Form 8-K - Current report

04 Agosto 2023 - 6:00AM

Edgar (US Regulatory)

0001677576

false

0001677576

2023-08-04

2023-08-04

0001677576

us-gaap:CommonStockMember

2023-08-04

2023-08-04

0001677576

us-gaap:SeriesAPreferredStockMember

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): August

4, 2023

Innovative Industrial

Properties, Inc.

(Exact name

of registrant as specified in its charter)

| Maryland |

|

001-37949 |

|

81-2963381 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

1389 Center

Drive, Suite 200

Park City, UT

84098

(Address of

principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (858) 997-3332

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IIPR |

|

New York Stock Exchange |

| Series A Preferred Stock, par value $0.001 per share |

|

IIPR-PA |

|

New York Stock Exchange |

Item 7.01

Regulation FD Disclosure.

On

August 4, 2023, Innovative Industrial Properties, Inc. (the “Company”) posted an investor presentation to its website located

at http://investors.innovativeindustrialproperties.com/. A copy of the investor presentation is attached hereto as Exhibit 99.1 and

is incorporated by reference herein.

The

information contained in this Current Report, including Exhibit 99.1 referenced herein, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof,

regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 4, 2023 |

INNOVATIVE INDUSTRIAL PROPERTIES, INC. |

| |

|

|

| |

By: |

/s/ David Smith |

| |

Name: |

David Smith |

| |

Title: |

Chief Financial Officer |

| |

|

Exhibit 99.1

| Innovative Industrial Properties

1

INNOVATIVE

INDUSTRIAL

PROPERTIES

NYSE: IIPR

INNOVATIVEINDUSTRIALPROPERTIES.COM

COMPANY PRESENTATION

POSTED: AUGUST 4, 2023 |

| Innovative Industrial Properties 2

FORWARD LOOKING STATEMENTS

This presentation and our associated comments include "forward-looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertainties. In particular, statements pertaining to our capital resources, portfolio

performance and results of operations contain forward-looking statements. Likewise, our statements regarding anticipated growth in our funds from operations and anticipated market and regulatory

conditions, our strategic direction, our dividend rate and policy, demographics, results of operations, plans and objectives are forward-looking statements. Forward-looking statements involve numerous

risks and uncertainties, and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise, and

we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). You can identify forward-looking statements

by the use of forward-looking terminology such as "believes“, "expects“, "may“, "will“, "should“, "seeks“, "approximately“, "intends“, "plans“, "estimates" or "anticipates" or the negative of these words and

phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The following factors, among others, could cause actual results and

future events to differ materially from those set forth or contemplated in the forward-looking statements: rates of default on leases for our assets; concentration of our portfolio of assets and limited

number of tenants; the estimated growth in and evolving market dynamics of the regulated cannabis market; the demand for regulated cannabis facilities; inflation dynamics; our ability to improve our

internal control over financial reporting, including our inability to remediate an identified material weakness, and the costs and the time associated with such efforts; the impact of pandemics on us, our

business, our tenants, or the economy generally; war and other hostilities, including the conflict in Ukraine; our business and investment strategy; our projected operating results; actions and initiatives of

the U.S. or state governments and changes to government policies and the execution and impact of these actions, initiatives and policies, including the fact that cannabis remains illegal under federal

law; availability of suitable investment opportunities in the regulated cannabis industry; our understanding of our competition and our potential tenants’ alternative financing sources; the expected

medical-use or adult-use cannabis legalization in certain states; shifts in public opinion regarding regulated cannabis; the potential impact on us from litigation matters, including rising liability and

insurance costs; the additional risks that may be associated with certain of our tenants cultivating, processing and/or dispensing adult-use cannabis in our facilities; the state of the U.S. economy

generally or in specific geographic areas; economic trends and economic recoveries; our ability to access equity or debt capital; financing rates for our target assets; our level of indebtedness, which

could reduce funds available for other business purposes and reduce our operational flexibility; covenants in our debt instruments, which may limit our flexibility and adversely affect our financial

condition; our ability to maintain our investment grade credit rating; changes in the values of our assets; our expected portfolio of assets; our expected investments; interest rate mismatches between

our assets and our borrowings used to fund such investments; changes in interest rates and the market value of our assets; the degree to which any interest rate or other hedging strategies may or may

not protect us from interest rate volatility; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a

real estate investment trust for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940; availability of qualified personnel;

and market trends in our industry, interest rates, real estate values, the securities markets or the general economy.

The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance. In addition, we discussed a number of material risks in our most recent

Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Those risks continue to be relevant to our performance and financial condition. Moreover, we operate in a very competitive

and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any forward-looking

statement made by us speaks only of the date on which we make it. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law. Stockholders and investors are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented

in our filings and reports.

Market and industry data are included in this presentation. We have obtained substantially all of this information from internal studies, public filings, other independent published industry sources and

market studies prepared by third parties. We believe these internal studies, public filings, other independent published industry sources and market studies prepared by third parties are reliable.

However, this information may prove to be inaccurate. No representation or warranty is made as to the accuracy of such information. All amounts shown in this presentation are unaudited. This is not an

offer to sell or solicitation to buy securities of Innovative Industrial Properties, Inc. Any offers to sell or solicitations to buy securities of Innovative Industrial Properties, Inc. shall be made only by means of

a prospectus approved for that purpose. |

| Innovative Industrial Properties 3

Founded in 2016

We are the first and only publicly traded company on

the New York Stock Exchange (NYSE: IIPR) to provide

real estate capital to the regulated cannabis industry

WHY IIPR WAS FORMED

Specialized Real

Estate

U.S. cannabis operators require mission

critical facilities with specialized buildouts

to optimize environment and conform to

licensing and zoning requirements

Outsized Need for

Capital

U.S. cannabis operators have an outsized

need for capital to fund growth

Rapid Adoption of

State Legalization

As of August 2023, 40 states and

Washington, D.C. have legalized cannabis

for medical-use, and 23 states and

Washington, D.C. have legalized cannabis

for adult-use

(2)

Large and Growing

Industry

Regulated cannabis sales estimated to

grow to $45 billion by 2027, almost

double 2022 estimated regulated sales of

$26 billion(1)

Limited Access to

Financing

Due to federal prohibition and being a

nascent industry, U.S. cannabis operators

were historically required to fund growth

through highly dilutive forms of capital

absent other forms of financing

(1) Source: BDSA Legal Cannabis Market Forecast (June 2023).

(2) Source: 2023 U.S. Cannabis Report, New Frontier Data, National Conference of State Legislatures (www.ncsl.org) as of June 2023. |

| Innovative Industrial Properties 4

OUR BUSINESS MODEL & BENEFITS

Structured long-term cash flows

• Generally, 15-20 year initial lease terms (vs. ~5

years for traditional industrial leases)

• Leases generally subject to parent company

guarantees covering operations throughout the

United States

Capital efficient lease structure

• Target leases are 100% triple-net

⚬ No recurring capital expenditures during lease

term

⚬ All property expenses paid by the tenant,

including capital repairs and replacements

Strong initial rental yields with

annual escalations

We work closely with

state-licensed

cannabis operators

Provide non-dilutive

capital

Facilitate our tenants’

growth plans

Execute sale-leasebacks

and fund improvements

for cultivation,

processing and retail

properties |

| Innovative Industrial Properties 5

# of Tenants by

Year

(5)

# of Properties

by Year

# of States by

Year 1

4

9

14

17

19 19 19

2016 2017 2018 2019 2020 2021 2022 6/30

1

4

8

18

20

26

29 30

2016 2017 2018 2019 2020 2021 2022 6/30

Capital

Committed by

Year ($)(1) 30.0M 73.3M 167.4M

690.0M

1.3B

2.0B

2.3B 2.4B

2016 2017 2018 2019 2020 2021 2022 6/30

IIPR AS OF JUNE 30, 2023

Note: Data as of June 30, 2023, unless otherwise noted.

(1) Total Committed / Invested Capital includes (1) total investments in properties (consisting of purchase price and construction funding and improvements reimbursed to tenants, if any, but excluding transaction costs) and (2) total additional commitments to reimburse certain tenants and sellers for completion of

construction and improvements at the properties. Excludes a $23.0 million loan commitment from us to a developer for construction of a regulated cannabis cultivation and processing facility in California and a seller-financed note issued to us by the buyer in connection with our disposition of a portfolio of four

properties in southern California.

(2) Operating Portfolio is defined as all properties that (a) are leased or (b) are not leased but ready for their intended use. Operating Portfolio includes approximately 1.0 million square feet under development or redevelopment.

(3) Reflects annualized common stock dividend paid on July 14, 2023 of $1.80 per share. The decision to declare or pay dividends is in the sole discretion of our board of directors in light of conditions then existing, and there can be no assurance that a dividend will be declared or paid for any time period in any

amount.

(4) Weighted average lease length calculated by weighting the remaining lease term based on the base rent and management fees, after the expiration of applicable base rent phase-in periods for the Operating Portfolio.

(5) Each “Tenant” represents the parent company of the tenant, for which the parent company has provided a corporate guaranty. A parent company may have multiple tenant subsidiaries across IIP’s properties. Includes one tenant for a pre-leased and under-development property in CA.

$2.4B

Total

Committed /

Invested

Capital(1)

108

Properties

(Operating

Portfolio - 103)(2)

8.1M

Rentable Square

Feet - Operating

Portfolio(2)

19

U.S. States

$7.20

Q2 2023

Annualized

Dividend(3)

$76.5M

Q2 2023

Total Revenue

14.9 Years

Weighted

Average Lease

Length(4)

1 5 11

45

65

102

110 108

2016 2017 2018 2019 2020 2021 2022 6/30 |

| Innovative Industrial Properties 6

PORTFOLIO OVERVIEW

IIPR has a geographically diversified portfolio of properties throughout the United States

State Diversification(1)

PA MA IL MI CA NY FL OH NJ MD Other Total

16.1% 12.8% 12.8% 11.7% 8.7% 8.0% 7.0% 4.7% 4.4% 3.7% 10.1% 100%

Public vs. Private

(1)

58% Public 42% Private

Note: Data as of June 30, 2023, unless otherwise noted.

(1) As a % of Total Committed / Invested Capital. % based on the Total Portfolio for State Diversification. % based on leased Operating Portfolio, for all others. See footnote (1) on page 5.

(2) “MSO” stands for Multi-State Operator which means the tenant (or guarantor) conducts cannabis operations in more than one state. “SSO” stands for Single-State Operator which means the tenant (or guarantor) conducts cannabis operations in a single state.

(3) “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space.

Property Type

(1)

3%

Retail

91%

Industrial(3)

6%

Industrial

/ Retail

Operator Type

(1)(2)

89% MSO 11% SSO |

| Innovative Industrial Properties 7

TRACK RECORD OF GROWTH

AND PROFITABILITY

Note: Dollars in thousands.

(1) “Net Operating Income (NOI)” reported as total revenue less property expenses on the company’s consolidated statements of income.

(2) "CAGR" represents compound annualized growth rate for the relevant metric.

(3) “G&A” reported as “general and administrative expense” on the company’s consolidated statements of income.

(4) See the company’s applicable periodic reports filed with the SEC for definitions of funds from operations (“FFO”) and adjusted funds from operations ("AFFO") (each a supplemental non-GAAP financial measure) and reconciliation of FFO and AFFO to GAAP net income attributable to common stockholders.

$2,352 $9,727

$34,992

$98,078

$174,984

$233,748

2017 2018 2019 2020 2021 2022

Year Over Year AFFO(2)(4)

Year Over Year G&A as a % of NOI

(1)(3)

$5,610 $6,375 $9,818

$14,182

$22,961

$38,520

89.0%

44.4%

22.6%

12.7% 11.5% 14.5%

2017 2018 2019 2020 2021 2022

G&A

G&A % of NOI

Year Over Year FFO(2)(4)

$520 $8,262

$30,722

$92,403

$154,414

$210,736

2017 2018 2019 2020 2021 2022

Year Over Year Net Operating Income (NOI)(1)(2)

$6,302 $14,342

$43,352

$111,944

$200,108

$265,839

2017 2018 2019 2020 2021 2022 |

| Innovative Industrial Properties 8

2% 1%

(3%)

10% 9% 9%

3%

19%

48%

1-Year CAGR 3-Year CAGR 5-Year CAGR

REIT(2) S&P 500 IIPR

Common Stock Dividend Per Share(1)

4%

(6%)

(2%)

8%

21%

10%

1%

25%

53%

1-Year CAGR 3-Year CAGR 5-Year CAGR

REIT(2) S&P 500 IIPR (Diluted)

Net Income Attributable to Common Stockholders Per Share

(1)

COMPARATIVE

PERFORMANCE

(1) Per S&P Capital IQ Pro latest available data as of August 2, 2023. S&P Capital IQ Pro excludes outliers for each index. See footnote (2) on page 7.

(2) REIT index is made up of constituent data for the FTSE NAREIT U.S. Real Estate Index Series found on the National Association of Real Estate Investment Trusts (“NAREIT”) website, representing publicly traded REITs across the United States.

(3) Calculated as base rent and property management fees collected over contractual base rent and property management fees due for the period. Includes security deposits applied for the payment of rent. Q3 2022, Q4 2022 and Q1 2023 include approximately $2.2 million, $541,000 and $3.1 million, respectively, of

security deposits applied in connection with non-payment of rent. Q1 2023 also includes approximately $1.1 million of security deposits applied for payment of rent in connection with previously disclosed amendments with Holistic Industries, Inc. (“Holistic”) at a California property and a Michigan property, which are

subject to repayment over a future twelve-month period. Q2 2023 includes $1.5 million of security deposits applied for payment of rent in connection with the Holistic amendments and a previously disclosed amendment with Temescal Wellness of Massachusetts, LLC, all of which are subject to repayment over a

future twelve-month period.

$30.0M $73.3M $167.4M

$690.0M

$1.3B

$2.0B

$2.3B $2.4B

100% 100% 100% 100% 99% 100% 97% 98%

2016 2017 2018 2019 2020 2021 2022 6/30

Invested Capital

% Rent Collection

Historical Rent Collection (Operating Portfolio)(3) |

| Innovative Industrial Properties 9

IIP Portfolio First Quarter 2023(3) Tenant Information

Total

Invested Capital(1) Investment # of Adjusted Market MSO

# Tenant $ % Square Feet(2) / Square Feet Leases Revenue EBITDA(4) Capitalization(5) / SSO(6)

1 PharmaCann $321,172 13.5% 688 $467 11 Private Co. Private Co. Private Co. MSO

2 Ascend Wellness (AWH) 214,050 9.0% 624 343 4 $114 $23 $127 MSO

3 Green Thumb Industries 176,800 7.4% 664 266 3 249 76 1,806 MSO

4 Parallel 175,650 7.4% 832 211 3 Private Co. Private Co. Private Co. MSO

5 Curaleaf 175,047 7.3% 578 303 8 336 73 2,236 MSO

6 Columbia Care 147,834 6.2% 588 251 21 125 16 189 MSO

7 Trulieve 146,503 6.1% 740 198 6 289 78 730 MSO

8 Holistic Industries 121,900 5.1% 333 366 5 Private Co. Private Co. Private Co. MSO

9 Cresco Labs 120,845 5.1% 379 319 5 194 29 511 MSO

10 4Front Ventures(7) 119,150 5.0% 488 244 4 30 4 98 MSO

Top 10 Tenants Total $1,718,951 72.0% 5,914 $291 70

TOP TEN TENANTS

BY INVESTED CAPITAL

Note: Data as of June 30, 2023, unless otherwise noted.

(1) Dollars in thousands, see footnote (1) on page 5.

(2) Square feet in thousands.

(3) Dollars in millions, based on each company’s public securities filings and earnings release, available at www.sec.gov, www.sedar.com, or each company’s respective website, for the quarter ended March 31, 2023.

(4) Adjusted EBITDA is a non-GAAP financial measure utilized in the industry. For definitions and reconciliations of Adjusted EBITDA to net income, see each company’s public securities filings, available at www.sec.gov or www.sedar.com.

(5) Dollars in millions, per S&P Capital IQ Pro as of 6/30/2023.

(6) See footnote (2) on page 6.

(7) Includes one property acquired in January 2022 for $16.0 million which did not satisfy the requirements for sale-leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our consolidated balance sheet.

Top ten tenants represent ~72% of the company’s invested capital |

| Innovative Industrial Properties 10

Balance Sheet Statistics

$4.4 Million

$300.0 Million

2023 2024 2025 2026 2027 Thereafter

Exchangeable Senior Notes Notes Due 2026

BALANCE SHEET

HIGHLIGHTS

Debt Overview

Exchangeable Senior Notes:

• $4.4M of 3.75% exchangeable senior notes, maturing February 21, 2024

• Exchangeable for cash, common stock, or a combination (at IIP’s option)

Unsecured Senior Notes:

• Investment Grade Rating BBB+ from Egan Jones, since May 2021

• $300.0M of 5.50% unsecured senior notes due May 25, 2026

Capital Structure(2) Debt Maturity Profile

(3)

Note: As of June 30, 2023, unless otherwise noted.

(1) Calculated in accordance with the indenture governing the Notes due 2026, included in the Current Report on Form 8-K filed with the Securities and Exchange Commission on May 25, 2021.

(2) Share price per S&P Capital IQ Pro as of 6/30/2023.

(3) Principal amount shown as provided in the Company’s latest quarterly filing.

$0.0B

$0.3B

$0.6B

$0.9B

$1.2B

$1.5B

$1.8B

$2.1B

$2.0B in Common Equity

$15.0M in Preferred Equity

$304.4M in Gross Debt

12% Debt to

Total Gross

Assets(1)

>16x Debt

Service Coverage

Ratio(1)

No Material Debt

Maturities Until

2026

IIP Is One of the Lowest Leveraged Public REITs |

| Innovative Industrial Properties 11

LICENSING, ZONING, &

REGULATORY DYNAMICS

Establishing a Cultivation, Processing or Dispensary Facility is a

Multifaceted Process with Significant Hurdles

• A regulated cannabis operator must

obtain proper licensing from the

state for the facility

• Licensing driven by state specific

program requirements, including

limited licensing, costs and applicant

requirements for licensing,

identification of specific real estate

for license approval

• In many states, a highly competitive

process, with highly valued license

Licensing Zoning Regulatory

• Limited opportunities for locating

regulated cannabis facilities based

on zoning and permitting

requirements imposed at county and

city levels, including community

support

• Extensive negotiations with local

governments for permitting and

approvals

• Highly regulated at the state and

local levels, including extensive

security, fire protection, seed to sale

tracking, testing, and other

requirements

• Periodic inspections by local fire and

safety officials and cannabis

authorities to ensure compliance |

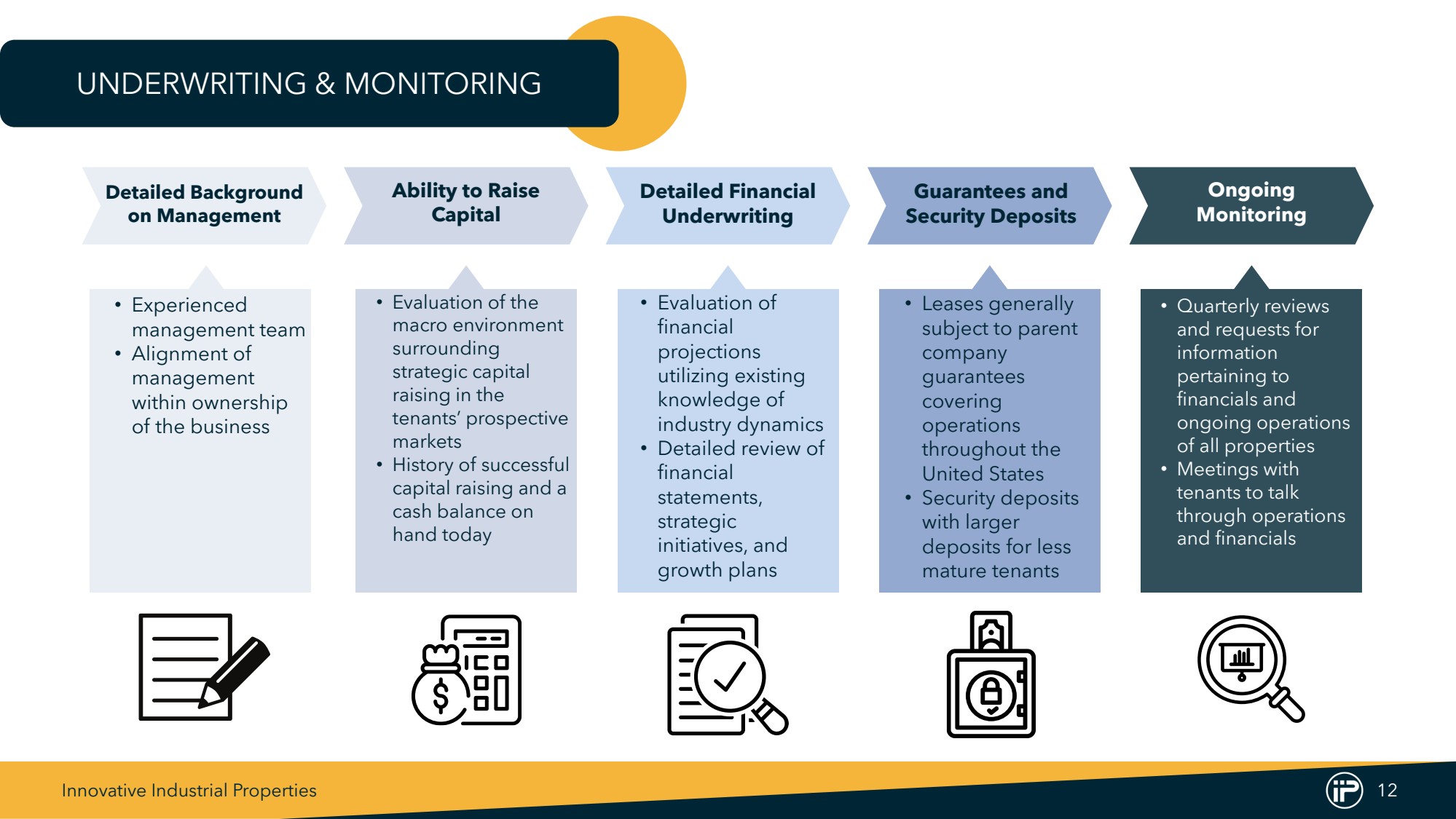

| Innovative Industrial Properties 12

UNDERWRITING & MONITORING

• Evaluation of

financial

projections

utilizing existing

knowledge of

industry dynamics

• Detailed review of

financial

statements,

strategic

initiatives, and

growth plans

• Experienced

management team

• Alignment of

management

within ownership

of the business

Detailed Background

on Management

Ability to Raise

Capital

Detailed Financial

Underwriting

Guarantees and

Security Deposits

Ongoing

Monitoring

• Quarterly reviews

and requests for

information

pertaining to

financials and

ongoing operations

of all properties

• Meetings with

tenants to talk

through operations

and financials

• Evaluation of the

macro environment

surrounding

strategic capital

raising in the

tenants’ prospective

markets

• History of successful

capital raising and a

cash balance on

hand today

• Leases generally

subject to parent

company

guarantees

covering

operations

throughout the

United States

• Security deposits

with larger

deposits for less

mature tenants |

| Innovative Industrial Properties 13

Grow Rooms:

• Mother room – houses the large plants with

genetics desired for the production plants

• Clone room – leaves from the mother plants are

used to propagate new plants

• Veg room – clone room plants are transferred to

the veg room, which may include tiered

benching for efficiency

• Flower room – veg room plants are transferred to

the flower room, which may also include tiering

for enhanced productivity

Flower rooms generally require the following:

• Temperature and humidity maintenance

• Grow lighting

• A growing medium or substrate

• Irrigation and fertigation control systems

• Carbon dioxide

• Mechanical ventilation

Other Key Infrastructure Considerations:

• Enhanced mechanical, electrical, and plumbing

infrastructure (“MEP”)

• Significant ceiling clearance

• Water recycling systems

• Emergency power systems

• On-site energy generation

Note: For illustrative purposes only; building infrastructure specifications can vary significantly from property to property.

INSIDE LOOK: CULTIVATION AND

PROCESSING FACILITY

Mother Room

Flower Room Fertigation Room

Extraction Room

Extraction Room Methods:

• Carbon dioxide extraction

• Ethanol extraction

• Hydrocarbon extraction

• Solventless extraction

Extraction Core Focus:

• Safety

• Workflow

• Scalability |

| Innovative Industrial Properties 14

$30B $35B $39B $44B

$51B

$57B

$62B

$67B

$71B

2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E

CANNABIS IS A LARGE

AND GROWING INDUSTRY

$30B

$35B

$40B $44B

$48B

$51B

$54B

$57B $58B

2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E

Long-Term Growth Outlook

for Cannabis

$71B

Est. Legal

Cannabis

Sales Growth

by 2030

representing a

11% CAGR(1)

68%

U.S.

Population of

States with an

IIP Presence(2)

+9%

Avg. 5 Yr. Est.

Cannabis

Sales CAGR

for IIP Property

Owned

States(3)

Est. Forecast Sales U.S. Potential Legal Cannabis

(1)

Est. Sales Forecast U.S. Current Legal Cannabis

(4)

(1) 2023 U.S. Cannabis Report, New Frontier Data, based on 9 states demonstrating strong likelihood to legalize adult use cannabis, and 9 states likely to legalize medical use prior to 2030 according to New Frontier Data.

(2) Per 2020 US Census Data.

(3) Per the 2023 MJBiz Factbook, 11th Edition. High-end sales estimates were used.

(4) 2023 U.S. Cannabis Report, New Frontier Data, based on existing states that have adopted adult use and/or medical use cannabis programs as of March 2023. |

| Innovative Industrial Properties 15

EXECUTIVE CHAIRMAN

& CO-FOUNDER

Alan Gold

Executive Chairman & Co-Founder

Co-founder of BioMed Realty Trust (formerly NYSE: BMR);

served as Chairman and CEO from inception of its predecessor

in 1998 through BMR’s sale in 2016

• Owner and operator of high-quality life science real estate

• Previously publicly traded investment grade REIT

Co-founded Alexandria Real Estate Equities (NYSE: ARE) in

1994 and served as President and a director until 1998

• Invests in office buildings and laboratories leased to

life science and technology companies

Executive Chairman of IQHQ, Inc.

• Privately-held life science real estate company with

properties in both the U.S. and U.K.

Alan Gold has experience starting real estate companies focused on nuanced, regulated industries. |

| Innovative Industrial Properties 16

SENIOR MANAGEMENT TEAM

David Smith

• 20+ years of finance and real

estate experience

• Former CFO of Aventine

Property Group, Inc.

CFO and Treasurer

• 35+ years of legal and

regulatory experience

• Previously co-founded Iso

Nano International, LLC

Paul Smithers

President, CEO and Co-Founder

Ben Regin

• 18+ years of real estate and

accounting experience

• Former Senior Associate,

Investments and Asset

Management at BioMed Realty

CIO

Catherine Hastings Ben Regin

• 20+ years of accounting and

real estate experience

• Former VP, Internal Audit of

BioMed Realty

COO

• Former VP, Corporate Legal of

BioMed Realty

• Former attorney at Latham &

Watkins LLP

Brian Wolfe

VP, GC, and Secretary

Andy Bui

• Former Senior Director,

Financial Reporting at BioMed

Realty

VP, Chief Accounting Officer

• 20+ years legal experience

representing real estate

matters

• Former attorney at Foley &

Lardner LLP

VP, Real Estate Counsel

Tracie Hager Kelly Spicher

• 30+ years of experience in

property management

• Former VP, Property

Management at BioMed Realty

VP, Asset Management |

Cover

|

Aug. 04, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 04, 2023

|

| Entity File Number |

001-37949

|

| Entity Registrant Name |

Innovative Industrial

Properties, Inc.

|

| Entity Central Index Key |

0001677576

|

| Entity Tax Identification Number |

81-2963381

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1389 Center

Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Park City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84098

|

| City Area Code |

858

|

| Local Phone Number |

997-3332

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IIPR

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

IIPR-PA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Innovative Industrial Pr... (NYSE:IIPR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Innovative Industrial Pr... (NYSE:IIPR)

Gráfica de Acción Histórica

De May 2023 a May 2024