Key Announcements

- In December 2023, Howmet Aerospace drew approximately $400

million from its two term loan facilities. $200 million was drawn

from a U.S. dollar-denominated term loan facility (the “USD Term

Loan Facility”) and approximately $200 million was drawn from a

Japanese yen-denominated term loan facility (the “JPY Term Loan

Facility”).

- The Company entered into interest rate swaps to exchange the

floating interest rates of the term loan facilities into fixed

interest rates. The weighted average fixed interest rate is

approximately 3.9%.

- On December 28, 2023, the Company completed an early partial

redemption of its 5.125% Notes due October 2024 (the “2024 Notes”)

in the aggregate principal amount of $500 million for approximately

$506 million, including approximately $6 million of accrued

interest. Following this redemption, the aggregate outstanding

principal amount of the 2024 Notes is approximately $205

million.

- The combined impact of the term loans and the early partial

redemption of the 2024 Notes is expected to reduce annualized

interest expense by approximately $10 million.

- On December 15, 2023, S&P Global Ratings (“S&P”)

upgraded Howmet Aerospace’s Long-Term Issue Credit Rating to “BBB-”

from “BB+” and updated the rating outlook to stable. With this

upgrade, Howmet Aerospace is now rated as investment grade by two

of the three credit rating agencies.

Howmet Aerospace (NYSE: HWM) today reported the completion of

debt actions in the fourth quarter 2023.

As previously disclosed, on November 22, 2023, the Company

entered into two senior unsecured term loan agreements. One term

loan facility is U.S. dollar denominated. The second term loan

facility is Japanese yen denominated, and Howmet Aerospace’s

operations in Japan provide a natural foreign currency hedge

against the term loan facility. In December 2023, the Company drew

$200 million from the USD Term Loan Facility and approximately $200

million from the JPY Term Loan Facility. The term loans are

prepayable without penalties or premiums and mature in November

2026.

In December 2023, the Company also entered into interest rate

swaps to exchange the floating interest rates of the approximately

$400 million in term loans into fixed interest rates. With the

benefit of the Company’s credit rating upgrade by S&P, the

Company obtained a weighted average fixed interest rate of

approximately 3.9%. All of Howmet Aerospace’s outstanding long-term

debt continues to be unsecured and at fixed interest rates, which

will provide stability of interest expense into the future.

On December 28, 2023, the Company completed an early partial

redemption of its 2024 Notes in the aggregate principal amount of

$500 million. The 2024 Notes were redeemed with approximately $106

million of cash on hand and approximately $400 million from the

term loans at an aggregate redemption price of approximately $506

million, including accrued interest of approximately $6 million.

Following this redemption, the aggregate outstanding principal

amount of the 2024 Notes, which were inherited from Alcoa Inc. at

an original outstanding principal balance of $1.25 billion, is

approximately $205 million.

The combined impact of the term loans and the early partial

redemption of the 2024 Notes is expected to reduce annualized

interest expense by approximately $10 million.

S&P Rating Upgrade and Update Outlook to Stable

On December 15, 2023, S&P upgraded the Company’s Long-Term

Issue Credit Rating to “BBB-” from “BB+” and updated the rating

outlook to stable. With this upgrade, Howmet Aerospace is now rated

as investment grade by two of the three credit rating agencies,

reflecting the Company’s improved financial leverage and strong

cash generation.

About Howmet Aerospace

Howmet Aerospace Inc., headquartered in Pittsburgh,

Pennsylvania, is a leading global provider of advanced engineered

solutions for the aerospace and transportation industries. The

Company’s primary businesses focus on jet engine components,

aerospace fastening systems, and airframe structural components

necessary for mission-critical performance and efficiency in

aerospace and defense applications, as well as forged aluminum

wheels for commercial transportation. With nearly 1,150 granted and

pending patents, the Company’s differentiated technologies enable

lighter, more fuel-efficient aircraft and commercial trucks to

operate with a lower carbon footprint. For more information, visit

www.howmet.com.

Dissemination of Company Information

Howmet Aerospace intends to make future announcements regarding

Company developments and financial performance through its website

at www.howmet.com.

Forward-Looking Statements

This release contains statements that relate to future events

and expectations and as such constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include those containing such

words as "anticipates," "believes," "could," “envisions,”

"estimates," "expects," "forecasts," "goal," "guidance," "intends,"

"may," "outlook," "plans," "projects," "seeks," "sees," "should,"

"targets," "will," "would," or other words of similar meaning. All

statements that reflect Howmet Aerospace’s expectations,

assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including,

without limitation, statements relating to any future debt actions.

These statements reflect beliefs and assumptions that are based on

Howmet Aerospace’s perception of historical trends, current

conditions and expected future developments, as well as other

factors Howmet Aerospace believes are appropriate in the

circumstances. Forward-looking statements are not guarantees of

future performance and are subject to risks, uncertainties and

changes in circumstances that are difficult to predict, which could

cause actual results to differ materially from those indicated by

these statements. Such risks and uncertainties include, but are not

limited to: (a) deterioration in global economic and financial

market conditions generally; (b) unfavorable changes in the markets

served by Howmet Aerospace; (c) the impact of potential cyber

attacks and information technology or data security breaches; (d)

the loss of significant customers or adverse changes in customers’

business or financial conditions; (e) manufacturing difficulties or

other issues that impact product performance, quality or safety;

(f) inability of suppliers to meet obligations due to supply chain

disruptions or otherwise; (g) failure to attract and retain a

qualified workforce and key personnel; (h) the inability to achieve

revenue growth, cash generation, restructuring plans, cost

reductions, improvement in profitability, or strengthening of

competitiveness and operations anticipated or targeted; (i)

inability to meet increased demand, production targets or

commitments; (j) competition from new product offerings, disruptive

technologies or other developments; (k) geopolitical, economic, and

regulatory risks relating to Howmet Aerospace’s global operations,

including geopolitical and diplomatic tensions, instabilities,

conflicts and wars, as well as compliance with U.S. and foreign

trade and tax laws, sanctions, embargoes and other regulations; (l)

the outcome of contingencies, including legal proceedings,

government or regulatory investigations, and environmental

remediation; (m) failure to comply with government contracting

regulations; (n) adverse changes in discount rates or investment

returns on pension assets; and (o) the other risk factors

summarized in Howmet Aerospace’s Form 10-K for the year ended

December 31, 2022 and other reports filed with the U.S. Securities

and Exchange Commission. The statements in this release are made as

of the date of this release, even if subsequently made available by

Howmet Aerospace on its website or otherwise. Howmet Aerospace

disclaims any intention or obligation to update publicly any

forward-looking statements, whether in response to new information,

future events, or otherwise, except as required by applicable

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231228357106/en/

Investor Contact Paul T. Luther (412) 553-1950

Paul.Luther@howmet.com

Media Contact Rob Morrison (412) 553-2666

Rob.Morrison@howmet.com

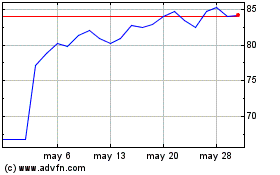

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025