreements, including the secured credit facilities, as well as

debt that could be incurred in the future; our ability to prevent a

cybersecurity attack or breach to our information security; the

possibility that we could lose our preferential tax rate in Puerto

Rico; our inability to integrate Sinqia successfully into the

Company or to achieve expected accretion to our earnings per common

share; any loss of personnel or customers in connection with the

Sinqia Transaction; any possibility of future catastrophic

hurricanes, earthquakes and other potential natural disasters

affecting our main markets in Latin America and the Caribbean; and

the other factors set forth under "Part 1, Item 1A. Risk Factors,"

in the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 filed with the Securities and Exchange

Commission (the "SEC") on February 29, 2024, as any such factors

may be updated from time to time in the Company’s filings with the

SEC. The Company undertakes no obligation to release publicly any

revisions to any forward-looking statements, to report events or to

report the occurrence of unanticipated events unless it is required

to do so by law.

EVERTEC, Inc. Schedule 1: Unaudited Condensed

Consolidated Statements of Income and Comprehensive Income

(Loss)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

(Dollar amounts in thousands, except share

data)

Revenues

$

211,795

$

173,198

$

629,091

$

500,088

Operating costs and expenses

Cost of revenues, exclusive of

depreciation and amortization

102,497

81,280

302,426

238,149

Selling, general and administrative

expenses

34,097

30,437

107,910

83,834

Depreciation and amortization

33,660

21,919

101,051

63,680

Total operating costs and expenses

170,254

133,636

511,387

385,663

Income from operations

41,541

39,562

117,704

114,425

Non-operating income (expenses)

Interest income

3,696

1,926

10,274

5,162

Interest expense

(18,704

)

(5,709

)

(57,352

)

(16,992

)

Loss on foreign currency remeasurement

(1,112

)

(2,806

)

(3,164

)

(7,337

)

Loss on foreign currency swap

—

(29,225

)

—

(29,225

)

Earnings of equity method investment

1,099

1,197

3,266

3,828

Other income, net

389

153

6,484

2,754

Total non-operating expenses

(14,632

)

(34,464

)

(40,492

)

(41,810

)

Income before income taxes

26,909

5,098

77,212

72,615

Income tax expense (benefit)

1,707

(4,858

)

3,100

4,546

Net income

25,202

9,956

74,112

68,069

Less: Net income (loss) attributable to

non-controlling interest

524

(80

)

1,554

(174

)

Net income attributable to EVERTEC, Inc.’s

common stockholders

24,678

10,036

72,558

68,243

Other comprehensive income (loss), net of

tax

Foreign currency translation

adjustments

15,354

(11,332

)

(75,473

)

9,426

(Loss) gain on cash flow hedges

(11,937

)

3,468

(8,555

)

3,739

Unrealized loss on change in fair value of

debt securities available-for-sale

(1

)

(11

)

(4

)

(31

)

Other comprehensive income (loss), net of

tax

$

3,416

$

(7,875

)

$

(84,032

)

$

13,134

Total comprehensive income (loss)

attributable to EVERTEC, Inc.’s common stockholders

$

28,094

$

2,161

$

(11,474

)

$

81,377

Net income per common share:

Basic

0.39

$

0.16

$

1.12

$

1.05

Diluted

$

0.38

$

0.15

$

1.11

$

1.04

Shares used in computing net income per

common share:

Basic

63,944,132

64,648,542

64,512,868

64,886,551

Diluted

64,719,129

65,779,259

65,316,948

65,705,596

EVERTEC, Inc. Schedule 2: Unaudited Condensed

Consolidated Balance Sheets

(In thousands)

September 30, 2024

December 31, 2023

Assets

Current Assets:

Cash and cash equivalents

$

275,359

$

295,600

Restricted cash

25,663

23,073

Accounts receivable, net

131,101

126,510

Settlement assets

37,441

51,467

Prepaid expenses and other assets

64,071

64,704

Total current assets

533,635

561,354

Debt securities available-for-sale, at

fair value

1,726

2,095

Equity securities, at fair value

5,287

9,413

Investment in equity investees

28,550

21,145

Property and equipment, net

64,178

62,453

Operating lease right-of-use asset

11,329

14,796

Goodwill

750,542

791,700

Other intangible assets, net

443,444

518,070

Deferred tax asset

32,751

47,847

Derivative asset

749

4,385

Other long-term assets

22,774

27,005

Total assets

$

1,894,965

$

2,060,263

Liabilities and stockholders’

equity

Current Liabilities:

Accrued liabilities

$

119,169

$

129,160

Accounts payable

53,702

66,516

Contract liability

23,034

21,055

Income tax payable

5,674

3,402

Current portion of long-term debt

23,867

23,867

Current portion of operating lease

liability

7,478

6,693

Settlement liabilities

37,500

47,620

Total current liabilities

270,424

298,313

Long-term debt

930,851

946,816

Deferred tax liability

45,116

87,916

Contract liability - long term

56,652

41,825

Operating lease liability - long-term

5,174

9,033

Derivative liability

9,001

900

Other long-term liabilities

31,804

40,084

Total liabilities

1,349,022

1,424,887

Commitments and contingencies

Redeemable non-controlling interests

39,771

36,968

Stockholders’ equity

Preferred stock, par value $0.01;

2,000,000 shares authorized; none issued

—

—

Common stock, par value $0.01; 206,000,000

shares authorized; 63,609,122 shares issued and outstanding as of

September 30, 2024 (December 31, 2023 - 65,450,799)

636

654

Additional paid-in capital

5,079

36,527

Accumulated earnings

562,727

538,903

Accumulated other comprehensive (loss)

income, net of tax

(65,823

)

18,209

Total stockholders’ equity

502,619

594,293

Non-redeemable non-controlling

interest

3,553

4,115

Total equity

506,172

598,408

Total liabilities and equity

$

1,894,965

$

2,060,263

EVERTEC, Inc. Schedule 3: Unaudited Condensed

Consolidated Statements of Cash Flows

Nine months ended September

30,

2024

2023

Cash flows from operating

activities

Net income

74,112

68,069

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

101,051

63,680

Amortization of debt issue costs and

accretion of discount

3,576

1,795

Operating lease amortization

5,340

4,619

Deferred tax benefit

(20,275

)

(16,491

)

Share-based compensation

22,387

18,812

Unrealized loss on foreign currency

hedge

—

29,225

Earnings of equity method investment

(3,266

)

(3,828

)

Dividend received from equity method

investment

3,364

3,497

Gain on sale of equity securities

(2,599

)

—

Loss on foreign currency remeasurement

3,164

7,337

Other, net

(287

)

380

(Increase) decrease in assets:

Accounts receivable, net

(838

)

(4,590

)

Prepaid expenses and other assets

(1,791

)

(11,181

)

Other long-term assets

3,247

(1,013

)

(Decrease) increase in liabilities:

Accrued liabilities and accounts

payable

(12,046

)

12,224

Income tax payable

2,359

(9,108

)

Contract liability

12,038

(1,146

)

Operating lease liabilities

(5,341

)

(3,739

)

Other long-term liabilities

702

(247

)

Total adjustments

110,785

90,226

Net cash provided by operating

activities

184,897

158,295

Cash flows from investing

activities

Additions to software

(48,778

)

(34,193

)

Property and equipment acquired

(21,050

)

(16,406

)

Acquisition of available-for-sale debt

securities

—

(962

)

Purchase of equity securities

(132

)

(26,505

)

Investment in equity investee

(2,000

)

(5,500

)

Proceeds from maturities of

available-for-sale debt securities

370

1,048

Proceeds from sale of equity

securities

6,128

—

Acquisitions, net of cash acquired

—

(22,915

)

Net cash used in investing activities

(65,462

)

(105,433

)

Cash flows from financing

activities

Withholding taxes paid on share-based

compensation

(9,907

)

(5,956

)

Net decrease in short-term borrowings

—

(14,000

)

Dividends paid

(9,692

)

(9,735

)

Repurchase of common stock

(82,293

)

(23,598

)

Repayment of long-term debt

(17,900

)

(15,563

)

Repayment of other financing

agreements

(7,046

)

—

Settlement activity, net

209

5,163

Other financing activities, net

(3,652

)

—

Net cash used in financing activities

(130,281

)

(63,689

)

Effect of foreign exchange rate on cash,

cash equivalents and restricted cash

(6,596

)

10,716

Net decrease in cash, cash equivalents

and restricted cash

(17,442

)

(111

)

Cash, cash equivalents, restricted

cash, and cash included in settlement assets at beginning of the

period

343,724

215,657

Cash, cash equivalents, restricted

cash, and cash included in settlement assets at end of the

period

$

326,282

$

215,546

Reconciliation of cash, cash

equivalents, restricted cash, and cash included in settlement

assets

Cash and cash equivalents

275,359

177,821

Restricted cash

25,663

20,607

Cash and cash equivalents included in

settlement assets

25,260

17,118

Cash, cash equivalents, restricted

cash, and cash included in settlement assets

$

326,282

$

215,546

EVERTEC, Inc. Schedule 4: Unaudited Segment

Information

Three Months Ended September

30, 2024

(In thousands)

Payment Services

-

Puerto Rico &

Caribbean

Latin America Payments and

Solutions

Merchant

Acquiring, net

Business

Solutions

Corporate and Other

(1)

Total

Revenues

$

52,755

$

76,029

$

45,437

$

61,103

$

(23,529

)

$

211,795

Operating costs and expenses

33,144

70,857

29,231

42,347

(5,325

)

170,254

Depreciation and amortization

7,599

14,152

1,217

5,614

5,078

33,660

Non-operating income (expenses)

149

(482

)

—

166

543

376

EBITDA

27,359

18,842

17,423

24,536

(12,583

)

75,577

Compensation and benefits (2)

758

1,349

775

928

3,785

7,595

Transaction, refinancing and other fees

(3)

296

(627

)

29

40

3,367

3,105

(Gain) loss on foreign currency

remeasurement (4)

(61

)

1,176

—

—

(3

)

1,112

Adjusted EBITDA

$

28,352

$

20,740

$

18,227

$

25,504

$

(5,434

)

$

87,389

___________________________

(1)

Corporate and Other consists of corporate

overhead, certain leveraged activities, other non-operating

expenses and intersegment eliminations. Intersegment revenue

eliminations predominantly reflect the $14.4 million processing fee

from Payments Services - Puerto Rico & Caribbean to Merchant

Acquiring, intercompany software developments and

transaction-processing of $5.5 million from Latin America Payments

and Solutions to both Payment Services- Puerto Rico & Caribbean

and Business Solutions, and transaction-processing and monitoring

fees of $3.7 million from Payment Services - Puerto Rico &

Caribbean to Latin America Payments and Solutions.

(2)

Primarily represents share-based

compensation and severance payments.

(3)

Primarily represents fees and expenses

associated with corporate transactions as defined in the Credit

Agreement, the elimination of unrealized earnings from equity

investments, net of dividends received.

(4)

Represents non-cash unrealized gains

(losses) on foreign currency remeasurement for assets and

liabilities denominated in non-functional currencies.

Three Months Ended September

30, 2023

(In thousands)

Payment Services

-

Puerto Rico &

Caribbean

Latin America Payments and

Solutions

Merchant

Acquiring, net

Business

Solutions

Corporate and Other

(1)

Total

Revenues

$

51,600

$

46,155

$

40,557

$

56,522

$

(21,636

)

$

173,198

Operating costs and expenses

28,402

38,608

26,997

40,643

(1,014

)

133,636

Depreciation and amortization

6,203

4,898

1,078

4,478

5,262

21,919

Non-operating income (expenses)

110

(2,148

)

—

69

(28,712

)

(30,681

)

EBITDA

29,511

10,297

14,638

20,426

(44,072

)

30,800

Compensation and benefits (2)

663

859

662

696

4,090

6,970

Transaction, refinancing and other (3)

269

3,451

—

—

34,363

38,083

(Gain) loss on foreign currency

remeasurement (4)

(87

)

2,885

—

—

8

2,806

Adjusted EBITDA

$

30,356

$

17,492

$

15,300

$

21,122

$

(5,611

)

$

78,659

___________________________

(1)

Corporate and Other consists of corporate

overhead, certain leveraged activities, other non-operating

expenses and intersegment eliminations. Intersegment revenue

eliminations predominantly reflect the $13.5 million processing fee

from Payments Services - Puerto Rico & Caribbean to Merchant

Acquiring, intercompany software developments and

transaction-processing of $4.4 million from Latin America Payments

and Solutions to both Payment Services- Puerto Rico & Caribbean

and Business Solutions, and transaction-processing and monitoring

fees of $3.7 million from Payment Services - Puerto Rico &

Caribbean to Latin America Payments and Solutions.

(2)

Primarily represents share-based

compensation and severance payments.

(3)

Primarily represents fees and expenses

associated with corporate transactions as defined in the Credit

Agreement, the foreign currency swap loss and the elimination of

unrealized earnings from equity investments, net of dividends

received.

(4)

Represents non-cash unrealized gains

(losses) on foreign currency remeasurement for assets and

liabilities denominated in non-functional currencies.

Nine months ended September

30, 2024

(In thousands)

Payment Services

-

Puerto Rico &

Caribbean

Latin America Payments and

Solutions

Merchant

Acquiring, net

Business

Solutions

Corporate and Other

(1)

Total

Revenues

$

159,985

$

224,914

$

133,855

$

181,567

$

(71,230

)

$

629,091

Operating costs and expenses

95,829

221,241

87,531

120,461

(13,675

)

511,387

Depreciation and amortization

22,357

45,460

3,859

13,802

15,573

101,051

Non-operating income

431

3,627

—

456

2,072

6,586

EBITDA

86,944

52,760

50,183

75,364

(39,910

)

225,341

Compensation and benefits (2)

2,227

4,501

2,269

2,619

11,570

23,186

Transaction, refinancing and other fees

(3)

1,019

(6,015

)

243

329

4,351

(73

)

(Gain) loss on foreign currency

remeasurement (4)

(128

)

3,291

—

—

1

3,164

Adjusted EBITDA

$

90,062

$

54,537

$

52,695

$

78,312

$

(23,988

)

$

251,618

___________________________

(1)

Corporate and Other consists of corporate

overhead, certain leveraged activities, other non-operating

expenses and intersegment eliminations. Intersegment revenue

eliminations predominantly reflect the $43.2 million processing fee

from Payments Services - Puerto Rico & Caribbean to Merchant

Acquiring, intercompany software developments and transaction

processing of $14.7 million from Latin America Payments and

Solutions to both Payment Services- Puerto Rico & Caribbean and

Business Solutions, and transaction processing and monitoring fees

of $13.4 million from Payment Services - Puerto Rico &

Caribbean to Latin America Payments and Solutions.

(2)

Primarily represents share-based

compensation and severance payments.

(3)

Primarily represents fees and expenses

associated with corporate transactions as defined in the Credit

Agreement, the elimination of realized gains from equity securities

and the elimination of unrealized earnings from equity investments,

net of dividends received.

(4)

Represents non-cash unrealized gains

(losses) on foreign currency remeasurement for assets and

liabilities denominated in non-functional currencies.

Nine months ended September

30, 2023

(In thousands)

Payment Services

-

Puerto Rico &

Caribbean

Latin America Payments and

Solutions

Merchant

Acquiring, net

Business

Solutions

Corporate and Other

(1)

Total

Revenues

$

150,824

$

120,548

$

122,152

$

169,188

$

(62,624

)

$

500,088

Operating costs and expenses

85,019

101,586

81,302

118,653

(897

)

385,663

Depreciation and amortization

18,178

13,002

3,357

13,436

15,707

63,680

Non-operating income (expenses)

590

(3,643

)

308

667

(27,902

)

(29,980

)

EBITDA

84,573

28,321

44,515

64,638

(73,922

)

148,125

Compensation and benefits (2)

2,033

2,510

2,054

2,226

12,693

21,516

Transaction, refinancing and other fees

(3)

850

3,704

—

—

38,741

43,295

(Gain) loss on foreign currency

remeasurement (4)

(41

)

7,372

—

—

6

7,337

Adjusted EBITDA

$

87,415

$

41,907

$

46,569

$

66,864

$

(22,482

)

$

220,273

___________________________

(1)

Corporate and Other consists of corporate

overhead, certain leveraged activities, other non-operating

expenses and intersegment eliminations. Intersegment revenue

eliminations predominantly reflect the $39.9 million processing fee

from Payments Services - Puerto Rico & Caribbean to Merchant

Acquiring, intercompany software developments and transaction

processing of $12.8 million from Latin America Payments and

Solutions to both Payment Services- Puerto Rico & Caribbean and

Business Solutions, and transaction processing and monitoring fees

of $9.9 million from Payment Services - Puerto Rico & Caribbean

to Latin America Payments and Solutions.

(2)

Primarily represents share-based

compensation and severance payments.

(3)

Primarily represents fees and expenses

associated with corporate transactions as defined in the Credit

Agreement the foreign currency swap loss and the elimination of

unrealized earnings from equity investments, net of dividends

received.

(4)

Represents non-cash unrealized gains

(losses) on foreign currency remeasurement for assets and

liabilities denominated in non-functional currencies.

EVERTEC, Inc. Schedule 5: Reconciliation of

GAAP to Non-GAAP Operating Results

Three months ended September

30,

Nine months ended September

30,

(Dollar amounts in thousands, except share

data)

2024

2023

2024

2023

Net income

25,202

9,956

74,112

68,069

Income tax expense

1,707

(4,858

)

3,100

4,546

Interest expense, net

15,008

3,783

47,078

11,830

Depreciation and amortization

33,660

21,919

101,051

63,680

EBITDA

75,577

30,800

225,341

148,125

Equity income (1)

1,929

1,834

(238

)

(797

)

Compensation and benefits (2)

7,595

6,970

23,186

21,516

Transaction, refinancing and other (3)

1,176

36,249

165

44,092

Loss on foreign currency remeasurement

(4)

1,112

2,806

3,164

7,337

Adjusted EBITDA

87,389

78,659

251,618

220,273

Operating depreciation and amortization

(5)

(16,293

)

(13,061

)

(45,732

)

(38,265

)

Cash interest expense, net (6)

(13,908

)

(3,755

)

(43,749

)

(11,575

)

Income tax expense (7)

(1,234

)

(9,447

)

(3,298

)

(25,855

)

Non-controlling interest (8)

(535

)

50

(1,601

)

96

Adjusted net income

$

55,419

$

52,446

$

157,238

$

144,674

Net income per common share

(GAAP):

Diluted

$

0.38

$

0.15

$

1.11

$

1.04

Adjusted Earnings per common share

(Non-GAAP):

Diluted

$

0.86

$

0.80

$

2.41

$

2.20

Shares used in computing adjusted earnings

per common share:

Diluted

64,719,129

65,779,259

65,316,948

65,705,596

___________________________

(1)

Represents the elimination of non-cash

equity earnings from our equity investments, net of dividends

received.

(2)

Primarily represents share-based

compensation and severance payments.

(3)

Represents fees and expenses associated

with corporate transactions as defined in the Credit Agreement,

recorded as part of selling, general and administrative expenses,

the elimination of realized gains from the change in fair market

value of equity securities and the foreign currency swap loss.

(4)

Represents non-cash unrealized gains

(losses) on foreign currency remeasurement for assets and

liabilities denominated in non-functional currencies.

(5)

Represents operating depreciation and

amortization expense, which excludes amounts generated as a result

of merger and acquisition activity.

(6)

Represents interest expense, less interest

income, as they appear on the condensed consolidated statements of

income and comprehensive income (loss), adjusted to exclude

non-cash amortization of the debt issue costs, premium and

accretion of discount.

(7)

Represents income tax expense calculated

on adjusted pre-tax income using the applicable GAAP tax rate,

adjusted for certain discrete items.

(8)

Represents the non-controlling equity

interests, net of amortization for intangibles created as part of

the purchase.

EVERTEC, Inc. Schedule 6: Outlook Summary and

Reconciliation to Non-GAAP Adjusted Earnings per Common Share

Outlook 2024

2023

(Dollar amounts in millions, except per

share data)

Low

High

Revenues

$

840.5

to

$

846.5

$

695

Earnings per Share (EPS) (GAAP)

$

1.64

to

$

1.73

$

1.21

Per share adjustment

to reconcile GAAP EPS to Non-GAAP Adjusted EPS:

Share-based comp, non-cash equity earnings

and other (1)

0.50

0.50

1.36

Merger and acquisition related

depreciation and amortization (2)

1.00

1.00

0.62

Non-cash interest expense (3)

0.05

0.04

(0.01

)

Tax effect of Non-GAAP adjustments (4)

(0.08

)

(0.08

)

(0.36

)

Non-controlling interest (5)

(0.03

)

(0.04

)

—

Total adjustments

1.44

1.42

1.61

Adjusted EPS (Non-GAAP)

$

3.08

to

$

3.15

$

2.82

Shares used in computing adjusted earnings

per common share

65.2

65.8

___________________________

(1)

Represents share-based compensation, the

elimination of non-cash equity earnings from equity investees,

non-cash unrealized gains (losses) on foreign currency

remeasurement for assets and liabilities denominated in

non-functional currencies, severance and other adjustments to

reconcile GAAP EPS to Non-GAAP EPS, net of dividends received.

(2)

Represents depreciation and amortization

expenses amounts generated as a result of M&A activity.

(3)

Represents non-cash amortization of the

debt issue costs, premium and accretion of discount.

(4)

Represents income tax expense on non-GAAP

adjustments using the applicable GAAP tax rate (anticipated at

approximately 5%).

(5)

Represents the non-controlling equity

interests, net of amortization for intangibles created as part of

the purchase.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106136199/en/

Investors Beatriz Brown-Sáenz (787) 773-5442

IR@evertecinc.com

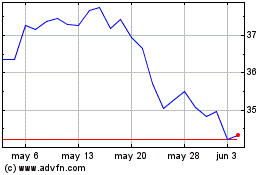

Evertec (NYSE:EVTC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Evertec (NYSE:EVTC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024