- Second Quarter Revenue Increased 3% on a Reported Basis and 2%

in Constant Currency, Ahead of Expectations, Led by Continued

Momentum in Asia

- Global Direct-to-Consumer Comparable Store Sales Accelerated to

6% Growth in the Quarter, Driven by Positive Retail Comps Across

All Regions and Channels and 10% AUR Growth

- Delivered Gross and Operating Margins Above Our Outlook, with

Continued Brand Elevation and Expense Discipline More than

Offsetting Ongoing Product Cost Headwinds and Higher Planned

Marketing and Digital Investments in the Period

- Drove Healthy Inventory Positioning Entering Holiday, with

Global Inventories Down 5% to Prior Year

- Returned Approximately $275 Million to Shareholders Through Our

Dividend and Repurchase of Class A Common Stock This Fiscal

Year-to-Date

- Reiterated Full Year Fiscal 2024 Outlook of Low-Single Digit

Revenue Growth, Centering on 1% to 2%, and Adjusted Operating

Margin Expansion on Higher Expected Gross Margins, All in Constant

Currency

Ralph Lauren Corporation (NYSE:RL), a global leader in the

design, marketing, and distribution of luxury lifestyle products,

today reported earnings per diluted share of $2.19 on a reported

basis and $2.10 on an adjusted basis, excluding

restructuring-related and other net charges and one-time tax events

for the second quarter of Fiscal 2024. This compared to earnings

per diluted share of $2.18 on a reported basis and $2.23 on an

adjusted basis, excluding restructuring-related and other net

charges for the second quarter of Fiscal 2023.

"We inspire people to embrace their sense of individual style

through a timeless, elegant way of living," said Ralph Lauren,

Executive Chairman and Chief Creative Officer. "From our recent

fashion show in Brooklyn to championing the resilience of sport at

the U.S. Open, Wimbledon and Ryder Cup, there is a spirit of

authenticity to everything we do and it endures beyond any economic

or fashion cycle."

"Our teams delivered solid second quarter performance ahead of

our commitments with stronger top-line growth across all regions,

supported by our iconic brand, pricing power and continued

strategic investments," said Patrice Louvet, President and Chief

Executive Officer. "While we continue to navigate an uncertain

macro environment, we are driving offense across our Next Great

Chapter: Accelerate plan's multiple growth drivers with agility,

discipline and a clear focus on what we can control."

Key Achievements in Second Quarter Fiscal 2024

We delivered the following highlights across our Next Great

Chapter: Accelerate priorities in the second quarter of Fiscal

2024:

- Elevate and Energize Our Lifestyle Brand

- Continued to recruit high-value, younger consumers to the brand

and re-engage existing consumers through a diverse range of

cultural moments spanning fashion, music, gaming and sports,

notably: our Collection show at New York Fashion Week in September;

sponsorships of the U.S. Open, Wimbledon and Ryder Cup; the launch

of Polo Ralph Lauren x Fortnite Race to Greatness; another

successful Golden Week in Asia; and dressing Beyoncé in her

Renaissance World Tour

- Added 1.3 million new consumers to our direct-to-consumer

businesses and reached 55.9 million social media followers

globally, up low-double-digits to last year driven by growth on

multiple platforms across key markets

- Drive the Core and Expand for More

- Increased average unit retail ("AUR") by 10% across our

direct-to-consumer network in the second quarter, on top of an 18%

increase last year, reflecting the durability of our multi-pronged

elevation approach

- Drove momentum in our Core business, up high-single digits to

last year, as well as our high-potential categories — including

Women's, Outerwear and Home — up low-double digits to last year,

both in constant currency

- Product highlights this quarter included: the launch of our

latest iconic Ralph Lauren Collection handbag, the RL 888; U.S.

Open, Wimbledon, and Ryder Cup collections and LA28 Olympic jacket;

and limited edition P-Wing Fortnite Sneaker-Boot

- Win in Key Cities with Our Consumer Ecosystem

- By region, constant currency sales performance was led by Asia,

up 10% on a reported basis and 13% in constant currency with China

up more than 20% to last year. Europe grew 7% on a reported basis

but was flat in constant currency, with a previously reported

timing shift into the first quarter. North America declined 1%,

improving sequentially and above our expectations, driven by better

performance across all direct-to-consumer channels

- Continued to expand and scale our key city ecosystems in the

second quarter, including our first connected ecosystem in Canada

with a new luxury store experience in Toronto and the October

launch of our Canadian digital flagship RalphLauren.ca site

Our business is supported by our fortress foundation, which we

define through our five key enablers, including: our people and

culture, best-in-class digital technology and analytics, superior

operational capabilities, a powerful balance sheet, and leadership

in citizenship and sustainability.

Second Quarter Fiscal 2024 Income Statement Review

Net Revenue. In the second quarter of Fiscal 2024,

revenue increased 3% to $1.6 billion on a reported basis and was up

2% in constant currency. Foreign currency favorably impacted

revenue growth by approximately 170 basis points in the second

quarter.

Revenue performance for the Company's reportable segments in the

second quarter compared to the prior year period was as

follows:

- North America Revenue. North America revenue in the second

quarter decreased 1% to $718 million. In retail, comparable store

sales in North America improved to 4% growth, including a 4%

increase in digital commerce and a 4% increase in brick and mortar

stores. North America wholesale revenue decreased 7% as the Company

carefully manages sell-in to align with softer consumer demand in

the channel.

- Europe Revenue. Europe revenue in the second quarter increased

7% to $527 million on a reported basis and was flat in constant

currency. Results included approximately 5 points of negative

impact from lapping last year's favorable post-pandemic wholesale

allowances and a timing shift of wholesale shipments into the first

quarter of Fiscal 2024 to maximize full-price selling. In retail,

comparable store sales in Europe improved to 6% growth, with a 5%

increase in brick and mortar stores and a 14% increase in digital

commerce. Europe wholesale revenue was flat to prior year on a

reported basis and declined 7% in constant currency due to the

previously disclosed impacts noted above.

- Asia Revenue. Asia revenue in the second quarter increased 10%

to $348 million on a reported basis and 13% in constant currency.

Comparable store sales in Asia increased 8%, with a 7% increase in

our brick and mortar stores and a 19% increase in digital

commerce.

Gross Profit. Gross profit for the second quarter of

Fiscal 2024 was $1.1 billion and gross margin was 65.5%. Adjusted

gross margin was 65.4%, 80 basis points above the prior year on

both a reported and constant currency basis. Gross margins were

driven by strong AUR growth across all regions, lower freight and

favorable channel and geographic mix shifts, more than offsetting

continued pressure from raw material costs.

Operating Expenses. Operating expenses in the second

quarter of Fiscal 2024 were $906 million on a reported basis. On an

adjusted basis, operating expenses were $897 million, up 11% to

last year. Adjusted operating expense rate was 54.9%, compared to

51.2% in the prior year period. The increase was driven by higher

compensation and rent & occupancy costs, along with higher

digital and marketing investments in the quarter due to the planned

timing of key marketing campaigns.

Operating Income. Operating income for the second quarter

of Fiscal 2024 was $164 million and operating margin was 10.1% on a

reported basis. Adjusted operating income was $172 million and

operating margin was 10.5%, 290 basis points below the prior year.

Operating income for the Company's reportable segments in the

second quarter compared to the prior year period was as

follows:

- North America Operating Income. North America operating income

in the second quarter was $110 million on a reported basis and $108

million on an adjusted basis. Adjusted North America operating

margin was 15.1%, down 210 basis points to last year, with strong

gross margin expansion more than offset by higher operating

expenses due to the timing of planned strategic investments.

- Europe Operating Income. Europe operating income in the second

quarter was $132 million on both a reported and adjusted basis.

Adjusted Europe operating margin was 25.1%, down 220 basis points

to last year. Foreign currency favorably impacted adjusted

operating margin rate by 130 basis points in the second

quarter.

- Asia Operating Income. Asia operating income in the second

quarter was $68 million on both a reported and adjusted basis.

Adjusted Asia operating margin was 19.6%, down 120 basis points to

last year.

Net Income and EPS. Net income in the second quarter of

Fiscal 2024 was $147 million, or $2.19 per diluted share on a

reported basis. On an adjusted basis, net income was $141 million,

or $2.10 per diluted share. This compared to net income of $151

million, or $2.18 per diluted share on a reported basis, and net

income of $154 million, or $2.23 per diluted share on an adjusted

basis, for the second quarter of Fiscal 2023.

In the second quarter of Fiscal 2024, the Company had an

effective tax rate of approximately 11% on a reported basis and 18%

on an adjusted basis. This compared to an effective tax rate of

approximately 25% on both a reported basis and adjusted basis in

the prior year period.

Balance Sheet and Cash Flow Review

The Company ended the second quarter of Fiscal 2024 with $1.5

billion in cash and short-term investments and $1.1 billion in

total debt, compared to $1.4 billion and $1.1 billion,

respectively, at the end of the second quarter of Fiscal 2023.

Inventory at the end of the second quarter of Fiscal 2024 was

$1.2 billion, down 5% compared to the prior year period, with a

decline in North America partly offset by an increase in Asia to

support growth initiatives and Europe aligned with revenue growth

expectations.

The Company repurchased approximately $125 million of Class A

Common Stock in the second quarter.

Full Year Fiscal 2024 and Third Quarter Outlook

The Company's outlook is based on its best assessment of the

current geopolitical and macroeconomic environment, including

inflationary pressures and other consumer spending-related

headwinds, and foreign currency volatility, among others. The full

year Fiscal 2024 and third quarter guidance excludes any potential

restructuring-related and other net charges that may be incurred in

future periods, as described in the "Non-U.S. GAAP Financial

Measures" section of this press release.

For Fiscal 2024, the Company continues to expect revenues to

increase approximately low-single digits to last year on a constant

currency basis, centering around 1% to 2%. This outlook reflects

slightly increased caution around the wholesale channel. Based on

current exchange rates, foreign currency is now expected to

negatively impact revenue growth by approximately 50 basis points

in Fiscal 2024.

The Company continues to expect operating margin for Fiscal 2024

to expand approximately 30 to 50 basis points in constant currency

to 12.3% to 12.5%, driven by gross margin expansion. Foreign

currency is expected to negatively impact operating margin by about

10 basis points in Fiscal 2024. Gross margin is now expected to

increase approximately 120 to 170 basis points in constant

currency, up from the prior outlook of 100 basis points, with

reduced freight costs, favorable channel and geographic mix and

continued growth in AUR more than offsetting product cost

inflation. Foreign currency is still expected to negatively impact

gross margins by approximately 30 basis points in Fiscal 2024.

Gross margin expansion is expected to more than offset higher

operating expenses as a percent of revenue due to channel mix

shifts and as the Company invests in long-term strategic growth

initiatives, notably digital and key city ecosystem expansion.

For the third quarter, the Company expects revenue to be up

approximately 1% to 2% to last year in constant currency. Foreign

currency is expected to negatively impact revenue growth by

approximately 30 basis points.

Operating margin for the third quarter is expected to be roughly

flat in constant currency, with about 10 basis points of foreign

currency benefit. The Company expects constant currency gross

margin expansion of approximately 100 to 150 basis points to be

largely offset by higher operating expenses due to the timing of

strategic investments in the period, with a higher proportion of

marketing and ecosystem investments planned in the second and third

quarters of the fiscal year. Foreign currency is expected to

negatively impact gross margin by approximately 20 basis points in

the third quarter.

Full year Fiscal 2024 tax rate is now expected in the range of

approximately 22% to 23%, assuming a continuation of current tax

laws, while third quarter tax rate is expected in the range of 23%

to 24%.

The Company expects capital expenditures for Fiscal 2024 of

approximately $250 million.

Conference Call

As previously announced, the Company will host a conference call

and live online webcast today, Wednesday, November 8, 2023, at 9:00

A.M. Eastern. Listeners may access a live broadcast of the

conference call on the Company investor relations website at

http://investor.ralphlauren.com or by dialing 517-623-4963 or

800-857-5209. To access the conference call, listeners should dial

in by 8:45 A.M. Eastern and request to be connected to the Ralph

Lauren Second Quarter 2024 conference call.

An online archive of the broadcast will be available by

accessing the Company's investor relations website at

http://investor.ralphlauren.com. A telephone replay of the call

will be available from 12:00 P.M. Eastern, Wednesday, November 8,

2023 through 6:00 P.M. Eastern, Wednesday, November 15, 2023 by

dialing 203-369-3269 or 800-391-9853 and entering passcode

3954.

ABOUT RALPH LAUREN

Ralph Lauren Corporation (NYSE:RL) is a global leader in the

design, marketing and distribution of luxury lifestyle products in

five categories: apparel, footwear & accessories, home,

fragrances, and hospitality. For more than 50 years, Ralph Lauren

has sought to inspire the dream of a better life through

authenticity and timeless style. Its reputation and distinctive

image have been developed across a wide range of products, brands,

distribution channels and international markets. The Company's

brand names — which include Ralph Lauren, Ralph Lauren Collection,

Ralph Lauren Purple Label, Polo Ralph Lauren, Double RL, Lauren

Ralph Lauren, Polo Ralph Lauren Children and Chaps, among others —

constitute one of the world's most widely recognized families of

consumer brands. For more information, go to

https://investor.ralphlauren.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release, and oral statements made from time to time

by representatives of the Company, may contain certain

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, statements regarding our

current expectations about the Company's future operating results

and financial condition, the implementation and results of our

strategic plans and initiatives, store openings and closings,

capital expenses, our plans regarding our quarterly cash dividend

and Class A common stock repurchase programs, and our ability to

meet environmental, social, and governance goals. Forward looking

statements are based on current expectations and are indicated by

words or phrases such as "aim," "anticipate," "outlook,"

"estimate," "ensure," "commit," "expect," "project," "believe,"

"envision," "goal," "target," "can," "will," and similar words or

phrases. These forward-looking statements involve known and unknown

risks, uncertainties, and other factors which may cause actual

results, performance or achievements to be materially different

from the future results, performance or achievements expressed in

or implied by such forward-looking statements. The factors that

could cause actual results to materially differ include, among

others: the loss of key personnel, including Mr. Ralph Lauren, or

other changes in our executive and senior management team or to our

operating structure, including any potential changes resulting from

the execution of our long-term growth strategy, and our ability to

effectively transfer knowledge and maintain adequate controls and

procedures during periods of transition; the potential impact to

our business resulting from inflationary pressures, including

increases in the costs of raw materials, transportation, wages,

healthcare, and other benefit-related costs; the impact of

economic, political, and other conditions on us, our customers,

suppliers, vendors, and lenders, including potential business

disruptions related to the Russia-Ukraine and Israel-Hamas wars,

civil and political unrest, diplomatic tensions between the U.S.

and other countries, rising interest rates, and bank failures,

among other factors described herein; the potential impact to our

business resulting from supply chain disruptions, including those

caused by capacity constraints, closed factories and/or labor

shortages (stemming from pandemic diseases, labor disputes,

strikes, or otherwise), scarcity of raw materials, port congestion,

and scrutiny or detention of goods produced in certain territories

resulting from laws, regulations, or trade restrictions, such as

those imposed by the Uyghur Forced Labor Prevention Act ("UFLPA")

or the Countering America's Adversaries Through Sanctions Act

("CAATSA"), which could result in shipment approval delays leading

to inventory shortages and lost sales; our ability to effectively

manage inventory levels and the increasing pressure on our margins

in a highly promotional retail environment; our exposure to

currency exchange rate fluctuations from both a transactional and

translational perspective; our ability to recruit and retain

employees to operate our retail stores, distribution centers, and

various corporate functions; the impact to our business resulting

from a recession or changes in consumers' ability, willingness, or

preferences to purchase discretionary items and luxury retail

products, which tends to decline during recessionary periods, and

our ability to accurately forecast consumer demand, the failure of

which could result in either a build-up or shortage of inventory;

our ability to successfully implement our long-term growth

strategy; our ability to continue to expand and grow our business

internationally and the impact of related changes in our customer,

channel, and geographic sales mix as a result, as well as our

ability to accelerate growth in certain product categories; our

ability to open new retail stores and concession shops, as well as

enhance and expand our digital footprint and capabilities, all in

an effort to expand our direct-to-consumer presence; our ability to

respond to constantly changing fashion and retail trends and

consumer demands in a timely manner, develop products that resonate

with our existing customers and attract new customers, and execute

marketing and advertising programs that appeal to consumers; our

ability to competitively price our products and create an

acceptable value proposition for consumers; our ability to continue

to maintain our brand image and reputation and protect our

trademarks; our ability to achieve our goals regarding

environmental, social, and governance practices, including those

related to climate change and our human capital; our ability and

the ability of our third-party service providers to secure our

respective facilities and systems from, among other things,

cybersecurity breaches, acts of vandalism, computer viruses,

ransomware, or similar Internet or email events; our efforts to

successfully enhance, upgrade, and/or transition our global

information technology systems and digital commerce platforms; the

potential impact to our business if any of our distribution centers

were to become inoperable or inaccessible; the potential impact to

our business resulting from pandemic diseases such as COVID-19,

including periods of reduced operating hours and capacity limits

and/or temporary closure of our stores, distribution centers, and

corporate facilities, as well as those of our customers, suppliers,

and vendors, and potential changes to consumer behavior, spending

levels, and/or shopping preferences, such as willingness to

congregate in shopping centers or other populated locations; the

potential impact on our operations and on our suppliers and

customers resulting from man-made or natural disasters, including

pandemic diseases, severe weather, geological events, and other

catastrophic events, such as terrorist attacks and military

conflicts; our ability to achieve anticipated operating

enhancements and cost reductions from our restructuring plans, as

well as the impact to our business resulting from

restructuring-related charges, which may be dilutive to our

earnings in the short term; the impact to our business resulting

from potential costs and obligations related to the early or

temporary closure of our stores or termination of our long-term,

non-cancellable leases; our ability to maintain adequate levels of

liquidity to provide for our cash needs, including our debt

obligations, tax obligations, capital expenditures, and potential

payment of dividends and repurchases of our Class A common stock,

as well as the ability of our customers, suppliers, vendors, and

lenders to access sources of liquidity to provide for their own

cash needs; the potential impact to our business resulting from the

financial difficulties of certain of our large wholesale customers,

which may result in consolidations, liquidations, restructurings,

and other ownership changes in the retail industry, as well as

other changes in the competitive marketplace, including the

introduction of new products or pricing changes by our competitors;

our ability to access capital markets and maintain compliance with

covenants associated with our existing debt instruments; a variety

of legal, regulatory, tax, political, and economic risks, including

risks related to the importation and exportation of products which

our operations are currently subject to, or may become subject to

as a result of potential changes in legislation, and other risks

associated with our international operations, such as compliance

with the Foreign Corrupt Practices Act or violations of other

anti-bribery and corruption laws prohibiting improper payments, and

the burdens of complying with a variety of foreign laws and

regulations, including tax laws, trade and labor restrictions, and

related laws that may reduce the flexibility of our business; the

impact to our business resulting from the potential imposition of

additional duties, tariffs, taxes, and other charges or barriers to

trade, including those resulting from trade developments between

the U.S. and China or other countries, and any related impact to

global stock markets, as well as our ability to implement

mitigating sourcing strategies; changes in our tax obligations and

effective tax rate due to a variety of factors, including potential

changes in U.S. or foreign tax laws and regulations, accounting

rules, or the mix and level of earnings by jurisdiction in future

periods that are not currently known or anticipated; the potential

impact to the trading prices of our securities if our operating

results, Class A common stock share repurchase activity, and/or

cash dividend payments differ from investors' expectations; our

ability to maintain our credit profile and ratings within the

financial community; our intention to introduce new products or

brands, or enter into or renew alliances; changes in the business

of, and our relationships with, major wholesale customers and

licensing partners; our ability to make strategic acquisitions and

successfully integrate the acquired businesses into our existing

operations; and other risk factors identified in the Company’s

Annual Report on Form 10-K, Form 10-Q and Form 8-K reports filed

with the Securities and Exchange Commission. The Company undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

RALPH LAUREN

CORPORATION

CONSOLIDATED BALANCE

SHEETS

Prepared in accordance with

U.S. Generally Accepted Accounting Principles

(Unaudited)

September 30,

2023

April 1, 2023

October 1, 2022

(millions)

ASSETS

Current assets:

Cash and cash equivalents

$

1,381.8

$

1,529.3

$

1,107.1

Short-term investments

85.1

36.4

309.6

Accounts receivable, net of allowances

461.1

447.7

489.6

Inventories

1,195.3

1,071.3

1,261.4

Income tax receivable

50.0

50.7

54.1

Prepaid expenses and other current

assets

221.2

188.7

218.8

Total current assets

3,394.5

3,324.1

3,440.6

Property and equipment, net

875.6

955.5

899.1

Operating lease right-of-use assets

1,088.2

1,134.0

1,016.7

Deferred tax assets

262.7

255.1

243.0

Goodwill

883.0

898.9

865.5

Intangible assets, net

82.2

88.9

95.6

Other non-current assets

136.9

133.0

173.1

Total assets

$

6,723.1

$

6,789.5

$

6,733.6

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

460.1

$

371.6

$

498.0

Current income tax payable

56.3

59.7

89.9

Current operating lease liabilities

270.9

266.7

244.6

Accrued expenses and other current

liabilities

823.1

795.5

877.1

Total current liabilities

1,610.4

1,493.5

1,709.6

Long-term debt

1,139.5

1,138.5

1,137.5

Long-term finance lease liabilities

266.9

315.3

323.8

Long-term operating lease liabilities

1,079.0

1,141.1

1,036.7

Non-current income tax payable

42.2

75.9

73.6

Non-current liability for unrecognized tax

benefits

100.7

93.8

86.6

Other non-current liabilities

115.2

100.9

110.2

Total liabilities

4,353.9

4,359.0

4,478.0

Equity:

Common stock

1.3

1.3

1.3

Additional paid-in-capital

2,875.0

2,824.3

2,789.5

Retained earnings

6,779.7

6,598.2

6,448.1

Treasury stock, Class A, at cost

(7,024.0

)

(6,797.3

)

(6,726.0

)

Accumulated other comprehensive loss

(262.8

)

(196.0

)

(257.3

)

Total equity

2,369.2

2,430.5

2,255.6

Total liabilities and equity

$

6,723.1

$

6,789.5

$

6,733.6

Net Cash & Short-term

Investments(a)

$

327.4

$

427.2

$

279.2

Cash & Short-term Investments

1,466.9

1,565.7

1,416.7

_____________________

(a)

Calculated as cash and cash equivalents,

plus short-term investments, less total debt.

RALPH LAUREN

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

Prepared in accordance with

U.S. Generally Accepted Accounting Principles

(Unaudited)

Three Months Ended

Six Months Ended

September 30,

2023

October 1, 2022

September 30,

2023

October 1, 2022

(millions, except per share

data)

Net revenues

$

1,633.0

$

1,579.9

$

3,129.5

$

3,070.5

Cost of goods sold

(562.9

)

(556.8

)

(1,027.4

)

(1,046.0

)

Gross profit

1,070.1

1,023.1

2,102.1

2,024.5

Selling, general, and administrative

expenses

(896.3

)

(809.5

)

(1,726.3

)

(1,630.1

)

Restructuring and other charges, net

(9.3

)

(6.9

)

(44.9

)

(12.5

)

Total other operating expenses,

net

(905.6

)

(816.4

)

(1,771.2

)

(1,642.6

)

Operating income

164.5

206.7

330.9

381.9

Interest expense

(10.0

)

(9.5

)

(20.0

)

(21.3

)

Interest income

15.8

6.6

31.5

10.2

Other expense, net

(4.8

)

(3.7

)

(6.3

)

(8.5

)

Income before income taxes

165.5

200.1

336.1

362.3

Income tax provision

(18.6

)

(49.6

)

(57.1

)

(88.4

)

Net income

$

146.9

$

150.5

$

279.0

$

273.9

Net income per common share:

Basic

$

2.24

$

2.21

$

4.24

$

3.97

Diluted

$

2.19

$

2.18

$

4.15

$

3.90

Weighted-average common shares

outstanding:

Basic

65.6

68.0

65.7

69.0

Diluted

67.2

69.0

67.3

70.3

Dividends declared per share

$

0.75

$

0.75

$

1.50

$

1.50

RALPH LAUREN

CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

Prepared in accordance with

U.S. Generally Accepted Accounting Principles

(Unaudited)

Six Months Ended

September 30,

2023

October 1, 2022

(millions)

Cash flows from operating

activities:

Net income

$

279.0

$

273.9

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

116.8

108.1

Deferred income tax expense

6.1

36.1

Stock-based compensation expense

50.7

40.7

Bad debt expense

0.3

0.6

Other non-cash charges

16.3

13.3

Changes in operating assets and

liabilities:

Accounts receivable

(26.5

)

(113.8

)

Inventories

(151.0

)

(345.8

)

Prepaid expenses and other current

assets

(37.8

)

(59.6

)

Accounts payable and accrued

liabilities

154.7

31.8

Income tax receivables and payables

(41.8

)

28.9

Operating lease right-of-use assets and

liabilities, net

(18.2

)

(12.3

)

Other balance sheet changes

(5.0

)

—

Net cash provided by operating

activities

343.6

1.9

Cash flows from investing

activities:

Capital expenditures

(82.4

)

(83.9

)

Purchases of investments

(158.6

)

(431.2

)

Proceeds from sales and maturities of

investments

108.1

849.2

Other investing activities

—

(6.0

)

Net cash provided by (used in)

investing activities

(132.9

)

328.1

Cash flows from financing

activities:

Repayments of long-term debt

—

(500.0

)

Payments of finance lease obligations

(11.2

)

(10.8

)

Payments of dividends

(98.2

)

(99.1

)

Repurchases of common stock, including

shares surrendered for tax withholdings

(225.7

)

(417.3

)

Net cash used in financing

activities

(335.1

)

(1,027.2

)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(23.9

)

(60.6

)

Net decrease in cash, cash equivalents,

and restricted cash

(148.3

)

(757.8

)

Cash, cash equivalents, and restricted

cash at beginning of period

1,536.9

1,872.0

Cash, cash equivalents, and restricted

cash at end of period

$

1,388.6

$

1,114.2

RALPH LAUREN

CORPORATION

SEGMENT INFORMATION

(Unaudited)

Three Months Ended

Six Months Ended

September 30,

2023

October 1, 2022

September 30,

2023

October 1, 2022

(millions)

Net revenues:

North America

$ 717.8

$ 726.6

$ 1,349.5

$ 1,427.3

Europe

526.8

493.5

977.3

909.1

Asia

348.4

316.4

725.9

650.5

Other non-reportable segments

40.0

43.4

76.8

83.6

Total net revenues

$ 1,633.0

$ 1,579.9

$ 3,129.5

$ 3,070.5

Operating income:

North America

$ 110.2

$ 127.1

$ 235.5

$ 259.9

Europe

132.4

134.6

229.6

207.8

Asia

68.4

65.7

161.7

144.4

Other non-reportable segments

34.1

40.0

67.9

77.2

345.1

367.4

694.7

689.3

Unallocated corporate expenses

(171.3)

(153.8)

(318.9)

(294.9)

Unallocated restructuring and other

charges, net

(9.3)

(6.9)

(44.9)

(12.5)

Total operating income

$ 164.5

$ 206.7

$ 330.9

$ 381.9

RALPH LAUREN

CORPORATION

CONSTANT CURRENCY FINANCIAL

MEASURES

(Unaudited)

Comparable Store Sales Data

September 30, 2023

Three Months Ended

Six Months Ended

% Change

% Change

Constant Currency

Constant Currency

North America:

Digital commerce

4

%

(2

%)

Brick and mortar

4

%

(1

%)

Total North America

4

%

(1

%)

Europe:

Digital commerce

14

%

11

%

Brick and mortar

5

%

3

%

Total Europe

6

%

4

%

Asia:

Digital commerce

19

%

15

%

Brick and mortar

7

%

10

%

Total Asia

8

%

11

%

Total Ralph Lauren Corporation

6

%

4

%

Operating Segment Net Revenues

Data

Three Months Ended

% Change

September 30,

2023

October 1, 2022

As Reported

Constant

Currency

(millions)

North America

$

717.8

$

726.6

(1.2

%)

(1.1

%)

Europe

526.8

493.5

6.8

%

(0.5

%)

Asia

348.4

316.4

10.1

%

12.6

%

Other non-reportable segments

40.0

43.4

(7.9

%)

(7.9

%)

Net revenues

$

1,633.0

$

1,579.9

3.4

%

1.7

%

Six Months Ended

% Change

September 30,

2023

October 1, 2022

As Reported

Constant

Currency

(millions)

North America

$

1,349.5

$

1,427.3

(5.4

%)

(5.3

%)

Europe

977.3

909.1

7.5

%

3.0

%

Asia

725.9

650.5

11.6

%

15.2

%

Other non-reportable segments

76.8

83.6

(8.2

%)

(8.2

%)

Net revenues

$

3,129.5

$

3,070.5

1.9

%

1.4

%

RALPH LAUREN

CORPORATION

NET REVENUES BY SALES

CHANNEL

(Unaudited)

Three Months Ended

September 30, 2023

October 1, 2022

North America

Europe

Asia

Other

Total

North America

Europe

Asia

Other

Total

(millions)

Sales Channel:

Retail

$

437.8

$

238.4

$

318.1

$

—

$

994.3

$

424.0

$

204.8

$

288.2

$

—

$

917.0

Wholesale

280.0

288.4

30.3

—

598.7

302.6

288.7

28.2

—

619.5

Licensing

—

—

—

40.0

40.0

—

—

—

43.4

43.4

Net revenues

$

717.8

$

526.8

$

348.4

$

40.0

$

1,633.0

$

726.6

$

493.5

$

316.4

$

43.4

$

1,579.9

Six Months Ended

September 30, 2023

October 1, 2022

North America

Europe

Asia

Other

Total

North America

Europe

Asia

Other

Total

(millions)

Sales Channel:

Retail

$

848.8

$

465.1

$

670.2

$

—

$

1,984.1

$

861.8

$

420.7

$

602.1

$

—

$

1,884.6

Wholesale

500.7

512.2

55.7

—

1,068.6

565.5

488.4

48.4

—

1,102.3

Licensing

—

—

—

76.8

76.8

—

—

—

83.6

83.6

Net revenues

$

1,349.5

$

977.3

$

725.9

$

76.8

$

3,129.5

$

1,427.3

$

909.1

$

650.5

$

83.6

$

3,070.5

RALPH LAUREN

CORPORATION

GLOBAL RETAIL STORE

NETWORK

(Unaudited)

September 30,

2023

October 1, 2022

North

America

Ralph Lauren Stores

49

46

Polo Outlet Stores

187

193

Total Directly Operated Stores

236

239

Concessions

1

1

Europe

Ralph Lauren Stores

44

39

Polo Outlet Stores

60

59

Total Directly Operated Stores

104

98

Concessions

27

29

Asia

Ralph Lauren Stores

128

107

Polo Outlet Stores

96

90

Total Directly Operated Stores

224

197

Concessions

682

682

Global Directly

Operated Stores and Concessions

Ralph Lauren Stores

221

192

Polo Outlet Stores

343

342

Total Directly Operated Stores

564

534

Concessions

710

712

Global Licensed

Stores

Total Licensed Stores

194

118

RALPH LAUREN

CORPORATION

RECONCILIATION OF NON-U.S.

GAAP FINANCIAL MEASURES

(Unaudited)

Three Months Ended

September 30, 2023

As Reported

Total

Adjustments(a)(b)

As Adjusted

(Reported $)

Foreign Currency

Impact

As Adjusted

(Constant $)

(millions, except per share

data)

Net revenues

$

1,633.0

$

—

$

1,633.0

$

(27.1

)

$

1,605.9

Gross profit

1,070.1

(1.8

)

1,068.3

(18.8

)

1,049.5

Gross profit margin

65.5

%

65.4

%

65.4

%

Total other operating expenses, net

(905.6

)

9.0

(896.6

)

4.9

(891.7

)

Operating expense margin

55.5

%

54.9

%

55.5

%

Operating income

164.5

7.2

171.7

(13.9

)

157.8

Operating margin

10.1

%

10.5

%

9.8

%

Income before income taxes

165.5

7.2

172.7

Income tax provision

(18.6

)

(13.2

)

(31.8

)

Effective tax rate

11.2

%

18.5

%

Net income

$

146.9

$

(6.0

)

$

140.9

Net income per diluted common share

$

2.19

$

2.10

SEGMENT

INFORMATION

REVENUE:

North America

$

717.8

$

—

$

717.8

$

0.9

$

718.7

Europe

526.8

—

526.8

(35.9

)

490.9

Asia

348.4

—

348.4

7.9

356.3

Other non-reportable segments

40.0

—

40.0

—

40.0

Total revenue

$

1,633.0

$

—

$

1,633.0

$

(27.1

)

$

1,605.9

OPERATING INCOME:

North America

$

110.2

$

(2.1

)

$

108.1

Operating margin

15.4

%

15.1

%

Europe

132.4

—

132.4

Operating margin

25.1

%

25.1

%

Asia

68.4

—

68.4

Operating margin

19.6

%

19.6

%

Other non-reportable segments

34.1

—

34.1

Operating margin

85.2

%

85.2

%

Unallocated corporate expenses and

restructuring & other charges, net

(180.6

)

9.3

(171.3

)

Total operating income

$

164.5

$

7.2

$

171.7

RALPH LAUREN

CORPORATION

RECONCILIATION OF NON-U.S.

GAAP FINANCIAL MEASURES (Continued)

(Unaudited)

Six Months Ended

September 30, 2023

As Reported

Total

Adjustments(a)(c)

As Adjusted

(Reported $)

Foreign Currency

Impact

As Adjusted

(Constant $)

(millions, except per share

data)

Net revenues

$

3,129.5

$

—

$

3,129.5

$

(15.3

)

$

3,114.2

Gross profit

2,102.1

(3.6

)

2,098.5

(3.6

)

2,094.9

Gross profit margin

67.2

%

67.1

%

67.3

%

Total other operating expenses, net

(1,771.2

)

44.5

(1,726.7

)

(3.2

)

(1,729.9

)

Operating expense margin

56.6

%

55.2

%

55.6

%

Operating income

330.9

40.9

371.8

(6.8

)

365.0

Operating margin

10.6

%

11.9

%

11.7

%

Income before income taxes

336.1

40.9

377.0

Income tax provision

(57.1

)

(21.0

)

(78.1

)

Effective tax rate

17.0

%

20.7

%

Net income

$

279.0

$

19.9

$

298.9

Net income per diluted common share

$

4.15

$

4.44

SEGMENT

INFORMATION

REVENUE:

North America

$

1,349.5

$

—

$

1,349.5

$

2.5

$

1,352.0

Europe

977.3

—

977.3

(41.3

)

936.0

Asia

725.9

—

725.9

23.5

749.4

Other non-reportable segments

76.8

—

76.8

—

76.8

Total revenue

$

3,129.5

$

—

$

3,129.5

$

(15.3

)

$

3,114.2

OPERATING INCOME:

North America

$

235.5

$

(3.8

)

$

231.7

Operating margin

17.4

%

17.2

%

Europe

229.6

(0.2

)

229.4

Operating margin

23.5

%

23.5

%

Asia

161.7

—

161.7

Operating margin

22.3

%

22.3

%

Other non-reportable segments

67.9

—

67.9

Operating margin

88.4

%

88.4

%

Unallocated corporate expenses and

restructuring & other charges, net

(363.8

)

44.9

(318.9

)

Total operating income

$

330.9

$

40.9

$

371.8

RALPH LAUREN

CORPORATION

RECONCILIATION OF NON-U.S.

GAAP FINANCIAL MEASURES (Continued)

(Unaudited)

Three Months Ended

October 1, 2022

As Reported

Total

Adjustments(a)(d)

As Adjusted

(millions, except per share

data)

Net revenues

$

1,579.9

$

—

$

1,579.9

Gross profit

1,023.1

(2.4

)

1,020.7

Gross profit margin

64.8

%

64.6

%

Total other operating expenses, net

(816.4

)

7.1

(809.3

)

Operating expense margin

51.7

%

51.2

%

Operating income

206.7

4.7

211.4

Operating margin

13.1

%

13.4

%

Income before income taxes

200.1

4.7

204.8

Income tax provision

(49.6

)

(1.2

)

(50.8

)

Effective tax rate

24.8

%

24.8

%

Net income

$

150.5

$

3.5

$

154.0

Net income per diluted common share

$

2.18

$

2.23

SEGMENT

INFORMATION

OPERATING INCOME:

North America

$

127.1

$

(2.4

)

$

124.7

Operating margin

17.5

%

17.2

%

Europe

134.6

—

134.6

Operating margin

27.3

%

27.3

%

Asia

65.7

—

65.7

Operating margin

20.8

%

20.8

%

Other non-reportable segments

40.0

—

40.0

Operating margin

92.3

%

92.3

%

Unallocated corporate expenses and

restructuring & other charges, net

(160.7

)

7.1

(153.6

)

Total operating income

$

206.7

$

4.7

$

211.4

RALPH LAUREN

CORPORATION

RECONCILIATION OF NON-U.S.

GAAP FINANCIAL MEASURES (Continued)

(Unaudited)

Six Months Ended

October 1, 2022

As Reported

Total

Adjustments(a)(e)

As Adjusted

(millions, except per share

data)

Net revenues

$

3,070.5

$

—

$

3,070.5

Gross profit

2,024.5

9.2

2,033.7

Gross profit margin

65.9

%

66.2

%

Total other operating expenses, net

(1,642.6

)

10.3

(1,632.3

)

Operating expense margin

53.5

%

53.2

%

Operating income

381.9

19.5

401.4

Operating margin

12.4

%

13.1

%

Income before income taxes

362.3

19.5

381.8

Income tax provision

(88.4

)

(4.8

)

(93.2

)

Effective tax rate

24.4

%

24.4

%

Net income

$

273.9

$

14.7

$

288.6

Net income per diluted common share

$

3.90

$

4.11

SEGMENT

INFORMATION

OPERATING INCOME:

North America

$

259.9

$

6.5

$

266.4

Operating margin

18.2

%

18.7

%

Europe

207.8

0.3

208.1

Operating margin

22.9

%

22.9

%

Asia

144.4

—

144.4

Operating margin

22.2

%

22.2

%

Other non-reportable segments

77.2

—

77.2

Operating margin

92.3

%

92.3

%

Unallocated corporate expenses and

restructuring & other charges, net

(307.4

)

12.7

(294.7

)

Total operating income

$

381.9

$

19.5

$

401.4

RALPH LAUREN CORPORATION

FOOTNOTES TO RECONCILIATION OF NON-U.S. GAAP

FINANCIAL MEASURES

(a)

Adjustments for non-routine

inventory-related charges (benefits) are recorded within cost of

goods sold in the consolidated statements of operations.

Adjustments for non-routine bad debt expense (benefit) and

impairment of assets are recorded within selling, general, and

administrative ("SG&A") expenses in the consolidated statements

of operations. Adjustments for one-time income tax events are

recorded within the income tax benefit (provision) in the

consolidated statements of operations. Adjustments for all other

charges are recorded within restructuring and other charges, net in

the consolidated statements of operations.

(b)

Adjustments for the three months ended

September 30, 2023 include (i) charges of $6.8 million recorded in

connection with the Company's restructuring activities, primarily

associated with severance and benefit costs; (ii) other charges of

$4.5 million primarily related to rent and occupancy costs

associated with certain previously exited real estate locations for

which the related lease agreements have not yet expired; (iii)

income of $2.0 million related to consideration received from

Regent, L.P. ("Regent") in connection with the Company's previously

sold Club Monaco business; (iv) non-routine inventory benefits of

$1.8 million primarily related to reversals of amounts previously

recognized in connection with delays in U.S. customs shipment

reviews and approvals; and (v) benefit of $0.3 million primarily

related to Russia-related bad debt reserve adjustments.

Additionally, the income tax provision reflects a benefit of $11.8

million recorded in connection with Swiss tax reform and the

European Union's anti-tax avoidance directive.

(c)

Adjustments for the six months ended

September 30, 2023 include (i) charges of $37.3 million recorded in

connection with the Company's restructuring activities, primarily

associated with severance and benefit costs; (ii) other charges of

$9.6 million primarily related to rent and occupancy costs

associated with certain previously exited real estate locations for

which the related lease agreements have not yet expired; (iii)

non-routine inventory benefits of $3.6 million primarily related to

reversals of amounts previously recognized in connection with

delays in U.S. customs shipment reviews and approvals and the

COVID-19 pandemic; (iv) income of $2.0 million related to

consideration received from Regent in connection with the Company's

previously sold the Club Monaco business; and (v) benefit of $0.4

million primarily related to Russia-related bad debt reserve

adjustments. Additionally, the income tax provision reflects a

benefit of $11.8 million recorded in connection with Swiss tax

reform and the European Union's anti-tax avoidance directive.

(d)

Adjustments for the three months ended

October 1, 2022 include (i) charges of $4.9 million recorded in

connection with the Company's restructuring activities; (ii) other

charges of $5.7 million primarily related to rent and occupancy

costs associated with certain previously exited real estate

locations for which the related lease agreements have not yet

expired; (iii) income of $3.5 million related to consideration

received from Regent in connection with the Company's previously

sold the Club Monaco business; and (iv) benefit of $2.4 million

related to COVID-19-related inventory adjustments.

(e)

Adjustments for the six months ended

October 1, 2022 include (i) other charges of $10.6 million

primarily related to rent and occupancy costs associated with

certain previously exited real estate locations for which the

related lease agreements have not yet expired; (ii) non-routine

inventory charges of $9.2 million largely recorded in connection

with the Russia-Ukraine war; (iii) charges of $5.6 million recorded

in connection with the Company's restructuring activities; (iv)

income of $3.5 million related to consideration received from

Regent in connection with the Company's previously sold the Club

Monaco business; and (v) benefit of $2.4 million related to

Russia-related bad debt reserve adjustments.

NON-U.S. GAAP FINANCIAL MEASURES

Because Ralph Lauren Corporation is a global company, the

comparability of its operating results reported in U.S. Dollars is

affected by foreign currency exchange rate fluctuations because the

underlying currencies in which it transacts change in value over

time compared to the U.S. Dollar. Such fluctuations can have a

significant effect on the Company's reported results. As such, in

addition to financial measures prepared in accordance with

accounting principles generally accepted in the U.S. ("U.S. GAAP"),

the Company's discussions often contain references to constant

currency measures, which are calculated by translating current-year

and prior-year reported amounts into comparable amounts using a

single foreign exchange rate for each currency. The Company

presents constant currency financial information, which is a

non-U.S. GAAP financial measure, as a supplement to its reported

operating results. The Company uses constant currency information

to provide a framework for assessing how its businesses performed

excluding the effects of foreign currency exchange rate

fluctuations. Management believes this information is useful to

investors for facilitating comparisons of operating results and

better identifying trends in the Company's businesses. The constant

currency performance measures should be viewed in addition to, and

not in lieu of or superior to, the Company's operating performance

measures calculated in accordance with U.S. GAAP.

This earnings release also includes certain other non-U.S. GAAP

financial measures relating to the impact of charges and other

items as described herein. The Company uses non-U.S. GAAP financial

measures, among other things, to evaluate its operating performance

and to better represent the manner in which it conducts and views

its business. The Company believes that excluding items that are

not comparable from period to period helps investors and others

compare operating performance between two periods. While the

Company considers non-U.S. GAAP measures useful in analyzing its

results, they are not intended to replace, nor act as a substitute

for, any presentation included in the consolidated financial

statements prepared in conformity with U.S. GAAP, and may be

different from non-U.S. GAAP measures reported by other

companies.

Adjustments made during the fiscal periods presented include

charges recorded in connection with the Company's restructuring

activities, as well as certain other charges (benefits) associated

with other non-recurring events, as described in the footnotes to

the non-U.S. GAAP financial measures above. The income tax benefit

(provision) has been adjusted for the tax-related effects of these

charges, which were calculated using the respective statutory tax

rates for each applicable jurisdiction. The income tax benefit

(provision) has also been adjusted for certain other one-time

income tax events and other adjustments, as described in the

footnotes to the non-U.S. GAAP financial measures above. Included

in this earnings release are reconciliations between the non-U.S.

GAAP financial measures and the most directly comparable U.S. GAAP

measures before and after these adjustments.

Additionally, the Company's full year Fiscal 2024 and third

quarter guidance excludes any potential restructuring-related and

other charges that may be incurred in future periods. The Company

is not able to provide a full reconciliation of these non-U.S. GAAP

financial measures to U.S. GAAP as it is not known at this time if

and when any such charges may be incurred in the future.

Accordingly, a reconciliation of the Company's non-U.S. GAAP based

financial measure guidance to the most directly comparable U.S.

GAAP measures cannot be provided at this time given the uncertain

nature of any such potential charges that may be incurred in future

periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107704161/en/

Investor Relations: Corinna Van der Ghinst ir@ralphlauren.com Or

Corporate Communications rl-press@ralphlauren.com

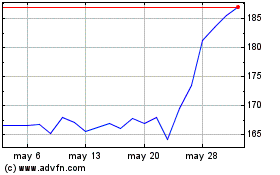

Ralph Lauren (NYSE:RL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ralph Lauren (NYSE:RL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025