UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities

Exchange Act of 1934

| For the month of |

October |

|

2024 |

| |

|

|

|

| Commission File Number |

001-41722 |

|

|

| METALS

ACQUISITION LIMITED |

| (Translation of registrant’s

name into English) |

| |

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive

offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Incorporation By Reference

This Report on Form 6-K, including all exhibits hereto, shall

be deemed to be incorporated by reference into the registration statement on Form F-3 (Registration No. 333-276216) of Metals

Acquisition Limited (including any prospectuses forming a part of such registration statement) and to be a part thereof from the date

on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| | METALS

ACQUISITION LIMITED |

| | (Registrant) |

| Date: |

October 21, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: Michael James McMullen |

| |

|

|

|

Title: Chief Executive Officer |

Exhibit 99.1

21 October 2024

SEPTEMBER 2024 QUARTERLY REPORT

STRONG QUARTERLY

PRODUCTION AND LOWER CASH COST

ST. HELIER, Jersey - (BUSINESS WIRE) - Metals

Acquisition Limited (NYSE: MTAL; ASX:MAC)

Metals Acquisition Limited ARBN 671 963 198 (NYSE:

MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC” or the “Company”)

is pleased to release its September 2024 quarterly activities report (“Q3 2024” or “September quarter”).

HIGHLIGHTS

TRIFR

of 14.2 a slight decrease in TRIFR quarter on quarter with further remediation strategies

implemented.

Strong and consistent quarterly copper production

with lower cash cost

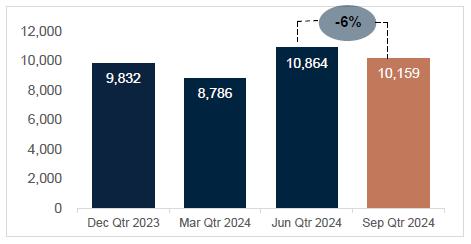

| · | Copper production of 10,159 tonnes at the CSA

Copper Mine (“CSA” or “CSA Mine”) is the second strongest copper production under MAC’s ownership

following on from the record June quarter |

| · | Copper production for 2024 tracking to mid-point

of annual guidance at 40,500 tonnes of copper |

| · | Double lift stope strategy implemented in the

June quarter driving high grade consistent copper production, delivering 21,023 tonnes of copper production for the June and

September quarters at an average grade of 4.1% Cu from the benefit of lower dilution than reserve assumptions |

| · | Q4 2024 mine plan targeting another record December quarterly

copper production |

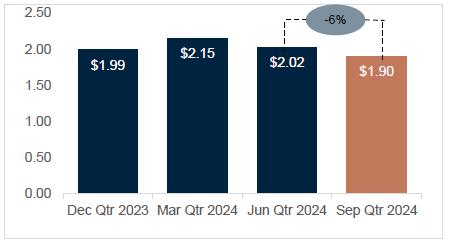

| · | C1 of US$1.90/lb1

improved by ~6% compared to the June quarter, driven by a reduction in milling costs, treatment and refining charges and an increase

in development costs capitalised |

Key copper growth projects expected to drive

25% increase in annual production by 2026

| · | MAC aiming to be a +50ktpa Copper producer by

2026 |

| · | Ventilation project – work well underway

on development drives to first major raise bore ventilation locations with procurement strategies advancing and completion targeted by

mid-2026 |

| · | QTS South Upper – procurement of equipment

and manning requirements commenced with planning taking place to start development in Q4 2024 and ore mining expected to commence from

Q3 2025 |

| · | Polymetals (“POL”) announced

that it secured financing to fund its mine restart in H1 2025 – the value of MAC’s investment in POL has increased by ~21%

since its initial investment. MAC has the right to invest a further A$2.5 million at A$35c a share when POL is fully funded for restart

of operations |

Generating material

operational free cash flow

| · | Operational

free cash flow of ~US$30 million2 for the quarter with an average realised copper sales

price of US$4.18/lb3 (Q3 2024 Copper spot average at US$4.17/lb) |

| · | Cash and cash equivalents of ~US$81 million after

repayment of ~US$8 million in senior debt principal and US$2.1 million of exploration and expenditure |

| · | MAC

also had ~US$9.0 million of receivable outstanding Quotational Period receipts, ~US$6.4 million of unsold concentrate and a strategic

investment in POL valued at ~A$2.94 million as at 30 September 2024 |

1 See “Non-IFRS financial information” and

refer to Table 2 for reconciliation of C1 Cash Cost

2 See “Non-IFRS financial information”

3 Realised provisional sales price excluding hedging impact

4 Valued at close of trading on ASX on 14 October 2024

A$150 million (~US$103 million) equity raise

completed subsequent to quarter end

| · | Raised

gross proceeds of ~A$150 million (~US$103 million)5 at an issue price of A$18.00 per

New CDI |

| · | Placement was well supported with support from

new and existing institutional and sophisticated investors |

| · | Proceeds will enable MAC to retire the high-cost

Mezzanine debt facility while also providing additional flexibility to pursue strategic inorganic growth opportunities |

| · | Pro-forma

liquidity as at 30 September 2024 of ~US$226 million6 |

ESG

Safety

The TRIFR for the CSA Copper Mine decreased from

an average of 14.4 in Q2 2024 to 14.2 in Q3 2024. This is below the NSW underground metalliferous TRIFR average for 2022 of 15.5. Although

a decrease quarter on quarter, Q3 2024 has not been favourable for safety performance with one LTI recorded for the period. Plans have

been initiated in the prior quarter to remediate the increase in TRIFR as compared to 2023 via increased awareness with extensive training

and coaching, as well as increased safety presence on site. Increased leadership field safety interactions have been a core focus of Q3

2024.

Figure 1 - CSA Copper Mine Recordable Injuries

by Quarter

Regulatory

The CSA Mine Rehabilitation Objectives Statement,

Final Landform and Rehabilitation Plan, the Annual Rehabilitation Report and the CSA Mine Forward Program have all been approved by the

NSW Resources Regulator. Planning for the CSA Annual Plan is underway and due for submission by April 2025.

The Environment Protection Authority annual return

was submitted during the quarter with no reportable incidents, pollution events, or licence breaches recorded during the reporting period,

demonstrating our clear commitment to managing environmental performance, and an owner operator mentality in a small community setting.

5 Placement proceeds converted into US$ based on an A$:US$

exchange rate of 0.6869, which represents the average exchange rate for the week from 30 September 2024 to 4 October 2024 (inclusive)

6

Includes equity raised of ~US103 million gross proceeds of ~A$150 million (~US$103 million) at an issue price of A$18.00

per New CDI as announced on 9 October 2024

Production and cost summary

Table 1 – Production and cost summary

(unaudited)

| |

Units |

Q4

2023 |

Q1

2024 |

Q2

2024 |

Q3

2024 |

QoQ

Change (%) |

| Copper

Production |

Tonnes |

9,832 |

8,786 |

10,864 |

10,159 |

(6.5%) |

| Sustaining capital |

US$ million |

$10.0 |

$13.0 |

$12.8 |

$12.5 |

(2.0%) |

| Cash

cost (C1)7 |

US$/lb |

$1.99 |

$2.15 |

$2.028 |

$1.90 |

(6.1%) |

| Total

cash cost9 |

US$/lb |

$2.73 |

$3.17 |

$2.72 |

$2.71 |

(0.4%) |

| Group

Net Debt10 |

US$ million |

$260 |

$253 |

$232 |

$232 |

0% |

Metals Acquisition Limited’s CEO, Mick

McMullen, said:

“Following

a record June quarter, our CSA Copper Mine operational team delivered another strong and consistent September quarter in line

with our mine plan, reaching copper production of 10,159 tonnes, while improving safety performance. This marks another

milestone as we produced 21,023 tonnes of copper for the last two quarters. Based on the reserve plan, we expect copper production to

increase over the remaining quarter of the year.

Higher grade stopes at the CSA Copper Mine

continue to form a large proportion of our annual production and played a key role again during the quarter, with milled copper grade

achieved of 4.0%.

MAC successfully completed an equity raise,

totalling approximately A$150 million or approximately US$103 million of gross proceeds. The oversubscribed placement was supported by

the new and existing institutional and sophisticated investors both in Australia and offshore. This broad support is a testament to the

high-quality nature of the CSA Copper Mine and the significant work that has been undertaken by management to deliver on a range of operational

improvements over the past year.

Proceeds of the Placement, together with existing

cash, will enable MAC to optimise its balance sheet, while also providing additional flexibility to pursue strategic inorganic growth

opportunities. We thank all shareholders for their continued support.

We have also commenced two key capital projects

to grow our copper production by a further 25% by 2026 to over 50,000 tonnes of copper production per annum; our growth projects include

the expansion of the mine to include QTS South Upper and the Ventilation project, which are brought online Q3 2025 and mid-2026 respectively.

Finally, we are proposing a special resolution

at the AGM to change the company name to MAC Copper Limited. The change of the company name better reflects the business activities of

the Company as we continue toward being the next high quality copper miner of scale.”

7 See “Non-IFRS Information” and refer to Table

2 for reconciliation of C1 Cash Cost.

8 Q2 2024 adjusted post finalisation of half year accounts

with additional freight and TCRCs included accrued for recognition of June pre-sales

9 Excludes corporate costs from parent entity. See “Non-IFRS

financial information” and refer to Table 2 for reconciliation of Total Cash Cost

10 Senior Debt + Mezzanine Facility – Cash and cash

equivalents (excluding streams)

Operations

Table 2 - Quarterly Operational Performance

of the CSA Copper Mine (unaudited)

|

CSA Copper Mine Metrics

(unaudited) |

Units |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

QoQ %

variance |

| U/g development - Capital |

Metres |

841 |

466 |

449 |

735 |

64% |

| U/g development - Operating |

Metres |

448 |

703 |

611 |

359 |

(41%) |

| Rehab |

Metres |

153 |

246 |

113 |

145 |

28% |

| Total development |

Metres |

1,441 |

1,415 |

1,173 |

1,239 |

6% |

| Ore Mined |

Tonnes |

268,685 |

256,031 |

271,469 |

238,937 |

(12%) |

| Tonnes Milled |

Tonnes |

266,105 |

260,297 |

266,936 |

260,953 |

(2%) |

| Copper grade processed |

% |

3.8% |

3.5% |

4.2% |

4.0% |

(5%) |

| Copper Recovery |

% |

97.6% |

97.6% |

97.9% |

97.2% |

(1%) |

| Copper Produced |

Tonnes |

9,832 |

8,786 |

10,864 |

10,159 |

(6%) |

| Silver Produced |

Ounces |

114,969 |

102,182 |

134,072 |

112,299 |

(16%) |

| Copper Sold |

Tonnes |

8,819 |

8,112 |

12,984 |

10,244 |

(21%) |

| Achieved

Copper price11 |

US$/lb |

3.85 |

3.87 |

4.41 |

4.18 |

(12%) |

| Mining Cost |

US$/t Mined |

$75.5 |

$95.7 |

$91.9 |

$85.9 |

(7%) |

| Processing Cost |

US$/t Milled |

$25.5 |

$25.7 |

$31.9 |

$26.3 |

(18%) |

| G+A Cost |

US$/t Milled |

$29.6 |

$33.1 |

$25.6 |

$27.5 |

7% |

| Total Operating Cost |

US$/t milled |

$130.6 |

$154.6 |

$149.3 |

$139.6 |

(6%) |

| Development Cost |

US$/metre |

$9,667 |

$15,478 |

$9,330 |

$12,825 |

37% |

| Capital

Expenditure12 |

US$ million |

$10.0 |

$13.0 |

$12.8 |

$12.5 |

(2%) |

| Tonnes Milled per employee |

t/employee |

189 |

184 |

186 |

174 |

(6%) |

| Mining |

US$/lb prod |

0.94 |

1.27 |

1.04 |

0.92 |

(12%) |

| Processing |

US$/lb prod |

0.31 |

0.35 |

0.36 |

0.31 |

(14%) |

| General and Admin |

US$/lb prod |

0.36 |

0.44 |

0.28 |

0.32 |

12% |

| Treatment and refining |

US$/lb prod |

0.36 |

0.17 |

0.26 |

0.23 |

(11%) |

| Work in Progress inventory |

US$/lb prod |

(0.01) |

(0.14) |

0.03 |

0.02 |

(34%) |

| Freight and other costs |

US$/lb prod |

0.17 |

0.17 |

0.21 |

0.24 |

18% |

| Silver Credits |

US$/lb prod |

(0.14) |

(0.10) |

(0.16) |

(0.14) |

(12%) |

| C1 Cash Cost |

US$/lb prod |

1.99 |

2.15 |

2.0213 |

1.90 |

(6%) |

| Leases |

US$/lb prod |

0.07 |

0.08 |

0.07 |

0.07 |

8% |

| Inventory WIP |

US$/lb prod |

0.01 |

0.14 |

(0.03) |

(0.02) |

(34%) |

| Royalties |

US$/lb prod |

0.20 |

0.13 |

0.13 |

0.20 |

52% |

| Sustaining capital |

US$/lb prod |

0.46 |

0.67 |

0.53 |

0.56 |

5% |

| Total Cash Cost |

US$/lb prod |

2.73 |

3.17 |

2.72 |

2.71 |

0% |

| Total Revenue |

US$ millions |

88.3 |

66.0 |

120.0 |

87.5 |

(27%) |

Unless stated otherwise all references to dollar

or $ are in USD.

11 Realised provisional sales price excluding hedging impact

12 Sustainable capex

13 Q2 2024 adjusted post finalisation of half year accounts

with additional freight and TCRCs included accrued for recognition of June pre-sales

The September quarter demonstrated consistent

mining processes that delivered above 10kt of copper production for two consecutive quarters. Production further benefited from a grade

of 4.0% for the quarter with August copper grade recorded at 4.36%. The grade achieved continues to demonstrate the high-quality

ore body present at CSA mine.

The double lift extraction sequence was again

successfully deployed during Q3 2024 after being implemented in the previous quarter, resulting in less mining dilution achieved with

stronger grades and less total ore tonnes for the same metal.

Figure 2 - CSA Copper Mine Quarterly Copper

Production (tonnes)

The average received copper price before hedge

settlements was lower when comparing to the prior period with the June quarter at US$4.18/lb, down ~5% compared to US$4.41/lb for

the June quarter, with the average spot copper price over the September quarter at ~US$4.17/lb14.

In addition, the Australian dollar exchange rate

was broadly flat compared to the prior quarter.

C1 cash costs decreased by ~6% quarter on quarter

from US$2.02/lb15 in the June quarter to US$1.90/lb for September quarter. The drivers of the lower C1 is a combination

of a reduction in milling costs, treatment and refining charges and an increase in development costs capitalised which had a positive

impact of approximately US$0.24/lb offset by lower production tonnes, which negatively impacted the C1 by US$0.12/lb.

14 Realised provisional sales price excluding hedging impact

15 Q2 2024 adjusted post finalisation of half year accounts

with additional freight and TCRCs included accrued for recognition of June pre-sales

Figure 3 - CSA Copper Mine C1 Cash Costs16

- US$/lb produced

MAC management continues to implement additional

productivity measures to further reduce C1 costs as is evident in the declining C1 that has been achieved since the June 2024 quarter

depicted above.

Q2 2024 adjusted post finalisation of half year accounts with additional

freight and TCRCs included accrued for recognition of June quarter pre-sales. Directionally

we expect that copper TCRCs for 2025 will settle at materially lower levels than for 2024 and MAC will benefit from this from January 2025

onwards.

Figure 4 provides an illustration of tonnes milled

per employee which remains relatively stable quarter on quarter.

| Figure 4 - CSA Mine Tonnes Milled per Employee | |

Figure 5 - CSA Mine Mining Unit Rate US$/t |

| | |

|

| |

|

Apart from copper production, the largest driver

of C1 costs is the mining unit rate as mining accounts for approximately 60% of total site operating costs.

Mining unit rates are trending down with better

cost control initiatives implemented. September 2024 mining rates decreased further with additional capital development metres achieved

(64% increase as seen in Figure 7), resulting in increased mining development costs being capitalised in Q3 2024. Additional capital metres

have been completed in the quarter with a focus on the North decline and both the return and fresh air drives.

16 See “Non-IFRS Information” and refer to

Table 2 for reconciliation of C1 Cash Cost

| Figure 6 - CSA Mining Development Costs US$/metre | |

Figure 7 - CSA Copper Mine Capital Development metres |

| | |

|

| |

|

Processing costs per tonne milled decreased in

the September 2024 quarter after the June 2024 quarter was negatively impacted by the plant shutdown in April 2024. Tonnes

processed for the September 2024 quarter were 261kt at a copper recovery rate of 97.2%.

G&A unit rates increased slightly during the

current quarter after the June 2024 quarter included a once-off re-allocation of stock consumables to mining and processing previously

allocated to G&A, reducing the G&A unit rate.

| Figure 8 - CSA Copper Mine Processing Unit Rate US$/t | |

Figure 9 - CSA Copper Mine Site G+A Unit Rate US$/t |

| | |

|

| |

|

As seen in Figure 10, capital spend (including

capitalized development) decreased slightly over the quarter, largely driven by diamond drilling and vent expansion drilling. MAC continues

to spend capital in accordance with its previous guidance of approximately US$52 million for FY 2024.

Figure 10 - CSA Copper Mine Site Capital

US$m

MAC raises ~A$150 million (~US$103

million) through successful placement

As announced on 9 October 2024, MAC raised

approximately A$150 million (approximately US$103 million) (before costs) at an issue price of A$18.00 per New CDI.

The placement was well supported with support

from new and existing institutional and sophisticated investors both in Australia and offshore, which is testament to the high-quality

nature of the CSA Copper Mine and the significant work that has been undertaken by management to deliver on a range of operational improvements

over the past year.

Proceeds of the Placement, together with existing

cash, will enable MAC to optimise its balance sheet and de-lever following the acquisition of the CSA Copper Mine from Glencore plc in

mid-2023, while also providing additional flexibility to pursue strategic inorganic growth opportunities.

Cash position, liquidity and

debt facilities

The Company’s unaudited cash holding at

the end of Q3 2024 was ~US$81 million for an unaudited net debt17 position of ~US$232 million. Post the equity raise noted

above, the pro-forma net debt as at 30 September 2024 amounted to ~US131 million, which represents a pro-forma net gearing of 16%.

The reduction in the underlying cash position

(before the equity raise) at quarter end is largely driven by the reduced pre-sales in the September quarter of ~US$13 million as

compared to the June quarter of ~US$37 million resulting from a timing difference in cash receipts in the September quarter.

Copper tonnes sold in Q3 2024 reduced by 2,741 as a result of the additional pre-sales in June.

The unaudited cash position also reflects outgoings

of ~US$8.1 million repaid on the Senior Debt Facility at the end of the quarter, ~US$8.9 million in interest payments for the Senior debt

(US$3.9 million) and Mezzanine facility (US$5.0 million) and ~US$4.6 million in Silver and Copper stream payments.

As of 30 September 2024, the pro-forma liquidity

was ~US$226 million which includes cash of ~US$81 million, US$25 million undrawn revolving facility, ~US$103 million equity raised subsequent

to quarter-end, ~US$17 million of outstanding Quotational Period receipts, unsold concentrate and the strategic investment held in POL

at valuation of ~A$2.918 million.

17 Net debt is calculated taking senior debt (+) mezzanine

debt (-) cash and cash equivalents excluding streams

18 Valued at close of trading on ASX on 14 October 2024

Figure 11 – Q3 2024 Cash flow waterfall (US$M)

Exploration

During the September quarter, US$2.1 million

was invested in exploration.

Investors are directed to the separate September quarterly

exploration update released dated 21 October 2024 for the detailed results.

Three Year Production Guidance

The copper production guidance provided to the

market covering 2024, 2025 and 2026 remains unchanged:

Table 3 - CSA Copper Mine Production Guidance

| Year

|

2024 |

2025 |

2026 |

| |

Low

|

High

|

Low |

High

|

Low |

High |

| Copper

Production (t) |

38,000 |

43,000 |

43,000 |

48,000 |

48,000 |

53,000 |

This 3-year production guidance is based primarily

on Ore Reserves but also on Measured and Indicated Mineral Resources (as at 31 August 2023) and, given that all the deposits are

open and a large drill program is underway, we consider it likely that there will be changes over the relevant period as the Company’s

overall plan to continue operational and production improvement continues to develop.

Changes to Board of Directors

Appointment of Ms Anne Templeman-Jones

As announced on 22 July 2024, Ms Templeman-Jones

has been appointed as a Non-Executive Director of the Company’s Board of Directors, effective 22 July 2024. Ms Templeman-Jones,

is an accomplished listed company director with substantial financial, operational risk, regulatory, governance and strategy experience

from a number of industries, including banking and finance, engineering services in the energy sector, consumer goods and manufacturing.

In addition to Metals Acquisition Limited, Ms

Templeman-Jones recently served as a Non-Executive Director, and was responsible for a diverse range of committee chairs and memberships

for Commonwealth Bank of Australia (Director March 2018 to October 2024) and Trifork Ag (Director since April 2021). From

November 2017 until 1 July 2024, Ms Templeman-Jones was a director of Worley Limited.

Change of Glencore Nominee Director

As announced on 22 July 2024, Mr Mohit Rungta

will replace Mr Matt Rowlinson and Mr John Burton as Glencore’s nominee Director to the Company’s Board of Directors. Glencore

is entitled to nominate one Director for every 10% it holds in the Company. Following completion of the Company’s ASX listing, warrant

redemption and recent placement Glencore now has a 12.13% interest (entitling it to one nominee).

Hedging

During the quarter, the Company delivered 3,105

tonnes of copper into the hedge book at an average price of US$3.72/lb. At the end of June 2024, the remaining copper hedge book

consisted of the following:

Table 4 – Hedge position

| |

Copper |

| |

2024 |

2025 |

2026 |

Total |

| Future

Sales (t) |

3,105 |

12,420 |

5,175 |

20,700 |

| Future

Sales ($/t) |

3.72 |

3.72 |

3.72 |

3.72 |

Conference Call

The Company will host a conference call and webcast

to discuss the Company’s third quarter 2024 results on Monday, October 21, 2024 at 6:00 pm (New York time) / Tuesday, October 22,

2024 at 9:00 am (Sydney time).

Details for the conference call and webcast are

included below.

Webcast

Participants can access the webcast

at the following link https://event.choruscall.com/mediaframe/webcast.html?webcastid=lgTwEDVD

Conference Call

Participants can dial into the live call by dialing

one of the numbers below and request the operator connect to the Metals Acquisition Limited call.

| Toll Free Dial In: | |

+1-844-763-8274 |

| International Dial In: | |

+1-647-484-8814 |

| Australia: | |

+61-3-8592-6289 |

Replay

A replay of the webcast will be available for

three months via the webcast link above and or by visiting the Events section of the company’s website.

-ENDS-

This report is authorised for release by the Board

of Directors.

Contacts

|

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited

investors@metalsacqcorp.com |

Morné Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX: MAC)

is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in

the electrification and decarbonization of the global economy.

Estimates of Mineral Resources and Ore Reserves

and Production Target

This release contains estimates of Ore Reserves

and Mineral Resources as well as a Production Target. The Ore Reserves, Mineral Resources and Production Target are reported in MAC’s

ASX Announcement dated 23 April 2024 titled ‘Updated Resource and Reserve Statement and Production Guidance’ (the “R&R

Announcement”). The Company is not aware of any new information or data that materially affects the information included in

the R&R Announcement, and that all material assumptions and technical parameters underpinning the estimates or Ore Reserves and Mineral

Resources in the R&R Announcement continue to apply and have not materially changed. The material assumptions underpinning the Production

Target in the R&R Announcement continue to apply and have not materially changed. It is a requirement of the ASX Listing Rules that

the reporting of ore reserves and mineral resources in Australia comply with the JORC Code. Investors outside Australia should note that

while exploration results, mineral resources and ore reserves estimates of MAC in this release comply with the JORC Code, they may not

comply with the relevant guidelines in other countries and, in particular, do not comply with (i) National Instrument 43-101 (Standards

of Disclosure for Mineral Projects) of the Canadian Securities Administrators; or (ii) the requirements adopted by the Securities

and Exchange Commission (SEC) in its Subpart 1300 of Regulation S-K. Information contained in this release describing mineral deposits

may not be comparable to similar information made public by companies subject to the reporting and disclosure requirements of Canadian

or US securities laws.

Forward Looking Statements

This release includes “forward-looking statements.”

The forward-looking information is based on the Company’s expectations, estimates, projections and opinions of management made in

light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management

of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove

to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of copper, continuing commercial production

at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating

cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors

and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove

to be accurate.

MAC’s actual results may differ from expectations,

estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words

or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation,

MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production,

costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated

reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties indicated from

time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive.

MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not

undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could

affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with

the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that

MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date

of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC

may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so,

except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any

date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-IFRS financial information

MAC’s results are reported under International

Financial Reporting Standards (“IFRS”), noting the results in this report have not been audited or reviewed. This release

may also include certain non-IFRS measures including C1, Total Cash costs and Free Cash Flow. These C1, Total Cash cost and Free Cash

Flow measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources

and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication

of or alternative to an IFRS measure of financial performance.

C1 Cash Cost

C1 costs are defined as the costs incurred to

produce copper at an operational level. This includes costs incurred in mining, processing and general and administration as well freight

and realisation and selling costs. By-product revenue is credited against these costs to calculate a dollar per pound metric. This metric

is used as a measure operational efficiency to illustrate the cost of production per pound of copper produced.

Total Cash Cost

Total cash costs include C1 cash costs plus royalties

and sustaining capital less inventory WIP movements. This metric is used as a measure operational efficiency to further illustrate the

cost of production per pound of copper produced whilst incurring government-based royalties and capital to sustain operations.

Free Cash Flow

Free cash flow is defined as net cash provided

by operating activities less additions to property, plant, equipment and mineral interests. This measure, which is used internally to

evaluate our underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors

with the ability to evaluate our underlying performance.

Exhibit 99.2

21 October 2024

Metals Acquisition Limited Reports Drill Results Including 19.8m

@ 10.9% Cu, 27.3m @ 8.7% Cu, 3.8m @ 17.1% Cu and 23.6m @ 5.2% Cu

ST. HELIER, Jersey--(BUSINESS WIRE)--Metals Acquisition Limited (NYSE:

MTAL) (ASX:MAC):

Metals Acquisition Limited (“MAC”

or the “Company”) today provides a market update on the continuing exploration and resource development at the CSA Copper

Mine:

Highlights

| · | All results reported in this release are after

the cut-off date (August 31, 2023) for the 2023 Resource and Reserve and will be incorporated in the 2024 Resource and Reserve Estimate

update. |

| · | Results from QTS North (“QTSN”) include: |

| o | 12.5m @ 5.4% Cu from 103.0m and 19.8m @ 10.9% Cu from 177.1m in UDD23021 |

| o | 27.3m @ 8.7% Cu from 126.0m in UDD23019 |

| o | 8.1m @ 7.3% Cu from 143.6m, 4.9m @ 10.9% Cu from 168.8m, 4.3m @ 8.3% Cu from 177.3m and 13.3m @ 9.2% Cu

from 183.7m in UDDD24063 |

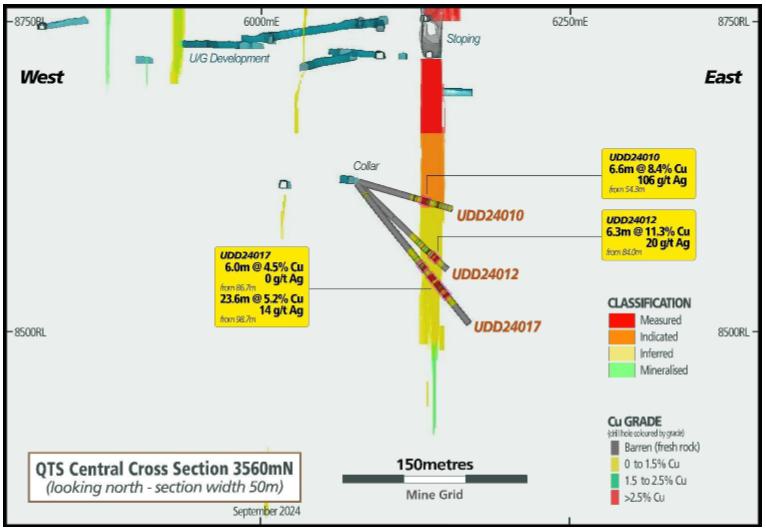

| · | Results from QTS Central (“QTSC”)

include: |

| o | 23.6m @ 5.2% Cu from 98.7 m in UDD24017 |

| o | 6.3m @ 11.3% Cu from 84.0m in UDD24012 |

| o | 6.6m @ 8.4% Cu from 54.3m in UDD24010 |

| · | Results for QTSS Upper A include: |

| o | 3.8m @ 17.1% Cu from 214.3m in QSDD061 |

Discussion

Underground exploration continued to focus on

the down dip and along strike extensions of the QTSN and QTSC deposits, as well as the shallower, up dip portions of the East and West

deposits and QTSS Upper.

Results are reported as down hole widths. A complete

list of September quarter 2024 resource drilling results is contained in Table 1 at the end of this report.

MAC CEO, Mick McMullen commented “The

CSA deposits continue to deliver the high-grade intervals we have come to expect from it. The drilling of the Inferred and mineralised

extensions of QTSN have shown good continuity with strike extensions adding to the tonnes per vertical metre of the mineralisation. Having

a core deposit that grades in excess of 8% Cu provides us with a lot of flexibility all through the cycle. As we continue to refine mining

methods and manage dilution better than in the past, we are seeing the benefit in the mill with the September quarter mill feed grade

at 4% Cu.

QTSSU-A has been drilled from surface now to

provide us the confidence to commence development works in the near term. In addition, we see good potential for additional discovery

between this deposit and the main mine with over 600m of poorly tested strike extension in this area that the development will pass through.

Our intention is to push the development past QTSSU-A to the Pink Panther prospect that is located 250m further to the South East along

strike to provide both a drill platform and potential access for development if that prospect can be converted to a resource.

Finally, drilling of the high-grade Zn mineralisation

above the East and West lenses has confirmed the presence as indicated by historical data and as Polymetals (“POL”) advance

their planning for restart of the Endeavour mill this should dovetail well with our timing for potentially mining this material.”

CSA Copper Mine

The CSA Copper Mine is a world class mine that

consists of a series of mineralized lenses that extend from surface to a depth of over 2.3km. The main deposits are QTSN, QTSC, QTSS,

Eastern and Western lenses with additional mineralisation in the near surface QTSS Upper A zone. Approximately 75% of the resources are

contained in QTSN.

Refer to Figure 1 below for the location of the

various deposits.

Exploration Results

Figure 1 – CSA Copper Mine Long Section

Drilling has been targeting conversion of Inferred

resource to Measured and Indicated for inclusion in the Reserve Estimate, as well as the known mineralized lenses to add incremental resources.

The location of the significant drill results

is shown in Figure 2 below.

Figure 2 – QTSN and QTSC Long Section

At QTSN, the most recent drilling continues to

confirm the location of the Inferred Resource and will enable it to be upgraded as well as confirmation of the smaller mineralized lenses

adjacent to the existing resource. This can be seen in Figures 3 to 4. QTSN is characterised by a series of high-grade lenses (grading

plus 5% Cu) that can range in width from 10-35m surrounded by a lower grade halo on the footwall.

As drilling has progressed down dip it would appear

that tonnes per vertical metre are increasing and drilling is now pushed down well into the Inferred resources (refer to Fig 3 &

Fig 3A) which will be helpful for upgrading of that material.

Figure 3 – QTSN Cross Section (4015mN)

Figure 3A – QTSN Cross Section (3665mN)

The 13.3m @ 9.2% Cu in UDD24063 is completely

outside any of the current resource of known mineralisation and has significantly extended the strike length of QTSN to the south and

is a high priority area for follow up infill drilling.

QTSC is located adjacent to QTSN and is centred

around a depth of 1.4km and is open both up and down dip. QTSC is typically narrower than QTSN but higher grade. As seen in Figures 4

and 5 the most recent drilling continues to confirm the presence of the high-grade mineralisation below the current working level through

the Inferred Resource and into mineralised material that will both extend the resource beyond its current limits and extend the Measured

and Indicated material for inclusion into the 2024 Mineral Reserve.

The interval in UDD24017 is substantially thicker

than typically seen at QTSC and in the middle of the Inferred resource which should have a materially positive impact for classification

of this resource.

Figure 4 – QTSC Cross Section

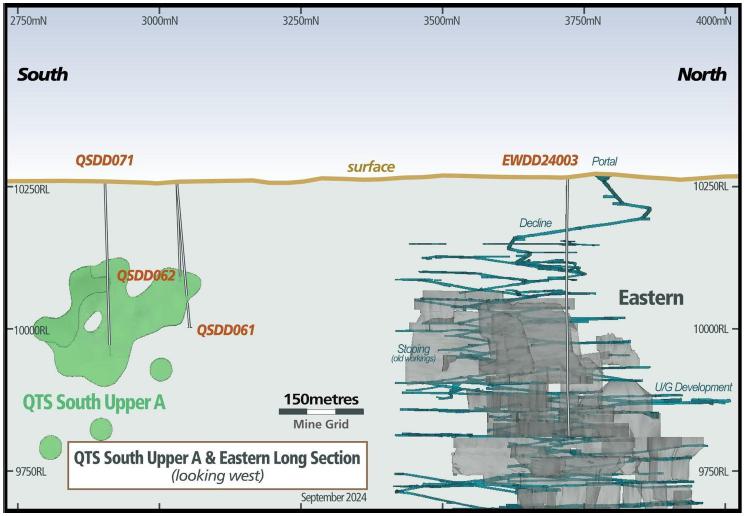

The shallow (< 400m from surface) portions

of the CSA Copper Mine include substantial mineralisation around the existing workings that are the up-dip portion of the Eastern and

Western lenses as seen in Figure 5. This material is at approximately the same elevation as the QTSS Upper deposit located approximately

600m to the south of the main mine as seen in Figure 5 also.

Figure 5 – QTSS Upper A and Eastern Long

section

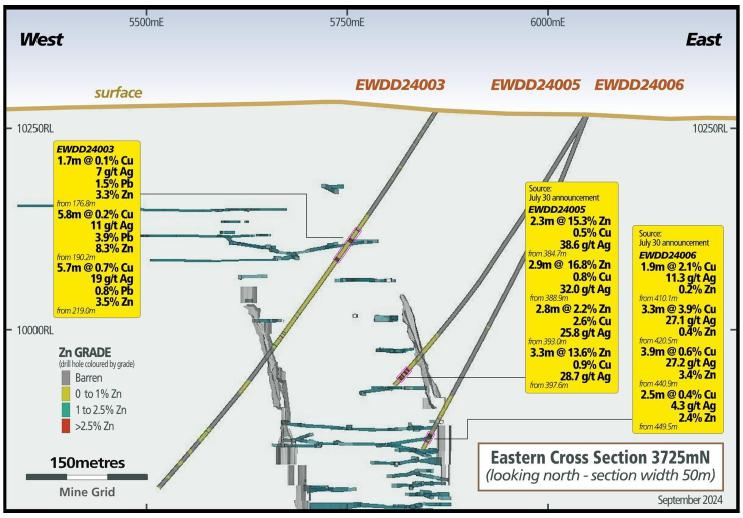

Drilling in the Pb- Zn areas over the Eastern

lens has intersected high grade Zn mineralisation plus Pb and Cu immediately adjacent to existing development. MAC’s focus is on

the Cu mineralisation within the rest of the mine, however with the agreement signed with Polymetals in the June quarter MAC now

has access to Zn material processing capacity. Results returned during the quarter (refer Fig 6) from Upper Pb-Zn Eastern and Western

Lenses (“Pb-Zn”) include:

| · | 1.7m @ 3.3% Zn, 1.5% Pb, 0.1% Cu & 7g/t

Ag from 176.8m (EWDD24003) |

| · | 5.8m @ 8.3% Zn, 3.9% Pb, 0.2% Cu & 11g/t

Ag from 190.2m (EWDD24003) |

| · | 5.7m @ 3.5% Zn, 0.87% Pb, 0.7% Cu &

19g/t Ag from 219m (EWDD24003) |

Figure 6 – Eastern Lens Cross Section

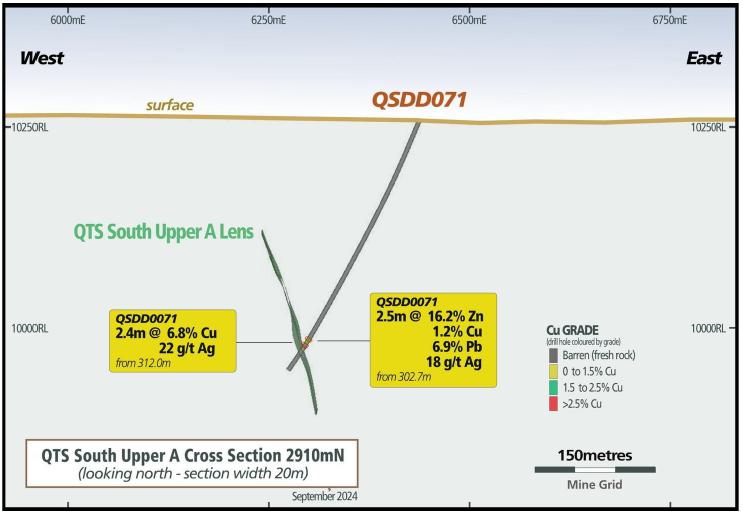

QTSS Upper A is a narrow (1.5 to 4m) but very

high-grade zone of mineralisation that is much shallower than the rest of the mine. This lens starts approximately 120m below surface

and extends to approximately 350m below surface.

As the majority of the mineral resource for QTSS

Upper is in the Inferred category, this material is being drilling out from surface to upgrade the classification for detailed mine planning.

The production guidance that MAC has published does not include any Inferred material, and as such, any production from QTSS Upper would

be in excess of the production guidance.

Figure 7 illustrates the recent Cu and Zn results

from this deposit which are typically narrow but very high grade and close to surface.

Figure 7 –QTSS Upper Cross Section

Figure 8 –QTSS Upper Cross Section -

Zn mineralisation

Qualified Person Statement

The information in this announcement that relates

to Exploration Results at the CSA Copper Mine is based on information compiled or reviewed by Eliseo Apaza, a Qualified Person for the

purpose of S-K 1300 who is a Member of the Australian Institute of Mining and Metallurgy. Mr Apaza is employed by a wholly owned subsidiary

of the Company. Mr. Apaza has given (and not withdrawn) written consent to the inclusion in the report of the results reported here

and the form and context in which it appears.

This announcement is authorised for release by

Mick McMullen, Chief Executive Officer and Director.

Contacts

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited

investors@metalsacqcorp.com |

Morné Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC)

is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in

the electrification and decarbonization of the global economy.

Cautionary and Forward Looking Statements

This release has been prepared by Metals Acquisition

Limited (“Company” or “MAC”) and includes “forward-looking statements.” The forward-looking information

is based on the Company’s expectations, estimates, projections and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to

be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions

have been made by the Company regarding, among other things: the price of copper, continuing commercial production at the CSA Copper Mine

without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the

ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and

when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented

by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations,

estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words

or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation,

MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production,

costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated

reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions; infrastructure risks;; and other risks and uncertainties indicated from

time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive.

MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not

undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could

affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with

the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that

MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date

of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC

may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so,

except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any

date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements

JORC / SK-1300

MAC is subject to the reporting requirements of

both the Securities Exchange Act of 1934 (US) and applicable Australian securities laws (including the ASX Listing Rules), and as a result,

has separately reported its Exploration Results according to the standards applicable to those requirements. U.S. reporting requirements

are governed by S-K 1300, as issued by the SEC. Australian reporting requirements are governed by Australasian Joint Ore Reserve Committee

Code, 2012 edition (JORC). Both sets of reporting standards have similar goals in terms of conveying an appropriate level of consistency

and confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions. All disclosure

of Exploration Results in this report are reported in accordance with S-K 1300. For JORC and ASX Listing Rule compliant disclosure

(including JORC Table 1 analysis) please see the Company’s separate release to be released on ASX on 22 October 2024.

Table 1 – Significant Drill Results for

QTSN, QTSC, QTSSU-A & Eastern Systems

Cu Results

| Hole |

East

(MG) |

North

(MG) |

RL.

(MG) |

EOH

(m) |

Azimuth

(MG) |

Dip |

From

(m) |

To (m) |

Length

(m) |

Cu % |

Ag g/t |

System |

| UDD21145 |

5,873.10 |

3,862.57 |

8,475.64 |

250.10 |

110.0 |

-5.0 |

94.5 |

101.0 |

6.5 |

4.8 |

26 |

QTS North |

| UDD22118 |

5,844.25 |

4,216.52 |

8,513.65 |

410.50 |

52.4 |

-35.0 |

283.8 |

290.8 |

7.0 |

4.8 |

14 |

QTS North |

| UDD23008 |

5,872.81 |

3,863.55 |

8,474.09 |

371.00 |

85.6 |

-59.4 |

108.7 |

112.0 |

3.3 |

4.7 |

19 |

QTS North |

| UDD23011 |

5,872.90 |

3,862.90 |

8,474.10 |

326.00 |

103.8 |

-58.9 |

110.9 |

114.9 |

4.0 |

7.3 |

35 |

QTS North |

| |

|

|

|

|

|

|

118.1 |

121.8 |

3.7 |

3.3 |

0 |

QTS North |

| |

|

|

|

|

|

|

181.8 |

187.2 |

5.4 |

5.5 |

42 |

QTS North |

| |

|

|

|

|

|

|

254.0 |

257.3 |

3.3 |

3.3 |

15 |

QTS North |

| UDD23019 |

5,903.65 |

3,963.35 |

8,417.72 |

250.00 |

83.0 |

-46.0 |

34.7 |

38.7 |

4.0 |

3.0 |

0 |

QTS North |

| |

|

|

|

|

|

|

82.6 |

88.2 |

5.6 |

6.5 |

25 |

QTS North |

| |

|

|

|

|

|

|

103.8 |

107.5 |

3.7 |

5.0 |

13 |

QTS North |

| |

|

|

|

|

|

|

126.0 |

153.3 |

27.3 |

8.7 |

37 |

QTS North |

| |

|

|

|

|

|

|

161.0 |

164.3 |

3.3 |

3.1 |

13 |

QTS North |

| UDD23035 |

5,850.64 |

4,148.23 |

8,443.31 |

330.00 |

110.5 |

-22.2 |

173.5 |

176.6 |

3.1 |

3.1 |

12 |

QTS North |

| |

|

|

|

|

|

|

185.2 |

189.7 |

4.5 |

5.5 |

29 |

QTS North |

| |

|

|

|

|

|

|

205.0 |

211.7 |

6.7 |

6.7 |

41 |

QTS North |

| |

|

|

|

|

|

|

214.7 |

218.3 |

3.6 |

3.7 |

17 |

QTS North |

| |

|

|

|

|

|

|

222.2 |

227.1 |

4.9 |

2.6 |

5 |

QTS North |

| UDD23098 |

5,850.23 |

4,149.51 |

8,442.73 |

330.30 |

82.5 |

-45.0 |

187.9 |

203.6 |

15.7 |

4.0 |

18 |

QTS North |

| |

|

|

|

|

|

|

209.9 |

230.6 |

20.7 |

3.7 |

11 |

QTS North |

| |

|

|

|

|

|

|

262.0 |

268.0 |

6.0 |

3.5 |

11 |

QTS North |

| UDD23099 |

5,850.42 |

4,149.58 |

8,442.78 |

300.00 |

82.5 |

-40.0 |

174.8 |

187.1 |

12.3 |

3.9 |

20 |

QTS North |

| |

|

|

|

|

|

|

192.0 |

199.0 |

7.0 |

4.5 |

7 |

QTS North |

| |

|

|

|

|

|

|

201.1 |

212.1 |

11.0 |

4.3 |

8 |

QTS North |

| |

|

|

|

|

|

|

229.0 |

232.0 |

3.0 |

4.4 |

28 |

QTS North |

| |

|

|

|

|

|

|

243.9 |

249.0 |

5.1 |

5.3 |

10 |

QTS North |

| UDT24020A |

5,839.18 |

4,209.38 |

8,443.29 |

497.00 |

63.5 |

-34.0 |

275.8 |

280.6 |

4.8 |

6.2 |

13 |

QTS North |

| UDD20143 |

5,873.03 |

3,862.78 |

8,474.16 |

400.00 |

105.7 |

-48.0 |

95.5 |

101.9 |

6.4 |

5.3 |

24 |

QTS North |

| UDD23021 |

5,903.13 |

3,964.45 |

8,417.63 |

280.00 |

55.0 |

-49.0 |

103.0 |

115.5 |

12.5 |

5.4 |

17 |

QTS North |

| |

|

|

|

|

|

|

131.4 |

135.9 |

4.5 |

4.2 |

11 |

QTS North |

| |

|

|

|

|

|

|

138.4 |

142.9 |

4.5 |

3.1 |

4 |

QTS North |

| |

|

|

|

|

|

|

177.1 |

196.9 |

19.8 |

10.9 |

37 |

QTS North |

| |

|

|

|

|

|

|

228.4 |

231.7 |

3.3 |

6.9 |

41 |

QTS North |

| UDD23093 |

5,850.58 |

4,148.66 |

8,443.05 |

332.03 |

101.2 |

-31.0 |

192.0 |

198.9 |

6.9 |

3.5 |

8 |

QTS North |

| |

|

|

|

|

|

|

208.0 |

231.0 |

23.0 |

3.9 |

13 |

QTS North |

| UDD23094 |

5,850.38 |

4,148.58 |

8,442.79 |

362.00 |

103.8 |

-39.0 |

171.6 |

174.6 |

3.0 |

4.6 |

35 |

QTS North |

| |

|

|

|

|

|

|

204.3 |

207.9 |

3.6 |

3.2 |

7 |

QTS North |

| Hole |

East

(MG) |

North

(MG) |

RL.

(MG) |

EOH

(m) |

Azimuth

(MG) |

Dip |

From

(m) |

To (m) |

Length

(m) |

Cu % |

Ag g/t |

System |

| |

|

|

|

|

|

|

224.5 |

235.0 |

10.5 |

3.9 |

19 |

QTS North |

| UDD23096 |

5,850.03 |

4,148.46 |

8,442.61 |

422.00 |

110.0 |

-50.5 |

212.5 |

218.1 |

5.6 |

3.8 |

9 |

QTS North |

| |

|

|

|

|

|

|

222.5 |

230.0 |

7.5 |

4.0 |

0 |

QTS North |

| |

|

|

|

|

|

|

249.8 |

254.0 |

4.2 |

3.6 |

10 |

QTS North |

| |

|

|

|

|

|

|

257.7 |

265.0 |

7.3 |

2.8 |

12 |

QTS North |

| |

|

|

|

|

|

|

275.0 |

280.0 |

5.0 |

6.3 |

16 |

QTS North |

| |

|

|

|

|

|

|

292.0 |

295.5 |

3.5 |

2.9 |

30 |

QTS North |

| UDD24062 |

5,871.71 |

3,859.79 |

8,476.46 |

210.00 |

140.0 |

8.0 |

110.0 |

114.0 |

4.0 |

6.0 |

35 |

QTS North |

| |

|

|

|

|

|

|

134.9 |

144.3 |

9.4 |

2.9 |

23 |

QTS North |

| UDD24063 |

5,870.81 |

3,860.53 |

8,474.32 |

565.50 |

145.0 |

-35.0 |

143.6 |

151.7 |

8.1 |

7.3 |

47 |

QTS North |

| |

|

|

|

|

|

|

168.8 |

173.7 |

4.9 |

10.9 |

44 |

QTS North |

| |

|

|

|

|

|

|

177.3 |

181.6 |

4.3 |

8.3 |

42 |

QTS North |

| |

|

|

|

|

|

|

183.7 |

197.0 |

13.3 |

9.2 |

53 |

QTS North |

| |

|

|

|

|

|

|

201.3 |

206.5 |

5.2 |

4.7 |

18 |

QTS North |

| UDD24136 |

5,870.90 |

3,861.60 |

8,474.08 |

466.70 |

130.0 |

-50.0 |

135.4 |

139.0 |

3.6 |

3.4 |

40 |

QTS North |

| |

|

|

|

|

|

|

150.8 |

156.0 |

5.2 |

4.1 |

24 |

QTS North |

| |

|

|

|

|

|

|

173.0 |

182.0 |

9.0 |

2.7 |

11 |

QTS North |

| |

|

|

|

|

|

|

220.5 |

224.3 |

3.8 |

3.2 |

11 |

QTS North |

| UDD23032 |

5,872.95 |

3,862.98 |

8,474.12 |

300.00 |

101.0 |

-52.5 |

93.0 |

96.3 |

3.3 |

8.6 |

59 |

QTS North |

| |

|

|

|

|

|

|

98.6 |

102.4 |

3.8 |

3.1 |

10 |

QTS North |

| UDD23041 |

5,839.10 |

4,207.41 |

8,443.54 |

330.00 |

98.0 |

-33.0 |

184.4 |

198.5 |

14.1 |

6.3 |

21 |

QTS North |

| |

|

|

|

|

|

|

201.9 |

206.7 |

4.8 |

5.2 |

10 |

QTS North |

| |

|

|

|

|

|

|

249.0 |

252.9 |

3.9 |

10.3 |

15 |

QTS North |

| UDD24060 |

5,872.94 |

3,860.32 |

8,476.48 |

350.00 |

125.0 |

7.0 |

124.3 |

128.0 |

3.7 |

3.9 |

39 |

QTS North |

| UDD24016 |

6,078.18 |

3,585.93 |

8,619.57 |

106.60 |

114.4 |

-41.0 |

75.7 |

79.4 |

3.7 |

6.2 |

8 |

QTS Central |

| UDD24017 |

6,077.89 |

3,585.86 |

8,619.29 |

150.20 |

117.5 |

-50.1 |

86.7 |

92.7 |

6.0 |

4.5 |

0 |

QTS Central |

| |

|

|

|

|

|

|

98.7 |

122.3 |

23.6 |

5.2 |

14 |

QTS Central |

| UDD24005 |

6,078.86 |

3,589.07 |

8,620.35 |

90.00 |

55.9 |

-14.1 |

71.7 |

76.3 |

4.6 |

6.7 |

15 |

QTS Central |

| UDD24008 |

6,078.80 |

3,587.39 |

8,620.08 |

88.70 |

82.5 |

-25.1 |

57.5 |

66.5 |

9.0 |

5.2 |

10 |

QTS Central |

| UDD24009 |

6,078.08 |

3,587.36 |

8,619.51 |

116.00 |

79.8 |

-49.5 |

95.7 |

98.8 |

3.1 |

3.1 |

5 |

QTS Central |

| UDD24010 |

6,078.90 |

3,586.42 |

8,620.58 |

80.00 |

100.4 |

-15.3 |

54.3 |

60.9 |

6.6 |

8.4 |

106 |

QTS Central |

| UDD24012 |

6,078.38 |

3,586.59 |

8,619.63 |

101.00 |

100.1 |

-44.7 |

84.0 |

90.3 |

6.3 |

11.3 |

20 |

QTS Central |

* Note: Boreholes intersections criteria based

on Copper grade >2.5% and >3m.

| Hole |

East (MG) |

North (MG) |

RL. (MG) |

EOH

(m) |

Azimuth

(MG) |

Dip |

From

(m) |

To

(m) |

Length

(m) |

Cu % |

Ag g/t |

System |

| QSDD061 |

6,378.57 |

3,030.45 |

10,259.66 |

289.10 |

280.3 |

-66.6 |

214.3 |

218.1 |

3.8 |

17.1 |

41 |

QTSSU-A |

| QSDD062 |

6,378.96 |

3,030.28 |

10,260.04 |

212.50 |

272.4 |

-58.3 |

193.7 |

196.6 |

2.9 |

4.1 |

12 |

QTSSU-A |

| QSDD071 |

6,436.06 |

2,903.27 |

10,258.00 |

347.20 |

274.5 |

-67.3 |

312.0 |

314.4 |

2.4 |

6.8 |

22 |

QTSSU-A |

* Note: The intersects criteria is not apply to

Eastern and QTS South Upper A due to their mineralization styles as narrow vein.

Zinc Results

| Hole |

East

(MG) |

North

(MG) |

RL.

(MG) |

EOH

(m) |

Azimuth

(MG) |

Dip |

From

(m) |

To (m) |

Length

(m) |

Cu % |

Ag g/t |

Pb % |

Zn % |

| EWDD24003 |

5,860.00 |

3,720.00 |

10,272.00 |

581.10 |

268.4 |

-57.2 |

176.8 |

178.5 |

1.7 |

0.1 |

7 |

1.5 |

3.3 |

| |

|

|

|

|

|

|

190.2 |

196.0 |

5.8 |

0.2 |

11 |

3.9 |

8.3 |

| |

|

|

|

|

|

|

219.0 |

224.7 |

5.7 |

0.7 |

19 |

0.8 |

3.5 |

| QSDD071 |

6,436.06 |

2,903.27 |

10,258.00 |

347.20 |

274.5 |

-67.3 |

302.7 |

305.2 |

2.5 |

1.2 |

18 |

6.9 |

16.2 |

* Note: The intersects criteria is not apply to

Eastern and QTS South Upper A due to their mineralization styles as narrow vein.

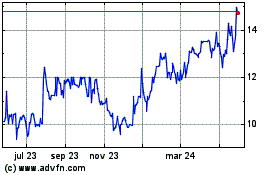

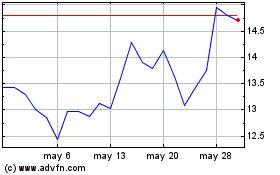

Metals Acquisition (NYSE:MTAL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Metals Acquisition (NYSE:MTAL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024