Form 8-K/A date of report 5-30-23

true

0000821483

0000821483

2023-05-30

2023-05-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023 (May 30, 2023)

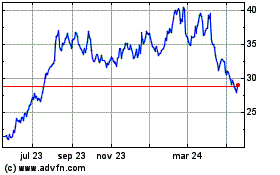

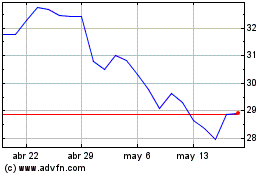

Par Pacific Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-36550

|

|

84-1060803

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

825 Town & Country Lane, Suite 1500

Houston, Texas

|

|

77024

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(281) 899-4800

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

PARR

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

As previously disclosed in the Current Report on Form 8-K of Par Pacific Holdings, Inc., a Delaware corporation (the “Company”), filed with the U.S. Securities and Exchange Commission on June 1, 2023 (the “Prior 8-K”), Par Montana, LLC, Par Montana Holdings, LLC, and Par Rocky Mountain Midstream, LLC (collectively, the “Purchasers”), each subsidiaries of the Company, completed the previously announced acquisition from Exxon Mobil Corporation, ExxonMobil Oil Corporation, and ExxonMobil Pipeline Company LLC (collectively, the “Sellers”) of (i) the high-conversion, complex refinery located in Billings, Montana and certain associated distribution and logistics assets (collectively, the “Billings Assets”), and (ii) 100% of the issued and outstanding equity interests in Exxon Billings Cogeneration, Inc. and in Yellowstone Logistics Holding Company (the “Equity Interests” and, collectively with the Billings Assets, the “Billings Refinery and Associated Logistics Business”), pursuant to that certain Equity and Asset Purchase Agreement dated as of October 20, 2022 (as amended, the “Purchase Agreement”), among the Sellers, the Purchasers and, solely for certain purposes specified in the Purchase Agreement, the Company.

This Current Report on Form 8-K/A (this “Amendment”) amends and supplements the Prior 8-K for the sole purpose of providing the historical financial statements of the Billings Refinery and Associated Logistics Business and the pro forma financial information of the Company and its subsidiaries required by Item 9.01 of Form 8-K. As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the Company has set forth the complete text of Item 9.01, as amended. This Amendment speaks as of the filing date of the Prior 8-K, does not update information in the Prior 8-K to reflect events that have occurred subsequent to the filing date of the Prior 8-K, and does not modify or update in any way disclosures made in the Prior 8-K. Except as described above, no other modification to the Prior 8-K is being made by this Amendment. Accordingly, this Amendment should be read in connection with the Prior 8-K, which provides a more complete description of the acquisition of the Billings Refinery and Associated Logistics Business.

Item 9.01 Financial Statements and Exhibits

|

(a)

|

Financial Statements of Business Acquired.

|

The audited combined financial statements of the Billings Refinery and Associated Logistics Business as of and for the years ended December 31, 2022 and 2021 are attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference herein.

The unaudited condensed combined financial statements of the Billings Refinery and Associated Logistics Business for the quarterly period ended March 31, 2023 are attached hereto as Exhibit 99.3 to this Current Report on Form 8-K and incorporated by reference herein.

|

(b)

|

Pro Forma Financial Information.

|

The unaudited pro forma condensed consolidated combined financial information of Par Pacific Holdings, Inc. and its subsidiaries for the six months ended June 30, 2023 and for the year ended December 31, 2022 is attached hereto as Exhibit 99.4 to this Current Report on Form 8-K and incorporated by reference herein.

|

(c)

|

Shell Company Transactions.

|

None.

|

2.1

|

Equity and Asset Purchase Agreement dated as of October 20, 2022, by and among Exxon Mobil Corporation, ExxonMobil Oil Corporation and ExxonMobil Pipeline Company, LLC, as sellers, and Par Montana, LLC, Par Montana Holdings, LLC, as purchaser entities, and solely for the limited purposes set forth therein, Par Pacific Holdings, Inc. Incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on October 21, 2022. @

|

|

2.2

|

First Amendment to Equity and Asset Purchase Agreement dated as of June 1, 2023, by and among Exxon Mobil Corporation, ExxonMobil Oil Corporation and ExxonMobil Pipeline Company, LLC, as sellers, and Par Montana, LLC, Par Montana Holdings, LLC, and Par Rocky Mountain Midstream, LLC, as purchaser entities, and solely for the limited purposes set forth therein, Par Pacific Holdings, Inc. Incorporated by reference to Exhibit 2.2 to the Company’s Current Report on Form 8-K filed on June 1, 2023.

|

|

10.1

|

Asset-Based Revolving Credit Agreement, dated as of April 26, 2023, by and among Par Pacific Holdings, Inc., as Holdings, Par Petroleum, LLC, Par Hawaii, LLC, Hermes Consolidated, LLC, Wyoming Pipeline Company LLC, Par Montana, LLC and Par Rocky Mountain Midstream, LLC, as Borrowers, Wells Fargo Bank, National Association, as Agent, Issuing Bank, and Swing Lender, the lenders party thereto, as the Lenders, and the other issuing banks party thereto, as Issuing Banks, and Wells Fargo Bank, National Association, Bank of America, N.A., Goldman Sachs Bank USA, MUFG Bank, LTD and Fifth Third Bank, National Association, as Joint Lead Arrangers and Joint Bookrunners. Incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on May 2, 2023. @

|

|

10.2

|

First Amendment to Asset-Based Revolving Credit Agreement, dated as of May 30, 2023, by and among Par Pacific Holdings, Inc., as Holdings, Par Petroleum, LLC, Par Hawaii, LLC, Hermes Consolidated, LLC, Wyoming Pipeline Company LLC, Par Montana, LLC and Par Rocky Mountain Midstream, LLC, as Borrowers, Wells Fargo Bank, National Association, as Agent, Issuing Bank, and Swing Lender, the lenders party thereto, as the Lenders, and the other issuing banks party thereto, as Issuing Banks, and Wells Fargo Bank, National Association, Bank of America, N.A., Goldman Sachs Bank USA, MUFG Bank, LTD and Fifth Third Bank, National Association, as Joint Lead Arrangers and Joint Bookrunners. Incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on June 1, 2023. @

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

@

|

Schedules to and portions of this exhibit have been omitted pursuant to Item 601(a)(5) and (b)(2)(ii) of Regulation S-K. The Company hereby undertakes to supplementally furnish copies of any omitted schedules to and portions of this exhibit to the Securities and Exchange Commission upon request.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 14, 2023

| |

PAR PACIFIC HOLDINGS, INC. |

| |

|

|

|

By: |

/s/ Jeffrey R. Hollis

|

| |

|

Jeffrey R. Hollis

|

| |

|

Senior Vice President, General Counsel, and

Secretary

|

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (Nos. 333-192519, 333-195662, 333-204597, 333-212107, 333-213471, 333-214593, 333-228933, 333-229278 and 333-262690) and on Form S-8 (Nos. 333-185612, 333-208575, 333-216518, 333-225054, 333-256130 and 333-272857) of Par Pacific Holdings, Inc. of our report dated May 25, 2023, relating to the financial statements of Billings Refinery and Associated Logistics Business, which appears in this Current Report on Form 8-K.

/s/ PricewaterhouseCoopers LLP

Dallas, TX

August 14, 2023

Exhibit 99.2

Billings Refinery & Associated Logistics Business

Combined Financial Statements

As of and for the years ended December 31, 2022 and 2021

TABLE OF CONTENTS

| |

Page |

| Report of Independent Auditors |

3 |

| Combined Balance Sheets as of December 31, 2022 and 2021 |

5 |

| Combined Statements of Income for the years ended December 31, 2022 and 2021 |

6 |

| Combined Statements of Net Parent Company Investment for the years ended December 31, 2022 and 2021 |

7 |

| Combined Statements of Cash Flows for the years ended December 31, 2022 and 2021 |

8 |

| Notes to Combined Financial Statements |

9 |

Report of Independent Auditors

To the Management of Exxon Mobil Corporation

Opinion

We have audited the accompanying combined financial statements of Billings Refinery & Associated Logistics Business (the "Business"), which comprise the combined balance sheets as of December 31, 2022 and 2021, and the related combined statements of income, of net parent company investment, and of cash flows for the years then ended, including the related notes (collectively referred to as the "combined financial statements").

In our opinion, the accompanying combined financial statements present fairly, in all material respects, the financial position of the Business as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Combined Financial Statements section of our report. We are required to be independent of the Business and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter

As discussed in Note 6 to the combined financial statements, the Business has entered into significant transactions with Exxon Mobil Corporation and its affiliates, which are related parties. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Combined Financial Statements

Management is responsible for the preparation and fair presentation of the combined financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the combined financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Business's ability to continue as a going concern for one year after the date the combined financial statements are available to be issued.

Auditors' Responsibilities for the Audit of the Combined Financial Statements

Our objectives are to obtain reasonable assurance about whether the combined financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors' report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the combined financial statements.

PricewaterhouseCoopers LLP, 1000 Louisiana Street, Suite 5800, Houston, TX 77002

T: (713) 356 4000, F: (713) 356 4717, www.pwc.com/us

In performing an audit in accordance with US GAAS, we:

| |

•

|

Exercise professional judgment and maintain professional skepticism throughout the audit.

|

| |

•

|

Identify and assess the risks of material misstatement of the combined financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the combined financial statements.

|

| |

•

|

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Business's internal control. Accordingly, no such opinion is expressed.

|

| |

•

|

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the combined financial statements.

|

| |

•

|

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Business's ability to continue as a going concern for a reasonable period of time.

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

Houston, Texas

May 25, 2023

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

COMBINED BALANCE SHEETS

(in thousands)

| |

|

December 31, 2022

|

|

|

December 31, 2021

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

$ |

50,489 |

|

|

$ |

30,866 |

|

|

Inventories

|

|

|

248,386 |

|

|

|

298,558 |

|

|

Prepaid expenses and other current assets

|

|

|

1,775 |

|

|

|

2,113 |

|

|

Total current assets

|

|

|

300,650 |

|

|

|

331,537 |

|

|

Investments

|

|

|

61,643 |

|

|

|

57,868 |

|

|

Property, plant, & equipment, net

|

|

|

303,688 |

|

|

|

312,067 |

|

|

Other assets, net

|

|

|

10,128 |

|

|

|

12,341 |

|

|

Total assets

|

|

$ |

676,109 |

|

|

$ |

713,813 |

|

|

Liabilities

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

47,317 |

|

|

|

36,303 |

|

| Accrued liabilities |

|

|

129,307 |

|

|

|

96,375 |

|

| Due to related parties |

|

|

143,273 |

|

|

|

131,657 |

|

| Total current liabilities |

|

|

319,897 |

|

|

|

264,335 |

|

| Deferred income tax liabilities |

|

|

66,583 |

|

|

|

69,126 |

|

| Total liabilities |

|

|

386,480 |

|

|

|

333,461 |

|

| Net parent company investment |

|

|

|

|

|

|

|

|

| Net parent company investment |

|

|

289,629 |

|

|

|

380,352 |

|

| Total liabilities and net parent company investment |

|

|

676,109 |

|

|

|

713,813 |

|

The accompanying notes are an integral part of these Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

COMBINED STATEMENTS OF INCOME

(in thousands)

| |

|

Year Ended

|

|

|

Year Ended

|

|

|

Revenues and other income

|

|

December 31, 2022

|

|

|

December 31, 2021

|

|

|

Sales and other operating revenue

|

|

$ |

2,798,249 |

|

|

$ |

2,171,259 |

|

|

Income from equity affiliates

|

|

|

18,204 |

|

|

|

21,235 |

|

|

Total revenues and other income

|

|

|

2,816,453 |

|

|

|

2,192,494 |

|

|

Costs and other deductions

|

|

|

|

|

|

|

|

|

|

Crude oil and product purchases - related party

|

|

|

(2,292,634 |

) |

|

|

(1,726,276 |

) |

|

Production and manufacturing expenses

|

|

|

(324,686 |

) |

|

|

(271,861 |

) |

|

Selling, general and administrative expenses

|

|

|

(40,878 |

) |

|

|

(35,827 |

) |

|

Depreciation expense

|

|

|

(22,633 |

) |

|

|

(22,315 |

) |

|

Other taxes and duties

|

|

|

(1,894 |

) |

|

|

(2,176 |

) |

|

Total costs and other deductions

|

|

|

(2,682,725 |

) |

|

|

(2,058,455 |

) |

|

Income before income taxes

|

|

|

133,728 |

|

|

|

134,039 |

|

|

Income taxes

|

|

|

(34,121 |

) |

|

|

(32,107 |

) |

|

Net income

|

|

$ |

99,607 |

|

|

$ |

101,932 |

|

The accompanying notes are an integral part of these Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

COMBINED STATEMENTS OF NET PARENT COMPANY INVESTMENT

(in thousands)

| |

|

Net Parent Company Investment |

|

|

Balance at December 31, 2020

|

|

$ |

357,124 |

|

|

Net income

|

|

|

101,932 |

|

|

Net transfers to Parent

|

|

|

(78,704 |

) |

|

Balance at December 31, 2021

|

|

$ |

380,352 |

|

|

Net income

|

|

|

99,607 |

|

|

Net transfers to Parent

|

|

|

(190,330 |

) |

|

Balance at December 31, 2022

|

|

$ |

289,629 |

|

The accompanying notes are an integral part of these Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

COMBINED STATEMENTS OF CASH FLOWS

(in thousands)

| |

|

Year Ended

December 31, 2022

|

|

|

Year Ended

December 31, 2021

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

99,607 |

|

|

$ |

101,932 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

22,633 |

|

|

|

22,315 |

|

|

Deferred income taxes

|

|

|

(2,543 |

) |

|

|

2,450 |

|

|

Other non-cash items, net

|

|

|

223 |

|

|

|

(210 |

) |

|

Dividends received less than equity in current earnings of equity companies

|

|

|

(3,775 |

) |

|

|

(5,498 |

) |

|

Change in assets and liabilities:

|

|

|

Accounts receivable

|

|

|

(19,848 |

) |

|

|

(8,030 |

) |

|

Inventory

|

|

|

50,173 |

|

|

|

(120,241 |

) |

|

Prepaid expenses and other current assets

|

|

|

339 |

|

|

|

(269 |

) |

|

Other assets

|

|

|

2,213 |

|

|

|

(2,432 |

) |

|

Accounts payable

|

|

|

11,014 |

|

|

|

19,387 |

|

|

Accrued liabilities

|

|

|

32,932 |

|

|

|

48,453 |

|

|

Due to related parties

|

|

|

11,616 |

|

|

|

35,178 |

|

|

Net cash provided by operating activities

|

|

|

204,584 |

|

|

|

93,035 |

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(13,436 |

) |

|

|

(9,033 |

) |

|

Other investing activities, net

|

|

|

(818 |

) |

|

|

(5,298 |

) |

|

Net cash used in investing activities

|

|

|

(14,254 |

) |

|

|

(14,331 |

) |

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Net transfers to Parent

|

|

|

(190,330 |

) |

|

|

(78,704 |

) |

|

Net cash used in financing activities

|

|

|

(190,330 |

) |

|

|

(78,704 |

) |

|

Net increase (decrease) in cash and cash equivalents

|

|

|

- |

|

|

|

- |

|

|

Cash and cash equivalents at beginning of period

|

|

|

- |

|

|

|

- |

|

|

Cash and cash equivalents at end of period

|

|

$ |

- |

|

|

$ |

- |

|

The accompanying notes are an integral part of these Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

|

1.

|

DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION Description of Business

|

On October 20, 2022, ExxonMobil Corporation (referred to as “ExxonMobil” or “Parent”) entered into a definitive agreement to sell its Billings Refinery & Associated Logistics Business (collectively the “Business”) to Par Pacific Holdings. The Business is a fully integrated fuels value chain, deriving value along the entire chain from the sourcing of crude oil to refining, distributing, and marketing of fuels to its customers, which includes operations in the states of Montana, Wyoming, Idaho, Utah, eastern Washington, and the Dakotas. The Business operates a high-conversion, complex 63,000 barrels per day (“bpd”) refinery in Billings, Montana, which processes low-cost Western Canadian and regional Rocky Mountain crude oil grades. In addition to the refinery, the Business owns a 65% interest in an adjacent cogeneration facility and an expansive Petroleum Administration for Defense Districts (“PADD”) IV & V marketing and logistics network. The logistics assets include the wholly-owned 70-mile, 55,000 bpd Silvertip Pipeline, a 40% interest in the 750-mile, 65,000 bpd Yellowstone refined products pipeline, and seven refined product terminals. Total storage capacity across the refinery and logistics locations totals 4.1 million barrels (“MMbbls”).

Basis of Presentation

These Combined Financial Statements were prepared on a stand-alone basis and have been derived from the Consolidated Financial Statements and accounting records of ExxonMobil. The Business has not operated as a separate stand-alone legal entity and is comprised of certain wholly-owned subsidiaries and other component operations of ExxonMobil. These Combined Financial Statements are presented as carve-out financial statements and reflect the combined historical results of operations, financial position, comprehensive loss and cash flows of the Business for the periods presented as historically managed within ExxonMobil in conformity with generally accepted accounting principles in the United States (“U.S. GAAP”). The Combined Financial Statements may not be indicative of the Business’s future performance and do not necessarily reflect what the financial position, results of operations, and cash flows would have been had it operated as a stand-alone company during the periods presented.

All intracompany transactions have been eliminated. All intercompany transactions between the Business and ExxonMobil have been included in these Combined Financial Statements. For those transactions between the Business and ExxonMobil that are historically settled in cash, the Business has reflected such balances in the Combined Balance Sheet as “Due to related parties”. The aggregate net effect of such transactions that are not historically settled in cash has been reflected in the Combined Balance Sheet as “Net parent company investment” and in the Combined Statements of Cash Flows as a financing activity.

ExxonMobil utilizes a centralized treasury management function for financing its operations. The Business did not maintain separate bank accounts. The cash generated and used by our operations is deposited to ExxonMobil’s centralized accounts, which are commingled with the cash of other entities controlled by the ExxonMobil. The cash and cash equivalents held by ExxonMobil have not been assigned to the Business for any of the periods presented, as the balances are not directly attributable to the Business. The Business reflects transfers of cash to and from ExxonMobil’s cash management system as a component of “Net parent company investment” in the Combined Balance Sheet. ExxonMobil’s third-party long-term debt and the related interest expense have not been allocated to the Business for any of the periods presented as the Business was not the legal obligor of such debt.

Historically, ExxonMobil and its affiliates provide a variety of services to the Business. The Combined Statements of Income includes expense allocations for services and certain support functions that are provided on a centralized basis within Parent such as treasury, accounting, human resources, and legal services. These allocations were based on direct usage when identifiable, with the remainder allocated on a basis of the percentage of operating expenses, the percentage of production capacity or headcount. The Business believes the basis from which the expenses have been allocated are a reasonable reflection of the utilization of services provided to, or the benefit received by, the Business during the periods presented. These allocated amounts, however, are not necessarily indicative of the actual amounts that might have been incurred or realized had the Business operated as a separate stand-alone entity during the periods presented. Consequently, these Combined Financial Statements do not necessarily represent the results the Business would have achieved if we had operated as a separate stand- alone entity from ExxonMobil during the periods presented. Refer to Note 6, “Related Party Transactions and Net Parent Company Investment” for additional information.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

The accompanying Combined Financial Statements have been prepared assuming the Business will continue as a going concern which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Principles of combination

|

The Business operates across many affiliates within ExxonMobil. All intercompany accounts and transactions occurring solely within the Business have been eliminated from the accompanying Combined Financial Statements. All intercompany accounts and transactions occurring between the Business and another ExxonMobil business have been included in the accompanying Combined Financial Statements and the Business has taken the assumption that all of these transactions have been settled in cash.

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent liabilities as of the date of the Combined Financial Statements and the reported amounts of revenues and expenses during the reporting periods. Actual results can differ from those estimates. The methods used in developing accounting estimates have been consistently applied in the periods presented.

Revenue Recognition

The Business generally sells crude oil and petroleum products under short-term agreements at prevailing market prices. Revenue is recognized at point in time at the amount the Business expects to receive when the customer has taken control, which is typically when title transfers and the customer has assumed the risks and rewards of ownership. Payment for revenue transactions is typically due within 30 days. Future volume delivery obligations that are unsatisfied at the end of the period are expected to be fulfilled through ordinary production or purchases. These performance obligations are based on market prices at the time of the transaction and are fully constrained due to market price volatility.

Purchases and sales of inventory with the same counterparty that are entered into in contemplation of one another are combined and recorded as exchanges measured at the book value of the item sold.

“Sales and other operating revenue” and “Accounts receivable” primarily arise from contracts with customers. Contract assets are mainly from marketing assistance programs provided to customers in exchange for a long-term commitment to purchase products over a future period of time. Contract liabilities are mainly accruals of volume discounts.

The Business had one customer representing 22% and 21% of revenue for the years ended December 31, 2022 and 2021, respectively.

Fair Value of Financial Instruments

Due to their short-term nature, the carrying amounts reported in the accompanying Combined Financial Statements approximate the fair value for accounts receivable, accounts payable and accrued expenses. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. Hierarchy levels 1, 2 and 3 are terms for the priority of inputs to valuation techniques used to measure fair value. Hierarchy level 1 inputs are quoted prices in active markets for identical assets or liabilities. Hierarchy level 2 inputs are inputs other than quoted prices included within level 1 that are directly or indirectly observable for the asset or liability. Hierarchy level 3 inputs are inputs that are not observable in the market.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

Cash and Financing Activities

ExxonMobil uses a centralized approach to the cash management and financing of the Business’s operations. No cash has been attributed to the Business for any of the periods presented, as the cash balances are not directly attributable to the Business. The cash generated by its operations is either directly received by or transferred to other ExxonMobil affiliates. ExxonMobil funded the Business’s operating and investing activities as needed. Therefore, the Business did not have a cash balance as of December 31, 2022 or 2021. The Business reflects cash management and financing activities performed by ExxonMobil as a component of the change in “Net parent company investment” on its accompanying Combined Balance Sheet, and as a “Net transfers to parent” on its accompanying Combined Cash Flows. The Business has not included any interest expense related to funding activities, since historically ExxonMobil has not allocated long-term debt or interest related to such activity with any of its business segments.

Accounts Receivable and Allowance for Doubtful Accounts

Trade and other receivables are recorded at their transaction amounts less allowance for doubtful accounts. Due to their short term nature, the valuation approximates its fair value. Allowance for doubtful accounts are recorded to the extent that there is likelihood that any of the amounts due will not be collected, which are not significant. The Business had one customer and four other customers representing 23% and 55% of trade accounts receivable as of December 31, 2022 and 2021, respectively.

Inventories

Crude oil and petroleum product inventories are stated at the lower of cost or market, and costs are determined using the first‑in, first‑out (“FIFO”) method. The method differs to that of the Parent who uses last-in, last-out (“LIFO”). The business believes that this method is preferable as it improves comparability with a majority of the business’s peers. Inventory costs include expenditures and other charges (including depreciation) directly and indirectly incurred in bringing the inventory to its existing condition and location. Selling expenses and general and administrative expenses are reported as period costs and excluded from inventory cost. Inventories of materials and supplies are valued at cost or less.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost and depreciated on a straight-line basis over the estimated useful lives of the assets, which ranges from 5 to 25-years for machinery and equipment and 30 to 50 years for buildings. Maintenance and repairs, including planned major maintenance, are expensed as incurred. Major renewals and improvements are capitalized and the assets replaced are retired.

In accordance with Accounting Standards Codification (ASC) 360, “Property, Plant, and Equipment” (ASC 360), the Business assesses the recoverability of the carrying value of its property, plant and equipment whenever events or changes in circumstances indicate that the carrying amount of the asset group may not be recoverable. Recoverability is measured by a comparison of the carrying amount of an asset group to the future net undiscounted cash flows expected to be generated by the asset group. If the undiscounted cash flows are less than the carrying amount of the asset group, an impairment loss is recognized for the amount by which the carrying value of the asset group exceeds the fair value of the asset group. There were no impairments during the periods presented.

Asset Retirement Obligations

The Business is subject to retirement obligations for certain assets. The fair values of these obligations are recorded as liabilities on a discounted basis, which is typically at the time the assets are installed. In the estimation of fair value, the Business uses assumptions and judgments regarding such factors as the existence of a legal obligation for an asset retirement obligation, technical assessments of the assets, estimated amounts and timing of settlements, discount rates, and inflation rates. Asset retirement obligations for the Business’s facilities generally become firm at the time the facilities are permanently shut down and dismantled. These obligations may include the costs of asset disposal and additional soil remediation. However, the Business’s sites generally have indeterminate lives based on plans for continued operations and as such, the fair value of the conditional legal obligations cannot be measured, since it is impossible to estimate the future settlement dates of such obligations.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

Accounting for Investments

The Combined Financial Statements include the accounts of certain subsidiaries the Business controls. Amounts representing the Business’s interest in entities that it does not control, but over which it exercises significant influence, are included in “Investments” in the Combined Balance Sheet. The Business’s share of the net income of these companies is included in the Combined Statements of Income caption “Income from equity affiliates”.

Majority ownership is normally the indicator of control that is the basis on which subsidiaries are consolidated. However, certain factors may indicate that a majority-owned investment is not controlled and therefore should be accounted for using the equity method of accounting. These factors occur where the minority shareholders are granted by law or by contract substantive participating rights. These include the right to approve operating policies, expense budgets, financing and investment plans, and management compensation and succession plans.

Investments in equity companies are assessed for possible impairment when events or changes in circumstances indicate that the carrying value of an investment may not be recoverable. Examples of key indicators include a history of operating losses, negative earnings and cash flow outlook, and the financial condition and prospects for the investee’s business segment. If the decline in value of the investment is other than temporary, the carrying value of the investment is written down to fair value. In the absence of market prices for the investment, discount cash flows are used to assess fair value.

As of December 31, 2022 and 2021, the Business had equity investments of $61.6 million and $57.9 million, respectively. These investments relate to the Business’s 40% ownership interest in the 65,000 bpd Yellowstone refined products pipeline, and its 65% ownership interest in a cogeneration facility and an expansive PADD IV & V marketing and logistics network.

Income Taxes

The Business’s operations are subject to U.S. federal, and state and local income taxes. In preparing these Combined Financial Statements and to the extent the Company has historically been included in the ExxonMobil income tax returns, the Business believes current and deferred income taxes should be presented in a manner that is systematic, rational and consistent with the asset and liability method prescribed by FASB ASC 740. Accordingly, the Business has prepared its tax provision for operations following a separate return method. The separate return method applies ASC 740 to the Combined Financial Statements on the basis the Business was a separate taxpayer. As a result, the tax treatment of certain items reflected in the Combined Financial Statements may not be reflected in the Consolidated Financial Statements and tax returns of ExxonMobil. Therefore, such items as net operating losses, credit and other similar loss carryforwards, and other deferred taxes may exist in the Combined Financial Statements that may not exist or will differ from the amounts reported in ExxonMobil’s Consolidated Financial Statements.

Since the Business’s results were previously included in ExxonMobil’s U.S. consolidated and combined income tax returns where applicable, payments to certain tax authorities were made by ExxonMobil and not by the Business. For tax jurisdictions where the Business is included with ExxonMobil in a consolidated tax filing, we do not maintain taxes payable to or from ExxonMobil and the payments are deemed settled immediately with the legal entities paying the tax in the respective tax jurisdictions through changes in net stockholders’ investment.

In determining the annual effective income tax rate, the Business analyzes various factors, including the Business’s annual earnings and taxing jurisdictions in which the earnings will be generated, the impact of state and local income taxes and the ability of the Business to use tax credits and net operating loss carryforwards.

Deferred income tax assets and liabilities are determined based on temporary differences between the financial reporting bases and the tax bases of assets and liabilities. Deferred income tax assets are also recognized for tax net operating loss carryforwards. These deferred income tax assets and liabilities are measured using the enacted tax rates and laws that will be in effect when such amounts are expected to be reversed or utilized. Valuation allowances are provided to reduce such deferred income tax assets to amounts more likely than not to be ultimately realized.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

The Business assesses uncertain tax positions in accordance with income tax accounting standards. Under these standards, income tax benefits should be recognized when, based on the technical merits of a tax position, the Business believes that if a dispute arose with the taxing authority and were taken to a court of last resort, it is more likely than not (i.e., a probability of greater than 50 percent) that the tax position would be sustained as filed. If a position is determined to be more likely than not of being sustained, the reporting enterprise should recognize the largest amount of tax benefit that is greater than 50 percent likely of being realized upon ultimate settlement with the taxing authority. The Business’s practice is to recognize interest and penalties related to income tax matters in income tax expense.

Defined Benefit Pension Plans and Other Employee Benefits

The Business’s employees participate in ExxonMobil’s defined benefit pension plans, which are offered to certain ExxonMobil employees. For purposes of the accompanying Combined Financial Statements, the Business accounts for its participation in these shared plans using the multiemployer approach under Topic 715 of the Accounting Standards Codification. As a participant in multiemployer benefit plans, the Business recognizes as expense a direct charge from ExxonMobil based on employees directly involved with the Business, and the Business does not recognize any employee benefit plan assets or liabilities in the accompanying Combined Balance Sheet.

Net Parent Company Investment

The Business’s equity on the Combined Balance Sheet represents ExxonMobil’s net investment in the Business, the accumulated net earnings after taxes and the net effect of the transactions with and allocations from ExxonMobil. Refer to Note 6, “Related Party Transactions and Net Parent Company Investment” for additional information.

|

3.

|

RECENTLY ISSUED ACCOUNTING STANDARDS

|

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, as part of its initiative to reduce complexity in the accounting standards. The amendments in the ASU include removal of certain exceptions to the general principles in Topic 740 related to recognizing deferred taxes for investments, performing intraperiod tax allocation and calculating income taxes in an interim period. The ASU also clarifies and simplifies other aspects of the accounting for income taxes, including the recognition of deferred tax liabilities for outside basis differences. The amendments in this ASU are effective for annual periods in fiscal years beginning after December 15, 2020, and interim periods therein. Early adoption is permitted. The Business adopted this accounting standard on January 1, 2021 with no material impact to the Combined Financial Statements.

|

4.

|

PROPERTY, PLANT, AND EQUIPMENT

|

Property, plant, and equipment at December 31, 2022 and 2021 consists of the following:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

(In thousands) |

|

|

Machinery & equipment

|

|

$ |

666,761 |

|

|

$ |

656,966 |

|

|

Buildings

|

|

|

51,756 |

|

|

|

50,093 |

|

|

Assets under construction

|

|

|

13,290 |

|

|

|

11,309 |

|

|

Other

|

|

|

1,511 |

|

|

|

1,510 |

|

|

Total property, plant, and equipment

|

|

|

733,318 |

|

|

|

719,878 |

|

|

Accumulated depreciation

|

|

|

(429,630 |

) |

|

|

(407,811 |

) |

|

Property and equipment, net

|

|

$ |

303,688 |

|

|

$ |

312,067 |

|

Depreciation expense related to property and equipment for the years ended December 31, 2022 and 2021 was $22.6 million and $22.3 million, respectively.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

Inventories at December 31, 2022 and 2021 consist of the following:

| |

|

|

|

|

|

|

| |

|

|

|

|

Crude oil

|

|

$ |

55,420 |

|

|

$ |

78,434 |

|

|

Petroleum products

|

|

|

167,805 |

|

|

|

200,297 |

|

|

Material and Supplies

|

|

|

25,161 |

|

|

|

19,827 |

|

|

Total

|

|

$ |

248,386 |

|

|

$ |

298,558 |

|

|

6.

|

RELATED PARTY TRANSACTIONS AND NET PARENT COMPANY INVESTMENT

|

The Combined Financial Statements have been prepared on a standalone basis and are derived from the Consolidated Financial Statements and accounting records of ExxonMobil. The following discussion summarizes activity between the Business and ExxonMobil.

The Business purchases all of crude oil and products from other ExxonMobil affiliates. Therefore, all “Crude oil and product purchases” in the Combined Statements of Income are related party transactions, and included in the Combined Balance Sheet, as “Due to related parties”. Additionally, the Business historically purchases all of its Renewable Identification Numbers (“RINs”) from other ExxonMobil affiliates at the settlement date. These RINs are necessary to meet the U.S. Environmental Protection Agency (“EPA”) renewable volume obligations under the Renewable Fuel Standard program, pursuant to the Energy Policy Act of 2005 and the EISA. During 2022, the Business purchased $15.9 million of RINs from other ExxonMobil affiliates. There were no RINs purchases in 2021. The Business had no sales to related parties during the periods presented.

Allocation of Corporate Expenses

The Combined Statements of Income include expenses for certain centralized functions and other programs provided and administered by ExxonMobil, as described in Note 1, “Description of Business and Basis of Presentation.” The costs of these services have been allocated to the Business and are included in the Combined Statements of Income, as follows:

| |

|

|

|

|

|

|

| |

|

|

|

| Production and manufacturing expenses |

|

|

|

|

|

|

35,226 |

|

|

Selling, general and administrative expenses

|

|

|

14,522 |

|

|

|

13,427 |

|

Total corporate allocations

|

|

|

|

|

|

|

|

|

Defined Benefit Pension Plans and Other Employee Benefits

Certain Business employees participate in the defined benefit pension, and defined contribution benefit plans sponsored by the Parent, which include employees from other ExxonMobil subsidiaries. The Business’s share of defined pension and postretirement health and life insurance costs were $8.9 million and $9.5 million in 2022 and 2021, respectively. The Business’s share of defined contribution plan costs were $3.1 million and $0.6 million in 2022 and 2021, respectively.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

Net Parent Company Investment

The net transfers to the Parent are included within “Net parent company investment” on the Combined Statements of Net Parent Company Investment The components of the transfers to Parent were as follows:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

(In thousands) |

|

|

Cash pooling and general financing activities, net of purchases from related parties

|

|

$ |

(278,529 |

) |

|

$ |

(157,014 |

) |

|

Corporate allocations

|

|

|

51,535 |

|

|

|

48,653 |

|

|

Income taxes

|

|

|

36,664 |

|

|

|

29,657 |

|

| Total net transfers to Parent |

|

|

(190,330 |

) |

|

|

(78,704 |

) |

Accrued liabilities consist of the following:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

(In thousands) |

|

|

Federal RINs liabilities

|

|

$ |

110,989 |

|

|

$ |

73,500 |

|

|

Accrued taxes other than income

|

|

|

15,865 |

|

|

|

18,055 |

|

|

Contract liabilities

|

|

|

804 |

|

|

|

1,095 |

|

|

Accrued compensation

|

|

|

1,649 |

|

|

|

3,725 |

|

|

Accrued liabilities

|

|

$ |

129,307 |

|

|

$ |

96,375 |

|

|

8.

|

COMMITMENTS AND CONTINGENCIES Litigation

|

Litigation

The Business can be subject to claims and complaints that may arise in the ordinary course of business. Management has regular litigation reviews, including updates from ExxonMobil, to assess the need for accounting recognition or disclosure of these contingencies. The Business would accrue an undiscounted liability for those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated. If a range of amounts can be reasonably estimated and no amount within range is a better estimate than any other amount, then the minimum of the range is accrued. The Business wouldn’t record liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated or when the liability is believed to be only reasonably possible or remote. For contingencies where an unfavorable outcome is reasonably possible and which are significant, the Business would disclose the nature of the contingency and, where feasible, an estimate of the reasonably possible loss. For purposes of the contingency disclosures, “significant” includes material matters as well as other matters which management believes should be disclosed. Based on a consideration of the process described, the Business does not have any material loss contingencies.

Commitments

During the normal course of business, in order to manage its refining process, the Parent enters into certain long-term agreements with third parties. The Parent’s purchase obligations, as part of these agreements, include commitments to engage a third party to process hydrogen sulfide into sweet fuel gas, and to discharge process wastewater into the treatment systems of local municipalities.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

As of December 31, 2022, expected payments for purchase commitments directly attributable to the Business are:

| |

|

Amount |

|

| |

|

(In thousands)

|

|

|

2023

|

|

$ |

10,379 |

|

|

2024

|

|

|

10,379 |

|

|

2025

|

|

|

3,461 |

|

|

2026

|

|

|

378 |

|

|

2027

|

|

|

378 |

|

|

Thereafter

|

|

|

1,470 |

|

|

Total

|

|

$ |

26,445 |

|

For purposes of our Combined Financial Statements, income taxes have been calculated as if we file income tax returns for the Business on a standalone basis for all periods presented. Historically, our U.S. operations and certain of our non-U.S. operations were included in the income tax returns of ExxonMobil and its subsidiaries. We believe the assumptions supporting the allocation and presentation of income taxes on a separate return basis are reasonable. However, our tax results, as presented in the Combined Financial Statements, may not be reflective of the results that the Business expects to generate in the future.

The components of income before income taxes are as follows:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

(In thousands) |

|

| Domestic |

|

$ |

151,671 |

|

|

$ |

121,394 |

|

|

Foreign

|

|

|

(17,943 |

) |

|

|

12,645 |

|

| Income from operations before income taxes |

|

|

133,728 |

|

|

|

134,039 |

|

The expense from income taxes consists of the following components:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

(In thousands) |

|

| Current: |

|

|

|

|

|

|

|

|

|

Federal

|

|

$ |

28,002 |

|

|

$ |

22,026 |

|

|

State

|

|

|

8,662 |

|

|

|

6,413 |

|

|

Foreign

|

|

|

- |

|

|

|

1,218 |

|

|

Total current expense from income taxes

|

|

$ |

36,664 |

|

|

$ |

29,657 |

|

|

Deferred:

|

|

|

|

|

|

|

|

|

|

Federal

|

|

|

1,187 |

|

|

|

912 |

|

|

State

|

|

|

1,294 |

|

|

|

(785 |

) |

|

Foreign

|

|

|

(5,024 |

) |

|

|

2,323 |

|

|

Total deferred expense from income taxes

|

|

$ |

(2,543 |

) |

|

$ |

2,450 |

|

|

Total expense from income taxes

|

|

$ |

34,121 |

|

|

$ |

32,107 |

|

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

A reconciliation of the statutory federal income tax rate to the effective income tax rate is as follows:

| |

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| |

|

|

(In thousands) |

|

| |

|

|

|

|

|

|

|

|

|

Federal statutory income tax rate

|

|

|

21.0 |

%

|

|

|

21.0 |

% |

|

State income tax expense

|

|

|

5.9 |

|

|

|

3.3 |

|

|

Foreign rate differential

|

|

|

(0.9 |

) |

|

|

0.7 |

|

|

Non-deductible expenses

|

|

|

(0.4 |

) |

|

|

(0.9 |

) |

|

Return to provision adjustments

|

|

|

- |

|

|

|

(0.1 |

) |

| Effective tax rate, operations |

|

|

25.6 |

% |

|

|

24.0 |

% |

The Business determined that all of its federal, state and foreign deferred tax assets were more likely than not to be realized. In making such a determination, the Business evaluates a variety of factors including the projected future taxable income, scheduled reversals of deferred tax liabilities, prudent tax planning strategies, and recent financial operations. The evaluation of this evidence requires significant judgement about the forecasts of future taxable income, based on the plans and estimates we are using to manage the underlying Business.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Business’s net deferred income taxes are as follows:

| |

|

December 31, 2022 |

|

|

December 31, 2022 |

|

| |

|

|

|

|

| Deferred tax assets: |

|

|

(In thousands) |

|

|

Net operating losses

|

|

$ |

2,091 |

|

|

$ |

- |

|

|

Accruals and reserves

|

|

|

925 |

|

|

|

1,574 |

|

|

Gross deferred tax assets

|

|

$ |

3,016 |

|

|

$ |

1,574 |

|

|

Deferred tax liabilities:

|

|

|

|

|

|

|

|

|

|

Inventory adjustments

|

|

|

(4,133 |

) |

|

|

(7,066 |

) |

|

Outside basis difference for unconsolidated subsidiary

|

|

|

(10,486 |

) |

|

|

(9,845 |

) |

|

Depreciation and amortization

|

|

|

(54,980 |

) |

|

|

(53,789 |

) |

|

Gross deferred tax liabilities

|

|

$ |

(69,599 |

) |

|

$ |

(70,700 |

) |

|

Deferred income tax liabilities, net

|

|

$ |

(66,583 |

) |

|

$ |

(69,126 |

) |

At December 31, 2022 and 2021, the Business had no U. S. federal and state NOL carryforwards. At December 31, 2022 and 2021, the Business also had no federal or state tax credit carryforwards. At December 31, 2022, the Business has approximately $2.1 M of foreign NOL carryforwards. The Business had no foreign NOL carryforwards, at December 31, 2021.

The Business’s operations are subject to U.S. federal, state and local and foreign income taxes. In preparing these Combined Financial Statements and to the extent the Business has historically been included in the Parent income tax returns, the Business has prepared its taxprovision for operations following a separate return method. The separate return method applies ASC 740 to the Combined Financial Statements on the basis the Business was a separate taxpayer. As a result, the tax treatment of certain items reflected in the Combined Financial Statements may not be reflected in the consolidated tax returns of Parent. Therefore, such items as net operating losses, credit and other similar loss carryforwards, and other deferred taxes may exist in the Combined Financial Statements that may not exist or will differ from the amounts reported in Parent’s consolidated tax return.

The Business recognizes the benefit of tax positions taken or expected to be taken in its tax returns in the financial statements when it is more likely than not that the position will be sustained upon examination by authorities. Recognized tax positions are measured at the largest amount of benefit that is greater than 50% likely of being realized upon settlement. As of December 31, 2022, the Business had no unrecognized tax benefits.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO COMBINED FINANCIAL STATEMENTS

As of December 31, 2022 and 2021, the Business has no unrecognized tax benefits which would affect the Business’s effective tax rate if recognized. The Business does not expect any significant changes in its tax positions that would warrant recognition of a liability for unrecognized income tax benefits during the next 12 months. The Business recognizes interest and penalties related to uncertain tax positions in income tax expense.

On August 16, 2022, the Inflation Reduction Act (the IRA) was signed into law in the U.S. Among other changes, the IRA introduced a corporate minimum tax on certain corporations with average adjusted financial statement income over a three-tax year period in excess of $1.0 billion and an excise tax on certain stock repurchases by certain covered corporations for taxable years beginning after December 31, 2022 and several tax incentives to promote clean energy. Based on our current analysis and pending future guidance to be issued by Treasury, we do not believe these provisions will have a material impact on our Combined Financial Statements.

The Business has evaluated subsequent events through the date that this report was available to be issued, May 25, 2023 and determined that there were no subsequent events requiring recognition or disclosure in the Business’ accompanying Combined Financial Statements and notes to the Combined Financial Statements.

Exhibit 99.3

Billings Refinery & Associated Logistics Business

Condensed Combined Financial Statements

For the quarterly period ended March 31, 2023

TABLE OF CONTENTS

| |

Page |

| Condensed Combined Balance Sheets as of March 31, 2023 and December 31, 2022 |

3 |

| Condensed Combined Statements of Income for the three months ended March 31, 2023 and 2022 |

4 |

| Condensed Combined Statements of Net Parent Company Investment for the three months ended March 31, 2023 a nd 2022 |

5 |

| Condensed Combined Statements of Cash Flows for the three months ended March 31, 2023 and 2022 |

6 |

| Notes to Condensed Combined Financial Statements |

7 |

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

CONDENSED COMBINED BALANCE SHEETS (Unaudited)

(in thousands)

| |

|

March 31, 2023

|

|

|

December 31, 2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

$ |

48,363 |

|

|

$ |

50,489 |

|

|

Inventories

|

|

|

282,105 |

|

|

|

248,386 |

|

|

Prepaid expenses and other current assets

|

|

|

1,587 |

|

|

|

1,775 |

|

|

Total current assets

|

|

|

332,055 |

|

|

|

300,650 |

|

|

Investments

|

|

|

64,928 |

|

|

|

61,643 |

|

|

Property, plant, & equipment, net

|

|

|

298,797 |

|

|

|

303,688 |

|

|

Other assets, net

|

|

|

9,182 |

|

|

|

10,128 |

|

|

Total assets

|

|

$ |

704,962 |

|

|

$ |

676,109 |

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

33,347 |

|

|

|

47,317 |

|

|

Accrued liabilities

|

|

|

110,039 |

|

|

|

129,307 |

|

|

Due to related parties

|

|

|

132,106 |

|

|

|

143,273 |

|

|

Total current liabilities

|

|

|

275,492 |

|

|

|

319,897 |

|

|

Deferred income tax liabilities

|

|

|

70,864 |

|

|

|

66,583 |

|

| Total liabilities |

|

$ |

346,356 |

|

|

$ |

386,480 |

|

| Net parent company investment |

|

|

|

|

|

|

|

|

| Net parent company investment |

|

|

358,606 |

|

|

|

289,629 |

|

| Total liabilities and net parent company investment |

|

$ |

704,962 |

|

|

$ |

676,109 |

|

The accompanying notes are an integral part of these Condensed Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

CONDENSED COMBINED STATEMENTS OF INCOME (Unaudited)

(in thousands)

| Revenues and other income |

|

Three Months Ended March 31, 2023 |

|

|

Three Months Ended March 31, 2022 |

|

|

Sales and other operating revenue

|

|

$ |

531,218 |

|

|

$ |

581,683 |

|

|

Income from equity affiliates

|

|

|

7,967 |

|

|

|

6,232 |

|

|

Total revenues and other income

|

|

|

539,185 |

|

|

|

587,915 |

|

|

Costs and other deductions

|

|

|

|

|

|

|

|

|

|

Crude oil and product purchases - related party

|

|

|

(357,317 |

) |

|

|

(449,193 |

) |

|

Production and manufacturing expenses

|

|

|

(85,581 |

) |

|

|

(68,133 |

) |

|

Selling, general and administrative expenses

|

|

|

(10,209 |

) |

|

|

(9,486 |

) |

|

Depreciation expense

|

|

|

(5,570 |

) |

|

|

(5,579 |

) |

|

Other taxes and duties

|

|

|

(757 |

) |

|

|

(930 |

) |

|

Total costs and other deductions

|

|

|

(459,434 |

) |

|

|

(533,321 |

) |

|

Income before income taxes

|

|

|

79,751 |

|

|

|

54,594 |

|

|

Income taxes

|

|

|

(20,413 |

) |

|

|

(14,177 |

) |

|

Net income

|

|

$ |

59,338 |

|

|

$ |

40,417 |

|

The accompanying notes are an integral part of these Condensed Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

CONDENSED COMBINED STATEMENTS OF NET PARENT COMPANY INVESTMENT (Unaudited)

(in thousands)

| |

|

Net Parent Company Investment |

|

| Balance at December 31, 2021 |

|

$ |

380,352 |

|

| Net income |

|

|

40,417 |

|

| Net transfers from (to) Parent |

|

|

(53,640 |

) |

| Balance at March 31, 2022 |

|

$ |

367,129 |

|

| |

|

|

|

|

|

Balance at December 31, 2022

|

|

|

289,629 |

|

|

Net income

|

|

|

59,338 |

|

|

Net transfers from (to) Parent

|

|

|

9,639 |

|

|

Balance at March 31, 2023

|

|

$ |

358,606 |

|

The accompanying notes are an integral part of these Condensed Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

CONDENSED COMBINED STATEMENTS OF CASH FLOWS (Unaudited)

(in thousands)

| |

|

Three Months Ended

|

|

|

Three Months Ended

|

|

| |

|

March 31, 2023

|

|

|

March 31, 2022

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

59,338 |

|

|

$ |

40,417 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

5,570 |

|

|

|

5,579 |

|

|

Deferred income taxes

|

|

|

4,281 |

|

|

|

371 |

|

|

Other non-cash items, net

|

|

|

- |

|

|

|

96 |

|

|

Dividends received less than equity in current earnings of equity companies

|

|

|

(3,285 |

) |

|

|

(2,089 |

) |

|

Change in assets and liabilities:

|

|

|

Accounts receivable

|

|

|

2,126 |

|

|

|

(21,960 |

) |

|

Inventory

|

|

|

(33,720 |

) |

|

|

(45,404 |

) |

|

Prepaid expenses and other current assets

|

|

|

188 |

|

|

|

733 |

|

|

Other assets

|

|

|

946 |

|

|

|

298 |

|

|

Accounts payable

|

|

|

(13,969 |

) |

|

|

(9,943 |

) |

|

Accrued liabilities

|

|

|

(19,268 |

) |

|

|

15,135 |

|

|

Due to related parties

|

|

|

(11,167 |

) |

|

|

72,119 |

|

|

Net cash (used by) provided from operating activities

|

|

|

(8,960 |

) |

|

|

55,352 |

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(671 |

) |

|

|

(1,635 |

) |

|

Other investing activities, net

|

|

|

(8 |

) |

|

|

(77 |

) |

|

Net cash used in investing activities

|

|

|

(679 |

) |

|

|

(1,712 |

) |

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Net transfers from (to) Parent

|

|

|

9,639 |

|

|

|

(53,640 |

) |

|

Net cash (used by) provided from financing activities

|

|

|

9,639 |

|

|

|

(53,640 |

) |

| Net increase (decrease) in cash and cash equivalents |

|

|

- |

|

|

|

- |

|

| Cash and cash equivalents at beginning of period |

|

|

- |

|

|

|

- |

|

| Cash and cash equivalents at end of period |

|

|

- |

|

|

|

- |

|

The accompanying notes are an integral part of these Condensed Combined Financial Statements.

BILLINGS REFINERY & ASSOCIATED LOGISTICS BUSINESS

NOTES TO CONDENSED COMBINED FINANCIAL STATEMENTS (Unaudited)

|

1.

|

DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION Description of Business

|

On October 20, 2022, ExxonMobil Corporation (referred to as “ExxonMobil” or “Parent”) entered into a definitive agreement to sell its Billings Refinery & Associated Logistics Business (collectively the “Business”) to Par Pacific Holdings. The Business is a fully integrated fuels value chain, deriving value along the entire chain from the sourcing of crude oil to refining, distributing, and marketing of fuels to its customers, which includes operations in the states of Montana, Wyoming, Idaho, Utah, eastern Washington, and the Dakotas. The Business operates a high-conversion, complex 63,000 barrels per day (“bpd”) refinery in Billings, Montana, which processes low-cost Western Canadian and regional Rocky Mountain crude oil grades. In addition to the refinery, the Business owns a 65% interest in an adjacent cogeneration facility and an expansive Petroleum Administration for Defense Districts (“PADD”) IV & V marketing and logistics network. The logistics assets include the wholly-owned 70-mile, 55,000 bpd Silvertip Pipeline, a 40% interest in the 750-mile, 65,000 bpd Yellowstone refined products pipeline, and seven refined product terminals. Total storage capacity across the refinery and logistics locations totals 4.1 million barrels (“MMbbls”).

Basis of Presentation