0000063330

MAUI LAND & PINEAPPLE CO INC

false

--12-31

Q3

2024

0

1

0.6

15

99,999

http://fasb.org/us-gaap/2024#PrimeRateMember

0

0

0

3

10

1

10

266,666

10

15.75

6.02

6.00

400,000

10

1

0

false

false

false

false

00000633302024-01-012024-09-30

xbrli:shares

00000633302024-11-08

iso4217:USD

00000633302024-09-30

00000633302023-12-31

0000063330mlp:ExcludingDepositsMember2024-09-30

0000063330mlp:ExcludingDepositsMember2023-12-31

0000063330mlp:MemberDepositsMember2024-09-30

0000063330mlp:MemberDepositsMember2023-12-31

0000063330mlp:LandAndDevelopmentSalesMember2024-07-012024-09-30

0000063330mlp:LandAndDevelopmentSalesMember2023-07-012023-09-30

00000633302024-07-012024-09-30

00000633302023-07-012023-09-30

0000063330mlp:ResortAmenitiesAndOtherMember2024-07-012024-09-30

0000063330mlp:ResortAmenitiesAndOtherMember2023-07-012023-09-30

iso4217:USDxbrli:shares

0000063330mlp:LandAndDevelopmentSalesMember2024-01-012024-09-30

0000063330mlp:LandAndDevelopmentSalesMember2023-01-012023-09-30

00000633302023-01-012023-09-30

0000063330mlp:ResortAmenitiesAndOtherMember2024-01-012024-09-30

0000063330mlp:ResortAmenitiesAndOtherMember2023-01-012023-09-30

0000063330us-gaap:CommonStockMember2023-12-31

0000063330us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000063330us-gaap:RetainedEarningsMember2023-12-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0000063330us-gaap:CommonStockMember2024-01-012024-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-30

00000633302024-01-012024-06-30

0000063330us-gaap:RetainedEarningsMember2024-01-012024-06-30

0000063330us-gaap:CommonStockMember2024-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2024-06-30

0000063330us-gaap:RetainedEarningsMember2024-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

00000633302024-06-30

0000063330us-gaap:CommonStockMember2024-07-012024-09-30

0000063330us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-30

0000063330us-gaap:RetainedEarningsMember2024-07-012024-09-30

0000063330us-gaap:CommonStockMember2024-09-30

0000063330us-gaap:AdditionalPaidInCapitalMember2024-09-30

0000063330us-gaap:RetainedEarningsMember2024-09-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-30

0000063330us-gaap:CommonStockMember2022-12-31

0000063330us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000063330us-gaap:RetainedEarningsMember2022-12-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

00000633302022-12-31

0000063330us-gaap:CommonStockMember2023-01-012023-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-30

00000633302023-01-012023-06-30

0000063330us-gaap:RetainedEarningsMember2023-01-012023-06-30

0000063330us-gaap:CommonStockMember2023-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000063330us-gaap:RetainedEarningsMember2023-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

00000633302023-06-30

0000063330us-gaap:CommonStockMember2023-07-012023-09-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0000063330us-gaap:RetainedEarningsMember2023-07-012023-09-30

0000063330us-gaap:CommonStockMember2023-09-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-09-30

0000063330us-gaap:RetainedEarningsMember2023-09-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

00000633302023-09-30

00000633302022-06-18

0000063330us-gaap:LandMember2024-09-30

0000063330us-gaap:LandMember2023-12-31

0000063330us-gaap:LandImprovementsMember2024-09-30

0000063330us-gaap:LandImprovementsMember2023-12-31

0000063330us-gaap:BuildingMember2024-09-30

0000063330us-gaap:BuildingMember2023-12-31

0000063330us-gaap:MachineryAndEquipmentMember2024-09-30

0000063330us-gaap:MachineryAndEquipmentMember2023-12-31

0000063330us-gaap:ConstructionInProgressMember2024-09-30

0000063330us-gaap:ConstructionInProgressMember2023-12-31

utr:acre

0000063330us-gaap:LandMembermlp:WestMauiMember2024-09-30

0000063330us-gaap:LandMembermlp:WestMauiMember2024-01-012024-09-30

0000063330us-gaap:LandMembermlp:KapaluaResortMembermlp:WestMauiMember2024-09-30

0000063330us-gaap:LandMembermlp:UpcountryMauiMember2024-09-30

0000063330us-gaap:BuildingMembermlp:MauiMember2024-09-30

0000063330mlp:JointVentureAgreementWithBRE2LLCMember2023-12-31

0000063330mlp:JointVentureAgreementWithBRE2LLCMember2023-01-012023-12-31

0000063330mlp:JointVentureAgreementWithBRE2LLCMember2023-12-012023-12-31

0000063330mlp:JointVentureAgreementWithBRE2LLCMember2024-01-012024-09-30

utr:Y

0000063330mlp:ClubMembershipMember2024-10-012024-09-30

0000063330mlp:ClubMembershipMember2024-01-012024-09-30

0000063330mlp:ClubMembershipMember2023-01-012023-09-30

0000063330us-gaap:LicenseMember2020-03-31

0000063330us-gaap:LicenseMember2024-10-012024-09-30

0000063330us-gaap:LicenseMember2024-01-012024-09-30

0000063330us-gaap:LicenseMember2023-01-012023-09-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2024-09-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2024-09-302024-09-30

thunderdome:item

xbrli:pure

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2024-01-012024-09-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMembermlp:KapaluaResortMember2024-09-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2023-12-31

0000063330us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-09-30

0000063330us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-31

0000063330us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-09-30

0000063330us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-31

0000063330mlp:NoticeAndFindingOfViolationAndOrderMember2018-06-012018-06-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2024-07-012024-09-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2023-07-012023-09-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2024-01-012024-09-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2023-01-012023-09-30

0000063330us-gaap:RestrictedStockMember2024-01-012024-09-30

0000063330mlp:Year2023Membermlp:AnnualBoardServiceMember2023-01-012023-12-31

0000063330mlp:Year2023Membermlp:BoardCommitteeServiceMember2023-01-012023-12-31

0000063330mlp:Year2023Membersrt:ChiefExecutiveOfficerMember2023-01-012023-12-31

0000063330mlp:Year2023Membermlp:BoardCommitteeServiceMember2023-12-31

0000063330mlp:Year2023Membermlp:BoardCommitteeServiceMember2024-01-012024-09-30

0000063330mlp:Year2023Membermlp:BoardCommitteeServiceMember2024-09-30

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMember2023-01-012023-12-31

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-31

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-31

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-31

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMember2023-12-31

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMember2024-09-30

0000063330srt:ChiefExecutiveOfficerMember2024-01-012024-03-31

0000063330srt:ChiefExecutiveOfficerMember2024-01-012024-09-30

0000063330srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-30

0000063330srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-09-30

0000063330srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-09-30

0000063330srt:ChiefExecutiveOfficerMember2024-09-30

0000063330mlp:Year2024Membermlp:AnnualBoardServiceMember2024-07-012024-09-30

0000063330mlp:Year2024Membermlp:BoardCommitteeServiceMember2024-07-012024-09-30

0000063330mlp:Year2024Membermlp:BoardCommitteeServiceMember2024-01-012024-09-30

0000063330mlp:Year2024Membermlp:BoardCommitteeServiceMember2024-09-30

0000063330us-gaap:RestrictedStockMember2023-01-012023-09-30

0000063330us-gaap:EmployeeStockOptionMember2024-01-012024-09-30

0000063330us-gaap:EmployeeStockOptionMember2023-01-012023-09-30

0000063330us-gaap:RestrictedStockMember2024-07-012024-09-30

0000063330us-gaap:RestrictedStockMember2023-07-012023-09-30

0000063330us-gaap:EmployeeStockOptionMember2024-07-012024-09-30

0000063330us-gaap:EmployeeStockOptionMember2023-07-012023-09-30

0000063330mlp:The2017EquityAndIncentiveAwardPlanMember2024-08-05

0000063330mlp:The2023PlanMembermlp:ChairSellersMember2024-07-012024-07-31

0000063330us-gaap:RestrictedStockMembermlp:The2023PlanMembermlp:ChairSellersMember2024-07-012024-07-31

0000063330mlp:The2017EquityAndIncentiveAwardPlanMember2024-07-01

0000063330us-gaap:RestrictedStockMembermlp:The2024PlanMembermlp:CeoRandleMember2024-08-052024-08-05

0000063330mlp:The2017EquityAndIncentiveAwardPlanMember2024-07-31

0000063330mlp:The2023PlanMembermlp:DirectorCaseMember2024-08-052024-08-05

0000063330us-gaap:RestrictedStockMembermlp:The2023PlanMembermlp:DirectorCaseMember2024-08-052024-08-05

0000063330mlp:The2024PlanMembermlp:DirectorCaseMember2024-08-052024-08-05

0000063330us-gaap:RestrictedStockMembermlp:The2024PlanMembermlp:DirectorCaseMember2024-08-052024-08-05

0000063330us-gaap:RestrictedStockMembermlp:The2017EquityAndIncentiveAwardPlanMember2024-07-012024-09-30

0000063330us-gaap:RestrictedStockMembermlp:The2017EquityAndIncentiveAwardPlanMembermlp:DirectorCaseMember2024-07-012024-09-30

0000063330us-gaap:RestrictedStockMembermlp:The2017EquityAndIncentiveAwardPlanMembermlp:CeoRandleMember2024-07-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LandDevelopmentAndSalesSegmentMember2024-07-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LandDevelopmentAndSalesSegmentMember2023-07-012023-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LandDevelopmentAndSalesSegmentMember2024-01-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LandDevelopmentAndSalesSegmentMember2023-01-012023-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2024-07-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2023-07-012023-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2024-01-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2023-01-012023-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2024-07-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2023-07-012023-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2024-01-012024-09-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2023-01-012023-09-30

0000063330us-gaap:OperatingSegmentsMember2024-07-012024-09-30

0000063330us-gaap:OperatingSegmentsMember2023-07-012023-09-30

0000063330us-gaap:OperatingSegmentsMember2024-01-012024-09-30

0000063330us-gaap:OperatingSegmentsMember2023-01-012023-09-30

0000063330mlp:StewardshipAndConservationEffortsSubsidizedByTheStateOfHawaiiAndTheCountyOfMauiMembermlp:LandInHonokeanaMemberus-gaap:SubsequentEventMember2024-10-22

0000063330mlp:MauiMemberus-gaap:SubsequentEventMember2024-10-22

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-06510

MAUI LAND & PINEAPPLE COMPANY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 99-0107542 |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

500 Office Road, Lahaina, Maui, Hawaii 96761

(Address of principal executive offices) (Zip Code)

(808) 877-3351

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | MLP | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | | Outstanding at November 8, 2024 |

| Common Stock, $0.0001 par value | | 19,631,630 shares |

MAUI LAND & PINEAPPLE COMPANY, INC.

AND SUBSIDIARIES

TABLE OF CONTENTS

| Cautionary Note Regarding Forward-Looking Statements |

3 |

| |

|

| PART I. FINANCIAL INFORMATION |

5 |

| |

|

| Item 1. Condensed Consolidated Interim Financial Statements (unaudited) |

5 |

| |

|

| Condensed Consolidated Balance Sheets, September 30, 2024 and December 31, 2023 (audited) |

5 |

| |

|

| Condensed Consolidated Statements of Operations and Comprehensive Loss, Three Months Ended September 30, 2024 and 2023 |

6 |

| |

|

| Condensed Consolidated Statements of Operations and Comprehensive Loss, Nine Months Ended September 30, 2024 and 2023 |

7 |

| |

|

| Condensed Consolidated Statements of Changes in Stockholders’ Equity, Three and Nine Months Ended September 30, 2024 and 2023 |

8 |

| |

|

| Condensed Consolidated Statements of Cash Flows, Nine Months Ended September 30, 2024 and 2023 |

9 |

| |

|

| Notes to Condensed Consolidated Interim Financial Statements |

10 |

| |

|

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

| |

|

| Item 3. Quantitative and Qualitative Disclosures About Market Risk |

25 |

| |

|

| Item 4. Controls and Procedures |

25 |

| |

|

| PART II. OTHER INFORMATION |

25 |

| |

|

| Item 1. Legal Proceedings |

25 |

| |

|

| Item 1A. Risk Factors |

26 |

| |

|

| Item 6. Exhibits |

27 |

| |

|

| Signature |

28 |

| |

|

| EXHIBIT INDEX |

|

| |

|

| Exhibit 10.1 |

|

| Exhibit 31.1 |

|

| Exhibit 31.2 |

|

| Exhibit 32.1 |

|

| Exhibit 32.2 |

|

| Exhibit 101 |

|

| Exhibit 104 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “Quarterly Report”) and other reports filed by us with the U.S. Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements include all statements included in or incorporated by reference to this Quarterly Report that are not statements of historical facts, which can generally be identified by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “project,” “pursue,” “will,” “would,” or the negative or other variations thereof or comparable terminology. We caution you that the foregoing list may not include all of the forward-looking statements made in this Quarterly Report. Actual results could differ materially from those projected in forward-looking statements as a result of the following factors, among others:

| |

• |

the occurrence of natural disasters such as the Maui wildfires that occurred on August 8, 2023, changes in weather conditions, or threats of the spread of contagious diseases; |

| |

• |

concentration of credit risk on deposits held at banks in excess of the Federal Deposit Insurance Corporation (the “FDIC”) insured limits and in receivables due from our commercial leasing portfolio; |

| |

• |

unstable macroeconomic market conditions, including, but not limited to, energy costs, credit markets, interest rates, inflationary pressures, and changes in income and asset values; |

| |

• |

risks associated with real estate investments, including demand for real estate and tourism in Hawaii and Maui; |

| |

• |

security incidents through cyber-attacks or intrusions on our information systems; |

| |

• |

our ability to complete land development projects within forecasted time and budget expectations; |

| |

• |

our ability to obtain required land use entitlements at reasonable costs; |

| |

• |

our ability to compete with other developers of real estate on Maui; |

| |

• |

potential liabilities and obligations under various federal, state, and local environmental regulations; |

| |

• |

our ability to cover catastrophic losses in excess of insurance coverages; |

| |

• |

unauthorized use of our trademarks could negatively impact our business; |

| |

• |

our ability to maintain the listing of our common stock on the New York Stock Exchange; |

| |

• |

our ability to comply with funding requirements of our retirement plans; |

| |

• |

our ability to comply with the terms of our indebtedness, including financial covenants, and to extend maturity dates, or refinance such indebtedness, prior to its maturity date; |

| |

• |

availability of capital on terms favorable to us, and our ability to raise capital through the sale of certain real estate assets, or at all; and |

| |

• |

changes in U.S. accounting standards adversely impacting us. |

Such risks and uncertainties also include those risks and uncertainties discussed in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”) and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Quarterly Report, as well as other factors described from time to time in our reports filed with the SEC. Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable as of the date of this Quarterly Report, we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially from the views and expectations set forth in this Quarterly Report. Thus, you should not place undue reliance on any forward-looking statements. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Further, any forward-looking statements speak only as of the date made and, except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Quarterly Report. We qualify all of our forward-looking statements by these cautionary statements.

PART I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Interim Financial Statements (unaudited)

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, 2024 | | | December 31, 2023 | |

| | | (unaudited) | | | (audited) | |

| | | (in thousands except share data) | |

| ASSETS | | | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 6,138 | | | $ | 5,700 | |

| Accounts receivable, net | | | 1,534 | | | | 1,166 | |

| Investments, current portion | | | 2,982 | | | | 2,671 | |

| Prepaid expenses and other assets | | | 795 | | | | 467 | |

| Total current assets | | | 11,449 | | | | 10,004 | |

| | | | | | | | | |

| PROPERTY & EQUIPMENT, NET | | | 17,061 | | | | 16,059 | |

| | | | | | | | | |

| OTHER ASSETS | | | | | | | | |

| Investments, noncurrent | | | 119 | | | | 464 | |

| Investment in joint venture | | | 1,627 | | | | 1,608 | |

| Deferred development costs | | | 13,917 | | | | 12,815 | |

| Other noncurrent assets | | | 1,743 | | | | 1,273 | |

| Total other assets | | | 17,406 | | | | 16,160 | |

| TOTAL ASSETS | | $ | 45,916 | | | $ | 42,223 | |

| | | | | | | | | |

| LIABILITIES & STOCKHOLDERS' EQUITY | | | | | | | | |

| LIABILITIES | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 2,293 | | | $ | 1,154 | |

| Payroll and employee benefits | | | 631 | | | | 502 | |

| Accrued retirement benefits, current portion | | | 142 | | | | 142 | |

| Deferred revenue, current portion | | | 307 | | | | 217 | |

| Long-term debt, current portion | | | 85 | | | | - | |

| Other current liabilities | | | 548 | | | | 465 | |

| Total current liabilities | | | 4,006 | | | | 2,480 | |

| | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Accrued retirement benefits, noncurrent portion | | | 1,485 | | | | 1,550 | |

| Deferred revenue, noncurrent portion | | | 1,267 | | | | 1,367 | |

| Deposits | | | 1,952 | | | | 2,108 | |

| Line of credit | | | 3,000 | | | | - | |

| Long-term debt, noncurrent portion | | | 189 | | | | - | |

| Other noncurrent liabilities | | | 27 | | | | 14 | |

| Total long-term liabilities | | | 7,920 | | | | 5,039 | |

| TOTAL LIABILITIES | | | 11,926 | | | | 7,519 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Preferred stock--$0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding | | | - | | | | - | |

| Common stock--$0.0001 par value; 43,000,000 shares authorized; 19,657,407 and 19,615,350 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | | 85,758 | | | | 84,680 | |

| Additional paid-in-capital | | | 14,026 | | | | 10,538 | |

| Accumulated deficit | | | (59,101 | ) | | | (53,617 | ) |

| Accumulated other comprehensive loss | | | (6,693 | ) | | | (6,897 | ) |

| Total stockholders' equity | | | 33,990 | | | | 34,704 | |

| TOTAL LIABILITIES & STOCKHOLDERS' EQUITY | | $ | 45,916 | | | $ | 42,223 | |

See Notes to Condensed Consolidated Interim Financial Statements

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | | Three Months Ended

September 30, | |

| | | 2024 | | | 2023 | |

| | | (in thousands except per share amounts) | |

| OPERATING REVENUES | | | | | | | | |

| Land development and sales | | $ | - | | | $ | - | |

| Leasing | | | 2,729 | | | | 1,931 | |

| Resort amenities and other | | | 299 | | | | 170 | |

| Total operating revenues | | | 3,028 | | | | 2,101 | |

| | | | | | | | | |

| OPERATING COSTS AND EXPENSES | | | | | | | | |

| Land development and sales | | | 237 | | | | 108 | |

| Leasing | | | 1,333 | | | | 1,151 | |

| Resort amenities and other | | | 251 | | | | 201 | |

| General and administrative | | | 1,158 | | | | 938 | |

| Share-based compensation | | | 2,094 | | | | 700 | |

| Depreciation | | | 187 | | | | 192 | |

| Total operating costs and expenses | | | 5,260 | | | | 3,290 | |

| | | | | | | | | |

| OPERATING LOSS | | | (2,232 | ) | | | (1,189 | ) |

| | | | | | | | | |

| Other income | | | 75 | | | | 120 | |

| Pension and other post-retirement expenses | | | (78 | ) | | | (121 | ) |

| Interest expense | | | (2 | ) | | | (2 | ) |

| NET LOSS | | $ | (2,237 | ) | | $ | (1,192 | ) |

| Other comprehensive income - pension, net | | | 68 | | | | 83 | |

| | | | | | | | | |

| TOTAL COMPREHENSIVE LOSS | | $ | (2,169 | ) | | $ | (1,109 | ) |

| | | | | | | | | |

| NET LOSS PER COMMON SHARE-BASIC AND DILUTED | | $ | (0.11 | ) | | $ | (0.06 | ) |

See Notes to Condensed Consolidated Interim Financial Statements

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | | Nine Months Ended

September 30, | |

| | | 2024 | | | 2023 | |

| | | (in thousands except | |

| | | per share amounts) | |

| OPERATING REVENUES | | | | | | | | |

| Land development and sales | | $ | 200 | | | $ | 19 | |

| Leasing | | | 7,148 | | | | 6,249 | |

| Resort amenities and other | | | 805 | | | | 604 | |

| Total operating revenues | | | 8,153 | | | | 6,872 | |

| | | | | | | | | |

| OPERATING COSTS AND EXPENSES | | | | | | | | |

| Land development and sales | | | 687 | | | | 526 | |

| Leasing | | | 3,447 | | | | 2,984 | |

| Resort amenities and other | | | 992 | | | | 1,113 | |

| General and administrative | | | 3,336 | | | | 2,996 | |

| Share-based compensation | | | 4,676 | | | | 2,472 | |

| Depreciation | | | 531 | | | | 683 | |

| Total operating costs and expenses | | | 13,669 | | | | 10,774 | |

| | | | | | | | | |

| OPERATING LOSS | | | (5,516 | ) | | | (3,902 | ) |

| | | | | | | | | |

| Other income | | | 271 | | | | 598 | |

| Pension and other post-retirement expenses | | | (234 | ) | | | (364 | ) |

| Interest expense | | | (5 | ) | | | (5 | ) |

| NET LOSS | | $ | (5,484 | ) | | $ | (3,673 | ) |

| Other comprehensive income - pension, net | | | 204 | | | | 247 | |

| | | | | | | | | |

| TOTAL COMPREHENSIVE LOSS | | $ | (5,280 | ) | | $ | (3,426 | ) |

| | | | | | | | | |

| NET LOSS PER COMMON SHARE-BASIC | | $ | (0.28 | ) | | $ | (0.19 | ) |

| NET LOSS PER COMMON SHARE-DILUTED | | $ | (0.27 | ) | | $ | (0.19 | ) |

See Notes to Condensed Consolidated Interim Financial Statements

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Three and Nine Months Ended September 30, 2024 and 2023

(UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | |

| | | | | | | | | | | Additional | | | | | | | Other | | | | | |

| | | Common Stock | | | Paid in | | | Accumulated | | | Comprehensive | | | | | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Loss | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2023 (audited) | | | 19,615 | | | $ | 84,680 | | | $ | 10,538 | | | $ | (53,617 | ) | | $ | (6,897 | ) | | $ | 34,704 | |

| Share-based compensation | | | 18 | | | | 411 | | | | 2,293 | | | | | | | | | | | | 2,704 | |

| Vested restricted stock issued | | | 21 | | | | 356 | | | | (356 | ) | | | | | | | | | | | - | |

| Shares cancelled to pay tax liability | | | (4 | ) | | | (78 | ) | | | | | | | | | | | | | | | (78 | ) |

| Other comprehensive income - pension | | | | | | | | | | | | | | | | | | | 136 | | | | 136 | |

| Net loss | | | | | | | | | | | | | | | (3,247 | ) | | | | | | | (3,247 | ) |

| Balance, June 30, 2024 | | | 19,650 | | | $ | 85,369 | | | $ | 12,475 | | | $ | (56,864 | ) | | $ | (6,761 | ) | | $ | 34,219 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based compensation | | | | | | | | | | | 1,320 | | | | | | | | | | | | 1,320 | |

| Restricted stock and options cancellation | | | | | | | 258 | | | | 372 | | | | | | | | | | | | 630 | |

| Vested restricted stock issued | | | 7 | | | | 141 | | | | (141 | ) | | | | | | | | | | | - | |

| Shares cancelled to pay tax liability | | | | | | | (10 | ) | | | | | | | | | | | | | | | (10 | ) |

| Other comprehensive income - pension | | | | | | | | | | | | | | | | | | | 68 | | | | 68 | |

| Net loss | | | | | | | | | | | | | | | (2,237 | ) | | | | | | | (2,237 | ) |

| Balance, September 30, 2024 | | | 19,657 | | | $ | 85,758 | | | $ | 14,026 | | | $ | (59,101 | ) | | $ | (6,693 | ) | | $ | 33,990 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2022 (audited) | | | 19,477 | | | $ | 83,392 | | | $ | 9,184 | | | $ | (50,537 | ) | | $ | (8,267 | ) | | $ | 33,772 | |

| Share-based compensation | | | 67 | | | | 620 | | | | 1,429 | | | | | | | | | | | | 2,049 | |

| Vested restricted stock issued | | | 96 | | | | 956 | | | | (956 | ) | | | | | | | | | | | - | |

| Shares cancelled to pay tax liability | | | (50 | ) | | | (547 | ) | | | | | | | | | | | | | | | (547 | ) |

| Other comprehensive income - pension | | | | | | | | | | | | | | | | | | | 164 | | | | 164 | |

| Net loss | | | | | | | | | | | | | | | (2,481 | ) | | | | | | | (2,481 | ) |

| Balance, June 30, 2023 | | | 19,590 | | | $ | 84,421 | | | $ | 9,657 | | | $ | (53,018 | ) | | $ | (8,103 | ) | | $ | 32,957 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based compensation | | | | | | | | | | | 611 | | | | | | | | | | | | 611 | |

| Vested restricted stock issued | | | 16 | | | | 170 | | | | (170 | ) | | | | | | | | | | | - | |

| Shares cancelled to pay tax liability | | | (1 | ) | | | (21 | ) | | | | | | | | | | | | | | | (21 | ) |

| Other comprehensive income - pension | | | | | | | | | | | | | | | | | | | 83 | | | | 83 | |

| Net loss | | | | | | | | | | | | | | | (1,192 | ) | | | | | | | (1,192 | ) |

| Balance, September 30, 2023 | | | 19,605 | | | $ | 84,570 | | | $ | 10,098 | | | $ | (54,210 | ) | | $ | (8,020 | ) | | $ | 32,438 | |

See Notes to Condensed Consolidated Interim Financial Statements.

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | Nine Months Ended

September 30, | |

| | | 2024 | | | 2023 | |

| | | (in thousands) | |

| | | | | | | | | |

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | | $ | 147 | | | $ | (197 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Payments for property and deferred development costs | | | (2,635 | ) | | | (872 | ) |

| Contributions to investment in joint venture | | | (19 | ) | | | - | |

| Purchases of debt securities | | | (3,155 | ) | | | (2,424 | ) |

| Maturities of debt securities | | | 3,189 | | | | 2,323 | |

| NET CASH USED IN INVESTING ACTIVITIES | | | (2,620 | ) | | | (973 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Borrowing under line of credit | | | 3,000 | | | | - | |

| Debt and common stock issuance costs and other | | | (89 | ) | | | (568 | ) |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | | | 2,911 | | | | (568 | ) |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 438 | | | | (1,738 | ) |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | | 5,700 | | | | 8,509 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 6,138 | | | $ | 6,771 | |

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES:

| | ● | Common stock issued under the Company’s 2017 Equity and Incentive Award Plan was $1.1 million and $1.2 million for the nine months ended September 30, 2024 and 2023, respectively. |

See Notes to Condensed Consolidated Interim Financial Statements.

9

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS (UNAUDITED)

For the Three and Nine Months Ended September 30, 2024 and 2023

The accompanying unaudited condensed consolidated interim financial statements have been prepared by Maui Land & Pineapple Company, Inc. (together with its subsidiaries, the “Company”) in conformity with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information that are consistent in all material respects with those applied in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), and pursuant to the instructions to Form 10-Q and Article 8 of Regulation S-X of the U.S. Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and notes to the annual audited consolidated financial statements required by GAAP for complete financial statements. In the opinion of management, the accompanying unaudited condensed consolidated interim financial statements contain all normal and recurring adjustments necessary to fairly present the Company’s consolidated financial position, results of operations and cash flows for the interim periods ended September 30, 2024 and 2023. The unaudited condensed consolidated interim financial statements and notes should be read in conjunction with the annual audited consolidated financial statements and notes thereto included in the Annual Report.

Maui Land & Pineapple Company, Inc. is a Delaware corporation and the successor to a business organized in 1909 as a Hawai‘i corporation. The Company reincorporated from Hawaii to Delaware pursuant to a plan of conversion completed on July 18, 2022. Total authorized capital stock of the Company includes 48,000,000 shares, consisting of 43,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, par value $0.0001 per share. Shares of the Company’s common stock are listed on the New York Stock Exchange (“NYSE”) under the ticker symbol “MLP.”

| 2. | CASH AND CASH EQUIVALENTS |

Cash and cash equivalents include cash on hand, deposits in banks, and money market funds.

| 3. | INVESTMENTS IN DEBT SECURITIES |

Held-to-maturity debt securities are stated at amortized cost. Investments are reviewed for impairment for each reporting period. If any impairment is considered other-than-temporary, an allowance for credit loss would be established and held-to-maturity debt securities will be presented net of the credit loss allowance. Adjustments to expected credit losses are recorded as a component of other income (expense).

Amortized cost and fair value of corporate debt securities at September 30, 2024 and December 31, 2023 consisted of the following:

| | | September 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | (unaudited) | | | (audited) | |

| | | (in thousands) | |

| Amortized cost | | $ | 3,101 | | | $ | 3,135 | |

| Unrealized gains | | | 9 | | | | 4 | |

| Fair value | | $ | 3,110 | | | $ | 3,139 | |

10

Maturities of debt securities at September 30, 2024 and December 31, 2023 were as follows:

| | | September 30, 2024 (unaudited) | | | December 31, 2023 (audited) | |

| | | | | | | |

| | | (in thousands) | |

| | | Amortized Cost | | | Fair Value | | | Amortized Cost | | | Fair Value | |

| One year or less | | $ | 2,982 | | | $ | 2,988 | | | $ | 2,671 | | | $ | 2,671 | |

| Greater than one year through five years | | | 119 | | | | 122 | | | | 464 | | | | 468 | |

| Fair value | | $ | 3,101 | | | $ | 3,110 | | | $ | 3,135 | | | $ | 3,139 | |

The fair value of debt securities was measured using Level 2 inputs, which are based on quotes for trades occurring in active markets for identical assets.

Property and equipment, net at September 30, 2024 and December 31, 2023 consisted of the following:

| | | September 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | (unaudited) | | | (audited) | |

| | | (in thousands) | |

| Land | | $ | 5,052 | | | $ | 5,052 | |

| Land improvements | | | 13,861 | | | | 13,853 | |

| Buildings | | | 23,105 | | | | 22,869 | |

| Machinery and equipment | | | 10,960 | | | | 10,500 | |

| Construction in progress | | | 829 | | | | - | |

| Total property and equipment | | | 53,807 | | | | 52,274 | |

| Less accumulated depreciation | | | (36,746 | ) | | | (36,215 | ) |

| Property and equipment, net | | $ | 17,061 | | | $ | 16,059 | |

Land

The Company holds approximately 22,400 acres of land. Most of this land was acquired between 1911 and 1932 and is carried in the Company’s balance sheets at cost. More than 20,900 acres are located in West Maui and are comprised of largely contiguous parcels which extend from the ocean to an elevation of approximately 5,700 feet. The West Maui landholdings include approximately 1,000 acres within Kapalua Resort, a master-planned, destination resort and residential community. Approximately 1,400 acres are located in Upcountry Maui in an area commonly known as Hali‘imaile and is mainly comprised of leased agricultural fields, commercial and light industrial properties.

Land Improvements

Land improvements are primarily comprised of roads, utilities, and landscaping infrastructure improvements at the Kapalua Resort. Also included are the Company’s potable and non-potable water systems in West Maui. A majority of the Company’s land improvements were either constructed and placed in service in the mid-to-late 1970s or conveyed in 2017. Depreciation expense would be considerably higher if these assets were stated at current replacement cost.

11

Buildings

The Company holds approximately 247,000 square feet of leasable area on Maui. The buildings are comprised of restaurant, retail, and light industrial spaces located at the Kapalua Resort and in Haliimaile. A majority of the Company’s buildings were constructed and placed in service in the mid-to-late 1970s. Depreciation expense would be considerably higher if these assets were stated at current replacement cost.

Machinery and Equipment

Machinery and equipment are mainly comprised of zipline course equipment installed at the Kapalua Resort in 2008 and used in the Company’s leasing operations.

Construction in Progress

Construction in progress is comprised of ongoing Kapalua Resort and Haliimaile projects, including renovations and improvements to buildings, warehouses and commercial assets.

| 5. | INVESTMENT IN JOINT VENTURE |

In December 2023, the Company entered into a joint venture agreement with a local developer to form a Hawaii limited liability company ("BRE2 LLC"). The Company's initial capital contribution to BRE2 LLC consisted of approximately 30 acres of former pineapple lands in Hali‘imaile valued at $1.6 million. There were no proceeds from the transaction as the land was an equity contribution to the joint venture and was recognized as land development and sales operating revenues. However, after reevaluating the accounting treatment of the transaction, it was determined that the $1.6 million should have been presented as a nonoperating gain on the derecognition of the land rather than operating revenue. The Company does not consider the misclassification to be material and intends on restating the gain in the Company’s Annual Report on Form 10-K for fiscal year 2024, anticipated to be filed in March 2025. During the nine months ended September 30, 2024, the Company expensed $19,000 on behalf of BRE2 LLC which was recorded as an additional capital contribution to BRE2 LLC. According to terms of the Operating Agreement for BRE2 LLC, net proceeds from the sales of improved agricultural lots will be distributed when the funds are available for distribution. Although the Company holds a majority of the equity of BRE2 LLC, the Company does not control BRE2 LLC, and as a result, BRE2 LLC is presented in the Company’s financial statements using the equity method of accounting.

| 6. | CONTRACT ASSETS AND LIABILITIES |

Receivables from contracts with customers were $0.5 million and $0.4 million at September 30, 2024 and December 31, 2023, respectively.

Deferred club membership revenue

The Company operates the Kapalua Club, a private, non-equity club program providing members special programs, access and other privileges to certain of the amenities within the Kapalua Resort. Deferred revenues from membership dues received from the Kapalua Club are recognized on a straight-line basis over one year. Revenue recognized for each of the nine months ended September 30, 2024 and 2023 was $0.6 million.

Deferred license fee revenue

Effective April 1, 2020, the Company entered into a trademark license agreement (the “Agreement”) with Kapalua Golf (the “Licensee”), the owner of Kapalua Plantation and Bay golf courses. Under the terms and conditions set forth in the Agreement, the Licensee is granted a perpetual, terminable on default, transferable, non-exclusive license to use the Company’s trademarks and service marks to promote its golf courses and to sell its licensed products. The Company received a single royalty payment of $2.0 million in March 2020. Revenue recognized on a straight-line basis over its estimated economic useful life of 15 years was $99,999 for each of the nine months ended September 30, 2024 and 2023.

Long-term debt is comprised of amounts outstanding under the Company’s $15.0 million revolving line of credit facility (“Credit Facility”) with First Hawaiian Bank (“Bank”) maturing on December 31, 2025. At September 30, 2024, $12.0 million was available from our Credit Facility, as the Company borrowed $3,000,000 during the three months ended September 30, 2024. The Credit Facility provides options for revolving or term loan borrowing. Interest on loan borrowing is based on the Bank’s prime rate minus 1.125 percentage points. Interest on term loan borrowing may be fixed at the Bank’s commercial loan rates using an interest rate swap option. The Company has pledged approximately 30,000 square feet of commercial leased space in the Kapalua Resort as security for the Credit Facility. Net proceeds from the sale of any collateral are required to be repaid toward outstanding borrowings and will permanently reduce the Credit Facility’s revolving commitment amount. There are no commitment fees on the unused portion of the Credit Facility.

The terms of the Credit Facility include various representations, warranties, affirmative, negative and financial covenants and events of default customary for financings of this type. Financial covenants include a minimum liquidity (as defined) of $2.0 million, a maximum of $45.0 million in total liabilities, and a limitation of new indebtedness on collateralized properties without the prior written consent of the Bank.

The outstanding balance of the Credit Facility was $3,000,000 at September 30, 2024 and zero at December 31, 2023. The Company was in compliance with Credit Facility at September 30, 2024.

| 8. | ACCRUED RETIREMENT BENEFITS |

Accrued retirement benefits at September 30, 2024 and December 31, 2023 consisted of the following:

| | | September 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | (unaudited) | | | (audited) | |

| | | (in thousands) | |

| | | | | | | | | |

| Defined benefit pension plan | | $ | (63 | ) | | $ | (33 | ) |

| Non-qualified retirement plans | | | 1,690 | | | | 1,725 | |

| Total | | | 1,627 | | | | 1,692 | |

| Less current portion | | | (142 | ) | | | (142 | ) |

| Non-current portion of accrued retirement benefits | | $ | 1,485 | | | $ | 1,550 | |

The Company has a defined benefit pension plan (the “Defined Plan”), which covers many of its former bargaining unit employees and an unfunded non-qualified retirement plan (the “Non-qualified Plan”) covering nine former non-bargaining unit management employees and former executives. In 2009, the Non-qualified Plan was frozen, and in 2011, the pension benefits under the Defined Plan were frozen. All future vesting of additional benefits were discontinued effective in 2009 for the Non-qualified Plan and in 2011 for the Defined Plan. The Board of Directors (the “Board”) approved the termination of the Defined Plan and the Non-qualified Plan in 2023.

The net periodic benefit costs for pension and post-retirement benefits for the three and nine months ended September 30, 2024 and 2023 were as follows:

| | | Three Months Ended September 30, (unaudited) | | | Nine Months Ended September 30, (unaudited) | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | (in thousands) | | | (in thousands) | |

| | | | | | | | | | | | | | | | | |

| Interest cost | | $ | 184 | | | $ | 203 | | | $ | 552 | | | $ | 608 | |

| Expected return on plan assets | | | (174 | ) | | | (165 | ) | | | (522 | ) | | | (491 | ) |

| Amortization of net loss | | | 68 | | | | 83 | | | | 204 | | | | 247 | |

| Pension and other postretirement expenses | | $ | 78 | | | $ | 121 | | | $ | 234 | | | $ | 364 | |

No contributions are required to be made to the Defined Plan in 2024.

| 9. | COMMITMENTS AND CONTINGENCIES |

On December 31, 2018, the State of Hawaii Department of Health (“DOH”) issued a Notice and Finding of Violation and Order (“Order”) for alleged wastewater effluent violations related to the Company’s Upcountry Maui wastewater treatment facility. The facility was built in the 1960s to serve approximately 200 single-family homes developed for workers in the Company’s former agricultural operations. The facility is comprised of two 1.5-acre wastewater stabilization ponds and surrounding disposal leach fields. The Order includes, among other requirements, payment of a $230,000 administrative penalty and development of a new wastewater treatment plant, which become final and binding unless a hearing is requested to contest the alleged violations and penalties.

13

The construction of additional leach fields and installation of a surface aerator, sludge removal system, and natural pond cover using water plants were completed in 2023. Test results from wastewater monitoring indicate effluent concentration amounts within allowable ranges. A feasibility study was prepared for and submitted to the Company on January 15, 2024, identifying various technical solutions that could be implemented to resolve the Order. The DOH agreed to defer the Order on February 15, 2024, as the Company continues to work to resolve and remediate the facility’s wastewater effluent issues through an approved corrective action plan. The Company submitted a plan (the Plan) and proposed solution to resolve the Order on March 14, 2024. The Plan included the installation of an additional pond that will be lined and installed with aerators. One of the existing ponds will be lined and renovated as necessary and the other pond will be taken offline and used as a backup pond if needed. The Company continues to work with the DOH to coordinate the timing and approval of the Plan to implement the technical solution to resolve the Order. Meetings continue to be scheduled to provide status updates and progress being made towards resolution.

In addition, from time to time, the Company is the subject of various other claims, complaints and other legal actions which arise in the normal and ordinary course of the Company’s business activities. The Company believes the resolution of these other matters, in the aggregate, is not likely to have a material adverse effect on the Company’s consolidated financial position or operations.

The Company leases land primarily to agriculture operators and leases space in commercial buildings primarily to restaurant and retail tenants with terms continuing through 2048. These operating leases generally provide for minimum rents for commercial properties and land assets and, in some cases, licensing fees for use of trade names, percentage rentals based on tenant revenues, and reimbursement of common area maintenance and other expenses. Certain leases allow the lessee an option to extend or terminate the agreement. There are no leases allowing a lessee an option to purchase the underlying asset. Leasing income subject to Accounting Standards Codification Topic 842 for the three and nine months ended September 30, 2024 and 2023 were as follows:

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | (unaudited) | | | (unaudited) | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | (in thousands) | | | (in thousands) | |

| | | | | | | | | | | | | | | | | |

| Minimum rentals | | $ | 1,083 | | | $ | 849 | | | $ | 3,105 | | | $ | 2,493 | |

| Percentage rentals | | | 734 | | | | 233 | | | | 1,783 | | | | 1,263 | |

| Licensing fees | | | 67 | | | | 188 | | | | 136 | | | | 706 | |

| Other | | | 374 | | | | 349 | | | | 725 | | | | 916 | |

| Total | | $ | 2,258 | | | $ | 1,619 | | | $ | 5,749 | | | $ | 5,378 | |

| 11. | SHARE-BASED COMPENSATION |

The Company’s directors and certain members of management receive a portion of their compensation in shares of the Company’s common stock granted under the Company’s 2017 Equity and Incentive Award Plan, as amended (the “Equity Plan”).

Share-based compensation is awarded annually to certain members of the Company’s management based on their achievement of predefined performance goals and objectives under the Equity Plan. Their share-based compensation is comprised of an annual incentive paid in shares of common stock and a long-term incentive paid in restricted shares of common stock vesting quarterly over a period of three years. Share-based compensation is valued based on the average of the high and low share price on the date of grant. Shares are issued upon execution of agreements reflecting the grantee’s acceptance of the respective shares subject to the terms and conditions of the Equity Plan. Restricted shares issued under the Equity Plan have voting and regular dividend rights but cannot be disposed of until such time as they are vested. All unvested restricted shares are forfeited upon the grantee’s termination of directorship or employment from the Company.

Directors receive both cash and share-based compensation under the Equity Plan. Their share-based compensation is comprised of restricted shares of common stock vesting quarterly over the directors’ annual period of service which are valued based on the average of the high and low share price on the date of grant. Shares are issued upon execution of agreements reflecting the grantee’s acceptance of the respective shares subject to the terms and conditions of the Equity Plan. Restricted shares issued under the Equity Plan have voting and regular dividend rights but cannot be disposed of until such time as they are vested. All unvested restricted shares are forfeited upon the grantee’s termination of directorship or employment from the Company.

Options to purchase shares of the Company’s common stock under the Equity Plan were granted to directors and the Chief Executive Officer in 2024 and 2023. Stock option grants are valued at the commitment date, based on the fair value of the equity instruments, and recognized as share-based compensation expense on a straight-line basis over its respective vesting periods. The option agreements provide for accelerated vesting if there is a change in control in ownership.

The number of common shares subject to options granted in 2023 for annual board service, board committee service, and continued service of the Chairman of the Board are 250,000 shares, 78,000 shares, and 400,000, respectively. For annual board service and board committee service, the stock options granted have a contractual period of ten years and vest quarterly over one year. The exercise price per share was based on the average of the high and low share price on the date of grant, or $12.11 per share. The fair value of these grants using the Black-Scholes option-pricing model was $3.88 per share based on an expected term of 5.25 years, expected volatility of 28%, and a risk-free rate of 4.16%. During the nine months ended September 30, 2024, 215,334 shares underlying the stock options granted to directors in 2023 for annual board and committee service vested. No shares underlying the 2023 stock option grants to directors remain unvested.

For continued board service of the Chairman, the stock option grant has a contractual period of ten years which vests as follows: 133,334 shares on June 1, 2024, 133,333 shares on June 1, 2025, and 133,333 shares on June 1, 2026. The exercise price per share was based on the average of the high and low share price on the date of grant, or $9.08 per share. The fair value of these grants using the Black-Scholes option-pricing model was $3.94 per share based on an expected term of 6.12 years, expected volatility of 37%, and a risk-free rate of 3.49%. There were 266,666 of unvested share options, or $0.8 million of unrecognized compensation cost, at September 30, 2024.

An option to purchase 400,000 shares of the Company’s common stock under the Equity Plan was granted to the Chief Executive Officer during the three months ended March 31, 2024. The stock option grant has a contractual period of ten years and vests annually as follows: 133,334 shares on January 1, 2025, 133,333 shares on January 1, 2026, and 133,333 shares on January 1, 2027. The exercise price per share was based on the average of the high and low share price on the date of grant, or $15.75 per share. The stock option grant is valued at the commitment date, based on the fair value, and recognized as share-based compensation expense on a straight-line basis over its vesting period beginning in January 2024. The fair value of the grant using the Black-Scholes option-pricing model was $6.02 per share at January 1, 2024 based on an expected term of 6.00 years, expected volatility of 31%, and a risk-free rate of 3.82%. There were 400,000 shares of unvested share options, or $1.8 million of unrecognized compensation cost at September 30, 2024.

The number of common shares subject to options granted in 2024 for annual board service and board committee service were 312,500 and 87,000, respectively. These option grants have a contractual period of ten years and vest quarterly over one year. The exercise price per share was based on the average of the high and low share price on the date of grant, or $22.25 per share. The fair value of these grants using the Black-Scholes option-pricing model was $8.87 per share based on an expected term of 5.25 years, expected volatility of 32.1%, and a risk-free rate of 4.40%. During the nine months ended September 30, 2024, 206,750 shares of stock options granted to directors in 2024 for annual board and committee service vested. There were 192,750 shares of unvested share options, or $1.7 million of unrecognized compensation cost at September 30, 2024.

The simplified method described in Staff Accounting Bulletin No. 107 was used by management due to the lack of historical option exercise behavior. The Company does not currently issue dividends. There were no forfeitures of stock option grants as of September 30, 2024. Management does not anticipate future forfeitures to be material.

Share-based compensation expenses totaled $4.7 million and $2.5 million for the nine months ended September 30, 2024 and 2023, respectively. Included in these amounts were $1.6 million and $0.7 million of restricted common stock vested during the nine months ended September 30, 2024 and 2023, respectively, and $3.1 million and $1.4 million of stock options vested during the nine months ended September 30, 2024 and 2023, respectively. Share-based compensation expense totaled $2.1 million and $0.7 million for the three months ended September 30, 2024 and 2023, respectively. Included in these amounts were $0.9 million and $0.1 million of restricted common stock vested during the three months ended September 30, 2024 and 2023, respectively, and $1.2 million and $0.6 million of stock options vested during the three months ended September 30, 2024 and 2023, respectively.

On August 5, 2024, R. Scot Sellers, a director and Chairman of the Board, Stephen M. Case, a director, and Race A. Randle, Chief Executive Officer, voluntarily executed agreements to cancel previously granted stock options and common stock grants. The Equity Plan was amended in February 2023 to increase the limit on the number of shares to be awarded during a plan year to 400,000 shares. In 2023, Mr. Sellers received options to purchase 63,500 shares and 18,804 shares of common stock that exceeded the 400,000 share limit. In February 2024, Mr. Randle received 28,511 shares of common stock that exceeded the 400,000 share limit. In addition, although grants to Mr. Case did not exceed the Equity Plan limit, he voluntarily opted to cancel the common stock grants and options issued to him in 2023 amounting to 6,659 shares and 56,000 shares, respectively, and options and restricted shares issued in 2024 amounting to 3,124 shares and 56,000 shares, respectively. The cancellation of the options and common stock grants resulted in recognizing the remaining unvested awards of options and common stock grants immediately. In the third quarter of 2024, $631,000 was recognized as expense due to the cancellations, $402,000 due to the cancellation of Mr. Case’s options and common stock grants and $229,000 due to the cancellation of Mr. Randle’s common stock grants.

The Company uses a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken on a tax return. The Company’s provision for income taxes is calculated using the liability method. Deferred income taxes are provided for all temporary differences between the consolidated financial statements and income tax bases of assets and liabilities using tax rates enacted by law or regulation. A full valuation allowance was established for deferred income tax assets at September 30, 2024, and December 31, 2023, respectively.

Basic net loss per common share is computed by dividing net loss by the weighted-average number of common shares outstanding. Diluted net loss per common share is computed similar to basic net loss per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the dilutive potential common shares had been issued. Potentially dilutive shares arise from non-vested restricted stock and non-qualified stock options granted under the Equity Plan. The treasury stock method is applied to determine the number of potentially dilutive shares.

Basic and diluted weighted-average shares outstanding were 19.7 million and 20.0 million for the three months ended September 30, 2024, respectively. Basic and diluted weighted-average shares were 19.6 million and 20.4 million for the nine months ended September 30, 2024, respectively.

| 14. | REPORTABLE OPERATING SEGMENTS |

The Company’s reportable operating segments are comprised of the discrete business units whose operating results are regularly reviewed by the Chief Executive Officer – its chief operating decision maker – in assessing performance and determining the allocation of resources and by the Board. Reportable operating segments are as follows:

| | • | Land development and sales, which includes the planning, entitlement, development, and sale of real estate inventory; |

| | • | Leasing, which includes revenues and expenses from real property leasing activities, license fees and royalties for the use of certain of the Company’s trademarks and brand names by third parties, and the cost of maintaining the Company’s real estate assets, including watershed conservation activities. The operating segment also includes the revenues and expenses from the management of ditch, reservoir and well systems that provide non-potable irrigation water to West and Upcountry Maui areas; and |

| | • | Resort amenities, which includes the Kapalua Club, which provides certain benefits and privileges within the Kapalua Resort for its members. |

The Company’s reportable operating segment results are measured based on operating income (loss), exclusive of interest, depreciation, general and administrative expenses, and share-based compensation.

The reportable segment data is presented as follows:

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | (unaudited) | | | (unaudited) | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | (in thousands) | | | (in thousands) | |

| Operating Segment Revenues | | | | | | | | | | | | | | | | |

| Land development and sales | | $ | - | | | $ | - | | | $ | 200 | | | $ | 19 | |

| Leasing | | | 2,729 | | | | 1,931 | | | | 7,148 | | | | 6,249 | |

| Resort amenities and other | | | 299 | | | | 170 | | | | 805 | | | | 604 | |

| Total Operating Segment Revenues | | $ | 3,028 | | | $ | 2,101 | | | $ | 8,153 | | | $ | 6,872 | |

| Operating Segment Income | | | | | | | | | | | | | | | | |

| Land development and sales | | $ | (237 | ) | | $ | (108 | ) | | $ | (487 | ) | | $ | (507 | ) |

| Leasing | | | 1,396 | | | | 780 | | | | 3,701 | | | | 3,265 | |

| Resort amenities and other | | | 48 | | | | (31 | ) | | | (187 | ) | | | (509 | ) |

| Total Operating Segment Income | | $ | 1,207 | | | $ | 641 | | | $ | 3,027 | | | $ | 2,249 | |

| 15. | FAIR VALUE MEASUREMENTS |

GAAP establishes a framework for measuring fair value and requires certain disclosures about fair value measurements to enable the reader of the unaudited condensed consolidated interim financial statements to assess the inputs used to develop those measurements by establishing a hierarchy for ranking the quality and reliability of the information used to determine fair values. GAAP requires that financial assets and liabilities be classified and disclosed in one of the following three categories:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs that are not corroborated by market data.

The Company considers all cash on hand to be unrestricted cash for the purposes of the unaudited condensed consolidated balance sheets and unaudited condensed consolidated statements of cash flows. The fair value of receivables and payables approximate their carrying value due to the short-term nature of the instruments. The method used to determine the valuation of stock options granted to directors during the three and nine months ended September 30, 2024 is described in Note 11.

| 16. | RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS |

The Company's significant accounting policies are described in Note 1 in Item 8 of the Annual Report. There have been no changes to the Company’s significant accounting policies during the nine months ended September 30, 2024. Previous changes to the Company's significant accounting policies are included herein.

In November 2023, the FASB issued ASU No. 2023-07 (“ASU 2023-07”), Segment Reporting (ASC Topic 280): Improvements to Reportable Segment Disclosures to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. In addition, the amendments in the ASU enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, provide new segment disclosure requirements for entities with a single reportable segment, and contain other disclosure requirements. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and requires retrospective application to all prior periods presented in the financial statements. Early adoption is permitted. The Company is currently evaluating the impact of this accounting standard update on its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU No. 2023-09 (“ASU 2023-09”), Income Taxes (ASC Topic 740): Improvement to Income Tax Disclosures to enhance the transparency and decision usefulness of income tax disclosures, primarily related to the rate reconciliation and income taxes paid information. ASU 2023-09 is effective for annual periods beginning after December 15, 2024, on a prospective basis. Early adoption is permitted. The Company is currently evaluating the impact of this accounting standard update on its consolidated financial statements and related disclosures.

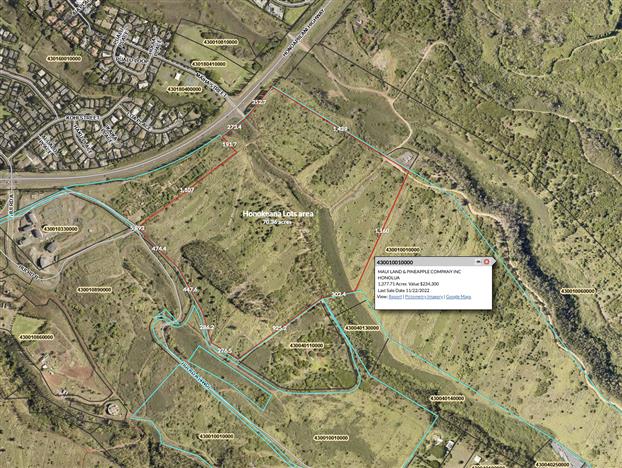

On October 22, 2024 the Company entered into a Memorandum of Agreement (the “Honokeana Agreement”) with the State of Hawai‘i Department of Transportation (“State”) to lease land and administer and manage the construction of improvements necessary to support temporary homes for individuals and families displaced by the Maui wildfires on August 8, 2023.

In furtherance of the Company’s stated mission to productively use its assets to meet the community’s critical needs, MLP agreed to lease approximately 50 acres of vacant land to the State in an area known as Honokeana, near Napili in Lahaina, Maui. The land will be leased to the State at no cost for five years, plus the duration of time necessary to construct the temporary homes. The land is a portion of a larger, 1,377-acre parcel owned by the Company.

The Honokeana Agreement provides the State will fund all costs to complete the project, including approximately $35,500,000 to complete the necessary horizontal improvements. The Company has agreed to administer and manage the construction of the horizontal improvements and, at the State’s election, the subsequent vertical improvements, at cost of which have yet to be estimated. The Company will provide its administration services to the State at its cost and will not directly profit from these services. After the end of the lease, the State will remove any vertical improvements unless MLP requests that specific improvements remain.

| Item 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our unaudited condensed consolidated interim financial condition and results of operations should be read in conjunction with our annual audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Annual Report") and the unaudited condensed consolidated interim financial statements and related notes included in this Quarterly Report on Form 10-Q (this “Quarterly Report”). The following discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those expressed or implied by the forward-looking statements below. Factors that could cause or contribute to those differences in our actual results include, but are not limited to, those discussed below and those discussed elsewhere within this Quarterly Report, particularly in the section entitled “Cautionary Note Regarding Forward-Looking Statements.” Depending upon the context, the terms the “Company,” “we,” “our,” and “us,” refer to either Maui Land & Pineapple Company, Inc. alone, or to Maui Land & Pineapple Company, Inc. and its subsidiaries collectively.

Overview

Maui Land & Pineapple Company, Inc. is a Delaware corporation and the successor to a business organized in 1909 as a Hawaii corporation. The Company reincorporated from Hawaii to Delaware pursuant to a plan of conversion completed on July 18, 2022. Total authorized capital stock of the Company includes 48,000,000 shares, consisting of 43,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, par value $0.0001 per share. Shares of the Company’s common stock are listed on the New York Stock Exchange under the ticker symbol “MLP.” The Company consists of a landholding and operating parent company, has a principal subsidiary, Kapalua Land Company, Ltd., and certain other subsidiaries

We own and manage a diverse portfolio including over 22,400 acres of land on the island of Maui, Hawaii along with 247,000 square feet of commercial real estate. For over a century, we have built a legacy of authentic innovation through conservation, agriculture, community building and land management. Our current portfolio of assets includes unimproved land, entitled land allowing for various residential and mixed-use construction, and completed commercial properties.

In April 2023, a leadership transition was initiated by appointing a new Chief Executive Officer and new Chairman of the Board, both of whom are experienced in large scale real estate portfolio management including master planning, community building, and asset management. The strengthening of our team has continued through September 2024 with the addition of team members with localized experience including planning, engineering, permitting, community development, land and natural resource stewardship, and asset management.

To continue our over 100-year legacy, we are driven by a renewed mission to strategically maximize the use of our assets, resulting in added value to the Company and improved quality of life on Maui for future generations.

As a key initiative of the new leadership team, we have advanced efforts to maximize the productivity of our leasable land and commercial properties. At September 30, 2024, our commercial properties and land were occupied at the following levels:

| Region |

Commercial Property |

|

Approx. Land Area (Acres) |

|

Current Uses |

Improvements in Process |

|

Approx. Leasable Area (sf) |

|

|

Leased Area at 9/30/24 |

|

|

Leased Area at 12/31/23 |

|

|

Variance |

|

| West Maui |

Kapalua Resort Commercial |

|

|

14 |

|

Resort mixed-use |

Asset mgmt. |

|

|

72,169 |

|

|

|

64,753 |

|

|

|

59,143 |

|

|

|

5,610 |

|

| West Maui |

Alaeloa Business Center |

|

|

14 |

|

Agriculture Mixed-use |

Asset mgmt. |

|

|

40,050 |

|

|

|

39,150 |

|

|

|

17,080 |

|

|

|

22,070 |

|

| Upcountry |

Hali‘imaile Village Commercial |

|

|

18 |

|

Light industrial, Commercial, |

Asset mgmt. |

|

|

135,109 |

|

|

|

108,234 |

|

|

|

101,553 |

|

|

|

6,681 |

|

| Total Commercial Property Land Area |

|

|

46 |

|

|

Total (sf) |

|

|

247,328 |

|

|

|

212,137 |

|

|

|

177,776 |

|

|

|

34,361 |

|

| |

|

|

|

|

|

|

|

|

Occupancy |

|

|

|

86% |

|

|

|

72% |

|

|

|

14% |

|

Year to date, the team has increased commercial property occupancy from 72% to 86%, including tenant relocations and improvements necessary to enhance the variety and quality of experiences in our town centers. This effort will continue, along with capital improvements necessary to continue attracting top tier tenants. In addition to stable cashflow in a supply-constrained market, our commercial properties allow us to perform value-creating placemaking for our surrounding landholdings. We anticipate cashflow from our commercial properties to increase in the coming years, as we reach stabilization and fund the near-term costs for tenant improvements and leasing costs inherent with new tenancies.

To enable the productive use of land for homes, businesses, farms, resort projects, or otherwise, we generally must make improvements to the land. These improvements take the form of master planning, entitlements and zoning, subdivision into useful lot sizes, and the addition of infrastructure, enabling it to be placed into productive use. In 2024 we completed portfolio-wide strategic plans across all 22,400 acres to prioritize and guide actions of the Company in the forthcoming quarters.

Our strategic plan for land utilization aligns with our mission to meet the current and future needs of the community, in a significantly supply-constrained market. The plan identified four categories of improved and unimproved land actions as follows in the table below.

| Category |

Region |

Property |

|

Approximate Land Area (Acres) |

|

Current Land Use/ Zoning |

Improvements in process |

# of Lots or Units |

| 1. Improved Land - Remnant and non-strategic parcels planned for sale |

West Maui |

Five Miscellaneous Non-strategic properties |

|

|

67 |

|

Miscellaneous |

N/A - Complete |

5 parcels |

| Upcountry |

Three Miscellaneous. Non-strategic properties |

|

|

24 |

|

Miscellaneous |

N/A - Complete |

3 parcels |

| 2. Improved Land - Property in active marketing for sale and/or development with partner(s) |

Upcountry |

Baldwin Ranch Phase 2 |

|

|

31 |

|

Agriculture |

N/A – By potential development partner |

3 parcels |

| West Maui |

Kapalua Resort - Makai |

|

|

37 |

|

Resort mixed-use |

Planning |

TBD |

| West Maui |

Kapalua Resort - Central |

|

|

46 |

|

Resort mixed-use |

Planning, Permitting |

TBD |

| 3. Unimproved Land - Property in active planning and improvements |

West Maui |

Honokeana Homes - State Temporary Housing |

|

|

50 |

|

Agriculture |

Design, permitting |

Up to 200 lots |

| West Maui |

Kapalua Resort - Mauka |

|

|

927 |

|

Resort Residential |

Planning |

Up to 639 lots |

| West Maui |

Kapalua area Agricultural Land |

|

|

915 |

|

Agriculture |

Planning |

TBD |

| West Maui |

Honokeana area Agricultural Land |

|

|

1,566 |

|

Agriculture |

Planning |

TBD |

| Upcountry |