Sprott Physical Copper Trust Announces Closing of Initial Public Offering

06 Junio 2024 - 8:31AM

Sprott Asset Management LP (“

Sprott Asset

Management”), a wholly-owned subsidiary of Sprott Inc.

(“

Sprott”) (NYSE/TSX: SII), announced today on

behalf of the Sprott Physical Copper Trust (the

“

Trust”) that the Trust has closed its initial

public offering of 10,000,000 transferable units (the

“

Units”) at a price of US$10.00 per Unit (the

“

Offering”). The Offering will generate gross

proceeds of US$100,000,000.

The Units will commence trading in both U.S.

dollars and Canadian dollars today on the Toronto Stock Exchange

under the symbols “COP.U” and “COP.UN”, respectively.

The Trust is a closed-end trust established to

invest and hold substantially all of its assets in physical copper

metal. The net proceeds of the Offering will generally be used to

purchase copper. The Trust’s investment objectives are to provide a

secure, convenient and exchange-traded investment alternative for

investors interested in holding copper without the inconvenience

that is typical of a direct investment in copper. The Trust does

not anticipate making regular cash distributions to holders of the

Units.

“We are pleased to introduce the Sprott Physical

Copper Trust, the world’s first physical copper investment fund,”

said John Ciampaglia, CEO of Sprott Asset Management. “The Trust

will address a need in the market by providing investors with an

alternative to holding copper futures. Investor interest in copper

is growing globally given its critical role as a key component in

electrification, clean energy technologies, electric vehicles and

artificial intelligence. With the launch of the Trust, Sprott now

offers four different copper investment strategies.”

Canaccord Genuity Corp., BMO Capital Markets and

Cantor Fitzgerald Canada Corporation acted as joint bookrunners for

the Offering. RBC Capital Markets and TD Securities Inc. also acted

as underwriters for the Offering.

WMC Energy B.V. is acting as technical advisor

to Sprott Asset Management and will arrange all procurement and

handling of Copper.

The Trust has granted to the underwriters an

over-allotment option, exercisable for a period of 30 days from the

date of closing of the Offering, to cover over-allotments, if any.

If such option is exercised in full, gross proceeds of the Offering

will be US$115,000,000.

About Sprott

Sprott Asset Management is a wholly-owned

subsidiary of Sprott and is the investment manager to the Trust.

Sprott is a global leader in precious metals and critical materials

investments. At Sprott, we are specialists. Our in-depth knowledge,

experience and relationships separate us from the generalists. Our

investment strategies include Exchange Listed Products, Managed

Equities and Private Strategies. Sprott has offices in Toronto, New

York, Connecticut and California and Sprott’s common shares are

listed on the New York Stock Exchange and the Toronto Stock

Exchange under the symbol “SII”. For more information, please

visit www.sprott.com.

Contact:Glen Williams Managing

PartnerInvestor and Institutional Client Relations Direct:

416-943-4394gwilliams@sprott.com

This Offering is only made by

prospectus. The prospectus contains important detailed information

relating to the securities being offered and has been filed with

the securities commissions or similar authorities in each of the

provinces and territories of Canada. Copies of the prospectus may

be obtained from any one of the underwriters noted above. Investors

should read the prospectus before making an

investment decision.

The Units have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or the securities laws of any

state of the United States, and may not be offered or sold,

directly or indirectly, in the United States (as defined in

Regulation S under the U.S. Securities Act) unless registered under

the U.S. Securities Act and applicable securities laws of any state

of the United States or in reliance on an exemption from such

registration requirements. This news release does not constitute an

offer to sell, or a solicitation of an offer to buy any of the

Trust’s securities referred to herein in the United

States.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which an offer,

solicitation or sale would be unlawful prior to registration or

qualifications under the securities laws of any such

jurisdiction.

This material may contain certain statements

which constitute “forward-looking information”. Forward-looking

information includes, among other things, projections, estimates,

and information about possible or future results related to the

Trust, market, or regulatory developments. The views expressed

herein are not guarantees of future performance or economic results

and involve certain risks, uncertainties, and assumptions that

could cause actual outcomes and results to differ materially from

the views expressed herein. The views expressed herein are subject

to change at any time based upon economic, market, or other

conditions and the Trust undertakes no obligation to update the

views expressed herein.

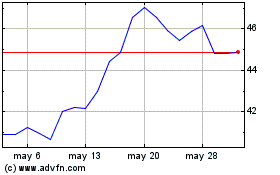

Sprott (NYSE:SII)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

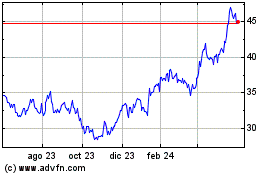

Sprott (NYSE:SII)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024