false

0000004281

0000004281

2024-07-30

2024-07-30

0000004281

us-gaap:CommonStockMember

2024-07-30

2024-07-30

0000004281

us-gaap:CumulativePreferredStockMember

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 30, 2024 (July 30, 2024)

HOWMET AEROSPACE INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

1-3610 |

25-0317820 |

| (State of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| 201 Isabella Street, Suite 200 |

|

| Pittsburgh, Pennsylvania |

15212-5872 |

| (Address of Principal

Executive Offices) |

(Zip Code) |

Office of Investor

Relations (412) 553-1950

Office of the

Secretary (412) 553-1940

(Registrant’s telephone numbers, including

area code)

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common Stock, par value $1.00 per share |

HWM |

New York Stock Exchange |

| $3.75 Cumulative Preferred Stock, par value $100 per share |

HWM PR |

NYSE American |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On July 30, 2024, Howmet Aerospace Inc. issued

a press release announcing its financial results for the second quarter of 2024. A copy of the press release is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

In accordance with General

Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed

to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other

document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HOWMET AEROSPACE INC. |

| |

|

| Dated: July 30, 2024 |

By: |

/s/ Lola F. Lin |

| |

Name: |

Lola F. Lin |

| |

Title: |

Executive Vice President, Chief Legal and Compliance Officer and Secretary |

Exhibit 99.1

FOR IMMEDIATE RELEASE

| Investor Contact |

Media Contact |

| Paul T. Luther |

Rob Morrison |

| (412) 553-1950 |

(412) 553-2666 |

| Paul.Luther@howmet.com |

Rob.Morrison@howmet.com |

Howmet Aerospace Reports Second Quarter 2024

Results

Record Quarterly Revenue, Up 14% Year Over Year;

Record Operating Income, Strong Cash Generation

Common Stock Repurchase Authorization Increased

by $2 Billion to $2.487 Billion

Third Quarter 2024 Common Stock Dividend 60%

Higher; 2025 Dividend Policy Payout Ratio 15% +/- 5%1

Full Year 2024 Guidance Raised for All Metrics

Above Second Quarter 2024 Beat

Second Quarter 2024 GAAP Financial Results

| | · | Revenue

of $1.88 billion, up 14% year over year, driven by commercial aerospace, up 27% |

| | · | Net income of $266 million versus $193 million in the second quarter 2023;

earnings per share of $0.65 versus $0.46 in the second quarter 2023 |

| | · | Operating income margin of 21.2% |

| | · | Generated $397 million of cash from operations; $123 million of cash used

for financing activities; and $54 million of cash used for investing activities |

| | · | Share repurchases of $60 million; $0.05 per share dividend on common stock |

Second Quarter 2024 Adjusted Financial Results

| | · | Adjusted

EBITDA excluding special items of $483 million, up 31% year over year |

| | · | Adjusted EBITDA margin excluding special items of 25.7% |

| | · | Adjusted operating income margin excluding special items of 22.0% |

| | · | Adjusted earnings per share excluding special items of $0.67, up 52% year

over year |

| | · | Generated $342 million of free cash flow |

2024 Guidance

| |

Q3 2024 Guidance |

|

FY 2024 Guidance |

| |

Low |

Baseline |

High |

|

Low |

Baseline |

High |

| Revenue |

$1.845B |

$1.855B |

$1.865B |

|

$7.400B |

$7.440B |

$7.480B |

| Adj. EBITDA*2 |

$460M |

$465M |

$470M |

|

$1.855B |

$1.865B |

$1.875B |

| Adj. EBITDA Margin*2 |

24.9% |

25.1% |

25.2% |

|

25.1% |

25.1% |

25.1% |

| Adj. Earnings per Share*2 |

$0.63 |

$0.64 |

$0.65 |

|

$2.53 |

$2.55 |

$2.57 |

| Free Cash Flow2 |

|

|

|

|

$840M |

$870M |

$900M |

1 Payout ratio of net income excluding special items

* Excluding special items

2 Reconciliations of the forward-looking non-GAAP measures

to the most directly comparable GAAP measures, as well as the directly comparable GAAP measures, are not available without unreasonable

efforts due to the variability and complexity of the charges and other components excluded from the non-GAAP measures – for further

detail, see “2024 Guidance” below.

Key Announcements

| · | On

July 1, 2024, Howmet Aerospace completed the early redemption of all the remaining outstanding aggregate principal amount of $205 million

of its 5.125% Notes due October 2024 with cash on hand at par value plus accrued interest at an aggregate redemption price of approximately

$208 million. In the second quarter 2024, the Company repurchased approximately $23 million aggregate principal amount of its 6.875%

Notes due May 2025 with cash on hand. These combined actions will reduce annualized interest expense by approximately $12 million. |

| · | In the second quarter 2024, the Company repurchased $60 million of common

stock at an average price of $81.66 per share, retiring approximately 0.73 million shares. |

| · | On

July 30, 2024, the Board of Directors of Howmet Aerospace (the “Board of Directors”) authorized an increase in the Company’s

share repurchase program by $2 billion to $2.487 billion of its outstanding common stock. |

| · | On

July 30, 2024, the Board of Directors declared a dividend of $0.08 per share on its common stock to be paid on August 26, 2024 to holders

of record as of the close of business on August 9, 2024. The quarterly dividend represents a 60% increase from the second quarter 2024

dividend of $0.05 per share. |

| · | On

July 30, 2024, the Board of Directors approved the establishment of a 2025 dividend policy on common stock at 15% plus or minus 5% of

net income excluding special items. |

PITTSBURGH, PA, July 30, 2024 – Howmet Aerospace (NYSE:

HWM) today reported second quarter 2024 results. The Company reported record second quarter 2024 revenue of $1.88 billion, up 14% year

over year, primarily driven by growth in the commercial aerospace market of 27%.

Howmet Aerospace reported net income of $266 million, or $0.65 per

share, in the second quarter 2024 versus $193 million, or $0.46 per share, in the second quarter 2023. Net income included approximately

$10 million in net charges from special items in the second quarter 2024. Second quarter 2024 operating income was $398 million, up 40%

year over year. Operating income margin was 21.2%, up approximately 390 basis points year over year.

Howmet Aerospace reported net income excluding special items of $276

million, or $0.67 per share, in the second quarter 2024 versus $181 million, or $0.44 per share, in the second quarter 2023. Adjusted

EBITDA excluding special items was $483 million, up 31% year over year. The year-over-year increase was driven by strong growth in the

commercial aerospace market. Adjusted EBITDA margin excluding special items was up approximately 340 basis points year over year at 25.7%.

Second quarter 2024 adjusted operating income excluding special items was $414 million, up 38% year over year. Adjusted operating income

margin excluding special items was 22.0%, up approximately 370 basis points year over year.

Howmet Aerospace Executive Chairman and Chief Executive Officer John

Plant said, “In the second quarter 2024, the Howmet Aerospace team drove another very strong set of results, again exceeding the

high end of guidance on all fronts. Revenue grew a healthy 14% year over year, with commercial aerospace revenue up 27%, continuing a

strong trend. For the second consecutive quarter, Howmet achieved record quarterly results in revenue, adjusted EBITDA*, adjusted EBITDA

margin* and adjusted earnings per share*. Adjusted EBITDA margin* of 25.7% was up approximately 340 basis points year over year, and adjusted

earnings per share* grew 52%.”

* Excluding special items

Mr. Plant continued, “The outlook for commercial aerospace continues

to be robust, with strong travel demand and an aging aircraft fleet, leading to an extremely high backlog at the aircraft OEMs. The issue

faced by Howmet Aerospace continues to be the aircraft manufacturers’ ability to build and deliver aircraft on a consistent basis.

We continue to take these factors into account in our guidance. Despite these challenges, we are again raising full year 2024 guidance

above the second quarter 2024 beat, reflecting strong continued performance at Howmet Aerospace.”

“Howmet Aerospace generated very healthy free cash flow of $342

million in the second quarter 2024 and $437 million in the first half 2024, which enabled the Company to redeem the remaining $205 million

of our notes due in October 2024 and $23 million of our notes due in May 2025, and repurchase $210 million of common stock year to date.

We are pleased that the Board of Directors approved a 60% increase in the common stock dividend to $0.08 per share for the third quarter

2024. Moreover, the Board of Directors approved the establishment of a 2025 dividend policy on common stock of 15% plus or minus 5% of

net income excluding special items. Finally, the Board of Directors authorized an increase in the share repurchase program by $2 billion

to $2.487 billion, reflecting the Company’s strong free cash flow outlook.”

Second Quarter 2024 Segment Performance

Engine Products

| (in U.S. dollar millions) | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | | |

Q1 2024 | | |

Q2 2024 | |

| Third-party sales | |

$ | 821 | | |

$ | 798 | | |

$ | 852 | | |

$ | 885 | | |

$ | 933 | |

| Inter-segment sales | |

$ | 5 | | |

$ | 5 | | |

$ | 1 | | |

$ | 2 | | |

$ | 1 | |

| Provision for depreciation and amortization | |

$ | 32 | | |

$ | 33 | | |

$ | 33 | | |

$ | 33 | | |

$ | 33 | |

| Segment Adjusted EBITDA | |

$ | 223 | | |

$ | 219 | | |

$ | 233 | | |

$ | 249 | | |

$ | 292 | |

| Segment Adjusted EBITDA Margin | |

| 27.2 | % | |

| 27.4 | % | |

| 27.3 | % | |

| 28.1 | % | |

| 31.3 | % |

| Restructuring and other credits | |

$ | (1 | ) | |

$ | — | | |

$ | (1 | ) | |

$ | — | | |

$ | (1 | ) |

| Capital expenditures | |

$ | 21 | | |

$ | 30 | | |

$ | 28 | | |

$ | 55 | | |

$ | 33 | |

Engine Products reported revenue of $933 million, an increase of 14%

year over year, due to growth in the commercial aerospace, defense aerospace, oil & gas, and industrial gas turbine markets. Segment

Adjusted EBITDA was a record $292 million, up 31% year over year, driven by growth in the commercial aerospace, defense aerospace, oil

& gas, and industrial gas turbine markets. The Segment absorbed approximately 315 net headcount in the quarter and 750 in the first

half 2024 in support of expected revenue increases. Segment Adjusted EBITDA margin increased approximately 410 basis points year over

year to a record 31.3%.

Fastening Systems

| (in U.S. dollar millions) | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | | |

Q1 2024 | | |

Q2 2024 | |

| Third-party sales | |

$ | 329 | | |

$ | 348 | | |

$ | 360 | | |

$ | 389 | | |

$ | 394 | |

| Provision for depreciation and amortization | |

$ | 12 | | |

$ | 12 | | |

$ | 11 | | |

$ | 11 | | |

$ | 13 | |

| Segment Adjusted EBITDA | |

$ | 64 | | |

$ | 76 | | |

$ | 80 | | |

$ | 92 | | |

$ | 101 | |

| Segment Adjusted EBITDA Margin | |

| 19.5 | % | |

| 21.8 | % | |

| 22.2 | % | |

| 23.7 | % | |

| 25.6 | % |

| Restructuring and other charges | |

$ | — | | |

$ | 1 | | |

$ | — | | |

$ | — | | |

$ | 2 | |

| Capital expenditures | |

$ | 5 | | |

$ | 9 | | |

$ | 8 | | |

$ | 7 | | |

$ | 5 | |

Fastening Systems reported revenue of $394 million, an increase of

20% year over year due to growth in the commercial aerospace market, including wide body aircraft recovery. Segment Adjusted EBITDA was

$101 million, up 58% year over year, driven by growth in the commercial aerospace market as well as labor productivity gains. Segment

Adjusted EBITDA margin increased approximately 610 basis points year over year to 25.6%.

Engineered Structures

| (in U.S. dollar millions) | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | | |

Q1 2024 | | |

Q2 2024 | |

| Third-party sales | |

$ | 200 | | |

$ | 227 | | |

$ | 244 | | |

$ | 262 | | |

$ | 275 | |

| Inter-segment sales | |

$ | 1 | | |

$ | — | | |

$ | 2 | | |

$ | 1 | | |

$ | 3 | |

| Provision for depreciation and amortization | |

$ | 12 | | |

$ | 12 | | |

$ | 11 | | |

$ | 11 | | |

$ | 11 | |

| Segment Adjusted EBITDA | |

$ | 20 | | |

$ | 30 | | |

$ | 33 | | |

$ | 37 | | |

$ | 40 | |

| Segment Adjusted EBITDA Margin | |

| 10.0 | % | |

| 13.2 | % | |

| 13.5 | % | |

| 14.1 | % | |

| 14.5 | % |

| Restructuring and other charges | |

$ | 5 | | |

$ | 1 | | |

$ | 14 | | |

$ | — | | |

$ | 14 | |

| Capital expenditures | |

$ | 5 | | |

$ | 6 | | |

$ | 5 | | |

$ | 6 | | |

$ | 5 | |

Engineered Structures reported revenue of $275 million, an increase

of 38% year over year due to growth in the commercial aerospace market, including wide body aircraft recovery, and the defense aerospace

market. Segment Adjusted EBITDA was $40 million, up 100% year over year, driven by growth in the commercial aerospace and defense aerospace

markets. Segment Adjusted EBITDA margin increased approximately 450 basis points year over year to 14.5%.

Forged Wheels

| (in U.S. dollar millions) | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | | |

Q1 2024 | | |

Q2 2024 | |

| Third-party sales | |

$ | 298 | | |

$ | 285 | | |

$ | 275 | | |

$ | 288 | | |

$ | 278 | |

| Provision for depreciation and amortization | |

$ | 10 | | |

$ | 10 | | |

$ | 10 | | |

$ | 10 | | |

$ | 10 | |

| Segment Adjusted EBITDA | |

$ | 81 | | |

$ | 77 | | |

$ | 72 | | |

$ | 82 | | |

$ | 75 | |

| Segment Adjusted EBITDA Margin | |

| 27.2 | % | |

| 27.0 | % | |

| 26.2 | % | |

| 28.5 | % | |

| 27.0 | % |

| Capital expenditures | |

$ | 7 | | |

$ | 9 | | |

$ | 11 | | |

$ | 12 | | |

$ | 9 | |

Forged Wheels reported revenue of $278 million, a decrease of 7% year

over year due to 4% lower volumes in the commercial transportation market as well as a decrease in aluminum and other inflationary cost

pass through. Segment Adjusted EBITDA was $75 million, a decrease of approximately 7% year over year. Segment Adjusted EBITDA margin decreased

approximately 20 basis points year over year to 27.0%.

Redeemed $205 Million of Debt in July 2024

On July 1, 2024, Howmet Aerospace completed the early redemption of

all the remaining outstanding principal amount of $205 million of its 5.125% Notes due October 2024 (the “2024 Notes”) at

par value plus accrued interest. The 2024 Notes were redeemed with cash on hand at an aggregate redemption price of approximately $208

million, including accrued interest of approximately $3 million. In the second quarter 2024, the Company repurchased approximately $23

million aggregate principal amount of its 6.875% Notes due May 2025 with cash on hand. These combined actions will reduce annualized interest

expense by approximately $12 million. All of the Company’s outstanding debt is unsecured and at fixed interest rates.

Repurchased $60 Million of Common Stock in Second Quarter 2024

In the second quarter 2024, Howmet Aerospace repurchased $60 million

of common stock at an average price of $81.66 per share, retiring approximately 0.73 million shares. Through the first half 2024, the

Company repurchased $210 million of common stock at an average price of $70.52 per share, retiring approximately 3.0 million shares.

Board of Directors Approved Share Repurchase Program Authorization

Increase to $2.487 Billion

On July 30, 2024, the Board of Directors authorized an increase in

the Company’s share repurchase program by $2 billion, which, together with the remaining authorization of $487 million, results

in authorization to repurchase up to $2.487 billion of the Company’s outstanding common stock. There is no stated expiration, and

the Company is not obligated to repurchase any specific number of shares.

Quarterly Common Stock Dividend Increased 60% to $0.08 Per Share

in Third Quarter 2024

On July 30, 2024, the Board of Directors declared a dividend of $0.08

per share on its common stock to be paid on August 26, 2024 to holders of record as of the close of business on August 9, 2024. The quarterly

dividend represents a 60% increase from the second quarter 2024 dividend of $0.05 per share.

Board of Directors Approved a 2025 Dividend Policy with a Payout

Ratio of 15% +/- 5%

On July 30, 2024, the Board of Directors approved the establishment

of a 2025 dividend policy that would pay dividends on the Company’s common stock in 2025 at a rate of 15% plus or minus 5% of net

income excluding special items, subject to Board approval of the declaration of any future dividends.

2024 Guidance

| |

Q3 2024 Guidance |

|

FY 2024 Guidance |

| |

Low |

Baseline |

High |

|

Low |

Baseline |

High |

| Revenue |

$1.845B |

$1.855B |

$1.865B |

|

$7.400B |

$7.440B |

$7.480B |

| Adj. EBITDA*1 |

$460M |

$465M |

$470M |

|

$1.855B |

$1.865B |

$1.875B |

| Adj. EBITDA Margin*1 |

24.9% |

25.1% |

25.2% |

|

25.1% |

25.1% |

25.1% |

| Adj. Earnings per Share*1 |

$0.63 |

$0.64 |

$0.65 |

|

$2.53 |

$2.55 |

$2.57 |

| Free Cash Flow1 |

|

|

|

|

$840M |

$870M |

$900M |

* Excluding Special Items

1 Reconciliations of the forward-looking non-GAAP financial

measures to the most directly comparable GAAP financial measures, as well as the directly comparable GAAP measures, are not available

without unreasonable efforts due to the variability and complexity of the charges and other components excluded from the non-GAAP measures,

such as the effects of foreign currency movements, gains or losses on sales of assets, taxes, and any future restructuring or impairment

charges. In addition, there is inherent variability already included in the GAAP measures, including, but not limited to, price/mix and

volume. Howmet Aerospace believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Howmet Aerospace will hold its quarterly conference call at 10:00

AM Eastern Time on Tuesday, July 30, 2024. The call will be webcast via www.howmet.com. The press release and presentation materials will

be available at approximately 7:00 AM ET on July 30, via the “Investors” section of the Howmet Aerospace website.

About Howmet Aerospace

Howmet Aerospace Inc., headquartered

in Pittsburgh, Pennsylvania, is a leading global provider of advanced engineered solutions for the aerospace and transportation industries.

The Company’s primary businesses focus on jet engine components, aerospace fastening systems, and airframe structural components

necessary for mission-critical performance and efficiency in aerospace and defense applications, as well as forged aluminum wheels for

commercial transportation. With approximately 1,150 granted and pending patents, the Company’s differentiated technologies enable

lighter, more fuel-efficient aircraft and commercial trucks to operate with a lower carbon footprint. For more information, visit www.howmet.com.

Dissemination of Company Information

Howmet Aerospace intends to make future announcements regarding Company

developments and financial performance through its website at www.howmet.com.

Forward-Looking Statements

This release contains statements that relate to future events and

expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include those containing such words as "anticipates", "believes",

"could", “envisions”, "estimates", "expects", "forecasts", "goal",

"guidance", "intends", "may", "outlook", "plans", "projects",

"seeks", "sees", "should", "targets", "will", "would", or other words of

similar meaning. All statements that reflect Howmet Aerospace’s expectations, assumptions or projections about the future,

other than statements of historical fact, are forward-looking statements, including, without limitation, statements, forecasts and

outlook relating to the condition of end markets; future financial results or operating performance; future strategic actions;

Howmet Aerospace's strategies, outlook, and business and financial prospects; and any future dividends, debt issuances, debt

reduction and repurchases of its common stock. These statements reflect beliefs and assumptions that are based on Howmet

Aerospace’s perception of historical trends, current conditions and expected future developments, as well as other factors

Howmet Aerospace believes are appropriate in the circumstances. Forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, which could cause actual results

to differ materially from those indicated by these statements. Such risks and uncertainties include, but are not limited to: (a)

deterioration in global economic and financial market conditions generally; (b) unfavorable changes in the markets served by Howmet

Aerospace; (c) the impact of potential cyber attacks and information technology or data security breaches; (d) the loss of

significant customers or adverse changes in customers’ business or financial conditions; (e) manufacturing difficulties or

other issues that impact product performance, quality or safety; (f) inability of suppliers to meet obligations due to supply chain

disruptions or otherwise; (g) failure to attract and retain a qualified workforce and key personnel, labor disputes or other

employee relations issues; (h) the inability to achieve revenue growth, cash generation, restructuring plans, cost reductions,

improvement in profitability, or strengthening of competitiveness and operations anticipated or targeted; (I) inability to meet

increased demand, production targets or commitments; (j) competition from new product offerings, disruptive technologies or other

developments; (k) geopolitical, economic, and regulatory risks relating to Howmet Aerospace’s global operations, including

geopolitical and diplomatic tensions, instabilities, conflicts and wars, as well as compliance with U.S. and foreign trade and tax

laws, sanctions, embargoes and other regulations; (l) the outcome of contingencies, including legal proceedings, government or

regulatory investigations, and environmental remediation, which can expose Howmet Aerospace to substantial costs and liabilities;

(m) failure to comply with government contracting regulations; (n) adverse changes in discount rates or investment returns on

pension assets; and (o) the other risk factors summarized in Howmet Aerospace’s Form 10-K for the year ended December 31, 2023

and other reports filed with the U.S. Securities and Exchange Commission. Market projections are subject to the risks discussed

above and other risks in the market. Under its share

repurchase program, the Company may repurchase shares from time to time, in amounts, at prices, and at such times as the Company

deems appropriate, subject to market conditions, legal requirements and other considerations. The Company is not obligated to

repurchase any specific number of shares or to do so at any particular time. The declaration of any future dividends is subject to

the discretion and approval of the Board of Directors after the Board’s consideration of all factors it deems relevant and

subject to applicable law. The Company may modify, suspend, or cancel its share repurchase program or its dividend policy in any

manner and at any time that it may deem necessary or appropriate. Credit ratings are not a recommendation to buy or hold any Howmet

Aerospace securities, and they may be revised or revoked at any time at the sole discretion of the credit rating organizations. The

statements in this release are made as of the date of this release, even if subsequently made available by Howmet Aerospace on its

website or otherwise. Howmet Aerospace disclaims any intention or obligation to update publicly any forward-looking statements,

whether in response to new information, future events, or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

Some of the information included in this release is derived from Howmet

Aerospace’s consolidated financial information but is not presented in Howmet Aerospace’s financial statements prepared in

accordance with accounting principles generally accepted in the United States of America (GAAP). Certain of these data are considered

“non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should

not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s

rationale for the use of the non-GAAP financial measures can be found in the schedules to this release.

Other Information

In this press release, the acronym “FY” means “full

year” and “Q” means “quarter”; and references to Howmet Aerospace performance that is “record”

means its best result since April 1, 2020 when Howmet Aerospace Inc. (previously named Arconic Inc.) separated from Arconic Corporation.

Howmet Aerospace Inc. and subsidiaries

Statement of Consolidated Operations (unaudited)

(in U.S. dollar millions, except per-share and share amounts)

| | |

Quarter ended | |

| | |

June 30, 2024 | | |

March 31, 2024 | | |

June 30, 2023 | |

| Sales | |

$ | 1,880 | | |

$ | 1,824 | | |

$ | 1,648 | |

| | |

| | | |

| | | |

| | |

| Cost of goods sold (exclusive of expenses below) | |

| 1,287 | | |

| 1,290 | | |

| 1,196 | |

| Selling, general administrative, and other expenses | |

| 97 | | |

| 88 | | |

| 88 | |

| Research and development expenses | |

| 7 | | |

| 10 | | |

| 9 | |

| Provision for depreciation and amortization | |

| 69 | | |

| 67 | | |

| 67 | |

| Restructuring and other charges | |

| 22 | | |

| — | | |

| 3 | |

| Operating income | |

| 398 | | |

| 369 | | |

| 285 | |

| | |

| | | |

| | | |

| | |

| Interest expense, net | |

| 49 | | |

| 49 | | |

| 55 | |

| Other expense (income), net | |

| 15 | | |

| 17 | | |

| (13 | ) |

| | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 334 | | |

| 303 | | |

| 243 | |

| Provision for income taxes | |

| 68 | | |

| 60 | | |

| 50 | |

| Net income | |

$ | 266 | | |

$ | 243 | | |

$ | 193 | |

| | |

| | | |

| | | |

| | |

| Amounts Attributable to Howmet Aerospace Common Shareholders: | |

| | | |

| | | |

| | |

| Earnings per share - basic(1): | |

| | | |

| | | |

| | |

| Net income per share | |

$ | 0.65 | | |

$ | 0.59 | | |

$ | 0.47 | |

| Average number of shares(2)(3) | |

| 408 | | |

| 410 | | |

| 413 | |

| | |

| | | |

| | | |

| | |

| Earnings per share - diluted(1): | |

| | | |

| | | |

| | |

| Net income per share | |

$ | 0.65 | | |

$ | 0.59 | | |

$ | 0.46 | |

| Average number of shares(2)(3) | |

| 411 | | |

| 412 | | |

| 417 | |

| | |

| | | |

| | | |

| | |

| Common stock outstanding at the end of the period | |

| 408 | | |

| 408 | | |

| 412 | |

| (1) | In order to calculate both basic and diluted earnings per share, preferred stock dividends declared of less than $1 for the quarters

presented need to be subtracted from Net income. |

| | |

| (2) | For the quarters presented, the difference between the diluted average number of shares and the basic average number of shares related

to share equivalents associated with outstanding restricted stock unit awards and employee stock options. |

| | |

| (3) | As average shares outstanding are used in the calculation of both basic and diluted earnings per share, the full impact of share repurchases

is not fully realized in earnings per share ("EPS") in the period of repurchase since share repurchases may occur at varying

points during a period. |

Howmet Aerospace Inc. and subsidiaries

Consolidated Balance Sheet (unaudited)

(in U.S. dollar millions)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 752 | | |

$ | 610 | |

| Receivables from customers, less allowances of $— in both 2024 and 2023 | |

| 749 | | |

| 675 | |

| Other receivables | |

| 19 | | |

| 17 | |

| Inventories | |

| 1,848 | | |

| 1,765 | |

| Prepaid expenses and other current assets | |

| 235 | | |

| 249 | |

| Total current assets | |

| 3,603 | | |

| 3,316 | |

| Properties, plants, and equipment, net | |

| 2,307 | | |

| 2,328 | |

| Goodwill | |

| 4,016 | | |

| 4,035 | |

| Deferred income taxes | |

| 32 | | |

| 46 | |

| Intangibles, net | |

| 489 | | |

| 505 | |

| Other noncurrent assets | |

| 232 | | |

| 198 | |

| Total assets | |

$ | 10,679 | | |

$ | 10,428 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable, trade | |

$ | 971 | | |

$ | 982 | |

| Accrued compensation and retirement costs | |

| 235 | | |

| 263 | |

| Taxes, including income taxes | |

| 81 | | |

| 68 | |

| Accrued interest payable | |

| 64 | | |

| 65 | |

| Other current liabilities | |

| 225 | | |

| 200 | |

| Short-term debt | |

| 782 | | |

| 206 | |

| Total current liabilities | |

| 2,358 | | |

| 1,784 | |

| Long-term debt, less amount due within one year | |

| 2,877 | | |

| 3,500 | |

| Accrued pension benefits | |

| 645 | | |

| 664 | |

| Accrued other postretirement benefits | |

| 90 | | |

| 92 | |

| Other noncurrent liabilities and deferred credits | |

| 432 | | |

| 351 | |

| Total liabilities | |

| 6,402 | | |

| 6,391 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Howmet Aerospace shareholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| 55 | | |

| 55 | |

| Common stock | |

| 408 | | |

| 410 | |

| Additional capital | |

| 3,486 | | |

| 3,682 | |

| Retained earnings | |

| 2,186 | | |

| 1,720 | |

| Accumulated other comprehensive loss | |

| (1,858 | ) | |

| (1,830 | ) |

| Total equity | |

| 4,277 | | |

| 4,037 | |

| Total liabilities and equity | |

$ | 10,679 | | |

$ | 10,428 | |

Howmet Aerospace and subsidiaries

Statement of Consolidated Cash Flows (unaudited)

(in U.S. dollar millions)

| | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Operating activities | |

| | | |

| | |

| Net income | |

$ | 509 | | |

$ | 341 | |

| Adjustments to reconcile net income to cash provided from operations: | |

| | | |

| | |

| Depreciation and amortization | |

| 136 | | |

| 136 | |

| Deferred income taxes | |

| 67 | | |

| 57 | |

| Restructuring and other charges | |

| 22 | | |

| 4 | |

| Net realized and unrealized losses | |

| 13 | | |

| 11 | |

| Net periodic pension cost | |

| 20 | | |

| 19 | |

| Stock-based compensation | |

| 38 | | |

| 26 | |

| Loss on debt redemption | |

| — | | |

| 1 | |

| Other | |

| 7 | | |

| — | |

| Changes in assets and liabilities, excluding effects of acquisitions, divestitures, and foreign currency translation adjustments: | |

| | | |

| | |

| Increase in receivables | |

| (100 | ) | |

| (141 | ) |

| Increase in inventories | |

| (109 | ) | |

| (99 | ) |

| Decrease (increase) in prepaid expenses and other current assets | |

| 5 | | |

| (9 | ) |

| Increase (decrease) in accounts payable, trade | |

| 6 | | |

| (80 | ) |

| Decrease in accrued expenses | |

| (17 | ) | |

| (15 | ) |

| Increase in taxes, including income taxes | |

| 13 | | |

| 31 | |

| Pension contributions | |

| (17 | ) | |

| (12 | ) |

| (Increase) decrease in noncurrent assets | |

| (7 | ) | |

| 1 | |

| Decrease in noncurrent liabilities | |

| (12 | ) | |

| (19 | ) |

| Cash provided from operations | |

| 574 | | |

| 252 | |

| Financing Activities | |

| | | |

| | |

| Repurchases and payments on debt | |

| (23 | ) | |

| (176 | ) |

| Premiums paid on early redemption of debt | |

| — | | |

| (1 | ) |

| Repurchases of common stock | |

| (210 | ) | |

| (125 | ) |

| Proceeds from exercise of employee stock options | |

| 6 | | |

| 9 | |

| Dividends paid to shareholders | |

| (42 | ) | |

| (35 | ) |

| Taxes paid for net share settlement of equity awards | |

| (32 | ) | |

| (75 | ) |

| Cash used for financing activities | |

| (301 | ) | |

| (403 | ) |

| Investing Activities | |

| | | |

| | |

| Capital expenditures | |

| (137 | ) | |

| (105 | ) |

| Proceeds from the sale of assets and businesses | |

| 8 | | |

| — | |

| Cash used for investing activities | |

| (129 | ) | |

| (105 | ) |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | |

| (2 | ) | |

| — | |

| Net change in cash, cash equivalents and restricted cash | |

| 142 | | |

| (256 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 610 | | |

| 792 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 752 | | |

$ | 536 | |

Howmet Aerospace Inc. and subsidiaries

Segment Information (unaudited)

(in U.S. dollar millions)

| | |

1Q23 | | |

2Q23 | | |

3Q23 | | |

4Q23 | | |

2023 | | |

1Q24 | | |

2Q24 | |

| Engine Products | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Third-party sales | |

$ | 795 | | |

$ | 821 | | |

$ | 798 | | |

$ | 852 | | |

$ | 3,266 | | |

$ | 885 | | |

$ | 933 | |

| Inter-segment sales | |

$ | 2 | | |

$ | 5 | | |

$ | 5 | | |

$ | 1 | | |

$ | 13 | | |

$ | 2 | | |

$ | 1 | |

| Provision for depreciation and amortization | |

$ | 32 | | |

$ | 32 | | |

$ | 33 | | |

$ | 33 | | |

$ | 130 | | |

$ | 33 | | |

$ | 33 | |

| Segment Adjusted EBITDA | |

$ | 212 | | |

$ | 223 | | |

$ | 219 | | |

$ | 233 | | |

$ | 887 | | |

$ | 249 | | |

$ | 292 | |

| Segment Adjusted EBITDA Margin | |

| 26.7 | % | |

| 27.2 | % | |

| 27.4 | % | |

| 27.3 | % | |

| 27.2 | % | |

| 28.1 | % | |

| 31.3 | % |

| Restructuring and other credits | |

$ | — | | |

$ | (1 | ) | |

$ | — | | |

$ | (1 | ) | |

$ | (2 | ) | |

$ | — | | |

$ | (1 | ) |

| Capital expenditures | |

$ | 33 | | |

$ | 21 | | |

$ | 30 | | |

$ | 28 | | |

$ | 112 | | |

$ | 55 | | |

$ | 33 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fastening Systems | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Third-party sales | |

$ | 312 | | |

$ | 329 | | |

$ | 348 | | |

$ | 360 | | |

$ | 1,349 | | |

$ | 389 | | |

$ | 394 | |

| Provision for depreciation and amortization | |

$ | 11 | | |

$ | 12 | | |

$ | 12 | | |

$ | 11 | | |

$ | 46 | | |

$ | 11 | | |

$ | 13 | |

| Segment Adjusted EBITDA | |

$ | 58 | | |

$ | 64 | | |

$ | 76 | | |

$ | 80 | | |

$ | 278 | | |

$ | 92 | | |

$ | 101 | |

| Segment Adjusted EBITDA Margin | |

| 18.6 | % | |

| 19.5 | % | |

| 21.8 | % | |

| 22.2 | % | |

| 20.6 | % | |

| 23.7 | % | |

| 25.6 | % |

| Restructuring and other charges | |

$ | — | | |

$ | — | | |

$ | 1 | | |

$ | — | | |

$ | 1 | | |

$ | — | | |

$ | 2 | |

| Capital expenditures | |

$ | 9 | | |

$ | 5 | | |

$ | 9 | | |

$ | 8 | | |

$ | 31 | | |

$ | 7 | | |

$ | 5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Engineered Structures | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Third-party sales | |

$ | 207 | | |

$ | 200 | | |

$ | 227 | | |

$ | 244 | | |

$ | 878 | | |

$ | 262 | | |

$ | 275 | |

| Inter-segment sales | |

$ | — | | |

$ | 1 | | |

$ | — | | |

$ | 2 | | |

$ | 3 | | |

$ | 1 | | |

$ | 3 | |

| Provision for depreciation and amortization | |

$ | 12 | | |

$ | 12 | | |

$ | 12 | | |

$ | 11 | | |

$ | 47 | | |

$ | 11 | | |

$ | 11 | |

| Segment Adjusted EBITDA | |

$ | 30 | | |

$ | 20 | | |

$ | 30 | | |

$ | 33 | | |

$ | 113 | | |

$ | 37 | | |

$ | 40 | |

| Segment Adjusted EBITDA Margin | |

| 14.5 | % | |

| 10.0 | % | |

| 13.2 | % | |

| 13.5 | % | |

| 12.9 | % | |

| 14.1 | % | |

| 14.5 | % |

| Restructuring and other charges | |

$ | 1 | | |

$ | 5 | | |

$ | 1 | | |

$ | 14 | | |

$ | 21 | | |

$ | — | | |

$ | 14 | |

| Capital expenditures | |

$ | 10 | | |

$ | 5 | | |

$ | 6 | | |

$ | 5 | | |

$ | 26 | | |

$ | 6 | | |

$ | 5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Forged Wheels | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Third-party sales | |

$ | 289 | | |

$ | 298 | | |

$ | 285 | | |

$ | 275 | | |

$ | 1,147 | | |

$ | 288 | | |

$ | 278 | |

| Provision for depreciation and amortization | |

$ | 9 | | |

$ | 10 | | |

$ | 10 | | |

$ | 10 | | |

$ | 39 | | |

$ | 10 | | |

$ | 10 | |

| Segment Adjusted EBITDA | |

$ | 79 | | |

$ | 81 | | |

$ | 77 | | |

$ | 72 | | |

$ | 309 | | |

$ | 82 | | |

$ | 75 | |

| Segment Adjusted EBITDA Margin | |

| 27.3 | % | |

| 27.2 | % | |

| 27.0 | % | |

| 26.2 | % | |

| 26.9 | % | |

| 28.5 | % | |

| 27.0 | % |

| Capital expenditures | |

$ | 9 | | |

$ | 7 | | |

$ | 9 | | |

$ | 11 | | |

$ | 36 | | |

$ | 12 | | |

$ | 9 | |

Differences between the total segment and consolidated

totals are in Corporate.

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited)

(in U.S. dollar millions)

| Reconciliation of Total Segment Adjusted EBITDA to Consolidated Income Before Income Taxes |

| | |

1Q23 | | |

2Q23 | | |

3Q23 | | |

4Q23 | | |

2023 | | |

1Q24 | | |

2Q24 | |

| Income before income taxes | |

$ | 220 | | |

$ | 243 | | |

$ | 242 | | |

$ | 270 | | |

$ | 975 | | |

$ | 303 | | |

$ | 334 | |

| Loss on debt redemption | |

| 1 | | |

| — | | |

| — | | |

| 1 | | |

| 2 | | |

| — | | |

| — | |

| Interest expense, net | |

| 57 | | |

| 55 | | |

| 54 | | |

| 52 | | |

| 218 | | |

| 49 | | |

| 49 | |

| Other expense (income), net | |

| 7 | | |

| (13 | ) | |

| 11 | | |

| 3 | | |

| 8 | | |

| 17 | | |

| 15 | |

| Operating income | |

$ | 285 | | |

$ | 285 | | |

$ | 307 | | |

$ | 326 | | |

$ | 1,203 | | |

$ | 369 | | |

$ | 398 | |

| Segment provision for depreciation and amortization | |

| 64 | | |

| 66 | | |

| 67 | | |

| 65 | | |

| 262 | | |

| 65 | | |

| 67 | |

| Unallocated amounts: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restructuring and other charges | |

| 1 | | |

| 3 | | |

| 4 | | |

| 15 | | |

| 23 | | |

| — | | |

| 22 | |

| Corporate expense(1) | |

| 29 | | |

| 34 | | |

| 24 | | |

| 12 | | |

| 99 | | |

| 26 | | |

| 21 | |

| Total Segment Adjusted EBITDA | |

$ | 379 | | |

$ | 388 | | |

$ | 402 | | |

$ | 418 | | |

$ | 1,587 | | |

$ | 460 | | |

$ | 508 | |

Total Segment Adjusted

EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Total Segment Adjusted

EBITDA provides additional information with respect to the Company's operating performance and the Company’s ability to meet its

financial obligations. The Total Segment Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

Howmet’s definition of Total Segment Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin

plus an add-back for depreciation and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling,

general administrative, and other expenses; Research and development expenses; and Provision for depreciation and amortization. Special

items, including Restructuring and other charges, are excluded from net margin and Segment Adjusted EBITDA. Differences between the total

segment and consolidated totals are in Corporate.

| (1) Pre-tax special items included in Corporate expense |

| | |

1Q23 | | |

2Q23 | | |

3Q23 | | |

4Q23 | | |

2023 | | |

1Q24 | | |

2Q24 | |

| Plant fire costs (reimbursements), net | |

$ | 4 | | |

$ | (4 | ) | |

$ | 1 | | |

$ | (13 | ) | |

$ | (12 | ) | |

$ | — | | |

$ | (6 | ) |

| Collective bargaining agreement negotiation | |

| — | | |

| 7 | | |

| 1 | | |

| — | | |

| 8 | | |

| — | | |

| — | |

| Costs associated with closures, supply chain disruptions, and other items | |

| 1 | | |

| 9 | | |

| 1 | | |

| 2 | | |

| 13 | | |

| 1 | | |

| — | |

| Total Pre-tax special items included in Corporate expense | |

$ | 5 | | |

$ | 12 | | |

$ | 3 | | |

$ | (11 | ) | |

$ | 9 | | |

$ | 1 | | |

$ | (6 | ) |

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited), continued

(in U.S. dollars millions)

| Reconciliation of Free cash flow | |

Quarter ended | | |

Six months ended | |

| | |

1Q24 | | |

2Q24 | | |

2Q24 | |

| Cash provided from operations | |

$ | 177 | | |

$ | 397 | | |

$ | 574 | |

| Capital expenditures | |

| (82 | ) | |

| (55 | ) | |

| (137 | ) |

| Free cash flow | |

$ | 95 | | |

$ | 342 | | |

$ | 437 | |

The Accounts Receivable Securitization program remains unchanged at

$250 outstanding.

Free cash flow is a non-GAAP financial measure. Management believes

that this measure is meaningful to investors because management reviews cash flows generated from operations after taking into consideration

capital expenditures (due to the fact that these expenditures are considered necessary to maintain and expand the Company's asset base

and are expected to generate future cash flows from operations). It is important to note that Free cash flow does not represent the residual

cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements,

are not deducted from the measure.

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited), continued

(in U.S. dollar millions, except per-share and share amounts)

| Reconciliation of Net income excluding Special items | |

Quarter ended | | |

Six months ended | |

| | |

2Q23 | | |

1Q24 | | |

2Q24 | | |

June 30, 2023 | | |

June 30, 2024 | |

| Net income | |

$ | 193 | | |

$ | 243 | | |

$ | 266 | | |

$ | 341 | | |

$ | 509 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per share (EPS) | |

$ | 0.46 | | |

$ | 0.59 | | |

$ | 0.65 | | |

$ | 0.81 | | |

$ | 1.23 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Special items: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restructuring

and other charges(1) | |

| 3 | | |

| — | | |

| 22 | | |

| 4 | | |

| 22 | |

| Loss on debt redemption and related costs | |

| — | | |

| — | | |

| — | | |

| 1 | | |

| — | |

| Plant fire reimbursements, net | |

| (4 | ) | |

| — | | |

| (6 | ) | |

| — | | |

| (6 | ) |

| Collective bargaining agreement negotiations | |

| 7 | | |

| — | | |

| — | | |

| 7 | | |

| — | |

| Settlement from legal proceeding(2) | |

| (24 | ) | |

| — | | |

| — | | |

| (24 | ) | |

| — | |

| Costs associated with closures, supply chain disruptions, and other items | |

| 9 | | |

| 1 | | |

| — | | |

| 10 | | |

| 1 | |

| Subtotal: Pre-tax special items | |

| (9 | ) | |

| 1 | | |

| 16 | | |

| (2 | ) | |

| 17 | |

| Tax impact of Pre-tax special items(3) | |

| 2 | | |

| — | | |

| — | | |

| 1 | | |

| — | |

| Subtotal | |

| (7 | ) | |

| 1 | | |

| 16 | | |

| (1 | ) | |

| 17 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Discrete and other tax special items(4) | |

| (5 | ) | |

| (6 | ) | |

| (6 | ) | |

| 16 | | |

| (12 | ) |

| Total: After-tax special items | |

| (12 | ) | |

| (5 | ) | |

| 10 | | |

| 15 | | |

| 5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income excluding Special items | |

$ | 181 | | |

$ | 238 | | |

$ | 276 | | |

$ | 356 | | |

$ | 514 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted EPS excluding Special items | |

$ | 0.44 | | |

$ | 0.57 | | |

$ | 0.67 | | |

$ | 0.85 | | |

$ | 1.25 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average number of shares - diluted EPS excluding Special items | |

| 417 | | |

| 412 | | |

| 411 | | |

| 417 | | |

| 411 | |

Net income excluding Special

items and Diluted EPS excluding Special items are non-GAAP financial measures. Management believes that these measures are meaningful

to investors because management reviews the operating results of the Company excluding the impacts of Restructuring and other charges,

Discrete tax items, and Other special items (collectively, “Special items”). There can be no assurances that additional Special

items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both

Net income and Diluted EPS determined under GAAP as well as Net income excluding Special items and Diluted EPS excluding Special items.

| (1) | Q2 2024 includes non-cash Special items of a loss on sale of a small manufacturing facility in Engineered Structures $14 and other

exit costs, including accelerated depreciation $1. |

| (2) | Settlement from legal proceeding, net of legal fees for the quarter and six months ended June 30, 2023 related to the reversal of

$25, net of legal fees of $1, of the $65 pre-tax charge taken in the third quarter of 2022 related to the LBIE legal proceeding. |

| (3) | The Tax impact of Pre-tax special items is based on the applicable statutory rates whereby the difference between such rates and the

Company’s consolidated estimated annual effective tax rate is itself a Special item. |

| (4) | Discrete tax items for each period included the following: |

| | · | for the quarter ended June 30, 2023, an excess benefit for stock compensation ($8) and a net charge for other small items $1; |

| | · | for the quarter ended March 31, 2024, a benefit to release a valuation allowance related to U.S. foreign tax credits ($6), and a net

benefit for other small items ($1). |

| | · | for the quarter ended June 30, 2024, an excess benefit for stock compensation ($5). |

| | · | for the six months ended June 30, 2023, a charge for a tax reserve established in France $20, an excess benefit for stock compensation

($8), and a net charge for other small items $2. |

| | · | for the six months ended June 30, 2024, an excess benefit for stock compensation ($7), a benefit to release a valuation allowance

related to U.S. foreign tax credits ($6), and a net charge for other small items $1. |

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited), continued

(in U.S. dollar millions)

| Reconciliation of Operational tax rate | |

2Q24 | | |

Six months ended June 30, 2024 | |

| | |

Effective tax

rate, as

reported | | |

Special

items(1)(2) | | |

Operational

tax rate, as

adjusted | | |

Effective tax

rate, as

reported | | |

Special

items(1)(2) | | |

Operational

tax rate, as

adjusted | |

| Income before income taxes | |

$ | 334 | | |

$ | 16 | | |

$ | 350 | | |

$ | 637 | | |

$ | 17 | | |

$ | 654 | |

| Provision for income taxes | |

$ | 68 | | |

$ | 6 | | |

$ | 74 | | |

$ | 128 | | |

$ | 12 | | |

$ | 140 | |

| Tax rate | |

| 20.4 | % | |

| | | |

| 21.1 | % | |

| 20.1 | % | |

| | | |

| 21.4 | % |

Operational tax rate is a non-GAAP financial measure. Management believes

that this measure is meaningful to investors because management reviews the operating results of the Company excluding the impacts of

Special items. There can be no assurances that additional Special items will not occur in future periods. To compensate for this limitation,

management believes that it is appropriate to consider both the Effective tax rate determined under GAAP as well as the Operational tax

rate.

| (1) | Pre-tax special items for the quarter ended June 30, 2024 included Restructuring and other charges $22 offset by Plant fire reimbursements

($6). Pre-tax special items for the six months ended June 30, 2024 included Restructuring and other charges $22 and Costs associated with

closures, supply chain disruptions, and other items $1 offset by Plant fire reimbursements ($6). |

| | |

| (2) | Tax Special items includes discrete tax items, the tax impact on Special items based on the applicable statutory rates, the difference

between such rates and the Company’s consolidated estimated annual effective tax rate and other tax related items. Discrete tax

items for each period included the following: |

| | · | for the quarter ended June 30, 2024, an excess benefit for stock compensation ($5). |

| | | |

| | · | for the six months ended June 30, 2024, an excess benefit for stock compensation ($7), a benefit to release a valuation allowance

related to U.S. foreign tax credits ($6), and a net charge for other small items $1. |

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited), continued

(in U.S. dollars millions)

| Reconciliation of Adjusted EBITDA and Adjusted EBITDA margin excluding Special items | |

| |

| | |

2Q23 | | |

1Q24 | | |

2Q24 | |

| Sales | |

$ | 1,648 | | |

$ | 1,824 | | |

$ | 1,880 | |

| Operating income | |

$ | 285 | | |

$ | 369 | | |

$ | 398 | |

| Operating income margin | |

| 17.3 | % | |

| 20.2 | % | |

| 21.2 | % |

| | |

| | | |

| | | |

| | |

| Net income | |

$ | 193 | | |

$ | 243 | | |

$ | 266 | |

| Add: | |

| | | |

| | | |

| | |

| Provision for income taxes | |

$ | 50 | | |

$ | 60 | | |

$ | 68 | |

| Other expense, net | |

| (13 | ) | |

| 17 | | |

| 15 | |

| Interest expense, net | |

| 55 | | |

| 49 | | |

| 49 | |

| Restructuring and other charges | |

| 3 | | |

| — | | |

| 22 | |

| Provision for depreciation and amortization | |

| 67 | | |

| 67 | | |

| 69 | |

| Adjusted EBITDA | |

$ | 355 | | |

$ | 436 | | |

$ | 489 | |

| | |

| | | |

| | | |

| | |

| Add: | |

| | | |

| | | |

| | |

| Plant fire costs reimbursements, net | |

$ | (4 | ) | |

$ | — | | |

$ | (6 | ) |

| Collective bargaining agreement negotiations | |

| 7 | | |

| — | | |

| — | |

| Costs associated with closures, supply chain disruptions, and other items | |

| 10 | | |

| 1 | | |

| — | |

| Adjusted EBITDA excluding Special items | |

$ | 368 | | |

$ | 437 | | |

$ | 483 | |

| | |

| | | |

| | | |

| | |

| Adjusted EBITDA margin excluding Special items | |

| 22.3 | % | |

| 24.0 | % | |

| 25.7 | % |

| Incremental margin | |

Quarter ended | | |

| |

| | |

June 30, 2023 | | |

June 30, 2024 | | |

Q2 2024 YoY | |

| Third-party sales (b) | |

$ | 1,648 | | |

$ | 1,880 | | |

$ | 232 | |

| | |

| | | |

| | | |

| | |

| Adjusted EBITDA excluding Special items (a) | |

$ | 368 | | |

$ | 483 | | |

$ | 115 | |

| | |

| | | |

| | | |

| | |

| Incremental margin (a)/(b) | |

| | | |

| | | |

| 50 | % |

Adjusted EBITDA, Adjusted EBITDA excluding Special items, Adjusted

EBITDA margin excluding Special items, Third-party sales, and Incremental margin are non-GAAP financial measures. Management believes

that these measures are meaningful to investors because they provide additional information with respect to the Company's operating performance

and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled

measures of other companies. The Company's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization)

is net margin plus an add-back for depreciation and amortization. Net margin is equivalent to Sales minus the following items: Cost of

goods sold, Selling, general administrative, and other expenses, Research and development expenses, and Provision for depreciation and

amortization. Special items, including Restructuring and other charges, are excluded from Adjusted EBITDA.

Howmet Aerospace Inc. and subsidiaries

Calculation of Financial Measures (unaudited), continued

(in U.S. dollar millions)

| Reconciliation of Adjusted Operating Income Excluding Special Items and Adjusted Operating Income Margin Excluding Special Items | |

Quarter ended | |

| | |

2Q23 | | |

1Q24 | | |

2Q24 | |

| Sales | |

$ | 1,648 | | |

$ | 1,824 | | |

$ | 1,880 | |

| Operating income | |

$ | 285 | | |

$ | 369 | | |

$ | 398 | |

| Operating income margin | |

| 17.3 | % | |

| 20.2 | % | |

| 21.2 | % |

| | |

| | | |

| | | |

| | |

| Add: | |

| | | |

| | | |

| | |

| Restructuring and other charges | |

$ | 3 | | |

$ | — | | |

$ | 22 | |

| Plant fire reimbursements, net | |

| (4 | ) | |

| — | | |

| (6 | ) |

| Collective bargaining agreement negotiations | |

| 7 | | |

| — | | |

| — | |

| Costs associated with closures, supply chain disruptions, and other items | |

| 10 | | |

| 1 | | |

| — | |

| Adjusted operating income excluding Special items | |

$ | 301 | | |

$ | 370 | | |

$ | 414 | |

| | |

| | | |

| | | |

| | |

| Adjusted operating income margin excluding Special items | |

| 18.3 | % | |

| 20.3 | % | |

| 22.0 | % |

Adjusted operating income excluding Special items and Adjusted operating

income margin excluding Special items are non-GAAP financial measures. Management believes that these measures are meaningful to investors

because management reviews the operating results of the Company excluding the impacts of Special items. There can be no assurances that

additional Special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate

to consider both Operating income determined under GAAP as well as Operating income excluding Special items.

v3.24.2

Cover

|

Jul. 30, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity File Number |

1-3610

|

| Entity Registrant Name |

HOWMET AEROSPACE INC.

|

| Entity Central Index Key |

0000004281

|

| Entity Tax Identification Number |

25-0317820

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

201 Isabella Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Pittsburgh

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

15212-5872

|

| City Area Code |

412

|

| Local Phone Number |

553-1940

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

HWM

|

| Security Exchange Name |

NYSE

|

| Cumulative Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

$3.75 Cumulative Preferred Stock, par value $100 per share

|

| Trading Symbol |

HWM PR

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CumulativePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

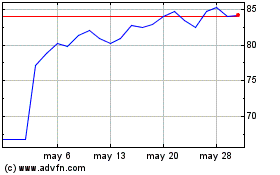

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Howmet Aerospace (NYSE:HWM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025