Nuveen New York AMT-Free Quality Municipal Income Fund Receives Unanimous Support from Glass Lewis for Nuveen’s Board Nominees and Against Dissident Termination Proposal

13 Agosto 2024 - 5:48PM

Business Wire

Recommendation from Glass Lewis Follows Full Support From

Institutional Shareholder Services

Nuveen announced today that Glass Lewis, a leading independent

proxy advisory firm, recommended that shareholders vote on the

WHITE proxy card FOR ALL Board nominees of Nuveen New York AMT-Free

Quality Municipal Income Fund (NYSE: NRK), and AGAINST the proposal

to terminate Nuveen as the investment advisor put forth by a

dissident shareholder in connection with the Fund’s annual meeting

scheduled for August 15, 2024.

Glass Lewis’ recommendation follows a report from Institutional

Shareholder Services (“ISS”) directing shareholders to vote in

favor of all Board nominee’s and against the termination proposal.

ISS also issued a parallel recommendation to preferred shareholders

of NRK.

In their report, Glass Lewis supported ALL of the Board’s

independent and qualified nominees: Joanne T. Medero, Loren M.

Starr, Matthew Thornton III, Albin F. Moschner and Margaret L.

Wolff. In issuing its recommendation, Glass Lewis has rejected the

nominees submitted by the dissident.

“We thank Glass Lewis for its sound judgment in recommending

shareholders support the Fund’s incumbent Trustees and reject the

proposal to terminate Nuveen as investment advisor. Glass Lewis was

correct to highlight NRK’s strong performance, the

shareholder-friendly actions the Board has taken, and the overall

quality of the Board’s nominees. Under Nuveen’s stewardship, NRK

continues to deliver outperformance with underlying strong

governance for the benefit of all shareholders. We appreciate their

continued support ahead of the upcoming meeting,” said Dave Lamb,

Head of Nuveen Closed-End Funds.

Important statements by Glass Lewis1 in issuing its voting

recommendations FOR the Fund’s Board Nominees and AGAINST the

termination proposal include:

The Fund’s Manager and Trustees Have Taken Actions to Deliver

Strong Performance, Address Discounts and Enhance Distributions for

the Benefit of All Shareholders

- “We recognize that the discount narrowed after the Fund

implemented an enhanced distribution policy in October 2023, and we

credit the board for taking deliberate action to address the

discount.”

- “We recognize that the Fund outperformed relative to the peer

group selected by the incumbent board over all periods discussed

above, including over longer-term periods ended June 30, 2024 and

over several ‘unaffected’ periods prior to Karpus’s initial

Schedule 13D filing.”

The Dissident’s Unqualified Nominees Have No Board Experience

and No Expertise in Closed-End Funds

- “With respect to the Dissident Nominees, we are somewhat

concerned that the three candidates do not appear to have any prior

closed-end fund experience or other relevant fund management

experience, nor do they appear to have prior board experience at

investment funds or other public companies.”

- “Overall, we find that the Management Nominees appear generally

better qualified to serve as trustees of the Fund than the

Dissident Nominees, including given their prior board and executive

experience.”

The Dissident Offered No Compelling Plan to Create Value for

All Shareholders

- “[the Dissident] may be seeking a liquidity event at the Fund

and may have interests that are not aligned with the interests of

other shareholders, in our view, particularly shareholders who may

prefer to maintain exposure to the Fund as a closed-end

vehicle.”

- “…we do not believe that Karpus has offered a sufficiently

compelling case that electing the Dissident Nominees or supporting

the Dissident’s shareholder proposal to terminate the Fund’s

investment advisory agreement is warranted or likely to lead to a

more favorable outcome for all shareholders, particularly

longer-term shareholders and shareholders who presumedly invested

in the Fund for the purpose of gaining exposure to its investment

strategy and closed-end structure.”

PROTECT YOUR FUND AND YOUR INVESTMENT

VOTE FOR YOUR TRUSTEES ON THE WHITE

PROXY CARD TODAY.

Vote for Nuveen’s three Class III Board Members.

Vote against Karpus’ proposal to terminate the Fund’s investment

advisory agreement.

Do not sign or return any card sent to you by Karpus, even to

vote “against” or to “withhold” or to “abstain” with respect to the

dissident’s proposal. Only your latest proxy will be counted.

If you have any questions about the proposals or the voting

instructions, please feel free to contact Georgeson LLC, the Funds’

proxy solicitor, at (866) 679-3234.

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.2 trillion in assets under management as

of 30 June 2024 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

__________________________

1 Permission to quote from the Glass Lewis

report was neither sought nor obtained.

EPS-3789275CR-E0824W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813085520/en/

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

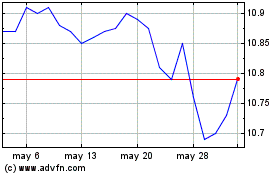

Nuveen New York AMT Free... (NYSE:NRK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Nuveen New York AMT Free... (NYSE:NRK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025