SCHEDULE

14A

PROXY

STATEMENT

PURSUANT

TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed

by Registrant ☒

Filed

by Party other than the Registrant

Check

the appropriate box:

| ☐ | Preliminary

Proxy Statement |

| ☐ | Confidential

for Use of the Commission Only as permitted by Rule 14a-6(e)(2) |

| ☒ | Definitive

Proxy Statement |

| ☐ | Definitive

Additional Materials |

| ☐ | Soliciting

Material Pursuant to Rule 14a-11c or Rule 14a-12 |

Flaherty & Crumrine Total Return Fund Incorporated

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ | Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title

of each class of securities to which transaction applies: ________________________________________________ |

| (2) | Aggregate

number of securities to which transaction applies: ________________________________________________ |

| (3) | Per

unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how

it was determined):___________________________________________________________________________________ |

| (4) | Proposed

maximum aggregate value of transaction:________________________________________________________________________________ |

| (5) | Total

fee paid:____________________________________________________________________________________________________________ |

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

| (1) | Amount previously paid: |

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

| |

|

| FLAHERTY & CRUMRINE PREFERRED AND INCOME FUND INCORPORATED |

(NYSE: PFD) |

| FLAHERTY & CRUMRINE PREFERRED AND INCOME OPPORTUNITY FUND INCORPORATED |

(NYSE: PFO) |

| FLAHERTY & CRUMRINE PREFERRED AND INCOME SECURITIES FUND INCORPORATED |

(NYSE: FFC) |

| FLAHERTY & CRUMRINE TOTAL RETURN FUND INCORPORATED |

(NYSE: FLC) |

| FLAHERTY & CRUMRINE DYNAMIC PREFERRED AND INCOME FUND INCORPORATED |

(NYSE: DFP) |

301 E. Colorado Boulevard, Suite 800

Pasadena, California 91101

NOTICE OF ANNUAL MEETINGS OF SHAREHOLDERS

To Be Held on April 20, 2022

To the Shareholders:

Notice is hereby

given that the Annual Meetings of Shareholders (the “Annual Meetings”) of Flaherty & Crumrine Preferred and Income

Fund Incorporated, Flaherty & Crumrine Preferred and Income Opportunity Fund Incorporated, Flaherty & Crumrine Preferred

and Income Securities Fund Incorporated, Flaherty & Crumrine Total Return Fund Incorporated and Flaherty & Crumrine Dynamic

Preferred and Income Fund Incorporated (each, a “Fund” and collectively, the “Funds”), each a Maryland

corporation, will be held on April 20, 2022, at 8:00 a.m. PDT, virtually via the Internet, for the following purposes:

Each Fund:

| 1. | To elect Directors of each Fund (Proposal 1). |

| 2. | To transact such other business as may properly come before the Annual Meetings or any adjournments

or postponements thereof. |

Due to the ongoing

coronavirus pandemic (“COVID-19”), and to support the health and well-being of the Funds’ shareholders, employees

and community, the Annual Meetings will be conducted exclusively online via live webcast. Shareholders may attend the Annual Meetings

online by visiting www.meetnow.global/MGPZG2H. To participate in the Annual Meetings, shareholders will need to follow the instructions

herein. The Annual Meetings will begin promptly at 8:00 a.m. PDT. The Funds encourage you to access the Annual Meetings prior to

the start time to allow for time to check in. If you experience technical difficulties prior to or during the Annual Meetings,

you may call 1-866-774-4940 for technical assistance. All shareholders will be required to enter their individual 14-digit

control number to enter the Annual Meetings. Only shareholders of the Funds will be able to participate in the Annual Meetings.

Because the Annual Meetings will be completely virtual, there will be no physical location for shareholders to attend.

Please follow the

instructions on your proxy card. Your individual control number, which is required to enter the Annual Meetings, is included on

your proxy card(s) accompanying the Joint Proxy Statement.

If you hold your

shares through an intermediary, such as a broker, bank or other custodian (i.e., in “street name”), you must register

in advance to access your individual control number to enter the Annual Meetings virtually online via live webcast using the instructions

below. To register and receive your individual control number, you must submit proof of your proxy power (“legal proxy”)

from your broker, bank or other nominee indicating that you are the beneficial owner of the shares in the Fund(s), on the record

date, and authorizing you to vote along with your name and email address to Computershare, Inc. (“Computershare”) in

accordance with the directions below. The letter must also state whether before the Annual Meetings you authorized a proxy to vote

for you, and if so, how you instructed such proxy to vote. Requests for registration must be labeled as “Legal Proxy”

and be received no later than April 15, 2022 at 2:00 p.m. PDT. You will receive a confirmation of your registration and your individual

control number by email after Computershare receives your registration information. Requests for registration for the Annual Meetings

should be directed to Computershare as follows:

By email:

Forward the email from your broker, or

attach an image of your legal proxy, to shareholdermeetings@computershare.com.

Your vote is important!

The Board of

Directors of each Fund has fixed the close of business on January 21, 2022 as the record date for the determination of shareholders

of each Fund entitled to notice of, and to vote at, the Annual Meetings and any adjournments or postponements thereof.

| |

By Order of the Boards of Directors, |

| |

|

| March 3, 2022 |

Chad C. Conwell |

| |

Secretary |

|

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meetings to be

Held on April 20, 2022

The notice of Annual Meetings, Joint Proxy

Statement, proxy cards and each Fund’s annual report, including audited financial statements for the fiscal year ended November

30, 2021, are available to you on the Funds’ website - www.preferredincome.com or upon request, without charge, by writing

to BNYIS c/o Computershare, P.O. Box 505000, Louisville, KY, 40233-5000, United States, or by calling 1-866-351-7446 (U.S. toll-free)

or 1-201-680-6578 (International). You are encouraged to review all of the information contained in the proxy materials before

voting.

Instructions to attend the Annual Meetings

online via live webcast are outlined herein and on your proxy card for the relevant Fund.

SEPARATE PROXY CARDS ARE ENCLOSED

FOR EACH FUND IN WHICH YOU OWN SHARES. YOUR VOTE IS IMPORTANT REGARDLESS OF THE SIZE OF YOUR HOLDINGS IN THE FUND. WHETHER OR NOT

YOU PLAN TO ATTEND THE RELEVANT ANNUAL MEETING(S), WE ASK THAT YOU PLEASE VOTE PROMPTLY. INSTRUCTIONS FOR THE PROPER VOTING AND/OR

EXECUTION OF PROXIES ARE SET FORTH ON THE INSIDE COVER. SHAREHOLDERS MAY SUBMIT VOTING INSTRUCTIONS BY SIGNING AND DATING THE PROXY

CARD OR VOTING INSTRUCTION FORM AND RETURNING IT IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE. |

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing

proxy cards may be of assistance to you and may minimize the time and expense to the Fund(s) involved in validating your vote if

you fail to sign your proxy card(s) properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy

card(s). |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform

exactly to a name shown in the registration. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated

unless it is reflected in the form registration. For example: |

|

Registration |

Valid Signature |

| |

|

|

Corporate Accounts |

|

| |

|

| (1) ABC Corp. |

ABC Corp. |

| (2) ABC Corp. |

John Doe, Treasurer |

| (3) ABC Corp. c/o John Doe, Treasurer |

John Doe |

| (4) ABC Corp. Profit Sharing Plan |

John Doe, Trustee |

| |

|

|

Trust Accounts |

|

| |

|

| (1) ABC Trust |

Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 |

Jane B. Doe |

| |

|

|

Custodian or Estate Accounts |

|

| |

|

|

(1) John

B. Smith, Cust.,

f/b/o John B. Smith, Jr. UGMA |

John B. Smith |

|

(2) John

B. Smith, Executor,

Estate of Jane Smith |

John B. Smith, Executor |

ANNUAL MEETINGS OF SHAREHOLDERS

April 20, 2022

JOINT PROXY STATEMENT

This document is

a joint proxy statement (“Joint Proxy Statement”) for Flaherty & Crumrine Preferred and Income Fund Incorporated

(“Preferred and Income Fund” or “PFD”), Flaherty & Crumrine Preferred and Income Opportunity Fund Incorporated

(“Preferred and Income Opportunity Fund” or “PFO”), Flaherty & Crumrine Preferred and Income Securities

Fund Incorporated (“Preferred and Income Securities Fund” or “FFC”), Flaherty & Crumrine Total Return

Fund Incorporated (“Total Return Fund” or “FLC”) and Flaherty & Crumrine Dynamic Preferred and Income

Fund Incorporated (“Dynamic Preferred Income Fund” or “DFP”) (each, a “Fund” and collectively,

the “Funds”). This Joint Proxy Statement is furnished in connection with the solicitation of proxies by each Fund’s

Board of Directors (each, a “Board” and collectively, the “Boards”) to be voted at the Annual Meeting of

Shareholders for each Fund to be held on April 20, 2022, at 8:00 a.m. PDT, virtually via the Internet, and at any adjournments

or postponements thereof (each, an “Annual Meeting” and collectively, the “Annual Meetings”). If you plan

to attend the Annual Meetings virtually online via live webcast, please follow the instructions as outlined in the proxy card for

the relevant Fund and this Joint Proxy Statement.

This Joint Proxy

Statement and the accompanying Notice of Annual Meetings and proxy card for each Fund in which you own shares were mailed on or

about March 3, 2022 to shareholders of record as of the close of business on January 21, 2022. Proxy solicitations will be made,

beginning on or about March 3, 2022, primarily by mail, but proxy solicitations may also be made by telephone, Internet, facsimile,

e-mail, or personal interviews conducted by officers of each Fund, Flaherty & Crumrine Incorporated (“Flaherty &

Crumrine”), the investment adviser of each Fund, BNY Mellon Investment Servicing (US) Inc. (“BNYIS”), the transfer

agent of each Fund, and The Bank of New York Mellon (“BNY Mellon”), the administrator of each Fund. With respect to

FFC, FLC and DFP, proxy solicitations may also be made by Destra Capital Advisors LLC, the servicing agent for FFC, FLC and DFP.

No proxy solicitation firm will be used in connection with this Joint Proxy Statement.

The Funds will evenly

split the expenses incurred in connection with the preparation of this Joint Proxy Statement and virtual hosting of the Annual

Meetings. Each Fund will pay for its respective expenses incurred in connection with printing and mailing of this Joint Proxy Statement

and its enclosures to shareholders. Each Fund also will reimburse brokerage firms and others for their expenses in forwarding solicitation

material to the beneficial owners of its shares.

References to the

websites above or herein do not incorporate their content into this Joint Proxy Statement.

|

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meetings to be

Held on April 20, 2022

The notice of Annual Meetings, Joint Proxy

Statement, proxy cards and each Fund’s annual report, including audited financial statements for the fiscal year ended November

30, 2021, are available to you on the Funds’ website - www.preferredincome.com or upon request, without charge, by writing

to BNYIS c/o Computershare, P.O. Box 505000, Louisville, KY, 40233-5000, United States, or by calling 1-866-351-7446 (U.S. toll-free)

or 1-201-680-6578 (International). Each Fund’s annual report is also available on the Securities and Exchange Commission’s

(“SEC”) website (www.sec.gov) or, for FFC, FLC and DFP only, by calling Destra Capital Advisors LLC at 1-877-855-3434.

You are encouraged to review all of the information contained in the proxy materials before voting.

Instructions to attend the Annual Meetings

online via live webcast are outlined herein and on your proxy card for the relevant Fund.

SEPARATE PROXY CARDS ARE ENCLOSED

FOR EACH FUND IN WHICH YOU OWN SHARES. YOUR VOTE IS IMPORTANT REGARDLESS OF THE SIZE OF YOUR HOLDINGS IN THE FUND. WHETHER OR NOT

YOU PLAN TO ATTEND THE RELEVANT ANNUAL MEETING(S), WE ASK THAT YOU PLEASE VOTE PROMPTLY. INSTRUCTIONS FOR THE PROPER VOTING AND/OR

EXECUTION OF PROXIES ARE SET FORTH ON THE INSIDE COVER. SHAREHOLDERS MAY SUBMIT VOTING INSTRUCTIONS BY SIGNING AND DATING THE PROXY

CARD OR VOTING INSTRUCTION FORM AND RETURNING IT IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE. |

If the enclosed proxy

card(s) are properly executed and returned in time to be voted at the relevant Annual Meeting(s), the Shares (as defined below)

represented thereby will be voted in accordance with the instructions marked thereon. Unless instructions to the contrary are marked

thereon, a proxy will be voted “FOR” Proposal 1 at the relevant Annual Meeting. Any shareholder who has given a proxy

has the right to revoke it at any time prior to its exercise either by attending the relevant Annual Meeting and voting his or

her Shares or by submitting a letter of revocation or a later-dated proxy card to the appropriate Fund at 301 E. Colorado Boulevard,

Suite 800 Pasadena, California 91101 prior to the date of the Annual Meetings.

Under the bylaws

of each Fund, the presence in person or by proxy of the holders of a majority of the outstanding shares of the Fund entitled to

vote shall be necessary and sufficient to constitute a quorum for the transaction of business (a “Quorum”) at that

Fund’s Annual Meeting. In the event that a Quorum is not present at the relevant Annual Meeting, or in the event that a Quorum

is present but sufficient votes to approve any of the proposals are not received, the Chair of the Annual Meeting may adjourn the

meeting without assigning a specific date or from time to time to a date not more than 120 days after the original record date

without notice other than announcement at the Annual Meeting. At such adjourned meeting at which a Quorum shall be present, any

business may be transacted which might have been transacted at the relevant Annual Meeting as originally notified. A shareholder

vote may be taken on a proposal in the Joint Proxy Statement relating to the applicable Annual Meeting prior to any such adjournment

if sufficient votes have been received for approval of that proposal. Once a Quorum has been established at the relevant Annual

Meeting, shareholders may continue to transact business, notwithstanding the withdrawal of shareholders and the loss of a Quorum.

INFORMATION REGARDING ATTENDING THE

MEETING

The Annual Meetings will be conducted

exclusively online via live webcast beginning promptly at 8:00 a.m. PDT on April 20, 2022. You will be able to attend the Annual

Meetings online, submit your questions during the Annual Meetings and vote your shares electronically at the relevant Annual Meetings

by going to www.meetnow.global/MGPZG2H and entering your 14 digit control number, which is included on the proxy card(s) that you

received. Because the Annual Meetings are completely virtual, shareholders will not be able to attend the Annual Meetings in person.

If you hold your

shares through an intermediary, such as a broker, bank or other custodian (i.e., in “street name”), you must register

in advance to access your individual control number to enter the Annual Meetings virtually online via live webcast using the instructions

below. To register and receive your individual control number, you must submit proof of your proxy power (“legal proxy”)

from your broker, bank or other nominee indicating that you are the beneficial owner of the shares in the Fund(s), on the record

date, and authorizing you to vote along with your name and email address to Computershare, Inc. (“Computershare”) in

accordance with the directions below. The letter must also state whether before the Annual Meetings you authorized a proxy to vote

for you, and if so, how you instructed such proxy to vote. Requests for registration must be labeled as “Legal Proxy”

and be received no later than April 15, 2022 at 2:00 p.m. PDT. You will receive a confirmation of your registration and your individual

control number by email after Computershare receives your registration information. Requests for registration for the Annual Meetings

should be directed to Computershare as follows: shareholdermeetings@computershare.com.

Due to the ongoing

coronavirus pandemic (“COVID-19”), we are pleased to offer shareholders completely virtual Annual Meetings, which provide

worldwide access and communication, while protecting the health and safety of our shareholders, Directors, management and other

stakeholders. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate

as they would at an in person meeting. We will try to answer as many questions submitted by shareholders as time permits that comply

with the rules of conduct for the Annual Meetings. However, we reserve the right to edit profanity or other inappropriate language,

or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If substantially similar

questions are received, we will group such questions together and provide a single response to avoid repetition.

Each Fund has one

class of capital stock outstanding: common stock, par value $0.01 per share (the “Common Stock” or the “Shares”).

Each Share is entitled to one vote at the relevant Annual Meeting with respect to matters to be voted on, with pro rata voting

rights for any fractional Shares. On the record date, January 21, 2022, the following number of Shares of each Fund were issued

and outstanding:

| Name of Fund |

|

Shares

Outstanding |

| Flaherty & Crumrine Preferred and Income Fund Incorporated (PFD) |

|

12,396,471 |

| Flaherty & Crumrine Preferred and Income Opportunity Fund Incorporated (PFO) |

|

13,046,266 |

| Flaherty & Crumrine Preferred and Income Securities Fund Incorporated (FFC) |

|

47,349,437 |

| Flaherty & Crumrine Total Return Fund Incorporated (FLC) |

|

10,408,575 |

| Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated (DFP) |

|

20,136,360 |

To the knowledge of each Fund and its

Board, the following shareholder(s), or “group” as that term is defined in Section 13(d) of the Securities Exchange

Act of 1934, as amended (the “1934 Act”), is the beneficial owner or owner of record of more than 5% of the relevant

Fund’s outstanding Shares as of January 21, 2022*:

|

Name and Address of

Beneficial/Record Owner |

|

Title of Class |

|

Amount and Nature of Ownership |

|

Percent of Class |

|

Cede & Co.**

Depository Trust Company

55 Water Street, 25th Floor

New York, NY 10041 |

|

Common Stock |

|

PFD – (record)

PFO – (record)

FFC – (record)

FLC – (record)

DFP – (record) |

|

98.51%

98.06%

99.88%

99.90%

99.96% |

* As of January 21, 2022, the Directors and officers, as a group, owned less than 1% of the Shares of each Fund.

** A nominee partnership of The Depository Trust Company.

This Joint Proxy

Statement is being used to reduce the preparation, printing, handling and postage expenses that would result from the use of a

separate proxy statement for each Fund. At each Fund’s Annual Meeting, shareholders of the Fund will vote as a single class.

Shareholders of each Fund will vote separately for each of PFD, PFO, FFC, FLC and DFP on the proposal(s) on which shareholders

of that Fund are entitled to vote at the relevant Annual Meeting. A separate proxy card is enclosed for each Fund in which a shareholder

owns Shares. Thus, if the proposal at the relevant Annual Meeting is approved by shareholders of one or more Funds and not approved

by shareholders of one or more other Funds, the proposal will be implemented for the Fund or Funds that approved the proposal and

will not be implemented for any Fund that did not approve the proposal. It is therefore essential that shareholders complete, date

and sign each enclosed proxy card. Shareholders of each Fund are entitled to vote on the proposal(s) pertaining to that Fund.

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meetings,

shareholders are being asked to consider the election of Directors of each Fund. The Board of each Fund is divided into three classes,

each class having a term of three years. Each year the term of office of one class expires and the successor or successors elected

to such class serve for a term of three years and until their successors are duly elected and qualify.

Nominees for the Boards of Directors

Each Nominee named

below is currently a Director of each Fund and has consented to serve as a Director for the Fund(s) for which he/she is nominated

if elected at the relevant Annual Meeting. If a designated Nominee declines or otherwise becomes unavailable for election, however,

the proxy confers discretionary power on the persons named therein to vote in favor of a substitute nominee or nominees. Each Nominee

has been nominated for a term of three years to expire at each Fund’s 2025 Annual Meeting of Shareholders and until his/her

successor is duly elected and qualifies. Shareholders of each Fund’s Common Stock are entitled to elect the Nominees for

election to the Board of the relevant Fund.

| Fund |

Nominees for Election |

| PFD |

R. Eric Chadwick and Morgan Gust |

| PFO |

R. Eric Chadwick and Karen H. Hogan |

| FFC |

R. Eric Chadwick and Karen H. Hogan |

| FLC |

R. Eric Chadwick and Karen H. Hogan |

| DFP |

R. Eric Chadwick and Morgan Gust |

Information About Each Director’s

or Nominee for Election as Director’s Experience, Qualifications, Attributes or Skills

Directors or Nominees

for election as Directors of the Funds, together with information as to their positions with the Funds, principal occupations,

and other board memberships for the past five years, are shown below.

|

Name, Address,

and Age |

|

Current

Position(s)

Held with Funds |

|

Term of Office

and Length of

Time Served* |

|

Principal

Occupation(s)

During Past

Five Years |

|

Number of Funds

In Fund Complex

Overseen

by Director** |

|

Other

Public Company

Board Memberships

During Past Five

Years |

|

NON-INTERESTED

DIRECTORS: |

|

|

|

|

|

|

|

|

|

|

Morgan Gust

301 E. Colorado Boulevard

Suite 800

Pasadena, CA 91101

Age: 74 |

|

Lead Independent Director and

Nominating and Governance Committee Chair |

|

Class II Director

FFC – since inception

FLC – since inception

Class III Director

PFD – since inception

PFO – since inception

DFP – since inception |

|

Majority owner and Executive Manager of various entities engaged in commercial farming, agriculture and real estate. |

|

5 |

|

None |

| |

|

|

|

|

|

|

|

|

|

|

David Gale

301 E. Colorado Boulevard

Suite 800

Pasadena, CA 91101

Age: 72 |

|

Director |

|

Class I Director

PFD – since 1997

PFO – since 1997

FFC – since inception

FLC – since inception

Class II Director

DFP – since inception |

|

President of Delta Dividend Group, Inc. (investments). |

|

5 |

|

None |

| |

|

|

|

|

|

|

|

|

|

|

|

Karen H. Hogan

301 E. Colorado Boulevard

Suite 800

Pasadena, CA 91101

Age: 60 |

|

Director and

Audit Committee Chair |

|

Class I Director†

DFP – since 2016

Class II Director†

PFD – since 2016

PFO – since 2016

Class III Director†

FFC – since 2016

FLC – since 2016 |

|

Board Member, IKAR, a non-profit organization; Active Committee Member and Volunteer to several non-profit organizations. |

|

5 |

|

None |

|

Name, Address,

and Age |

|

Current

Position(s)

Held with Funds |

|

Term of Office

and Length of

Time Served* |

|

Principal

Occupation(s)

During Past

Five Years |

|

Number of Funds

In Fund Complex

Overseen

by Director** |

|

Other

Public Company

Board Memberships

During Past Five

Years

|

|

INTERESTED

DIRECTOR AND OFFICER: |

|

|

|

|

|

|

|

|

|

|

|

R. Eric Chadwick(1)

301 E. Colorado Boulevard

Suite 800

Pasadena, CA 91101

Age: 46 |

|

Director, Chairman of the Board, Chief Executive Officer and President |

|

Class II Director

PFO – since 2016

Class III Director

PFD – since 2016

FFC – since 2016

FLC – since 2016

DFP – since 2016 |

|

Portfolio Manager and President of Flaherty & Crumrine. |

|

5 |

|

None |

| * |

The Class I Director of PFD, FFC, FLC and DFP and the Class III Director of PFO will serve until each Fund’s 2023 Annual Meeting of Shareholders and until their successors are duly elected and qualify. The Class II Director of PFD, FFC, FLC and DFP and the Class I Director of PFO will serve until each Fund’s 2024 Annual Meeting of Shareholders and until their successors are duly elected and qualify. The Class II Nominees of PFO and the Class III Nominees of PFD, FFC, FLC and DFP, if elected, will serve until each Fund’s 2025 Annual Meeting of Shareholders and until their successors are duly elected and qualify. |

| ** |

The Flaherty & Crumrine fund complex (the “Fund Complex”) consists solely of the Funds. |

| † |

Ms. Hogan served as a Class I Director of PFD from 2005 – 2016, a Class II Director of each of FFC and FLC from 2005 – 2016, a Class II Director of DFP since inception – 2016 and a Class III Director of PFO from 2005 – 2016. |

| (1) |

“Interested person” of the Funds as defined in the Investment Company Act of 1940, as amended (the “1940 Act”). Mr. Chadwick is considered an “interested person” because of his affiliation with Flaherty & Crumrine. |

No Non-Interested

Director of the Funds or their immediate family members owned beneficially or of record any securities in Flaherty & Crumrine,

or a person directly or indirectly controlling, controlled by, or under common control with the Flaherty & Crumrine.

Mr. Chadwick was

appointed as a Director of the Funds in January 2016 and was elected by each Fund’s shareholders to serve in that capacity

in April 2016. Each Director, other than Mr. Chadwick, has been a Director of the Funds for at least 15 years (or since the Fund’s

inception, in the case of DFP). Additional information about each Director follows (supplementing the information provided in the

table above) that describes some of the specific experiences, qualifications, attributes or skills that each Director possesses

which the Boards believe have prepared them to be effective Directors. The Boards believe that Directors should have the ability

to critically review, evaluate, question and discuss information provided to them, and interact effectively with Fund management,

service providers and counsel. The Boards believe that their members satisfy this standard. Experience relevant to having this

ability may be achieved through a Director’s educational background; business, professional training or practice (e.g., accounting

or law); public service or academic positions; experience from service as a board member (including the Boards of the Funds) or

as an executive of investment funds, public companies or significant private or not-for-profit entities or other organizations;

and/or other life experiences. The charter for the Boards’ Nominating and Governance Committees (each a "Nominating

Committee" and collectively, the "Nominating Committees") contains certain other factors considered by the Nominating

Committees in identifying and evaluating potential Director nominees. To assist them in evaluating matters under federal and state

law, the Independent Directors (defined below) are counseled by their own independent legal counsel, who participates in Board

meetings and interacts with Flaherty & Crumrine, and may also benefit from information provided by the Funds’ and Flaherty & Crumrine’s counsel. Both counsel to the Independent Directors and counsel to the Funds and Flaherty & Crumrine

have significant experience advising funds and fund directors. The Boards and their committees have the ability to engage other

experts as appropriate. The Boards evaluate their performance on an annual basis.

R. Eric Chadwick –

Mr. Chadwick was appointed as a Director and Chair of the Board of each Fund in January 2016. Mr. Chadwick has been the President

of each Fund since April 2015 and, previously, the Chief Financial Officer since 2004 (or in the case of DFP, from its inception).

Mr. Chadwick is also the President of Flaherty & Crumrine and has served as a portfolio manager of PFD and PFO since 1999 and

as portfolio manager of each of FFC, FLC and DFP since each Fund’s inception.

David Gale – In addition

to his tenure as a Director of the Funds, Mr. Gale has been President and Chief Executive Officer of Delta Dividend Group, Inc.,

a San Francisco-based investment management firm, since 1992. Prior to joining Delta Dividend Group, Inc., Mr. Gale was a Principal

with Morgan Stanley from 1983 to 1990, and a Managing Director of Lehman Brothers Holdings Inc. from 1990 to 1992. Mr. Gale previously

served as a director of Emmis Communications.

Morgan Gust – In

addition to his tenure as a Director of the Funds, Mr. Gust is a majority owner and executive manager of various entities engaged

in commercial farming, agriculture and real estate. From 1990 to 2007, Mr. Gust served in various capacities, including President,

Executive Vice President, General Counsel and Corporate Secretary of Giant Industries, Inc., a New York Stock Exchange listed public

company engaging in petroleum refining and marketing. Mr. Gust previously served as lead director of CoBiz Financial, Inc., a publicly

traded bank holding company. He is also a member of the Arizona State Bar. Mr. Gust was designated the Lead Independent Director

of each Fund in October 2016. He also serves as the Chair of the Nominating Committee of each Fund’s Board.

Karen H. Hogan –

In addition to her tenure as a Director of the Funds, Ms. Hogan serves on the Board of IKAR, a non-profit organization, and as

a committee member and active volunteer of several charitable and non-profit organizations. From 1985 to 1997, Ms. Hogan served

as Senior Vice President of Preferred Stock Origination, and previously Vice President of New Product Development, at Lehman Brothers

Holdings Inc. Ms. Hogan also served as a director, member and chair of the audit committee of New World Coffee, Inc. Ms. Hogan

currently serves as Chair of the Audit Committee of each Fund’s Board.

Board Composition and Leadership Structure

The 1940 Act requires

that at least 40% of the Funds’ Directors not be "interested persons" (as defined in the 1940 Act) of the Funds,

and therefore not affiliated with Flaherty & Crumrine ("Independent Directors"). To rely on certain exemptive rules

under the 1940 Act, a majority of the Funds’ Directors must be Independent Directors and, for certain important matters,

such as the approval of investment advisory agreements or transactions with affiliates, the 1940 Act or the rules thereunder require

the approval of a majority of the Independent Directors. Currently, three of the Funds’ four Directors are Independent Directors.

The Chair of the Boards is an interested person of each Fund. The three Independent Directors interact directly with the Chair

and other senior management of Flaherty & Crumrine at scheduled meetings and between meetings as appropriate. Independent Directors

have been designated to chair the Audit Committees and the Nominating Committees. The Board of each Fund has appointed Mr. Morgan

Gust as the Lead Independent Director. The Boards have determined that their leadership structures and composition, in which the

Chair of the Boards is an "interested person" of the Funds, the Funds have a Lead Independent Director and 75% of the

Directors are Independent Directors, are appropriate in light of the services that Flaherty & Crumrine provides to the Funds.

Boards’ Oversight Role in Management

The Boards’

role in management of the Funds is oversight. As is the case with virtually all investment companies (as distinguished from operating

companies), service providers to the Funds, primarily Flaherty & Crumrine, have responsibility for the day-to-day management

of the Funds, which includes responsibility for risk management (including management of investment performance and investment

risk, valuation risk, issuer and counterparty credit risk, compliance risk and operational risk). As part of their oversight, the

Boards, acting at their scheduled meetings, or the Chair, acting between Board meetings, regularly interacts with, and receives

reports from, senior personnel of service providers, including the Funds’ and Flaherty & Crumrine’s Chief Compliance

Officer and portfolio management personnel. The Boards’ Audit Committees (which consist of all the Independent Directors)

meet during their scheduled meetings, and between meetings the Chair of the Audit Committees maintains contact, with the Funds’

independent registered public accounting firm and the Funds’ Chief Financial Officer. The Boards also receive periodic presentations

from senior personnel of Flaherty & Crumrine regarding risk management generally, as well as periodic presentations regarding

specific operational, compliance or investment areas, such as business continuity, personal trading, valuation and credit. The

Boards have adopted policies and procedures designed to address certain risks to the Funds. In addition, Flaherty & Crumrine

and other service providers to the Funds have adopted a variety of policies, procedures and controls designed to address particular

risks to the Funds. Different processes, procedures and controls are employed with respect to different types of risks. However,

it is not possible to eliminate all of the risks applicable to the Funds. The Boards also receive reports from counsel to the Funds

and Flaherty & Crumrine and the Independent Directors’ own independent legal counsel regarding regulatory, compliance

and governance matters. The Boards’ oversight role does not make the Boards guarantors of the Funds’ investments or

activities.

Beneficial Ownership of Shares in

Funds and Fund Complex for each Director and Nominee for Election as Director

Set forth in the

table below is the dollar range of equity securities in each Fund and the aggregate dollar range of equity securities in the Flaherty & Crumrine Fund Complex beneficially owned by each Director and Nominee for election as Director.

Name of Director or

Nominee |

Dollar Range of Equity

Securities Held in a Fund*(1) |

Aggregate Dollar Range of Equity

Securities in All Registered Investment

Companies

Overseen by Director in

Family of Investment Companies*(2) |

| NON-INTERESTED DIRECTORS/NOMINEES: |

| |

PFD |

PFO |

FFC |

FLC |

DFP |

TOTAL |

| Morgan Gust |

E |

E |

D |

D |

D |

E |

| David Gale |

E |

D |

E |

D |

C |

E |

| Karen H. Hogan |

C |

C |

C |

C |

C |

E |

| INTERESTED DIRECTOR: |

| R. Eric Chadwick |

D |

E |

E |

D |

E |

E |

| |

|

|

|

|

|

|

| * |

Key to Dollar Ranges |

| A. |

None |

| B. |

$1 - $10,000 |

| C. |

$10,001 -

$50,000 |

| D. |

$50,001 - $100,000 |

| E. |

over $100,000 |

| All Shares were valued as of December 31, 2021. |

| (1) |

This information has been furnished by each Director/Nominee as of December 31, 2021. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)(2) under the 1934 Act. |

| (2) |

As of December 31, 2021, the Directors, Nominees and executive officers of each Fund, as a group, owned less than 1% of the Shares of each Fund. |

Officers of the Funds

The following table

provides information concerning each of the Fund’s officers.

|

Name, Address,

and Age |

|

Current Position(s)

Held with Funds |

|

Term of Office and

Length of Time

Served* |

|

Principal Occupation During

Past Five Years |

|

Chad C. Conwell

301 E. Colorado

Boulevard

Suite 800

Pasadena, CA 91101

Age: 49 |

|

Chief Compliance Officer, Vice President and Secretary |

|

PFD – since 2005

PFO – since 2005

FFC – since 2005

FLC – since 2005

DFP – since inception |

|

Executive Vice President, Chief Compliance Officer and Chief Legal Officer of Flaherty & Crumrine. |

| |

|

Bradford S. Stone

47 Maple Street

Suite 403

Summit, NJ 07901

Age: 62 |

|

Chief Financial Officer, Vice President and Treasurer |

|

PFD – since 2003

PFO – since 2003

FFC – since 2003

FLC – since inception

DFP – since inception |

|

Portfolio Manager, Executive Vice President and Chief Financial Officer of Flaherty & Crumrine. |

| |

|

|

|

|

|

|

|

Roger Ko

301 E. Colorado

Boulevard

Suite 800

Pasadena, CA 91101

Age: 47 |

|

Assistant Treasurer |

|

PFD – since 2014

PFO – since 2014

FFC – since 2014

FLC – since 2014

DFP – since 2014 |

|

Trader of Flaherty & Crumrine. |

| |

|

|

|

|

|

|

|

Laurie C. Lodolo

301 E. Colorado

Boulevard

Suite 800

Pasadena, CA 91101

Age: 58 |

|

Assistant Compliance Officer, Assistant Treasurer and

Assistant Secretary |

|

PFD – since 2004

PFO – since 2004

FFC – since 2004

FLC – since 2004

DFP – since inception |

|

Assistant Compliance Officer and Secretary of Flaherty & Crumrine. |

* Each officer serves until his or her successor is elected and qualifies or until his or her earlier resignation or removal.

Audit Committee

The role of each

Fund’s Audit Committee is to assist the Board of Directors in its oversight of: (i) the integrity of the Fund’s financial

statements and the independent audit thereof; (ii) the Fund’s accounting and financial reporting policies and practices,

and its internal control over financial reporting; (iii) the Fund’s compliance with legal and regulatory requirements; and

(iv) the independent auditor’s qualifications, independence and performance. Each Fund’s Audit Committee is also required

to prepare an audit committee report pursuant to applicable laws and regulations for inclusion in the Fund’s annual proxy

statement. Each Audit Committee operates pursuant to a charter (the “Audit Committee Charter” or “Charter”)

that was most recently reviewed and approved by the Board of Directors of each Fund on January 20, 2022, and which is available

at www.preferredincome.com. As set forth in the Charter, Fund management is responsible for the (i) preparation, presentation and

integrity of each Fund’s financial statements, (ii) maintenance of appropriate accounting and financial reporting principles

and policies and (iii) maintenance of internal controls and procedures designed to assure compliance with accounting standards

and applicable laws and regulations. The Funds’ independent registered public accounting firm, KPMG LLP (the “independent

accountants” or “KPMG”), is responsible for planning and carrying out proper audits and reviews of each Fund’s

financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United

States of America.

Audit Committee Report

In performing its

oversight function, at a meeting held on January 19, 2022, the Audit Committee of each Fund reviewed and discussed with Fund management

and the independent accountants, the audited financial statements of the Fund as of and for the fiscal year ended November 30,

2021, and discussed the audit of such financial statements with the independent accountants.

In addition, the

Audit Committee of each Fund discussed with the independent accountants the matters required to be discussed by the applicable

requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. Each Audit Committee also received

from the independent accountants the written disclosures and statements required by PCAOB Rule 3526, Communication with Audit

Committees Concerning Independence, as currently in effect and discussed the impact that any such relationships might have

on the objectivity and independence of the independent accountants.

As set forth above,

and as more fully set forth in each Fund’s Audit Committee Charter, the Audit Committee has significant duties and powers

in its oversight role with respect to the Fund’s financial reporting procedures, internal control systems, and the independent

audit process.

The members of each

Audit Committee are not, and do not represent themselves to be, professionally engaged in the practice of auditing or accounting

and are not employed by the Fund for accounting, financial management or internal control. Moreover, the Audit Committee relies

on, and makes no independent verification of, the facts presented to it or representations made by Fund management or the independent

accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that Fund management

has maintained appropriate accounting and financial reporting principles and policies, or internal controls and procedures, designed

to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations

and discussions referred to above do not provide assurance that the audit of each Fund’s financial statements has been carried

out in accordance with generally accepted accounting standards or that the financial statements are presented in accordance with

generally accepted accounting principles.

Based on its consideration

of the audited financial statements and the discussions referred to above with Fund management and the independent accountants,

and subject to the limitations on the responsibilities and role of the Audit Committee set forth in the Charter and those discussed

above, the Audit Committee of each Fund recommended to that Fund’s Board that the audited financial statements be included

in the Fund’s Annual Report for the fiscal year ended November 30, 2021.

This report was submitted by the Audit Committee of each

Fund’s Board of Directors

David Gale

Morgan Gust

Karen H. Hogan (Chair)

January 19, 2022

Each Audit Committee

was established in accordance with Section 3(a)(58)(A) of the 1934 Act. Each Audit Committee met four times in connection with

its Board of Directors’ regularly scheduled meetings during the fiscal year ended November 30, 2021. Each Audit Committee

is composed entirely of each Fund’s Independent Directors who are also “independent” (as such term is defined

by the New York Stock Exchange (“NYSE”) under the listing standards applicable to closed-end funds, as may be modified

or supplemented (the “NYSE Listing Standards”)), namely Ms. Hogan and Messrs. Gale and Gust.

Nominating Committee

Each Board of Directors

has a Nominating Committee composed entirely of each Fund’s Independent Directors who are also “independent”

(as such term is defined by the NYSE Listing Standards), namely Ms. Hogan and Messrs. Gale and Gust. The Nominating Committee

of each Fund met two times during the fiscal year ended November 30, 2021.

The Nominating Committee

of each Fund is responsible for identifying individuals believed to be qualified to become Board members; for recommending to the

Board such nominees to stand for election as Directors at each Fund’s annual meeting of shareholders and to fill any vacancies

on the Board; and for overseeing the Board’s governance practices. Each Fund’s Nominating Committee has a charter which

is available on its website, www.preferredincome.com.

Each Fund’s

Nominating Committee believes that it is in the best interest of each Fund and its shareholders to obtain highly qualified candidates

to serve as members of the Board. The Nominating Committees have not established a formal process for identifying candidates where

a vacancy exists on the Board. In nominating candidates, each Nominating Committee shall take into consideration such factors as

it deems appropriate, including educational background; business, professional training or practice (e.g., accounting or law);

public service or academic positions; experience from service as a board member (including the Boards of the Funds) or as an executive

of investment funds, public companies or significant private or not-for-profit entities or other organizations; and other life

experiences. Each Fund’s Nominating Committee may consider whether a potential nominee’s professional experience, education,

skills and other individual qualities and attributes, including gender, race or national origin, would provide beneficial diversity

of skills, experience or perspective to the Board’s membership and collective attributes. Each Fund’s Nominating Committee

will consider Director candidates recommended by shareholders and submitted in accordance with applicable law and procedures as

described in this Joint Proxy Statement. (See “Submission of Shareholder Proposals – 2023 Annual Meetings” below).

Other Board-Related Matters

Shareholders who

wish to send communications to the Board should send them to the address of their Fund(s), 301 E. Colorado Boulevard, Suite 800

Pasadena, California 91101, and to the attention of the Board. All such communications will be directed to the Board’s attention.

The Funds do not

have a formal policy regarding Board member attendance at the Annual Meetings. However, all the Directors of each Fund attended

the April 21, 2021 Annual Meetings of Shareholders.

Board Compensation

Each Director of

each Fund who is not a director, officer or employee of Flaherty & Crumrine or any of its affiliates receives from each Fund

a fee of $9,000 per annum plus $750 for each in person Board or Audit Committee meeting attended, $500 for each in person Nominating

Committee meeting attended, and $250 for each telephone meeting attended. In addition, the Audit Committee Chair receives from

each Fund an annual fee of $3,000. Each Director of each Fund is reimbursed for travel and out-of-pocket expenses associated with

attending Board and committee meetings. During the fiscal year ended November 30, 2021, the Board of Directors for each of PFD,

PFO, FFC, FLC and DFP held six meetings (two of which were telephone meetings). Each Director of each Fund attended 100% of the

Board meetings and 100% of any committee meetings of which he or she is a member. The aggregate remuneration paid to the Directors

of each Fund for the fiscal year ended November 30, 2021 is set forth below:

| |

Annual Directors Fees |

Board Meeting and

Committee Meeting Fees* |

Travel and Out-of-Pocket

Expenses** |

| PFD |

$27,000 |

$25,500 |

$70 |

| PFO |

$27,000 |

$25,500 |

$70 |

| FFC |

$27,000 |

$25,500 |

$70 |

| FLC |

$27,000 |

$25,500 |

$70 |

| DFP |

$27,000 |

$25,500 |

$70 |

| * |

Due to the ongoing coronavirus pandemic, each quarterly meeting of the Board and its committees held telephonically or virtually due to COVID-19 safety protocols was treated as an in person meeting. |

| ** |

Includes reimbursement for travel and out-of-pocket expenses for both “interested” and Independent Directors. |

| |

|

|

|

|

The table below

sets forth additional information regarding the compensation of each Fund’s Directors for the fiscal year ended November

30, 2021. No executive officer or person affiliated with a Fund received compensation from a Fund during the fiscal year ended

November 30, 2021 in excess of $60,000. Directors and executive officers of the Funds do not receive pension or retirement benefits

from the Funds.

COMPENSATION TABLE

| Name of Person and Position |

Aggregate

Compensation from

each Fund |

Total Compensation from the

Funds and Fund Complex Paid to

Directors* |

|

R. Eric Chadwick

Director, Chair of the Board, Chief Executive Officer and President |

$0 |

$0 (5) |

| |

|

|

|

Morgan Gust

Lead Independent Director, Nominating Committee Chair |

$16,500 – PFD

$16,500 – PFO

$16,500 – FFC

$16,500 – FLC

$16,500 – DFP |

$82,500 (5) |

| |

|

|

|

David Gale

Director |

$16,500 – PFD

$16,500 – PFO

$16,500 – FFC

$16,500 – FLC

$16,500 – DFP |

$82,500 (5) |

| |

|

|

|

Karen H. Hogan

Director, Audit Committee Chair |

$19,500 – PFD

$19,500 – PFO

$19,500 – FFC

$19,500 – FLC

$19,500 – DFP |

$97,500 (5) |

| * |

Represents the total compensation paid for the fiscal year ended November 30, 2021 to such persons by the Funds, which are considered part of the same “fund complex” because they have a common adviser. The parenthetical number represents the total number of investment company directorships held by the Director or Nominee in the Fund Complex as of November 30, 2021. |

Required Vote

The election of

Messrs. Chadwick and Gust as Directors of PFD and DFP and the election of Mr. Chadwick and Ms. Hogan as Directors of PFO,

FFC and FLC will require the affirmative vote of a plurality of the votes cast by holders of the Shares of each such Fund at the

relevant Annual Meeting in person or by proxy.

Independent Registered Public Accounting

Firm

KPMG, Two Financial

Center, 60 South Street, Boston, Massachusetts 02111, has been selected to serve as each Fund’s independent accountants for

each Fund’s fiscal year ending November 30, 2022. KPMG acted as the independent accountants for each Fund for the fiscal

year ended November 30, 2021. The Funds know of no direct financial or material indirect financial interest of KPMG in the Funds.

A representative of KPMG will not be present at the Annual Meetings, but will be available by telephone to respond to appropriate

questions and will have an opportunity to make a statement.

Set forth in the

table below are audit fees and non-audit related fees billed to each Fund by KPMG for professional services for the fiscal years

ended November 30, 2020 and November 30, 2021, respectively.

| Fund | | |

Fiscal Year Ended November 30 | | |

Audit Fees | | |

Audit-Related Fees | | |

Tax Fees* | | |

All Other Fees | |

| PFD | | |

| 2020 | | |

$ | 50,500 | | |

$ | 0 | | |

$ | 9,465 | | |

$ | 0 | |

| | | |

| 2021 | | |

$ | 53,550 | | |

$ | 0 | | |

$ | 10,030 | | |

$ | 26,000 | |

| PFO | | |

| 2020 | | |

$ | 50,500 | | |

$ | 0 | | |

$ | 9,465 | | |

$ | 0 | |

| | | |

| 2021 | | |

$ | 53,550 | | |

$ | 0 | | |

$ | 10,030 | | |

$ | 26,000 | |

| FFC | | |

| 2020 | | |

$ | 50,500 | | |

$ | 0 | | |

$ | 9,465 | | |

$ | 0 | |

| | | |

| 2021 | | |

$ | 53,550 | | |

$ | 0 | | |

$ | 10,030 | | |

$ | 26,000 | |

| FLC | | |

| 2020 | | |

$ | 50,500 | | |

$ | 0 | | |

$ | 9,465 | | |

$ | 0 | |

| | | |

| 2021 | | |

$ | 53,550 | | |

$ | 0 | | |

$ | 10,030 | | |

$ | 26,000 | |

| DFP | | |

| 2020 | | |

$ | 50,500 | | |

$ | 0 | | |

$ | 9,465 | | |

$ | 0 | |

| | | |

| 2021 | | |

$ | 53,550 | | |

$ | 0 | | |

$ | 10,030 | | |

$ | 26,000 | |

| * |

“Tax Fees” are those fees billed to each Fund by KPMG in connection with tax consulting services, including primarily the review of each Fund’s income tax returns. |

Each Fund’s

Audit Committee Charter requires that the Audit Committee pre-approve all audit and non-audit services to be provided by the independent

accountants to the Fund, and all non-audit services to be provided by the independent accountants to the Fund’s investment

adviser and any entity controlling, controlled by or under common control with the Fund’s investment adviser (“affiliates”)

that provide on-going services to each Fund, if the engagement relates directly to the operations and financial reporting of each

Fund, or to establish detailed pre-approval policies and procedures for such services in accordance with applicable laws. All of

the audit and non-audit services described above for which KPMG billed each Fund fees for the fiscal years ended November 30, 2020

and November 30, 2021, respectively, were pre-approved by the Audit Committee, as applicable.

For each Fund’s

fiscal years ended November 30, 2020 and November 30, 2021, respectively, KPMG did not provide any non-audit services (or bill

any fees for such services) to the Funds’ investment adviser or any affiliates.

OTHER MATTERS TO COME BEFORE THE ANNUAL

MEETINGS

Each Fund does not

intend to present any other business at the relevant Annual Meeting, nor is any Fund aware that any shareholder intends to do so.

If, however, any other matters are properly brought before the Annual Meetings, the persons named in the accompanying form of proxy

will vote thereon in accordance with their judgment.

ADDITIONAL INFORMATION

Investment Adviser, Administrator

and Servicing Agent

Flaherty & Crumrine

serves as the investment adviser to each Fund, and its business address is 301 E. Colorado Boulevard, Suite 800, Pasadena, California

91101. BNY Mellon acts as the administrator to each Fund and is located at 4400 Computer Drive, Westborough, Massachusetts 01581.

Destra Capital Advisors LLC acts as the servicing agent to FFC, FLC and DFP and is located at 444 West Lake Street, Suite 1700,

Chicago, Illinois 60606.

Submission of Shareholder Proposals

- 2023 Annual Meetings

All proposals by

shareholders of each Fund that are intended to be presented at each Fund’s next Annual Meeting of Shareholders to be held

in 2023 must be received by the relevant Fund for consideration for inclusion in the relevant Fund’s proxy statement relating

to the meeting no later than November 3, 2022, and must satisfy the requirements of federal securities laws.

Each Fund’s

bylaws require shareholders wishing to nominate Directors or make proposals to be voted on at the Fund’s annual meeting to

provide timely advance notice of the proposal in writing. To be considered timely, any such advance notice must be in writing delivered

to or mailed and received at the principal executive offices of the Fund at the address set forth on the first page of this Joint

Proxy Statement not earlier than the 150th day nor later than 2:00 p.m., PDT, on the 120th day prior to the first anniversary of

the date of the proxy statement for the preceding year’s annual meeting; provided, however, that in the event that the date

of the annual meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year’s

annual meeting, notice by the shareholder to be timely must be so delivered not earlier than the 150th day prior to the date of

such annual meeting and not later than 2:00 p.m., PDT, on the later of the 120th day prior to the date of such annual meeting,

as originally convened, or the tenth day following the day on which public announcement of the date of such meeting is first made.

Any such notice

by a shareholder shall set forth the information required by the Fund’s bylaws with respect to each matter the shareholder

proposes to bring before the annual meeting.

“Householding”

Please note that

only one annual or semi-annual report or Joint Proxy Statement may be delivered to two or more shareholders of a Fund who share

an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or semi-annual

report or this Joint Proxy Statement, or for instructions regarding how to request a separate copy of these documents or regarding

how to request a single copy if multiple copies of these documents are received, shareholders should contact BNYIS c/o Computershare,

P.O. Box 505000, Louisville, KY, 40233-5000, United States, or by calling 1-866-351-7446 (U.S. toll-free) or 1-201-680-6578 (International).

Voting Results

Each Fund will advise

its shareholders of the voting results of the matters voted upon at its Annual Meeting in its next Semi-Annual Report to shareholders.

Broker Non-Votes and Abstentions

A proxy which is

properly executed and returned accompanied by instructions to withhold authority to vote represents a broker “non-vote”

(i.e., Shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the

persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter). Proxies

that withhold authority or broker non-votes (collectively, “abstentions”) will be counted as Shares that are present

and entitled to vote at the relevant Annual Meeting for purposes of determining the presence of a Quorum.

With respect to

Proposal 1 for the Annual Meetings, abstentions do not constitute a vote “for” the Nominees for Directors.

NOTICE TO BANKS, BROKER/DEALERS AND

VOTING TRUSTEES AND THEIR NOMINEES

Please advise the

Funds whether other persons are the beneficial owners of Shares for which proxies are being solicited from you, and, if so, the

number of copies of the Joint Proxy Statement and other soliciting material you wish to receive to supply copies to the beneficial

owners of Shares.

IT IS IMPORTANT THAT PROXIES BE RETURNED

PROMPTLY. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE RELEVANT ANNUAL MEETING(S) ARE THEREFORE URGED TO COMPLETE, SIGN, DATE AND

RETURN ALL PROXY CARDS OR VOTING INSTRUCTION FORM AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

| |

EASY

VOTING OPTIONS: |

| |

|

| |

|

VOTE

BY MAIL

Vote,

sign and date this Proxy

Card

and return in the

postage-paid

envelope |

| |

|

|

| |

|

VIRTUAL

MEETING

at

the following Website:

www.meetnow.global/MGPZG2H

on

April 20, 2022 at 8:00 a.m. PDT.

To

participate in the Virtual Meeting,

enter

the 14-digit control number from

the shaded box on this card. |

Please

fold along the perforation, detach and return the bottom portion in the enclosed envelope.

PROXY |

FLAHERTY & CRUMRINE TOTAL RETURN FUND INCORPORATED |

|

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON APRIL 20, 2022

THIS PROXY

IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned holder of shares of Common Stock of Flaherty & Crumrine

Total Return Fund Incorporated, a Maryland corporation (the “Fund”), hereby appoints R. Eric Chadwick, Bradford S.

Stone and Chad C. Conwell, proxies for the undersigned, each with full powers of substitution and revocation, to represent the

undersigned and to vote on behalf of the undersigned all shares of Common Stock which the undersigned is entitled to vote at the

Annual Meeting of Shareholders of the Fund to be held virtually at the following Website: www.meetnow.global/MGPZG2H

at 8:00 a.m. PDT, on April 20, 2022, and any adjournments or postponements thereof (the “Meeting”). To participate

in the Meeting enter the 14-digit control number from the shaded box on this card.

The

undersigned hereby acknowledges receipt of the Notice of Annual Meetings of Shareholders and Joint Proxy Statement and hereby

instructs said proxies to vote said shares as indicated hereon. In their discretion, the proxies are authorized to vote upon such

other business as may properly come before the Meeting. A majority of the proxies present and acting at the Meeting in person

or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority

of said proxies hereunder. The undersigned hereby revokes any proxy previously given.

FLC_32521_022422

PLEASE

SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

Important

Notice Regarding the Availability of Proxy Materials for the

Annual

Meeting of Shareholders to be held virtually on April 20, 2022.

The

Notice of Annual Meetings of Shareholders, Joint Proxy Statement and Proxy Card for this meeting are available at:

www.preferredincome.com

Please

fold along the perforation, detach and return the bottom portion in the enclosed envelope.

TO

VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: ☒

| A |

|

Proposal |

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED. |

| |

|

FOR |

WITHHOLD |

|

| |

01

R. Eric Chadwick |

☐ |

☐ |

|

| |

02

Karen H. Hogan |

☐ |

☐ |

|

| 2. | To

vote and otherwise represent the undersigned on any other matter that may properly come

before the Meeting or any adjournment or postponement thereof in the discretion of the

Proxy holder. |

| B | |

Authorized

Signatures ─ This section must be completed for your vote to be counted.─

Sign and Date Below |

| Note: | Please

sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are

held jointly, each holder should sign. When signing as attorney, executor, guardian,

administrator, trustee, officer of corporation or other entity or in another representative

capacity, please give the full title under the signature. |

| Date

(mm/dd/yyyy) ─ Please print date below |

|

Signature

1 ─ Please keep signature within the box |

|

Signature

2 ─ Please keep signature within the box |

| /

/ |

|

|

|

|

| xxxxxxxxxxxxxx | FLC

32521 |

xxxxxxxx |

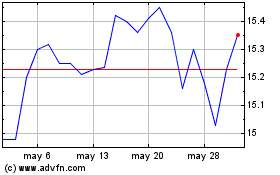

Flaherty and Crumrine To... (NYSE:FLC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Flaherty and Crumrine To... (NYSE:FLC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024