false000136447900013644792024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

HERC HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-33139 | | 20-3530539 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S Employer Identification No.) |

27500 Riverview Center Blvd.

Bonita Springs, Florida 34134

(Address of principal executive offices and zip code)

(239) 301-1000

(Registrant's telephone number,

including area code)

N/A

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

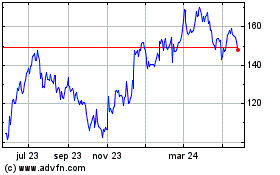

| Common Stock, par value $0.01 per share | | HRI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On February 13, 2024, Herc Holdings Inc. (the “Company”) issued a press release regarding its financial results for its fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

On February 13, 2024, the Company will conduct an earnings webcast relating to the Company’s financial results for the fourth quarter and full year of 2023. The earnings webcast will be made available to the public via a link on the Investor Relations section of the Company's website, IR.HercRentals.com, as well as via telephone dial-in, and the slides that will accompany the presentation will be available to the public at the time of the earnings webcast through the Company’s website. Certain financial information relating to completed fiscal periods that will be part of the earnings webcast is included in the set of slides that will accompany the earnings webcast, a copy of which is furnished as Exhibit 99.2 to this Form 8-K.

The information in this Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. | | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| HERC HOLDINGS INC. |

| (Registrant) |

| | |

| | |

| By: | /s/ MARK HUMPHREY |

| Name: | Mark Humphrey |

| Title: | Senior Vice President and Chief Financial Officer |

Date: February 13, 2024

Herc Holdings Reports Strong Full Year 2023 Results and

Announces 2024 Full Year Guidance

Fourth Quarter 2023 Highlights

–Record total revenues of $831 million, an increase of 6%

–Net income decreased 7% to $91 million, or $3.20 per diluted share

–Adjusted EBITDA of $382 million increased 6%; adjusted EBITDA margin at 46.0%

–Rental pricing increased 5.8% year-over-year

–Common stock repurchases of approximately 119,000 shares

–Added 15 new locations through M&A and greenfield openings

Full Year 2023 Highlights

–Record total revenues of $3,282 million, an increase of 20%

–Net income increased 5% to $347 million, or $12.09 per diluted share

–Adjusted EBITDA of $1,452 million increased 18%; adjusted EBITDA margin at 44.2%

–Rental pricing increased 6.9% year-over-year

–Common stock repurchases of approximately 1.1 million shares

–Added 42 new locations through M&A and greenfield openings

2024 Outlook

–Full year 2024 guidance, excluding the Cinelease studio entertainment and lighting and grip equipment rental business, announced at 7% to 10% equipment rental revenue growth, $1.55 billion to $1.60 billion for adjusted EBITDA and net rental equipment capital expenditures of $500 million to $700 million after gross capex of $750 million to $1 billion

–Quarterly dividend increased to $0.665 per share

Bonita Springs, Fla., February 13, 2024 -- Herc Holdings Inc. (NYSE: HRI) ("Herc Holdings" or the "Company") today reported financial results for the quarter and full year ended December 31, 2023.

“We closed out 2023 with positive operating momentum, contributing to another year of double-digit revenue and adjusted EBITDA growth. Inflationary pressures were successfully managed through revenue initiatives, and we maintained cost discipline while continuing to invest in our business,” said Larry Silber, president and chief executive officer. “I couldn’t be prouder of what our team accomplished last year. They demonstrated tremendous operational strength and agility throughout 2023, successfully leveraging our prominent industry position to capitalize on stimulus and secular opportunities, and to continue to scale our operations for profitable share growth while expanding margins.

“For 2024, we expect to deliver 7-10% organic rental-revenue growth and 6-9% higher adjusted EBITDA year over year, outpacing industry growth forecasts and driving incremental margin expansion as we enhance asset efficiency for greater operating leverage and roll out our new E3 Operating System. Our guidance excludes our Cinelease studio entertainment business, which is currently being held for sale.” Silber said, “We see continued market strength and remain confident that our diligent focus on our strategic priorities — including investing in our classic and specialty fleet, expanding our urban-market presence through greenfield locations and strategic acquisitions, enhancing our industry-leading digital offering, and delivering an exceptional customer experience — will improve performance in the near term and deliver value creation over the long term."

2023 Fourth Quarter Financial Results

•Total revenues increased 6% to $831 million compared to $786 million in the prior-year period. The year-over-year increase of $45 million primarily related to an increase in equipment rental revenue of $35 million, reflecting positive pricing of 5.8% and increased volume of 9.4%, partially offset by unfavorable mix driven by the studio entertainment business and inflation. Sales of rental equipment increased by $11 million during the period.

•Dollar utilization was 40.9% compared to 43.5% in the prior-year period. A decrease in the studio entertainment business as a result of labor disruptions in the film and television industry contributed 170 basis points of the change as well as a tough year-over-year comparison as a result of the benefits of Hurricane Ian in 2022.

•Direct operating expenses were $287 million, or 38.4% of equipment rental revenue, compared to $277 million, or 38.8% in the prior-year period, reflecting better cost performance and fixed cost absorption on higher revenue despite increases related to additional headcount and facilities expenses associated with strong rental activity and an expanding branch network.

•Depreciation of rental equipment increased 11% to $163 million due to higher year-over-year average fleet size. Non-rental depreciation and amortization increased 12% to $29 million primarily due to amortization of acquisition intangible assets.

•Selling, general and administrative expenses was $116 million, or 15.5% of equipment rental revenue, compared to $113 million, or 15.8% in the prior-year period due to continued focus on improving operating leverage while expanding revenues.

•Interest expense increased to $62 million compared with $41 million in the prior-year period due to higher interest rates on floating rate debt and increased borrowings on the ABL Credit Facility primarily to fund acquisition growth and invest in rental equipment.

•Net income was $91 million compared to $98 million in the prior-year period. Adjusted net income decreased 11% to $92 million, or $3.24 per diluted share, compared to $103 million, or $3.44 per diluted share, in the prior-year period. The effective tax rate was 26% in both periods.

•Adjusted EBITDA increased 6% to $382 million compared to $361 million in the prior-year period and adjusted EBITDA margin was 46.0% compared to 46.0% in the prior-year period. Margin performance was impacted by a decline in the Company's studio entertainment revenue year over year, as well as an increase in sales of used equipment in the fourth quarter.

2023 Full Year Financial Results

•Total revenues increased 20% to $3,282 million compared to $2,740 million in the prior-year period. The year-over-year increase of $542 million was related to an increase in equipment rental revenue of $318 million, reflecting positive pricing of 6.9% and increased volume of 14.8%, partially offset by unfavorable mix driven by the studio entertainment business and inflation. Sales of rental equipment increased $221 million compared to the prior-year period resulting from the return to more normal fleet rotation as fleet deliveries become more predictable in certain categories of equipment.

•Dollar utilization was 40.8% compared to 43.3% in the prior-year period. The change is primarily due to the shutdown in the studio entertainment business as a result of labor disruptions in the film and television industry, as well as the continued challenges managing the supply chain in certain categories of equipment that disrupted the normal cadence of deliveries, primarily in the first half of the year.

•Direct operating expenses were $1,139 million, or 39.7% of equipment rental revenue compared to $1,029 million, or 40.3% the prior-year period, reflecting better cost performance and fixed cost absorption on higher revenue despite increases related to additional headcount, facilities expenses and maintenance costs associated with strong rental activity and an expanding branch network.

•Depreciation of rental equipment increased 20% to $643 million, due to higher year-over-year average fleet size. Non-rental depreciation and amortization increased 18% to $112 million primarily due to amortization of acquisition intangible assets.

•Selling, general and administrative expenses was $448 million, or 15.6% of equipment rental revenue, compared to $411 million, or 16.1% in the prior-year period due to continued focus on improving operating leverage while expanding revenues.

•Interest expense increased to $224 million compared with $122 million in the prior-year period due to higher interest rates on floating rate debt and increased borrowings on the ABL Credit Facility primarily to fund acquisition growth and invest in rental equipment.

•Net income was $347 million compared to $330 million in the prior-year period. Adjusted net income increased 4% to $353 million, or $12.30 per diluted share, compared to $340 million, or $11.26 per diluted share, in the prior-year period. The effective tax rate was 22% in 2023 compared to 24% in the prior-year period.

•Adjusted EBITDA increased 18% to $1,452 million compared to $1,227 million in the prior-year period and adjusted EBITDA margin was 44.2% compared to 44.8% in the prior-year period. Margin performance was impacted by a decline in the Company's studio entertainment revenue year over year, as well as a significant increase in sales of used equipment during 2023.

Rental Fleet

Net rental equipment capital expenditures were as follows (in millions):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Rental equipment expenditures | $ | 1,320 | | | $ | 1,168 | |

| Proceeds from disposal of rental equipment | (325) | | | (121) | |

| Net rental equipment capital expenditures | $ | 995 | | | $ | 1,047 | |

•As of December 31, 2023, the Company's total fleet was approximately $6.3 billion at OEC.

•Average fleet at OEC in the fourth quarter increased 14% compared to the prior-year period and increased 21% year-to-date.

•Average fleet age was 45 months as of December 31, 2023, compared to 48 months in the comparable prior-year period.

Disciplined Capital Management

•The Company completed 12 acquisitions with a total of 21 locations and opened 21 new greenfield locations in 2023.

•Net debt was $3.6 billion as of December 31, 2023, with net leverage of 2.5x compared to 2.4x in the same prior-year period. Cash and cash equivalents and unused commitments under the ABL Credit Facility contributed to $1.5 billion of liquidity as of December 31, 2023.

•The Company declared its quarterly dividend of $0.665, an increase of $0.0325 or 5%, payable to shareholders of record as of February 21, 2024, with a payment date of March 7, 2024.

•The Company acquired approximately 1.1 million shares of its common stock for $120 million year-to-date in 2023. As of December 31, 2023, approximately $161 million remains available under the share repurchase program.

Outlook

The Company is announcing its full year 2024 equipment rental revenue growth, adjusted EBITDA, and gross and net rental capital expenditures guidance ranges presented below, excluding Cinelease studio entertainment and lighting and grip equipment rental business. The guidance range for the full year 2024 adjusted EBITDA reflects an increase of 6% to 9% compared to full year 2023 results, excluding Cinelease.

| | | | | | | | |

| Equipment rental revenue growth: | | 7% to 10% |

| Adjusted EBITDA: | | $1.55 billion to $1.60 billion |

| Net rental equipment capital expenditures after gross capex: | | $500 million to $700 million, after gross capex of $750 million to $1 billion |

As a leader in an industry where scale matters, the Company expects to continue to gain share by capturing an outsized position of the forecasted higher construction spending in 2024 by investing in its fleet, optimizing its existing fleet, capitalizing on strategic acquisitions and greenfield opportunities, and cross-selling a diversified product portfolio.

Earnings Call and Webcast Information

Herc Holdings' fourth quarter 2023 earnings webcast will be held today at 8:30 a.m. U.S. Eastern Time. Interested U.S. parties may call +1-888-660-6011 and international participants should call the country specific dial in numbers listed at https://registrations.events/directory/international/itfs.html, using the access code: 7812157. Please dial in at least 10 minutes before the call start time to ensure that you are connected to the call and to register your name and company.

Those who wish to listen to the live conference call and view the accompanying presentation slides should visit the Events and Presentations tab of the Investor Relations section of the Company's website at IR.HercRentals.com. The press release and presentation slides for the call will be posted to this section of the website prior to the call.

A replay of the conference call will be available via webcast on the Company website at IR.HercRentals.com, where it will be archived for 12 months after the call.

About Herc Holdings Inc.

Founded in 1965, Herc Holdings Inc., which operates through its Herc Rentals Inc. subsidiary, is a full-line rental supplier with 400 locations across North America, and 2023 total revenues were approximately $3.3 billion. We offer products and services aimed at helping customers work more efficiently, effectively, and safely. Our classic fleet includes aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment. Our ProSolutions® offering includes industry-specific, solutions-based services in tandem with power generation, climate control, remediation and restoration, pumps, and trench shorting equipment as well as our ProContractor professional grade tools. We employ approximately 7,200 employees, who equip our customers and communities to build a brighter future. Learn more at www.HercRentals.com and follow us on Instagram, Facebook and LinkedIn.

Certain Additional Information

In this release we refer to the following operating measures:

•Dollar utilization: calculated by dividing rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on the guidelines of the American Rental Association (ARA).

•OEC: original equipment cost based on the guidelines of the ARA, which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date).

Forward-Looking Statements

This press release includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy, projected profitability, performance or cash flows, future capital expenditures, our growth strategy, including our ability to grow organically and through M&A, anticipated financing needs, business trends, our capital allocation strategy, liquidity and capital management, exploring strategic alternatives for Cinelease, including the timing of the review process, the outcome of the process and the costs and benefits of the process, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward-looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Information Regarding Non-GAAP Financial Measures

In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this release that is not calculated according to GAAP (“non-GAAP”), such as EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per diluted common share and free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the supplemental schedules that accompany this release.

(See Accompanying Tables)

HERC HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Equipment rental | $ | 748 | | | $ | 713 | | | $ | 2,870 | | | $ | 2,552 | |

| Sales of rental equipment | 68 | | | 57 | | | 346 | | | 125 | |

| Sales of new equipment, parts and supplies | 9 | | | 9 | | | 38 | | | 36 | |

| Service and other revenue | 6 | | | 7 | | | 28 | | | 27 | |

| Total revenues | 831 | | | 786 | | | 3,282 | | | 2,740 | |

| Expenses: | | | | | | | |

| Direct operating | 287 | | | 277 | | | 1,139 | | | 1,029 | |

| Depreciation of rental equipment | 163 | | | 147 | | | 643 | | | 536 | |

| Cost of sales of rental equipment | 51 | | | 40 | | | 252 | | | 89 | |

| Cost of sales of new equipment, parts and supplies | 6 | | | 5 | | | 25 | | | 21 | |

| Selling, general and administrative | 116 | | | 113 | | | 448 | | | 411 | |

| | | | | | | |

| Non-rental depreciation and amortization | 29 | | | 26 | | | 112 | | | 95 | |

| Interest expense, net | 62 | | | 41 | | | 224 | | | 122 | |

| Other expense (income), net | (6) | | | 4 | | | (8) | | | 3 | |

| Total expenses | 708 | | | 653 | | | 2,835 | | | 2,306 | |

| Income before income taxes | 123 | | | 133 | | | 447 | | | 434 | |

| Income tax provision | (32) | | | (35) | | | (100) | | | (104) | |

| Net income | $ | 91 | | | $ | 98 | | | $ | 347 | | | $ | 330 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 28.2 | | | 29.4 | | | 28.5 | | | 29.6 | |

| Diluted | 28.4 | | | 29.9 | | | 28.7 | | | 30.2 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 3.23 | | | $ | 3.33 | | | $ | 12.18 | | | $ | 11.15 | |

| Diluted | $ | 3.20 | | | $ | 3.27 | | | $ | 12.09 | | | $ | 10.92 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 71 | | | $ | 54 | |

| Receivables, net of allowances | 563 | | | 523 | |

| Other current assets | 77 | | | 67 | |

| Current assets held for sale | 21 | | | — | |

| Total current assets | 732 | | | 644 | |

| Rental equipment, net | 3,831 | | | 3,485 | |

| Property and equipment, net | 465 | | | 392 | |

| Right-of-use lease assets | 665 | | | 552 | |

| Goodwill and intangible assets, net | 950 | | | 850 | |

| Other long-term assets | 10 | | | 34 | |

| Long-term assets held for sale | 408 | | | — | |

| Total assets | $ | 7,061 | | | $ | 5,957 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current maturities of long-term debt and financing obligations | $ | 19 | | | $ | 16 | |

| Current maturities of operating lease liabilities | 37 | | | 42 | |

| Accounts payable | 212 | | | 318 | |

| Accrued liabilities | 221 | | | 228 | |

| Current liabilities held for sale | 19 | | | — | |

| Total current liabilities | 508 | | | 604 | |

| Long-term debt, net | 3,673 | | | 2,922 | |

| Financing obligations, net | 104 | | | 108 | |

| Operating lease liabilities | 646 | | | 528 | |

| Deferred tax liabilities | 743 | | | 647 | |

| Other long term liabilities | 46 | | | 40 | |

| Long-term liabilities held for sale | 68 | | | — | |

| Total liabilities | 5,788 | | | 4,849 | |

| Total equity | 1,273 | | | 1,108 | |

| Total liabilities and equity | $ | 7,061 | | | $ | 5,957 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions) | | | | | | | | | | | |

| Year Ended December 31, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 347 | | | $ | 330 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation of rental equipment | 643 | | | 536 | |

| Depreciation of property and equipment | 71 | | | 64 | |

| Amortization of intangible assets | 41 | | | 31 | |

| Amortization of deferred debt and financing obligations costs | 4 | | | 4 | |

| Stock-based compensation charges | 18 | | | 27 | |

| | | |

| Provision for receivables allowances | 65 | | | 52 | |

| Deferred taxes | 89 | | | 83 | |

| Gain on sale of rental equipment | (94) | | | (36) | |

| Other | 1 | | | 5 | |

| Changes in assets and liabilities: | | | |

| Receivables | (98) | | | (172) | |

| Other assets | (22) | | | (15) | |

| Accounts payable | 7 | | | (23) | |

| Accrued liabilities and other long-term liabilities | 14 | | | 31 | |

| Net cash provided by operating activities | 1,086 | | | 917 | |

| Cash flows from investing activities: | | | |

| Rental equipment expenditures | (1,320) | | | (1,168) | |

| Proceeds from disposal of rental equipment | 325 | | | 121 | |

| Non-rental capital expenditures | (156) | | | (104) | |

| Proceeds from disposal of property and equipment | 15 | | | 7 | |

| Acquisitions, net of cash acquired | (430) | | | (515) | |

| Other investing activities | (15) | | | (23) | |

| Net cash used in investing activities | (1,581) | | | (1,682) | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving lines of credit and securitization | 2,127 | | | 2,618 | |

| Repayments on revolving lines of credit and securitization | (1,387) | | | (1,616) | |

| Principal payments under finance lease and financing obligations | (16) | | | (15) | |

| Dividends paid | (73) | | | (68) | |

| Repurchase of common stock | (120) | | | (115) | |

| Other financing activities, net | (19) | | | (19) | |

| Net cash provided by financing activities | 512 | | | 785 | |

| Effect of foreign exchange rate changes on cash and cash equivalents | — | | | (1) | |

| Net change in cash and cash equivalents during the period | 17 | | | 19 | |

| Cash and cash equivalents at beginning of period | 54 | | | 35 | |

| Cash and cash equivalents at end of period | $ | 71 | | | $ | 54 | |

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

EBITDA AND ADJUSTED EBITDA RECONCILIATIONS

Unaudited

(In millions)

EBITDA and adjusted EBITDA - EBITDA represents the sum of net income (loss), provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock-based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on the disposal of a business and certain other items. EBITDA and adjusted EBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, neither measure purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments.

Adjusted EBITDA Margin - Adjusted EBITDA Margin, calculated by dividing Adjusted EBITDA by Total Revenues, is a commonly used profitability ratio.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 91 | | | $ | 98 | | | $ | 347 | | | $ | 330 | |

| Income tax provision | 32 | | | 35 | | | 100 | | | 104 | |

| Interest expense, net | 62 | | | 41 | | | 224 | | | 122 | |

| Depreciation of rental equipment | 163 | | | 147 | | | 643 | | | 536 | |

| Non-rental depreciation and amortization | 29 | | | 26 | | | 112 | | | 95 | |

| EBITDA | 377 | | | 347 | | | 1,426 | | | 1,187 | |

| Non-cash stock-based compensation charges | 3 | | | 7 | | | 18 | | | 27 | |

| | | | | | | |

| Transaction related costs | 3 | | | 2 | | | 8 | | | 7 | |

Other(1) | (1) | | | 5 | | | — | | | 6 | |

| Adjusted EBITDA | $ | 382 | | | $ | 361 | | | $ | 1,452 | | | $ | 1,227 | |

| | | | | | | |

| Total revenues | $ | 831 | | | $ | 786 | | | $ | 3,282 | | | $ | 2,740 | |

| Adjusted EBITDA | $ | 382 | | | $ | 361 | | | $ | 1,452 | | | $ | 1,227 | |

| Adjusted EBITDA margin | 46.0 | % | | 46.0 | % | | 44.2 | % | | 44.8 | % |

(1) Pension settlement, impairment and spin-off costs are included in Other.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER DILUTED SHARE

Unaudited

(In millions)

Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income (loss), restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, transaction related costs, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 91 | | | $ | 98 | | | $ | 347 | | | $ | 330 | |

| | | | | | | |

| Transaction related costs | 3 | | | 2 | | | 8 | | | 7 | |

| Other | (1) | | | 5 | | | — | | | 6 | |

Tax impact of adjustments(1) | (1) | | | (2) | | | (2) | | | (3) | |

| Adjusted net income | $ | 92 | | | $ | 103 | | | $ | 353 | | | $ | 340 | |

| | | | | | | |

| Diluted shares outstanding | 28.4 | | | 29.9 | | | 28.7 | | | 30.2 | |

| | | | | | | |

| Adjusted earnings per diluted share | $ | 3.24 | | | $ | 3.44 | | | $ | 12.30 | | | $ | 11.26 | |

(1) The tax rate applied for adjustments is 25.5% in the three months and year ended December 31, 2023 and 25.7% in the three months and year ended December 31, 2022 and reflects the statutory rates in the applicable entities.

HERC HOLDINGS INC. AND SUBSIDIARIES

SUPPLEMENTAL SCHEDULES

FREE CASH FLOW

Unaudited

(In millions)

Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures.

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Net cash provided by operating activities | $ | 1,086 | | | $ | 917 | |

| | | |

| Rental equipment expenditures | (1,320) | | | (1,168) | |

| Proceeds from disposal of rental equipment | 325 | | | 121 | |

| Net rental equipment expenditures | (995) | | | (1,047) | |

| | | |

| Non-rental capital expenditures | (156) | | | (104) | |

| Proceeds from disposal of property and equipment | 15 | | | 7 | |

| Other | (15) | | | (23) | |

| Free cash flow | $ | (65) | | | $ | (250) | |

| | | |

| Acquisitions, net of cash acquired | (430) | | | (515) | |

| Increase in net debt, excluding financing activities | $ | (495) | | | $ | (765) | |

©2021 Herc Rentals Inc. All Rights Reserved. Shifting Into High Gear

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 2 Larry Silber President & Chief Executive Officer Herc Rentals Team & Agenda Aaron Birnbaum Senior Vice President & Chief Operating Officer Agenda • Safe Harbor • 2023 Overview • Q4 Operations Review • Q4 Financial Review • 2024 Outlook • Q&A Leslie Hunziker Senior Vice President Investor Relations, Communications & Sustainability Mark Humphrey Senior Vice President & Chief Financial Officer

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 3 Safe Harbor Statements and Non-GAAP Financial Measures Forward-Looking Statements This presentation includes forward-looking statements as that term is defined by the federal securities laws, including statements concerning our business plans and strategy, projected profitability, performance or cash flows, future capital expenditures, our growth strategy, including our ability to grow organically and through M&A, anticipated financing needs, business trends, our capital allocation strategy, liquidity and capital management, exploring strategic alternatives for Cinelease, including the timing of the review process, the outcome of the process and the costs and benefits of the process, and other information that is not historical information. Forward looking statements are generally identified by the words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," "looks," and future or conditional verbs, such as "will," "should," "could" or "may," as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and, there can be no assurance that our current expectations will be achieved. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from those in the forward- looking statements. Further information on the risks that may affect our business is included in filings we make with the Securities and Exchange Commission from time to time, including our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and in our other SEC filings. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Information Regarding Non-GAAP Financial Measures In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain information in this presentation that is not calculated according to GAAP (“non- GAAP”), such as adjusted net income, adjusted earnings per diluted share, EBITDA, adjusted EBITDA, adjusted EBITDA margin, REBITDA, REBITDA margin, REBITDA flow-through and free cash flow. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of companies in our industry. Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the appendix that accompanies this presentation.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 4 Equipment Rental Revenue $1,702 $1,544 $1,910 $2,552 $2,870 2019 2020 2021 2022 2023 Total Revenues $1,999 $1,780 $2,073 $2,740 $3,282 2019 2020 2021 2022 2023 Adjusted EBITDA¹ $741 $689 $895 $1,227 $1,452 2019 2020 2021 2022 2023 37.1% 38.7% 43.2% 44.8% 44.2% 2019 2020 2021 2022 2023 $1.63 $2.51 $7.37 $10.92 $12.09 2019 2020 2021 2022 2023 12% 18%20% $ in millions $ in millions $ in millions 11% Adjusted EBITDA Margin¹Earnings Per Diluted Share ROIC2 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 22 2. The company’s ROIC metric uses after-tax operating income for the trailing 12 months divided by average stockholders’ equity, debt and deferred taxes, net of average cash. To mitigate the volatility related to fluctuations in the company’s tax rate from period to period, the U.S. federal corporate statutory tax rate of 21% was used to calculate after-tax operating income. 6.0% 5.2% 9.6% 10.8% 10.2% 2019 2020 2021 2022 2023 FY 2023: Another Exceptional Year of Growth 2023 margin impacted by studio-entertainment industry shutdown and catch-up sales of used fleet 2023 ROIC impacted by studio-entertainment industry shutdown

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 5 Optimize branch network for fleet / operating efficiencies at scale • Completed 12 acquisitions - 21 locations; opened 21 greenfield locations Enhance fleet mix • Expanded high-margin specialty fleet by 11% at OEC YoY Support customers’ efficiency goals through data and telematics • Advanced our industry-leading digital capabilities: ProControl Next Gen™ Commit to purposeful Sustainability initiatives • Employee NPS improves YoY, scoring in benchmark's top tier • Listed among USA Today's 2023 America's Climate Leaders • Recognized on the Best and Brightest Companies to Work For list • Designated a Military Friendly Company for the 8th year in a row Prioritize Capital and Invest Responsibly • Disciplined investment in fleet and strategic M&A • Increased dividend in 2023 to $2.53 p/s; Increased in 2024 to $2.66 p/s • Repurchased ~1.1 million shares in 2023 FY 2023: Delivering on Growth Strategies Grow the Core Expand Specialty Elevate Technology Integrate ESG Allocate Capital Strategies to Accelerate ROIC and Increase Shareholder Returns:

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 6 Equipment rental market in N.A. • Supply chain recovering, but constraints persist in high-demand AWP categories • Positive industry trends aided by stimulus, reshoring, data usage and cloud adoption • Mega projects continue to ramp up • Shift from equipment ownership to rental continues • Used equipment market healthy HRI remains focused on building scale for sustainable profit growth • Stimulus-led demand drivers favor largest, most capable and agile players • Market consolidation continues with strong pipeline of opportunities in top 100 MSAs • Targeting ~30 greenfields to drive scale efficiencies, greater access to local customers • Continue investing in technology to improve customer and operating productivity • Rolling out new operating system, E3OS, to deliver easy, efficient, effective customer experience, every time • Channel shifting to increase retail sales of used equipment for higher returns on OEC • Capitalizing on more stable supply chain to improve fleet efficiency and optimize fleet mix FY 2024 Perspective Herc has a strong foundation in place to deliver 2024 financial targets

Operations Review Aaron Birnbaum Senior Vice President and Chief Operating Officer

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 8 2023: Focusing on Safety Continuing focus on Perfect Days • All branches reported > 98% Perfect Days • Perfect Days are those with no: ◦ OSHA recordable incidents ◦ At-fault motor vehicle accidents ◦ DOT violations Total Recordable Incident Rate of 0.8, below 1.0 industry standard Proven safety record is a must-have for customers Herc's Safety Program integrated into all acquisitions

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 9 Delivering on Growth Strategies—Increasing Branch Network Density Expanding Through Acquisitions and Greenfields Adding locations increases density and share in urban markets • Q4:23 - 4 acquisitions - 7 locations; 8 greenfield locations • FY:23 - 12 acquisitions - 21 locations; 21 greenfield locations ◦ Of 42 total new locations, specialty = 11 locations ◦ Invested $430 million in 2023 on M&A • FY:23 - Strategic acquisitions accounted for ~1/3 rental revenue Strategic M&A Opportunity ~$500 million per year Pipeline of acquisition opportunities remains strong Synergized Multiple Averaging 3.5x - 4.5x

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 10 Effectively Managing Fleet Lifecycle and Balancing Equipment Mix Specialty 24% Aerial 24% Earthmoving 12% Material Handling 18% Other 22% Fleet Composition $6.3 billion at OEC1,2 1. Original equipment cost based on ARA guidelines. 2. End fleet as of December 31, 2023. Fleet Expenditures at OEC1 $253 $327 $311 $327$348 $400 $274 $196 2022 2023 Q1 Q2 Q3 Q4 $ in millions $64 $64 $54 $140$144 $186 $309 $174 2022 2023 Q1 Q2 Q3 Q4 Fleet Disposals at OEC1 $ in millions • 4Q:23 more normal seasonal purchase and disposition cadence • 4Q:23 disposals generated proceeds of ~44% of OEC • Average age of disposals was 84 months in Q4 2023 • Average fleet age of 45 months at December 31, 2023

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 11 Business Model Driving Growth National: 43% Local: 57% • 4Q:23 revenue in local markets up double-digit YoY • 4Q:23 National account revenue continues to benefit from general growth and mega project activity ◦ Vertical sales strategy provides for end-market expertise and creates more diverse revenue mix ◦ Project pipeline remains strong; still in early innings of federal-funding opportunities • Long-term, balanced target of 60% local / 40% national accounts Contractors 37% Industrial 27% Infrastructure & Government 16% Commercial Facilities 14% Other 6.0% 1. Refer to our 10-K for description of industries related to each customer classification. Q4 Revenue by Customer1Q4 Local vs. National Mix

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 12 Investing to Capitalize on Growth Trends Across a Diverse Customer and Project Base Pipeline of new construction and maintenance projects offers wide spectrum of growth opportunities • Banks • Casinos • Hospitality (hotel & motel) • Parking Garages • Religious Building • Retail Facilities • Commercial Warehousing • Education • Facility Maintenance • Healthcare • Data Centers • Sporting Events • Theater • TV, Film & Radio • Homeowners • Live Events Contractors (37%) Industrial (27%) Commercial Facilities (14%) Other (6%) • Aerospace • Alternative • Automotive/EV • Energy/ Renewables • Food & Beverage • Agriculture • Chemical Processing • Industrial Manufacturing • Metals & Minerals • Oil & Gas Production • Oil & Gas Pipeline • Oil & Gas Refineries • Pharmaceutical • Power • Pulp. Paper & Wood • Shipbuilding/Yards • Electrical • General Contractors • Mechanical • Remediation & Environmental • Residential • Restoration • Specialty Contractors • Airports • Bridge • Federal Government • Local & State Government • Military Base • Prisons • Railroad & Mass Transportation • Streets, Road &Highway • Sewer & Waste Disposal • Water Supply & Distribution • Utilities Infrastructure & Gov. Direct (16%) Herc Rentals is Well Positioned with Current Trending Opportunities EV/Battery Chip Plants Data Centers LNG PlantRenewables Utilities Healthcare Infrastructure New verticals since 2016 in bold.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 13 2024 Key Initiatives Capturing Mega Project Tailwind Pricing to Offset Inflation Optimizing Customer Experience Through Technology Improving Processes and Customer Experience Through E3OS Managing Fleet Efficiency Increasing Density Through Greenfields and M&A

Financial Review Mark Humphrey Senior Vice President and Chief Financial Officer

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 15 Q4 and FY 2023 Financial Results Three Months Ended December 31, Year Ended December 31, $ in millions, except per share data 2023 2022 2023 vs 2022 % Change 2023 2022 2023 vs 2022 % Change Equipment Rental Revenue $748 $713 5% $2,870 $2,552 12% Total Revenues $831 $786 6% $3,282 $2,740 20% Net Income $91 $98 (7)% $347 $330 5% Earnings Per Diluted Share $3.20 $3.27 (2)% $12.09 $10.92 11% Adjusted Net Income1 $92 $103 (11)% $353 $340 4% Adjusted Earnings Per Diluted Share1 $3.24 $3.44 (6)% $12.30 $11.26 9% Adjusted EBITDA1 $382 $361 6% $1,452 $1,227 18% Adjusted EBITDA Margin1 46.0% 46.0% — bps 44.2% 44.8% (60) bps REBITDA Margin1,2 48.0% 47.3% 70 bps 46.4% 45.7% 70 bps REBITDA YoY Flow-Through1,2 64.7% 53.9% 1080 bps 53.0% 48.1% 490 bps Average Fleet3 (YoY) 13.5% 31.1% 21.0% 30.5% Pricing3 (YoY) 5.8% 6.6% 6.9% 5.8% ROIC 10.2% 10.8% (60) bps 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 22 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies 3. Based on ARA guidelines

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 16 Q4 2023 Adjusted EBITDA and Rental Revenue Bridge Adjusted EBITDA $361 $382 2022 Equipment Rental Revenue Gain on Sale of Rental Equipment DOE SG&A Studio Entertainment Other 2023 Adjusted EBITDA Margin drivers: DOE and SG&A were positive contributors as both declined as a percent of rental revenue Negative impact from higher sales of used equipment, which has a lower margin than equipment rental Studio entertainment industry's shutdown reduced revenue on a fixed cost basis $ in millions $ in millions Equipment Rental Revenue $713 $748 2022 Pricing OEC on Rent Ancillary Other Inflation Studio Entertainment 2023

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 17 Q4 and FY 2023 Financial Results Excluding Studio Entertainment Three Months Ended December 31, Year Ended December 31, $ in millions 2023 2022 2023 vs 2022 % Change 2023 2022 2023 vs 2022 % Change Core Equipment Rental Revenue1 $738 $682 8% $2,820 $2,430 16% Core Total Revenues1 $820 $753 9% $3,226 $2,610 24% Core Net Income1 $93 $98 (5)% $376 $319 18% Core Adjusted EBITDA1 $385 $350 10% $1,462 $1,180 24% Core Adjusted EBITDA Margin1 47.0% 46.5% 50 bps 45.3% 45.2% 10 bps Core REBITDA Margin1,2 48.9% 48.0% 90 bps 47.6% 46.1% 150 bps Core REBITDA YoY Flow-Through1,2 60.7% 54.9% 580 bps 57.4% 49.2% 820 bps 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 22 2. REBITDA measures contribution from our core rental business without impact of sales of equipment, parts and supplies • Strong margin and flow-through improvements YoY ◦ Record REBITDA margin for FY23 • Dollar utilization of 42.6% for 4Q23 and 42.4% for FY23 • Tough YoY comparison due to extraordinary benefit from Hurricane Ian in 4Q22 Core Business (ex-Cinelease) Delivered Double-Digit Profit Growth

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 18 Disciplined Capital Management Maturities As of December 31, 2023 $ in millions $1,200 $2,072 $345 2024 2025 2026 2027 No near-term maturities and ample liquidity2 of $1.5 billion provide financial flexibility Net capital expenditures outpaced cash flow from operations due to investments in growth, resulting in free cash outflow of $65 million for the year ended December 31, 2023 Net leverage3 of 2.5x compared with 2.4x in December 2022, within target range of 2.0x to 3.0x Quarterly dividend of $0.6325 per share, paid on December 26, 2023 to shareholders of record as of December 11, 2023 Q4 Share repurchases of ~119,000 shares for $13 million FY23 repurchases of ~1.1 million shares for $120 million 1. The AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to consummate refinancing and extend the term of the agreement 2. Total liquidity includes cash and cash equivalents and the unused commitments under the ABL Credit Facility and AR Facility 3. For a definition and calculation, see the Appendix beginning on Slide 22 $76 Finance Leases 2024-2031 AR Facility1 ABL Credit Facility Senior Unsecured Notes Credit Ratings: Moody’s CFR Ba2 S&P BB-/Positive

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 19 Continued Strength in Key End Markets N.A. Equipment Rental Market1 $50 $52 $57 $60 $55 $61 $69 $77 $82 $86 $89 $93 16 17 18 19 20 21 22 23 24E 25E 26E 27E 1. Source: ARA / S&P Global as of November 2023 3. Source: American Institute of Architects (AIA) as of January 2024 2. Source: IIR as of January 2024 4. Source: Dodge Analytics U.S. as of January 2024 $ in billions Industrial Spending2 $299 $310 $317 $328 $309 $317 $352 $413 $408 $406 $408 $392 16 17 18 19 20 21 22 23 24E 25E 26E 27E $ in billions Non-Residential Starts4 $258 $288 $298 $314 $260 $304 $444 $441 $458 $484 $508 $532 16 17 18 19 20 21 22 23E 24E 25E 26E 27E $ in billions — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — Architecture Billings Index3 16 17 18 19 20 21 22 Jan-23 50 Dec 45.4

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 20 2024 Outlook excluding Cinelease Key Assumptions Full-Year 2024 excluding Cinelease: • Adjusted EBITDA assumption includes $550 to $650 million fleet dispositions at OEC; 20-30% less YoY • Mega projects continue to ramp through year • Above-market revenue growth on diverse project pipeline, geographic expansion, cross-selling • Strategic pricing expected to offset equipment inflation of ~5% • Focusing on fleet efficiency; supply chain improvement affords greater flexibility throughout year • Beginning fleet of $6.0 billion at OEC • Used-equipment market remains healthy • Continued focus on operating leverage to improve margins • REBITDA Flow Through of mid-50% expected • Interest expense roughly flat YoY, dependent on rate actions • Tax rate ~25% Metric 2023 Excluding Cinelease1 2024 Full Year Guidance Equipment Rental Revenue $2,820 million +7% to 10% Adjusted EBITDA $1,462 million $1.55 billion to $1.60 billion Net Rental Equipment Expenditures after Gross Capex $995 million $500 to $700 million after gross capex of $750 to $1 billion 1. For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on Slide 22

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 21 Purpose, Vision, Mission and Values We equip our customers and communities to build a brighter future

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 22

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 23 Glossary of Terms Commonly Used in the Industry OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental Association (ARA), which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized refurbishment costs (with the basis of refurbished assets reset at the refurbishment date). Fleet Age: The OEC weighted age of the entire fleet, based on ARA guidelines. Net Fleet Capital Expenditures: Capital expenditures of rental equipment minus the proceeds from disposal of rental equipment. Dollar Utilization ($ UT): Dollar utilization is an operating measure calculated by dividing equipment rental revenue (excluding re-rent, delivery, pick-up and other ancillary revenue) by the average OEC of the equipment fleet for the relevant time period, based on ARA guidelines. Pricing: Change in pure pricing achieved in one period versus another period. This is applied both to year-over-year and sequential comparisons. Rental rates are based on ARA guidelines and are calculated based on the category class rate variance achieved either year-over-year or sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 24 Our Strategy is Delivering Results Equipment Rental Revenue Adjusted EBITDA1 $1,702 $1,544 $1,910 $2,552 $2,870 2019 2020 2021 2022 2023 $741 $689 $895 $1,227 $1,452 2019 2020 2021 2022 2023 Net Leverage2 2.8x 2.4x 2.1x 2.4x 2.5x 2019 2020 2021 2022 2023 Adjusted EBITDA Margin1 37.1% 38.7% 43.2% 44.8% 44.2% 2019 2020 2021 2022 2023 $ in millions 1. For a definition and reconciliation to the most comparable GAAP financial measure, see slides 26 and 27 and previously filed presentations 2. For a definition and calculation, see slide 35

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 25 Cinelease Studio Entertainment Assets Held for Sale Cinelease is Herc's studio management and lighting and grip business • Market preference for lighting and grip equipment to be part of studio ownership • Owning studio real estate does not align with Herc strategy • Lighting and grip equipment represents ~5% of OEC Cinelease sale process underway Herc Entertainment Services (HES) will continue to provide rentals to entertainment industry Equipment Types • aerial equipment, • forklifts, • carts, • generators, • climate solutions Cinelease assets held for sale HES to continue to service market Project Types • in-studio TV & Film productions • off-location TV & Film productions • live entertainment venues

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 26 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through EBITDA, Adjusted EBITDA, and REBITDA - EBITDA represents the sum of net income, provision (benefit) for income taxes, interest expense, net, depreciation of rental equipment and non-rental depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of transaction related costs, restructuring and restructuring related charges, spin-off costs, non-cash stock based compensation charges, loss on extinguishment of debt (which is included in interest expense, net), impairment charges, gain (loss) on disposal of a business and certain other items. REBITDA represents Adjusted EBITDA excluding the gain (loss) on sales of rental equipment and new equipment, parts and supplies. EBITDA, Adjusted EBITDA and REBITDA do not purport to be alternatives to net income as an indicator of operating performance. Additionally, none of these measures purports to be an alternative to cash flows from operating activities as a measure of liquidity, as they do not consider certain cash requirements such as interest payments and tax payments. Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through - Adjusted EBITDA Margin (Adjusted EBITDA / Total Revenues) is a commonly used profitability ratio. REBITDA Margin (REBITDA / Equipment rental, service and other revenues) and REBITDA Flow- Through (the year-over-year change in REBITDA/the year-over-year change in Equipment rental, service, and other revenues) are useful operating profitability ratios to management and investors. EBITDA, Adjusted EBITDA, REBITDA, Adjusted EBITDA Margin, REBITDA Margin and REBITDA Flow-Through Excluding Studio Entertainment - On slides 28 through 31, each metric has been adjusted to exclude the studio entertainment business due to the impact of labor disruptions in the television and film industry and provides the operating performance of the remaining business.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 27 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through $ in millions Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Net income $91 $98 $347 $330 Income tax provision 32 35 100 104 Interest expense, net 62 41 224 122 Depreciation of rental equipment 163 147 643 536 Non-rental depreciation and amortization 29 26 112 95 EBITDA 377 347 1,426 1,187 Non-cash stock-based compensation charges 3 7 18 27 Transaction related costs 3 2 8 7 Other (1) 5 — 6 Adjusted EBITDA 382 361 1,452 1,227 Less: Gain (loss) on sales of rental equipment 17 17 94 36 Less: Gain (loss) on sales of new equipment, parts and supplies 3 4 13 15 Rental Adjusted EBITDA (REBITDA) $362 $340 $1,345 $1,176 Total revenues $831 $786 $3,282 $2,740 Less: Sales of rental equipment 68 57 346 125 Less: Sales of new equipment, parts and supplies 9 9 38 36 Equipment rental, service and other revenues $754 $720 $2,898 $2,579 Total revenues $831 $786 $3,282 $2,740 Adjusted EBITDA $382 $361 $1,452 $1,227 Adjusted EBITDA Margin 46.0 % 46.0 % 44.2 % 44.8 % Equipment rental, service and other revenues $754 $720 $2,898 $2,579 REBITDA $362 $340 $1,345 $1,176 REBITDA Margin 48.0 % 47.3 % 46.4 % 45.7 % YOY Change in REBITDA $22 $169 YOY Change in Equipment rental, service and other revenues $34 $319 YOY REBITDA Flow-Through 64.7 % 53.0 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 28 Q4 2023 and 2022 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment $ in millions Three Months Ended December 31, 2023 2022 Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $748 $10 $738 $713 $31 $682 Total revenues 831 11 820 786 33 753 Total expenses 708 14 694 653 33 620 Income (loss) before income taxes 123 (3) 126 133 — 133 Income tax (provision) benefit (32) 1 (33) (35) — (35) Net income $91 ($2) $93 $98 $— $98 Income tax provision (benefit) 32 (1) 33 35 — 35 Interest expense, net 62 — 62 41 — 41 Depreciation of rental equipment 163 — 163 147 8 139 Non-rental depreciation and amortization 29 — 29 26 — 26 EBITDA 377 (3) 380 347 8 339 Non-cash stock-based compensation charges 3 — 3 7 — 7 Transaction related costs 3 1 2 2 — 2 Other (1) (1) — 5 3 2 Adjusted EBITDA 382 (3) 385 361 11 350 Less: Gain (loss) on sales of rental equipment 17 (1) 18 17 — 17 Less: Gain (loss) on sales of new equipment, parts and supplies 3 — 3 4 1 3 Rental Adjusted EBITDA (REBITDA) $362 ($2) $364 $340 $10 $330 Total revenues $831 $11 $820 $786 $33 $753 Less: Sales of rental equipment 68 — 68 57 — 57 Less: Sales of new equipment, parts and supplies 9 1 8 9 1 8 Equipment rental, service and other revenues $754 $10 $744 $720 $32 $688 Total revenues $831 $11 $820 $786 $33 $753 Adjusted EBITDA $382 ($3) $385 $361 $11 $350 Adjusted EBITDA Margin 46.0 % (27.3) % 47.0 % 46.0 % 33.3 % 46.5 % Equipment rental, service and other revenues $754 $10 $744 $720 $32 $688 REBITDA $362 ($2) $364 $340 $10 $330 REBITDA Margin 48.0 % (20.0) % 48.9 % 47.3 % 31.3 % 48.0 % YOY Change in REBITDA $22 ($12) $34 $91 ($4) $95 YOY Change in Equipment rental, service and other revenues $34 ($22) $56 $172 ($1) $173 YOY REBITDA Flow-Through 64.7 % (54.5) % 60.7 % 53.9 % (400.0) % 54.9 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 29 Full Year 2023 and 2022 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment $ in millions Year Ended December 31, 20231 2022 Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $2,870 $50 $2,820 $2,552 $122 $2,430 Total revenues 3,282 56 3,226 2,740 130 2,610 Total expenses 2,835 93 2,742 2,306 114 2,192 Income (loss) before income taxes 447 (37) 484 434 16 418 Income tax (provision) benefit (100) 8 (108) (104) (5) (99) Net income $347 ($29) $376 $330 $11 $319 Income tax provision (benefit) 100 (8) 108 104 5 99 Interest expense, net 224 — 224 122 — 122 Depreciation of rental equipment 643 24 619 536 26 510 Non-rental depreciation and amortization 112 2 110 95 2 93 EBITDA 1,426 (11) 1,437 1,187 44 1,143 Non-cash stock-based compensation charges 18 — 18 27 — 27 Transaction related costs 8 2 6 7 — 7 Other — (1) 1 6 3 3 Adjusted EBITDA 1,452 (10) 1,462 1,227 47 1,180 Less: Gain (loss) on sales of rental equipment 94 (1) 95 36 — 36 Less: Gain (loss) on sales of new equipment, parts and supplies 13 1 12 15 2 13 Rental Adjusted EBITDA (REBITDA) $1,345 ($10) $1,355 $1,176 $45 $1,131 Total revenues $3,282 $56 $3,226 $2,740 $130 $2,610 Less: Sales of rental equipment 346 1 345 125 1 124 Less: Sales of new equipment, parts and supplies 38 2 36 36 5 31 Equipment rental, service and other revenues $2,898 $53 $2,845 $2,579 $124 $2,455 Total revenues $3,282 $56 $3,226 $2,740 $130 $2,610 Adjusted EBITDA $1,452 ($10) $1,462 $1,227 $47 $1,180 Adjusted EBITDA Margin 44.2 % (17.9) % 45.3 % 44.8 % 36.2 % 45.2 % Equipment rental, service and other revenues $2,898 $53 $2,845 $2,579 $124 $2,455 REBITDA $1,345 ($10) $1,355 $1,176 $45 $1,131 REBITDA Margin 46.4 % (18.9) % 47.6 % 45.7 % 36.3 % 46.1 % YOY Change in REBITDA $169 ($55) $224 $310 ($13) $323 YOY Change in Equipment rental, service and other revenues $319 ($71) $390 $650 ($6) $656 YOY REBITDA Flow-Through 53.0 % (77.5) % 57.4 % 48.1 % (216.7) % 49.2 % 1. Sum of the quarters on slides 30 and 31 may not equal the full year due to rounding.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 30 Q1 and Q2 2023 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment $ in millions Three Months Ended March 31, 2023 June 30, 2023 Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $654 $19 $635 $702 $16 $686 Total revenues 740 20 720 802 18 784 Total expenses 665 28 637 699 27 672 Income (loss) before income taxes 75 (8) 83 103 (9) 112 Income tax (provision) benefit (8) 2 (10) (27) 2 (29) Net income $67 ($5) $72 $76 ($7) $83 Income tax provision (benefit) 8 (2) 10 27 (2) 29 Interest expense, net 48 — 48 54 — 54 Depreciation of rental equipment 152 8 144 161 8 153 Non-rental depreciation and amortization 26 1 25 28 1 27 EBITDA 301 2 299 346 — 346 Non-cash stock-based compensation charges 4 — 4 5 — 5 Transaction related costs 2 — 2 1 — 1 Other 1 — 1 — — — Adjusted EBITDA 308 2 306 352 — 352 Less: Gain (loss) on sales of rental equipment 25 — 25 27 — 27 Less: Gain (loss) on sales of new equipment, parts and supplies 3 — 3 3 — 3 Rental Adjusted EBITDA (REBITDA) $280 $2 $278 $322 $— $322 Total revenues $740 $20 $720 $802 $18 $784 Less: Sales of rental equipment 71 — 71 83 — 83 Less: Sales of new equipment, parts and supplies 8 — 8 10 — 10 Equipment rental, service and other revenues $661 $20 $641 $709 $18 $691 Total revenues $740 $20 $720 $802 $18 $784 Adjusted EBITDA $308 $2 $306 $352 $— $352 Adjusted EBITDA Margin 41.6 % 10.0 % 42.5 % 43.9 % — % 44.9 % Equipment rental, service and other revenues $661 $20 $641 $709 $18 $691 REBITDA $280 $2 $278 $322 $— $322 REBITDA Margin 42.4 % 10.0 % 43.4 % 45.4 % — % 46.6 % YOY Change in REBITDA $55 ($8) $63 $47 ($12) $59 YOY Change in Equipment rental, service and other revenues $129 ($3) $132 $97 ($14) $111 YOY REBITDA Flow-Through 42.6 % (266.7) % 47.7 % 48.5 % (85.7) % 53.2 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 31 Q3 and Q4 2023 Reconciliation of Net Income to Adj. EBITDA and Adj. EBITDA Margin, Rental Adj. EBITDA (REBITDA), REBITDA Margin and Flow-Through, Excluding Studio Entertainment Three Months Ended September 30, 2023 December 31, 2023 Herc Studio Entertainment Herc, excl Studio Herc Studio Entertainment Herc, excl Studio Equipment rental revenue $765 $5 $760 $748 $10 $738 Total revenues 908 7 901 831 11 820 Total expenses 762 25 737 708 14 694 Income (loss) before income taxes 146 (18) 164 123 (3) 126 Income tax (provision) benefit (33) 3 (36) (32) 1 (33) Net income $113 ($15) $128 $91 ($2) $93 Income tax provision (benefit) 33 (3) 36 32 (1) 33 Interest expense, net 60 — 60 62 — 62 Depreciation of rental equipment 167 8 159 163 — 163 Non-rental depreciation and amortization 29 1 28 29 — 29 EBITDA 402 (9) 411 377 (3) 380 Non-cash stock-based compensation charges 6 — 6 3 — 3 Transaction related costs 2 — 2 3 1 2 Other — — — (1) (1) — Adjusted EBITDA 410 (9) 419 382 (3) 385 Less: Gain (loss) on sales of rental equipment 25 — 25 17 (1) 18 Less: Gain (loss) on sales of new equipment, parts and supplies 4 — 4 3 — 3 Rental Adjusted EBITDA (REBITDA) $381 ($9) $390 $362 ($2) $364 Total revenues $908 $7 $901 $831 $11 $820 Less: Sales of rental equipment 124 — 124 68 — 68 Less: Sales of new equipment, parts and supplies 11 — 11 9 1 8 Equipment rental, service and other revenues $773 $7 $766 $754 $10 $744 Total revenues $908 $7 $901 $831 $11 $820 Adjusted EBITDA $410 ($9) $419 $382 ($3) $385 Adjusted EBITDA Margin 45.2 % (128.6) % 46.5 % 46.0 % (27.3) % 47.0 % Equipment rental, service and other revenues $773 $7 $766 $754 $10 $744 REBITDA $381 ($9) $390 $362 ($2) $364 REBITDA Margin 49.3 % (112.5) % 50.9 % 48.0 % (20.0) % 48.9 % YOY Change in REBITDA $45 ($21) $66 $22 ($12) $34 YOY Change in Equipment rental, service and other revenues $59 ($32) $91 $34 ($22) $56 YOY REBITDA Flow-Through 76.3 % (67.7) % 72.5 % 64.7 % (54.5) % 60.7 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 32 REBITDA Margin Quarterly Trend $ in millions Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 20222 Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 20232 Total Revenues $568 $640 $745 $786 $2,740 $740 $802 $908 $831 $3,282 Less: Sales of rental equipment 28 19 21 57 125 71 83 124 68 346 Less: Sales of new equipment, parts and supplies 8 9 10 9 36 8 10 11 9 38 Equipment rental, service and other revenues $532 $612 $714 $720 $2,579 $661 $709 773 $754 $2,898 Net income $58 $73 $101 $98 $330 $67 $76 $113 $91 $347 Income tax provision 9 25 34 35 104 8 27 33 32 100 Interest expense, net 23 25 33 41 122 48 54 60 62 224 Depreciation of rental equipment 119 130 140 147 536 152 161 167 163 643 Non-rental depreciation and amortization 21 23 25 26 95 26 28 29 29 112 EBITDA $230 $276 $333 $347 $1,187 $301 $346 $402 $377 $1,426 Non-cash stock-based compensation charges 6 5 9 7 27 4 5 6 3 18 Transaction related costs 1 2 3 2 7 2 1 2 3 8 Other(1) — 1 — 5 6 1 — — (1) — Adjusted EBITDA $237 $284 $345 $361 $1,227 $308 $352 $410 $382 $1,452 Less: Gain on sales of rental equipment 9 5 5 17 36 25 27 25 17 94 Less: Gain on sales of new equipment, parts and supplies 3 4 4 4 15 3 3 4 3 13 Rental Adjusted EBITDA (REBITDA) $225 $275 $336 $340 $1,176 $280 $322 $381 $362 $1,345 REBITDA Margin 42.3 % 45.0 % 47.1 % 47.3 % 45.7 % 42.4 % 45.4 % 49.3 % 48.0 % 46.4 % YOY REBITDA Flow-Through 37.6 % 47.7 % 50.5 % 53.9 % 48.1 % 42.6 % 48.5 % 76.3 % 64.7 % 53.0 % 1. Pension settlement, impairment, and spin-off costs are included in Other. 2. The sum of the quarters may not equal the full year due to rounding.

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 33 REBITDA Margin Annual Trend $ in millions 2018 2019 2020 2021 2022 2023 Total Revenues $1,978 $1,999 $1,780 $2,073 $2,740 $3,282 Less: Sales of rental equipment 256 243 198 113 125 346 Less: Sales of new equipment, parts and supplies 49 44 28 31 36 38 Equipment rental, service and other revenues $1,673 $1,712 $1,554 $1,929 $2,579 $2,898 Net income $69 $47 $74 $224 $330 $347 Income tax provision (benefit) — 16 20 67 104 100 Interest expense, net 137 174 93 86 122 224 Depreciation of rental equipment 387 410 403 420 536 643 Non-rental depreciation and amortization 58 62 63 68 95 112 EBITDA $651 $709 $653 $865 $1,187 $1,426 Restructuring 5 8 1 — — — Spin-off costs 15 — — — — — Non-cash stock-based compensation charges 14 19 16 23 27 18 Impairment — 4 15 3 3 — Transaction related costs — — — 4 7 8 Loss on disposal of business — — 3 — — — Other 1 1 1 — 3 — Adjusted EBITDA $686 $741 $689 $895 $1,227 $1,452 Less: Gain (loss) on sales of rental equipment 12 (1) (5) 19 36 94 Less: Gain on sales of new equipment, parts and supplies 11 11 8 10 15 13 Rental Adjusted EBITDA (REBITDA) $663 $731 $686 $866 $1,176 $1,345 REBITDA Margin 39.6 % 42.7 % 44.2 % 44.8 % 45.7 % 46.4 % YOY REBITDA Flow-Through 54.8 % 169.3 % 27.9 % 47.5 % 48.1 % 53.0 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 34 Reconciliation of Net Income and Adjusted Earnings Per Diluted Share Adjusted Net Income and Adjusted Earnings Per Diluted Share - Adjusted Net Income represents the sum of net income, transaction related costs, restructuring and restructuring related charges, spin-off costs, loss on extinguishment of debt, impairment charges, gain (loss) on the disposal of a business and certain other items. Adjusted Earnings per Diluted Share represents Adjusted Net Income divided by diluted shares outstanding. Adjusted Net Income and Adjusted Earnings Per Diluted Share are important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. (1) The tax rate applied for adjustments is 25.5% in the three months and year ended December 31, 2023 and 25.7% in the three months and year ended December 31, 2022 and reflects the statutory rates in the applicable entities. Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Net income $91 $98 $347 $330 Transaction related costs 3 2 8 7 Other (1) 5 — 6 Tax impact of adjustments(1) (1) (2) (2) (3) Adjusted net income $92 $103 $353 $340 Diluted common shares 28.4 29.9 28.7 30.2 Adjusted earnings per diluted share $3.24 $3.44 $12.30 $11.26

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 35 Calculation of Net Leverage Ratio Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve-month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies. $ in millions Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Long-Term Debt, Net $2,142 $2,503 $2,762 $2,922 $3,215 $3,493 $3,665 $3,673 (Plus) Current maturities of long-term debt 11 11 11 12 12 12 14 15 (Plus) Unamortized debt issuance costs 6 6 5 5 5 5 5 5 (Less) Cash and Cash Equivalents (23) (52) (57) (54) (40) (37) (71) (71) Net Debt $2,136 $2,468 $2,721 $2,885 $3,192 $3,473 $3,613 $3,622 Trailing Twelve-Month Adjusted EBITDA $947 $1,024 $1,123 $1,227 $1,298 $1,366 $1,431 $1,452 Net Leverage 2.3x 2.4x 2.4x 2.4x 2.5x 2.5x 2.5x 2.5x

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 36 Reconciliation of Free Cash Flow Free cash flow is not a recognized term under GAAP and should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP. Further, since all companies do not use identical calculations, our definition and presentation of this measure may not be comparable to similarly titled measures reported by other companies. Free cash flow represents net cash provided by (used in) operating activities less rental equipment expenditures and non-rental capital expenditures, plus proceeds from disposal of rental equipment, proceeds from disposal of property and equipment, and other investing activities. Free cash flow is used by management in analyzing the Company’s ability to service and repay its debt, fund potential acquisitions and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service debt or for other non-discretionary expenditures. $ in millions Year Ended December 31, 2023 2022 2021 2020 2019 Net cash provided by operating activities $1,086 $917 $743 $611 $636 Rental equipment expenditures (1,320) (1,168) (594) (345) (640) Proceeds from disposal of rental equipment 325 121 107 192 224 Net Fleet Capital Expenditures (995) (1,047) (487) (153) (416) Non-rental capital expenditures (156) (104) (47) (41) (56) Proceeds from disposal of property and equipment 15 7 5 7 8 Other (15) (23) — — 4 Free Cash Flow (65) (250) 214 424 176 Acquisitions, net of cash acquired (430) (515) (431) (45) (4) Proceeds from disposal of business — — — 24 — (Increase) decrease in Net Debt, excluding financing activities ($495) ($765) ($217) $403 $172

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 37 Historical Fleet at OEC1 1. Original equipment cost based on ARA guidelines $ in millions FY 2018 FY 2019 FY 2020 FY 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 Beginning Balance $3,651 $3,777 $3,822 $3,589 $4,381 $4,593 $5,097 $5,421 $4,381 $5,637 $5,915 $6,211 $6,217 $5,637 Expenditures $774 $627 $348 $725 $253 $327 $311 $327 $1,218 $348 $400 $274 $196 $1,218 Disposals ($607) ($593) ($552) ($281) ($64) ($64) ($54) ($140) ($322) ($144) ($186) ($309) ($174) ($813) Acquisitions $— $— $28 $346 $18 $251 $86 $40 $395 $77 $88 $55 $83 $303 Foreign Currency / Other ($41) $11 ($57) $2 $5 ($10) ($19) ($11) ($35) ($3) ($6) ($14) $6 ($17) Ending Balance $3,777 $3,822 $3,589 $4,381 $4,593 $5,097 $5,421 $5,637 $5,637 $5,915 $6,211 $6,217 $6,328 $6,328 Proceeds as a percent of OEC 37.8 % 40.9 % 37.0 % 41.8 % 45.0 % 46.6 % 42.5 % 44.2 % 44.4 % 51.5 % 47.0 % 39.4 % 44.3 % 44.2 %

NYSE: HRI ©2024 Herc Rentals Inc. All Rights Reserved. 38 For additional information, please contact: Leslie Hunziker SVP Investor Relations leslie.hunziker@hercrentals.com 239-301-1675

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |