Two Nuveen Closed-End Funds Announce Intention to Redeem Preferred Shares

19 Abril 2017 - 4:16PM

Business Wire

Nuveen, today announced that two municipal bond closed-end funds

have filed with the Securities and Exchange Commission notices of

intention to redeem all of their respective outstanding

Institutional MuniFund Term Preferred (iMTP) shares. The iMTP

redemption price will be the $5,000 liquidation preference per

share, plus an additional amount representing the final accumulated

distribution amounts owed. Each fund expects to finance the iMTP

share redemptions with the proceeds of newly issued preferred

shares and the redemptions are contingent upon the completion of

all aspects of such preferred share placements by each Fund, which

may not occur as planned. Official notification of the redemptions

will be delivered to iMTP shareholders of each Fund at a later date

through The Depository Trust Company (DTC).

The funds filing the notices and the anticipated dates of

redemption of their outstanding iMTP shares are as follows:

Fund & Common Share Symbol Share

Amount iMTP CUSIP

Anticipated Redemption Date Nuveen Municipal Credit Income

Fund (NYSE: NZF) 30,000 67070X804 May 25, 2017 Nuveen New York

AMT-Free Quality Municipal Income Fund (NYSE: NRK) 15,800 670656883

May 22, 2017

The address of the calculation and paying agent, The Bank of New

York Mellon, is 101 Barclay Street, Floor 7E, New York, New York

10286.

The funds intend to offer the new preferred shares to qualified

institutional buyers (as defined in Rule 144A of the Securities Act

of 1933 (the Securities Act)) in private offerings exempt from

registration under the Securities Act.

No preferred shares, including iMTP shares, have been registered

under the Securities Act or any state securities laws. Unless so

registered, no preferred shares may be offered or sold in the

United States except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release is neither an offer to sell nor a

solicitation of an offer to buy any securities.

About Nuveen

Nuveen offers a comprehensive range of outcome-focused

investment solutions designed to secure the long-term financial

goals of institutional and individual investors. As the investment

management arm of TIAA, Nuveen has $882 billion in assets under

management as of 12/31/16 and operations in 16 countries. Its

affiliates offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

The information contained on the Nuveen website is not a part of

this press release.

Securities offered through Nuveen Securities, LLC, member FINRA

and SIPC.

FORWARD LOOKING STATEMENTS

Certain statements made or referenced in this release may be

forward-looking statements. Actual future results or occurrences

may differ significantly from those anticipated in any

forward-looking statements due to numerous factors. These include,

but are not limited to:

- market developments, including the

successful sale of new preferred securities by the funds identified

in this press release;

- legal and regulatory developments;

and

- other additional risks and

uncertainties.

Nuveen and the closed-end funds managed by Nuveen and its

affiliates undertake no responsibility to update publicly or revise

any forward-looking statements.

24457-INV-O-04/19

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170419006689/en/

NuveenMedia Contact:Kathleen

Cardoza312-917-7813kathleen.cardoza@nuveen.com

Nuveen New York AMT Free... (NYSE:NRK)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

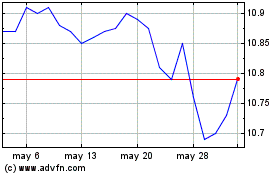

Nuveen New York AMT Free... (NYSE:NRK)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024