UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

|

Companhia de Saneamento

Básico do Estado de São Paulo-SABESP

(Name of Issuer) |

|

Common Shares |

| (Title of Class of Securities) |

|

N/A |

| (CUSIP Number) |

Rafael Antonio Cren Benini

State of São Paulo

Av. Iaiá, No. 126

São Paulo, SP, CEP 04542-906, Brazil

Copy to:

Jonathan Zonis

Clifford Chance US LLP

375 Ninth Avenue

New York, NY 10001

| |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| July 18, 2024 |

| (Date of Event Which Requires Filing of this Statement) |

| |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

The information required on the remainder of this

cover page shall not be deemed to be “filed”

for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions

of the Exchange Act (however, see the notes).

24010861653-v11 | - 1 - | 95-41078871 |

| |

1 |

NAMES OF REPORTING PERSONS |

|

|

|

| |

State of São Paulo |

|

|

|

| |

2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

[X] |

|

| |

|

(b) |

☐ |

|

| |

3 |

SEC USE ONLY |

|

|

|

| |

|

|

|

|

| |

4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

|

| |

OO |

|

|

|

| |

5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

☐ |

|

| |

|

|

|

|

| |

6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

|

| |

Federative Republic of Brazil |

|

|

|

| |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

|

| |

123,036,664 |

|

|

|

| |

8 |

SHARED VOTING POWER |

|

|

|

| |

0 |

|

|

|

| |

9 |

SOLE DISPOSITIVE POWER |

|

|

|

| |

123,036,664 |

|

|

|

| |

10 |

SHARED DISPOSITIVE POWER |

|

|

|

| |

0 |

|

|

|

| |

11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

|

| |

123,036,664 |

|

|

|

| |

12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

☐ |

|

| |

|

|

|

|

| |

13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

|

| |

18.0%* |

|

|

|

| |

14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

|

| |

OO |

|

|

|

|

* |

The percentage of common shares beneficially owned by the State of São Paulo is based on 683,509,869 common shares outstanding as of July 22, 2024. |

| |

|

|

|

|

|

|

|

|

|

|

24010861653-v11 | - 2 - | 95-41078871 |

EXPLANATORY NOTE |

| This Schedule 13D supersedes the Schedule 13G filed by the State of São Paulo (the "Reporting Person") on February 19, 2003, as amended by Amendment No. 1, which was filed on February 14, 2005. As discussed in Item 4 and Item 6 below, by virtue of certain arrangements, the Reporting Person may be deemed to be a member of a “group” with the persons identified in Exhibit 99.1 filed herewith for purposes of Section 13(d) of the Exchange Act. This Schedule 13D is now being filed by the Reporting Person because such “group” has acquired beneficial ownership during the preceding 12 months of in excess of 2% of the Issuer’s outstanding common shares. |

| Item 1. |

Security and Issuer. |

This statement on Schedule 13D relates to the

common shares of Companhia de Saneamento Básico do Estado de São Paulo—SABESP (“Issuer”

or “SABESP”), whose principal office is located at Rua Costa Carvalho,

300, CEP 05429-900, São Paulo, Federative Republic of Brazil.

| Item 2. |

Identity and Background.

|

| |

|

|

| (a) |

|

Name of Reporting Person: |

|

| |

|

|

|

| |

|

State of São Paulo |

|

| |

|

|

|

| (b) |

|

Address of Principal Business Office: |

|

| |

|

|

|

| |

|

Av. Iaiá, No. 126, São Paulo, SP, CEP 04542-906, Federative Republic of Brazil |

|

| |

|

|

|

| (c) |

|

Present principal occupation or employment of State of São Paulo: |

|

| |

|

|

|

| |

|

The State of São Paulo is a state in the Federative Republic of Brazil. |

|

| |

|

|

|

| (d) |

|

During the last five years, the State of São

Paulo has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

| |

|

|

|

| (e) |

|

During the last five years, the State of São

Paulo was not a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

|

|

| |

|

|

|

| (f) |

|

Citizenship: |

|

| |

|

|

|

| |

|

Brazil

|

|

| Item 3. |

|

Sources and Amount of Funds or Other Consideration.

|

| |

|

|

|

|

|

|

In June 1973, the incorporation of SABESP was

approved pursuant to São Paulo State Law No. 119/1973, arising from the merger of Companhia Metropolitana de Águas de

São Paulo, Superintendência de Águas e Esgotos da Capital, and Companhia Metropolitana de Saneamento

de São Paulo, with the purpose of implementing the directives of the Brazilian government set forth in the National Water Supply

and Sanitation Plan (Plano Nacional de Saneamento). No disbursement or payment was made by the State of São Paulo regarding

the common shares, given SABESP is the legal entity that resulted from the merger of the above referenced companies, which were wholly

owned by the State of São Paulo prior to such merger.

| Item 4. |

Purpose of Transaction

|

In December 2023, the privatization

of SABESP was approved pursuant to São Paulo State Law No. 17,853/2023. The privatization was conducted through a secondary public

offering of SABESP’s common shares within and outside of Brazil with the intent to dilute the direct and indirect interest of the

Brazilian government in the voting capital of SABESP (“Global

Offering”). As a result, the State of São Paulo sold common

shares representing approximately 32.2% of SABESP’s share capital in the Global Offering

that consisted of an international public offering in the United States and a public offering within Brazil.

24010861653-v11 | - 3 - | 95-41078871 |

As part of the Global Offering, and through a public

competitive process consisting of the submission of pricing and volume proposals, Equatorial Energia S.A., through its subsidiary Equatorial

Participações e Investimentos IV S.A., a Brazilian energy distribution company, was selected as the reference investor (“Reference

Investor”). Consequently, there was a priority allocation to the Reference Investor of

common shares representing 15.0% of SABESP’s share capital. The Reference Investor entered into a certain investment agreement,

lock-up and other covenants with the State of São Paulo (the “Investment Agreement”), as further described below

in Item 6.

In addition, in the context of the Global Offering,

on July 18, 2024 the State of São Paulo entered into an international underwriting and placement facilitation agreement, with the

global coordinators of the Global Offering (the "Underwriting Agreement"), and entered

into a lock-up agreement, the form of which is provided as Annex I-b to the Underwriting Agreement.

As a result of the completion of the Global Offering,

the State of São Paulo has reduced its controlling interest in SABESP. SABESP’s bylaws also have been amended. Included in

the amendments are, inter alia,

| · | an increase in the authorized capital of SABESP; |

| · | the inclusion of the golden share owned exclusively by the State of São Paulo, which has granted

the State of São Paulo veto powers over proposed changes to: (i) SABESP’s name and headquarters; (ii) SABESP’s corporate

purpose of providing water and sewage services; and (iii) any provisions in SABESP’s bylaws regarding limits on the exercise of

voting rights attributed to shareholders or groups of shareholders; and |

| · | a provision that will have the effect of avoiding the concentration of more than 30.0% of our common voting

shares in the hands of one or a small group of shareholders and poison pill provisions. |

In the terms of the privatization, the State of São

Paulo must maintain at least 10.0% of SABESP’s share capital to maintain the golden share, as provided for in SABESP’s amended

bylaws.

| Item 5. |

Interest in Securities of the Issuer

|

(a) –

(b) The following sets forth, as of the date of this Schedule 13D, the aggregate number of common shares and the percentage of common

shares beneficially owned by the Reporting Person, as well as the number of common shares as to which the Reporting Person has the sole

power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition of,

or shared power to dispose or to direct the disposition of, as of the date hereof, based on based on 683,509,869 common shares

outstanding as of July 22, 2024.

| Reporting Person |

Amount Beneficially

Owned |

Percent of Class |

Sole Power to vote

or to direct the vote |

Shared Power to

vote or to direct the vote |

Sole power

to dispose

or

to direct

the

disposition |

Shared power

to dispose

or

to direct

the

disposition |

| |

|

|

|

|

|

|

| State of São Paulo |

123,036,664 |

18.0% |

123,036,664 |

0 |

123,036,664 |

0 |

(c) Except

as described in Item 4, during the past 60 days, the Reporting Person has not effected any transactions with respect to the ordinary shares

of the Issuer.

(d) No

other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the ordinary

shares held by the Reporting Person.

(e) Not

applicable.

24010861653-v11 | - 4 - | 95-41078871 |

| Item 6. |

Contracts, Arrangements, Understanding or Relationships with Respect to Securities of the Issuer |

As part

of the privatization described in Item 4, on July 18, 2024, the State of São Paulo and the Reference Investor entered into the

Investment Agreement, which pursuant to its terms will be effective through January 1, 2035.

The Investment

Agreement provides specific rights and obligations for the State of São Paulo and the Reference Investor (together, the “Shareholders”),

including the following:

| · | Investment Commitment: The Reference Investor has undertaken,

as determined in the Investment Agreement, directly, irrevocably and irreversibly, the acquisition and liquidation of shares corresponding

to 15.0% of SABESP’s voting and total share capital. |

| · | Binding Vote: The Shareholders and their directors who are

not independent directors (“Binding Directors”) will exercise their voting rights in a binding manner at SABESP’s

general shareholders’ meeting and at any meeting of SABESP’s board of directors related to the election of directors and “matters

subject to consensus”, mainly: (i) amendments to SABESP’s bylaws, involving changes to SABESP’s corporate purpose, term

of duration, changes to the authorized capital, composition, powers and roles of the management bodies, rules related to the public offering

due to reaching relevant ownership, and/or limitation of voting rights; (ii) vote on any waiver of the obligation to hold a public offering

due to reaching relevant ownership; (iii) transformation, liquidation, dissolution, bankruptcy, judicial or extrajudicial reorganization

involving SABESP; (iv) SABESP’s delisting from the “Novo Mercado” or cancellation of SABESP’s registration as

a publicly-held company; (v) changes in SABESP’s related parties policy; (vi) changes in SABESP’s policy profit allocation

and distribution of dividends policy; and (vii) changes in SABESP’s employees’ pension plan. |

| · | Board of Directors: The Shareholders will elect the nine

members of the Board of Directors, for a unified term of two years, from a slate composed of (i) three members appointed by the Reference

Investor; (ii) three independent directors appointed jointly by the shareholders, pursuant to B3 Novo Mercado regulations; and (iii) three

members appointed by the State of São Paulo. The Reference Investor will have the right to appoint the chairman of the Board of

Directors. As for the executive board, the State of São Paulo undertakes to not appoint and to ensure that its Binding Directors

do not appoint any member for the Chief Executive Officer role. |

| · | Commitment to Call a General Shareholders’ Meeting:

The Shareholders undertake, as soon as possible after the Global Offering and, if applicable, after the Brazilian antitrust approval,

to have the board of directors of SABESP call a general shareholders’ meeting to substitute and to elect new members of SABESP’s

board of directors. SABESP’s shareholders will present their nominations for the slate voting and binding voting in relation to

the shares held by the Shareholders at the general shareholders’ meeting to be convened in due course. |

| · | Non-compete: From January 1, 2025, any potential new opportunities

involving public utility services for water supply and sewage services in Brazil (but outside the State of São Paulo), in any municipality

or group of municipalities that have a combined population of over 50,000 inhabitants, according to the most recent Instituto Brasileiro

de Geografia e Estatistica - IBGE data, shall be carried out or developed exclusively through SABESP. |

| · | Lock-up: The Shareholders may not transfer, for any reason,

in whole or in part, or encumber any shares or rights conferred on the shares or securities convertible into shares until December 31,

2029 (lock-up period). After the end of the lock-up period, the State of São Paulo is still restricted on transferring any shares

to any entity that operates in the same business as SABESP. |

In addition,

as part of the Global Offering described in Item 4, the State of São Paulo, on July 18, 2024, entered into a lock-up agreement,

the form of which is provided as Annex I-b to the Underwriting Agreement, by which the State of São Paulo agreed that for 180 days

after the date thereof, it will not, without first obtaining the written consent of Banco BTG Pactual S.A. – Cayman Branch (acting

as representative for the global coordinators):

24010861653-v11 | - 5 - | 95-41078871 |

| · | offer,

sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise transfer or dispose of, directly or indirectly,

or file with or confidentially submit to the U.S. Securities and Exchange Commission a registration statement under the Exchange Act relating

to, any of SABESP’s common shares, preferred shares or American Depositary Shares ("ADS") or any other similar securities or securities convertible into or exchangeable

or exercisable for any ADSs, common shares, preferred shares or such other similar securities, including, but not limited to, any options

or warrants to purchase such securities or publicly disclose the intention to make any offer, sale, pledge, disposition or filing; or |

| · | enter

into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of such securities,

whether any such transaction described above is to be settled by delivery of other securities, in cash or otherwise, |

whether any such

transaction described above is to be settled by delivery of other securities, in cash or otherwise, provided that the foregoing restrictions

do not apply to transfers:

| · | in

the Global Offering; or |

| · | to any

of its subsidiaries or affiliates, provided that prior to any such transfer, the recipient thereof agrees in writing to be bound by the

terms of the lock-up agreement; or |

| · | by

operation of law, provided that prior to any such transfer the recipient thereof agrees in writing to be bound by the terms of the lock-up

agreement. |

Any waiver would

be at the discretion of Banco BTG Pactual S.A. – Cayman Branch (acting as representative for the global coordinators in connection

with the Global Offering).

| Item 7. |

Material to be Filed as Exhibits |

24010861653-v11 | - 6 - | 95-41078871 |

SIGNATURES

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: August 2, 2024

| |

STATE OF SÃO PAULO

|

| |

By: |

/s/ Rafael Antonio Cren Benini |

| |

|

Name: Rafael Antonio Cren Benini |

| |

|

Title: Secretary of Investment Partnerships |

| |

|

|

Exhibit 99.1

Identification of Members of the Group

As a result of the Investment Agreement entered into

between the Reporting Person and the Reference Investor, among others, with respect to the shares of SABESP, the Reporting Person and

the Reference Investor may be deemed to constitute a “group” for purposes of Rule 13d-5 of the Exchange Act. The Reporting

Person has not entered into any joint filing agreement with the Reference Investor or its ultimate controlling persons, and understands

that the Reference Investor and its ultimate controlling persons will be responsible for filing their own Schedule 13D with respect to

the shares of SABESP that they beneficially own.

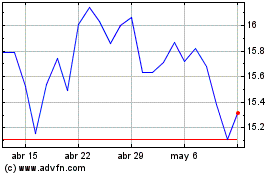

Companhia Sanea (NYSE:SBS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Companhia Sanea (NYSE:SBS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024